- Generates fourth quarter earnings per share of $1.57 and

adjusted earnings per share of $0.86, up 32% year over year

- Achieves third consecutive year of adjusted earnings per share

in excess of $4.00 baseline

- Delivers fourth quarter sales growth and record adjusted

operating earnings in Brand Portfolio segment

- Reduces revolver borrowings by $40 million compared to third

quarter 2023 and more than $125 million from fiscal 2022

- Expects fiscal 2024 net sales to be flat to up 2 percent

compared to fiscal 2023

- Expects fiscal 2024 earnings per share of $4.30 to $4.60

Caleres (NYSE: CAL), a market-leading portfolio of

consumer-driven footwear brands, today reported financial results

for the fourth quarter and fiscal 2023 and provided guidance for

fiscal 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240318757386/en/

Caleres Brand Portfolio Lead Brands --

Sam Edelman, Allen Edmonds, Naturalizer, and Vionic.(Graphic:

Business Wire)

“The Caleres team delivered another strong operational

performance in the fourth quarter, culminating in a third

consecutive year of adjusted earnings per share in excess of our

$4.00 baseline and underscoring the durability of our earnings

power,” said Jay Schmidt, president and chief executive officer.

“Our fourth quarter results were led by our Brand Portfolio, which

achieved a record-setting performance across key financial metrics.

Complementing that strong result, Famous Footwear leaned into its

competitive advantages to expand market share, particularly in

Kids, which has outpaced the total business for 12 straight

quarters.”

Specifically, during the quarter, the Brand Portfolio

capitalized on ongoing strength in its Lead Brands to power a

4.5-percent increase in year-over-year net sales and a

660-basis-point improvement in gross margin. The Brand Portfolio

segment also delivered its best-ever annual adjusted operating

earnings, which topped $148 million and was accompanied by an

11.7-percent adjusted return on sales. Notably, the segment led the

financial performance of the company. At the same time, Famous

Footwear navigated a competitive market environment, capitalizing

on pockets of holiday demand and delivering positive sales trends

in its Kids business. For the full year, Famous gained share in

shoe chains in the important Family Channel and achieved record

annual sales in the Kids category while generating robust levels of

cash flow.

“I am proud of the Caleres team and the tremendous progress we

have made across a wide range of strategic objectives,” said

Schmidt. “The transformation in earnings power that we have

achieved in recent years – combined with our value-driving

organizational structure, powerful brands, and best-in-class

capabilities – positions us exceptionally well for growth in 2024

and beyond. Our Brand Portfolio – powered by our Lead Brands – has

tremendous growth potential, and Famous is poised to strengthen its

position as the No. 1 footwear destination for the Millennial

family. Looking ahead, we are confident in our ability to execute

on our growth strategy, deliver on our long-term financial targets,

and create sustained value for our shareholders.”

Fourth Quarter 2023 Results

(14-weeks ended February 3, 2024, compared to 13-weeks

ended January 28, 2023)

- Net sales were $697.1 million, up 0.1 percent from the fourth

quarter of 2022;

- Famous Footwear segment net sales declined 1.5 percent, with

comparable sales down 5.9 percent on a 13-week basis

- Brand Portfolio segment net sales increased 4.5 percent

- Direct-to-consumer sales represented approximately 74 percent

of total net sales

- Gross profit was $305.7 million, while gross margin was 43.9

percent;

- Famous Footwear segment gross margin of 42.9 percent

- Brand Portfolio segment gross margin of 42.6 percent

- SG&A as a percentage of net sales was 39.1 percent;

- Net earnings of $55.8 million, or earnings per diluted share of

$1.57, compared to net earnings of $40.8 million, or earnings per

diluted share of $1.13 in the fourth quarter of fiscal 2022.

Earnings per diluted share of $1.57 include:

- Deferred tax valuation allowance releases of $0.76 per diluted

share; and

- Expense reduction initiatives of ($0.05) per diluted

share.

- Adjusted net earnings of $30.8 million, or adjusted earnings

per diluted share of $0.86, compared to adjusted net earnings of

$23.4 million, or adjusted earnings per diluted share of $0.65 in

the fourth quarter of fiscal 2022.

