SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2025

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the

registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

BRASKEM S.A.

National Register of Legal Entities (CNPJ) No. 42.150.391/0001-70

State Registration (NIRE) 29.300.006.939

a Publicly Held Company MINUTES OF THE BOARD OF DIRECTORS’ MEETING HELD ON FEBRUARY 26, 2025 |

1.

DATE, TIME, AND PLACE: On

February 26, 2025, at 9 am, at Refinaria Duque de Caxias - REDUC, located at Washington Luiz Highway, km 113,7, Campos Elíseos,

Administrative Building, in the city of Duque de Caxias, state of Rio de Janeiro.

2.

CALL NOTICE, ATTENDANCE AND PRESIDING BOARD:

Extraordinary Meeting called pursuant to the Bylaws of the Company, with the attendance of all Board Members indicated below, whereby

Gesner José de Oliveira Filho, José Mauro M. Carneiro da Cunha, Juliana Sá Vieira Baiardi e Paulo Roberto Britto

Guimarães participated by teams. Also participated Roberto Ramos as Chief Executive Officer, the Vice-Presidents Felipe

Jens, Geraldo Vilaça, Stefan Lepecki and Nir Lander, and Mr. Daniel Furlaneto, Artur Cordella, Renato Ramos, Eduardo Pascowitch

and Mrs. Rosana Avolio, Rayane Castro, Clarisse Mello Machado Schlieckmann, Naiara Assad

and Larissa Varella also were attending. Was also attending the Chairman of the Company’s Fiscal Council. The Chairman of the Board

of Directors presided over the meeting, and Ms. Clarisse Schlieckmann acted as secretary.

3.

AGENDA, RESOLUTIONS AND SUBJECTS FOR ACKNOWLEDGEMENT

OR OF INTEREST TO THE COMPANY:

3.1.

SUBJECT FOR RESOLUTION: After

due analysis of the subject submitted for resolution, which was previously forwarded to the Board Members and shall remain duly filed

at the Company’s Governance Portal, the following resolutions was unanimously taken by the Board Members:

| (i) | To express an opinion on

the Annual Financial Statements, the Annual Report of the Administrators and the respective Accounts of the Administrators, and the

Allocation of Results for the Fiscal Year ended on December 31, 2024: After a prior analysis of the matter by the Finance and

Investments Committee and by the Statutory Compliance and Audit Committee (“CCAE”), following the presentation by Mr.

Felipe Jens Chief Financial and Investor Relations Officer, during which the matter was discussed and the President of the Fiscal

Council and the Coordinator of the CCAE, the Directors expressed their approval on the Report of the Administrators, the respective

Accounts of the Administrators, and the Financial Statements, containing the

explanatory notes, related to the fiscal year ended on December 31, 2024, for submission to the Annual General Meeting, which reflect

the loss recorded for the fiscal year ended on December 31, 2024, as shown in the Statement of Changes in Net Equity, in the amount of

BRL 11,320,184,626.99 (eleven billion, three hundred and twenty million, one hundred and eighty-four thousand, six hundred and twenty-six

reais and ninety-nine cents), fully recorded under the heading “Accumulated Losses,” which now records an updated balance

of BRL 14,034,197,580.41 (fourteen billion, thirty-four million, one hundred and ninety-seven thousand, five hundred and eighty reais

and forty-one cents). The representatives of the KPMG Independent Auditors made themselves available to the Directors for clarification

of any questions, and, there being no doubts, the Directors excused their participation in the meeting. |

BRASKEM S.A.

National Register of Legal Entities (CNPJ) No. 42.150.391/0001-70

State Registration (NIRE) 29.300.006.939

a Publicly Held Company MINUTES OF THE BOARD OF DIRECTORS’ MEETING HELD ON FEBRUARY 26, 2025 |

3.2.

Subjects for Acknowledgement:

Nothing to record.

3.3.

Subjects of Interest to the Company:

Nothing to record.

4. ADJOURNMENT:

As there were no further matters to be discussed, the meeting was closed and these minutes were drawn up, and, after being read, discussed,

and found to be in order, were signed by all Board Members in attendance at the meeting, by the Chairman and by the Secretary of the Meeting.

Duque de Caxias/RJ, February 26, 2025.

Héctor

Nuñez |

Clarisse Schlieckmann |

Chairman |

Secretary |

BRASKEM S.A.

National Register of Legal Entities (CNPJ) No. 42.150.391/0001-70

State Registration (NIRE) 29.300.006.939

a Publicly Held Company MINUTES OF THE BOARD OF DIRECTORS’ MEETING HELD ON FEBRUARY 26, 2025 |

Carlos Plachta |

Gesner

José de Oliveira Filho |

|

|

José Mauro M. Carneiro da Cunha |

João

Pinheiro Nogueira Batista |

|

|

Juliana Sá Vieira Baiardi |

Luiz

Eduardo Valente Moreira |

|

|

Mauricio Dantas Bezerra |

Olavo Bentes David |

|

|

Paulo Roberto Britto Guimarães |

Roberto

Faldini |

| |

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: February 27, 2025

| |

BRASKEM S.A. |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Felipe Montoro Jens |

| |

|

|

| |

|

Name: |

Felipe Montoro Jens |

| |

|

Title: |

Chief Financial Officer |

DISCLAIMER ON FORWARD-LOOKING STATEMENTS

This

report on Form 6-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. These statements are statements that are not historical facts, and are based on our management’s current view and estimates

of future economic and other circumstances, industry conditions, company performance and financial results, including any potential

or projected impact of the geological event in Alagoas and related legal proceedings and of COVID-19 on our business, financial

condition and operating results. The words “anticipates,” “believes,” “estimates,” “expects,”

“plans” and similar expressions, as they relate to the company, are intended to identify forward-looking statements.

Statements regarding the potential outcome of legal and administrative proceedings, the implementation of principal operating and

financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting our

financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the

current views of our management and are subject to a number of risks and uncertainties, many of which are outside of the our control.

There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions

and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such

assumptions or factors, including the projected impact of the geological event in Alagoas and related legal proceedings and the

unprecedented impact of COVID-19 pandemic on our business, employees, service providers, stockholders, investors and other stakeholders,

could cause actual results to differ materially from current expectations. Please refer to our annual report on Form 20-F for the

year ended December 31, 2019 filed with the SEC, as well as any subsequent filings made by us pursuant to the Exchange Act, each

of which is available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact

any forward-looking statements in this presentation.

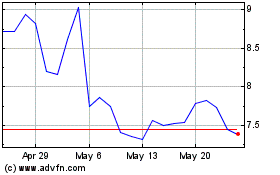

Braskem (NYSE:BAK)

Historical Stock Chart

From Feb 2025 to Mar 2025

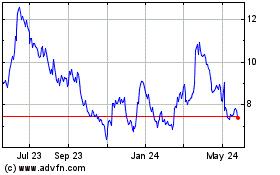

Braskem (NYSE:BAK)

Historical Stock Chart

From Mar 2024 to Mar 2025