Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

November 07 2023 - 5:11PM

Edgar (US Regulatory)

Free Writing Prospectus dated November 7, 2023

(to Prospectus dated July 29, 2022 and

Preliminary Prospectus Supplement dated November 7, 2023)

Filed pursuant to Rule 433

Registration Statement No. 333-266391

PRICING TERM SHEET

U.S.$750,000,000 TIER 2 SUBORDINATED CALLABLE FIXED-TO-FIXED RATE NOTES DUE 2034

(the “Notes”)

This Free Writing Prospectus relates only to the Notes described below and should only be read together with the preliminary prospectus supplement dated

November 7, 2023 (the “Preliminary Prospectus Supplement”) and the accompanying prospectus dated July 29, 2022 relating to these notes (the “Prospectus”). Terms and expressions used but not defined herein shall have the

same meanings as defined in the Preliminary Prospectus Supplement or Prospectus, as applicable.

|

|

|

| Issuer: |

|

Banco Bilbao Vizcaya Argentaria, S.A. (“BBVA”) |

|

|

| Expected Issue Ratings: * |

|

Baa2 Moody’s / BBB S&P / BBB- Fitch |

|

|

| Issuer Ratings: * |

|

A3 (stable) Moody’s / A (stable) S&P / BBB+ (stable) Fitch |

|

|

| Status and Ranking: |

|

The payment obligations of the Issuer under the Notes shall be direct, unconditional, unsecured and subordinated obligations (créditos subordinados) of the Issuer, and upon the insolvency (concurso de

acreedores) of the Issuer, in accordance with and to the extent permitted by the Insolvency Law and other applicable laws relating to or affecting the enforcement of creditors’ rights in Spain (including, without limitation, Additional

Provision 14.3 of Law 11/2015), but subject to any other ranking that may apply as a result of any mandatory provision of law (or otherwise), such payment obligations, for so long as the Notes constitute Tier 2 Instruments of the Issuer, will rank:

(i) junior to any (a) claim in respect of any unsubordinated obligations of the Issuer (including where the relevant claim subsequently becomes subordinated pursuant to Article 281.1.1 of the Insolvency Law), (b) claim in respect of Senior

Subordinated Debt and (c) other subordinated obligations (créditos subordinados) of the Issuer which by law and/or by their terms, to the extent permitted by Spanish law, rank senior to the obligations of the Issuer in respect of

the Notes and do not qualify as Additional Tier 1 Instruments or Tier 2 Instruments; (ii) pari passu without any preference or priority among themselves and with all claims in respect of other contractually subordinated

obligations of the Issuer under any outstanding Tier 2 Instruments, present and future, and any other subordinated obligations (créditos subordinados) of the Issuer which by law and/or by their terms, to the extent permitted

by |

|

|

|

|

|

Spanish law, rank pari passu with the obligations of the Issuer in respect of the Notes; and (iii) senior to (a) any claim

in respect of any other subordinated obligations (créditos subordinados) of the Issuer which by law and/or by their terms, to the extent permitted by Spanish law, rank junior to the obligations of the Issuer in respect of the Notes,

including, without limitation, any claim in respect of contractually subordinated obligations of the Issuer under any outstanding Additional Tier 1 Instruments, present and future, and (b) ordinary shares of the Issuer, such that any relevant

claim in respect of the Notes will be satisfied, as appropriate, only to the extent that all claims ranking senior to it have first been satisfied in full, and then pro rata with any claims ranking pari passu with it, in each case as

provided herein. To the extent the Notes cease to constitute Tier 2 Instruments of

the Issuer, the payment obligations of the Issuer under the Notes, upon the insolvency (concurso de acreedores) of the Issuer, will rank as described under “Certain Terms of the Notes—Status and Ranking of the Notes” in

the Preliminary Prospectus Supplement. |

|

|

| Principal Amount: |

|

U.S. $750,000,000 |

|

|

| Form of Issuance: |

|

SEC Registered |

|

|

| Pricing Date: |

|

November 7, 2023 |

|

|

| Issue Date / Settlement Date: ** |

|

November 15, 2023 (T+6) |

|

|

| Reset Date: |

|

November 15, 2033 |

|

|

| Stated Maturity Date: |

|

November 15, 2034 |

|

|

| CUSIP / ISIN: |

|

05946K AN1 / US05946KAN19 |

|

|

| Benchmark Treasury: |

|

T 3.875% due August 15, 2033 |

|

|

| Benchmark Treasury Yield: |

|

4.583% |

|

|

| Spread to Benchmark Treasury: |

|

UST+ 330 bps |

|

|

| Re-offer Yield: |

|

7.883% |

|

|

| Coupon: |

|

The Notes will bear interest (i) from (and including) the Issue Date to (but excluding) the Reset Date or any date of earlier redemption at a fixed rate of 7.883% per annum and (ii) thereafter, from (and including) the