Fiscal Year 2023 Results

(53-weeks ended February 3, 2024, compared to 52-weeks

ended January 28, 2023)

- Net sales were $2.82 billion, down 5.1 percent from fiscal

2022;

- Famous Footwear segment net sales declined 5.6 percent, with

comparable sales down 6.3 percent on a 52-week basis

- Brand Portfolio segment net sales declined 3.9 percent

- Direct-to-consumer sales represented approximately 72 percent

of total net sales

- Gross profit was $1.26 billion, while gross margin was 44.8

percent;

- Famous Footwear segment gross margin of 44.7 percent

- Brand Portfolio segment gross margin of 43.0 percent

- SG&A as a percentage of net sales was 37.7 percent;

- Net earnings of $171.4 million, or earnings per diluted share

of $4.80, compared to net earnings of $181.7 million, or earnings

per diluted share of $4.92 in fiscal 2022. Earnings of $4.80 per

diluted share include:

- Deferred tax valuation allowance releases of $0.75 per diluted

share; and

- Expense reduction initiatives of ($0.13) per diluted share

- Adjusted net earnings of $149.3 million, or adjusted earnings

per diluted share of $4.18, compared to adjusted net earnings of

$167.1 million, or adjusted earnings per diluted share of $4.52 in

fiscal 2022;

- Earnings before interest, taxes, depreciation, and amortization

(EBITDA) of $253.5 million and adjusted EBITDA of $259.6 million,

or 9.2 percent of sales;

- Inventory was down 6.8 percent compared to fiscal year-end

2022, due to strategic inventory management – primarily in the

Brand Portfolio segment; and

- Borrowings under the asset-based revolving credit facility were

$182.0 million at the end of the period.

Fiscal 2023 Benefit from 53rd

Week

Consolidated net sales

$25.0 million

Famous Footwear sales

$18.2 million

Brand Portfolio sales

$6.8 million

Capital Allocation Update

Caleres continued to reduce the borrowings under its asset-based

revolving credit facility, paying down $40.0 million during the

fourth quarter. The company also returned $2.5 million to

shareholders through its quarterly dividend.

In fiscal 2023, Caleres continued to invest in value-driving

growth opportunities while at the same time reduced short-term

borrowings by $125.5 million. The company ended fiscal 2023 with

$182.0 million of borrowings. This represents its lowest total

indebtedness since the fiscal first quarter 2010. In addition,

Caleres returned $27.4 million to shareholders through share

repurchases and dividend payments. Specifically, the company

repurchased 763,000 shares of common stock, or approximately 2

percent of shares outstanding, for $17.4 million and an average

price of $22.86 per share. The company returned $10.0 million to

shareholders through quarterly dividend payments.

Fiscal 2024 Outlook:

The company is introducing its financial outlook for fiscal 2024

and first quarter of 2024 and notes that its fiscal 2024 is a

52-week year and compares to a 53-week year in fiscal 2023.

Caleres expects consolidated net sales to be flat to up 2

percent, compared to 2023, and earnings per diluted share to be in

the range of $4.30 to $4.60. This outlook considers and balances

the positive momentum in our Brand Portfolio segment and ongoing

companywide cost reduction initiatives against anticipated

headwinds that include a forecasted decline in the footwear market,

inflationary pressures that could affect consumer demand at Famous

Footwear, and higher freight costs.

In addition, for fiscal 2024, the company expects:

- Consolidated operating margin of 7.3 percent to 7.5

percent;

- Effective tax rate of about 24 percent; and

- Capital expenditures of $60 million to $70 million.

For first quarter 2024, the company expects:

- Consolidated net sales to be flat to up 1 percent; and

- Earnings per diluted share in line with fourth quarter 2023 on

an adjusted basis.

Investor Conference Call

Caleres will host a conference call at 10:00 a.m. ET today,

Tuesday, March 19. The webcast and associated slides will be

available at investor.caleres.com/news/events. A live conference

call will be available at (877) 704-4453 for North America

participants or (201) 389-0920 for international participants, no

passcode necessary. A replay will be also available at

investor.caleres.com/news/events/archive for a limited period.

Investors may also access the replay by dialing (844) 512-2921 in

North America or (412) 317-6671 internationally and using the

conference pin 13744814.

Definitions

All references in this press release, outside of the condensed

consolidated financial statements that follow, unless otherwise

noted, related to net earnings attributable to Caleres, Inc. and

diluted earnings per common share attributable to Caleres, Inc.

shareholders, are presented as net earnings and earnings per

diluted share, respectively.

