Black Hills Corp. (NYSE: BKH) today announced financial results for

the second quarter of 2024. Net income available for common stock

and earnings per share for the three and six months ended

June 30, 2024, compared to the three and six months ended

June 30, 2023, were:

| |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

| |

(in millions, except per share amounts) |

|

|

Net income available for common stock |

$ |

22.8 |

|

$ |

23.1 |

|

|

$ |

150.6 |

|

$ |

137.1 |

|

| Earnings per share,

Diluted |

$ |

0.33 |

|

$ |

0.35 |

|

|

$ |

2.19 |

|

$ |

2.06 |

|

Second quarter earnings were $0.33 per share compared to $0.35

per share in the second quarter of 2023. Financial results were

driven by new rates and rider recovery and lower operating

expenses, which offset the unfavorable impacts of mild weather and

a prior year income tax benefit.

“Year-to-date earnings were up 6% compared to last year and we

are reaffirming our earnings guidance for the year,” said Linn

Evans, president and CEO of Black Hills Corp.

“We continue to deliver progress on our customer-focused

strategy and are excited about powering Meta’s newest AI data

center in Cheyenne, which we expect to begin serving in 2026. Our

team continues to attract new data centers with our leading

mission-critical reliability and innovative energy solutions,

including our unique tariffs and capital-light energy procurement

model.

“Regulatory activities continue to move forward to recover

investments and costs critical to serving our customers safely and

reliably. Our rate review for Arkansas Gas is advancing through its

final stages, while rate reviews filed during the second quarter

for Iowa Gas and Colorado Electric are on schedule.

“As we execute on our commitment to a reliable, cost-effective

and cleaner energy future, we are delivering new resources to serve

the growing needs of our customers and communities. In Colorado, we

continue to pursue regulatory approval of our preferred portfolio

of clean energy resources to reduce emissions 80% by 2030 as

outlined in our Clean Energy Plan. In South Dakota, we plan to add

100 megawatts of utility-owned generation by 2026 to serve growing

customer demand. Construction is on schedule for our 260-mile Ready

Wyoming electric transmission line to enhance reliability,

resiliency and energy market access,” concluded Evans.

SECOND-QUARTER 2024 HIGHLIGHTS AND UPDATES

Electric Utilities

- During the second quarter, South Dakota Electric continued its

resource planning process to add 100 megawatts of utility-owned,

dispatchable natural gas resources by mid-year 2026. South Dakota

Electric expects to file a pre-application notice in South Dakota

and request a certificate of public convenience and necessity in

Wyoming in the second half of 2024.

- On July 11, Wyoming Electric announced it will partner with

Meta to provide power for its newest AI data center to be

constructed in Cheyenne, Wyoming. The company plans to procure

market energy under its Large Power Contract Service tariff with

customized energy resources essential to Meta's operations and

sustainability objectives.

- On June 14, Colorado Electric filed a rate review with the

Colorado Public Utilities Commission seeking the recovery of

significant infrastructure investments in its 3,200-mile electric

distribution and 600-mile electric transmission systems. The rate

review requested $37 million in new annual revenue based on a

capital structure of 53% equity and 47% debt and a return on equity

of 10.5%. The company requested new rates effective in the first

quarter of 2025.

- On April 17, Colorado Electric filed its 120-Day report

recommending 400 megawatts of renewable energy resources to advance

its Clean Energy Plan. The final composition of resources and

timing is subject to review and approval by the Colorado Public

Utilities Commission, which is expected later this year.

- During the second quarter, Wyoming Electric continued

construction on Ready Wyoming, a 260-mile electric transmission

project. Construction is expected to be completed in multiple

segments in 2024 and 2025.

Gas Utilities

- On May 1, Iowa Gas filed a rate review request with the Iowa

Utilities Commission seeking approval to recover approximately $100

million of system investments and inflationary impacts on expenses

to serve customers. The rate review requested $21 million of new

annual revenue based on a capital structure of 51% equity and 49%

debt and a return on equity of 10.5%. Interim rates were effective

on May 11, 2024, with final rates requested in the first quarter of

2025.

- During the second quarter, Arkansas Gas advanced its rate

review request to recover $130 million of system investments and

the inflationary impacts on expenses to serve customers. Filed on

Dec. 4, 2023, the rate review requested $44 million of new annual

revenue based on a capital structure of 48% equity and 52% debt and

a return on equity of 10.5%. The company requested new rates in the

fourth quarter of 2024.

