Neiman Marcus Delays IPO

October 13 2015 - 9:30PM

Dow Jones News

Luxury retailer Neiman Marcus Group Inc. has delayed its planned

initial public offering until the beginning of next year at the

earliest following the recent bout of stock-market volatility.

Neiman had filed for a U.S. listing in early August and been

considering a debut ahead of the conclusion of the 2015 holiday

shopping season, people familiar with the matter said. But recent

market declines and a slump in stocks of other luxury-goods

purveyors have prompted the company to wait, they said.

Neiman hadn't yet set a price range for the offering. The delay

was earlier reported by Reuters.

The retailer is backed by private-equity firm Ares Management LP

and Canada Pension Plan Investment Board. It was one of several

large, highly indebted and private-equity-owned companies looking

to go public this quarter.

The outcome of those plans was expected to provide signs of the

health of an IPO market that has suffered this year. But the

picture is mixed as shares of First Data Corp. and Albertsons

Companies Inc., other members of the group, are scheduled to begin

trading this week.

The U.S. IPO market has struggled this year after a strong 2014,

due in part to weakness in the broader stock market since August.

U.S. listings had raised just $30 billion through the beginning of

the week, versus $81 billion by that point last year, according to

Dealogic.

Write to Telis Demos at telis.demos@wsj.com and Dana Cimilluca

at dana.cimilluca@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 13, 2015 21:15 ET (01:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

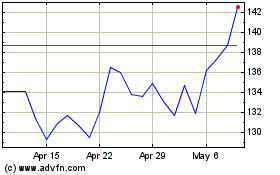

Ares Management (NYSE:ARES)

Historical Stock Chart

From Apr 2024 to May 2024

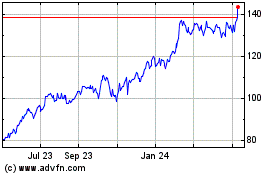

Ares Management (NYSE:ARES)

Historical Stock Chart

From May 2023 to May 2024