Non-GAAP Financial Measures

In this press release, the company’s financial results are

provided both in accordance with generally accepted accounting

principles (GAAP) and using certain non-GAAP financial measures. In

particular, the company provides earnings before interest, taxes,

depreciation and amortization, and estimated and future operating

earnings, net earnings and earnings per diluted share, adjusted to

exclude certain gains, charges, and recoveries, which are non-GAAP

financial measures. These results are included as a complement to

results provided in accordance with GAAP because management

believes these non-GAAP financial measures help identify underlying

trends in the company’s business and provide useful information to

both management and investors by excluding certain items that may

not be indicative of the company’s core operating results. These

measures should not be considered a substitute for or superior to

GAAP results.

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995

This press release contains certain forward-looking statements

and expectations regarding the company’s future performance and the

performance of its brands. Such statements are subject to various

risks and uncertainties that could cause actual results to differ

materially. These risks include (i) changing consumer demands,

which may be influenced by general economic conditions and other

factors; (ii) inflationary pressures and supply chain disruptions

(iii) rapidly changing consumer preferences and purchasing patterns

and fashion trends; (iv) supplier concentration, customer

concentration and increased consolidation in the retail industry;

(v) intense competition within the footwear industry; (vi) foreign

currency fluctuations; (vii) political and economic conditions or

other threats to the continued and uninterrupted flow of inventory

from China and other countries, where the company relies heavily on

third-party manufacturing facilities for a significant amount of

its inventory; (viii) cybersecurity threats or other major

disruption to the company’s information technology systems; (ix)

the ability to accurately forecast sales and manage inventory

levels; (x) a disruption in the company’s distribution centers;

(xi) the ability to recruit and retain senior management and other

key associates; (xii) the ability to secure/exit leases on

favorable terms; (xiii) the ability to maintain relationships with

current suppliers; (xiv) transitional challenges with acquisitions

and divestitures; (xv) changes to tax laws, policies and treaties;

(xvi) our commitments and shareholder expectations related to

environmental, social and governance considerations; (xvii)

compliance with applicable laws and standards with respect to

labor, trade and product safety issues; and (xviii) the ability to

attract, retain, and maintain good relationships with licensors and

protect our intellectual property rights. The company's reports to

the Securities and Exchange Commission contain detailed information

relating to such factors, including, without limitation, the

information under the caption Risk Factors in Item 1A of the

company’s Annual Report on Form 10-K for the year ended January 28,

2023, which information is incorporated by reference herein and

updated by the company’s Quarterly Reports on Form 10-Q. The

company does not undertake any obligation or plan to update these

forward-looking statements, even though its situation may

change.

SCHEDULE 1

CALERES, INC. CONDENSED CONSOLIDATED STATEMENTS OF

EARNINGS

(Unaudited)

Fourteen Weeks Ended

Thirteen Weeks Ended

Fifty-three Weeks Ended

Fifty-two Weeks Ended

($ thousands, except per share data)

February 3, 2024

January 28, 2023

February 3, 2024

January 28, 2023

Net sales

$

697,123

$

696,434

$

2,817,294

$

2,968,138

Cost of goods sold

391,395

415,246

1,554,337

1,683,265

Gross profit

305,728

281,188

1,262,957

1,284,873

Selling and administrative expenses

272,830

255,323

1,062,399

1,067,636

Restructuring and other special charges,

net

2,151

—

6,103

2,910

Operating earnings

30,747

25,865

194,455

214,327

Interest expense, net

(4,103

)

(5,378

)

(19,343

)

(14,264

)

Other income, net

1,550

3,335

6,210

12,971

Earnings before income taxes

28,194

23,822

181,322

213,034

Income tax benefit (provision)

27,466

15,343

(9,490

)

(33,339

)

Net earnings

55,660

39,165

171,832

179,695

Net (loss) earnings attributable to

noncontrolling interests

(148

)

(1,643

)

441

(2,047

)

Net earnings attributable to Caleres,

Inc.

