Regulatory News:

Air Liquide (Paris:AI)

H1 2017 Key figures

H1 2017 highlights

As published(1)

-- Group Revenue

10,293 million euros

+28.4%

-- New contracts: long-term

contracts in Belgium forsteelmaking, in China for fiber optics and

electronics, inOman for petrochemicals; major Engineering

&Construction contract in China for the energy sector.

-- Net Income (Group share)

928 million euros

-- Cash Flows after changes in

WCR

+14.5%

+31.2%

-- Industrial Merchant

recovering.

-- Business portfolio management:

sale of Air LiquideWelding to Lincoln Electric expected to be

finalized July 31,and acquisitions in Healthcare (France and

Colombia).

Adjusted growth(2)

-- Group revenue

-- Gas & Services revenue

+5.7%

+6.9%

-- Innovation: 3 new investments in

start-ups and initiativesin the field of diabetes.

Comparable growth(3)

-- Gas & Services revenue

-- Group operating margin

+2.8%

+70 bps(4)

1) 2016 restated, Welding and Diving

activities reported as discontinued operations.

2) Variation H1 2017 vs. restated H1 2016,

adjusted as if on January 1, 2016 Airgas had been fully

consolidated and the divestments required by US competition

regulators had been completed.

3) Variation H1 2017 vs. adjusted H1 2016,

excluding currency and energy (natural gas and electricity)

impacts.

4) Excluding energy impact, vs adjusted H1

2016.

Commenting on the first six months of 2017, Benoît Potier,

Chairman and CEO of Air Liquide, said:

"The Group's performance in the first half of 2017 was solid,

with further growth in revenue and net profit, as well as an

improvement in the operating margin. Sales benefited from the end

of the Airgas consolidation effect and positive currency and energy

impacts.

The Gas & Services business continued to improve during

the first half of the year, benefiting from the confirmed recovery

in Industrial Merchant, strong volumes in Large Industries, a good

underlying level of activity in Electronics, and continuous

development in Healthcare. Global Markets & Technologies sales

continued to grow by double digits. Geographically, all regions are

generating growth, with Industrial Merchant and Healthcare

activities particularly dynamic in developing economies.

The Group's operational performance also improved further in

the first half of 2017: the new efficiencies and synergies

associated with Airgas contributed to the higher operating margin

and net profit. Lastly, the Group's balance sheet remains robust,

benefiting from strong growth in cash flows and well controlled

debt.

Investment decisions continued during the first half of the

year, and the Group can rely on €2.0 billion investment backlog to

support its future growth. With Airgas now fully integrated, Air

Liquide is focused on executing its mid-term strategic

plan.

Assuming a comparable environment, Air Liquide is confident

in its ability to deliver net profit growth in 2017."

Group revenue for the first half of 2017 grew by

+28.4% to reach 10,293 million euros,

benefiting from the consolidation of Airgas sales for the entire

semester. Adjusted1 for major changes in the portfolio, the first

half revenue growth was +5.7%.

On a comparable growth basis,2 Group revenue increased by +1.8%

over the first six months, to which are being added a positive

currency effect of +1.7% and a favorable energy impact of +2.2%.

Growth in the second quarter of 2017, which was +2.0% on a

comparable basis, is slightly higher than in the first quarter of

2017. Gas & Services sales rose steadily, while Engineering

& Construction remained weak in a challenging environment.

Gas & Services sales reached 9,978 million

euros for the first half of 2017, up +31.0% as

published. On a comparable basis, growth was +2.7% in the second

quarter, in line with the first quarter, despite a highly

unfavorable impact of working days in Europe.

All Gas & Services activities contributed to sales

growth over the first six months of this year, in particular

Industrial Merchant:

- Industrial Merchant experienced

a solid growth of +2.8%, driven by all economic sectors. The

improvement observed in the first quarter of 2017 in North America

and Europe is confirmed and includes both bulk and cylinder

volumes. In Asia, sales also increased in the second quarter,

particularly in China, where double-digit growth was recorded, and

in Japan. In developing economies, revenue rose by +7.2%. Globally,

the price effect for the period reached +1.2%, and is slightly

positive in Europe after two years of decline.

- Large Industries revenue grew by

+2.2% and was contrasted among geographic zones. Demand

remained strong in North America. Sales were down in Europe,

reflecting temporary maintenance turnarounds and the end of

operations in Ukraine, although volumes were improving sequentially

to meet demand from refineries and steelmakers. Sales from

cogeneration were lower due to decreasing electricity prices in

Europe and North America. In Asia, growth was driven by the ramp-up

of an air separation unit in Australia and strong demand in Japan,

Singapore, and South Korea. China was impacted by temporary

customer maintenance turnarounds. In the Middle East, the Yanbu

hydrogen production site in Saudi Arabia is running at full

capacity and Egypt benefited from the start-up of a new unit.

- Electronics sales were stable at

+0.4%, compared to the high first half of 2016, which saw

strong sales of equipment and installations. Excluding sales of

equipment and installations, activity remained dynamic, growing by

+7%, especially in the United States and Asia. In Taiwan and China,

growth came in above +10%. Demand for advanced molecules continued

to be strong, with double-digit sales growth.

- Healthcare revenue, up

+4.5%, continued its development, driven by the steady

growth of Home Healthcare, Hygiene, and Specialty Ingredients. In

the Americas, Home Healthcare is progressing strongly in Canada,

Brazil, and Argentina. In Europe, sales were impacted by less

working days for medical gases in the second quarter and a weak

contribution from complementary acquisitions. However, Home

Healthcare remained dynamic there, particularly in the field of

diabetes. The development of Hygiene and Specialty Ingredients

continued across the globe at a steady pace. In the developing

economies, Healthcare sales continued to increase, with strong

growth of +18% for the first six months of 2017.

Engineering & Construction sales stood at 146

million euros for the first six months of the year, down

-43.3% on a comparable basis due to the low level of

order intake in 2016. The overall environment remains difficult,

but is showing signs of improvement. Order intake, particularly for

the Chemicals and Energy sectors in China, increased significantly

over the period to reach 329 million euros.

Global Markets & Technologies continued to develop,

reporting comparable growth for the first six months of

+16.4%, with sales of 169 million euros. The biogas

and space segments were particularly dynamic.

________

____________________

1 Variation H1 2017 vs. restated H1 2016, adjusted as if on

January 1, 2016, Airgas had been fully consolidated and the

divestments required by the US competition regulators had been

completed.2 Comparable variation H1 2017 vs. adjusted H1 2016,

excluding currency and energy (natural gas and electricity): 2016

base restated, adjusted as if on January 1, 2016, Airgas had been

fully consolidated and the divestments required by the US

competition regulators had been completed.

The Group continues to reinforce its competitiveness.

Efficiency gains reached 148 million euros for the

first six months of this year, in line with the target of more than

300 million euros a year. In addition, the synergies related

to Airgas have reached a cumulative total of 138 million USD since

the acquisition, in line with the Group’s forecasts. Accordingly,

the Group’s operating margin, excluding the impact of

energy, improved by +70 bps on a comparable basis, reaching

16.5%.

Net profit (Group share) reached 928 million

euros, up +14.5% on a published basis, and Net

earnings per share increased +4.3% after taking into

account the dilutive impact of the 2016 capital increase.

Cash flow (after changes in Working Capital Requirements)

is up by +31.2%. Debt-to-equity ratio as of June 30,

2017, adjusted for the seasonality of the dividend and exchange

rates, is stable at 90%.

H1 2017 Performance

In millions of euros

H1 2017/2016

as published1

H1 2017/2016

adjusted2

H1 2017/2016

adjustedcomparable3

Group revenue

of which Gas & Services

10,293 M€

9,978 M€

+28.4%

+31.0%

+5.7%

+6.9%

+1.8%

+2.8%

Operating income recurring 1,656 M€ +21.2%

- -

Net profit (Group share) 928 M€

+14.5% - -

Net debt as of 06.30.2017

15,610 M€ - - -

1 2016 restated, Welding and Diving activities reported as

discontinued operations.2 Variation H1 2017 vs. restated H1 2016,

adjusted as if on January 1, 2016, Airgas had been fully

consolidated and the divestments required by the US competition

regulators had been completed.3 Comparable variation H1 2017 vs.

adjusted H1 2016, excluding currency and energy (natural gas and

electricity) impacts: 2016 base restated, adjusted as if on January

1, 2016, Airgas had been fully consolidated and the divestments

required by the US competition regulators had been completed.

