false000163411700016341172024-09-102024-09-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 10, 2024

| | | | | | | | | | | | | | | | | |

| BARNES & NOBLE EDUCATION, INC. |

| (Exact name of registrant as specified in its charter) |

| |

| Delaware | | 1-37499 | | 46-0599018 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | |

120 Mountainview Blvd., Basking Ridge, NJ 07920 |

| (Address of principal executive offices)(Zip Code) |

| |

| Registrant’s telephone number, including area code: | | (908) 991-2665 |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

□ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

□ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

□ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

□ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Class | | Trading Symbol | | Name of Exchange on which registered |

| Common Stock, $0.01 par value per share | | BNED | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company □

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. □

Item 2.02 Results of Operations and Financial Condition.

On September 10, 2024, Barnes & Noble Education, Inc. (the “Company”) issued a press release announcing its financial results for the first quarter ended July 27, 2024 (the “Press Release”). A copy of the Press Release and the financial statements and Non-GAAP reconciliation tables are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively.

The information in this Form 8-K and the Exhibit attached hereto pertaining to the Company’s financial results shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: September 10, 2024

BARNES & NOBLE EDUCATION, INC.

By: /s/ Kevin Watson

Name: Kevin Watson

Title: Chief Financial Officer

BARNES & NOBLE EDUCATION, INC.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Exhibit 99.1

Barnes & Noble Education Reports First Quarter Fiscal Year 2025 Financial Results

BNC First Day Program Revenues Increased 32%

Recent Initiatives Expected to Drive Over $10 Million of Go-Forward Savings

Basking Ridge, NJ, September 10, 2024 - Barnes & Noble Education, Inc. (NYSE: BNED), a leading solutions provider for the education industry, today reported sales and earnings for the first quarter ended on July 27, 2024. The following figures are GAAP results from continuing operations on a consolidated basis, unless noted otherwise. Note that Adjusted EBITDA is a non-GAAP calculation. Full quarterly financial tables and a reconciliation of non-GAAP measures to the most applicable GAAP measures can be found in the Investor Relations section of BNED’s website at https://investors.bned.com and its Current Report on Form 8-K filed with the SEC on the date of this release.

Barnes & Noble Education is a highly seasonal business, and the first quarter is historically a period of low sales activity for the Company. First quarter fiscal year 2025 revenue decreased by $(0.7) million, or -0.3%, from last year to $263.4 million, primarily driven by a net decrease in physical locations, many of which were closures of underperforming stores, which has helped to improve profitability. Revenues from BNC First Day programs increased approximately $19.6 million, or 32%, helping to offset much of the decline.

Overall net loss was $(99.5) million, which was elevated due to one-time expenses related to the recent milestone equity and refinancing transactions1, including a non-cash charge of $(55.2) million due to the extinguishment of debt caused by the conversion of our second lien debt into equity. This event meaningfully strengthened the Company’s balance sheet. Adjusted EBITDA improved by $5.2 million from last year to $(20.7) million, in part due to lower selling and administrative expenses of $10.5 million as the result of cost-saving and productivity initiatives.

Jonathan Shar, CEO, noted, “It was a very busy quarter as we completed our milestone equity and refinancing transactions and worked hard to prepare for the upcoming Fall Rush with our store teams, vendors and other business partners. We are excited by the momentum and fresh energy as we enter the new academic year.

“The rapid growth of our BNC First Day programs is a bright spot for our business, and we anticipate continued growth as numerous institutions adopt our affordable access models for the benefit of their students’ academic success through improved affordability, access and convenience.”

Shar further added, “Our stores are well stocked for Fall Rush, and we are prepared to support students across the country in their academic journey, ensuring they have the resources they need to succeed while providing all of our customers with an unmatched product assortment and retail experience."

