Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

June 04 2024 - 8:22PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO

RULE 13d-2(a)

(Amendment No. 1)*

BARNES & NOBLE EDUCATION,

INC.

(Name of Issuer)

Common Stock, par value $0.01

(Title of Class of

Securities)

06777U101

(CUSIP Number)

Greenhaven Road Investment Management, LP

8 Sound Shore Drive, Suite

190

Greenwich, CT 06830

Attention: Scott Stewart Miller

Telephone: (203) 569-8920

(Name, Address and

Telephone Number of Person

Authorized to Receive Notices and Communications)

May 31, 2024

(Date of Event Which

Requires Filing of this Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule

because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box x.

Note. Schedules filed

in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for

other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the

Notes.)

CUSIP No.: 06777U101

| 1 | NAME OF REPORTING PERSON |

Scott Stewart Miller

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

AF

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e) ¨ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION |

United States

NUMBER OF SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH: |

7. SOLE VOTING POWER |

0 |

| 8. SHARED VOTING POWER |

0 |

| 9. SOLE DISPOSITIVE POWER |

0 |

| 10. SHARED DISPOSITIVE POWER |

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

0

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES ¨ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

0.0%

| 14 | TYPE OF REPORTING PERSON |

IN

CUSIP No.: 06777U101

| 1 | NAME OF REPORTING PERSON |

Greenhaven Road Investment Management,

LP

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

AF

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e) ¨ |

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

NUMBER OF SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH: |

7. SOLE VOTING POWER |

0 |

| 8. SHARED VOTING POWER |

0 |

| 9. SOLE DISPOSITIVE POWER |

0 |

| 10. SHARED DISPOSITIVE POWER |

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

0

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES ¨ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

0.0%

| 14 | TYPE OF REPORTING PERSON |

PN

CUSIP No.: 06777U101

| 1 | NAME OF REPORTING PERSON |

MVM Funds, LLC

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

AF

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e) ¨ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION |

New York

NUMBER OF SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH: |

7. SOLE VOTING POWER |

0 |

| 8. SHARED VOTING POWER |

0 |

| 9. SOLE DISPOSITIVE POWER |

0 |

| 10. SHARED DISPOSITIVE POWER |

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

0

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES ¨ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

0.0%

| 14 | TYPE OF REPORTING PERSON |

OO

CUSIP No.: 06777U101

| 1 | NAME OF REPORTING PERSON |

Greenhaven Road Capital Fund 1, L.P.

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

WC

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e) ¨ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION |

Delaware

NUMBER OF SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH: |

7. SOLE VOTING POWER |

0 |

| 8. SHARED VOTING POWER |

0 |

| 9. SOLE DISPOSITIVE POWER |

0 |

| 10. SHARED DISPOSITIVE POWER |

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

0

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES ¨ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

0.0%

| 14 | TYPE OF REPORTING PERSON |

PN

CUSIP No.: 06777U101

| 1 | NAME OF REPORTING PERSON |

Greenhaven Road Capital Fund 2, L.P.

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

WC

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e) ¨ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION |

Delaware

NUMBER OF SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH: |

7. SOLE VOTING POWER |

0 |

| 8. SHARED VOTING POWER |

0 |

| 9. SOLE DISPOSITIVE POWER |

0 |

| 10. SHARED DISPOSITIVE POWER |

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

0

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES ¨ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

0.0%

| 14 | TYPE OF REPORTING PERSON |

PN

EXPLANATORY NOTE

This Amendment No. 1 to Schedule 13D (this “Amendment

No. 1”) is being filed with respect to the beneficial ownership of Common Stock, par value $0.01 per share (the “Common

Stock”), of Barnes & Noble Education, Inc. (the “Company” or the “Issuer”). This Amendment

No. 1 supplements Item 4, and amends and restates in its entirety Item 5, of the Schedule 13D originally filed on May 17, 2024 (the “Original

13D”).

| ITEM 4. | Purpose of Transaction. |

On May 31, 2024, the Reporting

Persons determined to sell all of their Common Stock (5,256,342 shares). The Reporting Persons sold all of their Common Stock on May 31,

2024 and June 3, 2024, as detailed in Item 5(c) below.

On June 4, 2024, the Reporting

Persons submitted notice to the Issuer of the Reporting Persons’ election to participate in the Issuer’s announced rights

offering, pursuant to which the Reporting Persons would receive 7 million shares of Common Stock. The closing of the rights offering is

subject to the approval of the Issuer’s shareholders and other closing conditions.

On June 4, 2024, the Reporting

Persons determined to sell, and did sell, call options on the Common Stock, as detailed in Item 5(c) below.

| ITEM 5. | Interest in Securities of the Issuer. |

(a) As

of June 4, 2024, the filing date of this Amendment No. 1, the Reporting Persons do not beneficially own any Common Stock.

(b) Not

applicable.

(c) No

transactions in the Common Stock have been effected by any Reporting Person since the filing of the Original 13D, except as follows:

Reporting

Person |

Trade

Date |

Type |

Shares |

Price Per

Share |

| Fund 1 |

5/31/2024 |

Open Market Sale |

29,176 |

$0.5000 |

| Fund 1 |

5/31/2024 |

Open Market Sale |

56,634 |

$0.5000 |

| Fund 1 |

5/31/2024 |

Open Market Sale |

1,487,726 |

$0.5382 |

| Fund 2 |

5/31/2024 |

Open Market Sale |

34,429 |

$0.5000 |

| Fund 2 |

5/31/2024 |

Open Market Sale |

66,833 |

$0.5000 |

| Fund 2 |

5/31/2024 |

Open Market Sale |

1,755,627 |

$0.5382 |

| Fund 1 |

6/3/2024 |

Open Market Sale |

718,215 |

$0.4426 |

| Fund 2 |

6/3/2024 |

Open Market Sale |

1,107,702 |

$0.4426 |

Reporting

Person |

Trade

Date |

Type |

Contracts

(100 shares each) |

Premium

Per Share |

| Fund 1 |

6/4/2024 |

Open Market Sale of Jan ’25 0.50 Call Option |

5,150 |

$0.1648 |

| Fund 2 |

6/4/2024 |

Open Market Sale of Jan ’25 0.50 Call Option |

6,079 |

$0.1648 |

(d) Not

applicable.

(e) On

May 31, 2024, the Reporting Persons ceased to be the beneficial owners of more than five percent of the Common Stock.

SIGNATURE

After reasonable inquiry and to the best of its

knowledge and belief, the undersigned each certifies that the information with respect to it set forth in this Statement is true, complete

and correct.

Dated: June 4, 2024

| Scott Stewart Miller |

|

| Greenhaven Road Investment Management, LP |

|

| MVM Funds, LLC |

|

| Greenhaven Road Capital Fund 1, L.P. |

|

| Greenhaven Road Capital Fund 2, L.P. |

|

| |

|

| |

|

| By: |

/s/ Scott Stewart Miller |

|

| Scott Miller, for himself and as the Managing Member of the General Partner (for itself and on behalf of the Funds and the Investment Manager) |

|

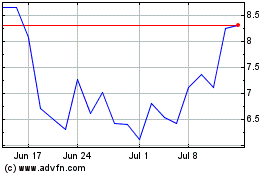

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Oct 2024 to Nov 2024

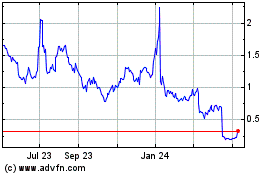

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Nov 2023 to Nov 2024