false 0001736035 0001736035 2024-02-28 2024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 28, 2024

Blackstone Secured Lending Fund

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

814-01299 |

|

82-7020632 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

| 345 Park Avenue, 31st Floor |

| New York, New York 10154 |

| (Address of Principal Executive Offices) (Zip Code) |

Registrant’s telephone number, including area code: (212) 503-2100

Not Applicable

(Former Name or Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Shares of Beneficial Interest, $0.001 par value per share |

|

BXSL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition |

On February 28, 2024, Blackstone Secured Lending Fund issued a press release and detailed presentation announcing its financial results for the fourth quarter ended December 31, 2023. The press release with the detailed presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information contained under Item 2.02 in this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and will not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

BLACKSTONE SECURED LENDING FUND |

|

|

|

|

| Date: February 28, 2024 |

|

|

|

By: |

|

/s/ Teddy Desloge |

|

|

|

|

Name: |

|

Teddy Desloge |

|

|

|

|

Title: |

|

Chief Financial Officer |

NEW YORK — February 28, 2024

— Blackstone Secured Lending Fund (NYSE: BXSL, or the “Company”) today reported its fourth quarter and full year 2023 results. Brad Marshall and Jonathan Bock, Co-Chief Executive Officers of Blackstone Secured Lending Fund, said,

“BXSL reported another strong quarter of results including growth in net investment income, increased net asset value, and solid credit performance. Our 98.5% first lien, senior secured portfolio continued to provide capital protection in the

current interest rate environment. New investments increased in the fourth quarter of 2023 to the highest level in two years. We remain optimistic about BXSL’s continued deployment opportunities with a growing Blackstone Credit & Insurance

investment pipeline.” Blackstone Secured Lending Fund issued a full detailed presentation of its fourth quarter and full year 2023 results, which can be viewed at www.bxsl.com. Dividend Declaration The Company's Board of Trustees has declared

a first quarter 2024 dividend of $0.77 per share to shareholders of record as of March 31, 2024, payable on April 26, 2024. Quarterly Investor Call Details Blackstone Secured Lending Fund will host its conference call today at 9:30 a.m. ET to

discuss results. To register for the webcast, please use the following link: https://event.webcasts.com/starthere.jsp?ei=1654639&tp_key=d2cf505449 Blackstone Secured Lending Fund 345 Park Avenue New York, NY 10154 T 212 583 5000 Blackstone

Secured Lending Fund Reports Fourth Quarter and Full Year 2023 Results Exhibit 99.1

2 For those unable to listen to the

live broadcast, there will be a webcast replay on the Shareholders section of BXSL’s website at https://ir.bxsl.com. About Blackstone Secured Lending Fund Blackstone Secured Lending Fund (NYSE: BXSL) is a specialty finance company that

invests primarily in the debt of private U.S. companies. As of December 31, 2023, BXSL’s fair value of investments was approximately $9.9 billion. BXSL has elected to be regulated as a business development company under the Investment Company

Act of 1940, as amended. BXSL is externally managed by Blackstone Credit BDC Advisors LLC, an SEC-registered investment adviser that is an affiliate of Blackstone Inc. Blackstone Inc., together with its subsidiaries, is the world’s largest

alternative investment firm with over $1 trillion of assets under management as of December 31, 2023. Forward-Looking Statements and Other Matters Certain information contained in this communication constitutes “forward-looking

statements” within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of forward-looking terminology, such as

“outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “can,” “will,” “should,” “seeks,”

“approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction,” “identified” or the negative versions

of these words or other comparable words thereof. These may include BXSL’s financial estimates and their underlying assumptions, statements about plans, statements regarding pending transactions, objectives and expectations with respect to

future operations, statements regarding future performance, statements regarding economic and market trends and statements regarding identified but not yet closed investments. Such forward‐looking statements are subject to various risks and

uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. BXSL believes these factors include but are not limited to those described

under the section entitled “Risk Factors” in its prospectus and annual report for the most recent fiscal year, and any such updated factors included in its periodic filings with the Securities and Exchange Commission (the

“SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this document (or

BXSL’s prospectus and other filings). Except as otherwise required by federal securities laws, BXSL undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future

developments or otherwise. Contacts Investors Stacy Wang, Head of Stakeholder Relations Blackstoneshareholderrelations@blackstone.com +1 888-756-8443 Media Mariel Seidman-Gati Mariel.seidmangati@blackstone.com +1 917-698-1674

BXSL – Quarter Ended December

31, 2021 Blackstone Secured Lending Fund Fourth Quarter and Full Year 2023 Results February 28, 2024 This presentation should be read in conjunction with BXSL’s latest annual report filed on Form 10-K for the period ended December 31, 2023.