________

The Air Liquide Board of Directors met on July 27, 2017.

During this meeting, the Board reviewed the consolidated financial

statements for the first half ending June 30, 2017.

Limited review procedures were completed with respect to the

consolidated interim financial statements, and an unqualified

review report is in the process of being issued by the statutory

auditors.

In addition, as announced on the occasion of the publication of

the 2016 annual results, the Group confirms that it will

distribute one free share for every 10 shares held. The new

shares will be allocated on October 4, 2017, and the price

adjustment will be made on October 2, 20171.

__________________

1 Attribution modalities and detailed calendar are available on

airliquide.com/shareholders.

The slideshow that accompanies this press

release will be available starting at 8:45 am (Paris time) on the

Air Liquide corporate website: airliquide.com.

Follow the announcement of first-half

results live on Twitter @AirLiquideGroup

UPCOMING EVENTSFree share attribution dateOctober

4, 2017

3rd quarter 2017 revenueOctober 25,

2017

Actionaria trade show, Paris, FranceNovember 23-24,

2017.

The world leader in gases, technologies

and services for Industry and Health, Air Liquide is present in 80

countries with approximately 67,000 employees and serves more than

3 million customers and patients. Oxygen, nitrogen and hydrogen are

essential small molecules for life, matter and energy. They embody

Air Liquide’s scientific territory and have been at the core of the

company’s activities since its creation in 1902.

Air Liquide’s ambition is to lead its

industry, deliver long-term performance and contribute to

sustainability. The company’s customer-centric transformation

strategy aims at profitable growth over the long term. It relies on

operational excellence, selective investments, open innovation and

a network organization implemented by the Group worldwide. Through

the commitment and inventiveness of its people, Air Liquide

leverages energy and environment transition, changes in healthcare

and digitization, and delivers greater value to all its

stakeholders.

Air Liquide’s revenue amounted to €18.1

billion in 2016 and its solutions that protect life and the

environment represented more than 40% of sales. Air Liquide is

listed on the Euronext Paris stock exchange (compartment A) and

belongs to the CAC 40, EURO STOXX 50 and FTSE4Good indexes.

H1 2017 Results

Management Report

H1 17 PERFORMANCE

2

H1 2017 Keys figures

3

H1 2017 Highlights

4

H1 2017 Income Statement

7

Change in Net Indebtedness

14

INVESTMENT CYCLE

15

RISK FACTORS

16

2017 OUTLOOK

16

APPENDIX

17

Currency, energy and significant scope

impacts (Semester)

17

Currency, energy and significant scope

impacts (Quarter)

18

2nd quarter 2017 revenue

19

Segment information

20

Consolidated income statement

21

Consolidated balance sheet

22

Consolidated cash flow statement

23

Revenue and adjusted 2016 Operating Income

Recurring

25

Return on Capital Employed – ROCE

26

H1 17 PERFORMANCE

With Airgas now integrated, Air Liquide focuses on executing its

mid-term strategic plan. The Group’s performance was solid in H1

17, with further growth of sales and net profit, as well as an

improvement of the margin.

Group revenue for H1 17 reached 10,293 million

euros, up +28.4% as published, thanks to the

consolidation of Airgas over a full semester. Comparable growth was

+1.8%, to which is being added a positive currency impact of

+1.7% and a favorable energy impact of +2.2% resulting in +5.7%

growth to adjusted 2016 sales. This was driven by a steady

improvement in Gas & Services sales and the dynamic momentum of

Global Markets & Technologies, but was impacted by a weak level

of activity in Engineering & Construction. Gas &

Services revenue amounted to 9,978 million euros,

up +31.0% as published and +2.8% on a comparable

basis. H1 2017 saw confirmation of a recovery in Industrial

Merchant, an activity which now accounts for almost half of Gas

& Services sales. Growth was also driven by solid Large

Industries volumes, consistent development in Healthcare and a

return to growth for Electronics. In terms of geography, all zones

posted growth.

Continuous efforts to reduce costs led to 148 million

euros in efficiencies, in line with the annual target of more

than 300 million euros. In addition to these recurrent

efficiency gains, Airgas synergies totaled 93 million US

dollars since the beginning of the year and reached cumulated

138 million US dollars since the acquisition of

Airgas. The operating margin was 16.5% excluding the

energy impact, a 70 basis point improvement compared with

the adjusted margin for H1 16. Net profit (Group share) rose

to 928 million euros, an increase of +14.5%. Earnings

per share were up +4.3% compared with H1 16, after taking into

account the dilutive impact of the October 2016 capital

increase.

Cash flow from operating activities after changes in working

capital requirements amounted to 1,593 million

euros, up +31.2%, and exceeded sales growth which stood at

+28.4%. Net indebtedness at the end of June 2017 amounted to

15.6 billion euros.

The 12-month portfolio of investment opportunities remained

stable at 2.1 billion euros at the end of June 2017.

Investment decisions totaled 1.1 billion euros.

Net capital expenditures represented 11.3% of sales and were in

line with the mid-term strategic plan.

Terms « published » and « comparable » used

in this document refer to the definitions below :

- Published

growth vs 2016 data is calculated in accordance with

IFRS 5. Other Activities (Aqua Lung and

Air Liquide Welding) are reported under “Net income from

discontinued operations” in the 2016 and 2017 income statement. The

Balance Sheet also presents Assets and Liabilities held for sale

under a dedicated line.

- Adjusted 2016

revenue and operating income recurring are computed as

if, on January 1st 2016, Airgas had been fully consolidated

and the divestitures requested by the U.S. Federal Trade Commission

completed, and Aqua Lung and Air Liquide Welding had

been deconsolidated.

- Comparable

growth: in 2017, Air Liquide will communicate a

comparable sales growth based on 2016 adjusted sales, excluding

currency and energy (natural gas and electricity) impacts.

- Reference to

Airgas now corresponds to the Group’s Industrial

Merchant and Healthcare activities in the United States within

the new scope, after the merger of Airgas and

Air Liquide U.S. operations.

Unless otherwise stated, all variations in revenue and operating

income recurring outlined below are on a comparable

basis.

H1 2017 Keys figures

(in millions of euros)

H1

2016 H1 2017

2017/2016publishedchange

2017/2016 adjustedcomparable

(a)

Total Revenue 8,018

10,293 +28.4% +1.8% Of which Gas

& Services 7,618 9,978 +31.0% +2.8%

Operating income recurring 1,367 1,656 +21.2%

+6.0% Operating income recurring (as % of revenue)

17.0% 16.1% -90bps Other non-recurring

operating income and expenses (84) (2)

Net profit (Group share) 811 928

+14.5%

Earnings per share (in euros)(b)

2.30 2.40 +4.3%

Net cash flows from operating activities (c) 1,215

1,593 +31.2% Net capital expenditure

(d) 13,105 1,162 Net debt

19,860 15,610

Debt-to-equity ratio (e) 151% 90%

Return On Capital Employed – ROCE after tax

(f) 8.3% 7.4%

(a) Comparable growth based on 2016

adjusted sales excluding currency and energy price fluctuation

impact.

(b) H1 2016 Earnings per share restated

for the impact of the preferential subscription rights allocated to

shareholders aspart of the capital increase carried out in October

2016.

(c) Cash flow from operating activities

after changes in working capital requirements and other

elements.

(d) Including transactions with minority

shareholders.

(e) Adjusted to spread the dividend

payment in H1 out over the full year and of change impact.

(f) Return on capital employed after tax:

see definition in appendix.

H1 2017 Highlights

INDUSTRIAL DEVELOPMENT

Large Industries

- In early January 2017, Air Liquide and

ArcelorMittal, signed long-term contracts for the

supply of oxygen, nitrogen and argon to ArcelorMittal’s production

sites in Benelux and France.

- In January 2017, Air Liquide announced

having recently commissioned the largest hydrogen storage

facility in the world. This underground cavern is located in

Beaumont, Texas, in the Gulf Coast region of the U.S. This unique

hydrogen storage cavern complements Air Liquide’s robust supply

capabilities along the Gulf Coast, offering greater flexibility and

reliable hydrogen supply solutions to customers via Air Liquide’s

extensive Gulf Coast Pipeline System. This facility is 1,500

meters deep and nearly 70 meters in diameter and is

capable of holding enough hydrogen to back up a large-scale

steam methane reformer (SMR) unit for 30 days.

