Axos Financial, Inc. (NYSE: AX) (“Axos” or the “Company”) today

announced unaudited financial results for the second fiscal quarter

ended December 31, 2024. Net income was $104.7 million and diluted

earnings per share (“EPS”) was $1.80 for the quarter ended December

31, 2024. Net income for the quarter ended December 31, 2023 was

$151.8 million and diluted EPS was $2.62, which included a $92.4

million one-time gain associated with the FDIC Loan Purchase during

that quarter. Adjusted earnings and adjusted earnings per diluted

common share (“Adjusted EPS”), non-GAAP measures described further

below, increased $13.4 million to $105.8 million and increased

$0.22 to $1.82, respectively, for the quarter ended December 31,

2024, compared to $92.5 million and $1.60, respectively, for the

quarter ended December 31, 2023.

Second Quarter Fiscal 2025 Financial Summary

Three Months Ended

December 31,

(Dollars in thousands, except per share

data)

2024

2023

% Change

Net interest income

$

280,099

$

228,606

22.5

%

Non-interest income

$

27,799

$

124,129

(77.6

)%

Net income

$

104,687

$

151,771

(31.0

)%

Adjusted earnings (Non-GAAP)1

$

105,829

$

92,452

14.5

%

Diluted EPS

$

1.80

$

2.62

(31.3

)%

Adjusted EPS (Non-GAAP)1

$

1.82

$

1.60

13.8

%

1 See “Use of Non-GAAP Financial

Measures”

“Excluding the one-time gain and the provision for credit losses

associated with the FDIC Loan Purchase in the prior year quarter,

net income and diluted EPS increased by 15.7% and 15.1%,

respectively. We generated loan growth across certain commercial

and industrial lending categories, single family warehouse and

auto,” stated Greg Garrabrants, President and Chief Executive

Officer of Axos. “Net interest margin of 4.83% in the quarter ended

December 31, 2024 was well above our target. We reduced our

interest-bearing deposit costs by 51 basis points from the linked

quarter while maintaining our ending deposit balances flat. Strong

expense management contributed to diluted EPS of $1.80.”

Other Highlights

- Net interest margin was 4.83% for the quarter ended December

31, 2024, compared to 4.55% for the quarter ended December 31,

2023

- Net interest income was $280.1 million for the three months

ended December 31, 2024, compared to $292.0 million for the three

months ended September 30, 2024. Excluding the prepayment of three

loans purchased from the Federal Deposit Insurance Corporation

(“FDIC”), net interest income in the three months ended September

30, 2024 was approximately $275.0 million

- Non-interest expense was $145.3 million in the three months

ended December 31, 2024, down 1.5% from $147.5 million in the three

months ended September 30, 2024

- Total assets were $23.7 billion at December 31, 2024, up $854.1

million, or 7.5% annualized, from $22.9 billion at June 30,

2024

- Total deposits were $19.9 billion at December 31, 2024, an

increase of $575.7 million, or 5.9% annualized, from $19.4 billion

at June 30, 2024

- Axos Advisory Services added $822 million of net new assets

under custody during the three months ended December 31, 2024, up

from $559 million of net new assets in the three months ended

September 30, 2024

- Total capital to risk-weighted assets was 15.23% for Axos

Financial, Inc. at December 31, 2024, up from 14.84% at June 30,

2024

- Book value per share increased to $44.17 at December 31, 2024 ,

up 20.9% from $36.53 at December 31, 2023

Second Quarter Fiscal 2025 Income Statement Summary

Net income was $104.7 million and diluted EPS was $1.80 for the

three months ended December 31, 2024, compared to net income of

$151.8 million and diluted EPS of $2.62 for the three months ended

December 31, 2023. Net interest income increased $51.5 million or

22.5% for the three months ended December 31, 2024, compared to the

three months ended December 31, 2023, primarily due to higher

interest income on loans and interest-earnings deposits at other

financial institutions, partially offset by higher interest expense

on demand and savings deposits, reflecting higher deposit balances,

partially offset by lower rates paid.

The provision for credit losses was $12.2 million for the three

months ended December 31, 2024, compared to $13.5 million for the

three months ended December 31, 2023. The provision for credit

losses for the three months ended December 31, 2024, was primarily

due to the quantitative impact of macroeconomic variables in the

allowance for credit losses model, primarily the U.S. unemployment

rate and commercial real estate mortgage rates.

