Kraft Heinz Profit Helped by Cost Cuts

November 03 2016 - 5:50PM

Dow Jones News

Kraft Heinz Co. posted a better-than-expected profit in its

latest quarter as the food company offset declining pro-forma sales

by slashing its expenses.

The packaged food industry has faced a bleak outlook of late, as

consumers opt for fresher alternatives to products like Kraft's

classic macaroni and cheese, Campbell Soup Co.'s iconic canned

dinners and the like. Kraft has pushed to attract new consumers

with more health-conscious fare, including a reformulated macaroni

and cheese with no artificial colors and a new frozen dinner brand

called Devour.

The new offerings may not have caught on yet. In the latest

quarter, half of the company's four regions posted a decline in net

sales year-over-year when assuming Kraft and Heinz were a merged

company in the year-earlier period.

The U.S., the company's biggest market, posted a 1.2% retreat,

while Europe fell 14.5%. Canada edged up 2%, while the rest of the

world rose 4.4%.

Overall, sales declined 1.5% to $6.27 billion from $6.36

billion, assuming the companies had been joined. Kraft Heinz was

formed in July 2015 by the merger of Kraft Foods Group and H.J.

Heinz.

For the quarter ended October 2, Kraft Heinz earned $842

million, or 69 cents a share. A year ago, assuming Kraft and Heinz

were a merged company, the company would have posted a loss of $168

million, or 14 cents a share. Excluding certain items, Kraft

Heinz's adjusted per-share earnings rose to 83 cents from 44

cents.

The company handily beat Wall Street's profit forecasts but fell

just short on revenue. Analysts surveyed by Thomson Reuters

expected earnings of 75 cents a share on revenue of $6.3

billion.

Kraft Heinz, among the largest food makers in the world, was

created by a 2015 merger of Kraft and Heinz. The company is run by

Brazilian private-equity firm 3G Capital, which is known for its

zero-base budgeting philosophy that calls for departments to

justify every cent they spend every year. In the latest quarter,

the company managed to trim general and administrative expenses by

42% to $805 million, on a pro forma basis.

Shares fell 1.3% to $85.11 after hours.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

November 03, 2016 17:35 ET (21:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

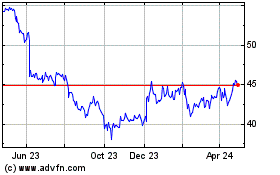

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Dec 2024 to Jan 2025

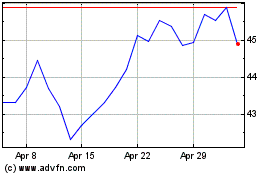

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Jan 2024 to Jan 2025