Apollo Commercial Real Estate Finance, Inc. Announces Pricing of Public Offering of Common Stock

December 13 2016 - 8:08AM

Business Wire

Apollo Commercial Real Estate Finance, Inc. (the “Company”)

(NYSE:ARI) today announced the Company has priced an underwritten

public offering of 10,500,000 shares of common stock for total

estimated gross proceeds of approximately $180.0 million. In

connection with the offering, the Company has granted the

underwriters a 30-day option to purchase up to an additional

1,575,000 shares of common stock. The offering is expected to close

on December 16, 2016, and is subject to customary closing

conditions.

ARI intends to use all or a portion of the net proceeds from the

offering to repay borrowings outstanding under the Company's

repurchase agreements (excluding repurchase agreements secured by

the Company’s commercial mortgage-backed securities (“CMBS”)

portfolio), and the balance, if any, to acquire the Company's

target assets, which include commercial first mortgage loans,

subordinate financings, CMBS and other commercial real

estate-related debt investments, and for general corporate

purposes.

BofA Merrill Lynch, J.P. Morgan, Citigroup and Morgan Stanley

are the joint book-running managers for the offering.

A registration statement relating to these securities has been

filed with the Securities and Exchange Commission and has become

effective. The offering will be made by means of a preliminary

prospectus supplement and accompanying prospectus. A copy of the

final prospectus supplement and accompanying prospectus related to

the offering can be obtained, when available, by contacting BofA

Merrill Lynch, NC1-004-03-43, 200 North College Street, 3rd floor,

Charlotte NC 28255-0001, Attention: Prospectus Department, Email:

dg.prospectus_requests@baml.com; J.P. Morgan Securities LLC, c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, Attention: Prospectus Department, or by calling

866-803-9204; Citigroup, c/o Broadridge Financial Solutions, 1155

Long Island Avenue, Edgewood, NY 11717 or by calling 800-831-9146;

or Morgan Stanley, Attention: Prospectus Department, 180 Varick

Street, Second Floor, New York, NY 10014.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of any securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Apollo Commercial Real Estate Finance, Inc.

Apollo Commercial Real Estate Finance, Inc. (NYSE: ARI) is a

real estate investment trust that primarily originates, acquires,

invests in and manages performing commercial first mortgage loans,

subordinate financings, CMBS and other commercial real

estate-related debt investments. The Company is externally managed

and advised by ACREFI Management, LLC, a Delaware limited liability

company and an indirect subsidiary of Apollo Global Management,

LLC, a leading global alternative investment manager with

approximately $189 billion of assets under management at September

30, 2016.

Forward-Looking Statements

Certain statements contained in this press release constitute

forward-looking statements as such term is defined in Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and such statements

are intended to be covered by the safe harbor provided by the same.

Forward-looking statements are subject to substantial risks and

uncertainties, many of which are difficult to predict and are

generally beyond the Company's control. These forward-looking

statements include information about possible or assumed future

results of the Company's business, financial condition, liquidity,

results of operations, plans and objectives. When used in this

release, the words believe, expect, anticipate, estimate, plan,

continue, intend, should, may or similar expressions, are intended

to identify forward-looking statements. Statements regarding the

following subjects, among others, may be forward-looking: the

return on equity; the yield on investments; the ability to borrow

to finance assets; the Company’s ability to deploy the proceeds of

its capital raises or acquire its target assets; and risks

associated with investing in real estate assets, including changes

in business conditions and the general economy. For a further list

and description of such risks and uncertainties, see the reports

filed by the Company with the Securities and Exchange Commission.

The forward-looking statements, and other risks, uncertainties and

factors are based on the Company's beliefs, assumptions and

expectations of its future performance, taking into account all

information currently available to the Company. Forward-looking

statements are not predictions of future events. The Company

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161213005697/en/

For Apollo Commercial Real Estate Finance, Inc.Hilary

Ginsberg, 212-822-0767Investor Relations

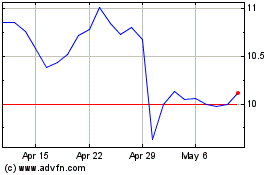

Apollo Commercial Real E... (NYSE:ARI)

Historical Stock Chart

From Oct 2024 to Nov 2024

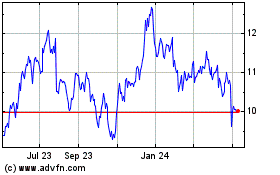

Apollo Commercial Real E... (NYSE:ARI)

Historical Stock Chart

From Nov 2023 to Nov 2024