Apollo Commercial Real Estate Finance, Inc. Closes $50 Million First Mortgage Loan

December 01 2014 - 4:30PM

Business Wire

Apollo Commercial Real Estate Finance, Inc. (the “Company” or

“ARI”) (NYSE:ARI) today announced the Company closed a $50 million

participating first mortgage loan secured by a portfolio of 24

condominiums located in New York City and Maui, Hawaii owned by a

luxury destination club. Earlier in the year, ARI provided a $210

million first mortgage loan to the same borrower, secured by an

additional portfolio of single-family and condominium destination

homes located throughout North America, Central America, England

and the Caribbean. With the closing of this transaction, ARI has

committed to invest over $1 billion of equity into $1.4 billion of

transactions year-to-date.

The fixed-rate, participating first mortgage loan has a

five-year term with two one-year extension options and an appraised

loan-to-value of 75%. The first mortgage loan was underwritten to

generate an internal rate of return (“IRR”)(1) of approximately 8%

on an unlevered basis. ARI anticipates financing the loan, and on a

levered basis, the loan was underwritten to generate an IRR of

approximately 15%.

Loan Repayments

In November, ARI received a $28 million principal repayment and

$6 million of deferred interest from a mezzanine loan secured by a

hotel in New York City.

About Apollo Commercial Real Estate Finance, Inc.

Apollo Commercial Real Estate Finance, Inc. (NYSE: ARI) is a

real estate investment trust that primarily originates, invests in,

acquires and manages performing commercial first mortgage loans,

subordinate financings, commercial mortgage-backed securities and

other commercial real estate-related debt investments. The Company

is externally managed and advised by ACREFI Management, LLC, a

Delaware limited liability company and an indirect subsidiary of

Apollo Global Management, LLC, a leading global alternative

investment manager with approximately $164 billion of assets under

management at September 30, 2014.

(1) The underwritten IRR for the investments listed in this

press release reflect the returns underwritten by ACREFI

Management, LLC, the Company’s external manager (the “Manager”),

calculated on a weighted average basis assuming no dispositions,

early prepayments or defaults. With respect to certain loans, the

underwritten IRR calculation assumes certain estimates with respect

to the timing and magnitude of future fundings for the remaining

commitments and associated loan repayments, and assumes no

defaults. IRR is the annualized effective compounded return rate

that accounts for the time-value of money and represents the rate

of return on an investment over a holding period expressed as a

percentage of the investment. It is the discount rate that makes

the net present value of all cash outflows (the costs of

investment) equal to the net present value of cash inflows (returns

on investment). It is derived from the negative and positive cash

flows resulting from or produced by each transaction (or for a

transaction involving more than one investment, cash flows

resulting from or produced by each of the investments), whether

positive, such as investment returns, or negative, such as

transaction expenses or other costs of investment, taking into

account the dates on which such cash flows occurred or are expected

to occur, and compounding interest accordingly. There can be no

assurance that the actual IRRs will equal the underwritten IRRs

shown in this press release. See “Item 1A—Risk Factors—The

Company may not achieve its underwritten internal rate of return on

its investments which may lead to future returns that may be

significantly lower than anticipated” included in the Company’s

Annual Report on Form 10-K for the year ended December 31,

2013 for a discussion of some of the factors that could adversely

impact the returns received by the Company from the investments

shown in the press release over time.

Forward-Looking Statements

Certain statements contained in this press release constitute

forward-looking statements as such term is defined in Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and such statements

are intended to be covered by the safe harbor provided by the same.

Forward-looking statements are subject to substantial risks and

uncertainties, many of which are difficult to predict and are

generally beyond the Company's control. These forward-looking

statements include information about possible or assumed future

results of the Company's business, financial condition, liquidity,

results of operations, plans and objectives. When used in this

release, the words believe, expect, anticipate, estimate, plan,

continue, intend, should, may or similar expressions, are intended

to identify forward-looking statements. Statements regarding the

following subjects, among others, may be forward-looking: the

return on equity; the yield on investments; the ability to borrow

to finance assets; the Company’s ability to deploy the proceeds of

its capital raises or acquire its target assets; and risks

associated with investing in real estate assets, including changes

in business conditions and the general economy. For a further list

and description of such risks and uncertainties, see the reports

filed by the Company with the Securities and Exchange Commission.

The forward-looking statements, and other risks, uncertainties and

factors are based on the Company's beliefs, assumptions and

expectations of its future performance, taking into account all

information currently available to the Company. Forward-looking

statements are not predictions of future events. The Company

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

Apollo Commercial Real Estate Finance, Inc.Hilary

Ginsberg, 212-822-0767Investor Relations

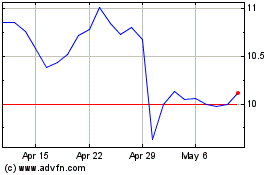

Apollo Commercial Real E... (NYSE:ARI)

Historical Stock Chart

From Oct 2024 to Nov 2024

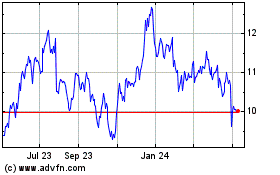

Apollo Commercial Real E... (NYSE:ARI)

Historical Stock Chart

From Nov 2023 to Nov 2024