Numbers are approximate and may not add up due to rounding.

4 Highlights Powerful earnings

capacity as the portfolio of 98.9%(1) floating rate debt continued to benefit from an elevated interest rate environment. Net investment income of $0.96 per share in the quarter. Portfolio is well positioned with investments in companies with solid

fundamentals and only 1 issuer on non-accrual. BXSL is designed with the aim to protect capital with a senior secured debt focus. Earnings Highlights Capital Protection Strong Dividend Consistent, disciplined focus on low-leverage loans to strong

sponsors 14.5% 4Q’23 annualized NII return(2) 11.6% 4Q’23 dividend yield based on NAV(3) $0.77 4Q’23 dividend declared 98.5% First lien, senior secured debt(1) 48.2% Average loan-to-value(5) Consistent regular dividend supported by

strong earnings power Senior lending positions further insulated by strong sponsor relationships BXSL’s asset-liability structure is efficient and optimized Note: All figures in this presentation are as of December 31, 2023, unless otherwise

stated. Opinions expressed reflect the current opinions of BXSL as of the date appearing in the materials only and are based on BXSL’s opinions of the current market environment, which is subject to change. BXSL’s manager is a subsidiary

of Blackstone Inc. Based on the fair market value of the portfolio as of December 31, 2023. Debt investments are 99.9% floating rate and debt investments represent 99.0% of total investments based on the fair market value of the portfolio as of

December 31, 2023. Annualized net investment income (“NII”) return is calculated as the 4Q'23 annualized net investment income per share divided by net asset value (“NAV”) per share at the beginning of the period. 4Q'23

Dividend yield is calculated as the 4Q'23 dividend ($0.77) annualized and divided by the ending NAV per share on December 31, 2023 ($26.66). 4Q'23 Dividend coverage is calculated as 4Q'23 net investment income per share ($0.96) divided by 4Q'23

regular dividend per share ($0.77). Average loan-to-value represents the net ratio of loan-to-value for each portfolio company, weighted based on the fair value of total applicable private debt investments. Loan-to-value is calculated as the current

total net debt through each respective loan tranche divided by the estimated enterprise value of the portfolio company as of the most recently available information. Based on non-accrual debt investments as a percentage of amortized cost of total

investments. Based on the fair market value, investments on non-accrual represent <0.1% of total investments. $0.88 4Q’23 Net income per share 125% 4Q’23 Dividend Coverage(4) <0.1% Non-accrual debt investments(6) $0.96 4Q’23

NII per share

Portfolio and Investment Activity

Weighted average yield on debt investments at fair value of 12.0% at quarter-end, up from 11.9% as of prior quarter-end New investment commitments in the quarter of $1.0 billion at par Proceeds from sales and repayments of $526 million, which

generated net realized gains on investments of $7 million in the quarter Earnings Summary Net investment income of $172 million, or $0.96 per share in the quarter, up 1% from $0.95 in the prior quarter, and up 7% compared to 4Q 2022 Net income of

$157 million, or $0.88 per share in the quarter, down 13% from $1.01 in the prior quarter, and up 16% compared to 4Q 2022 Regular dividend of $0.77 per share, representing a dividend yield of 11.6%(1) Net asset value of $5.0 billion, or $26.66 per

share at quarter-end Total return of 11.0% annualized inception to date and 3.3% for the quarter(2) 4Q'23 Dividend yield is calculated as the 4Q'23 dividend ($0.77) annualized and divided by the ending NAV per share on December 31, 2023 ($26.66).

