Amended Statement of Beneficial Ownership (sc 13d/a)

September 21 2020 - 3:57PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 3)*

BrandywineGLOBAL-Global

Income Opportunities Fund

(Name

of Issuer)

Common

Stock

(Title

of Class of Securities)

10537L104

(CUSIP

Number)

Phillip

Goldstein

Bulldog

Investors, LLC

Park

80 West – Plaza Two

250

Pehle Ave., Suite 708

Saddle

Brook, NJ 07663

201-556-0092

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

09/09/2020

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. [

]

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

|

*

|

The

remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

|

The

information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section

18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE

13D/A

DATE

OF EVENT WHICH REQUIRES FILING OF THIS STATEMENT

9/9/20

|

|

|

|

|

|

|

1.

|

|

NAME

OF REPORTING PERSON

Bulldog

Investors, LLC

|

|

|

|

2.

|

|

CHECK

THE BOX IF MEMBER OF A GROUP

a [ ]

b [ ]

|

|

|

|

3.

|

|

SEC

USE ONLY

|

|

|

|

4.

|

|

SOURCE

OF FUNDS

WC

|

|

|

|

5.

|

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) AND 2(e) [ ]

|

|

|

|

6.

|

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

DE

|

|

|

|

|

|

|

|

7.

|

|

SOLE

VOTING POWER

20,791

|

|

8.

|

|

SHARED

VOTING POWER

647,802

|

|

9.

|

|

SOLE

DISPOSITIVE POWER

20,791

|

|

10.

|

|

SHARED

DISPOSITIVE POWER

647,802

|

|

|

|

|

|

|

|

11.

|

|

AGGREGATE

AMOUNT OWNED BY EACH REPORTING PERSON

668,593(Footnote

1)

|

|

|

|

12.

|

|

CHECK

IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[ ]

|

|

|

|

13.

|

|

PERCENT

OF CLASS REPRESENTED BY ROW 11

3.19%

|

|

|

|

14.

|

|

TYPE

OF REPORTING PERSON

IA

|

|

|

|

|

|

|

|

|

|

1.

|

|

NAME

OF REPORTING PERSON

Phillip

Goldstein

|

|

|

|

2.

|

|

CHECK

THE BOX IF MEMBER OF A GROUP

a [ ]

b [ ]

|

|

|

|

3.

|

|

SEC

USE ONLY

|

|

|

|

4.

|

|

SOURCE

OF FUNDS

WC

|

|

|

|

5.

|

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) AND 2(e) [ ]

|

|

|

|

6.

|

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

USA

|

|

|

|

|

|

|

|

7.

|

|

SOLE

VOTING POWER

20,791

|

|

8.

|

|

SHARED

VOTING POWER

894,609

|

|

9.

|

|

SOLE

DISPOSITIVE POWER

20,791

|

|

10.

|

|

SHARED

DISPOSITIVE POWER

894,609

|

|

|

|

|

|

|

|

11.

|

|

AGGREGATE

AMOUNT OWNED BY EACH REPORTING PERSON

915,400

(Footnote 1)

|

|

|

|

12.

|

|

CHECK

IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[ ]

|

|

|

|

13.

|

|

PERCENT

OF CLASS REPRESENTED BY ROW 11

4.36%

|

|

|

|

14.

|

|

TYPE

OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

|

|

1.

|

|

NAME

OF REPORTING PERSON

Andrew

Dakos

|

|

|

|

2.

|

|

CHECK

THE BOX IF MEMBER OF A GROUP

a [ ]

b [ ]

|

|

|

|

3.

|

|

SEC

USE ONLY

|

|

|

|

4.

|

|

SOURCE

OF FUNDS

WC

|

|

|

|

5.

|

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) AND 2(e) [ ]

|

|

|

|

6.

|

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

USA

|

|

|

|

|

|

|

|

7.

|

|

SOLE

VOTING POWER

20,791

|

|

8.

|

|

SHARED

VOTING POWER

894,609

|

|

9.

|

|

SOLE

DISPOSITIVE POWER

20,791

|

|

10.

|

|

SHARED

DISPOSITIVE POWER

894,609

|

|

|

|

|

|

|

|

11.

|

|

AGGREGATE

AMOUNT OWNED BY EACH REPORTING PERSON

915,400

(Footnote 1)

|

|

|

|

12.

|

|

CHECK

IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[ ]

|

|

|

|

13.

|

|

PERCENT

OF CLASS REPRESENTED BY ROW 11

4.36%

|

|

|

|

14.

|

|

TYPE

OF REPORTING PERSON

IN

|

|

|

Item

1. SECURITY AND ISSUER

This

statement constitutes Amendment #3 to the schedule 13d filed July 8, 2020. Except as specifically set forth herein, the Schedule

13d remains unmodified.

ITEM

5. INTEREST IN SECURITIES OF THE ISSUER

(a) As

per the N-CSRS filed on June 25, 2020, there were 20,989,795 shares of common stock outstanding as of April 30, 2020. The percentages

set forth herein were derived using such number. Phillip Goldstein and Andrew Dakos own Bulldog Investors, LLC, a registered investment

advisor. As of September 17, 2020, Bulldog Investors, LLC is deemed to be the beneficial owner of 668,593 shares of BWG (representing

3.19% of BWG's outstanding shares) solely by virtue of Bulldog Investors LLC's power to direct the vote of,and dispose of, these

shares. These 668,593 shares of BWG include 20,791 shares (representing 0.10% of BWG's outstanding shares) that are beneficially

owned by Mr. Goldstein. All other shares included in the aforementioned 668,593 shares of BWG beneficially owned by Bulldog Investors

LLC (solely by virtue of its power to sell or direct the vote of these shares) are also beneficially owned by clients of Bulldog

Investors, LLC who are not members of any group. The total number of these "non-group" shares is 647,802 shares (representing

3.09% of BWG's outstanding shares).