Barnes & Noble Education is focused on driving material improvements in its profitability and seeks to further build upon the strong financial foundation that it recently attained from the milestone transactions. Management is working on consolidating and simplifying its operations to better focus on its core physical and virtual bookstore businesses. Recently completed and in-progress initiatives comprised of over $10.0 million in go-forward savings include the following:

–Streamlining corporate employee staffing levels.

–Optimizing, consolidating and bidding out various insurance programs.

–Repricing, eliminating or consolidating multiple IT and telecom vendors and programs. These efforts included enhancing certain customer support services by utilizing insourcing.

–Changing certain professional service providers and eliminating lower-impact investor and communication resources.

In the medium term, BNED believes that there are opportunities to materially improve its working capital position by lowering certain credit reserves, improving inventory turns, and enhancing the Company’s overall capital allocation framework.

BNED is also working to launch a new stock compensation program, linking elements of compensation to stock price performance, for a broad range of employees that will promote a more ownership-minded culture and better align management and employees with stockholders.

The Company anticipates spending approximately $20.0 million on capital expenditures in fiscal year 2025, with the bulk of those investments focused on store improvements and technology.

At this time, BNED is not providing formal guidance, but management’s budget goals target a material improvement in fiscal year 2025 GAAP operating results and Adjusted EBITDA versus last year. Based on current estimates of capital expenditures and significantly reduced interest costs from last fiscal year, BNED believes it can drive meaningful operating free cash flow, which will be used to further de-lever its balance sheet.

1.On June 10, 2024, the Company closed on the milestone equity and refinancing transactions, which included the infusion of approximately $80.0 million of net new cash into the business and a new four-year, $325.0 million credit facility.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Use of Non-GAAP Financial Information - Adjusted Earnings, Adjusted EBITDA, and Free Cash Flow | |

| | | | | | | | | | | |

To supplement the Company’s condensed consolidated financial statements presented in accordance with generally accepted accounting principles (“GAAP”) the Company uses the financial measures of Adjusted Earnings, Adjusted EBITDA, and Free Cash Flow, which are non-GAAP financial measures under Securities and Exchange Commission (the "SEC") regulations. We define Adjusted Earnings as net income (loss) adjusted for certain reconciling items that are subtracted from or added to net income (loss). We define Adjusted EBITDA as net income (loss) plus (1) depreciation and amortization; (2) interest expense and (3) income taxes, (4) as adjusted for items that are subtracted from or added to net income (loss). We define Free Cash Flow as Cash Flows from Operating Activities less capital expenditures, cash interest and cash taxes. | |

| | | | | | | | | | | |

These non-GAAP measures have been reconciled to the most comparable financial measures presented in accordance with GAAP as follows: the reconciliation of Adjusted Earnings to net income (loss); the reconciliation of consolidated Adjusted EBITDA to consolidated net income (loss); and the reconciliation of Free Cash Flow to Cash Flows from Operating Activities. All of the items included in the reconciliations are either (i) non-cash items or (ii) items that management does not consider in assessing our on-going operating performance. | | | | |

| | | | | | | | | | | |

| These non-GAAP financial measures are not intended as substitutes for and should not be considered superior to measures of financial performance prepared in accordance with GAAP. In addition, the Company's use of these non-GAAP financial measures may be different from similarly named measures used by other companies, limiting their usefulness for comparison purposes. | |

| | | | | | | | | | | |

We review these non-GAAP financial measures as internal measures to evaluate our performance at a consolidated level to manage our operations. We believe that these measures are useful performance measures which are used by us to facilitate a comparison of our on-going operating performance on a consistent basis from period-to-period. We believe that these non-GAAP financial measures provide for a more complete understanding of factors and trends affecting our business than measures under GAAP can provide alone, as they exclude certain items that management believes do not reflect the ordinary performance of our operations in a particular period. Our Board of Directors and management also use Adjusted EBITDA at a consolidated level as one of the primary methods for planning and forecasting expected performance, for evaluating on a quarterly and annual basis actual results against such expectations, and as a measure for performance incentive plans. We believe that the inclusion of Adjusted Earnings and Adjusted EBITDA results provides investors useful and important information regarding our operating results, in a manner that is consistent with management’s evaluation of business performance. We believe that Free Cash Flow provides useful additional information concerning cash flow available to meet future debt service obligations and working capital requirements and assists investors in their understanding of our operating profitability and liquidity as we manage the business to maximize margin and cash flow. | |