Total return is calculated as the change in NAV per share during the period, plus dividends per share (assuming dividends and distributions are reinvested in accordance with the Company's dividend reinvestment plan), divided by the beginning NAV per

share. Inception-to-date return is annualized. Available liquidity is comprised of cash and cash equivalents plus the amount available to borrow across all revolving credit facilities, net of limitations related to each respective credit

facility’s borrowing base. As of December 31, 2023, $1.7 billion of capacity is undrawn and $1.7 billion is available to borrow. Average debt to equity leverage ratio has been calculated using the average daily borrowings during the quarter

divided by average net assets. Weighted average interest rate is calculated by annualizing interest expense (includes unused fees and the accretion of original issue discount) divided by weighted average outstanding debt for the quarter. Fourth

quarter Results Liquidity Update $1.8 billion of liquidity in cash and undrawn debt (subject to borrowing base capacity)(3) 1.00x leverage at quarter-end and average leverage of 1.05x(4) 57% fixed rate, unsecured debt with a weighted average coupon

of 2.88% Total weighted average interest rate of 5.05%(5) in 4Q 2023 and a weighted average maturity of approximately 3.4 years

Annualized net investment income

return is calculated as the net investment income per share divided by NAV per share at the beginning of the period. Total return is calculated as the change in NAV per share during the period, plus dividends per share (assuming dividends and

distributions are reinvested in accordance with the Company’s dividend reinvestment plan), divided by the beginning NAV per share. Total debt outstanding is shown net of unamortized debt issuance costs. Average and ending debt-to-equity is

calculated using principal amounts outstanding. Computed as (a) the annual stated interest rate or yield plus the annual accretion of discounts or less the annual amortization of premiums, as applicable, on accruing debt included in such securities,

divided by (b) total debt investments (at fair value) included in such securities. Actual yields earned over the life of each investment could differ materially from the yields presented. Fourth quarter 2023 selected financial highlights ($ in

millions, unless otherwise noted) Prior Quarter PDF Page Reference: BXSL fourth quarter 2022 selected financial highlights for LTM formulas FY'22 Returns FY'23 Returns Page 6 4Q'21 4 4Q'22 8 12 4Q'23 2.9891304347826164E-2 3.277769329358704E-2 4Q'22

8 3Q'22 7 11 3Q'23 2.5878717651602878E-2 3.8403041825094908E-2 2Q'22 6 10 2Q'23 1.875239188672051E-2 3.3972569850844847E-2 1Q'22 5 9 1Q'23 2.4362390559573566E-2 3.4165410370578186E-2 Make PY Corresponding Q Make CQ 4Q'22 4Q'23 FY'22 FY'23 Operating

results Per Prior 8-K Prior Period AT Check Prior Period Prior Period AT Check Net investment income $143.66428343000001 $172.45457980999976 $484.20128342999999 $653.90676110999971 $144 ties to 8-K $484 ties to 8-K Net income 121.78137731 157.31

404.89437730999998 611.94932900000003 122 ties to 8-K 405 ties to 8-K Net investment income per share 0.9 0.96 2.9099999999999997 3.9 0.9 ties to 8-K 2.91 ties to 8-K Net income per share 0.76 0.88 2.4377651016186848 3.65 0.76 ties to 8-K 2.44 ties

to 8-K Regular dividends per share 0.6 0.77 2.2599999999999998 2.94 0.6 ties to 8-K 2.2599999999999998 ties to 8-K Special dividends per share 0 0 0.65 0 0 ties to 8-K 0.65 ties to 8-K Annualized net investment income return(1) 0.13975155279503104

0.14468726450640543 0.11077274457556147 0.15040493636714231 0.14000000000000001 ties to 8-K 0.111 ties to 8-K Total return based on NAV(2) 2.9891304347826164 3.277769329358704 0.10257890201772391 0.14675812592427384 0.03 ties to 8-K

0.10299999999999999 ties to 8-K Portfolio activity New investment commitments, at par $177.41954527999997 $1,037.55703106183 $1,109.5817896000001 $1,946.2355763089301 updated in v2 master 177 ties to 8-K 1,110 ties to 8-K New investment fundings

