Stocks to Watch: Amazon.com, JPMorgan, KeyCorp, J&J, Domino's Pizza and More

July 16 2019 - 9:34AM

Dow Jones News

By Merdie Nzanga and Micah Maidenberg

Here are some of the companies with shares expected to trade

actively in Tuesday's session. Stock movements noted by ticker

reflect movements during regular trading hours; premarket trading

is specified separately.

JPMorgan Chase & Co. -- down 1.8% premarket: The banking

giant said profit rose in the second quarter, to $2.82 a share from

$2.29 a share a year earlier. Earnings at the bank surpassed

expectations from analysts.

Goldman Sachs Group Inc. -- up 1.4% premarket: Goldman's profit

weakened 6% in the second quarter amid a pullback by trading

clients worried about trade and interest rates.

Wells Fargo & Co. -- down 0.6%: Revenue of $21.6 billion in

the second quarter was about the same last year, but better than

targets. The company is still seeking a permanent chief executive

officer to replace Timothy Sloan, who retired in March.

Johnson & Johnson -- up 0.2% premarket: J&J raised its

revenue guidance for the year as it reported second-quarter results

Tuesday. The company earned $2.58 a share in profit after

adjustments, beating Wall Street expectations.

Charles Schwab Corp. -- up 0.9% premarket: The company is in

talks to purchase brokerage and wealth-management operations from

USAA for roughly $2 billion, potentially giving it another $100

billion in assets, The Wall Street Journal reported Monday.

KeyCorp. -- down 2.2% premarket. KeyCorp said a business

customer of its regional bank engaged in fraudulent activity that

could cost the bank up to $90 million. The company is working with

law enforcement on the matter, KeyCorp said in a securities

filing.

Domino's Pizza Inc. -- down 7.4%. The pizza chain's growth

slowed in the second quarter, as U.S. same-store sales notched a 3%

gain, almost 4 percentage points slower than last year's increase

on that measure. The $811.6 million in revenue Domino's reported

for the quarter was less than what analysts expected.

Rio Tinto PLC -- down 1.2%. The American depositary receipts for

the mining company weakened after Rio said Monday it will cost more

than previously expected and take longer to complete its

underground copper mine in southern Mongolia.

Amazon.com Inc. -- down 0.2%: The e-commerce giant's annual

Prime Day featuring discounts and deals on its site for members

ends Tuesday. Amazon's Prime service penetrates 30% of U.S.

households and less than 5% of international markets, according to

Jeffries.

J.B. Hunt Transport Services Inc. -- up 7.2%: The company's

second-quarter revenue met analysts' expectations, while profit

fell short of estimates.

Arrow Electronics Inc. -- down 4.9%: The electronic-component

distributor warned that the company's second-quarter adjusted

profit would be lower than previous expectations. The company also

announced plans to wind down its personal-computer business.

ServisFirst Bancshares Inc. -- down 2.7%: The bank holding

company reported net-interest income rose less than expected in the

latest quarter.

This is a version of the "Stocks to Watch" section of our

Markets newsletter. To receive it every morning via email, click

here.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

July 16, 2019 09:19 ET (13:19 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

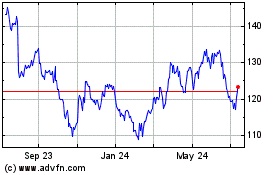

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Dec 2024 to Jan 2025

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Jan 2024 to Jan 2025