| | | | | | | | | | | |

The Company urges investors to carefully review the GAAP financial information included as part of the Company’s Form 10-K dated April 27, 2024 filed with the SEC on July 1, 2024, which includes consolidated financial statements for each of the three years for the period ended April 27, 2024, April 29, 2023, and April 30, 2022 (Fiscal 2024, Fiscal 2023, and Fiscal 2022, respectively). The Company also urges investors to carefully review the financial information included as part of the Company’s Quarterly Report on Form 10-Q for the period ended July 27, 2024, filed with the SEC on September 10, 2024. We do not provide a reconciliation of forward-looking non-GAAP financial metrics, because reconciling information is not available without an unreasonable effort, such as attempting to make assumptions that cannot reasonably be made on a forward-looking basis to determine the corresponding GAAP metric. | |

| |

ABOUT BARNES & NOBLE EDUCATION, INC.

Barnes & Noble Education, Inc. (NYSE: BNED) is a leading solutions provider for the education industry, driving affordability, access and achievement at hundreds of academic institutions nationwide and ensuring millions of students are equipped for success in the classroom and beyond. Through its family of brands, BNED offers campus retail services and academic solutions, wholesale capabilities and more. BNED is a company serving all who work to elevate their lives through education, supporting students, faculty and institutions as they make tomorrow a better and smarter world. For more information, visit www.bned.com.

| | |

Media & Investor Contact: |

Kevin Watson |

Executive Vice President |

Chief Financial Officer |

| kwatson@bned.com |

Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and information relating to us and our business that are based on the beliefs of our management as well as assumptions made by and information currently available to our management. When used in this communication, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “will,” “forecasts,” “projections,” and similar expressions, as they relate to us or our management, identify forward-looking statements. Actual results could differ materially from those projected in the forward-looking statements, which include but are not limited to the anticipated savings and benefits of our expense management initiatives, anticipated growth in our BNC First Day program, future capital expenditures, expected trends in financial results, including forward-looking Adjusted EBITDA and operating free cash flow. We caution you not to place undue reliance on these forward-looking statements. Such statements reflect our current views with respect to future events, the outcome of which is subject to certain risks, including, but not limited to: the amount of our indebtedness and ability to comply with covenants contained in our credit agreement; our ability to maintain adequate liquidity levels to support ongoing inventory purchases and related vendor payments in a timely manner; slower than anticipated pace of adoption of our BNC First Day® equitable and inclusive access course material models; our dependency on strategic service provider relationships and the potential for adverse operational and financial changes to these strategic service provider relationships; non-renewal of our managed bookstore, physical and/or online store contracts; general competitive conditions; a decline in college enrollment or decreased funding available for students; technological changes, including the adoption of artificial intelligence technologies for educational content; disruptions to our information technology systems, infrastructure, data, supplier systems, and customer ordering and payment systems due to computer malware, viruses, hacking and phishing attacks; disruption of or interference with third party service providers and our own proprietary technology; impacts that public health crises may have on the overall demand for BNED products and services, our operations, the operations of our suppliers, service providers, and campus partners as well as the ability of our suppliers to manufacture or source products, particularly from outside of the United States; and changes in applicable domestic and international laws, rules or regulations or changes in enforcement practices, including, without limitation, the impact of recently proposed regulatory changes by the United States Department of Education, U.S. tax reform, or changes to consumer data privacy rights legislation, as well as related guidance. Moreover, we operate in a very competitive and rapidly changing environment and new risks may emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make.