174.75372128999993 874.42518050971194 983.45372128999998 1,483.3031147797133 updated in v2 master 175 ties to 8-K 983 ties to 8-K Investments sold and repaid -,218.59836920999967 -,526.5702839045694 -1,174.333692099996 -1,305.234427480457 -,219 ties

to 8-K -1,174 ties to 8-K 44926 45291 Balance sheet Investments at fair value $9,617.2484348499984 $9,868.4395834392544 9,617 ties to 8-K Total debt outstanding(3) 5,527.71475362 4,911.9299780000001 5,528 ties to 8-K Net asset value

4,158.9665368599999 4,952.428626700004 4,159 ties to 8-K Net asset value per share 25.93 26.66 25.93 ties to 8-K Ending debt-to-equity(3) 1.34x 1.00x 1.34x ties to 8-K Average debt-to-equity(3) 1.35x 1.05x 1.35x ties to 8-K % First lien

0.97948634033454796 0.98516694248651882 0.97899999999999998 ties to 8-K Weighted average yield on debt and income producing investments, at fair value(4) 0.10729617147617028 0.11962179816407889 0.107 ties to 8-K Number of portfolio companies 176 196

176 ties to 8-K Prior Quarter PDF Page Reference: BXSL fourth quarter 2022 selected financial highlights for LTM formulas FY'22 Returns FY'23 Returns Page 6 4Q'21 4 4Q'22 8 12 4Q'23 2.9891304347826164E-2 3.277769329358704E-2 4Q'22 8 3Q'22 7 11 3Q'23

2.5878717651602878E-2 3.8403041825094908E-2 2Q'22 6 10 2Q'23 1.875239188672051E-2 3.3972569850844847E-2 1Q'22 5 9 1Q'23 2.4362390559573566E-2 3.4165410370578186E-2 Make PY Corresponding Q Make CQ 4Q'22 4Q'23 FY'22 FY'23 Operating results Per Prior

8-K Prior Period AT Check Prior Period Prior Period AT Check Net investment income $143.66428343000001 $172.45457980999976 $484.20128342999999 $653.90676110999971 $144 ties to 8-K $484 ties to 8-K Net income 121.78137731 157.31 404.89437730999998

611.94932900000003 122 ties to 8-K 405 ties to 8-K Net investment income per share 0.9 0.96 2.9099999999999997 3.9 0.9 ties to 8-K 2.91 ties to 8-K Net income per share 0.76 0.88 2.4377651016186848 3.65 0.76 ties to 8-K 2.44 ties to 8-K Regular

dividends per share 0.6 0.77 2.2599999999999998 2.94 0.6 ties to 8-K 2.2599999999999998 ties to 8-K Special dividends per share 0 0 0.65 0 0 ties to 8-K 0.65 ties to 8-K Annualized net investment income return(1) 0.13975155279503104

0.14468726450640543 0.11077274457556147 0.15040493636714231 0.14000000000000001 ties to 8-K 0.111 ties to 8-K Total return based on NAV(2) 2.9891304347826164 3.277769329358704 0.10257890201772391 0.14675812592427384 0.03 ties to 8-K

0.10299999999999999 ties to 8-K Portfolio activity New investment commitments, at par $177.41954527999997 $1,037.55703106183 $1,109.5817896000001 $1,946.2355763089301 updated in v2 master 177 ties to 8-K 1,110 ties to 8-K New investment fundings

174.75372128999993 874.42518050971194 983.45372128999998 1,483.3031147797133 updated in v2 master 175 ties to 8-K 983 ties to 8-K Investments sold and repaid -,218.59836920999967 -,526.5702839045694 -1,174.333692099996 -1,305.234427480457 -,219 ties

to 8-K -1,174 ties to 8-K 44926 45291 Balance sheet Investments at fair value $9,617.2484348499984 $9,868.4395834392544 9,617 ties to 8-K Total debt outstanding(3) 5,527.71475362 4,911.9299780000001 5,528 ties to 8-K Net asset value

4,158.9665368599999 4,952.428626700004 4,159 ties to 8-K Net asset value per share 25.93 26.66 25.93 ties to 8-K Ending debt-to-equity(3) 1.34x 1.00x 1.34x ties to 8-K Average debt-to-equity(3) 1.35x 1.05x 1.35x ties to 8-K % First lien

