Argan, Inc. (NYSE: AGX) today announced financial

results for the three months and fiscal year ended January 31,

2015.

For the year ended January 31, 2015, revenues were $383.1

million compared to $227.5 million for the year ended

January 31, 2014. Gemma Power Systems, LLC and affiliates

(Gemma) contributed $376.7 million, or 98% of revenues in fiscal

2015, compared to $218.6 million, or 96% of revenues in fiscal

2014.

Argan reported consolidated EBITDA (Earnings before interest,

taxes, depreciation and amortization) attributable to the

stockholders of Argan, Inc. of $52.2 million for the year ended

January 31, 2015 compared to $66.3 million for the prior

fiscal year. Gemma reported $58.0 million in EBITDA attributable to

the stockholders of Argan, Inc. for fiscal 2015 compared to $69.5

million for fiscal 2014.

Income from operations for fiscal 2015 was $64.1 million

compared to income from operations for fiscal 2014 of $65.9

million.

Net income attributable to the stockholders of Argan, Inc. for

fiscal 2015 was $30.4 million, or $2.05 per diluted share based on

14,823,000 diluted shares outstanding, compared to $40.1 million,

or $2.78 per diluted share based on 14,427,000 diluted shares

outstanding for fiscal 2014.

For the three months ended January 31, 2015, consolidated

revenues were $102.3 million compared to $59.5 million for the

three months ended January 31, 2014. Gemma contributed $100.8

million, or 98% of consolidated revenues for the fourth quarter of

fiscal 2015, compared to $58.3 million, or 98% of consolidated

revenues for the fourth quarter of fiscal 2014.

Argan reported consolidated EBITDA attributable to the

stockholders of Argan, Inc. of $11.9 million for the three months

ended January 31, 2015 compared to $15.8 million in the fourth

quarter of last fiscal year. Gemma reported $13.7 million in EBITDA

attributable to the stockholders of Argan, Inc. for the three

months ended January 31, 2015 compared to $17.6 million for

the three months ended January 31, 2014.

Income from operations for the three months ended

January 31, 2015 was $15.5 million, compared to income from

operations of $16.4 million for the fourth quarter of fiscal

2014.

For the three months ended January 31, 2015, Argan reported

net income attributable to Argan, Inc. stockholders of $6.0

million, or $0.40 per diluted share based on 14,838,000 diluted

shares outstanding, compared to net income of $9.2 million, or

$0.63 per diluted share based on 14,581,000 diluted shares

outstanding for the fourth quarter of fiscal 2014.

Argan had consolidated cash and cash equivalents of $333.7

million as of January 31, 2015. During the current fiscal

year, Argan used cash of $10.2 million to pay a $0.70 dividend per

share of common stock. Consolidated working capital increased

during the current fiscal year to approximately $148.9 million as

of January 31, 2015 from approximately $133.3 million as of

January 31, 2014. Consolidated tangible net worth attributable

to the stockholders of Argan, Inc. increased to $165.2 million at

January 31, 2015 from $135.7 million at January 31,

2014.

Gemma’s backlog as of January 31, 2015 was $423 million

compared to $790 million as of January 31, 2014. The decrease

in backlog reflects the current year progress on the construction

of the Panda Liberty and Panda Patriot power plants.

Commenting on Argan’s financial results, Rainer Bosselmann,

Chairman and Chief Executive Officer stated, “Gemma’s continued

execution in fiscal 2015 on the Panda Liberty and Panda Patriot

projects contributed to record earnings during fiscal 2015. We

appreciate the dedicated efforts of our Gemma associates.”

About Argan, Inc.

Argan’s primary business is designing and building energy plants

through its Gemma Power Systems subsidiary. These energy

plants include single and combined cycle natural gas-fired power

plants as well as alternative energy facilities including

biodiesel, ethanol, and those powered by renewable energy sources

such as wind and solar. Argan also owns Southern Maryland

Cable, Inc.

Certain matters discussed in this press release may constitute

forward-looking statements within the meaning of the federal

securities laws and are subject to risks and uncertainties

including, but not limited to: (1) the Company’s ability to

achieve its business strategy while effectively managing costs and

expenses; (2) the Company’s ability to successfully and

profitably integrate acquisitions; and (3) the continued

strong performance of our power industry services business. Actual

results and the timing of certain events could differ materially

from those projected in or contemplated by the forward-looking

statements due to a number of factors detailed from time to time in

Argan’s filings with the Securities and Exchange Commission. In

addition, reference is hereby made to cautionary statements with

respect to risk factors set forth in the Company’s most recent

reports on Form 10-K and 10-Q, and other SEC filings.

