As filed with the Securities and Exchange Commission on August 15, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ARCHER AVIATION INC.

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of incorporation or organization)

|

|

|

83-2292321

(I.R.S. Employer Identification Number)

|

|

190 West Tasman Drive

San Jose, California 95134

(650) 272-3233

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Adam Goldstein

Chief Executive Officer and Director

Archer Aviation Inc.

190 West Tasman Drive

San Jose, California 95134

(650) 272-3233

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| |

Patrick Grilli

Ran D. Ben-Tzur

Joshua W. Damm

Fenwick & West LLP

801 California Street

Mountain View, California 94041

(650) 988-8500

|

|

|

Andy Missan

Eric Lentell

Archer Aviation Inc.

190 West Tasman Drive

San Jose, California 95134

(650) 272-3233

|

|

From time to time after the effective date of this registration statement.

(Approximate date of commencement of proposed sale to the public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Securities and Exchange Commission pursuant to Rule 462(e) under the -Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I. D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended:

| |

Large accelerated filer

|

|

|

☐

|

|

|

Accelerated filer

|

|

|

☐

|

|

| |

Non-accelerated filer

|

|

|

☒

|

|

|

Smaller reporting company

|

|

|

☒

|

|

| |

|

|

|

|

|

|

Emerging growth company

|

|

|

☒

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 15, 2023

PROSPECTUS

Archer Aviation Inc.

94,671,586 shares of Class A Common Stock

Offered by the Selling Stockholders

This prospectus relates to the offer and resale from time to time of up to 94,671,586 shares of our Class A common stock, $0.0001 par value per share (the “Class A common stock”), by the selling stockholders identified in the “Selling Stockholders” section of this prospectus or their permitted donees, pledgees, transferees, distributees or other successors in interest (the “Selling Stockholders”). The Selling Stockholders or their donees, pledgees, transferees, distributees or other successors in interest may offer, sell or distribute the shares of our Class A common stock in a number of different ways and at varying prices. We provide more information about how the Selling Stockholders may offer, sell or distribute the shares of our Class A common stock in the section of this prospectus titled “Plan of Distribution.” We will not receive any of the proceeds from the sale of our Class A common stock by the Selling Stockholders. We have paid or will pay the fees and expenses incident to the registration of the shares of our Class A common stock for sale by the Selling Stockholders. The Selling Stockholders will bear all commissions, discounts, brokerage fees and similar expenses, if any, attributable to their sales of shares of our Class A common stock.

You should read this prospectus, the information incorporated, or deemed to be incorporated, by reference in this prospectus, and any applicable prospectus supplement and related free writing prospectus carefully before you invest.

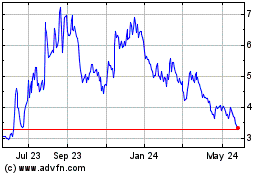

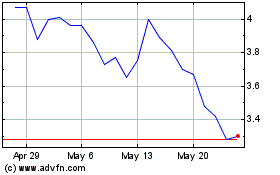

Our Class A common stock and public warrants are traded on the New York Stock Exchange under the symbols “ACHR” and “ACHR WS,” respectively. On August 14, 2023, the last reported sales price for our Class A common stock was $6.56 per share and the last reported sales price of our public warrants was $1.75 per warrant. The applicable prospectus supplement and any related free writing prospectus will contain information, where applicable, as to any other listing on the New York Stock Exchange or any securities market or exchange of the shares of our Class A common stock covered by the prospectus supplement and any related free writing prospectus.

We are currently an “emerging growth company” and a “smaller reporting company” as defined under U.S. federal securities laws and, as such, have elected to comply with reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company and Smaller Reporting Company.” This prospectus complies with the requirements that apply to an issuer that is an emerging growth company and a smaller reporting company.

An investment in shares of our Class A common stock involves a high degree of risk. You should carefully consider the information under the heading “Risk Factors” beginning on page 8 of this prospectus before investing in shares of our Class A common stock.

The registration statement to which this prospectus relates registers the resale of a substantial number of shares of our Class A common stock by the Selling Stockholders. Sales in the public market of a large number of shares of our Class A common stock, or the perception in the market that holders of a large number of shares of our Class A common stock intend to sell shares, could reduce the market price of our Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023

TABLE OF CONTENTS

| |

|

|

PAGE

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|

|

|

33

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, from time to time, the Selling Stockholders may sell up to 94,671,586 shares of our Class A common stock from time to time in one or more offerings as described in this prospectus. Each time the Selling Stockholders offer shares of our Class A common stock under this prospectus, the Selling Stockholders will provide a prospectus supplement to the extent required, or if appropriate, a post-effective amendment to the registration statement of which this prospectus is part that will contain more specific information about the terms of the offering. We have provided to you in this prospectus a general description of the shares of our Class A common stock that the Selling Stockholders may offer. Any prospectus supplement may also add, update or change information contained in this prospectus or in documents we have incorporated by reference into this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement; provided that, if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference in this prospectus or any prospectus supplement — the statement in the document having the later date modifies or supersedes the earlier statement. This prospectus, together with the applicable prospectus supplements and the documents incorporated by reference into this prospectus, includes all material information relating to this offering. You should carefully read both this prospectus and the applicable prospectus supplement, together with the additional information described under the headings “Where You Can Find More Information” and “Incorporation of Information by Reference” before buying any shares of our Class A common stock in this offering.

You should rely only on the information contained in or incorporated by reference into this prospectus or any applicable prospectus supplement. Neither we nor the Selling Stockholders have authorized anyone to give you any information or to make any representation other than the information and representations contained in or incorporated by reference into this prospectus or any applicable prospectus supplement. We and the Selling Stockholders take no responsibility for, and can provide no assurance as to the reliability of, any other information others may give you. If different information is given or different representations are made, you may not rely on that information or those representations as having been authorized by us. You may not imply from the delivery of this prospectus and any applicable prospectus supplement, nor from a sale made under this prospectus and any applicable prospectus supplement, that our affairs are unchanged since the date of this prospectus and any applicable prospectus supplement or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus and any applicable prospectus supplement or any sale of shares of our Class A common stock. This prospectus and any applicable prospectus supplement may only be used where it is legal to sell shares of our Class A common stock.

THIS PROSPECTUS MAY NOT BE USED TO OFFER AND SELL SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT TO THE EXTENT SUCH PROSPECTUS SUPPLEMENT IS REQUIRED.