0.97948634033454796 0.98516694248651882 0.97899999999999998 ties to 8-K Weighted average yield on debt and income producing investments, at fair value(4) 0.10729617147617028 0.11962179816407889 0.107 ties to 8-K Number of portfolio companies 176 196

176 ties to 8-K

Portfolio Characteristics Portfolio

Predominantly First Lien Debt(1) $9.9B investments at fair value 196 portfolio companies <0.1% non-accrual debt investments(4) 98.9% of investments are floating rate debt(1) 98.5% of investments are first lien, senior secured debt(1) 48.2%

average loan-to-value (LTV)(2)(3) Based on the fair market value of the portfolio as of December 31, 2023. Debt investments are 99.9% floating rate and debt investments represent 99.0% of total investments based on the fair market value of the

portfolio as of December 31, 2023. Average loan-to-value represents the net ratio of loan-to-value for each portfolio company, weighted based on the fair value of total applicable private debt investments. Loan-to-value is calculated as the current

total net debt through each respective loan tranche divided by the estimated enterprise value of the portfolio company as of the most recently available information. Includes all private debt investments for which fair value is determined by the

Board of Trustees in conjunction with a third-party valuation firm and excludes quoted assets. Amounts are weighted on fair market value of each respective investment. Amounts were derived from the most recently available portfolio company financial

statements, have not been independently verified by BXSL, and may reflect a normalized or adjusted amount. Accordingly, BXSL makes no representation or warranty in respect of this information. Private debt investments represent approximately 98% of

the total debt portfolio based on fair value. Based on non-accrual debt investments as a percentage of amortized cost of total investments. Based on the fair market value, investments on non-accrual represent <0.1% of total investments. Revenue

data excludes private debt instruments where revenue data was not provided to BXSL. EBITDA is a non-GAAP financial measure. For a particular portfolio company, LTM EBITDA is generally defined as net income before net interest expense, income tax

expense, depreciation and amortization over the last twelve months (“LTM”). Portfolio Company Weighted Average Statistics(3) ($ in millions, unless otherwise noted)

Private credit market trends by size

As of December 31, 2023. Source: The “Lincoln International Private Market Database” (“Lincoln database”), compiled by the Lincoln Valuations & Opinions Group (“VOG”), is a quarterly compilation of over 4,750

portfolio companies from a wide assortment of private equity investors and non-bank lenders. Most of these companies are highly levered with debt financing provided via the direct lending market and, in many instances, Lincoln estimates the fair

value of at least one senior debt security in the portfolio companies’ capital structures. In assessing the data, VOG relies on commonly accepted valuation methodologies and each valuation analysis is unique and conforms to fair value

accounting principles. The analyses are then vetted by auditors, fund managers, and their board of directors, as well as other regulators. © 2024 Lincoln Partners Advisors LLC. All rights reserved. Used with permission. Third party use is at

user’s own risk. EBITDA is a non-GAAP financial measure. For a particular portfolio company, LTM EBITDA is generally defined as net income before net interest expense, income tax expense, depreciation and amortization over the last twelve

months ("LTM"). Average LTM EBITDA of companies that issue loans in the Lincoln database as of 4Q’23. BXSL LTM EBITDA as of December 31, 2023, includes all private debt investments for which fair value is determined by BXSL’s Board of

Trustees in conjunction with a third-party valuation firm, excludes quoted assets, and is weighted by fair market value of each respective investment. BXSL LTM EBITDA was derived from the most recently available portfolio company financial

statements which are generally one quarter in arrears, have not been independently verified by BXSL, and may reflect a normalized or adjusted amount. Accordingly, BXSL makes no representation or warranty in respect of this information. Represented

as the average quarterly share of companies in the Lincoln database that have breached at least one covenant for the period 2Q’18 through 4Q’23, which is the full sample for which data is currently available. BXSL invests in larger

companies because we believe they provide the opportunity for better risk-adjusted returns Private credit market data from Lincoln International shows larger borrowers experienced greater growth over the last year and fewer defaults historically

than smaller borrowers Average Issuer EBITDA in BXSL is 2x Larger than that of the Private Credit Market Larger Companies Grew 4x the Rate of Smaller Companies Last Year… … and Larger Companies Have Historically Defaulted Less Often