Non-interest income decreased to $27.8 million for the three

months ended December 31, 2024, compared to $124.1 million for the

three months ended December 31, 2023. The decrease was primarily

due to the absence of the gain on the FDIC Loan Purchase in the

prior year period, as well as decreases in mortgage banking and

servicing rights income and lower broker-dealer fee income.

Non-interest expense, comprised of various operating expenses,

increased $23.5 million to $145.3 million for the three months

ended December 31, 2024 from $121.8 million for the three months

ended December 31, 2023. The increase was primarily due to higher

salaries and related costs, higher professional services expenses

and an increase in FDIC and regulatory fees.

Balance Sheet Summary

Axos’ total assets increased by $0.9 billion, or 3.7%, to $23.7

billion, at December 31, 2024, from $22.9 billion at June 30, 2024,

primarily due to an increase in cash and cash equivalents and

loans. Total liabilities increased by $0.6 billion, or 3.0%, to

$21.2 billion at December 31, 2024, from $20.6 billion at June 30,

2024, primarily due to higher deposit balances. Stockholders’

equity increased by $231.4 million, or 10.1%, to $2.5 billion at

December 31, 2024 from $2.3 billion at June 30, 2024, primarily due

to net income of $217.0 million.

Conference Call

A conference call and webcast will be held on Tuesday, January

28, 2025, at 5:00 PM Eastern / 2:00 PM Pacific. Analysts and

investors may dial in and participate in the question/answer

session. To access the call, please dial: 877-407-8293. The

conference call will be webcast live, and both the webcast and the

earnings supplement may be accessed at Axos’ website,

investors.axosfinancial.com. For those unable to listen to the live

broadcast, a replay will be available until February 28, 2025, at

Axos’ website and telephonically by dialing toll-free number

877-660-6853, passcode 13750720.

About Axos Financial, Inc. and Subsidiaries

Axos Financial, Inc., with approximately $23.7 billion in

consolidated assets as of December 31, 2024, is the holding company

for Axos Bank, Axos Clearing LLC and Axos Invest, Inc. Axos Bank

provides consumer and business banking products nationwide through

its low-cost distribution channels and affinity partners. Axos

Clearing LLC (including its business division Axos Advisor

Services), with approximately $37.7 billion of assets under custody

and/or administration as of December 31, 2024, and Axos Invest,

Inc., provide comprehensive securities clearing services to

introducing broker-dealers and registered investment advisor

correspondents, and digital investment advisory services to retail

investors, respectively. Axos Financial, Inc.’s common stock is

listed on the NYSE under the symbol “AX” and is a component of the

Russell 2000® Index, the S&P SmallCap 600® Index, the KBW

Nasdaq Financial Technology Index, and the Travillian Tech-Forward

Bank Index. For more information on Axos Financial, Inc., please

visit http://investors.axosfinancial.com.

Segment Reporting

The Company operates through two segments: the Banking Business

Segment and the Securities Business Segment. In order to reconcile

the two segments to the consolidated totals, the Company includes

corporate activities and intercompany eliminations. Inter-segment

transactions are eliminated in consolidation and primarily include

non-interest income earned by the Securities Business Segment and

non-interest expense incurred by the Banking Business Segment for

cash sorting fees related to deposits sourced from Securities

Business Segment customers.

The following tables present the operating results of the

segments:

For the Three Months Ended

December 31, 2024

(Dollars in thousands)

Banking Business

Segment

Securities Business

Segment

Corporate/

Eliminations

Axos Consolidated

Net interest income

$

276,720

$

7,007

$

(3,628

)

$

280,099

Provision for credit losses

12,248

—

—

12,248

Non-interest income

2,948

29,004

(4,153

)

27,799

Non-interest expense

114,536

28,178

2,606

145,320

Income before income taxes

$

152,884

$

7,833

$

(10,387

)

$

150,330

For the Three Months Ended

December 31, 2023

(Dollars in thousands)

Banking Business

Segment

Securities Business

Segment

Corporate/

Eliminations

Axos Consolidated

Net interest income

$

226,635

$

6,080

$

(4,109

)

$

228,606

Provision for credit losses

13,500

—

—

13,500

Non-interest income

103,779

32,641

(12,291

)

124,129

Non-interest expense

102,282

27,968

(8,411

)

121,839

Income before income taxes

$

214,632

$

10,753

$

(7,989

)

$

217,396

For the Six Months Ended

December 31, 2024

(Dollars in thousands)

Banking

Business

Securities Business

Corporate/

Eliminations

Axos Consolidated

Net interest income

$

565,212

$

14,274

$

(7,339

)

