- Achieved $0.88 in earnings per share, exceeding

expectations

- Generated record first quarter consolidated gross margin of 47

percent

- Reiterates fiscal 2024 outlook of net sales flat to up 2

percent and earnings per share of $4.30 to $4.60

Caleres (NYSE: CAL), a market-leading portfolio of

consumer-driven footwear brands, today reported financial results

for first quarter 2024 and reaffirmed its guidance for fiscal

2024.

“Caleres began 2024 in strong fashion, achieving earnings per

share ahead of expectations, generating record first quarter

consolidated gross margin, and making significant progress on our

key strategic initiatives, all while investing for the long-term,”

said Jay Schmidt, president and chief executive officer. “While the

consumer demand environment remained challenging, we achieved

growth in sales and profitability from our Lead Brands and strong

margin performance across the Brand Portfolio. Notably, the segment

delivered more than half of the company’s operating earnings during

the quarter, with a 13 percent operating margin, and is once again

expected to lead the financial performance of Caleres this year. At

the same time, Famous Footwear maintained total year-over-year

sales levels and generated solid gross margins, with sales and

market share up significantly in the strategically important Kids

category.”

“Looking ahead, we are confident in our ability to deliver

earnings per share in line with our guidance range in 2024,” said

Schmidt. “Longer-term, we believe we are exceptionally well

positioned to execute our clear and actionable strategic plan,

invest to fuel our growth initiatives, and drive sustained value

for our shareholders.”

First Quarter 2024 Results (13-weeks ended May 4, 2024,

compared to 13-weeks ended April 29, 2023)

- Net sales were $659.2 million, down 0.5 percent from the first

quarter of 2023;

- Famous Footwear segment net sales increased 0.1 percent, with

comparable sales down 2.3 percent

- Brand Portfolio segment net sales declined 2.6 percent

- Direct-to-consumer sales represented approximately 69 percent

of total net sales

- Gross profit was $309.1 million, while gross margin was 46.9

percent, up 120 basis points versus last year;

- Famous Footwear segment gross margin of 46.1 percent, up 50

basis points versus last year

- Brand Portfolio segment gross margin of 46.6 percent, up 240

basis points versus last year

- SG&A as a percentage of net sales was 40.4 percent,

reflecting planned investment in marketing at certain Lead Brands,

international expansion and the implementation of the integrated

SAP platform;

- Net earnings of $30.9 million, or earnings per diluted share of

$0.88, compared to net earnings of $34.7 million, or earnings per

diluted share of $0.97 in the first quarter 2023.

- Earnings before interest, taxes, depreciation, and amortization

(EBITDA) of $57.4 million, or 8.7 percent of sales;

- Inventory was down 5.2 percent from the first quarter 2023, due

to strategic inventory management – primarily in the Brand

Portfolio segment; and

- Borrowings under the asset-based revolving credit facility were

$191.0 million at the end of the period, down about $100 million

from the first quarter of 2023.

Capital Allocation Update

During the quarter, Caleres continued to invest in value-driving

growth opportunities while at the same time returning cash to

shareholders through share buybacks and dividends. More

specifically, the company repurchased 416,000 shares of common

stock, for $15.1 million and an average price of $36.23 per share.

It also returned $2.4 million to shareholders through quarterly

dividend payments.

In the near term, the company expects to continue to focus on

reducing debt and still expects borrowings under its asset-based

revolving credit facility will be less than $100 million by 2026.

Caleres will continue to consider business performance and market

conditions as it evaluates all opportunities for free cash flow as

the year progresses.

Fiscal 2024 Outlook:

Caleres is reiterating its fiscal 2024 financial outlook and as

previously noted, its fiscal 2024 is a 52-week year and compares to

a 53-week year in fiscal 2023. Specifically, the company still

expects consolidated net sales to be flat to up 2 percent, compared

to 2023, and earnings per diluted share to be in the range of $4.30

to $4.60.

