0001428205false12/3100014282052024-08-232024-08-230001428205arr:PreferredClassCMember2024-08-232024-08-230001428205us-gaap:CommonStockMember2024-08-232024-08-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________

FORM 8-K

______________

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) August 23, 2024 (August 22, 2024)

ARMOUR Residential REIT, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Maryland | 001-34766 | 26-1908763 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 3001 Ocean Drive, Suite 201 | | |

| Vero Beach, | Florida | | 32963 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(772) 617-4340

(Registrant’s Telephone Number, Including Area Code)

n/a

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading symbols | | Name of Exchange on which registered |

| Preferred Stock, 7.00% Series C Cumulative Redeemable | | ARR-PRC | | New York Stock Exchange |

| Common Stock, $0.001 par value | | ARR | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 1.01 Entry into a Material Definitive Agreement.

On August 23, 2024, ARMOUR Residential REIT, Inc. (“ARMOUR” or the “Company”) entered into Amendment No. 3 (the “Third Common Stock Sales Agreement Amendment”), pursuant to which ARMOUR increased by 25,000,000 the number of shares of common stock, par value $0.001 per share, that may be offered and sold under the Company’s Equity Sales Agreement, dated July 26, 2023 (the “Original Common Stock Sales Agreement”), with BUCKLER Securities LLC, an affiliate of the Company (“BUCKLER”), JonesTrading Institutional Services LLC (“Jones”), Citizens JMP Securities LLC (“Citizens JMP”), Ladenburg Thalmann & Co. Inc. (“Ladenburg Thalmann”) and B. Riley Securities, Inc. (“B. Riley Securities”) as sales agents and the Company’s external manager, ARMOUR Capital Management LP (“ACM”), as amended by Amendment No. 1, dated October 25, 2023 (the “First Common Stock Sales Agreement Amendment”), pursuant to which the Company added StockBlock Securities LLC (“StockBlock”) to the Original Common Stock Sales Agreement, as further amended by Amendment No. 2, dated June 20, 2024 (the “Second Common Stock Sales Agreement Amendment”), pursuant to which the Company added BTIG, LLC (“BTIG,” and together with BUCKLER, Jones, Citizens JMP, Ladenburg Thalmann and StockBlock, the “Common ATM Agents”) to the Original Common Stock Sales Agreement (as amended by the First Common Stock Sales Agreement Amendment, the Second Common Stock Sales Agreement Amendment and the Third Common Stock Sales Agreement Amendment, the “Amended Common Stock Sales Agreement”). The purpose of the Third Common Stock Sales Agreement Amendment was to, among other things, increase the number of shares of Common Stock available under the Original Common Stock Sales Agreement by 25,000,000 shares. Pursuant to the Amended Common Stock Sales Agreement, the Company may, from time to time, issue and sell up to 32,759,146 shares (“Shares”) of the Company’s Common Stock through or to the Common ATM Agents. The Amended Common Stock Sales Agreement includes the offer of 32,759,146 Shares that remained unsold under the Original Common Stock Sales Agreement, as amended by the First Common Stock Sales Agreement Amendment and the Second Common Stock Sales Agreement Amendment, in addition to the offer of an additional 25,000,000 Shares.

The Amended Common Stock Sales Agreement relates to an “at the market offering” (“ATM”) program (the “Common ATM Offering”) and the shares of Common Stock to be sold in the Common ATM Offering will be issued pursuant to a prospectus supplement (the “Common ATM Prospectus Supplement”) filed with the Securities and Exchange Commission on August 23, 2024, in connection with the Company’s effective shelf registration statement on Form S-3 (Registration No. 333-278327). ARMOUR originally established the Common Stock equity sales program on July 26, 2023 when it entered into the Original Common Stock Sales Agreement, and filed a related prospectus supplement. ARMOUR entered into the First Common Stock Sales Agreement Amendment on October 25, 2023 and filed a related prospectus supplement, and entered into the Second Common Stock Sales Agreement on June 20, 2024 and filed a related prospectus supplement. The Common Stock ATM Prospectus Supplement amends and restates in its entirety such related prospectus supplement and the Common Stock to which the Common Stock ATM Prospectus Supplement relates is offered pursuant to the terms of the Common Stock Amended Sales Agreement.