For a more detailed discussion of these factors, and other factors that could cause actual results to vary materially, interested parties should review the risk factors listed in the Company’s Annual Report on Form 10-K for the year ended April 27, 2024 as filed with the SEC. Any forward-looking statements made by us in this press release speak only as of the date of this press release, and we do not intend to update these forward-looking statements after the date of this press release, except as required by law.

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(In thousands, except per share data) (Unaudited)

| | | | | | | | | | | | | | | | | |

| | | 13 weeks ended |

| | | | | July 27, 2024 | | July 29, 2023 |

| Sales: | | | | | | | |

| Product sales and other | | | | | $ | 250,926 | | | $ | 252,650 | |

| Rental income | | | | | 12,505 | | | 11,511 | |

| Total sales | | | | | 263,431 | | | 264,161 | |

| Cost of sales (exclusive of depreciation and amortization expense): | | | | | | | |

| Product and other cost of sales | | | | | 209,425 | | | 207,014 | |

| Rental cost of sales | | | | | 6,800 | | | 6,513 | |

| Total cost of sales | | | | | 216,225 | | | 213,527 | |

| Gross profit | | | | | 47,206 | | | 50,634 | |

| Selling and administrative expenses | | | | | 67,023 | | | 77,476 | |

| Depreciation and amortization expense | | | | | 13,057 | | | 10,253 | |

| | | | | | | |

Loss on extinguishment of debt (a) | | | | | 55,233 | | | — | |

Restructuring and other charges (a) | | | | | 3,618 | | | 4,633 | |

| | | | | | | |

| Operating loss | | | | | (91,725) | | | (41,728) | |

| Interest expense, net | | | | | 7,618 | | | 8,254 | |

| Loss from continuing operations before income taxes | | | | | (99,343) | | | (49,982) | |

| Income tax expense (benefit) | | | | | 136 | | | (11) | |

| Loss from continuing operations | | | | | $ | (99,479) | | | $ | (49,971) | |

| Loss from discontinued operations, net of tax of $0 and $20, respectively | | | | | $ | — | | | $ | (417) | |

| Net Loss | | | | | $ | (99,479) | | | $ | (50,388) | |

| | | | | | | |

| Loss per common share: | | | | | | | |

| Basic and Diluted: | | | | | | | |

| Continuing operations | | | | | $ | (7.36) | | | $ | (18.87) | |

| Discontinued operations | | | | | $ | — | | | $ | (0.16) | |

| Total Basic and Diluted Earnings per share | | | | | $ | (7.36) | | | $ | (19.03) | |

| Weighted average common shares outstanding - Basic and Diluted | | | | | 13,511 | | | 2,648 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

|

(a) For additional information, see the Notes in the Non-GAAP disclosure information of this Press Release.

| | | | | | | | | | | | | | | | | |

| | | 13 weeks ended |

| | | | | July 27, 2024 | | July 29, 2023 |

| Percentage of sales: | | | | | | | |

| Sales: | | | | | | | |

| Product sales and other | | | | | 95.3 | % | | 95.6 | % |

| Rental income | | | | | 4.7 | % | | 4.4 | % |

| Total sales | | | | | 100.0 | % | | 100.0 | % |

| Cost of sales (exclusive of depreciation and amortization expense): | | | | | | | |

Product and other cost of sales (a) | | | | | 83.5 | % | | 81.9 | % |

Rental cost of sales (a) | | | | | 54.4 | % | | 56.6 | % |

| Total cost of sales | | | | | 82.1 | % | | 80.8 | % |

| Gross profit | | | | | 17.9 | % | | 19.2 | % |

| Selling and administrative expenses | | | | | 25.4 | % | | 29.3 | % |

| Depreciation and amortization expense | | | | | 5.0 | % | | 3.9 | % |

| | | | | | | |

Loss on extinguishment of debt | | | | | 21.0 | % | | — | % |

| Restructuring and other charges | | | | | 1.4 | % | | 1.8 | % |

| | | | | | | |

| Operating loss | | | | | (34.9) | % | | (15.8) | % |

| Interest expense, net | | | | | 2.9 | % | | 3.1 | % |

| Loss from continuing operations before income taxes | | | | | (37.8) | % | | (18.9) | % |

Income tax expense (benefit) | | | | | 0.1 | % | | — | % |

| Loss from continuing operations | | | | | (37.9) | % | | (18.9) | % |

| | | | | | | |

(a) Represents the percentage these costs bear to the related sales, instead of total sales.