- Air Liquide inaugurated on January 26th

in France, in the frame of the Connect project, an operation

center that is unique in the industrial gas sector. It enables the

remote management of production for 22 of the Group’s units

in France, optimizing their energy consumption and improving their

reliability. With “technological showcase” certification

from the Industry of the Future Alliance, Connect represents an

investment of €20 million. This project is based on the

implementation of new digital technologies at French production

sites and on the creation of new skills.

- In early April, Air Liquide and Oman

Oil Refineries and Petroleum Industries Company (Orpic), Oman’s

national refining company, signed a long-term agreement for

the supply of nitrogen to the Liwa Plastics Industries Complex

(LPIC), a new plastics production complex including the country’s

first steam cracker Orpic is adding to its existing production

facilities, in Sohar industrial port area in Oman. Investing around

€20 million to build a state-of-the-art nitrogen production

unit with a total capacity of 500 tons of nitrogen per day, Air

Liquide will strengthen its leadership position in a key industrial

area to support the growth of its customer Orpic.

Industrial Merchant

- In June 2017, Air Liquide announced new

supply contracts covering a period of 10 to 15 years with

three major Chinese fiber optics manufacturers. In the frame

of these new contracts with Futong Group Communication Technology,

Yangtze Optical Fibre, and Zhongtian Technology Fine Materials,

Air Liquide will supply a total exceeding 6,000 Nm3 per

hour of hydrogen and 4,000 Nm3 per hour of nitrogen via

on-site generator solutions, together with bulk oxygen, helium,

argon and carbon dioxide. Air Liquide will thus support the

further development of China’s fiber optics industry.

Engineering & Construction

- In May 2017, Air Liquide

Engineering & Construction announced it had recently signed a

major contract amounting to around €100 million to

design and build three Air Separation Units (ASU) for

Yankuang Group, one of the largest energy and chemical companies in

China. Each of the ASUs will have a production capacity of

3,200 tonnes per day of oxygen, plus nitrogen for the

production of methanol-based chemicals, an additive widely used in

the energy industry to increase combustion efficiency of

hydrocarbon. The new ASUs will be built by using Air Liquide’s

latest innovative technologies expertise and best in class

standards to ensure a safe, optimized and reliable operation of the

plants. All three ASUs will start operation in the second half

of 2019.

DEVELOPMENTS IN HEALTHCARE

- Air Liquide pursued its external growth

strategy in Healthcare. The Group’s subsidiary Seppic, designer and

supplier of specialty ingredients for health and beauty, recently

finalized the acquisition of the Serdex division of Bayer.

This acquisition strengthens Seppic’s footprint in natural

active ingredients for cosmetics. The global specialty active

ingredients for cosmetics represent a market over €900 million, of

which natural active ingredients are a fast growing segment.

- The Group announced on January 24th the

acquisition of Oxymaster, a national home healthcare

sector player in Colombia. Present in the Colombian market for

almost 20 years, Oxymaster is specialized in home treatment and

support for patients suffering from respiratory conditions

(sleep apnea, Chronic Obstructive Pulmonary Disease, chronic

respiratory failure). Oxymaster has more than 240 employees and

serves over 21,000 patients. The company generated revenues of

approximately €9 million in 2016.

- Air Liquide strengthens its

position in home care for patients with diabetes and

participates in the French artificial pancreas project. By

signing a partnership with CERITD, the French Center for Studies

and Research for the Intensification of Diabetes Treatment,

Air Liquide continues the approach based on cooperation

between hospital teams and homecare nurses. In addition, to

increase its level of expertise in the field of diabetes and

support innovation, Air Liquide has acquired an equity stake via

ALIAD, the Group’s venture capital investment arm, in the French

start-up Diabeloop, which is designing an electronic

artificial pancreas composed of an insulin pump in the form of

a patch and a glucose sensor both connected. The investment made by

Air Liquide in Diabeloop confirms the Group’s commitment to

digital technologies and healthcare, in the aim of helping

patients achieve a better quality of life and care.

PROJECTS IN INNOVATION AND TECHNOLOGY

- Air Liquide and 12 leading energy,

transport and industry companies have launched on January 17th, a

global initiative to voice a united vision and long-term ambition

for hydrogen to foster the energy transition. In the first global

initiative of its kind, the ‘Hydrogen Council’ is determined

to position hydrogen among the key solutions of the energy

transition and aims to promote hydrogen to help meet

climate goals.

- In March, Air Liquide completed the

construction of two hydrogen charging stations in Japan. The

Fukuoka Miyata and Kobe Shichinomiya stations are respectively the

4th and 5th hydrogen charging stations for public use in

Japan. To date, 75 hydrogen charging stations have already been

designed and installed by Air Liquide worldwide.

- ALIAD, Air Liquide’s venture

capital investment arm, continues to gain strength in the

industries of the future with three new equity investments

in technology start-ups, UBleam and Dietsensor, and in the

investment fund Investisseurs & Partenaires. With these new

equity investments in addition to its further financial commitment

to six companies in which it has already invested before, ALIAD has

committed more than €10 million to start-ups since the start

of 2017. The investment strategy of ALIAD targets sectors linked to

the energy transition, health and digital. ALIAD also

supports these start-ups that are developing the technologies of

the future by rolling out R&D and/or business partnerships with

Group entities.

NEW VISUAL IDENTITY

- The acquisition of Airgas and the

launch of the NEOS Company Program for the period 2016-2020 mark a

new milestone in the history of Air Liquide. The Group is

transforming and is changing its visual identity with a new

logo, the fifth since the company was founded 115 years ago.

This new visual identity introduced in January 2017, which embodies

the transformation of Air Liquide, is that of a leading Group,

expert and innovative, that is close to its stakeholders and open

to the world.

BOND ISSUE

- A transaction, issued under the Group’s

€12 billion Euro Medium Term Note (EMTN) program, allowed the

issuance of a €600 million bond with a 10-year

maturity at a yield of 1.116%. This recent transaction

brought the total outstanding amount of bonds issued to

approximately €15.2 billion, with an average maturity of 6.8 years.

Proceeds from this bond allow the Group to refinance its two bonds

maturing in June and July 2017, and to continue funding sustainably

its long-term growth while benefiting from very attractive market

conditions.

PORTFOLIO MANAGEMENT

- On April 27, 2017, Air Liquide

announced it signed an agreement with Lincoln Electric

France SAS, subsidiary of Lincoln Electric Holdings, Inc. (“Lincoln

Electric”) (Nasdaq: LECO), to sell

Air Liquide Welding, its subsidiary specialized in

the manufacture of welding and cutting technologies. This agreement

follows the exclusive negotiations agreement announced on March

2, 2017 with Lincoln Electric, the world leader in design,

development and manufacture of arc welding products, robotic arc

welding systems, plasma and oxy-fuel cutting equipment. Both

parties having now obtained the necessary regulatory approvals, the

transaction will be completed on July 31, 2017.

H1 2017 Income Statement

INCOME STATEMENT

Revenue

(in millions of euros)

H1 2016 H1 2017

2017/2016publishedchange

2017/2016 comparable

change

Gas & Services 7,618 9,978 +31.0%

+2.8% Engineering & Construction 254 146

-42.7% -43.3% Global Markets & Technologies

146 169 +15.8% +16.4%

TOTAL

REVENUE 8,018 10,293

+28.4% +1.8%

Group

Group revenue in the 1st half of 2017 totaled

10,293 million euros, up +28.4% as published

compared to the 1st half of 2016. Comparable growth was

+1.8%, to which are being added positive currency impact of

+1.7% and favorable energy impact of +2.2% resulting in +5.7%

growth to adjusted 2016 sales. The currency and energy impacts

remained positive in the 2nd quarter of 2017, but eased

compared with the 1st quarter of 2017. Comparable growth was

driven by a steady improvement in Gas & Services sales, but was

affected by a weak activity level in Engineering &

Construction.

Revenue by quarter

(in millions of euros)

Q1 2017 Q2 2017 Gas &

Services 5,046 4,932 Engineering & Construction

53 93 Global Markets & Technologies 77

92

TOTAL REVENUE 5,176

5,117 2017/2016 published change +38.5%

+19.5% 2017/2016 comparable

+1.5% +2.0%

Gas & Services

Gas & Services revenue totaled 9,978 million

euros, up +31.0% as published compared with the

1st half of 2016. Comparable growth was +2.8%, to which

are being added a positive currency impact of +1.8% and a favorable

energy impact of +2.3% resulting in +6.9% growth to adjusted 2016

sales. This was driven in particular by steady sales growth in

Industrial Merchant, at close to +3% over the half-year.