Corporate and Other

- On July 22, Black Hills’ board of directors approved a

quarterly dividend of $0.65 per share payable on Sept. 1, 2024, to

common shareholders of record at the close of business on Aug. 19,

2024. The dividend, on an annualized rate, represents 54

consecutive years of dividend increases, the second longest track

record in the electric and natural gas industry.

- On May 31, Black Hills amended and restated its revolving

credit facility with similar terms as the former facility,

maintaining total commitments of $750 million and extending the

term through May 31, 2029.

- On May 16, Black Hills completed a public debt offering of $450

million, 6.00% senior unsecured notes due Jan. 15, 2035. Proceeds

were used for general corporate purposes and, along with available

cash or short-term borrowings under the company's existing

facilities, will be used to fully repay the $600 million notes due

Aug. 23, 2024.

- On May 9, S&P Global Ratings affirmed Black Hills’ issuer

credit rating at BBB+ with a stable outlook.

- During the second quarter, Black Hills issued 0.8 million

shares of new common stock for net proceeds of $42 million under

its at-the-market equity offering program. Year-to-date, the

company has issued a total of 1.4 million shares of new common

stock for net proceeds of $73 million.

- During the second quarter, Black Hills

published its 2023 Corporate Sustainability Report, highlighting

the company’s environmental, social and governance impacts and its

progress on major projects and climate goals. The company reported

a 27% reduction in greenhouse gas emissions from its natural gas

distribution system since 2022 and is on track to achieve its goal

of net zero emissions by 2035. Additionally, the company has

reduced its electric utility greenhouse gas emissions by nearly one

third since 2005 and is on track to achieve its goals to reduce

electric emissions intensity by 40% by 2030 and 70% by 2040

compared to 2005.

2024 EARNINGS GUIDANCE

Black Hills affirms its guidance for 2024 earnings per share

available for common stock to be in the range of $3.80 to $4.00

based on the follow assumptions:

- Normal weather conditions within our utility service

territories including temperatures, precipitation levels and wind

conditions;

- Normal operations and weather conditions for planned

construction, maintenance and/or capital investment projects;

- Constructive and timely outcomes of utility regulatory

dockets;

- No significant unplanned outages at our generating

facilities;

- Equity issuance of $170 million to $190 million through the

at-the-market equity offering program; and

- Production tax credits of approximately $18 million associated

with wind generation assets.

CONFERENCE CALL AND WEBCAST

Black Hills will host a live conference call and webcast at 11

a.m. EDT on Thursday, Aug. 1, 2024, to discuss its financial and

operating performance.

To access the live webcast and download a copy of the investor

presentation, go to the “Investor Relations” section of the Black

Hills website at www.blackhillscorp.com and click on “News and

Events” and then “Events & Presentation.” The presentation will

be posted on the website before the webcast. Listeners should allow

at least five minutes for registering and accessing the

presentation. For those unable to listen to the live broadcast, a

replay will be available on the company’s website.

To ask a question during the live broadcast, users can access

dial-in information and a personal identification number by

registering for the event at

https://register.vevent.com/register/BI127d514d8e3a423191cc495600c59aa6.

A listen-only webcast player and presentation slides can be

accessed live at https://edge.media-server.com/mmc/p/j9weytyi with

a replay of the event available for up to one year.