In addition, for fiscal 2024, the company still expects:

- Consolidated operating margin of 7.3 percent to 7.5

percent;

- Effective tax rate of about 24 percent; and

- Capital expenditures of $60 million to $70 million.

For second quarter 2024 the company expects:

- Consolidated net sales to be up 3 percent to 4 percent. This

includes an estimated $20 to $25 million benefit in Famous Footwear

as a result of the calendar shift of an important back-to-school

week into second quarter 2024 from third quarter 2023; and

- Earnings per diluted share of $1.20 to $1.25.

Investor Conference Call

Caleres will host a conference call at 11:00 a.m. ET today,

Thursday, May 30. The webcast and associated slides will be

available at investor.caleres.com/news/events. A live conference

call will be available at (877) 704-4453 for North America

participants or (201) 389-0920 for international participants, no

passcode necessary. A replay will be also available at

investor.caleres.com/news/events/archive for a limited period.

Investors may also access the replay by dialing (844) 512-2921 in

North America or (412) 317-6671 internationally and using the

conference pin 13746617.

Definitions

All references in this press release, outside of the condensed

consolidated financial statements that follow, unless otherwise

noted, related to net earnings attributable to Caleres, Inc. and

diluted earnings per common share attributable to Caleres, Inc.

shareholders, are presented as net earnings and earnings per

diluted share, respectively.

Non-GAAP Financial Measures and Metrics

In this press release, the company’s financial results are

provided both in accordance with generally accepted accounting

principles (GAAP) and using certain non-GAAP financial measures and

metrics. In particular, the company provides earnings before

interest, taxes, depreciation and amortization (EBITDA), which is a

non-GAAP financial measure, and the debt to EBITDA leverage ratio,

which is a non-GAAP financial metric. These results are included as

a complement to results provided in accordance with GAAP because

management believes this non-GAAP financial measure and metric help

identify underlying trends in the company’s business and provide

useful information to both management and investors by excluding

certain items that may not be indicative of the company’s core

operating results. This measure and metric should not be considered

a substitute for or superior to GAAP results.

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995

This press release contains certain forward-looking statements

and expectations regarding the company’s future performance and the

performance of its brands. Such statements are subject to various

risks and uncertainties that could cause actual results to differ

materially. These risks include (i) changing consumer demands,

which may be influenced by general economic conditions and other

factors; (ii) inflationary pressures and supply chain disruptions

(iii) rapidly changing consumer preferences and purchasing patterns

and fashion trends; (iv) supplier concentration, customer

concentration and increased consolidation in the retail industry;

(v) intense competition within the footwear industry; (vi) foreign

currency fluctuations; (vii) political and economic conditions or

other threats to the continued and uninterrupted flow of inventory

from China and other countries, where the company relies heavily on

third-party manufacturing facilities for a significant amount of

its inventory; (viii) cybersecurity threats or other major

disruption to the company’s information technology systems; (ix)

the ability to accurately forecast sales and manage inventory

levels; (x) a disruption in the company’s distribution centers;

(xi) the ability to recruit and retain senior management and other

key associates; (xii) the ability to secure/exit leases on

favorable terms; (xiii) the ability to maintain relationships with

current suppliers; (xiv) transitional challenges with acquisitions

and divestitures; (xiv) changes to tax laws, policies and treaties;

(xvi) our commitments and shareholder expectations related to

environmental, social and governance considerations; (xvii)

compliance with applicable laws and standards with respect to

labor, trade and product safety issues; and (xvii) the ability to

attract, retain, and maintain good relationships with licensors and

protect our intellectual property rights. The company's reports to

the Securities and Exchange Commission contain detailed information

relating to such factors, including, without limitation, the

information under the caption Risk Factors in Item 1A of the

company’s Annual Report on Form 10-K for the year ended February 3,

2024, which information is incorporated by reference herein and

updated by the company’s Quarterly Reports on Form 10-Q. The

company does not undertake any obligation or plan to update these

forward-looking statements, even though its situation may

change.

