Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 25 2025 - 7:30AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or

15d-16 of

the Securities Exchange Act of 1934

|

|

|

|

|

| For the month of: February, 2025 |

|

|

|

Commission File Number: 002-09048 |

THE BANK OF NOVA SCOTIA

(Name of registrant)

40 Temperance

Street, Toronto, Ontario, M5H 0B4

(416) 933-4103

(Address of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form

40-F ☒

This report on Form 6-K shall be deemed to be

incorporated by reference in The Bank of Nova Scotia’s registration statements on Form S-8 (File No. 333-199099) and Form F-3 (File No. 333-282565) and to be a part thereof from the date on which this report is filed, to the extent not

superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

THE BANK OF NOVA SCOTIA |

|

|

|

|

| Date: February 25, 2025 |

|

|

|

By: |

|

/s/ Roula Kataras |

|

|

|

|

|

|

Name: Roula Kataras |

|

|

|

|

|

|

Title: Senior Vice-President & Chief Accountant |

EXHIBIT INDEX

|

|

|

| Exhibit |

|

Description of Exhibit |

|

|

| 99.1 |

|

2025 First Quarter Earnings Coverage |

Exhibit 99.1

THE BANK OF NOVA SCOTIA

EARNINGS COVERAGE

Earnings Coverage on Subordinated Indebtedness and Preferred Shares and Other Equity Instruments

The consolidated financial ratios for the Bank are set forth in the table below:

|

|

|

|

|

| |

|

Twelve months ended

January 31, 2025(1) |

|

| Grossed up dividend coverage on outstanding preferred shares and other equity instruments |

|

|

13.82 |

|

|

|

| Interest coverage on subordinated indebtedness |

|

|

20.73 |

|

|

|

| Grossed up dividend and interest coverage on preferred shares, other equity instruments and

subordinated indebtedness |

|

|

8.54 |

|

The Bank’s dividend requirements on all of its outstanding preferred shares and other equity instruments was

$648 million for the 12 months ended January 31, 2025, adjusted to a before-tax equivalent using an effective income tax rate of 24.97% for the 12 months ended January 31, 2025. The Bank’s

interest requirements for subordinated indebtedness was $454 million for the 12 months ended January 31, 2025. The Bank’s earnings before interest on subordinated indebtedness and income tax for the 12 months ended January 31,

2025 were $9,410 million after deducting non-controlling interest. In calculating the dividend and interest coverages, foreign currency amounts have been converted to Canadian dollars.

Consolidated Ratios of Earnings to Fixed Charges

The table below sets forth the Bank’s consolidated ratios of earnings to fixed charges:

|

|

|

|

|

| |

|

Twelve months ended

January 31, 2025(1) |

|

| Excluding interest on deposits |

|

|

3.99 |

|

| Including interest on deposits |

|

|

1.21 |

|

For purposes of computing these ratios:

(a) earnings represent income from continuing operations plus income taxes and fixed charges (excluding capitalized interest and net income from investments in

associated corporations);

(b) fixed charges, excluding interest on deposits, represent interest (including capitalized interest), and amortization

of debt issuance costs; and

(c) fixed charges, including interest on deposits, represent all interest.

All amounts presented herein are derived from financial information prepared in accordance with International Financial Reporting Standards (IFRS) as issued

by the International Accounting Standards Board (IASB). The ratios reported are not defined by IFRS and do not have any standardized meanings under IFRS and thus may not be comparable to similar measures used by other issuers.

| (1) |

This measure has been disclosed in this document in accordance with section 8.4 of National Instrument 44-102

– Shelf Distributions. |

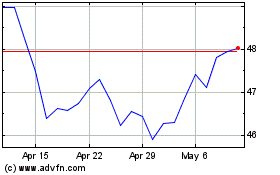

Bank Nova Scotia Halifax (NYSE:BNS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Bank Nova Scotia Halifax (NYSE:BNS)

Historical Stock Chart

From Feb 2024 to Feb 2025