|

BLACK HILLS CORPORATIONCONSOLIDATED

FINANCIAL RESULTS |

|

|

|

(Minor differences may result due to rounding) |

| |

| |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

| |

(in millions) |

|

| Operating income: |

|

|

|

|

|

|

|

|

|

|

Electric Utilities |

$ |

46.3 |

|

$ |

46.6 |

|

|

$ |

110.9 |

|

$ |

107.7 |

|

|

Gas Utilities |

|

23.0 |

|

|

17.7 |

|

|

|

153.7 |

|

|

132.4 |

|

|

Corporate and Other |

|

1.3 |

|

|

(0.8 |

) |

|

|

(0.6 |

) |

|

(1.7 |

) |

| Operating income |

|

70.6 |

|

|

63.5 |

|

|

|

264.0 |

|

|

238.4 |

|

| |

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

(42.6 |

) |

|

(41.5 |

) |

|

|

(86.7 |

) |

|

(85.0 |

) |

| Other income (expense),

net |

|

0.4 |

|

|

(1.5 |

) |

|

|

(0.5 |

) |

|

(0.9 |

) |

| Income tax benefit

(expense) |

|

(3.7 |

) |

|

6.1 |

|

|

|

(20.6 |

) |

|

(8.6 |

) |

| Net income |

|

24.7 |

|

|

26.6 |

|

|

|

156.2 |

|

|

143.9 |

|

| Net income attributable to

non-controlling interest |

|

(1.9 |

) |

|

(3.5 |

) |

|

|

(5.6 |

) |

|

(6.8 |

) |

| Net income available for

common stock |

$ |

22.8 |

|

$ |

23.1 |

|

|

$ |

150.6 |

|

$ |

137.1 |

|

| |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

| Weighted

average common shares outstanding (in millions): |

|

|

|

|

|

|

|

Basic |

|

69.0 |

|

|

66.6 |

|

|

|

68.6 |

|

|

66.3 |

|

|

Diluted |

|

69.0 |

|

|

66.7 |

|

|

|

68.7 |

|

|

66.4 |

|

| |

|

|

|

|

|

|

|

|

|

| Earnings per

share: |

|

|

|

|

|

|

|

|

|

|

Earnings Per Share, Basic |

$ |

0.33 |

|

$ |

0.35 |

|

|

$ |

2.20 |

|

$ |

2.07 |

|

|

Earnings Per Share, Diluted |

$ |

0.33 |

|

$ |

0.35 |

|

|

$ |

2.19 |

|

$ |

2.06 |

|

USE OF NON-GAAP FINANCIAL MEASURES

Gas and Electric Utility Margin

Gas and Electric Utility margin (revenue less cost of sales) is

considered a non-GAAP financial measure due to the exclusion of

operation and maintenance expenses, depreciation and amortization

expenses, and property and production taxes from the measure. The

presentation of Gas and Electric Utility margin is intended to

supplement investors’ understanding of operating performance.

Electric Utility margin is calculated as operating revenue less

cost of fuel and purchased power. Gas Utility margin is calculated

as operating revenue less cost of gas sold. Our Gas and Electric

Utility margin is impacted by the fluctuations in power purchases

and natural gas and other fuel supply costs. However, while these

fluctuating costs impact Gas and Electric Utility margin as a

percentage of revenue, they only impact total Gas and Electric

Utility margin if the costs cannot be passed through to

customers.

Our Gas and Electric Utility margin measure may not be

comparable to other companies’ Gas and Electric Utility margin

measures. Furthermore, this measure is not intended to replace

operating income as determined in accordance with GAAP as an

indicator of operating performance.

SEGMENT PERFORMANCE SUMMARY

Operating results from our business segments for the three and

six months ended June 30, 2024, and 2023, compared to the

three and six months ended June 30, 2023, are discussed

below.

Certain lines of business in which we operate are highly

seasonal, and revenue from, and certain expenses for, such

operations may fluctuate significantly between quarterly periods.

Demand for electricity and natural gas is sensitive to seasonal

cooling, heating and industrial load requirements. In particular,

the normal peak usage season for our electric utilities is June

through August while the normal peak usage season for our gas

utilities is November through March. Significant earnings variances

can be expected between the Gas Utilities segment’s peak and

off-peak seasons. Due to this seasonal nature, our results of

operations for the three and six months ended June 30, 2024

and 2023 are not necessarily indicative of the results of

operations to be expected for any other period or for the entire

year.

All amounts are presented on a pre-tax basis unless otherwise

indicated. Minor differences in amounts may result due to

rounding.

| Electric

Utilities |

| |

| |

Three Months Ended June 30, |

|

Variance |

|

|

Six Months Ended June 30, |

|

Variance |

|

| |

2024 |

|

2023 |

|

2024 vs. 2023 |

|

|

2024 |

|

2023 |

|

2024 vs. 2023 |

|

| |

(in millions) |

|

|

Revenue |

$ |

205.1 |

|

$ |

193.1 |

|

$ |

12.0 |

|

|

$ |

427.3 |

|

$ |

411.8 |

|

$ |

15.5 |

|

| Cost of fuel and purchased

power |

|

45.9 |

|

|

36.4 |

|

|

9.5 |

|

|

|

100.8 |

|

|

91.8 |

|

|

9.0 |

|

| Electric Utility margin

(non-GAAP) |

|

159.2 |

|

|

156.7 |

|

|

2.5 |

|

|

|

326.5 |

|

|

320.0 |

|

|

6.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operations and

maintenance |

|

68.1 |

|

|

65.4 |

|

|

2.7 |

|

|

|

125.5 |

|

|

122.8 |

|

|

2.7 |

|

| Depreciation and

amortization |

|

35.5 |

|

|

35.8 |

|

|

(0.3 |

) |

|

|

70.8 |

|

|

70.9 |

|

|

(0.1 |

) |

| Taxes - property and

production |

|

9.3 |

|

|

8.9 |

|

|

0.4 |

|

|

|

19.3 |

|

|

18.6 |

|

|

0.7 |

|

| Operating income |

$ |

46.3 |

|

$ |

46.6 |

|

$ |

(0.3 |

) |

|

$ |

110.9 |

|

$ |

107.7 |

|

$ |

3.2 |

|

Three Months Ended June 30, 2024, Compared with

Three Months Ended June 30, 2023

Electric Utility margin increased as a result of:

| |

(in millions) |

|

|

Weather |

$ |

2.4 |

|

| New rates and rider

recovery |

|

2.3 |

|

| Retail customer growth and

usage |

|

1.8 |

|

| Integrated Generation (a) |

|

(4.4 |

) |

| Other |

|

0.4 |

|

| |

$ |

2.5 |

|

_________________a) Primarily driven by

decreased revenues due to unplanned outages at Wygen I and Pueblo

Airport Generation #4-5.

Operations and maintenance expense increased primarily due to

$1.9 million of higher outside services expenses driven by

unplanned Integrated Generation outages and $1.2 million of higher

insurance expense.

Depreciation and amortization was comparable to the same period

in the prior year.

Taxes - property and production was comparable to the same

period in the prior year.

Six Months Ended June 30, 2024, Compared with Six

Months Ended June 30, 2023

Electric Utility margin increased as a result of:

| |

(in millions) |

|

|

New rates and rider recovery |

$ |

10.5 |

|

| Weather |

|

1.2 |

|

| Integrated Generation (a) |

|

(3.5 |

) |

| Off-system excess energy

sales |

|

(3.2 |

) |

| Other |

|

1.5 |

|

| |

$ |

6.5 |

|

_________________a) Primarily driven by

decreased revenues due to unplanned outages at Wygen I and Pueblo

Airport Generation #4-5.Operations and maintenance expense

increased primarily due to a prior year one-time $7.7 million gain

on the sale of Northern Iowa Windpower assets and $1.6 million of

higher insurance expense partially offset by $3.2 million of lower

employee-related expenses and $2.6 million of lower outside

services expenses.Depreciation and amortization was comparable to

the same period in the prior year.

Taxes - property and production was comparable to the same

period in the prior year.

| |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

Operating Statistics |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Quantities Sold (GWh): |