On September 16, 2021, Archer, Atlas and Merger Sub consummated the closing of the transactions contemplated by the Business Combination Agreement (each such term as defined below), following the approval at the special meeting of stockholders held on September 14, 2021. Pursuant to the terms of the Business Combination Agreement, a business combination of Archer and Atlas was effected by the merger of Merger Sub with and into Archer, with Archer surviving the Merger (as defined below) as a wholly-owned subsidiary of Atlas. Following the consummation of the Merger on the Closing Date (as defined below), Atlas changed its name from Atlas Crest Investment Corp. to Archer Aviation Inc.

Unless the context indicates otherwise, references in this prospectus to the “company,” “Archer,” “we,” “us,” “our” and similar terms refer to Archer Aviation Inc. (f/k/a Atlas Crest Investment Corp.) and its consolidated subsidiaries (including Legacy Archer). References to “Atlas” refer to our predecessor company prior to the Closing (as defined below). References to “Legacy Archer” refer to Archer Aviation Inc. prior to the Closing.

This prospectus contains or incorporates by reference summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information” and “Incorporation of Information by Reference.”

This document contains or incorporates by reference documents containing references to trademarks, service marks and trade names owned by us or belonging to other entities. Solely for convenience, trademarks, service marks and trade names referred to in this document may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we or the applicable licensor will not assert, to the fullest extent under applicable law, our or its rights to these trademarks, service marks and trade names. Archer does not intend its use or display of other companies’ trademarks, service marks or trade names to imply a relationship with, or endorsement or sponsorship of it by, any other companies. All trademarks, service marks and trade names included in this document are the property of their respective owners.

SELECTED DEFINITIONS

Unless otherwise stated in this prospectus or the context otherwise requires, references to:

“2021 Registration Rights Agreement” means that certain amended and restated Registration Rights Agreement, dated September 16, 2021, by and among Archer and certain securityholders who are parties thereto.

“2023 Registration Rights Agreement” means that certain Registration Rights Agreement, dated August 10, 2023, by and among Archer and certain securityholders who are parties thereto.

“Atlas” means Atlas Crest Investment Corp. (which was renamed Archer Aviation Inc. in connection with the Business Combination).

“Archer,” the “Company,” “Registrant,” “we,” “us,” “our,” and similar terms include Archer Aviation Inc. and its subsidiaries, unless the context indicates otherwise.

“Atlas IPO” means Atlas’s initial public offering of units, consummated on October 30, 2020.

“Board” means the board of directors of Archer.

“Business Combination” means the transactions contemplated by the Business Combination Agreement, including among other things, the Merger.

“Business Combination Agreement” means that certain business combination agreement dated as of February 10, 2021, by and among Atlas, the Merger Sub and Archer, as amended and restated on July 29, 2021, and as it may be further amended, supplemented or otherwise modified from time to time.

“Bylaws” means the Amended and Restated Bylaws of Archer, as amended and/or restated from time to time.

“Certificate of Incorporation” means the Amended and Restated Certificate of Incorporation of Archer, as amended and/or restated from time to time.

“Class A common stock” means the shares of Class A common stock of Archer, par value $0.0001 per share.

“Class B common stock” means the shares of Class B common stock of Archer, par value $0.0001 per share.

“Closing” means the closing of the Business Combination.

“Closing Date” September 16, 2021, the date on which the Closing occurred.

“Common Stock” and “common stock” means the Class A common stock and Class B common stock, or any one of such classes of common stock.

“DGCL” means the Delaware General Corporation Law.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Legacy Archer” means Archer Aviation Operating Corp., a Delaware corporation (prior to the Merger, known as Archer Aviation Inc.), and, unless the context requires otherwise, its consolidated subsidiaries.

“Merger” means the merger of Merger Sub with and into Legacy Archer with Legacy Archer being the surviving company in the merger.

“Merger Sub” means Artemis Acquisition Sub Inc., a Delaware corporation and wholly owned subsidiary of Atlas.

“NYSE” or “New York Stock Exchange” means the New York Stock Exchange.

“Registration Rights Agreements” means, together, the 2021 Registration Rights Agreement, the 2023 Registration Rights Agreement and the Stellantis Registration Rights Agreement.

“SEC” means the Securities and Exchange Commission or any successor organization.

“Securities Act” means the Securities Act of 1933, as amended.

“Sponsor” means Atlas Crest Investment LLC.

“Stellantis” means Stellantis N.V.

“Stellantis Registration Rights Agreement” means that certain Registration Rights Agreement, dated January 3, 2023, by and between Archer and Stellantis.

PROSPECTUS SUMMARY

This summary highlights information contained in other parts of this prospectus or incorporated by reference into this prospectus. This summary may not contain all the information that you should consider before investing in shares of our Class A common stock. You should read the entire prospectus and the information incorporated by reference in this prospectus carefully, including “Risk Factors” and the financial data and related notes and other information incorporated by reference, before making an investment decision. See “Cautionary Note Regarding Forward-Looking Statements.”

Our Company

We are designing and developing electric vertical takeoff and landing (“eVTOL”) aircraft for use in urban air mobility (“UAM”) networks. Our mission is to unlock the skies, freeing everyone to reimagine how they move and spend time. Our eVTOL aircraft are designed to be safe, sustainable and quiet. Our production aircraft, Midnight, which we unveiled in November of 2022, is designed around our proprietary twelve-tilt-six configuration. This means that it has twelve propellers attached to six booms on a fixed wing with all twelve propellers providing vertical lift during take-off and landing and the forward six propellers tilting forward to cruise position to provide propulsion during forward flight with the wing providing aerodynamic lift like a conventional airplane.

Midnight is designed to carry four passengers plus a pilot up to 100 miles at speeds up to 150 miles per hour, but is optimized for back-to-back short distance trips of around 20-miles, with a charging time of approximately 10 minutes between trips. We are working to certify Midnight with the U.S. Federal Aviation Administration (“FAA”) in late 2024 so that we can then enter into commercial service in 2025.

Midnight is the evolution of our demonstrator eVTOL aircraft, Maker, which through its flight test program has validated our proprietary twelve-tilt-six configuration and certain key enabling technologies. The design of Midnight marries what we believe to be cutting-edge electric propulsion technology with state-of-the-art aircraft systems to deliver the key attributes of our eVTOL aircraft:

•

Safety. High redundancy and simplified propulsion systems make for a significantly safer aircraft compared to a helicopter. Midnight has no single critical points of failure, meaning that should any single component fail, the aircraft can still safely complete its flight.