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands, except per share data) (Unaudited)

| | | | | | | | | | | |

| July 27, 2024 | | July 29, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 8,212 | | | $ | 7,657 | |

| Receivables, net | 154,405 | | | 140,858 | |

| Merchandise inventories, net | 395,272 | | | 384,185 | |

| Textbook rental inventories | 10,320 | | | 6,860 | |

| Prepaid expenses and other current assets | 33,152 | | | 59,012 | |

| | | |

| | | |

| Total current assets | 601,361 | | | 598,572 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Property and equipment, net | 48,264 | | | 64,438 | |

| Operating lease right-of-use assets | 241,852 | | | 283,096 | |

| Intangible assets, net | 87,828 | | | 107,413 | |

| | | |

| | | |

| Other noncurrent assets | 25,930 | | | 17,298 | |

| Total assets | $ | 1,005,235 | | | $ | 1,070,817 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 266,304 | | | $ | 275,380 | |

| Accrued liabilities | 75,713 | | | 89,792 | |

| Current operating lease liabilities | 147,839 | | | 150,917 | |

| | | |

| | | |

| Total current liabilities | 489,856 | | | 516,089 | |

| Long-term deferred taxes, net | 1,306 | | | 1,836 | |

| Long-term operating lease liabilities | 132,200 | | | 171,154 | |

| Other long-term liabilities | 15,553 | | | 23,016 | |

| Long-term borrowings | 221,916 | | | 277,663 | |

| Total liabilities | 860,831 | | | 989,758 | |

| Commitments and contingencies | — | | | — | |

| Stockholders' equity: | | | |

| | | |

Preferred stock, $0.01 par value; authorized, 5,000 shares; issued and outstanding, none | — | | | — | |

Common stock, $0.01 par value; authorized, 200,000 shares; issued, 26,235 and 553 shares, respectively; outstanding, 26,208 and 527 shares, respectively | 262 | | | 553 | |

| Additional paid-in-capital | 922,744 | | | 746,724 | |

| Accumulated deficit | (756,046) | | | (643,744) | |

| Treasury stock, at cost | (22,556) | | | (22,474) | |

| Total stockholders' equity | 144,404 | | | 81,059 | |

| Total liabilities and stockholders' equity | $ | 1,005,235 | | | $ | 1,070,817 | |

| | | |

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Non-GAAP Information (a)

(In thousands) (Unaudited)

| | | | | | | | | | | | | | | | | |

Consolidated Adjusted Earnings (non-GAAP) (a) - Continuing Operations | | | 13 weeks ended |

| | | | | July 27, 2024 | | July 29, 2023 |

| Net loss from continuing operations | | | | | $ | (99,479) | | | $ | (49,971) | |

| Reconciling items (below) | | | | | 57,988 | | | 5,590 | |

| Adjusted Earnings (non-GAAP) | | | | | $ | (41,491) | | | $ | (44,381) | |

| | | | | | | |

| Reconciling items | | | | | | | |

| | | | | | | |

| | | | | | | |

Loss on extinguishment of debt (b) | | | | | $ | 55,233 | | | $ | — | |

| | | | | | | |

Restructuring and other charges (c) | | | | | 3,618 | | | 4,633 | |

Stock-based compensation expense (non-cash) | | | | | (863) | | | 957 | |

Reconciling items (d) | | | | | $ | 57,988 | | | $ | 5,590 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Consolidated Adjusted EBITDA (non-GAAP) (a) - Continuing Operations | | | 13 weeks ended |