|

|

|

|

|

|

|

|

|

|

Retail Sales |

|

1,424.8 |

|

|

1,340.8 |

|

|

|

2,913.2 |

|

|

2,737.2 |

|

|

Contract/Off-system/Power Marketing Wholesale |

|

301.8 |

|

|

241.7 |

|

|

|

565.4 |

|

|

643.2 |

|

|

Total Regulated |

|

1,726.6 |

|

|

1,582.5 |

|

|

|

3,478.6 |

|

|

3,380.4 |

|

|

Non-regulated |

|

21.1 |

|

|

22.8 |

|

|

|

49.1 |

|

|

77.2 |

|

|

Total quantities sold |

|

1,747.7 |

|

|

1,605.3 |

|

|

|

3,527.7 |

|

|

3,457.6 |

|

| |

|

|

|

|

|

|

|

|

|

| Contracted generated

facilities availability by fuel type: |

|

|

|

|

|

|

|

|

|

|

Coal |

|

75.5 |

% |

|

92.0 |

% |

|

|

85.6 |

% |

|

92.4 |

% |

|

Natural gas and diesel oil |

|

91.6 |

% |

|

93.5 |

% |

|

|

94.1 |

% |

|

93.9 |

% |

|

Wind |

|

92.1 |

% |

|

93.0 |

% |

|

|

91.2 |

% |

|

93.4 |

% |

|

Total availability |

|

87.1 |

% |

|

93.0 |

% |

|

|

91.3 |

% |

|

93.4 |

% |

| |

|

|

|

|

|

|

|

|

|

| Wind capacity factor |

|

36.9 |

% |

|

34.4 |

% |

|

|

38.4 |

% |

|

41.2 |

% |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| Degree

Days |

2024 |

2023 |

|

2024 |

2023 |

|

|

Actual |

Variance from Normal |

Actual |

Variance from Normal |

|

Actual |

Variance from Normal |

Actual |

Variance from Normal |

|

Heating Degree Days |

757 |

(13)% |

840 |

(6)% |

|

3,577 |

(8)% |

3,940 |

4% |

| Cooling Degree Days |

219 |

25% |

75 |

(60)% |

|

219 |

25% |

75 |

(60)% |

| Gas

Utilities |

| |

| |

Three Months Ended June 30, |

|

Variance |

|

|

Six Months Ended June 30, |

|

Variance |

|

| |

2024 |

|

2023 |

|

2024 vs. 2023 |

|

|

2024 |

|

2023 |

|

2024 vs. 2023 |

|

| |

(in millions) |

|

|

Revenue |

$ |

202.0 |

|

$ |

222.7 |

|

$ |

(20.7 |

) |

|

$ |

710.6 |

|

$ |

929.6 |

|

$ |

(219.0 |

) |

| Cost of natural gas sold |

|

61.3 |

|

|

85.0 |

|

|

(23.7 |

) |

|

|

323.2 |

|

|

555.9 |

|

|

(232.7 |

) |

| Gas Utility margin

(non-GAAP) |

|

140.7 |

|

|

137.7 |

|

|

3.0 |

|

|

|

387.4 |

|

|

373.7 |

|

|

13.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operations and

maintenance |

|

79.3 |

|

|

84.0 |

|

|

(4.7 |

) |

|

|

157.9 |

|

|

171.2 |

|

|

(13.3 |

) |

| Depreciation and

amortization |

|

31.1 |

|

|

28.8 |

|

|

2.3 |

|

|

|

61.5 |

|

|

55.3 |

|

|

6.2 |

|

| Taxes - property and

production |

|

7.3 |

|

|

7.2 |

|

|

0.1 |

|

|

|

14.3 |

|

|

14.8 |

|

|

(0.5 |

) |

| Operating income |

$ |

23.0 |

|

$ |

17.7 |

|

$ |

5.3 |

|

|

$ |

153.7 |

|

$ |

132.4 |

|

$ |

21.3 |

|

Three Months Ended June 30, 2024, Compared with

Three Months Ended June 30, 2023

Gas Utility margin increased as a result of:

| |

(in millions) |

|

|

New rates and rider recovery |

$ |

9.1 |

|

| Retail customer growth and

usage |

|

0.9 |

|

| Weather |

|

(6.2 |

) |

| Mark-to-market on non-utility

natural gas commodity contracts |

|

(0.5 |

) |

| Other |

|

(0.3 |

) |

| |

$ |

3.0 |

|

Operations and maintenance expense decreased primarily due to

lower employee-related expenses.

Depreciation and amortization increased primarily due to a

higher asset base driven by current year and prior year capital

expenditures.

Taxes - property and production was comparable to the same

period in the prior year.

Six Months Ended June 30, 2024, Compared with Six

Months Ended June 30, 2023

Gas Utility margin increased as a result of:

| |

(in millions) |

|

|

New rates and rider recovery |

$ |

22.1 |

|

| Mark-to-market on non-utility

natural gas commodity contracts |

|

3.2 |

|

| Retail customer growth and

usage |

|

2.4 |

|

| Weather |

|

(13.6 |

) |

| Other |

|

(0.4 |

) |

| |

$ |

13.7 |

|

Operations and maintenance expense decreased primarily due to

$11.5 million of lower employee-related expenses and $1.9 million

of lower outside services expenses.

Depreciation and amortization increased primarily due to a

higher asset base driven by current year and prior year capital

expenditures.

Taxes - property and production was comparable to the same

period in the prior year.

| |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

Operating Statistics |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Quantities Sold and Transported (Dth in millions): |

|

|

|

|

|

|

|

|

|

|

Distribution |

|

12.6 |

|

|

13.1 |

|

|

|

54.3 |

|

|

58.0 |

|

|

Transport and Transmission |

|

34.5 |

|

|

34.2 |

|

|

|

81.2 |

|

|

81.4 |

|

| Total Quantities Sold |

|

47.1 |

|

|

47.3 |

|

|

|

135.5 |

|

|

139.4 |

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

2023 |

|

2024 |

2023 |

|

|

Actual |

Variance from Normal |

Actual |

Variance from Normal |

|

Actual |

Variance from Normal |

Actual |

Variance from Normal |

|

Heating Degree Days |

587 |

(20)% |

674 |

(10)% |

|

3,452 |

(10)% |

3,870 |

1% |

Corporate and Other

Corporate and Other represents certain unallocated expenses for

administrative activities that support our reportable operating

segments. Corporate and Other also includes business development

activities that are not part of our operating segments and

inter-segment eliminations.