Reset Date to (but excluding) the Stated Maturity Date or any date of earlier redemption at a fixed rate per annum equal to the 1-year UST, as determined by the Calculation Agent, plus 330 basis points, such

sum being converted to a semi-annual rate in accordance with market convention (rounded to the fifth decimal place, with 0.000005 being rounded upwards). |

|

|

|

|

|

“1-year UST” means an interest rate expressed as a percentage determined by the Calculation

Agent to be the per annum rate equal to the yield to maturity for U.S. Treasury securities with a maturity of one year, as published in the most recent H.15.

“H.15” means the daily statistical release designated as such and published by the Board of Governors of the United States Federal Reserve System

under the caption “Treasury constant maturities”, or any successor or replacement publication as reasonably determined by the Issuer and notified to the Calculation Agent, that establishes yield on actively traded U.S. Treasury securities,

and “most recent H.15” means the H.15 that includes a yield to maturity for U.S. Treasury securities with a maturity of one year published closest in time (but prior to) the Reset Determination Date.

“Reset Determination Date” means the second Business Day immediately preceding

the Reset Date. |

|

|

| Interest Payment Dates: |

|

Semi-annually in arrears on May 15 and November 15 of each year, beginning May 15, 2024 up to (and including) the Stated Maturity Date or any date of earlier redemption |

|

|

| Price to Public: |

|

100.000% |

|

|

| Underwriting Discount: |

|

0.300% |

|

|

| Proceeds to Issuer (before Expenses): |

|

99.700% (U.S.$ 747,750,000) |

|

|

| Day Count Fraction / Business Day Convention: |

|

30/360 (following business day, unadjusted) |

|

|

| Business Days: |

|

New York City, London and Madrid |

|

|

| Minimum Denominations / Multiples: |

|

Minimum denominations of U.S.$200,000 and multiples of U.S.$200,000 in excess thereof |

|

|

| Expected Listing: |

|

New York Stock Exchange |

|

|

| Trustee, Paying Agent, Transfer Agent, Calculation Agent and Security Registrar: |

|

The Bank of New York Mellon, acting (except with respect to its role as Security Registrar) through its London Branch |

|

|

|

| Redemption Provisions: |

|

Tax call: All or part at 100% of principal and accrued but unpaid interest

Capital Event call: So long as the Notes are included in, or count towards, the

Group’s or the Issuer’s Tier 2 Capital, all (but not less than all) at 100% of principal and accrued but unpaid interest

Eligible Liabilities Event call: To the extent the Notes cease to be included in, or count towards, the Group’s or the Issuer’s Tier 2 Capital, all

(but not less than all) at 100% of principal and accrued but unpaid interest

Optional early redemption (Issuer call): All or part at 100% of principal and accrued but unpaid interest on the Reset Date

Clean-up Call: In whole but not in part at 100%

of principal and accrued but unpaid interest if Notes representing, in the aggregate, 75% or more of the aggregate principal amount of the Notes (including any Notes issued after the Issue Date and any Notes which have been cancelled by the Trustee

in accordance with the Indenture) have been purchased by or on behalf of BBVA or any member of the BBVA Group

Any redemption shall be subject to the prior consent of the Regulator, if required pursuant to Applicable Banking Regulations, and otherwise in accordance with

Articles 77 and 78 of CRR and/or any other Applicable Banking Regulations then in force. See “Certain Terms of the Notes—Redemption” in the Preliminary Prospectus Supplement for material information on the redemption of the

Notes. |

|

|

| Purchases of the Notes: |

|

The Issuer or any member of the BBVA Group or any other legal entity acting on behalf of the Issuer may purchase or otherwise acquire any of the outstanding Notes at any price in the open market or otherwise, subject to the prior

consent of the Regulator, if required pursuant to Applicable Banking Regulations, and otherwise in accordance with Articles 77 and 78 of CRR and/or any other Applicable Banking Regulations in force at the relevant time. Upon their acquisition, such