The Third Common Stock Sales Agreement Amendment is filed as Exhibit 1.1 to this Current Report on Form 8-K and is incorporated herein by reference. The foregoing description of the Third Common Stock Sales Agreement Amendment and the transactions contemplated thereby is qualified in its entirety by reference to Exhibit 1.1.

The Company is also filing this Current Report on Form 8-K to provide a legal opinion regarding the validity of the Shares to be issued and sold in the Common ATM Offering, which opinion is attached hereto as Exhibit 5.1, and is incorporated herein by reference.

This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

| | | | | |

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year |

On August 22, 2024, the Company submitted Articles of Amendment with the State of Maryland to increase the number of authorized shares of common stock from 90,000,000 shares to 125,000,000 shares to be effective as of August 22, 2024. A copy of the Articles of Amendment is attached hereto as Exhibit 3.1 and incorporated herein by reference.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| 1.1 | Amendment No. 3, dated August 23, 2024, by and among ARMOUR Residential REIT, Inc. and ARMOUR Capital Management LP, and BUCKLER Securities LLC, JonesTrading Institutional Services LLC, Citizens JMP Securities, LLC, Ladenburg Thalmann & Co. Inc., B. Riley Securities, Inc., StockBlock Securities LLC and BTIG, LLC. |

| 3.1 | |

| 5.1 | |

| 23.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 23, 2024

| | | | | | | | | | | |

| | ARMOUR RESIDENTIAL REIT, INC. |

| | | | |

| | By: | /s/ Gordon M. Harper | |

| | Name: | Gordon M. Harper | |

| | Title: | Chief Financial Officer | |

Exhibit 1.1

Execution Version

AMENDMENT NO. 3 TO EQUITY SALES AGREEMENT

August 23, 2024

BUCKLER Securities LLC

5 Greenwich Office Park, Suite 450

Greenwich, CT 06831

Citizens JMP Securities, LLC

600 Montgomery Street, Suite 1100

San Francisco, California 94111

Ladenburg Thalmann & Co. Inc.

640 5th Ave., 4th Floor

New York, NY 10019

B. Riley Securities, Inc.

299 Park Avenue, 21st Floor

New York, New York 10171

JonesTrading Institutional Services LLC

325 Hudson St., 6th Floor

New York, NY 10013

StockBlock Securities LLC

600 Lexington Avenue, 32nd Floor

New York, New York 10022

BTIG, LLC

350 Bush Street, 9th Floor

San Francisco, CA 94104

Ladies and Gentlemen:

ARMOUR Residential REIT, Inc., a Maryland corporation (the “Company”), together with ARMOUR Capital Management LP, a Delaware limited partnership (the “Manager”) and BUCKLER Securities LLC, Citizens JMP Securities, LLC, Ladenburg Thalmann & Co. Inc., B. Riley Securities, Inc., JonesTrading Institutional Services LLC, StockBlock Securities LLC and BTIG, LLC (each an “Agent,” and collectively, the “Agents”), are parties to that certain Equity Sales Agreement dated July 26, 2023 as amended by Amendment No. 1 to Equity Sales Agreement dated October 25, 2023 and Amendment No. 2 to Equity Sales Agreement dated June 20, 2024 (together, the “Original Agreement”). All capitalized terms not defined herein shall have the meanings ascribed to them in the Original Agreement. The Company, Manager and the Agents desire to amend the Original Agreement as set forth in this Amendment No. 3 thereto (this “Amendment”) as follows:

1.The first paragraph of the Original Agreement is hereby deleted in its entirety and replaced with the following:

ARMOUR Residential REIT, Inc., a Maryland corporation (the “Company”), that is externally managed by ARMOUR Capital Management LP, a Delaware limited partnership (the “Manager”), proposes, subject to the terms and conditions stated herein, to issue and sell from time to time to or through one or more of BUCKLER Securities LLC (“BUCKLER”), Citizens JMP Securities LLC (“Citizens JMP”), Ladenburg Thalmann & Co. Inc. (“Ladenburg”), B. Riley Securities, Inc. (“B. Riley Securities”) JonesTrading Institutional Services LLC (“Jones”), StockBlock Securities LLC (“StockBlock”) and BTIG, LLC (“BTIG” and together with BUCKLER, Citizens JMP, Ladenburg, B. Riley Securities, Jones and StockBlock, the “Agents”), shares (the “Shares”) of the Company’s common stock, $0.001 par value (the “Common Stock”), in an aggregate amount up to 40,000,000 Shares, on the terms set forth in this agreement (the “Agreement”).

