Statement of Changes in Beneficial Ownership (4)

September 15 2021 - 6:37PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

SIEBEL THOMAS M |

2. Issuer Name and Ticker or Trading Symbol

C3.ai, Inc.

[

AI

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Executive Officer |

|

(Last)

(First)

(Middle)

C/O C3.AI, INC., 1300 SEAPORT BLVD, SUITE 500 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/13/2021 |

|

(Street)

REDWOOD CITY, CA 94603

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 9/13/2021 | | S(1) | | 98698 | D | $48.71 (2) | 5138629 | I | See Footnote (3) |

| Class A Common Stock | 9/13/2021 | | S(1) | | 197253 | D | $49.52 (4) | 4941376 | I | See Footnote (3) |

| Class A Common Stock | 9/13/2021 | | S(1) | | 41415 | D | $50.30 (5) | 4899961 | I | See Footnote (3) |

| Class A Common Stock | 9/14/2021 | | S(1) | | 205650 | D | $48.62 (6) | 4694311 | I | See Footnote (3) |

| Class A Common Stock | 9/14/2021 | | S(1) | | 22450 | D | $49.42 (7) | 4671861 | I | See Footnote (3) |

| Class A Common Stock | 9/15/2021 | | S(1) | | 29466 | D | $48.57 (8) | 4642395 | I | See Footnote (3) |

| Class A Common Stock | 9/15/2021 | | S(1) | | 23334 | D | $49.19 (9) | 4619061 | I | See Footnote (3) |

| Class A Common Stock | 9/15/2021 | | S(1) | | 17300 | D | $50.27 (10) | 4061761 | I | See Footnote (3) |

| Class A Common Stock | 9/15/2021 | | S(1) | | 5300 | D | $50.95 (11) | 4596461 | I | See Footnote (3) |

| Class A Common Stock | | | | | | | | 1756390 | D | |

| Class A Common Stock | | | | | | | | 9216 | I | See Footnote (12) |

| Class A Common Stock | | | | | | | | 170294 | I | See Footnote (13) |

| Class A Common Stock | | | | | | | | 72695 | I | See Footnote (14) |

| Class A Common Stock | | | | | | | | 1237115 | I | See Footnote (15) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Transaction pursuant to a previously established Rule 10b5-1 Plan. |

| (2) | Represents weighted average sales price. The shares were sold at prices ranging from $48.04 to $49.0375. The Reporting Person will provide upon request, to the SEC, the Issuer or security holder of the Issuer, full information regarding the number of shares sold at each separate price. |

| (3) | The shares are held by The Siebel Living Trust u/a/d 7/27/93, as amended, of which the Reporting Person is trustee. |

| (4) | Represents weighted average sales price. The shares were sold at prices ranging from $49.04 to $50.035. The Reporting Person will provide upon request, to the SEC, the Issuer or security holder of the Issuer, full information regarding the number of shares sold at each separate price. |

| (5) | Represents weighted average sales price. The shares were sold at prices ranging from $50.04 to $50.55. The Reporting Person will provide upon request, to the SEC, the Issuer or security holder of the Issuer, full information regarding the number of shares sold at each separate price. |

| (6) | Represents weighted average sales price. The shares were sold at prices ranging from $48.185 to $49.18. The Reporting Person will provide upon request, to the SEC, the Issuer or security holder of the Issuer, full information regarding the number of shares sold at each separate price. |

| (7) | Represents weighted average sales price. The shares were sold at prices ranging from $49.1875 to $49.805. The Reporting Person will provide upon request, to the SEC, the Issuer or security holder of the Issuer, full information regarding the number of shares sold at each separate price. |

| (8) | Represents weighted average sales price. The shares were sold at prices ranging from $47.85 to $48.835. The Reporting Person will provide upon request, to the SEC, the Issuer or security holder of the Issuer, full information regarding the number of shares sold at each separate price. |

| (9) | Represents weighted average sales price. The shares were sold at prices ranging from $48.84 to $49.82. The Reporting Person will provide upon request, to the SEC, the Issuer or security holder of the Issuer, full information regarding the number of shares sold at each separate price. |

| (10) | Represents weighted average sales price. The shares were sold at prices ranging from $49.84 to $50.8375. The Reporting Person will provide upon request, to the SEC, the Issuer or security holder of the Issuer, full information regarding the number of shares sold at each separate price. |

| (11) | Represents weighted average sales price. The shares were sold at prices ranging from $50.84 to $51.15. The Reporting Person will provide upon request, to the SEC, the Issuer or security holder of the Issuer, full information regarding the number of shares sold at each separate price. |

| (12) | The shares are held by First Virtual Holdings, LLC, of which the Reporting Person is Chairman. |

| (13) | The shares are held by Siebel Asset Management, L.P., of which the Reporting Person is the general partner. |

| (14) | The shares are held by Siebel Asset Management III, L.P., of which the Reporting Person is the general partner. |

| (15) | The shares are held by The Siebel 2011 Irrevocable Children's Trust, of which the Reporting Person is co-trustee. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

SIEBEL THOMAS M

C/O C3.AI, INC.

1300 SEAPORT BLVD, SUITE 500

REDWOOD CITY, CA 94603 | X | X | Chief Executive Officer |

|

Signatures

|

| /s/ Brady Mickelsen, Attorney-in-Fact | | 9/15/2021 |

| **Signature of Reporting Person | Date |

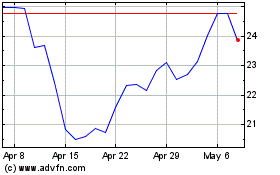

C3 AI (NYSE:AI)

Historical Stock Chart

From Jun 2024 to Jul 2024

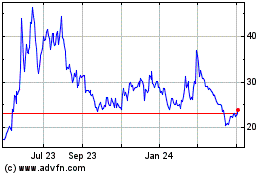

C3 AI (NYSE:AI)

Historical Stock Chart

From Jul 2023 to Jul 2024