ARGAN, INC. AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF OPERATIONS Three Months

Ended January 31, Years Ended January 31, 2015

2014 2015 2014

(Unaudited) REVENUES Power industry services

$ 100,774,000 $ 58,257,000 $ 376,676,000

$ 218,649,000 Telecommunications infrastructure services

1,551,000 1,234,000 6,434,000

8,806,000 Revenues 102,325,000

59,491,000 383,110,000 227,455,000

COST OF REVENUES Power industry services 79,469,000

37,745,000 294,643,000 141,807,000 Telecommunications

infrastructure services 1,181,000 1,059,000

4,864,000 6,800,000 Cost of revenues

80,650,000 38,804,000

299,507,000 148,607,000

GROSS PROFIT

21,675,000 20,687,000 83,603,000 78,848,000 Selling, general and

administrative expenses 6,137,000

4,329,000 19,470,000 12,918,000

INCOME FROM OPERATIONS 15,538,000 16,358,000 64,133,000

65,930,000 Gains on the deconsolidation of variable interest

entities -- -- -- 2,444,000 Other income, net 72,000

134,000 234,000 961,000

INCOME BEFORE INCOME TAXES 15,610,000 16,492,000 64,367,000

69,335,000 Income tax expense 5,734,000

6,460,000 20,912,000 25,991,000

NET

INCOME 9,876,000 10,032,000 43,455,000 43,344,000

NET INCOME ATTRIBUTABLE TO

NONCONTROLLING INTERESTS

3,878,000

868,000

13,010,000

3,219,000

NET INCOME ATTRIBUTABLE TO THE

STOCKHOLDERS OF ARGAN, INC.

$ 5,998,000 $ 9,164,000 $ 30,445,000 $

40,125,000

EARNINGS PER SHARE ATTRIBUTABLE TO THE

STOCKHOLDERS OF ARGAN, INC.

Basic $ 0.41 $ 0.64 $ 2.11 $ 2.85 Diluted

$ 0.40 $ 0.63 $ 2.05 $ 2.78

WEIGHTED AVERAGE NUMBER OF SHARES

OUTSTANDING

Basic 14,561,000 14,219,000

14,433,000 14,072,000 Diluted

14,838,000 14,581,000 14,823,000

14,427,000

CASH DIVIDENDS PER COMMON SHARE

$ -- $ -- $ 0.70 $ 0.75

ARGAN, INC. AND SUBSIDIARIES RECONCILIATIONS TO EBITDA

(Unaudited) Consolidated Three Months Ended January

31, 2015 2014 Net income $ 9,876,000 $

10,032,000 Less net income - noncontrolling interests (3,878,000 )

(868,000 ) Interest expense 30,000 -- Income tax expense 5,699,000

6,460,000 Depreciation 129,000 141,000 Amortization of purchased

intangible assets 61,000 61,000

EBITDA attributable to the stockholders of

Argan, Inc.

$ 11,917,000 $ 15,826,000

Power Industry Services

Three Months Ended January 31, 2015

2014 Income before income taxes $ 17,486,000 $ 18,324,000

Less income before income taxes - noncontrolling interests

(3,913,000 ) (868,000 ) Interest expense 30,000 -- Depreciation

85,000 97,000 Amortization of purchased intangible assets

61,000 61,000 EBITDA attributable to the

stockholders of Argan, Inc. $ 13,749,000 $ 17,614,000

Consolidated

Years Ended January 31, 2015

2014 Net income $ 43,455,000 $ 43,344,000 Less net income -

noncontrolling interests (13,010,000 ) (3,219,000 ) Interest

expense 30,000 (161,000 ) Income tax expense 20,956,000 25,559,000

Depreciation 551,000 549,000 Amortization of purchased intangible

assets 243,000 243,000 EBITDA

attributable to the stockholders of Argan, Inc. $ 52,225,000

$ 66,315,000

Power Industry Services

Years Ended January 31, 2015

2014 Income before income taxes $ 70,334,000 $ 72,669,000

Less income before income taxes - noncontrolling interests

(12,966,000 ) (3,651,000 ) Interest expense 30,000 (161,000 )