| | | | | July 27, 2024 | | July 29, 2023 |

| Net loss from continuing operations | | | | | $ | (99,479) | | | $ | (49,971) | |

| Add: | | | | | | | |

| Depreciation and amortization expense | | | | | 13,057 | | | 10,253 | |

| Interest expense, net | | | | | 7,618 | | | 8,254 | |

| Income tax expense (benefit) | | | | | 136 | | | (11) | |

| | | | | | | |

| | | | | | | |

Loss on extinguishment of debt (b) | | | | | 55,233 | | | — | |

| | | | | | | |

Restructuring and other charges (c) | | | | | 3,618 | | | 4,633 | |

Stock-based compensation expense (non-cash) | | | | | (863) | | | 957 | |

| Adjusted EBITDA (Non-GAAP) - Continuing Operations | | | | | $ | (20,680) | | | $ | (25,885) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(a) For additional information, see "Use of Non-GAAP Financial Information" in the Non-GAAP disclosure information of this Press Release.

(b) We recognized a loss on extinguishment of debt of $55.2 million in the condensed consolidated statement of operations in connection with the June 10, 2024 Term Loan debt conversion, which represents the difference between the debt fair value and net carrying value, plus unamortized deferred financing costs related to the Term Loan.

(c) Restructuring and other charges are comprised primarily of professional service costs for restructuring and process improvements, including costs related to evaluating strategic alternatives, and severance and other employee termination and benefit costs associated with the elimination of various positions as part of cost reduction objectives.

(d) There is no pro forma income effect of the non-GAAP items.

Free Cash Flow (non-GAAP) (a)

| | | | | | | | | | | | | | | |

| 13 weeks ended | | |

| July 27, 2024 | | July 29, 2023 | | | | |

| Net cash flows used in operating activities | $ | (143,992) | | | $ | (119,858) | | | | | |

| Less: | | | | | | | |

Capital expenditures (b) | 3,470 | | | 4,219 | | | | | |

| Cash interest paid | 4,732 | | | 5,534 | | | | | |

| Cash taxes (refund) paid | 204 | | | 345 | | | | | |

| Free Cash Flow (non-GAAP) | $ | (152,398) | | | $ | (129,956) | | | | | |

| | | | | | | |

(a) For additional information, see "Use of Non-GAAP Financial Information" in the Non-GAAP disclosure information of this Press Release.

(b) Purchases of property and equipment are also referred to as capital expenditures. Our investing activities consist principally of capital expenditures for contractual capital investments associated with renewing existing contracts, new store construction, digital initiatives and enhancements to internal systems and our website. The following table provides the components of total purchases of property and equipment:

| | | | | | | | | | | | | | | |

| Capital Expenditures | 13 weeks ended | | |

| July 27, 2024 | | July 29, 2023 | | | | |

| Physical store capital expenditures | $ | 1,964 | | | $ | 2,205 | | | | | |

| Product and system development | 1,160 | | | 1,763 | | | | | |

| | | | | | | |

| Other | 346 | | | 251 | | | | | |

| Total Capital Expenditures | $ | 3,470 | | | $ | 4,219 | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Use of Non-GAAP Financial Information - Adjusted Earnings, Adjusted EBITDA, and Free Cash Flow | |

| | | | | | | | | | | |

To supplement the Company’s condensed consolidated financial statements presented in accordance with generally accepted accounting principles (“GAAP”), the Company uses the financial measures of Adjusted Earnings, Adjusted EBITDA, and Free Cash Flow, which are non-GAAP financial measures under Securities and Exchange Commission (the "SEC") regulations. We define Adjusted Earnings as net income (loss) adjusted for certain reconciling items that are subtracted from or added to net income (loss). We define Adjusted EBITDA as net income (loss) plus (1) depreciation and amortization; (2) interest expense and (3) income taxes, (4) as adjusted for items that are subtracted from or added to net income (loss). We define Free Cash Flow as Cash Flows from Operating Activities less capital expenditures, cash interest and cash taxes. | |

