false0000922864false00018208780000922864aiv:AimcoPropertiesLpMember2024-08-072024-08-0700009228642024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 7, 2024

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

AIMCO OP L.P.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Maryland (Apartment Investment and Management Company) |

|

1-13232 |

|

84-1259577 |

Delaware (Aimco OP L.P.) |

|

0-56223 |

|

85-2460835 |

(State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

of incorporation or organization) |

|

File Number) |

|

Identification No.) |

4582 SOUTH ULSTER STREET

SUITE 1450, DENVER, CO 80237

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (303) 224-7900

NOT APPLICABLE

(Former name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

|

|

Securities registered pursuant to section 12(b) of the Act: |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Apartment Investment and Management Company Class A Common Stock |

AIV |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the exchange act. ☐

ITEM 2.02. Results of Operations and Financial Conditions.

On August 7, 2024 Apartment Investment and Management Company and Aimco OP L.P. (the “Company”) issued a press release announcing results for the period ended June 30, 2024. A copy of the press release is attached as exhibit 99.1 to this report.

The information under this Item 2.02 and Exhibit 99.1 is furnished by the Company in accordance with the rules of the Securities and Exchange Commission. This information shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01. Financial Statements and Exhibits.

(d) The following exhibits are filed with this report:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

Dated: August 7, 2024 |

|

|

|

|

|

|

APARTMENT INVESTMENT AND MANAGEMENT COMPANY |

|

|

|

|

|

|

|

/s/ H. Lynn C. Stanfield |

|

|

|

H. Lynn C. Stanfield |

|

|

|

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

AIMCO OP L.P. |

|

|

By: Aimco OP GP, LLC, its general partner By: Apartment Investment and Management Company, its managing member |

|

|

|

/s/ H. Lynn C. Stanfield |

|

|

|

H. Lynn C. Stanfield |

|

|

|

Executive Vice President and Chief Financial Officer |

Table of Contents

|

|

Page |

|

3 |

Earnings Release |

7 |

Outlook |

10 |

Consolidated Statements of Operations |

11 |

Consolidated Balance Sheets |

12 |

Schedule 1 – EBITDAre and Adjusted EBITDAre |

13 |

Schedule 2 – Aimco Leverage and Maturities |

14 |

Schedule 3 – Aimco Portfolio |

15 |

Schedule 4 – Aimco Capital Additions |

16 |

Schedule 5 – Aimco Development and Redevelopment Project Summaries |

18 |

Schedule 6 – Stabilized Operating Properties |

19 |

Schedule 7 – Acquisitions, Dispositions, and Leased Communities |

20 |

Schedule 8 – Net Asset Value Components |

21 |

Glossary and Reconciliations of Non-GAAP Financial and Operating Measures |

Aimco Reports Second Quarter Results, Updates Guidance, and

Provides Highlights on Recent Activities

Denver, Colorado, August 7, 2024 – Apartment Investment and Management Company (“Aimco”) (NYSE: AIV) announced today second quarter results for 2024, updated guidance, and provided highlights on recent and planned activities.

Financial Results and Highlights

•Aimco's net loss attributable to common stockholders per share, on a fully dilutive basis, was $(0.43) for the quarter ended June 30, 2024, due primarily to a non-cash impairment charge related to its passive equity investment in IQHQ.

•Second quarter 2024 revenue, expenses, and net operating income ("NOI") from Aimco’s Stabilized Operating Properties increased 4.6%, 5.7%, and 4.1%, respectively, year-over-year, with average monthly revenue per apartment home increasing by 4.4% to $2,392.

•During the second quarter, construction of Aimco's Strathmore Square and Oak Shore development projects advanced on plan. Aimco has substantially completed construction at Upton Place in Upper Northwest Washington, D.C. and, as of July 31, 2024, had leased 240 of the 689 units at rates ahead of underwriting.

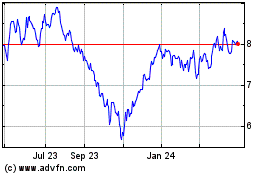

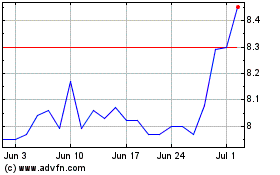

•Aimco acquired 3.0 million shares of its common stock during the second quarter at an average cost of $8.02 per share.

CEO Commentary

Wes Powell, Aimco President and Chief Executive Officer, comments: "In the second quarter, Aimco continued to produce solid results and made steady progress toward our 2024 plans and objectives.

“Aimco’s diversified portfolio of apartment communities continued to perform well during the second quarter with NOI up 4.1% year-over-year. Nearly 66% of residents whose leases were expiring signed renewals during the quarter and average monthly revenue per apartment home grew by 4.4% to $2,392. With the majority of 2024’s leasing transactions now complete, and considering the strong performance to date, we have revised our full year guidance and now expect revenue to grow between 3.25% and 3.75% and expenses to increase between 6.00% and 7.50%, resulting in NOI growth of between 1.50% to 2.75%, an increase of more than 100 basis points at the mid-point.