(in millions of euros)

H1 2016 H1 2017

2017/2016 published

change

2017/2016 comparable

change

Americas 2,185 4,251 +94.5%

+3.3% Europe 3,225 3,371 +4.6% +2.0%

Asia-Pacific 1,920 2,032 +5.9% +2.8%

Middle East & Africa 288 324 +12.4%

+3.5%

GAS & SERVICES REVENUE 7,618

9,978 +31.0% +2.8% Large

Industries 2,388 2,694 +12.8% +2.2%

Industrial Merchant 2,964 4,757 +60.5%

+2.8% Healthcare 1,451 1,690 +16.5%

+4.5% Electronics 815 837 +2.8% +0.4%

Americas

Gas & Services revenue in the Americas zone amounted to

4,251 million euros, up +95% as published

following the integration of Airgas and up +3.3% on a

comparable basis. In Large Industries, sales were up markedly

(+5.1%) in the 1st half and in particular in the

1st quarter. The recovery was confirmed in Industrial

Merchant, with revenue growth of +3.3% over the half-year and an

increase of +4.0% during the 2nd quarter. In South America,

sales continued to improve significantly, notably in Large

Industries and Healthcare.

- Large Industries posted a sharp

+5.1% growth in sales in H1, with more modest growth in the

2nd quarter. In North America, air gases volumes were up +4.7%

over H1 2017 with record levels of oxygen delivered in the United

States in June 2017. In the 2nd quarter, hydrogen volumes were

impacted by maintenance turnarounds and sales from cogeneration

units were down due to the fall in electricity prices in North

America. In Latin America, new units contributed to the dynamic

growth momentum.

- The recovery in Industrial

Merchant was confirmed, with sales growth of +3.3% over

the 1st half and +4.0% in the 2nd quarter. Liquid gas and

cylinder volumes were up in the United States and Canada. Sales

improved in almost all market segments. In the United States they

progressed particularly in Food, Pharmaceuticals, Materials,

Energy, Professionals and Retail. In Canada, they increased

markedly in Energy with a rebound in oil services and related

industries. Activity in South America continued its dynamic

momentum. The price impact in the zone was +1.7% over the

half-year.

- Healthcare revenue was up

+4.2%, driven by solid activity in Canada and South America

where Home Healthcare was enjoying sustained growth.

- Electronics revenue declined

-4.3% due to weak Equipment & Installation sales in the

2nd quarter of 2017. Gas sales remained dynamic, in particular

in Advanced Materials which continued to post double-digit

growth.

Europe

Revenue in Europe zone totaled 3,371 million euros,

up +2.0%. Despite solid volumes, Large Industries sales

remained down at -1.4%, due to customer maintenance turnarounds and

the stoppage of activity in Ukraine. The recovery in Industrial

Merchant was confirmed with growth of +2.7% over H1; during the

2nd quarter, despite a very unfavorable working day impact,

growth remained positive at +1.2%. Healthcare continued to improve

steadily (+4.2%), with limited contribution to growth from bolt-on

acquisitions.

- Large Industries revenue was

down -1.4% over H1, penalized by customer maintenance

turnarounds. Nevertheless, sales improved on a sequential basis:

Air gases benefited from increased demand from steel producers

(France, Germany, Italy) and hydrogen from the good activity level

at refineries. Sales in Eastern Europe continued to grow, but were

impacted by the stoppage of activity in Ukraine.

- Industrial Merchant revenue was

up +2.7% over the half-year, with the recovery in most

countries confirmed, especially in Southern Europe (Iberia, Italy)

and Benelux. Liquid gas and cylinder volumes were up over the

half-year. Sales per working day continued to increase in the

2nd quarter. The Food & Pharmaceuticals and the Materials

& Energy market segments continued to improve. Growth was more

limited for the Professionals and Retail segment with low volumes

for gas cylinders in particular due to the negative working day

impact in the H1 17. Developing economies continued to enjoy

sustained sales growth, in particular in Russia, Poland and Turkey.

Following two years of decline, pricing returned to slightly

positive territory in the region in the 2nd quarter and were

flat over the half-year.

- Healthcare continued to improve

steadily posting sales growth of +4.2%, with new

acquisitions having a limited contribution. Home Healthcare sales

continued to grow with an increase in the number of patients.

Revenue from medical gases for hospitals was affected in the

2nd quarter by an unfavorable working day impact. Sales in the

Hygiene and Specialty Ingredients activities grew significantly,

driven by bolt-on acquisitions.

Asia-Pacific

Revenue in the Asia-Pacific zone totaled 2,032 million

euros and climbed +2.8% in the 1st half-year and at

a faster pace in the 2nd quarter, at +4.0%. Solid growth was

achieved across all business lines. In Large Industries, sales were

up +3.9% in the 1st half-year, driven by the loading of a new

unit and strong volumes. Industrial Merchant grew strongly in the

2nd quarter (+4.0%) with double-digit growth in China and an

improvement in activity in Japan. Electronics sales saw a return to

growth, up +4.5% in the 2nd quarter, thanks to continued

underlying activity momentum.

- Large Industries sales were up

+3.9%, driven by the ramp-up of a new unit in Australia and

by strong customer demand notably in South Korea, Singapore and

Japan. Several customer maintenance turnarounds affected growth in

China in the 2nd quarter.

- Industrial Merchant improved

+1.7% over the half-year, and enjoyed a strong

2nd quarter at +4.0%. In China, growth exceeded +15% in the

2nd quarter, driven by increases in volumes and liquid gas

prices (in particular nitrogen, argon) and by the very strong

growth in gas cylinders volumes (oxygen, argon). In Japan, after a

negative comparison effect for Equipment & Installation sales

in the 1st quarter, revenue climbed in the 2nd quarter thanks

to an improvement in Industrial Production. In Singapore, sales

were compared to high Equipment & Installation revenue seen in

the 2nd quarter of 2016. Business in Australia was down

slightly in a challenging environment. Pricing rose and were

positive at +0.4% in the 1st half-year.

- Electronics revenue was up

+1.7% over the half-year, with a strong 2nd quarter at

+4.5%, driven in particular by double-digit sales growth in China

and Taiwan. Underlying activity momentum was strong, climbing more

than +10% in the 2nd quarter, in particular thanks to Advanced

Materials, carrier gases and services. Nevertheless, the basis of

comparison was unfavorable, with Equipment & Installation sales

extremely high in the 1st half of 2016. In the

2nd half-year, the basis of comparison with 2016 should be

more favorable.

Middle East and Africa

Middle East and Africa zone revenue amounted to 324 million

euros, an increase of +3.5% on a comparable basis. In

the 2nd quarter, sales benefited from the fact that two large

hydrogen production units in Yanbu, Saudi Arabia are operating at

full capacity. In Egypt, pre-loading of production units

contributed to growth in Large Industries and Industrial Merchant.

South Africa continued to enjoy sustained growth in Healthcare.

Engineering & Construction

Engineering & Construction revenue totaled

146 million euros in the 1st half of 2017, down

-43.3% compared with the 1st half of 2016, due to the

low level of order intake in 2016. Business nonetheless improved

sequentially during the 1st half-year.

Order intake reached 329 million euros in the 1st half

of 2017, up +161% compared with the 1st half of 2016. More

than 80% of all orders concerned air gas units (ASU). These mainly

included Group projects and orders on behalf of third parties in

the Energy and Chemicals sectors in China and South Korea. The

number of tenders continued to increase.

Global Markets & Technologies

Global Markets & Technologies revenue was up +16.4%

at 169 million euros. Sales were particularly dynamic

in the biogas and space sectors. Helium sales increased in the

2nd quarter despite logistical challenges relating to the

geopolitical context in Qatar.

Order intake totaled 148 million euros in the 1st half

of 2017.

OPERATING INCOME RECURRING

Operating income recurring before depreciation and

amortization totaled 2,556 million euros, up +22.6%

as published compared to H1 16. This reflected the integration of

Airgas.