2.Except as specifically set forth herein, all other provisions of the Original Agreement shall remain in full force and effect.

3.This Amendment together with the Original Agreement (including all exhibits attached hereto) constitutes the entire agreement and supersedes all other prior and contemporaneous agreements and undertakings, both written and oral, among the parties hereto with regard to the subject matter hereof. Neither this Amendment nor any term hereof may be amended except pursuant to a written instrument executed by the Company, Manager and the Agents. In the event that any one or more of the provisions contained herein, or the application thereof in any circumstance, is held invalid, illegal or unenforceable as written by a court of competent jurisdiction, then such provision shall be given full force and effect to the fullest possible extent that it is valid, legal and enforceable, and the remainder of the terms and provisions herein shall be construed as if such invalid, illegal or unenforceable term or provision was not contained herein, but only to the extent that giving effect to such provision and the remainder of the terms and provisions hereof shall be in accordance with the intent of the parties as reflected in this Amendment. All references in the Original Agreement to the “Agreement” shall mean the Original Agreement as amended by this Amendment; provided, however, that all references to “date of this Agreement” in the Original Agreement shall continue to refer to the date of the Original Agreement.

4.EACH OF THE COMPANY (ON ITS BEHALF AND, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ON BEHALF OF ITS STOCKHOLDERS AND AFFILIATES), THE MANAGER AND THE AGENTS HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS AMENDMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY.

5.THIS AMENDMENT AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF, THE STATE OF NEW YORK WITHOUT REGARD TO ITS CHOICE OF LAW PROVISIONS.

6.Each of the Company, the Manager and the Agents agrees that any legal suit, action or proceeding arising out of or based upon this Amendment or the transactions contemplated hereby (“Related Proceedings”) shall be instituted in (i) the federal courts of the United States of America located in the City and County of New York, Borough of Manhattan or (ii) the courts of the State of New York located in the City and County of New York, Borough of Manhattan (collectively, the “Specified Courts”), and irrevocably submits to the exclusive jurisdiction (except for proceedings instituted in regard

to the enforcement of a judgment of any Specified Court, as to which such jurisdiction is non-exclusive) of the Specified Courts in any such suit, action or proceeding. Service of any process, summons, notice or document by mail to a party’s address set forth in Section 10 of the Original Agreement, as amended by this Amendment, shall be effective service of process upon such party for any suit, action or proceeding brought in any Specified Court. Each of the Company, the Manager and the Agents irrevocably and unconditionally waives any objection to the laying of venue of any suit, action or proceeding in the Specified Courts and irrevocably and unconditionally waives and agrees not to plead or claim in any Specified Court that any such suit, action or proceeding brought in any Specified Court has been brought in an inconvenient forum.

7.This Amendment may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Delivery of an executed amendment by one party to the other may be made by facsimile transmission or electronic transmission (e.g., PDF).

[Remainder of Page Intentionally Blank]

If the foregoing correctly sets forth the understanding between the Company, the Manager and the Agents, please so indicate in the space provided below for that purpose, whereupon this Amendment shall constitute a binding amendment to the Original Agreement between the Company, the Manager and the Agents.

Very truly yours,

BUCKLER SECURITIES LLC

By: /s/ Richard Misiano_________________

Name: Richard Misiano

Title: CEO

CITIZENS JMP SECURITIES, LLC

By: /s/ Jorge-Solares-Parkhurst___________

Name: Jorge Solares-Parkhurst

Title: Managing Director

LADENBURG THALMANN & CO. INC.

By: /s/ Nicholas Stergis_________________

Name: Nicholas Stergis

Title: Managing Director

B. RILEY SECURITIES, INC.

By: /s/ Patrice McNicoll_________________

Name: Patrice McNicoll

Title: Co-Head of Investment Banking

JONESTRADING INSTITUTIONAL SERVICES LLC

By: /s/ Burke Cook_____________________

Name: Burke Cook

Title: General Counsel & Secretary

STOCKBLOCK SECURITIES LLC

By: /s/ President_______________________

Name: David W. Dinkin

Title: President

[Signature Page to Amendment No. 3 to Equity Sales Agreement]

BTIG, LLC

By: Tosh Chandra______________________

Name: Tosh Chandra

Title: Managing Director

[Signature Page to Amendment No. 3 to Equity Sales Agreement]

ACCEPTED as of the date

first-above written:

ARMOUR RESIDENTIAL REIT, INC.