| | | | | | | | | | | |

These non-GAAP measures have been reconciled to the most comparable financial measures presented in accordance with GAAP as follows: the reconciliation of Adjusted Earnings to net income (loss); the reconciliation of consolidated Adjusted EBITDA to consolidated net income (loss); and the reconciliation of Free Cash Flow to Cash Flows from Operating Activities. All of the items included in the reconciliations are either (i) non-cash items or (ii) items that management does not consider in assessing our on-going operating performance. | | | | |

| | | | | | | | | | | |

| These non-GAAP financial measures are not intended as substitutes for and should not be considered superior to measures of financial performance prepared in accordance with GAAP. In addition, the Company's use of these non-GAAP financial measures may be different from similarly named measures used by other companies, limiting their usefulness for comparison purposes. | |

| | | | | | | | | | | |

We review these non-GAAP financial measures as internal measures to evaluate our performance at a consolidated level to manage our operations. We believe that these measures are useful performance measures which are used by us to facilitate a comparison of our on-going operating performance on a consistent basis from period-to-period. We believe that these non-GAAP financial measures provide for a more complete understanding of factors and trends affecting our business than measures under GAAP can provide alone, as they exclude certain items that management believes do not reflect the ordinary performance of our operations in a particular period. Our Board of Directors and management also use Adjusted EBITDA at a consolidated level as one of the primary methods for planning and forecasting expected performance, for evaluating on a quarterly and annual basis actual results against such expectations, and as a measure for performance incentive plans. We believe that the inclusion of Adjusted Earnings and Adjusted EBITDA results provides investors useful and important information regarding our operating results, in a manner that is consistent with management’s evaluation of business performance. We believe that Free Cash Flow provides useful additional information concerning cash flow available to meet future debt service obligations and working capital requirements and assists investors in their understanding of our operating profitability and liquidity as we manage the business to maximize margin and cash flow. | |

| | | | | | | | | | | |

The Company urges investors to carefully review the GAAP financial information included as part of the Company’s Form 10-K dated April 27, 2024 filed with the SEC on July 1, 2024, which includes consolidated financial statements for each of the three years for the period ended April 27, 2024, April 29, 2023, and April 30, 2022 (Fiscal 2024, Fiscal 2023, and Fiscal 2022, respectively). The Company also urges investors to carefully review the financial information included as part of the Company’s Quarterly Report on Form 10-Q for the period ended July 27, 2024, filed with the SEC on September 10, 2024. We do not provide a reconciliation of forward-looking non-GAAP financial metrics, because reconciling information is not available without an unreasonable effort, such as attempting to make assumptions that cannot reasonably be made on a forward-looking basis to determine the corresponding GAAP metric. | |

| |

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flow (Unaudited)

(In thousands, except per share data)

| | | | | | | | | | | | | | |

| | 13 weeks ended |

| | July 27, 2024 | | July 29, 2023 |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (99,479) | | | $ | (50,388) | |

| Less: Loss from discontinued operations, net of tax | | — | | | (417) | |

| Loss from continuing operations | | (99,479) | | | (49,971) | |

| Adjustments to reconcile net loss from continuing operations to net cash flows from operating activities from continuing operations: | | | | |

| Depreciation and amortization expense | | 13,057 | | | 10,253 | |

| | | | |

| Amortization of deferred financing costs | | 2,417 | | | 1,244 | |

| | | | |

| Loss on extinguishment of debt | | 55,233 | | | — | |

| Deferred taxes | | 17 | | | (3) | |

| Stock-based compensation expense | | (863) | | | 957 | |

| | | | |

| Changes in operating lease right-of-use assets and liabilities | | (3,691) | | | 721 | |

| Changes in other long-term assets and liabilities, net | | 2,446 | | | 4,056 | |