"Our active development projects are progressing on schedule and on budget. Year-to-date, through July, the Aimco team has brought more than 600 new apartment homes online and executed more than 250 new leases across those projects. Our current class of development projects are expected to be fully delivered by year end with NOI stabilization projected to occur during 2026. We continue to advance planning efforts in anticipation of select new project starts. Consistent with our stated guidance, total Aimco equity allocated to development and related activities is projected to be substantially reduced when compared to prior years.

“Together with our brokerage teams we continue to advance efforts related to the marketing and sale of our two-property assemblage in Miami’s Brickell neighborhood and The Hamilton, our recently completed redevelopment in Miami’s Edgewater neighborhood. While we do not plan to comment on specific pricing, terms or timelines until definitive agreements have been executed and deposits have become nonrefundable,

Second Quarter 2024 Earnings Release and Supplemental Schedules | 3

we remain committed to unlocking the value embedded within these assets and prudently allocating the net proceeds, with a preference for returning capital to stockholders.

“We continue to believe that Aimco shares represent an accretive use of excess capital and, as of July 31, 2024, had repurchased 4.2 million shares year-to-date at an average price of $7.93 per share.

“Aimco's strong performance is the result of the good work produced by a talented and engaged team, whom I am thankful to work alongside, and from the diligent oversight provided by an experienced Board of Directors. Above all else, we are committed to creating and unlocking value for Aimco stockholders.”

Operating Property Results

Aimco owns a diversified portfolio of operating apartment communities located in eight major U.S. markets with average rents in line with local market averages.

Results at Aimco’s Stabilized Operating Properties were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

Second Quarter |

|

Year-to-Date |

Stabilized Operating Properties |

Year-over-Year |

|

Sequential |

|

Year-over-Year |

($ in millions) |

2024 |

2023 |

Variance |

|

1Q 2024 |

Variance |

|

2024 |

2023 |

Variance |

Average Daily Occupancy |

96.3% |

96.2% |

0.1% |

|

97.9% |

(1.6)% |

|

97.1% |

97.1% |

— |

Revenue, before utility reimbursements |

$38.7 |

$37.0 |

4.6% |

|

$38.6 |

0.2% |

|

$77.3 |

$73.7 |

5.0% |

Expenses, net of utility reimbursements |

12.2 |

11.5 |

5.7% |

|

11.5 |

5.6% |

|

23.7 |

22.7 |

4.3% |

Net operating income (NOI) |

26.5 |

25.5 |

4.1% |

|

27.1 |

(2.2)% |

|

53.7 |

51.0 |

5.3% |

•Revenue in the second quarter 2024 was $38.7 million, up 4.6% year-over-year, resulting from a 4.4% increase in average monthly revenue per apartment home to $2,392 and a 10-basis point increase in Average Daily Occupancy to 96.3%.

•Effective rents on all leases during the second quarter 2024 were 3.5% higher, on average, than the previous lease and 65.8% of residents whose leases were expiring signed renewals.

•The median annual household income of new residents was $126,000 in the second quarter 2024, representing a rent-to-income ratio of 20.0%.

•Expenses in the second quarter 2024 were up 5.7% year-over-year primarily due to higher real estate taxes.

•NOI in the second quarter 2024 was $26.5 million, up 4.1% year-over-year.

•Year to date, as of July 31, 2024, effective rents on all transacted leases were 3.7% higher, on average, than the previous lease.

Value Add and Opportunistic Investments

Development and Redevelopment

Aimco generally seeks development and redevelopment opportunities where barriers to entry are high, target customers can be clearly defined, and Aimco has a comparative advantage over others in the market. Aimco’s value add and opportunistic investments may also target portfolio acquisitions, operational turnarounds, and re-entitlements.

Second Quarter 2024 Earnings Release and Supplemental Schedules | 4

As of June 30, 2024, Aimco had two multifamily development projects under construction, a multifamily community that has been substantially completed and is now in lease-up, and a hotel that was completed in 2023 and is being stabilized. These projects remain on track, as measured by construction budget and lease-up metrics. Additionally, Aimco has a pipeline of future value add opportunities totaling approximately 13 million gross square feet of development in Aimco's target markets of Southeast Florida, the Washington D.C. Metro, and Colorado's Front Range.

During the second quarter, $29.8 million of capital was invested in Aimco's development and redevelopment activities, primarily funded through construction loan draws. Updates on active development projects and Aimco's pipeline include:

•In Upper Northwest Washington D.C., construction at Upton Place is substantially complete. As of July 31, 2024, Aimco has delivered all 689 apartment homes with 240 units leased or pre-leased and 150 homes occupied, at rates ahead of our initial projections. Additionally, as of July 31, 2024, approximately 88% of the project's 105K square feet of retail space had been leased with tenant fit-out ongoing.

