-Establishes new statutorily mandated service

platform in the highly attractive elevator and escalator services

space-

-Accelerates business mix shift towards 60% of

revenues from inspection, service, and monitoring-

-Company raises full year guidance-

APi Group Corporation (NYSE: APG) (“APi” or the “Company”) today

announced that it has completed its previously announced

acquisition of Elevated Facility Services Group (“Elevated”) from a

fund managed by L Squared Capital Partners for approximately $570

million.

Headquartered in Tampa, Florida, Elevated has approximately 600

leaders and serves customers in over 18 states. Elevated is a

premier provider of contractually based services for all major

brands of elevator and escalator equipment. Elevated is expected to

contribute approximately $220 million in annual revenue at an

approximate 20% adjusted EBITDA margin.

Russ Becker, APi’s President and Chief Executive Officer stated:

“Today we welcome our 600 new teammates to the APi family and begin

our work leveraging the opportunities created by this acquisition.

We are excited to collaborate with Elevated and its talented

leadership team as we expand into the $10+ billion U.S. elevator

and escalator services market. This acquisition further strengthens

APi’s financial profile and represents a continuation of our focus

on building a robust line of businesses that provide mandatorily

required life safety services."

Becker continued, “We believe there is a long runway of

opportunity for Elevated to grow organically and through

acquisition. The strength of our balance sheet today and our track

record executing complementary bolt-on M&A over the last 20

years makes APi the perfect owner to help Elevated accelerate its

growth in the fragmented elevator and escalator services market. We

expect the second half of 2024 to bring record profitability and a

return to strong organic revenue growth. Our updated full year

guidance for net revenues including Elevated represents reported

revenue growth of approximately 7% to 11% and organic revenue

growth of approximately 5% to 9% in the back half of year.”

2024 Full Year Guidance

APi is raising its full year net revenue and adjusted EBITDA

guidance.

- Net Revenues of $7,150 to $7,350 million, up from $7,050 to

$7,250 million

- Adjusted EBITDA of $875 to $925 million, up from $855 to $905

million

- Adjusted Free Cash Flow Conversion of approximately 70% remains

unchanged

Net Revenues

Adjusted EBITDA

February 2024

$

7,050

–

$

7,250

$

855

–

$

905

(-) Current FX Impact (1)

–

–

(-) Specialty Services Divestitures

($20

)

($2

)

(+) Safety Services Acquisitions

$

120

–

$

130

$

23

–

$

24

June 2024

$

7,150

–

$

7,350

$

875

–

$

925

Note: All amounts shown in millions

(1) Reflects change in impact from

February 2024 guide to June 2024 guide.

APi now expects full year 2024 interest expense to be

approximately $145 million, down from $150 million. Prior

expectations for full year 2024 depreciation of approximately $80

million, capital expenditures of approximately $95 million,

adjusted effective tax rate of approximately 23% and adjusted

weighted average share count of approximately 279 million remain

unchanged.

About APi:

APi is a global, market-leading business services provider of

fire and life safety, security, elevator and escalator, and

specialty services with a substantial recurring revenue base and

over 500 locations worldwide. APi provides statutorily mandated and

other contracted services to a strong base of long-standing

customers across industries. We have a winning leadership culture

driven by entrepreneurial business leaders to deliver innovative

solutions for our customers. More information can be found at

www.apigroupcorp.com.

Non-GAAP Financial

Measures

This press release contains a non-U.S. GAAP financial measure

within the meaning of Regulation G promulgated by the Securities

and Exchange Commission. The Company uses the non-U.S. GAAP

financial measure included in this press release and the additional

financial information both in explaining its results to

shareholders and the investment community and in its internal

evaluation and management of its businesses. The Company’s

management believes that this non-U.S. GAAP financial measures and

the information it provides is useful to investors since this

measure (a) permits investors to view the Company’s performance

using the same tools that management uses to evaluate the Company’s

past performance, reportable business segments and prospects for

future performance, (b) permits investors to compare the Company

with its peers,(c) determines certain elements of management’s

incentive compensation and (d) provides consistent period-to-period

comparisons of the results. Specifically:

- Earnings before interest, taxes, depreciation and amortization

(“EBITDA”) is the measure of profitability used by management to

manage its segments and, accordingly, in its segment reporting. The

Company supplements the reporting of its consolidated financial

information with certain non-U.S. GAAP financial measures,

including EBITDA and adjusted EBITDA, which is defined as EBITDA

excluding the impact of certain non-cash and other specifically

identified items (“adjusted EBITDA”). Adjusted EBITDA margin is

calculated as adjusted EBITDA divided by net revenues. The Company

believes these non-U.S. GAAP measures provide meaningful

information and help investors understand the Company’s financial

results and assess its prospects for future performance. The

Company uses EBITDA and adjusted EBITDA to evaluate its

performance, both internally and as compared with its peers,

because it excludes certain items that may not be indicative of the

Company’s core operating results. Consolidated EBITDA is calculated

in a manner consistent with segment EBITDA, which is a measure of

segment profitability.