•

Low noise. With its intended cruising altitude at approximately 2,000 feet, the design of Midnight is such that the noise that reaches the ground is expected to measure around 45 A-weighted decibels (“dBA”), approximately 100 times quieter than that of a helicopter. During forward flight, the aircraft’s tilt propellers spin on axes that are aligned with the oncoming air flow, rather than edge-wise to the flow, as is the case with traditional helicopters — further decreasing noise levels. Since Archer’s aircraft is spinning 12 small propellers rather than one large rotor, it can also spin them at significantly lower tip speeds, resulting in much lower noise levels.

•

Sustainable. Midnight is all electric, resulting in zero operating emissions. Archer is committed to sourcing renewable energy wherever possible to power its aircraft. Archer’s design and engineering teams have worked to integrate materials into this aircraft that have their own unique sustainability stories. For example, Midnight’s seats are constructed out of “flax” fiber, a natural plant which requires very little irrigation and is highly absorbent of CO2. In addition, Archer’s design uses fabric made from recycled contents like plastic bottles.

We continue to work to optimize our eVTOL aircraft design for both manufacturing and certification. The development of an eVTOL aircraft that meets our business requirements demands significant design and development efforts on all facets of the aircraft. We believe that by bringing together a mix of talent with eVTOL, traditional commercial aerospace, as well as electric propulsion backgrounds, we have built a team that enables us to move through the design, development, and certification of our eVTOL aircraft with the FAA in an efficient manner, thus allowing us to achieve our end goal of bringing to market our eVTOL aircraft as soon as possible.

Corporate Information

We were originally known as Atlas Crest Investment Corp. On September 16, 2021, Legacy Archer, Atlas and Merger Sub consummated the transactions contemplated under the Business Combination

Agreement, following the approval at the special meeting of the stockholders of Legacy Archer held September 14, 2021. Pursuant to the terms of the Business Combination Agreement, a business combination of Legacy Archer and Atlas was effected by the merger of Merger Sub with and into Legacy Archer, with Legacy Archer surviving the Merger as a wholly-owned subsidiary of Atlas. In connection with the consummation of the Merger on the Closing Date, the surviving company changed its name to Archer Aviation Operating Corp. and Atlas changed its name from Atlas Crest Investment Corp. to Archer Aviation Inc.

Our principal executive offices are located at 190 West Tasman Drive, San Jose, California 95134, and our telephone number is (650) 272-3233. Our corporate website address is www.archer.com. Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

“Archer” and our other registered and common law trade names, trademarks and service marks are property of Archer Aviation Inc. This prospectus contains additional trade names, trademarks and service marks of others, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols.

The Shares of Class A Common Stock That May Be Offered

With this prospectus, the Selling Stockholders may offer and sell up to 94,671,586 shares of our Class A common stock from time to time in one or more offerings as described in this prospectus. Each time the Selling Stockholders offer shares of our Class A common stock with this prospectus, we will provide offerees with a prospectus supplement that will contain the specific terms of the shares of our Class A common stock being offered, to the extent such prospectus supplement is required.

Implications of Being an Emerging Growth Company and Smaller Reporting Company

We are currently an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we are exempt from certain requirements related to executive compensation, including the requirements to hold a nonbinding advisory vote on executive compensation and to provide information relating to the ratio of total compensation of our Chief Executive Officer to the median of the annual total compensation of all of our employees, each as required by the Investor Protection and Securities Reform Act of 2010, which is part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can choose not to take advantage of the extended transition period and comply with the requirements that apply to non-emerging growth companies, and any such election to not take advantage of the extended transition period is irrevocable. We will be an emerging growth company until December 31, 2023, and will take advantage of the benefits of the extended transition period emerging growth company status permits until such date. During the extended transition period, it may be difficult or impossible to compare our financial results with the financial results of another public company that complies with public company effective dates for accounting standard updates because of the potential differences in accounting standards used.

Additionally, we are currently a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until we reflect the change in our filer status on our Quarterly Report on Form 10-Q for the three months ended March 31, 2024.

THE OFFERING

Class A common stock registered for sale by Selling Stockholders

Up to 94,671,586 shares of our Class A common stock, consisting of (i) 34,073,600 shares of Class A common stock, and (ii) 60,597,986 shares of our Class A common stock that are issuable upon the exercise of certain warrants.

The Selling Stockholders will determine when and how they will dispose of the shares of our Class A common stock registered for resale under this prospectus.

We will not receive any proceeds from the sale of our shares of Class A common stock by the Selling Stockholders.

Before investing in our shares of Class A common stock, you should carefully read and consider the information set forth in “Risk Factors.”

Certain of our stockholders, including The Boeing Company (‘‘Boeing’’), and Stellantis, each Selling Stockholders hereunder, as well as our executive officers and members of our Board, are subject to restrictions on transfer of their shares of Class A common stock.

“ACHR” and “ACHR WS”

For additional information concerning the offering, see the section of this prospectus titled “Plan of Distribution.”

RISK FACTORS

An investment in our shares of Class A common stock involves a high degree of risk. The prospectus supplement applicable to each offering of our shares of Class A common stock will contain a discussion of the risks applicable to an investment in our shares of Class A common stock. Prior to making a decision about investing in our shares of Class A common stock, you should carefully consider the specific factors discussed under the heading “Risk Factors” in the applicable prospectus supplement, together with all of the other information contained or incorporated by reference in the prospectus supplement or appearing or incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions detailed under the section titled “Risk Factors” in our Annual Report on Form 10-K for our most recently completed fiscal year, in any Quarterly Reports on Form 10-Q that have been filed since our most recent Annual Report on Form 10-K and in any other documents that we file (not furnish) with the SEC under the Exchange Act. See “Where You Can Find More Information” and “Incorporation of Information by Reference.” The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein contain “forward-looking statements” that involve substantial risks and uncertainties. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “will” and “would,” or the negative of these terms or other similar expressions intended to identify statements about the future. These statements speak only as of the date of this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein, and involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Some factors that could cause actual results to differ include:

•

we are an early-stage company with a history of losses and expectation of significant losses for the foreseeable future;

•

our ability to design, manufacture and deliver our aircraft to customers;

•

risks associated with contracts with United Airlines, Inc. (“United”) and the United States Air Force, which constitute all of the current orders for our aircraft, and which are subject to the satisfaction of certain conditions and/or further negotiation and reaching mutual agreement on certain material terms;

•

risks associated with the Agreement (as defined below) with Boeing and Wisk Aero LLC, a wholly-owned subsidiary of Boeing (‘‘Wisk’’);