$

572,147

Provision for credit losses

26,248

—

—

26,248

Non-interest income

11,538

58,906

(14,036

)

56,408

Non-interest expense

232,851

56,269

3,665

292,785

Income before income taxes

$

317,651

$

16,911

$

(25,040

)

$

309,522

For the Six Months Ended

December 31, 2023

(Dollars in thousands)

Banking

Business

Securities Business

Corporate/

Eliminations

Axos Consolidated

Net interest income

$

435,854

$

11,622

$

(7,715

)

$

439,761

Provision for credit losses

20,500

—

—

20,500

Non-interest income

116,336

67,196

(24,896

)

158,636

Non-interest expense

203,068

55,491

(16,214

)

242,345

Income before income taxes

$

328,622

$

23,327

$

(16,397

)

$

335,552

Use of Non-GAAP Financial Measures

In addition to the results presented in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”), this release includes non-GAAP financial measures

such as adjusted earnings, adjusted earnings per diluted common

share, and tangible book value per common share. Non-GAAP financial

measures have inherent limitations, may not be comparable to

similarly titled measures used by other companies and are not

audited. Readers should be aware of these limitations and should be

cautious as to their reliance on such measures. Although we believe

the non-GAAP financial measures disclosed in this release enhance

investors’ understanding of our business and performance, these

non-GAAP measures should not be considered in isolation, or as a

substitute for GAAP basis financial measures.

We define “adjusted earnings”, a non-GAAP financial measure, as

net income without the after-tax impact of non-recurring

acquisition-related items (including amortization of intangible

assets related to acquisitions) and other costs (unusual or

non-recurring charges). Adjusted EPS, a non-GAAP financial measure,

is calculated by dividing non-GAAP adjusted earnings by the average

number of diluted common shares outstanding during the period. We

believe the non-GAAP measures of adjusted earnings and Adjusted EPS

provide useful information about Axos’ operating performance. We

believe excluding the non-recurring acquisition-related costs and

other costs provides investors with an alternative understanding of

Axos’ core business.

Below is a reconciliation of net income, the nearest comparable

GAAP measure, to adjusted earnings and adjusted EPS (Non-GAAP) for

the periods shown:

For the Three Months Ended

December 31,

For the Six Months Ended

December 31,

(Dollars in thousands, except per share

data)

2024

2023

2024

2023

Net income

$

104,687

$

151,771

$

217,027

$

234,416

FDIC Loan Purchase - Gain on purchase

—

(92,397

)

—

(92,397

)

FDIC Loan Purchase - Provision for credit

losses

—

4,648

—

4,648

Acquisition-related costs

1,645

2,780

4,199

5,570

Income tax effect

(503

)

25,650

(1,255

)

24,811

Adjusted earnings (Non-GAAP)

$

105,829

$

92,452

$

219,971

$

177,048

Average dilutive common shares

outstanding

58,226,006

57,932,834

58,262,923

58,930,427

Diluted EPS

$

1.80

$

2.62

$

3.72

$

3.98

FDIC Loan Purchase - Gain on purchase

—

(1.59

)

—

(1.57

)

FDIC Loan Purchase - Provision for credit

losses

—

0.08

—

0.08

Acquisition-related costs

0.03

0.05

0.07

0.09

Income tax effect

(0.01

)

0.44

(0.02

)

0.42

Adjusted EPS (Non-GAAP)

$

1.82

$

1.60

$

3.77

$

3.00

We define “tangible book value”, a non-GAAP financial measure,

as book value adjusted for goodwill and other intangible assets.

Tangible book value is calculated using common stockholders’ equity

minus servicing rights, goodwill and other intangible assets.

Tangible book value per common share is calculated by dividing

tangible book value by the common shares outstanding at the end of

the period. We believe tangible book value per common share is

useful in evaluating the Company’s capital strength, financial

condition, and ability to manage potential losses.