- The Company also presents organic changes in net revenues on a

consolidated basis or segment specific basis to provide a more

complete understanding of underlying revenue trends by providing

net revenues on a consistent basis as it excludes the impacts of

material acquisitions, completed divestitures, and changes in

foreign currency from year-over-year comparisons on reported net

revenues, calculated as the difference between the reported net

revenues for the current period and reported net revenues for the

current period converted at fixed foreign currency exchange rates

(excluding material acquisitions and divestitures). The remainder

is divided by prior year fixed currency net revenues, excluding the

impacts of completed divestitures.

While the Company believes this non-U.S. GAAP measure is useful

in evaluating the Company’s performance, this information should be

considered as supplemental in nature and not as a substitute for or

superior to the related financial information prepared in

accordance with U.S. GAAP. Additionally, this non-U.S. GAAP

financial measure may differ from similar measures presented by

other companies.

The Company does not provide reconciliations of forward-looking

non-U.S. GAAP adjusted EBITDA and growth in organic net revenues to

GAAP due to the inherent difficulty in forecasting and quantifying

certain amounts that are necessary for such reconciliations,

including adjustments that could be made for acquisitions and

divestitures, business transformation and other expenses for the

integration of acquired businesses, one-time and other events such

as impairment charges, transaction and other costs related to

acquisitions, restructuring costs, amortization of intangible

assets, and other charges reflected in the Company’s reconciliation

of historic numbers, the amount of which, based on historical

experience, could be significant.

Forward-Looking Statements and

Disclaimers

Please note that in this press release the Company may discuss

events or results that have not yet occurred or been realized,

commonly referred to as forward-looking statements. The Private

Securities Litigation Reform Act of 1995 provides a safe harbor for

forward-looking statements made by or on behalf of the Company.

Such discussion and statements may contain words such as “expect,”

“anticipate,” “will,” “should,” “believe,” “intend,” “plan,”

“estimate,” “predict,” “seek,” “continue,” “pro forma”, “outlook,”

“may,” “might,” “should,” “can have,” “have,” “likely,”

“potential,” “target,” “indicative,” “illustrative,” and variations

of such words and similar expressions, and relate in this press

release, without limitation, to statements, beliefs, projections

and expectations about future events. Such statements are based on

the Company’s expectations, intentions and projections regarding

the Company’s future performance, anticipated events or trends and

other matters that are not historical facts. These statements

include (i) the Company’s expectations and beliefs regarding the

acquisition of Elevated, including with respect to the Company’s

market position, the Company’s long-term strategies and targets,

the expected revenue contribution, that the acquisition will be

accretive, and the expected synergies.

These statements are not guarantees of future performance and

are subject to known and unknown risks, uncertainties and other

factors that could cause actual results to differ materially from

those expressed or implied by such forward-looking statements,

including: (i) economic conditions, competition, political risks,

and other risks that may affect the Company’s future performance,

including the impacts of inflationary pressures and other

macroeconomic factors on the Company’s business, markets, supply

chain, customers and workforce, on the credit and financial

markets, on the alignment of expenses and revenues and on the

global economy generally;(ii) failure to realize the anticipated

benefits of the acquisition of Elevated and its ability to

successfully execute the Company’s bolt-on acquisition strategy to

acquire other businesses and successfully integrate them into its

operations; (iii) changes in applicable laws or regulations; (iv)

the possibility that the Company may be adversely affected by other

economic, business, and/or competitive factors; and (v) other risks

and uncertainties, including those discussed in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023

under the heading “Risk Factors.” Given these risks and

uncertainties, you are cautioned not to place undue reliance on

forward-looking statements. Additional information concerning these

risks, uncertainties and other factors that could cause actual

results to vary is, or will be, included in the periodic and other

reports filed by the Company with the Securities and Exchange

Commission. Forward-looking statements included in this press

release speak only as of the date hereof and, except as required by

applicable law, the Company does not undertake any obligation to

update or revise publicly any forward-looking statements, whether

as a result of new information, future events or circumstances

after the date.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240604823338/en/

Investor Relations and Media

Inquiries: Adam Fee Vice President of Investor Relations

Tel: +1 651-240-7252 Email: investorrelations@apigroupinc.us

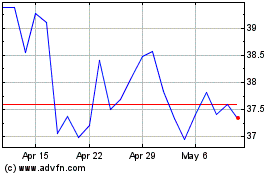

APi (NYSE:APG)

Historical Stock Chart

From Oct 2024 to Nov 2024

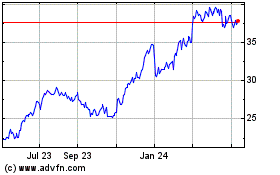

APi (NYSE:APG)

Historical Stock Chart

From Nov 2023 to Nov 2024