•

our ability to realize the expected benefits of an autonomous aircraft development program, as well as the cost, timing and results of our development activities relating to autonomous aircraft;

•

our ability to remediate material weaknesses in internal control over financial reporting and ability to maintain an effective system of internal control;

•

our ability to realize operating and financial results forecasts which rely in large part upon assumptions and analyses that we have developed;

•

our ability to effectively market and sell air transportation as a substitute for conventional methods of transportation, following receipt of governmental operating authority;

•

our ability to compete effectively in the urban air mobility and electric vertical takeoff and landing industries;

•

our ability to obtain expected or required certifications, licenses, approvals, and authorizations from transportation authorities;

•

our ability to achieve expected business milestones or launch products on anticipated timelines;

•

risks associated with our reliance on our relationships with our suppliers and service providers for the parts and components in our aircraft;

•

our ability to successfully develop commercial-scale manufacturing capabilities;

•

our ability to successfully address obstacles outside of our control that slow market adoption of electric aircraft;

•

our ability to attract, integrate, manage, train and retain qualified senior management personnel or other key employees;

•

natural disasters, outbreaks and pandemics, economic, social, weather, growth constraints and regulatory conditions or other circumstances affecting metropolitan areas;

•

the potential for losses and adverse publicity stemming from any accident involving our lithium-ion battery cells or test flights of our prototype eVTOL aircraft;

•

risks associated with indexed price escalation clauses in customer contracts, which could subject us to losses if we have cost overruns or if increases in costs exceed the applicable escalation rate;

•

our ability to address a wide variety of extensive and evolving laws and regulations, including data privacy and security laws;

•

our ability to protect our intellectual property rights from unauthorized use by third parties;

•

our ability to obtain additional capital to pursue our business objectives and respond to business opportunities, challenges or unforeseen circumstances;

•

cybersecurity risks to our various systems and software;

•

risks associated with the dual-class structure of our common stock which has the effect of concentrating voting power with certain shareholders of our Class B common stock, including Adam Goldstein, Legacy Archer’s co-founder, and our Chief Executive Officer and a member of our Board; and

•

other factors detailed under the section “Risk Factors.”

The foregoing list of risks is not exhaustive. Other sections of this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein may include additional factors that could harm our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein will prove to be accurate. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise, except as required by law.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus, the events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. You should refer to the “Risk Factors” section of this prospectus for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements.

You should read this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the shares of our Class A common stock offered hereby. This prospectus, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement, the exhibits filed therewith or the documents incorporated by reference therein. For further information about us and the shares of our Class A common stock offered hereby, reference is made to the registration statement, the exhibits filed therewith and the documents incorporated by reference therein. Statements contained in this prospectus regarding the contents of any contract or any other document that is filed as an exhibit to the registration statement are not necessarily complete, and in each instance, we refer you to the copy of such contract or other document filed as an exhibit to the registration statement.

We are subject to the informational requirements of the Exchange Act, and are required to file annual, quarterly and other reports, proxy statements and other information with the SEC. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and various other information about us. You may access, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such each such report is electronically filed with, or furnished to, the SEC.

Information about us is also available on our website at www.archer.com. However, the information on our website is not a part of this prospectus and is not incorporated by reference into this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

INCORPORATION OF INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus and any prospectus supplement information that we file with the SEC. This means that we can disclose important information to you by referring you to another document filed separately with the SEC. Any information referenced in this way is considered part of this prospectus. Any subsequent information filed with the SEC will automatically be deemed to update and supersede the information either contained, or incorporated by referenced, into this prospectus, and will be considered to be part of this prospectus from the date those documents are filed. The information incorporated by reference is an important part of this prospectus.

We incorporate by reference in this prospectus the documents listed below that have been previously filed with the SEC as well as any filings made by us with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act from the initial filing of the registration statement of which this prospectus forms a part until the termination or completion of the offering of the shares of our Class A common stock described in this prospectus:

•

•

our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 28, 2023 (but only with respect to information specifically incorporated by reference into our Annual Report on Form 10-K for the year ended December 31, 2022);

•

our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2023, filed with the SEC on May 11, 2023, and June 30, 2023, filed with the SEC on August 14, 2023;

•

our Current Reports on Form 8-K filed with the SEC on January 9, 2023, February 7, 2023, February 16, 2023, February 27, 2023, March 15, 2023, June 26, 2023, July 7, 2023 and August 10, 2023;

•

the description of our common stock contained in our registration statement on Form 8-A (File No. 001-39668), filed with the SEC under Section 12(b) of the Exchange Act on October 27, 2020, including any amendment or report filed for the purpose of updating such description; and

•

all reports and other documents we subsequently file with the SEC pursuant to the Exchange Act after the date of the initial registration statement, of which this prospectus is a part, and prior to the effectiveness of the registration statement.

Notwithstanding the foregoing, information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits under Item 9.01, is not incorporated by reference in this prospectus or any prospectus supplement.

We will furnish without charge to you, on written or oral request, a copy of any or all of such documents that has been incorporated herein by reference (other than exhibits to such documents unless such exhibits are specifically incorporated by reference into the documents that this prospectus incorporates). Written or oral requests for copies should be directed to Archer Aviation Inc., 190 West Tasman Drive, San Jose, CA 95134, telephone (650) 272-3233. See the section of this prospectus entitled “Where You Can Find More Information” for information concerning how to obtain copies of materials that we file with the SEC.

Any statement contained in this prospectus, or in a document, all or a portion of which is incorporated by reference, shall be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus, any prospectus supplement or any document incorporated by reference modifies or supersedes such statement. Any such statement so modified or superseded shall not, except as so modified or superseded, constitute a part of this prospectus.

USE OF PROCEEDS

The proceeds from the sale of the shares of Class A common stock offered pursuant to this prospectus are solely for the accounts of the Selling Stockholders. Accordingly, we will not receive any of the proceeds from the sale of the shares of Class A common stock offered by this prospectus. See “Selling Stockholders” and “Plan of Distribution” below.

The Selling Stockholders will pay any underwriting discounts and commissions and expenses incurred by the Selling Stockholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Stockholders in disposing of the shares of Class A common stock. We will bear the costs, fees and expenses incurred in effecting the registration of the shares of Class A common stock covered by this prospectus, including all registration and filing fees, NYSE listing fees and fees and expenses of our counsel and our independent registered public accounting firm.