Purchases were up +33.6%, at a faster pace than published sales

growth at +28.4%: this difference was due to trading activity

(hardgoods sales) at Airgas which is greater than at

Air Liquide. Personnel costs also grew at a faster pace

(+32.3%) than sales, mainly due to the change in business mix.

Indeed, Industrial Merchant, which now accounts for close to half

of Group sales, requires more staff than other activities such as

Large Industries. However, other expenses increased at a slower

pace (+21.7%), as Airgas’ structure is leaner, for example has no

Research and Development department.

Depreciation and amortization reached 900 million

euros, up +25.4%. This also increased at a slower pace than

sales as the relative weighting of Industrial Merchant, a business

with lower capital intensity than Large Industries, is now larger

within the Group’s business lines.

Over the first six months of the year, efficiencies

amounted to 148 million euros, up +3.5% and in line

with the annual target of over 300 million euros. More than 40% of

these efficiencies related to industrial projects (optimization of

production units particularly in China and Benelux, logistics, and

maintenance), more than one third to purchasing gains (energy in

Large Industries, molecules in Electronics), and the balance mainly

to administrative efficiencies and restructuring. Large Industries

and Industrial Merchant were the Business Lines generating most of

the efficiencies and accounted for almost two thirds of total

efficiencies.

Airgas synergies continued to materialize: these

represented 93 million US dollars in H1 2017 and

cumulated 138 million US dollars since the

acquisition of Airgas in 2016. Cost synergies are divided into four

main categories: cylinder operations where more than 90% of site

closures and restructuring have been completed; liquid gas

operations where the entire logistics of liquid products are being

optimized; the review of processes where best practices are being

implemented and procurement where contracts are renegotiated; and,

finally, the back office, where more than 90% of duplicate

positions have already been eliminated. Revenue synergies have

started to materialize with better availability of bulk products

and new offers proposed to customers.

The Group’s operating income recurring (OIR) reached

1,656 million euros in H1 17, up +21.2% as published

and up +6.0% versus H1 16 adjusted OIR. The operating margin

(OIR to revenue) was up +30 basis points on a comparable basis at

16.1% compared with H1 16 adjusted operating margin. Excluding

the energy impact, H1 17 operating margin was up +70 basis

points at 16.5% compared to the adjusted H1 16 operating margin

and in line with the Group’s objective to improve

profitability.

Gas & Services

Gas & Services operating income recurring amounted to

1,761 million euros, an increase of +20.7%. The OIR margin

as published was 17.6%. Excluding the energy impact, the operating

margin stood at 18.1%.

Against a backdrop of limited global inflation, average selling

prices were up +0.6% due in particular to Industrial Merchant

(+1.2%). Prices were slightly down in Electronics and pricing

pressure in Healthcare continued in certain countries.

Efficiencies totaled 136 million euros in H1 2017 for

Gas & Services activity.

Gas & Services Operating margin (a)

H1 2016 H1 2017 Americas 19.7%

15.8% Europe 19.8% 18.9% Asia-Pacific

18.0% 19.7% Middle-East & Africa 15.5%

16.4%

TOTAL 19.2% 17.6%

(a) Operating income

recurring/revenue.

Operating income recurring in the Americas reached

670 million euros, an increase of +55.5%.

Excluding energy impact, the operating margin was 16.1%, which

represented a -360 basis point decrease. This ratio

reflected the change in business mix following the acquisition of

Airgas with reinforcement of the relative weight of Industrial

Merchant.

Operating income recurring in Europe reached

637 million euros, almost unchanged at -0.3%.

Excluding energy impact, the operating margin stood at 19.3%,

representing a -50 basis point decrease compared with

H1 16. This result was in line with the change in business and

country mix of the zone.

Operating income recurring in the Asia-Pacific region

stood at 401 million euros, an increase of +16.3%.

Excluding energy impact, the operating margin was 20.0%, up +200

basis points. This increase was due to efficiencies and

adjustment plans implemented in the zone. It also benefited from

higher volumes in Industrial Merchant and the continued very

dynamic growth in Advanced Materials in Electronics.

Operating income recurring for Middle East and Africa

amounted to 53 million euros, an increase of

+19.3%. Excluding the energy effect, the operating margin

stood at 18.3%, an increase by +280 basis points,

driven by higher loading of the Yanbu production units in Saudi

Arabia.

Engineering & Construction

Operating income recurring for Engineering & Construction

stood at -6 million euros, penalized by a weak level of

activity in a challenging environment. The Group’s mid-term

operating margin target remains between 5% and 10%.

Global Markets & Technologies

Operating income recurring for Global Markets & Technologies

was 18 million euros and the operating margin was

10.6%, almost stable compared with H1 16 (10.8%). Some activities

are currently being launched. The margin level for this activity is

dependent on the nature of the projects carried out during the

period and may vary markedly from one year to the next.

Research and Development and Corporate Costs

Research and Development and Corporate Costs stood at

117 million euros and were stable compared with H1 16

(119 million euros).

NET PROFIT

Other operating income and expenses showed a net

balance of -2 million euros. This was mainly related to

costs for Airgas integration and expenses relating to alignment

plans currently underway, in particular in the United States. They

were much lower than in 2016 and were mostly offset by provision

reversals. In H2 17, the balance of other operating income and

expenses should be more negative.

The net financial expense of -259 million euros was

+51.6% higher than H1 16. Net finance costs at the end of

June 2017 stood at -223 million euros and were up +40.7%

excluding the currency impact, due to the financing of the Airgas

acquisition. The currency impact was a negative -10 million

euros, mainly related to the increase of the average rate of the US

dollar. At 3.1%, the average cost of net indebtedness

was down -40 basis points compared with H1 16, due to the

favorable impact of refinancing relating to Airgas. However, it was

up +20 basis points compared with the average cost for 2016

(2.9%), due to the increase in the cost of indebtedness in

developing countries. The increase in “other financial income and

expenses” (+88.6%) was mostly related to the increase in fees on

bank card payments with the consolidation of Airgas.

Taxes totaled 389 million euros, up +47.3% due to the

consolidation of Airgas. The effective tax rate was

27.9%. This was due to the new breakdown of the Group’s

businesses with a greater share in the United States where the tax

rate is higher, but also due to the decrease in tax rates in

several countries where the Group is present.

The share of profit of associates was 1 million

euros compared with 3 million euros in H1 16.

Minority interests rose by +14.9% to 49 million

euros, due to an increase in earnings for subsidiaries with

minority shareholders, notably in Saudi Arabia.

Net result from discontinued operations stood at

-30 million euros, the Group having made a provision

for the impact of the disposal of Air Liquide Welding which should

be completed on July 31st, 2017, as both parties have now obtained

the necessary regulatory approvals to finalize the disposal

project.

Net profit (Group share) amounted to 928 million

euros in H1 17, an increase of +14.5%.

Net earnings per share, at 2.40 euros, were up

+4.3% compared with H1 16, after taking into account

the impact of the October 2016 capital increase and thus had a

solid accretive impact. The average number of outstanding shares

used for the calculation of net earnings per share as at

June 30, 2017 was 386,833,119.

Change in the number of shares

H1 2016 H1 2017

Average number of outstanding shares (a)

352,569,431 386,833,119

(a) Used to calculate net earnings per

share. The average number of outstanding shares in H1 2016 was

restated for the impact of the preferential subscription rights

allocated to shareholders as part of the capital increase carried

out in October 2016.

Change in Net Indebtedness

Cash flow from operating activities before changes in working

capital amounted to 1,947 million euros. This

amount corresponded to a high level of sales (18.9%).

Net cash after changes in working capital requirement (and

other items) was 1,593 million euros, a marked

increase of +31.2% compared with H1 16, exceeding sales

growth of +28.4%.

The increase in working capital requirement (WCR) was

limited to 317 million euros, compared with

335 million euros in H1 16. The working capital

requirements ratio to sales, excluding taxes, remained stable at

9.0% compared with 9.1% at June 30, 2016. That

ratio for Gas & Services declined, from 11.2% at

June 30, 2016 to 9.1% at the end of H1 17.

This decrease is mainly due to a reduction in trade receivables

notably through an improvement of payment conditions for certain

customers and factoring measures. Engineering & Construction

WCR increased due to the cycle of projects.