$

55,808

$

40,808

$

171,391

$

181,742

Basic earnings per common share

attributable to Caleres, Inc. shareholders

$

1.57

$

1.14

$

4.80

$

4.98

Diluted earnings per common share

attributable to Caleres, Inc. shareholders

$

1.57

$

1.13

$

4.80

$

4.92

SCHEDULE 2

CALERES, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

($ thousands)

February 3, 2024

January 28, 2023

ASSETS

Cash and cash equivalents

$

21,358

$

33,700

Receivables, net

140,400

132,802

Inventories, net

540,674

580,215

Property and equipment, held for sale

16,777

16,777

Prepaid expenses and other current

assets

69,700

67,961

Total current assets

788,909

831,455

Lease right-of-use assets

528,029

518,196

Property and equipment, net

167,583

160,883

Goodwill and intangible assets, net

203,310

215,392

Other assets

116,915

110,546

Total assets

$

1,804,746

$

1,836,472

LIABILITIES AND EQUITY

Borrowings under revolving credit

agreement

$

182,000

$

307,500

Trade accounts payable

251,912

229,908

Lease obligations

112,764

136,051

Other accrued expenses

196,280

237,737

Total current liabilities

742,956

911,196

Noncurrent lease obligations

453,097

444,074

Other liabilities

41,123

55,089

Total other liabilities

494,220

499,163

Total Caleres, Inc. shareholders’

equity

560,631

420,683

Noncontrolling interests

6,939

5,430

Total equity

567,570

426,113

Total liabilities and equity

$

1,804,746

$

1,836,472

SCHEDULE 3

CALERES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

Fifty-three Weeks Ended

Fifty-two Weeks Ended

($ thousands)

February 3, 2024

January 28, 2023

OPERATING ACTIVITIES:

Net cash provided by operating

activities

$

200,151

$

125,879

INVESTING ACTIVITIES:

Purchases of property and equipment

(44,584

)

(55,913

)

Capitalized software

(5,034

)

(8,124

)

Net cash used for investing activities

(49,618

)

(64,037

)

FINANCING ACTIVITIES:

Borrowings under revolving credit

agreement

532,500

859,500

Repayments under revolving credit

agreement

(658,000

)

(842,000

)

Dividends paid

(9,954

)

(10,184

)

Acquisition of treasury stock

(17,445

)

(63,225

)

Issuance of common stock under share-based

plans, net

(11,094

)

(5,387

)

Contributions by noncontrolling

interests

1,000

3,142

Net cash used for financing activities

(162,993

)

(58,154

)

Effect of exchange rate changes on cash

and cash equivalents

118

(103

)

(Decrease) increase in cash and cash

equivalents

(12,342

)

3,585

Cash and cash equivalents at beginning of

period

33,700

30,115

Cash and cash equivalents at end of

period

$

21,358

$

33,700

SCHEDULE 4

CALERES, INC. RECONCILIATION OF

NET EARNINGS AND DILUTED EARNINGS PER SHARE (GAAP BASIS) TO

ADJUSTED NET EARNINGS AND ADJUSTED DILUTED EARNINGS PER SHARE

(NON-GAAP BASIS)

(Unaudited)

Fourteen Weeks Ended

Thirteen Weeks Ended

February 3, 2024

January 28, 2023

($ thousands, except per share data)

Pre-Tax Impact of Charges/Other

Items

Net Earnings Attributable to

Caleres, Inc.

Diluted Earnings Per Share

Pre-Tax Impact of Charges/Other

Items

Net Earnings Attributable to

Caleres, Inc.

Diluted Earnings Per Share

GAAP earnings

$

55,808

$

1.57

$

40,808

$

1.13

Charges/other

items:

Deferred tax valuation allowances

adjustment

$

—

(26,654

)

(0.76

)

$

—

(17,374

)

(0.48

)

Expense reduction initiatives

2,151

1,597

0.05

—

—

—

Total charges/other items

$

2,151

$

(25,057

)

$

(0.71

)

$

—

$

(17,374

)

$

(0.48

)

Adjusted earnings

$

30,751

$

0.86

$

23,434

$

0.65

(Unaudited)

Fifty-three Weeks Ended

Fifty-two Weeks Ended

February 3, 2024

January 28, 2023

Pre-Tax

Net Earnings

Pre-Tax

Net Earnings

Impact of

Attributable

Diluted

Impact of

Attributable

Diluted

Charges/Other

to Caleres,

Earnings

Charges/Other

to Caleres,

Earnings

($ thousands, except per share data)

Items

Inc.