SELLING STOCKHOLDERS

This prospectus relates to the resale by the Selling Stockholders from time to time of up to 94,671,586 shares of our Class A common stock pursuant to certain agreements between the Company and the Selling Stockholders which provide the Selling Stockholders with certain registration rights. We are required to file this registration statement in accordance with our obligations set forth in the Registration Rights Agreements as more fully described in “Material Relationships with Selling Stockholders — Registration Rights Agreements.” The Selling Stockholders may from time to time offer and sell some, all or none of their shares of Class A common stock set forth below pursuant to this prospectus and any accompanying prospectus supplement. As used in this prospectus, the term “Selling Stockholders” includes the persons listed in the table below, together with any additional Selling Stockholders listed in any subsequent amendment to this prospectus, and their pledgees, donees, transferees, distributees, assignees, successors, designees and others who later come to hold any of the Selling Stockholders’ interests in the Class A common stock.

Except as set forth in the footnotes below, the following table sets forth, based on written representations from the Selling Stockholders, certain information as of the date hereof regarding the beneficial ownership of our Class A common stock by the Selling Stockholders and the shares of Class A common stock being offered by the Selling Stockholders. The applicable percentage ownership of Class A common stock is based on 236,737,538 shares of Class A common stock outstanding as of August 4, 2023, after giving effect to the issuance of Class A common stock pursuant to the 2023 Private Placement and the Restricted Stock Purchase Agreement on the date of this prospectus. Information with respect to shares of Class A common stock owned beneficially after the offering assumes the sale of all of the shares of Class A common stock held by the Selling Stockholders or that may be acquired upon exercise of other securities that are registered hereby.

We have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the Selling Stockholders have sole voting and investment power with respect to all shares of Class A common stock that they beneficially own, subject to applicable community property laws. Except as otherwise described below, based on the information provided to us by the Selling Stockholder, no Selling Stockholder is a broker-dealer or an affiliate of a broker dealer.

Please see the section titled “Plan of Distribution” for further information regarding the Selling Stockholders’ method of distributing these shares.

| |

|

|

Beneficial ownership

before the offering

|

|

|

Number of shares

of Class A common

stock being offered by

Selling Stockholders

|

|

|

Beneficial ownership

after the offering

|

|

|

Name of Selling Stockholders

|

|

|

Number of

shares of

Class A

common

stock

|

|

|

Number of

shares of

Class A

common

stock

|

|

|

%

|

|

|

ACM ASOF VIII Secondary-C LP(1)

|

|

|

|

|

3,610,108 |

|

|

|

|

|

3,610,108 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

Alyeska Master Fund, LP(2)

|

|

|

|

|

541,516 |

|

|

|

|

|

541,516 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

CVI Investments, Inc.(3)

|

|

|

|

|

2,951,808 |

|

|

|

|

|

2,256,317 |

|

|

|

|

|

695,491 |

|

|

|

|

|

* |

|

|

|

Deep Field Opportunities Fund, LP(4)

|

|

|

|

|

184,847 |

|

|

|

|

|

184,847 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

Empyrean Capital Overseas Master Fund, Ltd.(5)

|

|

|

|

|

902,527 |

|

|

|

|

|

902,527 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

Entities Affiliated with Alta Fundamental Advisers LLC(6)

|

|

|

|

|

722,019 |

|

|

|

|

|

722,019 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

Entities Affiliated with ARK Investment Management LLC(7)

|

|

|

|

|

7,937,906 |

|

|

|

|

|

7,937,906 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

Entities Affiliated with Connective Capital Management, LLC(8)

|

|

|

|

|

361,010 |

|

|

|

|

|

361,010 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

Gibson Dunn & Crutcher LLP(9)

|

|

|

|

|

1,985,559 |

|

|

|

|

|

1,985,559 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

| |

|

|

Beneficial ownership

before the offering

|

|

|

Number of shares

of Class A common

stock being offered by

Selling Stockholders

|

|

|

Beneficial ownership

after the offering

|

|

|

Name of Selling Stockholders

|

|

|

Number of

shares of

Class A

common

stock

|

|

|

Number of

shares of

Class A

common

stock

|

|

|

%

|

|

|

Gratia Capital Concentrated Master Fund, Ltd.(10)

|

|

|

|

|

854,023 |

|

|

|

|

|

722,021 |

|

|

|

|

|

132,002 |

|

|

|

|

|

* |

|

|

|

HBK Master Fund L.P.(11)

|

|

|

|

|

812,274 |

|

|

|

|

|

812,274 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

Marc Lore(12)

|

|

|

|

|

28,086,358 |

|

|

|

|

|

24,925,286 |

|

|

|

|

|

3,161,072 |

|

|

|

|

|

1.34 |

|

|

|

Marnell Management Fund, L.P(13)

|

|

|

|

|

361,010 |

|

|

|

|

|

361,010 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

Maven Investment Partners US Limited — NY

Branch(14)

|

|

|

|

|

541,516 |

|

|

|

|

|

541,516 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

MMF LT, LLC(15)

|

|

|

|

|

722,021 |

|

|

|

|

|

722,021 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

Stellantis N.V.(16)

|

|

|

|

|

21,483,129 |

|

|

|

|

|

21,337,039 |

|

|

|

|

|

15,146,090 |

|

|

|

|

|

6.32 |

|

|

|

The Boeing Company(17)

|

|

|

|

|

1,263,538 |

|

|

|

|

|

1,263,538 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

The HGC Fund LP(18)

|

|

|

|

|

722,021 |

|

|

|

|

|

722,021 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

|

Thomas Muniz(19)

|

|

|

|

|

1,245,333 |

|

|

|

|

|

1,176,816 |

|

|

|

|

|

68,517 |

|

|

|

|

|

* |

|

|

|

United Airlines Ventures, Ltd.(20)

|

|

|

|

|

10,508,106 |

|

|

|

|

|

10,409,340 |

|

|

|

|

|

3,047,119 |

|

|

|

|

|

1.29 |

|

|

|

Wisk Aero LLC(21)

|

|

|

|

|

4,512,636 |

|

|

|

|

|

13,176,895 |

|

|

|

|

|

— |

|

|

|

|

|

* |

|

|

*

Less than one percent

(1)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement. Atalaya Capital Management LP (“ACM”) is the Manager of ACM ASOF VIII Secondary-C LP and has investment and dispositive power over the securities held by it. Drew Phillips is the Partner/Chief Operating Officer of ACM and may be deemed to have voting and investment control with respect to the shares held by these entities. Each of the parties in this footnote disclaims any beneficial ownership of the reported shares other than to the extent of any pecuniary interest the party may have therein. The business address of each of the aforementioned parties is One Rockefeller Plaza, New York, NY 10020.