| |

Three Months Ended June 30, |

|

Variance |

|

|

Six Months Ended June 30, |

|

Variance |

|

| |

2024 |

|

2023 |

|

2024 vs. 2023 |

|

|

2024 |

|

2023 |

|

2024 vs. 2023 |

|

| |

(in millions) |

|

|

Operating income (loss) |

$ |

1.3 |

|

$ |

(0.8 |

) |

$ |

2.1 |

|

|

$ |

(0.6 |

) |

$ |

(1.7 |

) |

$ |

1.1 |

|

Three Months Ended June 30, 2024, Compared with

Three Months Ended June 30, 2023

Operating income was comparable to the same period in the prior

year.

Six Months Ended June 30, 2024, Compared with Six Months

Ended June 30, 2023

Operating income was comparable to the same period in the prior

year.

|

Consolidated Interest Expense, Other Income and Income Tax

Expense |

| |

| |

Three Months Ended June 30, |

|

Variance |

|

|

Six Months Ended June 30, |

|

Variance |

|

|

|

2024 |

|

2023 |

|

2024 vs. 2023 |

|

|

2024 |

|

2023 |

|

2024 vs. 2023 |

|

| |

(in millions) |

|

|

Interest expense, net |

$ |

(42.6 |

) |

$ |

(41.5 |

) |

$ |

(1.1 |

) |

|

$ |

(86.7 |

) |

$ |

(85.0 |

) |

$ |

(1.7 |

) |

| Other income (expense),

net |

$ |

0.4 |

|

$ |

(1.5 |

) |

$ |

1.9 |

|

|

$ |

(0.5 |

) |

$ |

(0.9 |

) |

$ |

0.4 |

|

| Income tax benefit

(expense) |

$ |

(3.7 |

) |

$ |

6.1 |

|

$ |

(9.8 |

) |

|

$ |

(20.6 |

) |

$ |

(8.6 |

) |

$ |

(12.0 |

) |

Three Months Ended June 30, 2024, Compared with Three

Months Ended June 30, 2023

Interest expense, net was comparable to the same period in the

prior year primarily due to higher interest rates on higher

long-term debt balances mostly offset by increased interest income

on higher cash and cash equivalents balances.

Other (expense), net was comparable to the same period in the

prior year.

Income tax (expense) increased primarily due to higher pre-tax

income and a higher effective tax rate. For the three months ended

June 30, 2024, the effective tax rate was 13.0% compared to

(29.8)% for the same period in 2023. The higher effective tax rate

was primarily driven by a prior year $8.2 million tax benefit from

a Nebraska income tax rate decrease.

Six Months Ended June 30, 2024, Compared with Six Months

Ended June 30, 2023

Interest expense, net was comparable to the same period in the

prior year primarily due to higher interest rates on higher

long-term debt balances mostly offset by increased interest income

on higher cash and cash equivalents balances.

Other (expense), net was comparable to the same period in the

prior year.

Income tax (expense) increased primarily due to higher pre-tax

income and a higher effective tax rate. For the six months ended

June 30, 2024, the effective tax rate was 11.7% compared to

5.6% for the same period in 2023. The higher effective tax rate was

primarily driven by a prior year $8.2 million tax benefit from a

Nebraska income tax rate decrease.

ABOUT BLACK HILLS CORP.

Black Hills Corp. (NYSE: BKH) is a customer-focused,

growth-oriented utility company with a tradition of improving life

with energy and a vision to be the energy partner of choice. Based

in Rapid City, South Dakota, the company serves 1.34 million

natural gas and electric utility customers in eight states:

Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota

and Wyoming. More information is available at

www.blackhillscorp.com,

www.blackhillscorp.com/corporateresponsibility and

www.blackhillsenergy.com.

CAUTION REGARDING FORWARD-LOOKING

STATEMENTS

This press release includes “forward-looking statements” as

defined by the Securities and Exchange Commission. We make these

forward-looking statements in reliance on the safe harbor

protections provided under the Private Securities Litigation Reform

Act of 1995. All statements, other than statements of historical

facts, included in this press release that address activities,

events or developments that we expect, believe or anticipate will

or may occur in the future are forward-looking statements. This

includes, without limitations, our 2024 earnings guidance. These

forward-looking statements are based on assumptions which we

believe are reasonable based on current expectations and

projections about future events and industry conditions and trends

affecting our business. However, whether actual results and

developments will conform to our expectations and predictions is

subject to a number of risks and uncertainties that, among other

things, could cause actual results to differ materially from those

contained in the forward-looking statements, including without

limitation, the risk factors described in Item 1A of Part I of our

2023 Annual Report on Form 10-K and other reports that we file with

the SEC from time to time, and the following:

- The accuracy of our assumptions on which our earnings guidance

is based;

- Our ability to obtain adequate cost recovery for our utility

operations through regulatory proceedings and favorable rulings on

periodic applications to recover costs for capital additions, plant

retirements and decommissioning, fuel, transmission, purchased

power, and other operating costs and the timing in which new rates

would go into effect;

- Our ability to complete our capital program in a cost-effective

and timely manner;

- Our ability to execute on our strategy;

- Our ability to successfully execute our financing plans;

- The effects of changing interest rates;

- Our ability to achieve our greenhouse gas emissions intensity

reduction goals;

- Board of Directors’ approval of any future quarterly

dividends;

- The impact of future governmental regulation;

- Our ability to overcome the impacts of supply chain disruptions

on availability and cost of materials;

- The effects of inflation and volatile energy prices;

- Our ability to obtain sufficient insurance coverage at

reasonable costs and whether such coverage will protect us against

significant losses; and

- Other factors discussed from time to time in our filings with

the SEC.

New factors that could cause actual results to differ materially

from those described in forward-looking statements emerge from

time-to-time, and it is not possible for us to predict all such

factors, or the extent to which any such factor or combination of

factors may cause actual results to differ from those contained in

any forward-looking statement. We assume no obligation to update

publicly any such forward-looking statements, whether as a result

of new information, future events or otherwise.