SCHEDULE 1

CALERES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

EARNINGS

(Unaudited)

Thirteen Weeks Ended

($ thousands, except per share data)

May 4, 2024

April 29, 2023

Net sales

$

659,198

$

662,734

Cost of goods sold

350,103

360,052

Gross profit

309,095

302,682

Selling and administrative expenses

266,337

253,095

Operating earnings

42,758

49,587

Interest expense, net

(3,778

)

(5,623

)

Other income, net

992

1,492

Earnings before income taxes

39,972

45,456

Income tax provision

(9,174

)

(10,664

)

Net earnings

30,798

34,792

Net (loss) earnings attributable to

noncontrolling interests

(141

)

65

Net earnings attributable to Caleres,

Inc.

$

30,939

$

34,727

Basic earnings per common share

attributable to Caleres, Inc. shareholders

$

0.88

$

0.97

Diluted earnings per common share

attributable to Caleres, Inc. shareholders

$

0.88

$

0.97

SCHEDULE 2

CALERES, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

($ thousands)

May 4, 2024

April 29, 2023

ASSETS

Cash and cash equivalents

$

30,709

$

36,151

Receivables, net

164,865

148,068

Inventories, net

530,570

559,467

Property and equipment, held for sale

16,777

16,777

Prepaid expenses and other current

assets

62,415

60,417

Total current assets

805,336

820,880

Lease right-of-use assets

565,822

513,817

Property and equipment, net

168,154

157,730

Goodwill and intangible assets, net

200,551

212,353

Other assets

121,247

113,303

Total assets

$

1,861,110

$

1,818,083

LIABILITIES AND EQUITY

Borrowings under revolving credit

agreement

$

191,000

$

291,500

Trade accounts payable

267,388

261,753

Lease obligations

120,872

136,297

Other accrued expenses

185,105

189,727

Total current liabilities

764,365

879,277

Noncurrent lease obligations

482,163

437,171

Other liabilities

37,553

49,754

Total other liabilities

519,716

486,925

Total Caleres, Inc. shareholders’

equity

570,304

446,317

Noncontrolling interests

6,725

5,564

Total equity

577,029

451,881

Total liabilities and equity

$

1,861,110

$

1,818,083

SCHEDULE 3

CALERES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

Thirteen Weeks Ended

($ thousands)

May 4, 2024

April 29, 2023

OPERATING ACTIVITIES:

Net cash provided by operating

activities

$

36,074

$

37,497

INVESTING ACTIVITIES:

Purchases of property and equipment

(9,802

)

(5,750

)

Capitalized software

(524

)

(798

)

Net cash used for investing activities

(10,326

)

(6,548

)

FINANCING ACTIVITIES:

Borrowings under revolving credit

agreement

118,500

126,000

Repayments under revolving credit

agreement

(109,500

)

(142,000

)

Dividends paid

(2,442

)

(2,482

)

Acquisition of treasury stock

(15,070

)

—

Issuance of common stock under share-based

plans, net

(7,847

)

(10,006

)

Net cash used for financing activities

(16,359

)

(28,488

)

Effect of exchange rate changes on cash

and cash equivalents

(38

)

(10

)

Increase in cash and cash equivalents

9,351

2,451

Cash and cash equivalents at beginning of

period

21,358

33,700

Cash and cash equivalents at end of

period

$

30,709

$

36,151

SCHEDULE 4

CALERES, INC.

SUMMARY FINANCIAL RESULTS BY

SEGMENT

SUMMARY FINANCIAL

RESULTS

(Unaudited)

Thirteen Weeks Ended

Famous Footwear

Brand Portfolio

Eliminations and Other

Consolidated

May 4,

April 29,

May 4,

April 29,

May 4,

April 29,

May 4,

April 29,

($ thousands)

2024

2023

2024

2023

2024

2023

2024

2023

Net sales

$

349,553

$

349,158

$

317,211

$

325,516

$

(7,566

)

$

(11,940

)

$

659,198

$

662,734

Gross profit

161,005

159,133

147,812

143,858

278

(309

)