(2)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement. Alyeska Investment Group, L.P., the investment manager of Alyeska Master Fund, L.P. (“Alyeska”) and as such may be deemed to have voting and investment discretion over securities directly held by Alyeska. Anand Parekh is the Chief Executive Officer of Alyeska Investment Group, L.P. and as such may be deemed to beneficially own securities held by Alyeska. Mr. Parekh disclaims any beneficial ownership of the shares held by Alyeska. The registered address of Alyeska is c/o Maples Corporate Services Limited, P.O. Box 309, Ugland House, South Church Street George Town, Grand Cayman, KY1-1104, Cayman Islands. The business address of Mr. Parekh and Alyeska Investment Group, L.P. is 77 W. Wacker, Suite 700, Chicago, IL 60601.

(3)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement. Heights Capital Management, Inc., the authorized agent of CVI Investments, Inc. (“CVI”), has discretionary authority to vote and dispose of the CVI Shares and may be deemed to be the beneficial owner of the CVI Shares. Martin Kobinger, in his capacity as Investment Manager of Heights Capital Management, Inc., may also be deemed to have investment discretion and voting power over the CVI Shares. Mr. Kobinger disclaims any such beneficial ownership of the CVI Shares. The principal business address of CVI is c/o Heights Capital Management, Inc., 101 California Street, Suite 3250, San Francisco, CA 94111.

(4)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement. Deep Field Asset Management, LLC is the general partner of Deep Field Opportunities Fund, L.P. (the “Deep Field Fund”), and Jordan Moelis is the managing member of Deep Field Asset Management, LLC. As such, each of them may be deemed to have voting and investment control over securities held

by the Deep Field Fund. The business address for each of the aforementioned parties is 9355 Wilshire Boulevard, Suite 350 Beverly Hills, CA 90210.

(5)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement. Empyrean Capital Partners, LP (“Empyrean”) serves as investment manager to Empyrean Capital Overseas Master Fund, Ltd. (“ECOMF”), and has investment and voting discretion over the securities held by ECOMF. Empyrean Capital, LLC serves as the general partner to Empyrean. Amos Meron is the managing member of Empyrean Capital, LLC, and as such may be deemed to have investment and voting discretion over the securities directly held by ECOMF. The address of each of the aforementioned parties is c/o Empyrean Capital Partners, LP, 10250 Constellation Boulevard, Suite 2950, Los Angeles, CA 90067.

(6)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement and consist of the following shares of Class A common stock: (i) 27,075 shares held directly by Alta Fundamental Advisers SP LLC — Series S (“Alta Series S”); (ii) 162,870 shares held directly by Alta Fundamental Advisers Master LP (“Alta Master”); (iii) 395,027 shares held directly by Blackwell Partners LLC — Series A (“Blackwell Series A”); and (iv) 137,047 shares held directly by Star V Partners LLC (“Star V” and, together with Alta Series S, Alta Master, and Blackwell Series A, the “Alta Funds”). Alta Fundamental Advisers LLC, a registered investment adviser, serves as the investment manager for the Alta Funds and as such may be deemed to have voting and investment discretion over the securities directly held by the Alta Funds. Mr. Jeremy Carton and Mr. Gilbert Li are the managing members of Alta Fundamental Advisers LLC and have sole management authority with respect to assets managed by Alta Fundamental Advisers LLC. The business address of (i) Blackwell Series A is 280 South Mangum Street, Suite 210, Durham, NC 27701; (ii) Star V is 2100 West End Avenue, Suite 1000, Nashville, TN 37203; and (iii) each of the aforementioned parties is 1500 Broadway Suite 704, New York, NY 10036.

(7)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement and consist of the following shares of Class A common stock: (i) 7,125,982 shares directly held by ARK Innovation ETF (“ARK Innovation”); (ii) 594,649 shares directly held by ARK Autonomous Technology & Robotics ETF (“ARK Autonomous”); (iii) 153,478 shares directly held by ARK Space Exploration & Innovation ETF (“ARK Space”); and (iv) 63,797 shares directly held by ARK Venture Fund (“ARK Venture” and, together with ARK Innovation, ARK Autonomous, and ARK Space, the “ARK Funds”). Investment and voting discretion with respect to the securities owned directly by the ARK Funds is vested in ARK Investment Management LLC, a registered investment adviser. The business address of each of the aforementioned parties is 200 Central Avenue, St. Petersburg, FL 33701.

(8)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement and consist of (i) 130,125 directly held by Connective Capital I QP, LP (“CC I QP”) and (ii) 230,885 directly held by Connective Capital Emerging Energy QP, LP (“CC EE QP” and, together with CC I QP, the “Connective Funds”). Voting and investment discretion over securities held by the Connective Funds resides with their investment manager, CCM LLC. Robert Romero is the Managing Member of CCM LLC and as such may be deemed to be the beneficial owner of the shares held by such entities. The business address of each of the aforementioned parties is 385 Homer Avenue, Palo Alto, CA 94301.

(9)

The shares of Class A common stock registered hereby were received by Gibson Dunn & Crutcher LLP pursuant to the Restricted Stock Purchase Agreement (as defined below). The address of Gibson Dunn & Crutcher LLP is 555 Mission Street, #3000, San Francisco, CA 94105.

(10)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement. Gratia Capital LLC is the General Partner of Gratia Capital Concentrated Master Fund, Ltd. Steve Pei is the Managing Member of Gratia Capital LLC and as such may be deemed to have voting and investment discretion over securities directly held by it. The business address of each of the aforementioned parties is of 11835 West Olympic Boulevard, Suite 385, Los Angeles, CA 90064.

(11)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement. HBK Investments L.P. (“HBK Investments”) has shared voting and dispositive power over the shares directly held by HBK Master Fund LP (“HBK Master”) pursuant to an Investment Management Agreement between HBK Investments and HBK Master. HBK Investments has delegated discretion to vote and dispose of the shares held by HBK Master to HBK Services LLC (“HBK Services”). The following individuals may be deemed to have control over HBK Investments and HBK Services (i) Jamiel

A. Akhtar; (ii) Jon L. Mosle III; and (iii) Matthew F. Luth. Each of HBK Services and the individuals listed above disclaim beneficial ownership of any of the securities reported. The business address of each of the aforementioned parties is 2300 North Field Street, Suite 2200, Dallas, Texas 75201.