Depreciation 372,000 366,000 Amortization of purchased intangible

assets 243,000 243,000 EBITDA

attributable to the stockholders of Argan, Inc. $ 58,013,000

$ 69,466,000

Management uses EBITDA, a non-GAAP financial measure, for

planning purposes, including the preparation of operating budgets

and to determine appropriate levels of operating and capital

investments. Management believes that EBITDA provides additional

insight for analysts and investors in evaluating the Company's

financial and operational performance and in assisting investors in

comparing the Company's financial performance to those of other

companies in the Company's industry. However, EBITDA is not

intended to be an alternative to financial measures prepared in

accordance with GAAP and should not be considered in isolation from

our GAAP results of operations. Pursuant to the requirements of SEC

Regulation G, a reconciliation between the Company's GAAP and

non-GAAP financial results is provided above and investors are

advised to carefully review and consider this information as well

as the GAAP financial results that are presented in the Company's

SEC filings.

ARGAN, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE

SHEETS JANUARY 31, 2015 2014

ASSETS

CURRENT ASSETS

Cash and cash equivalents $ 333,691,000 $ 272,209,000 Accounts

receivable, net of allowance for doubtful accounts 27,330,000

23,687,000 Costs and estimated earnings in excess of billings

455,000 527,000 Prepaid expenses 1,092,000 1,754,000 Notes

receivable and accrued interest 1,786,000 204,000 Deferred income

tax assets -- 178,000

TOTAL CURRENT

ASSETS 364,354,000 298,559,000

Property, plant and equipment, net of

accumulated depreciation (including $2,658,000 in costs related to

a variable interest entity as of January 31, 2015)

6,518,000 4,183,000 Goodwill 18,476,000 18,476,000 Intangible

assets, net of accumulated amortization 1,845,000

2,088,000

TOTAL ASSETS $ 391,193,000 $

323,306,000

LIABILITIES AND STOCKHOLDERS’

EQUITY CURRENT LIABILITIES Accounts payable $

37,691,000 $ 22,589,000 Accrued expenses 15,976,000 7,912,000

Billings in excess of costs and estimated earnings 161,564,000

134,736,000 Deferred income tax liabilities 201,000

--

TOTAL CURRENT LIABILITIES 215,432,000

165,237,000 Deferred income tax liabilities 809,000

292,000

TOTAL LIABILITIES 216,241,000

165,529,000

COMMITMENTS AND

CONTINGENCIES STOCKHOLDERS’ EQUITY

Preferred stock, par value $0.10 per share

– 500,000 shares authorized; no shares issued and outstanding

--

--

Common stock, par value $0.15 per share –

30,000,000 shares authorized; 14,634,434 and 14,289,134 shares

issued at January 31, 2015 and 2014, respectively; 14,631,201 and

14,285,901 shares outstanding at January 31, 2015 and 2014,

respectively

2,195,000

2,143,000

Additional paid-in capital 109,696,000 100,863,000 Retained

earnings 73,614,000 53,335,000 Treasury stock, at cost – 3,233

shares at January 31, 2015 and 2014 (33,000 ) (33,000

)

TOTAL STOCKHOLDERS’ EQUITY 185,472,000 156,308,000

Noncontrolling interests (10,520,000 ) 1,469,000

TOTAL EQUITY 174,952,000

157,777,000

TOTAL LIABILITIES AND EQUITY $

391,193,000 $ 323,306,000

Argan, Inc.Company Contact:Rainer Bosselmann,

301-315-0027orInvestor Relations Contact:Cynthia Flanders,

301-315-0027

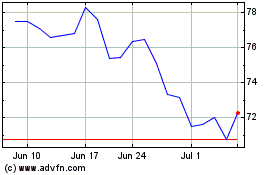

Argan (NYSE:AGX)

Historical Stock Chart

From Jun 2024 to Jul 2024

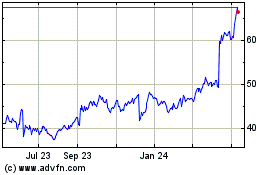

Argan (NYSE:AGX)

Historical Stock Chart

From Jul 2023 to Jul 2024