Fourth quarter GAAP net income (loss) of

$(39.4) million or $(0.73) per diluted common share and

Distributable Earnings(1) of $10.8 million or $0.20 per diluted

common share

Full year GAAP net income (loss) of $(38.9)

million or $(0.72) per diluted common share and Distributable

Earnings(1) of $58.4 million or $1.06 per diluted common

share

- Subsequent to year ended December 31, 2023

-

Declared first quarter 2024 dividend of

$0.25 per common share

Ares Commercial Real Estate Corporation (the “Company”)

(NYSE:ACRE), a specialty finance company engaged in originating and

investing in commercial real estate assets, reported generally

accepted accounting principles (“GAAP”) net income (loss) of

$(39.4) million or $(0.73) per diluted common share and

Distributable Earnings(1) of $10.8 million or $0.20 per diluted

common share for the fourth quarter of 2023. The Company reported

GAAP net income (loss) of $(38.9) million or $(0.72) per diluted

common share and Distributable Earnings(1) of $58.4 million or

$1.06 per diluted common share for full year 2023.

“Our fourth quarter and full-year 2023 earnings were primarily

impacted by the continuing deterioration of the commercial office

property sector,” said Bryan Donohoe, Chief Executive Officer of

Ares Commercial Real Estate Corporation. “However, based upon our

experience and capabilities across the Ares Real Estate Group, our

liquidity, and our level of loss reserves, we believe that we are

well positioned to resolve many of our underperforming loans and

redeploy recovered capital into new loans to enhance our earnings

going forward.”

“We increased our CECL reserves in the fourth quarter largely

due to the performance of our commercial office and residential

condominium loan portfolio, which accounted for 87% of our total

CECL reserves at year-end,” said Tae-Sik Yoon, Chief Financial

Officer of Ares Commercial Real Estate Corporation. “In addition,

we ended the year with $185 million of available capital which

includes cash and undrawn availability under our working capital

facility. Together with reducing our debt-to-equity ratio over the

past few years, we believe that our balance sheet puts us in a

flexible position to manage and resolve our underperforming

loans.”

_________________________________ (1) Distributable Earnings is

a non-GAAP financial measure. Refer to Schedule I for the

definition and reconciliation of Distributable Earnings.

COMMON STOCK DIVIDEND

On November 3, 2023, the Board of Directors of the Company

declared a regular cash dividend of $0.33 per common share for the

fourth quarter of 2023. The fourth quarter 2023 dividend was paid

on January 17, 2024 to common stockholders of record as of December

29, 2023.

On February 22, 2024, the Board of Directors of the Company

declared a regular cash dividend of $0.25 per common share for the

first quarter of 2024. The first quarter 2024 dividend will be

payable on April 16, 2024 to common stockholders of record as of

March 28, 2024.

ADDITIONAL INFORMATION

The Company issued a presentation of its fourth quarter and full

year 2023 results, which can be viewed at www.arescre.com on the

Investor Resources section of our home page under Events and

Presentations. The presentation is titled “Fourth Quarter and Full

Year 2023 Earnings Presentation.” The Company also filed its Annual

Report on Form 10-K for the year ended December 31, 2023 with the

U.S. Securities and Exchange Commission on February 22, 2024.

CONFERENCE CALL AND WEBCAST INFORMATION

On Thursday, February 22, 2024, the Company invites all

interested persons to attend its webcast/conference call at 9:00

a.m.(Eastern Time) to discuss its fourth quarter and full year 2023

financial results.

All interested parties are invited to participate via telephone

or the live webcast, which will be hosted on a webcast link located

on the Home page of the Investor Resources section of the Company’s

website at www.arescre.com. Please visit the website to test your

connection before the webcast. Domestic callers can access the

conference call by dialing +1 (800) 343-4136. International callers

can access the conference call by dialing +1 (203) 518-9814. Please

provide passcode ACREQ423. All callers are asked to dial in 10-15

minutes prior to the call so that name and company information can

be collected. For interested parties, an archived replay of the

call will be available through March 21, 2024 at 5:00 p.m. (Eastern

Time) to domestic callers by dialing +1 (800) 723-0544 and to

international callers by dialing +1 (402) 220-2656. An archived

replay will also be available through March 21, 2024 on a webcast

link located on the Home page of the Investor Resources section of

the Company’s website.

ABOUT ARES COMMERCIAL REAL ESTATE CORPORATION

Ares Commercial Real Estate Corporation (the “Company”) is a

specialty finance company primarily engaged in originating and

investing in commercial real estate loans and related investments.

Through its national direct origination platform, the Company

provides a broad offering of flexible and reliable financing

solutions for commercial real estate owners and operators. The

Company originates senior mortgage loans, as well as subordinate

financings, mezzanine debt and preferred equity, with an emphasis

on providing value added financing on a variety of properties

located in liquid markets across the United States. Ares Commercial

Real Estate Corporation elected and qualified to be taxed as a real

estate investment trust and is externally managed by a subsidiary

of Ares Management Corporation. For more information, please visit

www.arescre.com. The contents of such website are not, and should

not be deemed to be, incorporated by reference herein.