Per Share

Items

Inc.

Per Share

GAAP earnings

$

171,391

$

4.80

$

181,742

$

4.92

Charges/other

items:

Deferred tax valuation allowance

adjustment

$

—

(26,654

)

(0.75

)

$

—

(17,374

)

(0.47

)

Expense reduction initiatives

6,103

4,532

0.13

—

—

—

Organizational changes

—

—

—

2,910

2,723

0.07

Total charges/other items

$

6,103

$

(22,122

)

$

(0.62

)

$

2,910

$

(14,651

)

$

(0.40

)

Adjusted earnings

$

149,269

$

4.18

$

167,091

$

4.52

SCHEDULE 5

CALERES, INC.

SUMMARY FINANCIAL RESULTS BY

SEGMENT

SUMMARY FINANCIAL

RESULTS

(Unaudited)

Famous Footwear

Brand Portfolio

Eliminations and Other

Consolidated

14 weeks ended

13 weeks ended

14 weeks ended

13 weeks ended

14 weeks ended

13 weeks ended

14 weeks ended

13 weeks ended

February 3,

January 28,

February 3,

January 28,

February 3,

January 28,

February 3,

January 28,

($ thousands)

2024

2023

2024

2023

2024

2023

2024

2023

Net sales

$

396,227

$

402,265

$

323,689

$

309,729

$

(22,793

)

$

(15,560

)

$

697,123

$

696,434

Gross profit

170,129

170,562

137,868

111,465

(2,269

)

(839

)

305,728

281,188

Gross margin

42.9

%

42.4

%

42.6

%

36.0

%

10.0

%

5.4

%

43.9

%

40.4

%

Operating earnings (loss)

19,551

24,386

37,751

19,281

(26,555

)

(17,802

)

30,747

25,865

Adjusted operating earnings (loss)

19,551

24,386

38,634

19,281

(25,287

)

(17,802

)

32,898

25,865

Operating margin

4.9

%

6.1

%

11.7

%

6.2

%

n/m

%

n/m

%

4.4

%

3.7

%

Adjusted operating earnings %

4.9

%

6.1

%

11.9

%

6.2

%

n/m

%

n/m

%

4.7

%

3.7

%

Comparable sales % (on a 13-week

basis)

(5.9

)%

0.7

%

(3.8

)%

20.4

%

—

%

—

%

—

%

—

%

Number of stores

860

873

98

92

—

—

958

965

n/m – Not meaningful

RECONCILIATION OF ADJUSTED

RESULTS (NON-GAAP)

(Unaudited)

Famous Footwear

Brand Portfolio

Eliminations and Other

Consolidated

14 weeks ended

13 weeks ended

14 weeks ended

13 weeks ended

14 weeks ended

13 weeks ended

14 weeks ended

13 weeks ended

February 3,

January 28,

February 3,

January 28,

February 3,

January 28,

February 3,

January 28,

($ thousands)

2024

2023

2024

2023

2024

2023

2024

2023

Operating earnings (loss)

$

19,551

$

24,386

$

37,751

$

19,281

$

(26,555

)

$

(17,802

)

$

30,747

$

25,865

Charges/Other

Items:

Expense reduction initiatives

—

—

883

—

1,268

—

2,151

—

Total charges/other items

—

—

883

—

1,268

—

2,151

—

Adjusted operating earnings (loss)

$

19,551

$

24,386

$

38,634

$

19,281

$

(25,287

)

$

(17,802

)

$

32,898

$

25,865

SCHEDULE 5

CALERES, INC.

SUMMARY FINANCIAL RESULTS BY

SEGMENT

SUMMARY FINANCIAL

RESULTS

(Unaudited)

Famous Footwear

Brand Portfolio

Eliminations and Other

Consolidated

53 weeks ended

52 weeks ended

53 weeks ended

52 weeks ended

53 weeks ended

52 weeks ended

53 weeks ended

52 weeks ended

February 3,

January 28,

February 3,

January 28,

February 3,

January 28,

February 3,

January 28,

($ thousands)

2024

2023

2024

2023

2024

2023

2024

2023

Net sales

$

1,609,396

$

1,705,093

$

1,270,853

$

1,322,772

$

(62,955

)