By: /s/ Gordon M. Harper________________

Name: Gordon M. Harper

Title: Chief Financial Officer

ARMOUR CAPITAL MANAGEMENT, LP

By: /s/ Gordon M. Harper________________

Name: Gordon M. Harper

Title: Chief Financial Officer

[Signature Page to Amendment No. 3 to Equity Sales Agreement]

ARMOUR RESIDENTIAL REIT, INC.

ARTICLES OF AMENDMENT

ARMOUR Residential REIT, Inc., a Maryland corporation (the “Corporation”), hereby certifies to the State Department of Assessments and Taxation of Maryland that:

FIRST: The first two sentences of Section 6.1 of the Charter of the Corporation currently specify that the Corporation has authority to issue 140,000,000 shares of stock, consisting of 90,000,000 shares of Common Stock, $0.001 par value per share, and 50,000,000 shares of Preferred Stock, $0.001 par value per share. The aggregate par value of all authorized shares of stock having par value is $140,000.

SECOND: The Charter of the Corporation is hereby further amended, as of the Effective Time (as defined below), by deleting the first two sentences of Section 6.1 in their entirety and replacing them with the following:

“6.1 Authorized Shares. The Corporation has authority to issue 175,000,000 shares of stock, consisting of 125,000,000 shares of Common Stock, $0.001 par value per share (“Common Stock”), and 50,000,000 shares of Preferred Stock, $0.001 par value per share (“Preferred Stock”). The aggregate par value of all authorized shares of stock having par value is $175,000.”

THIRD: The amendments to the Charter of the Corporation as set forth above have been duly approved by a majority of the entire Board of Directors of the Corporation as required by the Maryland General Corporation Law (the “MGCL”). The amendments set forth herein are limited to changes expressly authorized to be made without action by the stockholders of the Corporation by, as applicable, (a) Section 2-105(a)(13) of the MGCL and the Charter of the Corporation; or (b) Section 2-605(a)(2) of the MGCL.

FOURTH: The preferences, conversion and other rights, voting powers, restrictions, limitations as to dividends, qualifications, and terms and conditions of redemption, if any, of the Corporation’s classes of stock remain unchanged by these Articles of Amendment.

FIFTH: These Articles of Amendment shall be effective at 5:00 p.m. EDT on August 22, 2024 (the “Effective Time”).

FIFTH: The undersigned officer of the Corporation acknowledges these Articles of Amendment to be the corporate act of the Corporation and as to all matters or facts required to be verified under oath, the undersigned officer acknowledges that to the best of his knowledge, information and belief, these matters and facts are true in all material respects and that this statement is made under the penalties for perjury.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the Corporation has caused these Articles of Amendment to be executed in its name and on its behalf by its Chief Executive Officer and attested to by its Chief Financial Officer on this 22nd day of August, 2024.

ATTEST: ARMOUR RESIDENTIAL REIT, INC.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

By: /s/ Gordon M. Harper | | By: /s/ Scott J. Ulm |

Name: Gordon M. Harper | | Name: Scott J. Ulm |

Title: Chief Financial Officer | | Title: Chief Executive Officer |

Holland & Knight

701 Brickell Avenue, Suite 3300 | Miami, FL 33131 | T 305.374.8500 | F 305.789.7799

Holland & Knight LLP | www.hklaw.com

August 23, 2024

ARMOUR Residential REIT, Inc.