FORWARD-LOOKING STATEMENTS

Statements included herein or on the webcast / conference call

may constitute “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995, Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities and Exchange Act of 1934, as amended, which relate to

future events or the Company’s future performance or financial

condition. These statements are not guarantees of future

performance, condition or results and involve a number of risks and

uncertainties. Actual results may differ materially from those in

the forward-looking statements as a result of a number of factors,

including the return or impact of current and future investments,

rates of prepayments on the Company’s mortgage loans and the effect

on the Company’s business of such prepayments, availability of

investment opportunities in mortgage-related and real

estate-related investments and securities, ACREM’s ability to

locate suitable investments for the Company, monitor, service and

administer the Company’s investments and execute its investment

strategy, the Company’s ability to obtain, maintain, repay or

refinance financing arrangements, including securitizations, global

economic trends and economic conditions, including high inflation,

slower growth or recession, changes to fiscal and monetary policy,

higher interest rates and currency fluctuations, as well as

geopolitical instability, including conflicts between Russia and

Ukraine and between Israel and Hamas, changes in interest rates,

credit spreads and the market value of the Company's investments,

the demand for commercial real estate loans, and the risks

described from time to time in the Company’s filings with the

Securities and Exchange Commission (the “SEC”), including, but not

limited to, the risk factors described in Part I, Item 1A. Risk

Factors in the Company’s Annual Report on Form 10-K, filed with the

SEC on February 22, 2024. Any forward-looking statement, including

any contained herein, speaks only as of the time of this press

release and Ares Commercial Real Estate Corporation undertakes no

duty to update any forward-looking statements made herein or on the

webcast/conference call. Projections and forward-looking statements

are based on management’s good faith and reasonable assumptions,

including the assumptions described herein.

ARES COMMERCIAL REAL ESTATE

CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

and per share data)

As of December 31,

2023

2022

ASSETS

Cash and cash equivalents

$

110,459

$

141,278

Loans held for investment ($892,166 and

$887,662 related to consolidated VIEs, respectively)

2,126,524

2,264,008

Current expected credit loss reserve

(159,885

)

(65,969

)

Loans held for investment, net of current

expected credit loss reserve

1,966,639

2,198,039

Loans held for sale, at fair value

($38,981 related to consolidated VIEs as of December 31, 2023)

38,981

—

Investment in available-for-sale debt

securities, at fair value

28,060

27,936

Real estate owned, net

83,284

—

Other assets ($3,690 and $2,980 of

interest receivable related to consolidated VIEs, respectively;

$32,002 and $129,495 of other receivables related to consolidated

VIEs, respectively)

52,354

155,749

Total assets

$

2,279,777

$

2,523,002

LIABILITIES AND STOCKHOLDERS'

EQUITY

LIABILITIES

Secured funding agreements

$

639,817

$

705,231

Notes payable

104,662

104,460

Secured term loan

149,393

149,200

Collateralized loan obligation

securitization debt (consolidated VIEs)

723,117

777,675

Due to affiliate

4,135

5,580

Dividends payable

18,220

19,347

Other liabilities ($2,263 and $1,913 of

interest payable related to consolidated VIEs, respectively)

14,584

13,969

Total liabilities

1,653,928

1,775,462

Commitments and contingencies

STOCKHOLDERS' EQUITY

Common stock, par value $0.01 per share,

450,000,000 shares authorized at December 31, 2023 and 2022 and

54,149,225 and 54,443,983 shares issued and outstanding at December

31, 2023 and 2022, respectively

532

537

Additional paid-in capital

812,184

812,788

Accumulated other comprehensive income

153

7,541

Accumulated earnings (deficit)

(187,020

)

(73,326

)

Total stockholders' equity

625,849

747,540

Total liabilities and stockholders'

equity

$

2,279,777

$

2,523,002

ARES COMMERCIAL REAL ESTATE

CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except share

and per share data)

For The Three Months

Ended

December 31, 2023

For the Year Ended

December 31, 2023

Revenue:

Interest income

$

44,348

$

198,608

Interest expense

(29,957

)

(109,652

)

Net interest margin

14,391

88,956

Revenue from real estate owned

3,161

3,970

Total revenue

17,552

92,926

Expenses:

Management and incentive fees to

affiliate

2,946

12,263

Professional fees

974

3,054

General and administrative expenses

1,830

7,244

General and administrative expenses

reimbursed to affiliate

818

3,434

Expenses from real estate owned

2,038

2,518

Total expenses

8,606

28,513

Provision for current expected credit

losses

47,452

91,825

Realized losses on loans

—

10,499

Unrealized losses on loans held for

sale

995

995

Income (loss) before income

taxes

(39,501

)

(38,906

)

Income tax expense (benefit), including

excise tax

(87

)

(39

)

Net income (loss) attributable to

common stockholders

$

(39,414

)

$

(38,867

)

Earnings per common share:

Basic earnings (loss) per common share

$

(0.73

)

$

(0.72

)

Diluted earnings (loss) per common

share

$

(0.73

)

$

(0.72

)

Weighted average number of common

shares outstanding:

Basic weighted average shares of common

stock outstanding

54,111,544

54,281,998

Diluted weighted average shares of common

stock outstanding

54,111,544

54,281,998

Dividends declared per share of common

stock(1)

$

0.33

$

1.36

(1) There is no assurance dividends will

continue at these levels or at all.