As of

September 17, 2020, each of Messrs. Goldstein and Dakos is deemed to be the beneficial owner of 915,400 shares of BWG (representing

4.36% of BWG's outstanding shares) by virtue of their power to direct the vote of, and dispose of, these shares.

(b)Bulldog

Investors,LLC has sole power to dispose of and vote 20,791 shares. Bulldog Investors, LLC has shared power to dispose of and vote

647,802 shares. Certain of Bulldog Investors, LLC's clients (none of whom beneficially own more than 5% of BWG's shares) share

this power with Bulldog Investors, LLC. Messrs.Goldstein and Dakos are members of Bulldog Investors, LLC. Messrs. Goldstein and

Dakos have shared power to dispose of and vote an additional 246,807 shares.

c) During

the past 60 days the following shares of BWG were purchased:

|

Date:

|

Shares:

|

Price:

|

|

8/11/20

|

5000

|

12.5900

|

|

8/10/20

|

5000

|

12.6000

|

|

8/06/20

|

5000

|

12.6000

|

|

7/31/20

|

306

|

12.5200

|

During

the past 60 days the following shares of BWG were sold:

|

07/31/20

|

(4,465)

|

12.5542

|

|

07/31/20

|

(12,735)

|

12.5542

|

|

08/04/20

|

(3,997)

|

12.6231

|

|

08/04/20

|

(11,403)

|

12.6231

|

|

08/05/20

|

(100)

|

12.6500

|

|

08/06/20

|

(6,494)

|

12.6043

|

|

08/06/20

|

(18,506)

|

12.6043

|

|

08/07/20

|

(7,109)

|

12.6200

|

|

08/07/20

|

(2,495)

|

12.6200

|

|

08/17/20

|

(6,494)

|

12.4820

|

|

08/17/20

|

(18,506)

|

12.4820

|

|

08/18/20

|

(7,351)

|

12.5082

|

|

08/18/20

|

(20,949)

|

12.5082

|

|

08/19/20

|

(6,494)

|

12.5638

|

|

08/19/20

|

(18,506)

|

12.5638

|

|

08/24/20

|

(1,407)

|

12.4854

|

|

08/24/20

|

(494)

|

12.4854

|

|

08/25/20

|

(1,859)

|

12.4300

|

|

08/25/20

|

(652)

|

12.4300

|

|

08/26/20

|

(1,040)

|

12.4000

|

|

08/26/20

|

(365)

|

12.4000

|

|

08/27/20

|

(649)

|

12.3596

|

|

08/27/20

|

(1,851)

|

12.3596

|

|

08/31/20

|

(10,827)

|

12.3597

|

|

08/31/20

|

(3,799)

|

12.3597

|

|

8/5/2020

|

(2,376)

|

12.6354

|

|

9/9/2020

|

(4,000)

|

12.4765

|

|

9/10/2020

|

(9,000)

|

12.5416

|

|

9/14/2020

|

(4,500)

|

12.4974

|

|

9/15/2020

|

(7,800)

|

12.5037

|

|

9/17/2020

|

(5,500)

|

12.5319

|

|

9/15/2020

|

(1,000)

|

12.5100

|

|

9/17/2020

|

(500)

|

12.5200

|

|

9/15/2020

|

(500)

|

12.5050

|

|

9/17/2020

|

(1,500)

|

12.5550

|

|

9/17/2020

|

(70,000)

|

12.5357

|

|

9/16/2020

|

(6,580)

|

12.5400

|

|

9/15/2020

|

(25,811)

|

12.5000

|

|

9/15/2020

|

(21,083)

|

12.4959

|

|

9/14/2020

|

(8,400)

|

12.5001

|

|

9/11/2020

|

(12,245)

|

12.5078

|

|

9/10/2020

|

(25,100)

|

12.4590

|

|

9/9/2020

|

(14,916)

|

12.4826

|

|

9/8/2020

|

(33,970)

|

12.4300

|

|

9/2/2020

|

(19,072)

|

12.5018

|

|

9/1/2020

|

(41,646)

|

12.4000

|

d) Clients

of Bulldog Investors, LLC, Mr. Goldstein, and an account managed by Messrs. Goldstein and Dakos are entitled to receive any dividends

or sales proceeds.

e) The

Reporting Persons ceased to be the beneficial owner of more than 5% of BWG's common stock on September 15, 2020 based on the N-CSRS

filed June 25, 2020.

ITEM

6. CONTRACTS,ARRANGEMENTS,UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER.

N/A

ITEM

7. MATERIAL TO BE FILED AS EXHIBITS

None

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated:

9/18/2020

By: /S/

Phillip Goldstein

Name:

Phillip Goldstein

By: /S/

Andrew Dakos

Name:

Andrew Dakos

Bulldog

Investors, LLC

By: /s/

Andrew Dakos

Andrew

Dakos, Member

Footnote

1: The reporting persons disclaim beneficial ownership except to the extent of any pecuniary interest therein.

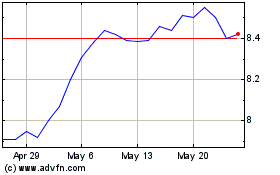

BrandywineGlobal Global ... (NYSE:BWG)

Historical Stock Chart

From Oct 2024 to Nov 2024

BrandywineGlobal Global ... (NYSE:BWG)

Historical Stock Chart

From Nov 2023 to Nov 2024