Gross industrial capital expenditure reached

1,108 million euros, an increase of only +5.0%

despite the integration of Airgas. Financial investments totaled

86 million euros, slightly higher than the 76 million

euros made in H1 16 excluding the Airgas acquisition. Gross

capital expenditure in H1 17 amounted to 1,194 million

euros. Including transactions with minority shareholders and

proceeds from the sale of assets of 36 million euros, net

capital expenditure totaled 1,162 million euros and

represented 11.3% of sales, in line with the NEOS strategic

plan.

Net indebtedness at June 30, 2017 reached

15,610 million euros, slightly more (+1.6%) than at

December 31, 2016. Dividends were higher due to the

October 2016 capital increase; share buy-backs increased to

offset stock options exercised and performance shares granted. The

net debt to equity ratio, adjusted for the seasonal effect

of the dividend payment and excluding the currency impact, remained

stable at 90%.

The return on capital employed after tax (ROCE) was

7.4%, an improvement of 50 basis points compared with

adjusted ROCE of 6.9% at the end of 2016.

INVESTMENT CYCLE

The Group’s steady long-term growth is largely due to its

ability to invest in new projects each year. Investment projects in

the industrial gas business are spread throughout the world, highly

capital intensive and supported by long-term contracts, in

particular for Large Industries.

INVESTMENT OPPORTUNITIES

At the end of June 2017, the 12-month portfolio of

opportunities totaled 2.1 billion euros and remained

stable compared with March 2017. New projects entering the

portfolio offset those signed by the Group, awarded to the

competition or delayed. The long-term portfolio, which includes all

projects including those which may be signed after the next 12

months, was strong and remained at between 4.5 and

5 billion euros.

More than half of the investment opportunities in the 12-month

portfolio are located in developing economies. Americas remain the

geography with the highest number of opportunities, closely

followed by Europe and then Asia. This breakdown of the portfolio

of opportunities is similar to the new breakdown of Group

sales.

Half of the investment opportunities correspond to projects with

investments of less than 50 million euros; a few projects are

greater than 100 million euros. The more modest size of

projects contributes to a better distribution of risk.

INVESTMENT DECISIONS AND INVESTMENT BACKLOG

Industrial and financial investment decisions totaled

1.1 billion euros during the 1st half of 2017.

Industrial decisions accounted for more than 90% of that amount.

These include in particular the takeover of a site from a major

customer in China, a new nitrogen supply contract in Oman and a

contract for a new electronics production unit in China.

The total investment backlog amounted to 2.0 billion

euros and was stable compared with the end of March 2017.

The investment backlog should represent a future contribution to

annual sales of approximately 0.8 billion euros per year after

full ramp-up.

START-UPS

Nine new production units were started up during the

1st half of 2017, including two air gas units in the Americas,

two in Europe, two hydrogen-related units and three dedicated to

Electronics in Asia.

Over the half-year, the contribution to sales of unit start-ups

and ramp-ups totaled approximately 70 million

euros.

A greater number of start-ups is expected during the second half

of the year. However, the Chinese project whose start-up was

scheduled for September 2017 is expected to extend its testing

period until the beginning of 2018.

Thus, for 2017 as a whole, the contribution to sales of unit

start-ups and ramp-ups should reach 170 to

190 million euros. This contribution is expected to be

higher in 2018, above 370 million euros, as several

major unit start-ups are scheduled for the end of 2017 and the

1st half of 2018.

RISK FACTORS

There was no change in risk factors during first half 2016. Risk

factors are described in the 2016 Reference Document on pages 28 to

33.

2017 OUTLOOK

The Group's performance in the first half of 2017 was

solid, with further growth in revenue and net profit, as well as an

improvement in the operating margin. Sales benefited from the end

of the Airgas consolidation effect and positive currency and energy

impacts.

The Gas & Services business continued to improve

during the first half of the year, benefiting from the

confirmed recovery in Industrial Merchant, strong volumes in Large

Industries, a good underlying level of activity in Electronics, and

continuous development in Healthcare. Global Markets &

Technologies sales continued to grow by double digits.

Geographically, all regions are generating growth, with Industrial

Merchant and Healthcare activities particularly dynamic in

developing economies.

The Group's operational performance also improved further in the

first half of 2017: the new efficiencies and synergies

associated with Airgas contributed to the higher operating margin

and net profit. Lastly, the Group's balance sheet remains robust,

benefiting from strong growth in cash flows and well controlled

debt.

Investment decisions continued during the first half of the

year, and the Group can rely on €2.0 billion investment

backlog to support its future growth. With Airgas now fully

integrated, Air Liquide is focused on executing its mid-term

strategic plan.

Assuming a comparable environment, Air Liquide is confident in

its ability to deliver net profit growth in 2017.

APPENDIX

Currency, energy and significant scope impacts

(Semester)

Applied method

In addition to the comparison of published figures, financial

information is given excluding significant scope, currency, and

natural gas and electricity price fluctuation impact.

- The significant scope effect

corresponds to the impact on sales of all acquisitions or disposals

of a significant size for the Group. These changes in scope of

consolidation are determined:

- for acquisitions during the period, by

deducting from the aggregates for the period the contribution of

the acquisition,

- for acquisitions during the previous

period, by deducting from the aggregates for the period the

contribution of the acquisition between January 1 of the current

period and the anniversary date of the acquisition,

- for disposals during the period, by

deducting from the aggregates for the previous period the

contribution of the disposed entity as of the anniversary date of

the disposal,

- for disposals during the previous

period, by deducting from the aggregates for the previous period

the contribution of the disposed entity.

- Since industrial and medical gases are

rarely exported, the impact of currency fluctuations on activity

levels and results is limited to euro translation impacts with

respect to the financial statements of subsidiaries located outside

the euro zone. The currency effect is calculated based on the

aggregates for the period converted at the exchange rate for the

previous period.

- In addition, the Group passes on

variations in the cost of energy (electricity and natural gas) to

its customers via indexed invoicing integrated into their medium

and long-term contracts. This indexing can lead to significant

variations in sales (mainly in the Large Industries Business Line)

from one period to another depending on fluctuations in prices on

the energy market.

- An energy impact is calculated based on

the sales of each of the main subsidiaries in Large Industries.

Their consolidation allows the determination of the energy impact

for the Group as a whole. The foreign exchange rate used is the

average annual exchange rate for the year N-1Thus, at the

subsidiary level, the following formula provides the energy impact,

calculated for natural gas and electricity respectively:Energy

impact = Share of sales index to energy year (N-1) x (Average

energy price over the year (N) - Average energy price over the year

(N-1))Neutralizing the impact of variations in energy prices

against sales allows analysis of evolution in revenue on a

comparable basis.

(in millions of euros)

Group

Gas & Services

H1 2017 Revenue

10,293

9,978

2017/2016 published change (in %)

+28.4%

+31.0%

Currency impact

166

166

Natural gas impact

179

179

Electricity impact

42

42

2017/2016 comparable growth (in

%)

+1.8%

+2.8%

Currency, energy and significant scope impacts

(Quarter)

In addition to the comparison of published figures, financial

information for second quarter 2016 is provided before currency,

energy price fluctuations and significant scope impacts. As of

January 1, 2015, the energy impact includes impacts of natural gas

and electricity. In the future, it may also include other energy

Large Industries feedstocks.

Since gases for industry and health are rarely exported, the

impact of currency fluctuations on activity levels and results is

limited to euro translation impacts with respect to the financial

statements of subsidiaries located outside the Euro zone.

Fluctuations in natural gas and electricity prices are passed on to

customers through price indexation clauses.

Consolidated 2017 second quarter revenue includes the following

impact:

(in millions of euros)

Revenue Q22017

Q2 2017/2016Change

Currency Natural gas

Electricity

Q2

2017/2016Comparablechange (a)

Group 5,117 +19.5% 49 75 17

+2.0% Gas and Services 4,932 +21.2% 50

75 17 +2.7%

(a) Comparable change based on 2016

adjusted sales excluding currency and energy impacts.

For the Group,

- The currency impact was +1.0%.

- The impact of natural gas price

fluctuations was +1.5%.

- The impact of electricity price

fluctuations was +0.4%.

For Gas & Services,

- The currency impact was +1.1%.

- The impact of natural gas price

fluctuations was +1.6%.

- The impact of electricity price

fluctuations was +0.4%.