(12)

The shares of Class A common stock registered hereby were received by Mr. Lore pursuant to the Business Combination in exchange for shares of Legacy Archer stock. Of such shares, 109,171 are subject to a lapsing right of repurchase in favor of the Company. Mr. Lore’s principal office address is 443 Greenwich Street, PHA, New York, NY 10013.

(13)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement. The general partner of Marnell Management Fund, L.P. (the “Marnell Fund”) is Marnell Capital LLC (“Marnell Capital”), and Stevan Rosenberg serves as the Manager of Marnell Capital. The investment manager of the Marnell Fund is Marnell Management LLC (“Marnell Management”). Each of Marnell Management, Marnell Capital, and Mr. Rosenberg may be deemed to exercise voting and investment control over securities held directly by the Marnell Fund. The business address of each of the aforementioned parties is 30445 Northwestern Hwy, Suite 235, Farmington Hills, MI 48334.

(14)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement. Ian Toon, Ivan Koedjikov and Benjamin Huda are the natural controlling persons of Maven Investment Partners US Limited-New York Branch and as such may be deemed the beneficial owners of such shares. The business address of each of the aforementioned parties is 675 Third Avenue, 20th Floor, New York, NY 10017.

(15)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement. Moore Capital Management, LP, the investment manager of MMF LT, LLC (‘‘MMF LT’’), has voting and investment control of the shares held by MMF LT. Mr. Louis M. Bacon controls the general partner of Moore Capital Management, LP and may be deemed the beneficial owner of the shares of Class A common stock of the Company held by MMF LT. Mr. Bacon also is the indirect majority owner of MMF LT. The address of MMF LT, Moore Capital Management, LP and Mr. Bacon is 11 Times Square, New York, NY 10036.

(16)

The securities registered hereby consist of (i) 15,000,000 shares of Class A common stock which are issuable upon the vesting and exercise of the Stellantis Warrant (as defined below), subject to the satisfaction of certain contractual conditions provided in the Stellantis Warrant and (ii) 6,337,039 shares of Class A common stock issued to Stellantis pursuant Milestone 1 of the Forward Purchase Agreement (as defined below). Barbara Pilarski, a member of our Board of Directors, is employed as the Global Head of Business Development of the stockholder. The address of Stellantis is Taurusavenue 1 2132LS, Hoofddorp, The Netherlands.

(17)

The securities registered hereby consist of 1,263,538 shares of Class A common stock acquired in the 2023 Private Placement. The business address for The Boeing Company is 929 Long Bridge Drive, Arlington, VA 22202.

(18)

The shares of Class A common stock registered hereby were acquired in the 2023 Private Placement. Sean Kallir is CEO and PM of HGC Investment Management Inc, the investment manager of The HGC Fund LP, and as such may be deemed to have voting and investment discretion over the securities held by it. The business address for each of the aforementioned parties is 1073 Yonge St, 2nd Floor, Toronto, ON M4W 2L2, Canada.

(19)

The shares of Class A common stock registered hereby were received by Mr. Muniz pursuant to the Business Combination in exchange for shares of Legacy Archer stock. Mr. Muniz currently serves as our Chief Operating Officer, and our business address is 190 West Tasman Drive, San Jose, CA 95134.

(20)

The shares of Class A common stock registered hereby consist of: (i) 4,512,635 shares of Class A common stock acquired in the 2023 Private Placement (as defined below); (ii) 1,474,176 shares of Class B common stock issuable upon the exercise of the vested but unexercised tranche 3 of the United Warrant (as defined below) which shares are convertible into an equal number of shares of our Class A common stock; and (iii) an aggregate 4,422,529 shares of Class B common stock issuable upon, subject to the satisfaction of certain contractual conditions provided in the United Warrant, the vesting and exercise of the remainder of the United Warrant, and the conversion of such shares into an equal number of shares of our Class A common stock. United Airlines Ventures, Ltd. (“UAV”) is an indirect, wholly owned subsidiary of United Airlines Holdings, Inc. (“UAH”). The address of UAV and UAH is 233 South Wacker Drive, Chicago, IL 60606.

(21)

The securities registered hereby consist of 13,176,895 shares of Class A common stock issuable pursuant to the Wisk Warrant (as defined below), 4,512,636 of which are vested and exercisable. The business address for Wisk Aero LLC is 2700 Broderick Way, Mountain View, CA 94043.

Material Relationships with Selling Stockholders

Below is a description of material relationships in the past three years between the Company, its predecessors or affiliates and the Selling Stockholders.

Stellantis Forward Purchase Agreement and Warrant

On January 2, 2023, we entered into the Stellantis Collaboration Agreement (as defined below) with Stellantis. In connection with the Stellantis Collaboration Agreement, we entered into the Forward Purchase Agreement (as defined below) and issued to Stellantis the Stellantis Warrant (as defined below). On June 23, 2023, we issued 6,337,039 shares of Class A common stock to Stellantis in connection with the first milestone under the Forward Purchase Agreement. On August 10, 2023, Stellantis waived certain conditions relating to the second milestone of the Forward Purchase Agreement. On the same date, we submitted an election notice to draw down the $70.0 million associated with the second milestone, which equals 12,313,234 shares of Class A common stock. Such shares of Class A common stock issuable to Stellantis upon such election notice will be subject to satisfaction of customary closing conditions, including the submission of a filing pursuant to the Hart-Scott Rodino Act. For more information on the Stellantis Collaboration Agreement, Forward Purchase Agreement and Stellantis Warrant, see the section entitled “Description of Capital Stock — Warrants — Stellantis Forward Purchase Agreement and Warrant.”

Pursuant to the Forward Purchase Agreement, subject to certain limited exceptions, Stellantis will also be restricted from transferring or entering into an agreement that transfers the economic consequences of ownership of any of Stellantis’ shares of Class A Common Stock, the Forward Purchase Shares (as defined below), the Stellantis Warrant or any shares of Class A Common Stock to be issued upon the exercise of the Stellantis Warrant commencing on the initial closing of the sale of Forward Purchase Shares and ending on the earlier of (i) December 31, 2024 and (ii) a Change in Control (as defined in the Forward Purchase Agreement), the entry into a definitive agreement for a transaction that, if consummated, would result in a Change in Control or the announcement by a third party to commence a tender or exchange offer that if consummated would result in a Change in Control.