Notes may be held, resold or, at the option of the Issuer, surrendered to the Trustee for cancellation (subject to such holding, resale or cancellation being in compliance with Applicable Banking Regulations). Any such purchased Notes will cease to

be deemed “outstanding” under the Indenture (i) for so long such purchased Notes are held by the Issuer or any member of the Group or any other legal entity acting on behalf of the Issuer or (ii) if such purchased Notes have been

surrendered to the Trustee for cancellation. |

|

|

| Governing Law: |

|

New York law, except that the authorization and execution by the Issuer of the Indenture, the authorization, issuance and execution by the Issuer of the Notes and certain provisions related to the status and ranking of the Notes,

the waiver of the right of set-off and the agreement by holders with respect to the exercise and effects of the Spanish Bail-in Power shall be governed by and construed

in accordance with the common laws of Spain. See “Certain Terms of the Notes—Governing Law” in the Preliminary Prospectus Supplement. |

|

|

|

| Submission to Jurisdiction: |

|

Any U.S. federal or state court in the Borough of Manhattan, the City of New York, New York, except that the Spanish courts have exclusive jurisdiction in respect of a Bail-in Dispute. See

“Certain Terms of the Notes—Submission to Jurisdiction” in the Preliminary Prospectus Supplement. |

|

|

| U.S. Federal Tax Considerations: |

|

See the section of the Prospectus entitled “U.S. Federal Tax Considerations” for a discussion of the material U.S. federal income tax consequences of the ownership and disposition of the Notes to the U.S. holders

described therein. |

|

|

| Spanish Tax Considerations: |

|

Exemption from Spanish withholding tax applies subject to compliance with certain Spanish tax requirements, including the timely provision by

the paying agent of a duly executed and completed Payment Statement. If the paying

agent fails to deliver a duly executed and completed Payment Statement on a timely basis, the related payment will be subject to Spanish withholding tax. If this occurs, the Issuer will not pay Additional Amounts and holders will have to apply

directly to the Spanish tax authorities for any refund to which they may be entitled. See “Certain Terms of the Notes—Maintenance of Tax Procedures” and “Spanish Tax Considerations” in the Preliminary

Prospectus Supplement. |

|

|

| Substitution and Modification and Agreement with Respect Thereto: |

|

If (only so long as the Notes are included in, or count towards, the Group’s or the Issuer’s Tier 2 Capital) a Capital Event or (to

the extent the Notes cease to be included in, or count towards, the Group’s or the Issuer’s Tier 2 Capital) an Eligible Liabilities Event occurs with respect to the Notes, including as a result of any change in law or regulation or the

application or official interpretation thereof, the Issuer may, under certain circumstances and without the consent or approval of the holders or beneficial owners of the Notes, substitute all (but not less than all) of the Notes or modify the terms

of all (but not less than all) of the Notes, so that such Notes are substituted by, or their terms are modified to, become again, or remain, Qualifying Securities.

By its acquisition of any Note or any beneficial interest therein, each holder and beneficial owner of such Note, (i) acknowledges, accepts, consents to

and agrees to be bound by the substitution of or modification to the terms of the Notes as set forth above and to grant to the Issuer and the Trustee full power and authority to take any action and/or to execute and deliver any document in the name

and/or on behalf of such holder or beneficial owner, as the case may be, which is necessary or convenient to complete the substitution of or modification to the terms of the Notes, as applicable; and (ii) to the extent permitted by the Trust

Indenture Act, waives any and all claims, in law and/or in equity, against the Trustee and/or the Issuer for, agrees not to initiate a suit against |

|

|

|

|

|

the Trustee and/or the Issuer in respect of, and agrees that neither the Trustee nor the Issuer shall be liable for, any action that the

Trustee or the Issuer takes, or abstains from taking, in either case in connection with the substitution of or modification to the terms of the Notes upon the occurrence of an Eligible Liabilities Event or a Capital Event, as the case may be.