2nd quarter 2017 revenue

BY GEOGRAPHY

Revenue

(in millions of euros)

Q2 2016 Q2 2017

Publishedchange

Comparablechange

(a)

Americas 1,361 2,109 +54.9%

+2.9% Europe 1,611 1,661 +3.2% +1.5%

Asia-Pacific 954 1,008 +5.7% +4.0%

Middle-East & Africa 144 154 +6.8%

+4.3%

Gas & Services Revenue 4,070

4,932 +21.2% +2.7% Engineering

& Construction 130 93 -28.8% -29.1%

Global Markets & Technologies 81 92 +13.3%

+14.1%

GROUP REVENUE 4,281

5,117 +19.5% +2.0%

BY WORLD BUSINESS LINE

Revenue

(in millions of euros)

Q2 2016 Q2 2017

Publishedchange

Comparablechange

(a)

Large industries 1,181 1,302 +10.3%

+1.8% Industrial Merchant 1,726 2,373

+37.5% +3.1% Healthcare 756 840 +11.1%

+3.5% Electronics 407 417 +2.4%

+1.2%

GAS & SERVICES REVENUE 4,070

4,932 +21.2% +2.7%

(a) Comparable change based on adjusted

2016 sales excluding currency and energy impacts.

Segment information

H1 2016 H1 2017 (in millions of

euros and %)

Revenue

Operatingincomerecurring

OIR margin Revenue

Operatingincomerecurring

OIR margin Americas

2,185.3 431.2 19.7% 4,250.7

670.3 15.8% Europe 3,224.4 638.4 19.8%

3,371.2 636.5 18.9% Asia-Pacific

1,919.7 344.8 18.0% 2,032.6 400.9

19.7% Middle-East and Africa 288.1 44.5

15.5% 323.8 53.1 16.4%

Gas and Services

7,617.5 1,458.9 19.2%

9,978.3 1,760.8 17.6%

Engineering and Construction 254.3 10.8 4.2%

145.8 (5.6) -3.9% Global Markets and

Technologies 145.7 15.8 10.8% 168.6

17.9 10.6% Reconciliation - (118.8)

- - (117.0) -

TOTAL GROUP

8,017.5 1,366.7 17.0%

10,292.7 1,656.1 16.1%

The operating margin (OIR to revenue) was up +30 basis points on

a comparable basis at 16.1% compared with H1 16 adjusted operating

margin. Excluding the energy impact, H1 17 operating margin

was up +70 basis points at 16.5% compared to the adjusted H1

16 operating margin and in line with the Group’s objective to

improve profitability.

Consolidated income statement

Considering the disposal of Aqua Lung as announced on 30

December 2016, and the on-going divestment of its subsidiary

Air Liquide Welding (communicated on

15 December 2016, last press release on

27 April 2017),“Other activities” have been reallocated

to “Net Profit from Discontinued Operations” in the 2016 and 2017

Income Statement, in accordance with IFRS 5.

In the same manner, “Other activities” have been reallocated to

“Assets held for sale” and “Liabilities held for sale” on the

balance sheet.

(in millions of euros)

1st Half 2016

aspublished

1st Half

2016restated (a)

1st Half 2017 Revenue

8,294.6 8,017.5 10,292.7

Other income 62.2 60.3 58.6 Purchases

(3,056.6) (2,924.6) (3,907.9) Personnel expenses

(1,655.9) (1,586.5) (2,098.4) Other expenses

(1,538.2) (1,482.0) (1,788.5)

Operating

income recurring before depreciation and amortization

2,106.1 2,084.7 2,556.5

Depreciation and amortization expense (724.5) (718.0)

(900.4)

Operating income recurring

1,381.6 1,366.7 1,656.1 Other

non-recurring operating income 12.3 12.3 (0.3)

Other non-recurring operating expenses (101.6) (96.7)

(1.4)

Operating income 1,292.3

1,282.3 1,654.4 Net finance costs

(153.8) (151.7) (222.9) Other financial income

11.2 11.0 11.3 Other financial expenses (32.1)

(30.3) (47.7) Income taxes (268.2)

(264.0) (388.8) Share of profit of associates 3.6

3.3 0.6

NET PROFIT FROM CONTINUING OPERATIONS

853.0 850.6 1,006.9

NET RESULT FROM DISCONTINUED OPERATIONS -

2.4 (30.4) PROFIT FOR THE PERIOD

853.0 853.0 976.5 ■

Minority interests 42.4 42.4 48.7 ■ Net profit

(Group share)

810.6 810.6

927.8

Basic earnings per share (in euros)

(b)

2.30 2.30 2.40 Diluted

earnings per share (in euros)

2.29

2.29 2.39

Basic earnings per share from continuing

operations (in euros)

2.30 2.29

2.48 Diluted earnings per share from continuing

operations (in euros)

2.29 2.28

2.47

Basic earnings per share from discontinued operations (in

euros)

- 0.01 (0.08)

Diluted earnings per share from discontinued operations (in

euros)

- 0.01 (0.08)

(a) 1st half 2016 restated

applying the IFRS 5 as mentioned above.

(b) Used to calculate net earnings per

share. The average number of outstanding shares in H1 2016 was

restated for the impact of the preferential subscription rights

allocated to shareholders as part of the capital increase carried

out in October 2016.

Consolidated balance sheet

ASSETS (in millions of euros)

December 31, 2016 June 30, 2017

Goodwill 13,889.5 13,298.7 Other intangible assets

1,887.4 1,749.4 Property, plant and equipment

20,115.7 19,156.1

Non-current assets

35,892.6 34,204.2 Non-current financial assets

584.0 619.1 Investments in associates 134.2

122.2 Deferred tax assets 181.9 238.5 Fair

value of non-current derivatives (assets) 60.1 67.3

Other non-current assets 960.2

1,047.1 TOTAL NON-CURRENT ASSETS

36,852.8 35,251.3 Inventories and

work-in-progress 1,323.1 1,361.9 Trade receivables

3,115.0 3,124.1 Other current assets 697.5

746.9 Current tax assets 277.4 102.0 Fair

value of current derivatives (assets) 53.2 48.0 Cash

and cash equivalents 1,523.0 895.0

TOTAL CURRENT

ASSETS 6,989.2 6,277.9 ASSETS

HELD FOR SALE 275.8 277.4 TOTAL

ASSETS 44,117.8 41,806.6

LIABILITIES (in millions of euros)

December 31,

2016 June 30, 2017 Share capital

2,138.8 2,135.2 Additional paid-in capital

3,103.3 3,017.2 Retained earnings 9,767.4

9,739.4 Treasury shares (111.7) (143.3) Net profit

(Group share) 1,844.0 927.8

Shareholders'

equity 16,741.8 15,676.3

Minority interests 383.2 372.7

TOTAL EQUITY 17,125.0 16,049.0

Provisions, pensions and other employee benefits 2,592.4

2,461.8 Deferred tax liabilities 2,378.2

2,248.8 Non-current borrowings 14,890.1 13,914.6

Other non-current liabilities 270.6 233.0 Fair value

of non-current derivatives (liabilities) 233.7 48.7

TOTAL NON-CURRENT LIABILITIES 20,365.0

18,906.9 Provisions, pensions and other employee benefits

279.5 251.3 Trade payables 2,485.9

2,283.8 Other current liabilities 1,473.3 1,332.8

Current tax payables 144.3 148.2 Current borrowings

2,001.0 2,590.5 Fair value of current derivatives

(liabilities) 63.0 85.3

TOTAL CURRENT

LIABILITIES 6,447.0 6,691.9

LIABILITIES HELD FOR SALE 180.8

158.8 TOTAL EQUITY AND LIABILITIES

44,117.8 41,806.6

Consolidated cash flow statement

(in millions of euros)

1st Half 2016

aspublished

1st Half 2016 (a)

1st Half 2017 Operating

activities Net

profit (Group share) 810.6 810.6

927.8 Minority interests 42.4

42.4 48.7 Adjustments:

● Depreciation and amortization

724.5 724.5 903.9 ● Changes in deferred taxes

42.7 42.7 71.3 ● Increase (decrease) in provisions

(29.6) (29.6) (79.3) ● Share of profit of

associates - - 2.4 ● Profit/loss on disposal

of assets (16.1) (16.1) 19.9 ● Net finance

costs related to the acquisition of Airgas - 22.1

52.5

Cash flows from operating activities before

changes in working capital 1,574.5

1,596.6 1,947.2 Changes in working capital

(335.0) (335.0) (316.5) Others (46.8)

(46.8) (37.2)

Net cash flows from operating

activities 1,192.7 1,214.8

1,593.5 Investing activities

Purchase of property, plant and equipment and

intangible assets (1,054.9) (1,054.9)

(1,107.8) Acquisition of consolidated companies and financial

assets (12,099.7) (12,099.7) (85.8) Proceeds

from sale of property, plant and equipment and intangible assets

49.4 49.4 32.9 Proceeds from sale of financial

assets 0.3 0.3 3.0

Net cash flows used in

investing activities (13,104.9)

(13,104.9) (1,157.7) Financing

activities Dividends

paid ● L'Air Liquide S.A.

