Brookfield Infrastructure Partners L.P. (“BIP”) (NYSE: BIP; TSX:

BIP.UN) today announced that the Toronto Stock Exchange (the “TSX”)

accepted a notice filed by BIP of its intention to renew its normal

course issuer bid for its outstanding limited partnership units

(“LP Units”) and its cumulative class A preferred limited

partnership units (“Preferred Units”, and together with LP Units,

“Units”). Brookfield Infrastructure Corporation (“BIPC”) (NYSE/TSX:

BIPC) also today announced that the TSX accepted a notice filed by

BIPC of its intention to renew its normal course issuer bid for its

outstanding class A exchangeable subordinate voting shares

(“Exchangeable Shares”).

BIP and BIPC believe that the renewed normal

course issuer bid will provide the flexibility to use available

funds to purchase Units or Exchangeable Shares, as applicable,

should they be trading in price ranges that do not fully reflect

their value.

Under BIP’s normal course issuer bid, the Board

of Directors of the general partner of BIP authorized BIP to

repurchase up to 5% of the issued and outstanding LP Units, or up

to 23,088,572 LP Units. At the close of business on November 19,

2024, there were 461,771,450 LP Units issued and outstanding. Under

BIP’s normal course issuer bid, it may repurchase up to 126,133 LP

Units on the TSX during any trading day, which represents 25% of

the average daily trading volume of 504,532 LP Units on the TSX for

the six months ended October 31, 2024, calculated in accordance

with the rules of the TSX.

BIP currently has four series of Preferred Units

outstanding and that trade on the TSX. Under BIP’s normal course

issuer bid, BIP is authorized to repurchase up to 10% of the total

public float of each series of Preferred Units as follows:

|

Series |

Ticker |

Issued and outstanding

units1 |

Public float1 |

Average daily trading

volume2 |

Maximum number of units subject to

repurchase3 |

|

|

|

|

|

|

Total |

Daily |

|

Series 1 |

BIP.PR.A |

4,989,265 |

4,989,265 |

6,031 |

498,926 |

1,507 |

|

Series 3 |

BIP.PR.B |

4,989,262 |

4,989,262 |

2,964 |

498,926 |

1,000 |

|

Series 9 |

BIP.PR.E |

7,986,595 |

7,986,595 |

4,451 |

798,659 |

1,112 |

|

Series 11 |

BIP.PR.F |

9,936,190 |

9,936,190 |

5,363 |

993,619 |

1,340 |

- Calculated as at November 19,

2024.

- For the 6 months ended October 31,

2024.

- In accordance with TSX rules, any

daily repurchases with respect to each of the Series 1, Series 9

and Series 11 Preferred Units will be limited to 25% of the average

daily trading volume on the TSX of the respective series and any

daily repurchases with respect to the Series 3 Preferred Units will

be limited to 1,000 Preferred Units.

Under BIPC’s normal course issuer bid, the Board

of Directors of BIPC authorized BIPC to repurchase up to 10% of the

total public float of Exchangeable Shares, or up to 11,889,600

Exchangeable Shares. At the close of business on November 19, 2024,

there were 132,029,368 Exchangeable Shares issued and outstanding

and 118,896,006 Exchangeable Shares in the public float. Under

BIPC’s normal course issuer bid, it may repurchase up to 46,896

Exchangeable Shares on the TSX during any trading day, which

represents 25% of the average daily trading volume of 187,586

Exchangeable Shares on the TSX for the six months ended October 31,

2024, calculated in accordance with the rules of the TSX.

Repurchases under each normal course issuer bid

are authorized to commence on December 2, 2024 and each normal

course issuer bid will terminate on December 1, 2025, or earlier

should BIP or BIPC, as applicable, complete its repurchases under

its respective normal course issuer bid prior to such date.

Under BIP’s current normal course issuer bid

that commenced on December 1, 2023 and expires on November 30,

2024, BIP previously sought and received approval from the TSX to

repurchase up to 23,107,234 LP Units, 498,926 Series 1 Preferred

Units, 498,586 Series 3 Preferred Units, 798,659 Series 9 Preferred

Units and 993,619 Series 11 Preferred Units. BIP has not

repurchased any Units under its current normal course issuer bid in

the past twelve months.