3001 Ocean Drive, Suite 201

Vero Beach, Florida 32963

Re: Shelf Registration Statement on Form S-3 (Registration No. 333-278327)

Ladies and Gentlemen:

Reference is made to the Registration Statement on Form S-3 (Registration No. 333-333-278327) (the “Registration Statement”) filed with the Securities and Exchange Commission (the “Commission”) on March 28, 2024 by ARMOUR Residential REIT, Inc. (the “Company”) pursuant to the requirements of the Securities Act of 1933, as amended (the “Act”). We are rendering this opinion letter in connection with the filing of a prospectus supplement dated August 23, 2024 (the “Prospectus Supplement”). The Prospectus Supplement relates to the offering by the Company of up to 32,759,146 shares (the “Shares”) of the Company's common stock, par value $0.001 per share (the “Common Stock”), in an “at-the-market” offering, pursuant to an Equity Sales Agreement dated July 26, 2023, as amended by Amendment No. 1 dated October 25, 2023, as further amended by Amendment No. 2 dated June 20, 2024, as further amended by Amendment No. 3 dated August 23, 2024, which Shares are covered by the Registration Statement. We understand that the Shares are to be offered and sold in the manner set forth in the Registration Statement and the Prospectus Supplement.

We have acted as your counsel in connection with the preparation of the Prospectus Supplement. We are familiar with the proceedings taken by the Board of Directors of the Company in connection with the authorization, issuance and sale of the Shares. We have examined all such documents as we have considered necessary in order to enable us to render this opinion letter, including, but not limited to, (i) the Registration Statement, (ii) the Base Prospectus, dated March 28, 2024, included with the Registration Statement (the “Prospectus”), (iii) the Prospectus Supplement, (iv) the Company’s Articles of Incorporation, as amended, (v) the Company’s Bylaws, as amended, (vi) certain resolutions adopted by the Board of Directors of the Company, the independent members of the Board of Directors of the Company and the Audit Committee of the Board of Directors of the Company, (vii) corporate records and instruments, (viii) a specimen certificate representing the Shares, and (ix) such laws and regulations as we have deemed necessary for the purposes of rendering the opinion set forth herein. In our examination, we have assumed the genuineness of all signatures, the legal capacity of all natural persons, the authenticity of and conformity to originals of such documents that have been presented to us as duplicates or certified or conformed copies, the accuracy, completeness and authenticity of originals, the due execution and delivery of all documents (except that no such assumption is made as to the Company) where due execution and delivery are a prerequisite to the effectiveness thereof, and that the Shares will be issued against payment of valid consideration under applicable law. As to any facts material to the opinion expressed herein, which were not independently established or verified, we have relied, to the extent we have deemed reasonably appropriate, upon statements and representations or certificates of officers or directors of the Company.

Based upon the foregoing, we are of the opinion that the Shares have been duly authorized and, when issued and delivered by the Company against payment therefor as set forth in the Registration Statement and the Prospectus Supplement, will be validly issued, fully paid and non-assessable.

The opinion expressed herein is limited to the corporate laws of the State of Maryland and we express no opinion as to the effect on the matters covered by the laws of any other jurisdiction. We assume no obligation to supplement this opinion letter if any applicable law changes after the date hereof or if we become aware of any fact that may change the opinion expressed herein after the date hereof.

We hereby consent to the filing of this opinion letter as part of the Registration Statement and to the reference of our firm under the caption “Legal Matters” in the Prospectus Supplement. In giving such consent, we do not

hereby admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission.

Very truly yours,

/s/ HOLLAND & KNIGHT LLP

HOLLAND & KNIGHT LLP

v3.24.2.u1

Cover Document

|

Aug. 23, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 23, 2024

|

| Entity Registrant Name |

ARMOUR Residential REIT, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-34766

|

| Entity Tax Identification Number |

26-1908763

|

| Entity Address, Address Line One |

3001 Ocean Drive, Suite 201

|

| Entity Address, City or Town |

Vero Beach,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32963

|

| City Area Code |

772

|

| Local Phone Number |

617-4340

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001428205

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| Preferred Class C [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, 7.00% Series C Cumulative Redeemable

|

| Trading Symbol |

ARR-PRC

|

| Security Exchange Name |

NYSE

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

ARR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=arr_PreferredClassCMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

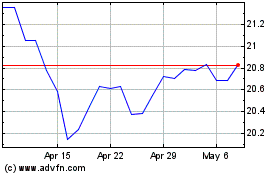

ARMOUR Residential REIT (NYSE:ARR-C)

Historical Stock Chart

From Oct 2024 to Nov 2024

ARMOUR Residential REIT (NYSE:ARR-C)

Historical Stock Chart

From Nov 2023 to Nov 2024