(946.7) (946.7) (1,061.7) ● Minority interests

(48.5) (48.5) (41.2) Proceeds from issues of

share 102.7 102.7 26.9 Purchase of treasury

shares (0.1) (0.1) (158.4) Increase (decrease)

in borrowings 13,072.4 13,050.3 138.5

Transactions with minority shareholders (0.5) (0.5)

(4.4)

Net cash flows from (used in) financing

activities 12,179.3 12,157.2

(1,100.3) Effect of exchange rate changes and change in

scope of consolidation 60.5 60.5 (23.1)

Net

increase (decrease) in net cash and cash equivalents

327.6 327.6 (687.6) NET CASH

AND CASH EQUIVALENTS AT THE BEGINNING OF THE PERIOD

875.4 875.4 1,430.5 NET CASH

AND CASH EQUIVALENTS AT THE END OF THE PERIOD

1,203.0 1,203.0 742.9

(a) The 1st half of 2016 cash flow

statement has been restated in compliance with IAS 8 to

include the restatement of Airgas net finance costs.

The analysis of net cash and cash equivalents at the end of

the period is as follows:

(in millions of euros)

June 30,

2016 December 31, 2016 June 30,

2017 Cash and cash equivalents 1,315.8

1,523.0 895.0 Bank overdrafts (included in current

borrowings) (112.8) (92.5) (152.1)

NET CASH

AND CASH EQUIVALENTS 1,203.0

1,430.5 742.9

Net indebtedness calculation

(in millions of euros)

June 30,

2016 December 31, 2016 June 30,

2017 Non-current borrowings (long-term debt)

(11,101.8) (14,890.1) (13,914.6) Current borrowings

(short-term debt) (10,073.8) (2,001.0)

(2,590.5)

TOTAL GROSS INDEBTEDNESS (21,175.6)

(16,891.1) (16,505.1) Cash and cash

equivalents 1,315.8 1,523.0

895.0

Derivative instruments (assets) - fair

value hedge ofborrowings

- - -

Derivative instruments (liabilities) -

fair value hedge ofborrowings

- - -

TOTAL NET INDEBTEDNESS AT THE END OF

THE PERIOD (19,859.8) (15,368.1)

(15,610.1)

Statement of changes in net indebtedness

(in millions of euros)

June 30, 2016

aspublished

June 30, 2016 (a)

December 31,2016

June 30, 2017 Net indebtedness at the

beginning of the period (7,238.7)

(7,238.7) (7,238.7) (15,368.1)

Net cash flows from operating activities 1,192.7

1,214.8 3,696.5 1,593.5 Net cash flows used in

investing activities (13,104.9) (13,104.9)

(13,594.3) (1,157.7)

Net cash flows used in financing

activities excludingincrease (decrease) in borrowings

(893.1) (893.1) 2,331.5 (1,238.8)

Total net cash flows (12,805.3)

(12,783.2) (7,566.3) (803.0)

Effect of exchange rate changes, opening

net indebtednessof newly acquired companies and others

184.2 162.1 (563.1) 561.0

Change in

net indebtedness (12,621.1)

(12,621.1) (8,129.4) (242.0)

NET INDEBTEDNESS AT THE END OF THE PERIOD

(19,859.8) (19,859.8) (15,368.1)

(15,610.1)

(a) The 1st half of 2016 cash flow

statement has been restated in compliance with IAS 8 to

include the restatement of Airgas net finance costs.

Revenue and adjusted 2016 Operating Income Recurring

Adjusted 2016 revenue and operating income recurring are

computed as if, on January 1, 2016, Airgas had been fully

consolidated and the divestitures requested by the U.S Federal

Trade Commission completed, and Aqua Lung and

Air Liquide Welding had been deconsolidated.

(in millions of euros)

1st

Half 2016 2016 Revenue 9,734

19,812 Operating income recurring before depreciation and

amortization 2,401 4,916 Operating income recurring

1,543 3,189 Operating Margin (a) 15.8%

16.1%

(a) Operating Income Recurring/Revenue

The adjusted 2016 sales figures are reposted hereunder in order

to provide a 2016 comparable basis:

Adjusted 2016 Sales

(in millions of euros)

Q1 2016 Q2 2016 Q3 2016

Q4 2016 2016 Group 4,857

4,877 4,922 5,156 19,812 Gas & Services

4,668 4,666 4,744 4,930 19,008

Industrial Merchant 2,261 2,271 2,270

2,293 9,095 Healthcare 792 807 813

846 3,258

Americas 1,944

1,957 2,003 2,003 7,907 IM Americas

1,381 1,370 1,381 1,369 5,501

Healthcare Americas 181 186 191 188

746

NB: the figures not shown here above correspond to the published

figures and are not concerned by the adjustment from the Airgas

acquisition.

Return on Capital Employed – ROCE

Applied method

Return on capital employed after tax is calculated based on the

Group’s consolidated financial statements, by applying the

following ratio for the period in question:

For the numerator: net profit - net finance costs after taxes

for the period in question.

For the denominator: the average of (total shareholders' equity

+ net indebtedness) at the end of the past three half-years.

The adjusted 2016 ROCE taking into account the

acquisition of Airgas for the full year 2016 reached 6.9%.

Hence, the ROCE at end of June 2017 increased +50 bps

to adjusted 2016 ROCE.

ROCE H1 2017 H1

2016 2016 H1 2017

ROCECalculation

(in millions of euros)

(a) (b)

(c) Numerator

((b)-(a))+(c)

Net profit after tax before deduction of minority interests

853.0 1,926.7 976.5 2,050.2 Net finance costs

-151.7 -389.1 -222.9 -460.3 Group

effective tax rate 23.8% 28.2% 27.9% -

Net financial costs after tax -115.7 -279.4

-160.8 -324.5

Net profit after tax before deduction

of minority interests - Net financial costs after

tax

968.7 2,206.1 1,137.3

2,374.7

Denominator

((a)+(b)+(c))/3

Total equity 12,329.7 17,125.0 16,049.0

15,167.9 Net indebtedness 19,859.8 15,368.1

15,610.1 16,946.0

Average of (total equity + net

indebtedness)

32,113.9 ROCE

7.4% ROCE H1 2016

H1 2015 2015 H1 2016

ROCECalculation

(in millions of euros)

(a) (b)

(c) Numerator

((b)-(a))+(c)

Net profit after tax before deduction of minority interests

888.6 1,838.7 853.0 1,803.1 Net finance costs

-121.7 -227.1 -151.7 -257.1 Group

effective tax rate 29.2% 26.8% 23.8% -

Net financial costs after tax -86.2 -166.2

-115.7 -195.8

Net profit after tax before deduction

of minority interests - Netfinancial costs after tax

974.8 2,004.9 968.7

1,998.9

Denominator

((a)+(b)+(c))/3

Total equity 12,150.8 12,770.8 12,329.7

12,417.1 Net indebtedness 7,926.6 7,238.7

19,859.8 11,675.0

Average of (total equity + net

indebtedness)

24,092.1 ROCE

8.3%

www.airliquide.comFollow us on Twitter

@airliquidegroup

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170727006632/en/

Air LiquideCorporate CommunicationsAnnie Fournier,

+33 (0)1 40 62 51 31orInvestor RelationsParis, +33 (0)1 40

62 50 87orRadnor, +1 610 263 8277

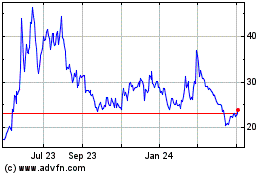

C3 AI (NYSE:AI)

Historical Stock Chart

From Jun 2024 to Jul 2024

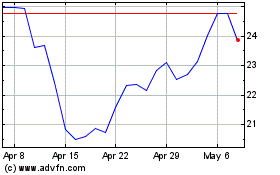

C3 AI (NYSE:AI)

Historical Stock Chart

From Jul 2023 to Jul 2024