Under BIPC’s normal course issuer bid that

commenced on December 1, 2023 and expires on November 30, 2024,

BIPC previously sought and received approval from the TSX to

repurchase up to 11,867,195 Exchangeable Shares. BIPC has not

repurchased any Exchangeable Shares under its current normal course

issuer bid in the past twelve months.

Repurchases of Series 1, Series 3, Series 9 and

Series 11 Preferred Units will be effected through the facilities

of the TSX and/or alternative trading systems. Repurchases of LP

Units and Exchangeable Shares will be effected through the

facilities of the TSX, the NYSE and/or alternative trading systems.

All Units and Exchangeable Shares acquired by BIP and BIPC,

respectively, under the applicable normal course issuer bid will be

cancelled. Repurchases will be subject to compliance with

applicable United States federal securities laws, including Rule

10b-18 under the United States Securities Exchange Act of 1934, as

amended, as well as applicable Canadian securities laws.

BIP and BIPC intend to enter into automatic

share purchase plans on or about the week of December 23, 2024 in

relation to their respective normal course issuer bids. The

automatic share purchase plans will allow for the purchase of Units

or Exchangeable Shares, as applicable, subject to certain trading

parameters, at times when BIP or BIPC ordinarily would not be

active in the market due to its own internal trading blackout

periods, insider trading rules or otherwise. Outside these periods,

the Units or Exchangeable Shares will be repurchased in accordance

with management’s discretion, subject to applicable law.

About Brookfield

Infrastructure

Brookfield Infrastructure is a leading global

infrastructure company that owns and operates high-quality,

long-life assets in the utilities, transport, midstream and data

sectors across the Americas, Asia Pacific and Europe. We are

focused on assets that have contracted and regulated revenues that

generate predictable and stable cash flows. Investors can access

its portfolio either through Brookfield Infrastructure Partners

L.P. (NYSE: BIP; TSX: BIP.UN), a Bermuda-based limited partnership,

or Brookfield Infrastructure Corporation (NYSE, TSX: BIPC), a

Canadian corporation. Further information is available at

https://bip.brookfield.com.

Brookfield Infrastructure is the flagship listed

infrastructure company of Brookfield Asset Management, a global

alternative asset manager with over US$1 trillion of assets under

management. For more information, go to https://brookfield.com.

Contact Information

|

Media: |

Investor Relations: |

|

Simon MaineManaging DirectorCorporate CommunicationsTel: +44 739

890 9278Email: simon.maine@brookfield.com |

Stephen FukudaSenior Vice PresidentCorporate Development &

Investor RelationsTel: +1 416 956

5129Email: stephen.fukuda@brookfield.com |

Cautionary Statement Regarding

Forward-looking Statements

This news release contains forward-looking

statements and information within the meaning of applicable

securities laws. The words “believes,” “may” or derivations thereof

and other expressions which are predictions of or indicate future

events, trends or prospects and which do not relate to historical

matters identify forward-looking statements. Forward-looking

statements in this news release include statements regarding

potential future repurchases by BIP of its Units and by BIPC of its

Exchangeable Shares pursuant to their respective normal course

issuer bids and, as applicable, automatic repurchase plans.

Although BIP and BIPC believe that these forward-looking statements

and information are based upon reasonable assumptions and

expectations, the reader should not place undue reliance on them,

or any other forward-looking statements or information in this news

release. The future performance and prospects of BIP and BIPC are

subject to a number of known and unknown risks and uncertainties.

Factors that could cause actual results of BIP and BIPC to differ

materially from those contemplated or implied by the statements in

this news release include: general economic conditions; interest

rate changes; availability of equity and debt financing; the

performance of Units and Exchangeable Shares or the stock exchanges

generally; and other risks and factors described in the documents

filed by BIP and BIPC with securities regulators in Canada and the

United States including under “Risk Factors” in BIP’s and BIPC’s

most recent Annual Reports on Form 20-F and other risks and factors

that are described therein. Except as required by law, BIP and BIPC

undertake no obligation to publicly update or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise.

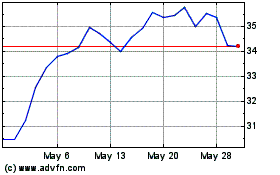

Brookfield Infrastructure (NYSE:BIPC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Brookfield Infrastructure (NYSE:BIPC)

Historical Stock Chart

From Feb 2024 to Feb 2025