Average LTM EBITDA ($ in millions) Growth in LTM EBITDA (Year-over-Year %) Average Quarterly Covenant Default Rate 2Q’18 ― 4Q’23(3) (%) (1) (2)

Portfolio Construction Broad industry

representation with largest exposures in software, health care providers & services, professional services and commercial services & supplies Diversified portfolio across issuers with no single issuer accounting for more than 4% of the

portfolio Top Ten Portfolio Companies(1,2) (as of December 31, 2023) Top Ten Industries(1,3) (as of December 31, 2023) Note: Amount may not sum due to rounding. Based on the fair market value of the portfolio. 196 portfolio companies. 36 individual

industries.

Portfolio company fundamentals

Private Credit Market benchmark figures are as of December 31, 2023 and are sourced from the Lincoln database. © 2024 Lincoln Partners Advisors LLC. All rights reserved. Used with permission. Third party use is at user’s own risk. BXSL

amounts are as of December 31, 2023, and, other than average LTM EBITDA Growth which excludes private debt investments that funded after December 31, 2022, includes all private debt investments for which fair value is determined by BXSL’s

Board of Trustees in conjunction with a third-party valuation firm and excludes quoted assets. BXSL amounts are weighted by fair market value of each respective investment. BXSL amounts were derived from the most recently available portfolio company

financial statements which are generally one quarter in arrears, have not been independently verified by BXSL, and may reflect a normalized or adjusted amount. Accordingly, BXSL makes no representation or warranty in respect of this information.

EBITDA is a non-GAAP financial measure. For a particular portfolio company, LTM EBITDA is generally defined as net income before net interest expense, income tax expense, depreciation and amortization over the last twelve months ("LTM"). EBITDA

growth year-over-year may reflect some inorganic growth due to mergers and acquisitions (M&A). Average LTM EBITDA Growth for BXSL excludes companies that grew EBITDA over 100% year-over-year due to M&A. LTM EBITDA Margin is the ratio of LTM

EBITDA-to-LTM revenue. Average LTM EBITDA Growth year-over-year of companies that issue loans in the Lincoln database as of 4Q’23. Average LTM EBITDA Margin of companies that issue loans in the Lincoln database as of 4Q’23. BXSL

portfolio companies are generally growing faster and are more profitable than the average private credit borrower 15% More Profitable LTM EBITDA Margin (%) ~2x the Growth LTM EBITDA Growth (Year-over-Year %) (1) (2)

Dividend Coverage History Regular

dividend of $0.77 per share, representing an annualized dividend yield of 11.6%(1) Our dividend is exceeded by net investment income, with a dividend coverage ratio of 125%(2) Quarterly Dividends Per Share 4Q'23 dividend yield is calculated as the

4Q'23 dividend ($0.77) annualized and divided by the ending NAV per share on December 31, 2023 ($26.66). Dividend coverage is calculated as net investment income per share ($0.96) divided by regular dividend per share ($0.77). Changes to Slide:

Changed format to roadshow style - Added dividend yield Click icon to add SmartArt graphic

Summary of Operating Results Per

share data is calculated based on weighted average shares outstanding, unless otherwise noted. Dividends declared were derived by using the actual shares outstanding at the date of the relevant transactions. ($ in millions, except share and per

share data)

Summary Statements of Financial

Condition ($ in millions, except per share data)

Total Debt: $4,938 Funding Profile

Funding Profile ($ in millions) 76% of assets funded by unsecured debt and equity 3.4 years weighted average maturity Well-structured, diversified capital structure with significant available liquidity Well positioned for the current environment

with 57% of liabilities unsecured, at a 2.88% fixed coupon and no debt maturities within the next two years, as of December 31, 2023 BXSL maintains its investment grade corporate credit ratings: Baa3/Positive from Moody’s, BBB-/Stable from