|

CONSOLIDATING INCOME STATEMENTS |

|

|

|

(Minor differences may result due to rounding) |

| |

| |

Consolidating Income Statement |

|

| Three Months Ended

June 30, 2024 |

Electric Utilities |

|

Gas Utilities |

|

Corporate and Other |

|

Total |

|

| |

(in millions) |

|

|

Revenue |

$ |

205.1 |

|

$ |

202.0 |

|

$ |

(4.5 |

) |

$ |

402.6 |

|

| |

|

|

|

|

|

|

|

|

| Fuel, purchased power and cost

of natural gas sold |

|

45.9 |

|

|

61.3 |

|

|

(0.1 |

) |

|

107.1 |

|

| Operations and

maintenance |

|

68.1 |

|

|

79.3 |

|

|

(5.7 |

) |

|

141.7 |

|

| Depreciation and

amortization |

|

35.5 |

|

|

31.1 |

|

|

- |

|

|

66.6 |

|

| Taxes - property and

production |

|

9.3 |

|

|

7.3 |

|

|

- |

|

|

16.6 |

|

| Operating income (loss) |

|

46.3 |

|

|

23.0 |

|

|

1.3 |

|

|

70.6 |

|

| |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

|

|

|

|

|

(42.6 |

) |

| Other income (expense),

net |

|

|

|

|

|

|

|

0.4 |

|

| Income tax (expense) |

|

|

|

|

|

|

|

(3.7 |

) |

| Net income |

|

|

|

|

|

|

|

24.7 |

|

| Net income attributable to

non-controlling interest |

|

|

|

|

|

|

|

(1.9 |

) |

| Net income available for

common stock |

|

|

|

|

|

|

$ |

22.8 |

|

| |

Consolidating Income Statement |

|

| Three Months Ended

June 30, 2023 |

Electric Utilities |

|

Gas Utilities |

|

Corporate and Other |

|

Total |

|

| |

(in millions) |

|

|

Revenue |

$ |

193.1 |

|

$ |

222.7 |

|

$ |

(4.5 |

) |

$ |

411.3 |

|

| |

|

|

|

|

|

|

|

|

| Fuel, purchased power and cost

of natural gas sold |

|

36.4 |

|

|

85.0 |

|

|

(0.1 |

) |

|

121.3 |

|

| Operations and

maintenance |

|

65.4 |

|

|

84.0 |

|

|

(3.6 |

) |

|

145.8 |

|

| Depreciation and

amortization |

|

35.8 |

|

|

28.8 |

|

|

0.1 |

|

|

64.7 |

|

| Taxes - property and

production |

|

8.9 |

|

|

7.2 |

|

|

(0.1 |

) |

|

16.0 |

|

| Operating income (loss) |

|

46.6 |

|

|

17.7 |

|

|

(0.8 |

) |

|

63.5 |

|

| |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

|

|

|

|

|

(41.5 |

) |

| Other income (expense),

net |

|

|

|

|

|

|

|

(1.5 |

) |

| Income tax benefit |

|

|

|

|

|

|

|

6.1 |

|

| Net income |

|

|

|

|

|

|

|

26.6 |

|

| Net income attributable to

non-controlling interest |

|

|

|

|

|

|

|

(3.5 |

) |

| Net income available for

common stock |

|

|

|

|

|

|

$ |

23.1 |

|

| |

Consolidating Income Statement |

|

| Six Months Ended June

30, 2024 |

Electric Utilities |

|

Gas Utilities |

|

Corporate and Other |

|

Total |

|

| |

(in millions) |

|

|

Revenue |

$ |

427.3 |

|

$ |

710.6 |

|

$ |

(8.9 |

) |

$ |

1,129.0 |

|

| |

|

|

|

|

|

|

|

|

| Fuel, purchased power and cost

of natural gas sold |

|

100.8 |

|

|

323.2 |

|

|

(0.3 |

) |

|

423.7 |

|

| Operations and

maintenance |

|

125.5 |

|

|

157.9 |

|

|

(8.2 |

) |

|

275.2 |

|

| Depreciation and

amortization |

|

70.8 |

|

|

61.5 |

|

|

0.2 |

|

|

132.5 |

|

| Taxes - property and

production |

|

19.3 |

|

|

14.3 |

|

|

- |

|

|

33.6 |

|

| Operating income (loss) |

|

110.9 |

|

|

153.7 |

|

|

(0.6 |

) |

|

264.0 |

|

| |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

|

|

|

|

|

(86.7 |

) |

| Other income (expense),

net |

|

|

|

|

|

|

|

(0.5 |

) |

| Income tax (expense) |

|

|

|

|

|

|

|

(20.6 |

) |

| Net income |

|

|

|

|

|

|

|

156.2 |

|

| Net income attributable to

non-controlling interest |

|

|

|

|

|

|

|

(5.6 |

) |

| Net income available for

common stock |

|

|

|

|

|

|

$ |

150.6 |

|

| |

Consolidating Income Statement |

|

| Six Months Ended June

30, 2023 |

Electric Utilities |

|

Gas Utilities |

|

Corporate and Other |

|

Total |

|

| |

(in millions) |

|

|

Revenue |

$ |

411.8 |

|

$ |

929.6 |

|

$ |

(9.0 |

) |

$ |

1,332.4 |

|

| |

|

|

|

|

|

|

|

|

| Fuel, purchased power and cost

of natural gas sold |

|

91.8 |

|

|

555.9 |

|

|

(0.2 |

) |

|

647.5 |

|

| Operations and

maintenance |

|

122.8 |

|

|

171.2 |

|

|

(7.3 |

) |

|

286.7 |

|

| Depreciation and

amortization |

|

70.9 |

|

|

55.3 |

|

|

0.2 |

|

|

126.4 |

|

| Taxes - property and

production |

|

18.6 |

|

|

14.8 |

|

|

- |

|

|

33.4 |

|

| Operating income (loss) |

|

107.7 |

|

|

132.4 |

|

|

(1.7 |

) |

|

238.4 |

|

| |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

|

|

|

|

|

(85.0 |

) |

| Other income (expense),

net |

|

|

|

|

|

|

|

(0.9 |

) |

| Income tax (expense) |

|

|

|

|

|

|

|

(8.6 |

) |

| Net income |

|

|

|

|

|

|

|

143.9 |

|

| Net income attributable to

non-controlling interest |

|

|

|

|

|

|

|

(6.8 |

) |

| Net income available for

common stock |

|

|

|

|

|

|

$ |

137.1 |

|

|

Investor Relations: |

|

| Sal Diaz |

|

| Phone |

605-399-5079 |

| Email |

investorrelations@blackhillscorp.com |

|

|

|

| Media

Contact: |

|

| 24-hour Media Assistance |

888-242-3969 |

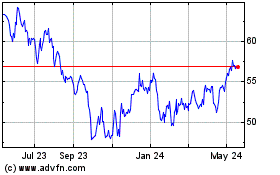

Black Hills (NYSE:BKH)

Historical Stock Chart

From Sep 2024 to Oct 2024

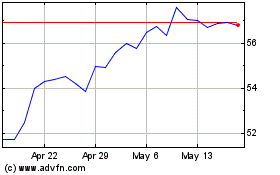

Black Hills (NYSE:BKH)

Historical Stock Chart

From Oct 2023 to Oct 2024