See “Certain Terms of the Notes—Substitution and Modification” in

the Preliminary Prospectus Supplement. |

|

|

| Agreement and Acknowledgement with Respect to Exercise of Spanish Bail-In Power: |

|

By its acquisition of any Notes, each holder (including each holder of a beneficial interest in the Notes) acknowledges, accepts, consents to and agrees to be bound by (i) the exercise and effects of the Spanish Bail-in Power by the Relevant Spanish Resolution Authority and (ii) the variation of the terms of the Notes, or the rights of the holders thereunder or under the Indenture, as deemed necessary by the Relevant

Spanish Resolution Authority, to give effect to the exercise of the Spanish Bail-in Power by the Relevant Spanish Resolution Authority. No repayment or payment of Amounts Due on the Notes will become due and

payable or be paid after the exercise of the Spanish Bail-in Power by the Relevant Spanish Resolution Authority if, and to the extent that such amounts have been reduced, converted, cancelled, amended or

altered as a result of such exercise. See “Certain Terms of the Notes— Agreement and Acknowledgement with Respect to the Exercise of the Spanish Bail-in Power” in the Preliminary

Prospectus Supplement. |

|

|

| Event of Default: |

|

“Event of Default”, wherever used with respect to the Notes, means that (except as set forth under “Certain Terms of the Notes—Events of Default” in the Preliminary Prospectus) an order shall have

been made by any competent court commencing insolvency proceedings (procedimiento concursal) against the Issuer or an order of any competent court or administrative agency shall have been made or a resolution shall have been passed by the

Issuer for the dissolution or winding up of the Issuer. There are no other Events of Default under the Notes. |

|

|

| Use of Proceeds: |

|

General corporate purposes |

|

|

| Target Market: |

|

MiFID II and UK MiFIR - professionals / ECPs-only / No EEA or UK PRIIPs KID / UK FCA PI restriction – Manufacturer target market (MiFID II and UK MiFIR product governance) is eligible counterparties and professional clients

only (all distribution channels). No EEA or UK PRIIPs key information document (KID) has been prepared as not available to retail investors in the EEA or in the United Kingdom. No sales to retail clients (as defined in MiFID II and COBS 3.4) in the

EEA or in the United Kingdom. The Notes are incompatible with the knowledge, experience, needs, characteristics and objectives of clients which are retail clients. |

|

|

|

| Joint Bookrunners: |

|

Citigroup Global Markets Inc.

BBVA Securities Inc.***

Deutsche Bank Securities Inc.

J.P. Morgan Securities LLC

TD Securities (USA) LLC

UBS Securities LLC |

| * |

Any ratings obtained will reflect only the views of the respective rating agency and should not be considered a

recommendation to buy, sell or hold the Notes. The ratings assigned by the rating agencies are subject to revision or withdrawal at any time by such rating agencies in their sole discretion. Each rating should be evaluated independently of any other

rating. |

| ** |

Pursuant to Rule 15c6-1 under the Exchange Act, trades in the secondary

market are generally required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to the delivery of the Notes will be required to specify

alternative settlement arrangements to prevent a failed settlement. Such purchasers should consult their own advisors. |

| *** |

BBVA Securities Inc., which is participating in this offering as a Joint Bookrunner, is a wholly-owned

subsidiary of BBVA. The offering is being conducted pursuant to FINRA Rule 5121. See “Underwriting (Conflicts of Interest)” in the Preliminary Prospectus Supplement. |

The Issuer has filed a registration statement (including the Prospectus) with the U.S. Securities and Exchange Commission (SEC) for this offering. Before you

invest, you should read the Preliminary Prospectus Supplement and the Prospectus in that registration statement, and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get

these documents for free by searching the SEC online database (EDGAR®) at www.sec.gov. Alternatively, you may obtain a copy of the Prospectus and Preliminary Prospectus Supplement from

Citigroup Global Markets Inc. by calling toll free +1-800-831-9146, BBVA Securities Inc. by calling toll free +1-800-422-8692, Deutsche Bank Securities Inc. by calling toll free +1-800-503-4611, J.P. Morgan Securities LLC by calling toll free +1-212-834-4533,

TD Securities (USA) LLC by calling toll free +1-855-495-9846 or UBS Securities LLC by calling toll free +1-888-827-7275.

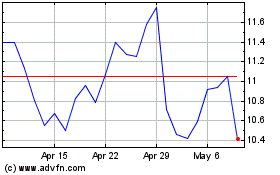

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

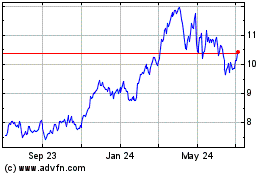

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Nov 2023 to Nov 2024