$

(59,727

)

$

2,817,294

$

2,968,138

Gross profit

719,549

789,004

546,005

497,265

(2,597

)

(1,396

)

1,262,957

1,284,873

Gross profit rate

44.7

%

46.3

%

43.0

%

37.6

%

4.1

%

2.3

%

44.8

%

43.3

%

Operating earnings (loss)

123,838

195,837

145,459

112,345

(74,842

)

(93,855

)

194,455

214,327

Adjusted operating earnings (loss)

125,204

195,837

148,067

112,345

(72,713

)

(90,945

)

200,558

217,237

Operating earnings %

7.7

%

11.5

%

11.4

%

8.5

%

n/m%

n/m%

6.9

%

7.2

%

Adjusted operating earnings %

7.8

%

11.5

%

11.7

%

8.5

%

n/m%

n/m%

7.1

%

7.3

%

Comparable sales % (on a 52-week

basis)

(6.3

)%

(1.8

)%

1.3

%

31.4

%

—

%

—

%

—

%

—

%

Number of stores

860

873

98

92

—

—

958

965

n/m – Not meaningful

RECONCILIATION OF ADJUSTED RESULTS (NON-GAAP)

(Unaudited)

Famous Footwear

Brand Portfolio

Eliminations and Other

Consolidated

53 weeks ended

52 weeks ended

53 weeks ended

52 weeks ended

53 weeks ended

52 weeks ended

53 weeks ended

52 weeks ended

February 3,

January 28,

February 3,

January 28,

February 3,

January 28,

February 3,

January 28,

($ thousands)

2024

2023

2024

2023

2024

2023

2024

2023

Operating earnings (loss)

$

123,838

$

195,837

$

145,459

$

112,345

$

(74,842)

$

(93,855)

$

194,455

$

214,327

Charges/Other

Items:

Expense reduction initiatives

1,366

—

2,608

—

2,129

—

6,103

—

Organizational changes

—

—

—

—

—

2,910

—

2,910

Total charges/other items

1,366

—

2,608

—

2,129

2,910

6,103

2,910

Adjusted operating earnings (loss)

$

125,204

$

195,837

$

148,067

$

112,345

$

(72,713)

$

(90,945)

$

200,558

$

217,237

SCHEDULE 6

CALERES, INC.

BASIC AND DILUTED EARNINGS PER SHARE

RECONCILIATION

(Unaudited)

Fourteen Weeks Ended

Thirteen Weeks Ended

Fifty-three Weeks Ended

Fifty-two Weeks Ended

February 3,

January 28,

February 3,

January 28,

2024

2023

2024

2023

($ thousands, except per share data)

Net earnings attributable to Caleres,

Inc.:

Net earnings

$

55,660

$

39,165

$

171,832

$

179,695

Net loss (earnings) attributable to

noncontrolling interests

148

1,643

(441

)

2,047

Net earnings attributable to Caleres,

Inc.

55,808

40,808

171,391

181,742

Net earnings allocated to participating

securities

(2,414

)

(1,763

)

(7,517

)

(7,716

)

Net earnings attributable to Caleres, Inc.

after allocation of earnings to participating securities

$

53,394

$

39,045

$

163,874

$

174,026

Basic and diluted common shares

attributable to Caleres, Inc.:

Basic common shares

33,965

34,102

34,142

34,930

Dilutive effect of share-based awards

115

548

10

475

Diluted common shares attributable to

Caleres, Inc.

34,080

34,650

34,152

35,405

Basic earnings per common share

attributable to Caleres, Inc. shareholders

$

1.57

$

1.14

$

4.80

$

4.98

Diluted earnings per common share

attributable to Caleres, Inc. shareholders

$

1.57

$

1.13

$

4.80

$

4.92

SCHEDULE 7

CALERES, INC.

BASIC AND DILUTED ADJUSTED EARNINGS PER

SHARE RECONCILIATION

(Unaudited)

Fourteen Weeks Ended

Thirteen Weeks Ended

Fifty-three Weeks Ended

Fifty-two Weeks Ended

February 3,

January 28,

February 3,

January 28,

2024

2023

2024

2023

($ thousands, except per share data)

Adjusted net earnings attributable to

Caleres, Inc.:

Adjusted net earnings

$

30,603

$

21,791

$

149,710

$

165,044

Net loss (earnings) attributable to

noncontrolling interests

148

1,643

(441

)

2,047

Adjusted net earnings attributable to

Caleres, Inc.

