Current Report Filing (8-k)

September 07 2022 - 9:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 7, 2022

Blackstone Secured Lending Fund

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

814-01299 |

|

82-7020632 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

345 Park Avenue, 31st Floor

New York, New York |

|

10154 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (212) 503-2100

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Shares of Beneficial Interest, $0.001 par value per share |

|

BXSL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 7.01. Regulation FD Disclosure.

On September 7, 2022, Blackstone Secured Lending Fund (NYSE: BXSL) announced the increase of its regular quarterly distribution from $0.53 per share to $0.60

per share, which represents a 9.3% annualized distribution yield based on second quarter NAV per share of $25.89. BXSL’s Board of Trustees (the “Board”) approved the increase in distribution, which will become effective in the third

quarter of 2022 and apply to the previously declared quarterly distribution to shareholders of record as of September 30, 2022, payable on November 14, 2022. The foregoing quarterly distribution will be in addition to the previously announced $0.20

special distribution payable on November 14, 2022.

The regular quarterly distribution increase is driven by BXSL’s strong earnings, the quality of

its portfolio and the positive impact from rising interest rates. With nearly 100% of the portfolio invested in floating rate debt which benefits from rising rates, and BXSL’s low fee structure, BXSL believes this creates an opportunity to

raise its regular quarterly distributions to more appropriately align with its earnings power.

BXSL focuses on senior secured investments in high quality

and larger business across sectors Blackstone believes have tailwinds. As of June 30, 2022, the portfolio is 98% senior secured with an average loan-to-value (LTV) of 46% and an average issuer EBITDA of $149 million. BXSL expects this focus on

seniority and quality to continue going forward.1

A copy of the Fund’s press release announcing

the foregoing is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

| 1 |

These calculations include all private debt investments for which fair value is determined by the Board in

conjunction with a third-party valuation firm and excludes quoted assets. Amounts are weighted based on fair market value of each respective investment. Amounts were derived from the most recently available portfolio company financial statements,

have not been independently verified by us, and may reflect a normalized or adjusted amount. Accordingly, BXSL makes no representation or warranty in respect of this information. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

| Date: September 7, 2022 |

|

|

|

BLACKSTONE SECURED LENDING FUND |

|

|

|

|

|

|

|

|

By: |

|

/s/ Marisa J. Beeney |

|

|

|

|

Name: |

|

Marisa J. Beeney |

|

|

|

|

Title: |

|

Chief Legal Officer and Secretary |

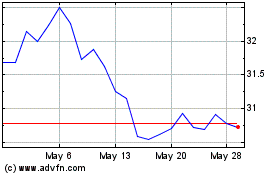

Blackstone Secured Lending (NYSE:BXSL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Blackstone Secured Lending (NYSE:BXSL)

Historical Stock Chart

From Jul 2023 to Jul 2024