S&P, and BBB-/Positive from Fitch(1) 5.05% weighted average interest rate(4) $1.8B of available liquidity provides material capacity to the business(2) $6.6B of total committed debt Available Cash Undrawn Borrowing Capacity (subject to borrowing

base availability)(2) Unsecured Notes (2.88% weighted average coupon) Asset Based Facilities (SOFR + 1.70% - 2.525%) Secured Revolver (SOFR + 1.75% - 1.875% (+ 10bps CSA)(3)) Equity As of December 31, 2023. BXSL has an investment grade credit rating

of BBB- / Positive outlook from Fitch, reiterated on April 3, 2023, an investment grade credit rating of Baa3 / Positive outlook from Moody’s, provided on September 5, 2023, and an investment grade credit rating of BBB- / Stable from S&P,

reiterated on April 5, 2023. The underlying loans in BXSL are not rated. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. Blackstone provides compensation directly to

Fitch, Moody’s and S&P for its evaluation of the Underlying Fund. Credit ratings do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.

Available liquidity is comprised of cash and cash equivalents plus the amount available to borrow across all revolving credit facilities, net of limitations related to each respective credit facility’s borrowing base. As of December 31, 2023,

$1.7 billion of capacity is undrawn and $1.7 billion is available to borrow. Interest rate is SOFR + 1.75% up to + 1.875% (+ 10bps CSA) depending on borrowing base availability at the time of borrowing. Weighted average interest rate is calculated

by annualizing interest expense for the quarter (includes unused fees and the accretion of original issue discount) divided by weighted average outstanding debt for the quarter.

Supplemental Details

Investment Activity Net funded

investment activity of $348 million in the quarter: New investment commitments of $1.0 billion at par, and investment fundings of $874 million Proceeds from sales and repayments of $526 million Originations and Fundings ($ in millions) Investment

Activity Summary ($ in millions, unless otherwise noted) Computed as (a) the annual stated interest rate or yield plus the annual accretion of discounts or less the annual amortization of premiums, as applicable, on accruing debt included in such

securities, divided by (b) total debt investments (at fair value) included in such securities. Actual yields earned over the life of each investment could differ materially from the yields presented.

Fourth Quarter 2023 Net Asset Value

Bridge The per share data was derived by using the weighted average shares outstanding during the period. The per share data for dividends was derived by using the actual shares outstanding as of each respective record date. (2) (1) (1) Q1 FY22

12/31/21 NAV Net investmentincome Regular dividendsdeclared Net realized and unrealized gain (loss) 3/31/22 NAV before special dividends Special dividends 3/31/22 NAV $26.270000000000003 $26.270000000000003 $26.35 $26.32 $26.38 $26.13

$26.126758313784507 $0.61 $0.53 $0.03 $0.25 $26.270000000000003 $0.61 $-0.53 $-0.03 $-0.25 $26.380000000000003 2.12 0.65 2.77 0.10544347164065475 2.2999999999999998 0.8 1.4999999999999998 Q2 FY22 3/31/22 NAV Net investmentincome Regular

dividendsdeclared Net realized and unrealized gain (loss) 6/30/22 NAV before special dividends Special dividends 6/30/22 NAV $26.126758313784507 $26.126758313784507 $26.213772445283695 $26.092297665448012 $26.092297665448012 $25.892297665448012

$25.892297665448012 $0.61701413149919027 $0.53 $0.12147477983568426 $0.2 $26.126758313784507 $0.61701413149919027 $-0.53 $-0.12147477983568426 $-0.2 $26.335247225119378 2.12 0.65 2.77 0.10544347164065475 2.2999999999999998 0.8 1.4999999999999998 Q1

FY22 12/31/21 NAV Net investmentincome Regular dividendsdeclared Net realized and unrealized gain (loss) 3/31/22 NAV before special dividends Special dividends 3/31/22 NAV $26.270000000000003 $26.270000000000003 $26.35 $26.32 $26.38 $26.13

$26.126758313784507 $0.61 $0.53 $0.03 $0.25 $26.270000000000003 $0.61 $-0.53 $-0.03 $-0.25 $26.380000000000003 2.12 0.65 2.77 0.10544347164065475 2.2999999999999998 0.8 1.4999999999999998 Q2 FY22 3/31/22 NAV Net investmentincome Regular

dividendsdeclared Net realized and unrealized gain (loss) 6/30/22 NAV before special dividends Special dividends 6/30/22 NAV $26.126758313784507 $26.126758313784507 $26.213772445283695 $26.092297665448012 $26.092297665448012 $25.892297665448012