Registration Rights Agreements

In connection with the Closing of the Business Combination, certain holders of our capital stock entered into that certain 2021 Registration Rights Agreement. Pursuant to the 2021 Registration Rights Agreement, the holders of, among other securities, the shares of Class A common stock issued or issuable to holders of greater than 2% of Legacy Archer common stock on a fully diluted basis as of the Closing Date, including Marc Lore, Thomas Muniz and UAV, have registration rights to require us to register a sale of any of our securities held by them.

In connection with the Forward Purchase Agreement, the Company and Stellantis entered into a registration rights agreement (the “Stellantis Registration Rights Agreement”), dated January 3, 2023, pursuant to which the Company has granted Stellantis certain demand, piggyback and resale shelf registration rights with respect to the Forward Purchase Shares (as defined therein) and shares of Class A Common Stock issuable upon exercise of the Stellantis Warrant. The registration rights terminate after Stellantis no longer holds any Registrable Securities (as defined in the Stellantis Registration Rights Agreement) or with respect to any Registrable Securities, seven years after the date such Registrable Securities were issued to Stellantis.

In August 2023, we entered into subscription agreements with certain accredited investors, pursuant to which we agreed to sell and issue, in a private placement transaction (the “2023 Private Placement”), 26,173,286 shares of Class A common stock at a purchase price of $5.54 per share. In connection with the 2023 Private Placement, we granted to the participating accredited investors certain registration rights with respect to the shares of Class A common stock issued in the 2023 Private Placement pursuant to the 2023 Registration Rights Agreement.

Restricted Stock Purchase Agreement

On August 10, 2023, we entered into a Restricted Stock Purchase Agreement (the “Restricted Stock Purchase Agreement”) with Gibson, Dunn & Crutcher LLP (the “Gibson Dunn”). Pursuant to the Restricted Stock Purchase Agreement, we, among other things, issued 1,985,559 shares of our Class A common stock to Gibson Dunn in a private placement pursuant to Section 4(a)(2) of the Securities Act.

Series A Preferred Stock Financing

Between July 2020 and October 2020, Legacy Archer issued and sold an aggregate of 41,872,399 shares of its Series A Preferred Stock at a purchase price of $1.2046 per share, for an aggregate purchase price of $50.4 million, and issued an aggregate of 4,395,023 shares of Legacy Archer’s Series A Preferred Stock upon conversion of the convertible promissory notes sold between November 2019 and December 2019 with an aggregate principal amount of $5.0 million and an interest rate of 10% per annum. Each share of Legacy Archer’s Series A Preferred Stock converted into one share of Legacy Archer’s common stock in connection with the Closing.

The table below sets forth the number of shares of Legacy Archer Series A Preferred Stock purchased by the Selling Stockholders:

|

Stockholder

|

|

|

Shares of Series A

Preferred Stock

|

|

|

Total Cash

Purchase Price

|

|

|

Principal &

Interest

Cancelled

|

|

|

Marc Lore

|

|

|

|

|

5,675,959 |

|

|

|

|

|

6,837,260 |

|

|

|

|

|

— |

|

|

| |

|

|

|

|

2,633,739 |

|

|

|

|

|

— |

|

|

|

|

|

3,172,603 |

|

|

United Airlines Agreements

On January 29, 2021, we entered into a Purchase Agreement (the “Purchase Agreement”), Collaboration Agreement (the “United Collaboration Agreement”), and Warrant Agreement with United. Under the terms of the Purchase Agreement, United has a conditional purchase order for up to 200 of our aircraft, with an option to purchase an additional 100 aircraft. Those purchases are conditioned upon us meeting certain conditions that include, but are not limited to, the certification of our aircraft by the FAA and further negotiation and reaching of mutual agreement on certain material terms related to the purchases. We issued 14,741,764 warrants to United to purchase shares of Class A common stock. Each warrant provides United with the right to purchase one share of Class A common stock at an exercise price of $0.01 per share. The warrants vest in four installments in accordance with the following milestones: the execution of the Purchase Agreement and the United Collaboration Agreement, the completion of the Business Combination, the certification of the aircraft by the FAA, and the initial sale of aircraft to United. On August 9, 2022, we entered into Amendment No. 1 to the Warrant Agreement (the “Warrant Amendment”), by and between us and United, pursuant to which the parties amended the fourth milestone’s vesting conditions relating to the initial sale of the aircraft to United. The Warrant Amendment provided that 4,422,529 shares of our Class A common stock became vested and exercisable by United upon the occurrence of certain alternate vesting conditions as described in the Warrant Amendment. Please see the section titled “Description of Capital Stock” for further information.

Business Combination Private Placement

In connection with the execution of the Business Combination Agreement, Subscription Agreements were entered into with certain investors, pursuant to which each investor agreed to purchase an aggregate of 60,000,000 shares of Class A common stock (the “PIPE Shares”), for a purchase price of $10.00 per share and an aggregate purchase price of $600.0 million, in that certain private placement consummated substantially concurrently with the consummation of the Business Combination, pursuant to those certain subscription agreements with Atlas, and subject to the conditions set forth therein. UAV purchased 2,500,000 PIPE Shares for an aggregate purchase price of $25.0 million. Marc Lore purchased 1,000,000 PIPE Shares for an aggregate purchase price of $10.0 million.

Transaction Support Agreements

In February 2021, Atlas, Legacy Archer and certain Legacy Archer stockholders, including holders affiliated with members of the Legacy Archer’s board of directors, including Marc Lore, and beneficial owners of greater than 5%, of Legacy Archer’s capital stock, including UAV, entered into the Transaction Support Agreements, whereby such Legacy Archer stockholders agreed to, among other things, vote all of their shares of Legacy Archer’s capital stock in favor of the approval and adoption of the transactions contemplated by the Business Combination Agreement. Additionally, such stockholders agreed, among other things, not to transfer any of their shares of Legacy Archer common stock and Legacy Archer preferred stock (or enter into any arrangement with respect thereto), subject to certain customary exceptions, or enter into any voting arrangement that is inconsistent with the Transaction Support Agreement.

PLAN OF DISTRIBUTION

We are required to pay all fees and expenses incident to the registration of the shares of our Class A common stock to be offered and sold pursuant to this prospectus. The Selling Stockholders will bear all commissions and discounts, if any, attributable to their sale of shares of our Class A common stock.

We will not receive any of the proceeds from the sale of the shares of our Class A common stock by the Selling Stockholders. The aggregate proceeds to the Selling Stockholders will be the purchase price of the shares of our Class A common stock less any discounts and commissions borne by the Selling Stockholders.