30,751

23,434

149,269

167,091

Net earnings allocated to participating

securities

(1,324

)

(1,012

)

(6,537

)

(7,092

)

Adjusted net earnings attributable to

Caleres, Inc. after allocation of earnings to participating

securities

$

29,427

$

22,422

$

142,732

$

159,999

Basic and diluted common shares

attributable to Caleres, Inc.:

Basic common shares

33,965

34,102

34,142

34,930

Dilutive effect of share-based awards

115

548

10

475

Diluted common shares attributable to

Caleres, Inc.

34,080

34,650

34,152

35,405

Basic adjusted earnings per common share

attributable to Caleres, Inc. shareholders

$

0.87

$

0.66

$

4.18

$

4.58

Diluted adjusted earnings per common share

attributable to Caleres, Inc. shareholders

$

0.86

$

0.65

$

4.18

$

4.52

SCHEDULE 8

CALERES, INC.

CALCULATION OF EBITDA AND DEBT/EBITDA

LEVERAGE RATIO (NON-GAAP METRICS)

(Unaudited)

Fourteen Weeks Ended

Thirteen Weeks Ended

($ thousands)

February 3, 2024

January 28, 2023

EBITDA:

Net earnings attributable to Caleres,

Inc.

$

55,808

$

40,808

Income tax benefit

(27,466

)

(15,343

)

Interest expense, net

4,103

5,378

Depreciation and amortization (1)

14,875

12,317

EBITDA

$

47,320

$

43,160

EBITDA margin

6.8

%

6.2

%

Adjusted EBITDA:

Adjusted net earnings attributable to

Caleres, Inc. (2)

$

30,751

$

23,434

Income tax (benefit) provision (3)

(258

)

2,031

Interest expense, net

4,103

5,378

Depreciation and amortization (1)

14,875

12,317

Adjusted EBITDA

$

49,471

$

43,160

Adjusted EBITDA margin

7.1

%

6.2

%

(Unaudited)

Trailing Twelve Months Ended

($ thousands)

February 3, 2024

January 28, 2023

EBITDA:

Net earnings attributable to Caleres,

Inc.

$

171,391

$

181,742

Income tax provision

9,490

33,339

Interest expense, net

19,343

14,264

Depreciation and amortization (1)

53,280

49,011

EBITDA

$

253,504

$

278,356

EBITDA margin

9.0

%

9.4

%

Adjusted EBITDA:

Adjusted net earnings attributable to

Caleres, Inc. (2)

$

149,269

$

167,091

Income tax provision (3)

37,715

50,900

Interest expense, net

19,343

14,264

Depreciation and amortization (1)

53,280

49,011

Adjusted EBITDA

$

259,607

$

281,266

Adjusted EBITDA margin

9.2

%

9.5

%

(Unaudited)

($ thousands)

February 3, 2024

January 28, 2023

Debt/EBITDA leverage ratio:

Borrowings under revolving credit

agreement (4)

$

182,000

$

307,500

EBITDA (trailing twelve months)

253,504

278,356

Debt/EBITDA

0.7

1.1

______________________________

(1)

Includes depreciation and amortization of

capitalized software and intangible assets.

(2)

Refer to Schedule 4 for the consolidated

reconciliation of net earnings attributable to Caleres, Inc. to

adjusted net earnings attributable to Caleres, Inc.

(3)

Excludes the income tax impacts of the

adjustments on Schedule 4.

(4)

Total availability under the revolving

credit agreement was $308.5 million and $181.9 million as of

February 3, 2024 and January 28, 2023, respectively. Total

liquidity, which includes cash and cash equivalents and

availability under the revolving credit agreement, was $329.9

million and $215.6 million for the respective periods.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240318757386/en/

Logan Bonacorsi lbonacorsi@caleres.com

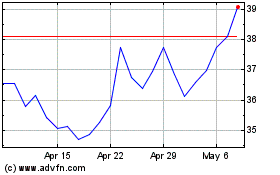

Caleres (NYSE:CAL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Caleres (NYSE:CAL)

Historical Stock Chart

From Jan 2024 to Jan 2025