Current Report Filing (8-k)

November 05 2019 - 4:27PM

Edgar (US Regulatory)

false0000109563

0000109563

2019-10-30

2019-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

October 30, 2019

Date of Report (date of earliest event reported)

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Ohio

|

1-2299

|

34-0117420

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

One Applied Plaza

|

Cleveland

|

Ohio

|

44115

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

(216) 426-4000

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, without par value

|

AIT

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

|

|

|

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

|

Amendment to Private Shelf Agreement

On October 30, 2019 Applied Industrial Technologies, Inc. (“Applied”) and certain of its subsidiaries entered into an Amended and Restated Note Purchase and Private Shelf Agreement (the “New Shelf Agreement”) with PGIM, Inc. (f/k/a Prudential Investment Management, Inc.) and certain of its affiliates (collectively, “Prudential”). The New Shelf Agreement amends and restates, and replaces, the Private Shelf Agreement between Applied and Prudential, dated as of November 27, 1996 (as amended, the “Prior Shelf Agreement”). The New Shelf Agreement and the documents related thereto contain the terms that govern and apply to Applied’s (a) 3.19% Series C Senior Notes in the original principal amount of $120 million (“Series C Notes”), (b) 3.21% Series D Senior Notes in the original principal amount of $50 million (“Series D Notes”), and (c) 3.08% Series E Senior Notes in the original principal amount of $25 million (“Series E Notes,” and, together with the Series C and Series D Notes, the “Prudential Notes”). Together, after giving effect to amortization payments, the Prudential Notes represent $170 million in principal amount of unsecured indebtedness. The New Shelf Agreement also provides Applied with the ability to request, until October 30, 2022, that Prudential purchase, on an uncommitted basis, up to an additional $100 million in principal amount of Applied’s senior unsecured notes, for a total maximum facility amount of $270 million, on an uncommitted basis.

Like the Prior Shelf Agreement, (a) the New Shelf Agreement is guaranteed, on an unsecured basis, by those U.S. and foreign subsidiaries of Applied that have also provided a guaranty for Applied’s senior bank credit facility; (b) the New Shelf Agreement contains customary covenants, including but not limited to, limitations on Applied's ability, and in certain instances, Applied's subsidiaries' ability to incur indebtedness, incur liens, make acquisitions and investments, sell or transfer assets and stock, make dividends or repurchase common stock; and (c) the New Shelf Agreement requires Applied to maintain a leverage ratio not in excess of (i) 4.00 to 1.0 from September 30, 2019 through and March 30, 2020, and (ii) 3.75 to 1.0 thereafter (provided, that upon notification to Prudential, the applicable required maximum leverage ratio level can be relaxed by 0.25 to 1.0 for a one-year period on up to two occasions (each a “Leverage Ratio Step-Up Period”) in connection with certain material acquisitions); and (d) the New Shelf Agreement requires that the quarterly fee payable by Applied during a Leverage Ratio Step-Up Period increase from 0.50% per annum to 1.25% per annum of the daily average outstanding principal amount of such notes during the applicable quarter, and, solely with respect to the Series C Notes and the Series D Notes, requires Applied to pay an additional quarterly excess leverage fee, ranging from 0.25% per annum to 1.25% per annum (depending on Applied’s leverage ratio), for each fiscal quarter where Applied’s leverage ratio exceeds 2.00 to 1.0.

Upon the occurrence of certain events of default, Applied’s obligations under the New Shelf Agreement may be accelerated. Such events of default include payment defaults to noteholders, covenant defaults, certain ERISA defaults, change of control and other customary defaults.

The foregoing description of the Shelf Amendment does not purport to be complete and is subject to, and qualified by, the full text of the Shelf Amendment, which is attached as Exhibit 10.1 to this Form 8-K.

|

|

|

|

ITEM 2.03

|

CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT

|

The disclosure set forth in Item 1.01 is hereby incorporated by reference into this Item 2.03.

|

|

|

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

By: /s/ Fred D. Bauer

|

|

|

Fred D. Bauer, Vice President-General Counsel & Secretary

|

|

Date: November 5, 2019

|

|

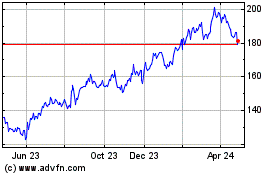

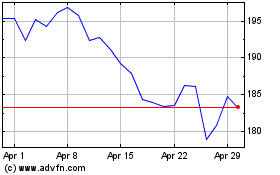

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

From Jul 2023 to Jul 2024