309,095

302,682

Gross margin

46.1

%

45.6

%

46.6

%

44.2

%

(3.7

)%

2.6

%

46.9

%

45.7

%

Operating earnings (loss)

16,855

17,056

41,425

42,669

(15,522

)

(10,138

)

42,758

49,587

Operating margin

4.8

%

4.9

%

13.1

%

13.1

%

n/m

%

n/m

%

6.5

%

7.5

%

Comparable sales % (on a 13-week

basis)

(2.3

)%

(8.5

)%

0.1

%

9.4

%

—

%

—

%

—

%

—

%

Number of stores

855

866

99

93

—

—

954

959

n/m – Not meaningful

SCHEDULE 5

CALERES, INC.

BASIC AND DILUTED EARNINGS PER SHARE

RECONCILIATION

(Unaudited)

Thirteen Weeks Ended

May 4, 2024

April 29, 2023

($ thousands, except per share data)

Net earnings attributable to Caleres,

Inc.:

Net earnings

$

30,798

$

34,792

Net loss (earnings) attributable to

noncontrolling interests

141

(65

)

Net earnings attributable to Caleres,

Inc.

30,939

34,727

Net earnings allocated to participating

securities

(1,208

)

(1,478

)

Net earnings attributable to Caleres, Inc.

after allocation of earnings to participating securities

$

29,731

$

33,249

Basic and diluted common shares

attributable to Caleres, Inc.:

Basic common shares

33,793

34,407

Dilutive effect of share-based awards

106

—

Diluted common shares attributable to

Caleres, Inc.

33,899

34,407

Basic earnings per common share

attributable to Caleres, Inc. shareholders

$

0.88

$

0.97

Diluted earnings per common share

attributable to Caleres, Inc. shareholders

$

0.88

$

0.97

SCHEDULE 6

CALERES, INC.

CALCULATION OF EBITDA AND DEBT/EBITDA

LEVERAGE RATIO (NON-GAAP METRICS)

(Unaudited)

Thirteen Weeks Ended

($ thousands)

May 4, 2024

April 29, 2023

EBITDA:

Net earnings attributable to Caleres,

Inc.

$

30,939

$

34,727

Income tax provision

9,174

10,664

Interest expense, net

3,778

5,623

Depreciation and amortization (1)

13,490

12,714

EBITDA

$

57,381

$

63,728

EBITDA margin

8.7

%

9.6

%

(Unaudited)

Trailing Twelve Months Ended

($ thousands)

May 4, 2024

April 29, 2023

EBITDA:

Net earnings attributable to Caleres,

Inc.

$

167,603

$

165,960

Income tax provision

8,000

26,670

Interest expense, net

17,498

17,588

Depreciation and amortization (1)

54,056

49,368

EBITDA

$

247,157

$

259,586

EBITDA margin

8.8

%

9.0

%

(Unaudited)

($ thousands)

May 4, 2024

April 29, 2023

Debt/EBITDA leverage ratio:

Borrowings under revolving credit

agreement (2)

$

191,000

$

291,500

EBITDA (trailing twelve months)

247,157

259,586

Debt/EBITDA

0.8

1.1

__________________________________

(1)

Includes depreciation and amortization of

capitalized software and intangible assets.

(2)

Total availability under the revolving

credit agreement was $299.6 million and $197.9 million as of May 4,

2024 and April 29, 2023, respectively. Total liquidity, which

includes cash and cash equivalents and availability under the

revolving credit agreement, was $330.3 million and $234.0 million

for the respective periods.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240529537132/en/

Investor Contact: Logan Bonacorsi

lbonacorsi@caleres.com

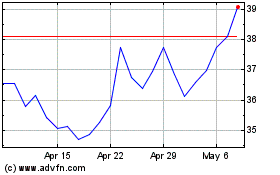

Caleres (NYSE:CAL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Caleres (NYSE:CAL)

Historical Stock Chart

From Feb 2024 to Feb 2025