Below is a reconciliation of total stockholders’ equity, the

nearest comparable GAAP measure, to tangible book value per common

share (non-GAAP) as of the dates indicated:

(Dollars in thousands, except per share

amounts)

December 31,

2024

June 30, 2024

December 31,

2023

Common stockholders’ equity

$

2,521,962

$

2,290,596

$

2,078,224

Less: servicing rights, carried at fair

value

28,045

28,924

28,043

Less: goodwill and other intangible

assets—net

137,570

141,769

146,793

Tangible common stockholders’ equity

(Non-GAAP)

$

2,356,347

$

2,119,903

$

1,903,388

Common shares outstanding at end of

period

57,097,632

56,894,565

56,898,377

Book value per common share

$

44.17

40.26

$

36.53

Less: servicing rights, carried at fair

value per common share

0.49

0.51

0.49

Less: goodwill and other intangible

assets—net per common share

2.41

2.49

2.59

Tangible book value per common share

(Non-GAAP)

$

41.27

$

37.26

$

33.45

Forward-Looking Safe Harbor Statement

This press release contains forward-looking statements that

involve risks and uncertainties, including without limitation

statements relating to Axos’ financial prospects and other

projections of its performance and asset quality, Axos’ deposit

balances and capital ratios, Axos’ ability to continue to grow

profitably and increase its business, Axos’ ability to continue to

diversify its lending and deposit franchises, the anticipated

timing and financial performance of other offerings, initiatives,

and acquisitions, expectations of the environment in which Axos

operates and projections of future performance. These

forward-looking statements are made on the basis of the views and

assumptions of management regarding future events and performance

as of the date of this press release. Actual results and the timing

of events could differ materially from those expressed or implied

in such forward-looking statements as a result of risks and

uncertainties, including without limitation Axos’ ability to

successfully integrate acquisitions and realize the anticipated

benefits of the transactions, changes in the interest rate

environment, monetary policy, inflation, government regulation,

general economic conditions, changes in the competitive

marketplace, conditions in the real estate markets in which we

operate, risks associated with credit quality, our ability to

attract and retain deposits and access other sources of liquidity,

and the outcome and effects of litigation and other factors beyond

our control. These and other risks and uncertainties detailed in

Axos’ periodic reports filed with the Securities and Exchange

Commission, including its Annual Report on Form 10-K for the fiscal

year ended June 30, 2024, could cause actual results to differ

materially from those expressed or implied in any forward-looking

statements. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

of this press release. Axos undertakes no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. All written

and oral forward-looking statements made in connection with this

press release, which are attributable to us or persons acting on

Axos’ behalf are expressly qualified in their entirety by the

foregoing information.

AXOS FINANCIAL, INC.

SELECTED CONSOLIDATED

FINANCIAL INFORMATION

(Unaudited – dollars in

thousands)

December 31,

2024

June 30, 2024

December 31,

2023

Selected Balance Sheet Data:

Total assets

$

23,709,422

$

22,855,334

$

21,623,764

Loans—net of allowance for credit

losses

19,486,727

19,231,385

18,264,354

Loans held for sale, carried at fair

value

25,436

16,482

13,468

Allowance for credit losses

270,605

260,542

251,749

Trading securities

241

353

329

Available-for-sale securities

97,848

141,611

239,812

Securities borrowed

114,672

67,212

145,176

Customer, broker-dealer and clearing

receivables

298,887

240,028

265,857

Total deposits

19,934,904

19,359,217

18,203,912

Advances from the Federal Home Loan

Bank

60,000

90,000

90,000

Borrowings, subordinated notes and

debentures

358,692

325,679

341,086

Securities loaned

135,258

74,177

155,492

Customer, broker-dealer and clearing

payables

309,593

301,127

368,885

Total stockholders’ equity

$

2,521,962

$

2,290,596

$

2,078,224

Common shares outstanding at end of

period

57,097,632

56,894,565

56,898,377

Common shares issued at end of period

70,571,332

70,221,632

69,828,709

Per Common Share Data:

Book value per common share

$

44.17

$

40.26

$

36.53

Tangible book value per common share

(Non-GAAP)1

$

41.27

$

37.26

$

33.45

Capital Ratios:

Equity to assets at end of period

10.64

%

10.02

%

9.61

%

Axos Financial, Inc.:

Tier 1 leverage (to adjusted average

assets)

10.02

%

9.43

%

9.39

%

Common equity tier 1 capital (to

risk-weighted assets)

12.42

%

12.01

%

10.97

%

Tier 1 capital (to risk-weighted

assets)

12.42

%

12.01

%

10.97

%

Total capital (to risk-weighted

assets)

15.23

%

14.84

%

13.79

%

Axos Bank:

Tier 1 leverage (to adjusted average

assets)

9.85

%

9.74

%

10.22

%

Common equity tier 1 capital (to

risk-weighted assets)

12.67

%

12.74

%

12.26

%

Tier 1 capital (to risk-weighted

assets)

12.67

%

12.74

%

12.26

%

Total capital (to risk-weighted

assets)

13.86

%

13.81

%

13.25

%

Axos Clearing LLC:

Net capital

$

83,932

$

101,462

$

103,454

Excess capital

$

78,282

$

96,654

$

98,397

Net capital as a percentage of aggregate

debit items

29.71

%

42.21

%

40.92

%

Net capital in excess of 5% aggregate

debit items

$

69,805

$

89,442

$

90,812

AXOS FINANCIAL, INC.