$25.892297665448012 $0.61701413149919027 $0.53 $0.12147477983568426 $0.2 $26.126758313784507 $0.61701413149919027 $-0.53 $-0.12147477983568426 $-0.2 $26.335247225119378 2.12 0.65 2.77 0.10544347164065475 2.2999999999999998 0.8

1.4999999999999998

Summary of Operating Results

– Comparative Per share data is calculated based on weighted average shares outstanding, unless otherwise noted. Dividends declared were derived by using the actual shares outstanding at the date of the relevant transactions. ($ in millions,

except share and per share data) 18

Selected Financial Highlights ($ in

millions, except share and per share data) Annualized net investment income return is calculated as the total quarterly net investment income per share (annualized) divided by NAV per share at the beginning of the quarter. Total return is calculated

as the change in NAV per share during the period, plus dividends per share (assuming dividends and distributions are reinvested in accordance with the Company's dividend reinvestment plan), divided by the beginning NAV per share. Total debt

outstanding is shown net of unamortized debt issuance costs. Average and ending debt-to-equity is calculated using principal amounts outstanding. Computed as (a) the annual stated interest rate or yield plus the annual accretion of discounts or less

the annual amortization of premiums, as applicable, on accruing debt included in such securities, divided by (b) total debt investments (at cost or fair value, as applicable) included in such securities. Actual yields earned over the life of each

investment could differ materially from the yields presented. 19

Funding sources Summary $1.8B of

liquidity in cash and undrawn debt (subject to borrowing base availability) as of December 31, 2023(1) (7) ($ in millions) Available liquidity is comprised of cash and cash equivalents plus the amount available to borrow across all revolving credit

facilities, net of limitations related to each respective credit facility’s borrowing base. As of December 31, 2023, $1.7 billion of capacity is undrawn and $1.7 billion is available to borrow. Certain foreign currency advances incur an

interest rate of the benchmark rate in effect for the applicable currency plus the applicable margin of 2.375% per annum. As of December 31, 2023, the Company had no borrowings denominated in currencies other than USD Dollar in the Jackson Hole

Funding facility. Interest rate is SOFR + 1.70%, SOFR + 2.05% or SOFR + 2.30% per annum depending on the nature of the advances and underlying collateral. Until September 25, 2024. From and after September 25, 2024, a range between SOFR + 2.10% and

SOFR + 2.45% per annum depending on the nature of the collateral securing the advances. Commitments of certain lenders in the amount of $200 million mature on June 28, 2027. Interest rate is SOFR + 1.75% up to + 1.875% (+ 10bps CSA) depending on

borrowing base availability at the time of borrowing. Weighted average interest rate is calculated by annualizing interest expense for the quarter (includes unused fees and the accretion of original issue discount) divided by weighted average

outstanding debt for the quarter.

Important Disclosure Information

Forward Looking Statements Certain

information contained in this communication constitutes “forward-looking statements” within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be

identified by the use of forward-looking terminology, such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “can,”

“will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates”, “confident,”

“conviction,” “identified” or the negative versions of these words or other comparable words thereof. These may include BXSL’s financial estimates and their underlying assumptions, statements about plans, statements

regarding pending transactions, objectives and expectations with respect to future operations, statements regarding future performance, statements regarding economic and market trends and statements regarding identified but not yet closed

investments. Such forward‐looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in such

statements. BXSL believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its prospectus and annual report for the most recent fiscal year, and any such updated factors included

in its periodic filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with

the other cautionary statements that are included in this document (or BXSL’s prospectus and other filings). Except as otherwise required by federal securities laws, BXSL undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future developments or otherwise.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

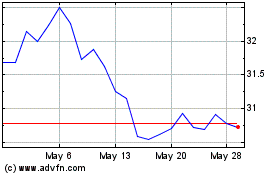

Blackstone Secured Lending (NYSE:BXSL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Blackstone Secured Lending (NYSE:BXSL)

Historical Stock Chart

From Jul 2023 to Jul 2024