Blackstone/GSO Closed-End Funds Announce Portfolio Manager Change

August 17 2015 - 6:35PM

Business Wire

Blackstone/GSO Senior Floating Rate Term Fund (NYSE:

BSL), Blackstone/GSO Long-Short Credit Income Fund (NYSE:

BGX) and Blackstone/GSO Strategic Credit Fund (NYSE:

BGB) (each a “Fund” and, together, the “Funds”) today announced

that Robert Zable will become the lead portfolio manager of each

Fund, effective upon the retirement of the Funds’ current lead

portfolio manager, Lee Shaiman, on or before September 30,

2015.

Mr. Zable is a Managing Director with GSO Capital Partners LP

(“GSO”), the parent company of GSO/Blackstone Debt Funds Management

LLC (“GSO DFM”), the Funds’ investment adviser, and serves as the

Chairman of GSO DFM’s investment committee. Mr. Zable is also the

senior portfolio manager for GSO DFM’s U.S. CLOs and high yield

separately managed accounts.

Before joining GSO in 2007, Mr. Zable was a Vice President at

FriedbergMilstein LLC, where he was responsible for credit

opportunity investments and junior capital origination and

execution. Prior to that, Mr. Zable was a Principal with Abacus

Advisors Group, a restructuring and distressed investment firm. Mr.

Zable began his career at JP Morgan Securities Inc., where he

focused on leveraged finance in New York and London.

Mr. Zable received a BS from Cornell University, and an MBA in

Finance from The Wharton School at the University of

Pennsylvania.

The Funds’ current lead portfolio manager, Lee Shaiman, will

retire following the transition of his duties to Mr. Zable, on or

before September 30, 2015. Gordon McKemie, who has served as

portfolio manager since the second quarter of 2015, will remain a

portfolio manager of the Funds.

“On behalf of GSO, I would like to thank Lee for his many

contributions to the growth and success of the business,” said Dan

Smith, Senior Managing Director of GSO.

About The Blackstone Group and GSO Capital Partners

Blackstone is one of the world’s leading investment firms. We

seek to create positive economic impact and long-term value for our

investors, the companies we invest in, and the communities in which

we work. We do this by using extraordinary people and flexible

capital to help companies solve problems. Our asset management

businesses, with over $330 billion in assets under management,

include investment vehicles focused on private equity, real estate,

public debt and equity, non-investment grade credit, real assets

and secondary funds, all on a global basis. Blackstone also

provides various financial advisory services, including financial

and strategic advisory, restructuring and reorganization advisory

and fund placement services. Further information is available at

www.blackstone.com. Follow Blackstone on Twitter @Blackstone.

GSO Capital Partners LP is the global credit and distressed

investment platform of Blackstone. With approximately $81 billion

of assets under management, GSO is one of the largest alternative

managers in the world focused on the leveraged-finance, or

non-investment grade related, marketplace. GSO seeks to generate

attractive risk-adjusted returns in its business by investing in a

broad array of strategies including mezzanine debt, distressed

investing, leveraged loans and other special-situation strategies.

Its funds are major providers of credit for small and middle-market

companies and they also advance rescue financing to help distressed

companies.

Investors wishing to buy or sell shares need to place orders

through an intermediary or broker.

Contact the Funds at 1-877-299-1588 or visit the Funds’

website at www.blackstone-gso.com for additional

information.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150817006357/en/

Blackstone/GSOJane Lee, 877-876-1121

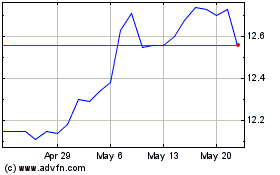

Blackstone Long Short Cr... (NYSE:BGX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Blackstone Long Short Cr... (NYSE:BGX)

Historical Stock Chart

From Nov 2023 to Nov 2024