SELECTED CONSOLIDATED

FINANCIAL INFORMATION

(Unaudited – dollars in

thousands, except per share data)

As of or for the

Three Months Ended

As of or for the

Six Months Ended

December 31,

December 31,

(Dollars in thousands, except per share

data)

2024

2023

2024

2023

Selected Income Statement Data:

Interest and dividend income

$

456,068

$

394,663

$

940,330

$

758,615

Interest expense

175,969

166,057

368,183

318,854

Net interest income

280,099

228,606

572,147

439,761

Provision for credit losses

12,248

13,500

26,248

20,500

Net interest income, after provision for

credit losses

267,851

215,106

545,899

419,261

Non-interest income

27,799

124,129

56,408

158,636

Non-interest expense

145,320

121,839

292,785

242,345

Income before income taxes

150,330

217,396

309,522

335,552

Income tax expense

45,643

65,625

92,495

101,136

Net income

$

104,687

$

151,771

$

217,027

$

234,416

Weighted average number of common

shares outstanding:

Basic

57,094,153

57,216,621

57,014,412

58,082,830

Diluted

58,226,006

57,932,834

58,262,923

58,930,427

Per Common Share Data:

Net income:

Basic

$

1.83

$

2.65

$

3.81

$

4.04

Diluted

$

1.80

$

2.62

$

3.72

$

3.98

Adjusted earnings per common share

(Non-GAAP)1

$

1.82

$

1.60

$

3.77

$

3.00

Performance Ratios and Other

Data:

Growth in loans held for investment,

net

$

206,118

$

1,309,313

$

255,342

$

1,807,626

Loan originations for sale

66,826

44,325

136,396

96,910

Return on average assets

1.74

%

2.90

%

1.83

%

2.29

%

Return on average common stockholders’

equity

16.97

%

30.39

%

18.02

%

23.72

%

Interest rate spread2

3.91

%

3.58

%

4.01

%

3.48

%

Net interest margin3

4.83

%

4.55

%

5.00

%

4.46

%

Net interest margin3 – Banking Business

Segment

4.87

%

4.62

%

5.04

%

4.54

%

Efficiency ratio4

47.20

%

34.54

%

46.58

%

40.50

%

Efficiency ratio4 – Banking Business

Segment

40.95

%

30.96

%

40.37

%

36.78

%

Asset Quality Ratios:

Net annualized charge-offs to average

loans

0.10

%

0.04

%

0.13

%

0.04

%

Non-accrual loans to total loans

1.26

%

0.65

%

1.26

%

0.65

%

Non-performing assets to total assets

1.06

%

0.60

%

1.06

%

0.60

%

Allowance for credit losses - loans to

total loans held for investment

1.37

%

1.33

%

1.37

%

1.33

%

Allowance for credit losses - loans to

non-accrual loans5

107.58

%

205.50

%

107.58

%

205.50

%

1 See “Use of Non-GAAP Financial

Measures.”

2 Interest rate spread represents the

difference between the annualized weighted average yield on

interest-earning assets and the annualized weighted average

rate paid on interest-bearing

liabilities.

3 Net interest margin represents

annualized net interest income as a percentage of average

interest-earning assets.

4 Efficiency ratio represents non-interest

expense as a percentage of the aggregate of net interest income and

non-interest income.

5 The decrease in the Allowance for credit

losses - loans to nonaccrual loans is primarily attributable to the

change in nonaccrual loans.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128435491/en/

Investor Relations Contact: Johnny Lai, CFA SVP, Corporate

Development & Investor Relations 858-649-2218

jlai@axosfinancial.com

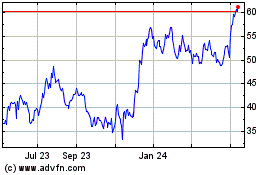

Axos Financial (NYSE:AX)

Historical Stock Chart

From Jan 2025 to Feb 2025

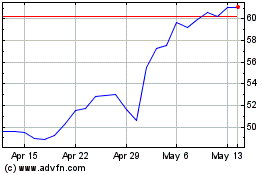

Axos Financial (NYSE:AX)

Historical Stock Chart

From Feb 2024 to Feb 2025