Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 16 2024 - 6:02AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of October, 2024

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of

registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal

executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Banco Santander,

S.A.

TABLE OF CONTENTS

Item

|

|

| |

|

| 1 |

Report of Inside Information dated October 16, 2024 |

Item

1

Banco Santander,

S.A., in compliance with the Securities Market legislation, hereby communicates the following:

INSIDE INFORMATION

Banco Santander,

S.A. (the “Issuer” or “Banco Santander”) announces its decision to carry out the optional early

redemption of all outstanding contingent redeemable perpetual bonds (Obligaciones Perpetuas contingentemente amortizables (Bonos de

Fidelización)), with ISIN code ES0213900220, for a nominal total value of nine hundred eighty-one million euros (EUR 981,000,000),

which are traded on the AIAF Fixed Income Market (Mercado AIAF de Renta Fija) (the “Bonds”).

The early redemption

of all of the outstanding Bonds, for which the pertinent regulatory authorization has already been received, will be carried out on the

first optional early redemption window on the seventh anniversary date of the issuance, falling on the remuneration payment date on 15

December 2024, pursuant to the provisions of section 4.8 (Maturity date and redemption assumptions) of the Note on Securities relating

to the public offer for sale of the Bonds approved and registered with the CNMV on 12 September 2017 (the “Securities Note”).

The decision of the Issuer to exercise the optional early redemption right is irrevocable, and holders of the Bonds are being informed

by means of this announcement of inside information and other foreseen notices, in the form, within the required timeframe, and for the

purposes set out in section 4.8 of the Securities Note.

The early redemption

price, which will be equal to 100% of the outstanding nominal value of each Bond plus any accrued and unpaid remuneration associated

to each Bond up to 15 December 2024, will be paid on such date to the holders of the Bonds by Banco Santander as the paying agent, in

accordance with the Securities Note.

Boadilla del Monte

(Madrid), 16 October 2024

IMPORTANT INFORMATION

Not a securities

offer

This document and

the information it contains does not constitute an offer to sell nor the solicitation of an offer to buy any securities.

Past performance

does not indicate future outcomes

Statements about

historical performance or growth rates must not be construed as suggesting that future performance, share price or results (including

earnings per share) will necessarily be the same or higher than in a previous period. Nothing in this document should be taken as a profit

and loss forecast.

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

Banco Santander, S.A. |

| |

|

| |

|

| Date: |

October 16, 2024 |

By: |

/s/ Pedro de Mingo Kaminouchi |

| |

|

|

Name: |

Pedro de Mingo Kaminouchi |

| |

|

|

Title: |

Head of Regulatory Compliance |

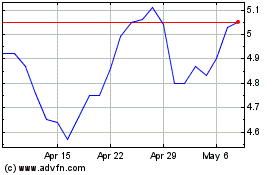

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Sep 2024 to Oct 2024

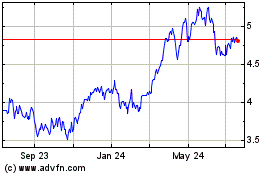

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Oct 2023 to Oct 2024