SCHEDULE I

Reconciliation of Net Income to Non-GAAP

Distributable Earnings

Distributable Earnings is a non-GAAP financial measure that

helps the Company evaluate its financial performance excluding the

effects of certain transactions and GAAP adjustments that it

believes are not necessarily indicative of its current loan

origination portfolio and operations. To maintain the Company’s

REIT status, the Company is generally required to annually

distribute to its stockholders substantially all of its taxable

income. The Company believes the disclosure of Distributable

Earnings provides useful information to investors regarding the

Company’s ability to pay dividends, which is one of the principal

reasons the Company believes investors invest in the Company. The

presentation of this additional information is not meant to be

considered in isolation or as a substitute for financial results

prepared in accordance with GAAP. Distributable Earnings is defined

as net income (loss) attributable to common stockholders computed

in accordance with GAAP, excluding non-cash equity compensation

expense, the incentive fees the Company pays to its Manager (Ares

Commercial Real Estate Management LLC), depreciation and

amortization (to the extent that any of the Company’s target

investments are structured as debt and the Company forecloses on

any properties underlying such debt), any unrealized gains, losses

or other non-cash items recorded in net income (loss) for the

period, regardless of whether such items are included in other

comprehensive income or loss, or in net income (loss), one-time

events pursuant to changes in GAAP and certain non-cash charges

after discussions between the Company’s Manager and the Company’s

independent directors and after approval by a majority of the

Company’s independent directors. Loan balances that are deemed to

be uncollectible are written off as a realized loss and are

included in Distributable Earnings. Distributable Earnings is

aligned with the calculation of “Core Earnings,” which is defined

in the Management Agreement and is used to calculate the incentive

fees the Company pays to its Manager.

Reconciliation of net income (loss) attributable to common

stockholders, the most directly comparable GAAP financial measure,

to Distributable Earnings is set forth in the table below for the

three months and year ended December 31, 2023 ($ in thousands):

For the Three Months Ended

December 31, 2023

For the Year Ended December

31, 2023

Net income (loss) attributable to common

stockholders

$

(39,414

)

$

(38,867

)

Stock-based compensation

1,041

3,991

Incentive fees to affiliate

—

334

Depreciation and amortization of real

estate owned

809

1,015

Provision for current expected credit

losses

47,452

91,825

Realized gain on termination of interest

rate cap derivative(1)

(105

)

(921

)

Unrealized losses on loans held for

sale

995

995

Distributable Earnings

$

10,778

$

58,372

Net income (loss) attributable to common

stockholders

$

(0.73

)

$

(0.72

)

Stock-based compensation

0.02

0.07

Incentive fees to affiliate

—

0.01

Depreciation and amortization of real

estate owned

0.01

0.02

Provision for current expected credit

losses

0.88

1.69

Realized gain on termination of interest

rate cap derivative(1)

—

(0.02

)

Unrealized losses on loans held for

sale

0.02

0.02

Basic Distributable Earnings per common

share

$

0.20

$

1.08

Net income (loss) attributable to common

stockholders

$

(0.72

)

$

(0.71

)

Stock-based compensation

0.02

0.07

Incentive fees to affiliate

—

0.01

Depreciation and amortization of real

estate owned

0.01

0.02

Provision for current expected credit

losses

0.87

1.67

Realized gain on termination of interest

rate cap derivative(1)

—

(0.02

)

Unrealized losses on loans held for

sale

0.02

0.02

Diluted Distributable Earnings per

common share

$

0.20

$

1.06

(1)

For the three months and year ended December 31, 2023,

Distributable Earnings includes a $105 thousand and $921 thousand,

respectively, adjustment to reverse the impact of the $2.0 million

realized gain from the termination of the interest rate cap

derivative that was amortized into GAAP net income.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221369754/en/

INVESTOR RELATIONS Ares Commercial Real Estate

Corporation Carl Drake or John Stilmar (888) 818-5298

iracre@aresmgmt.com

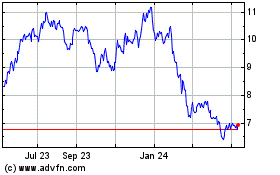

Ares Commercial Real Est... (NYSE:ACRE)

Historical Stock Chart

From Dec 2024 to Jan 2025

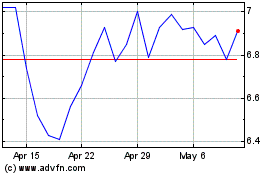

Ares Commercial Real Est... (NYSE:ACRE)

Historical Stock Chart

From Jan 2024 to Jan 2025