| Changes in other operating assets and liabilities, net: | | | | |

| Receivables, net | | (50,295) | | | (48,346) | |

| Merchandise inventories | | (51,235) | | | (61,206) | |

| Textbook rental inventories | | 22,672 | | | 23,489 | |

| Prepaid expenses and other current assets | | 315 | | | (12,168) | |

| Accounts payable and accrued liabilities | | (34,586) | | | 11,116 | |

| Changes in other operating assets and liabilities, net | | (113,129) | | | (87,115) | |

| Net cash flows used in operating activities from continuing operations | | (143,992) | | | (119,858) | |

| Net cash flows used in operating activities from discontinued operations | | — | | | (3,266) | |

| Net cash flow used in operating activities | | $ | (143,992) | | | $ | (123,124) | |

| Cash flows from investing activities: | | | | |

| Purchases of property and equipment | | $ | (3,470) | | | $ | (4,219) | |

| Net change in other noncurrent assets | | 223 | | | 78 | |

| Net cash flows used in investing activities from continuing operations | | (3,247) | | | (4,141) | |

| Net cash flows provided by investing activities from discontinued operations | | — | | | 21,395 | |

| Net cash flow (used in) provided by investing activities | | $ | (3,247) | | | $ | 17,254 | |

| Cash flows from financing activities: | | | | |

| Proceeds from borrowings | | $ | 217,647 | | | $ | 145,187 | |

| Repayments of borrowings | | (160,696) | | | (49,606) | |

| Proceeds from Rights Offering | | 50,000 | | | — | |

| Proceeds from Private Equity Investment | | 45,000 | | | — | |

| Payment of equity issuance costs | | (9,524) | | | — | |

| Payment of deferred financing costs | | (3,669) | | | (2,307) | |

| | | | |

| Purchase of treasury shares | | (4) | | | (98) | |

| Proceeds from principal stockholder expense reimbursement | | 1,190 | | | — | |

| | | | |

| Net cash flows provided by financing activities from continuing operations | | 139,944 | | | 93,176 | |

| | | | | | | | | | | | | | |

| Net cash flows provided by financing activities from discontinued operations | | — | | | — | |

| Net cash flows provided by financing activities | | $ | 139,944 | | | $ | 93,176 | |

| Net decrease in cash, cash equivalents and restricted cash | | $ | (7,295) | | | $ | (12,694) | |

| Cash, cash equivalents and restricted cash at beginning of period | | 28,570 | | | 31,988 | |

| Cash, cash equivalents, and restricted cash at end of period | | 21,275 | | | 19,294 | |

| Less: Cash, cash equivalents, and restricted cash of discontinued operations at end of period | | — | | | — | |

| Cash, cash equivalents, and restricted cash of continuing operations at end of period | | $ | 21,275 | | | $ | 19,294 | |

| | | | |

| | | | |

|

v3.24.2.u1

Cover

|

Sep. 10, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 10, 2024

|

| Entity Registrant Name |

BARNES & NOBLE EDUCATION, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-37499

|

| Entity Tax Identification Number |

46-0599018

|

| Entity Address, Address Line One |

NJ

|

| Entity Address, Address Line One |

120 Mountainview Blvd.,

|

| Entity Address, City or Town |

Basking Ridge,

|

| Entity Address, Postal Zip Code |

07920

|

| City Area Code |

(908)

|

| Local Phone Number |

991-2665

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

BNED

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001634117

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

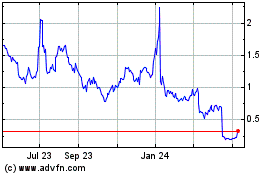

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Oct 2024 to Nov 2024

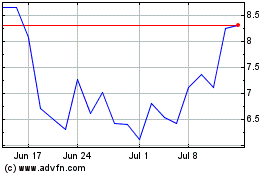

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Nov 2023 to Nov 2024