•In Bethesda, Maryland, construction is progressing on plan at the first phase of Strathmore Square, which will contain 220 highly tailored apartment homes in two buildings. As of July 31, 2024, Aimco had delivered 175 apartment homes, leased 40 units at rates ahead of our initial projections, and welcomed residents into their new homes.

•In Corte Madera, California, construction is ongoing at Oak Shore where 16 luxury single-family rental homes and eight accessory dwelling units are being developed. As of July 31, 2024, 13 of the residences had been delivered, seven were occupied and Aimco had pre-leased another two at rates ahead of our initial projections.

•In the second quarter 2024, Aimco invested $3.3 million into programming, design, documentation, and entitlement efforts related to select pipeline projects located in South Florida and on the Anschutz Medical Campus in Aurora, Colorado. Consistent with Aimco's capital allocation strategy, it may choose to monetize certain of these assets prior to vertical construction in an effort to maximize value add and risk-adjusted returns.

Investment & Disposition Activity

Aimco is focused on prudently allocating capital and delivering strong investment returns. Consistent with Aimco's capital allocation philosophy, it monetizes the value within its assets when accretive uses of the proceeds are identified and invests when the risk-adjusted returns are superior to other uses of capital.

Aimco is currently marketing three assets for sale in the Miami market: 1001 and 1111 Brickell Bay Drive (The Brickell Assemblage) and The Hamilton. Our respective brokerage teams remain in active discussions with interested parties and continue to solicit offers. Aimco does not intend to comment on specific pricing, terms or timelines until definitive agreements have been executed and buyers' deposits have become nonrefundable.

Balance Sheet and Financing Activity

Aimco is highly focused on maintaining a strong balance sheet, including ample liquidity. As of June 30, 2024, Aimco had access to $259.4 million, including $88.5 million of cash on hand, $20.9 million of restricted cash, and the capacity to borrow up to $150.0 million on its revolving credit facility.

Second Quarter 2024 Earnings Release and Supplemental Schedules | 5

Aimco’s net leverage as of June 30, 2024, was as follows:

|

|

|

|

|

|

|

|

|

|

|

as of June 30, 2024 |

|

Aimco Share, $ in thousands |

|

Amount |

|

|

Weighted Avg.

Maturity (Yrs.) [1] |

|

Total non-recourse fixed rate debt |

|

$ |

774,474 |

|

|

|

6.7 |

|

Total non-recourse floating rate debt |

|

|

90,660 |

|

|

|

1.3 |

|

Total non-recourse construction loan debt |

|

|

337,539 |

|

|

|

1.6 |

|

Cash and restricted cash |

|

|

(108,995 |

) |

|

|

|

Net Leverage |

|

$ |

1,093,678 |

|

|

|

|

[1] Weighted average maturities presented exclude contractual extension rights.

As of June 30, 2024, 100% of Aimco's total debt was either fixed rate or hedged with interest rate cap protection and, including contractual extensions, Aimco has only $9.4 million, or less than 1% of its total debt, maturing prior to May 2026.

Public Market Equity

Common Stock Repurchases

•In the second quarter, Aimco repurchased 3.0 million shares of its common stock at a weighted average price of $8.02 per share. As of July 31, 2024, Aimco had repurchased 4.2 million shares, year-to-date, at an average cost of $7.93 per share and since the start of 2022, Aimco had repurchased 13.8 million shares at an average cost of $7.48 per share.

•In the second quarter, approximately 14,395 units of the Aimco Operating Partnership's equity securities were redeemed in exchange for cash at a weighted average price per unit of $7.99. Year to date, approximately 51,302 units were redeemed in exchange for cash at a weighted average price per unit of $7.81.

Commitment to Enhance Stockholder Value

The Aimco Board of Directors, in coordination with management, remains intently focused on maximizing and unlocking value for Aimco stockholders and continues to engage regularly with several leading advisory firms, including Morgan Stanley & Co. LLC.

Aimco’s announced plans to reduce exposure to development activity and monetize certain assets represent a commitment to simplify the portfolio and unlock embedded value when there are opportunities to do so. These efforts will further improve Aimco’s positioning in the market and provide increased flexibility as the Board of Directors continues its review and consideration of broader strategic actions to maximize stockholder value. In addition, in conjunction with our contemplated asset sales, we will prioritize return of capital to our stockholders as a key component of our capital allocation philosophy.

There can be no assurance that the ongoing review will result in any particular transaction or transactions or other strategic changes or outcomes and the timing of any such event is similarly uncertain. The Company does not intend to disclose or comment on developments related to the foregoing unless or until it determines that further disclosure is appropriate or required.

Second Quarter 2024 Earnings Release and Supplemental Schedules | 6

2024 Outlook

|

|

|

|

|

|

|

|

2Q 2024 |

|

2024 |

|

2024 |

$ in millions (except per share amounts), Square Feet in millions Forecast is full year unless otherwise noted |

YTD Results |

|

Forecast |

|

Prior Forecast |

Net income (loss) per share – diluted [1] |

|

$(0.50) |

|

$(0.80) - $(0.75) |

|

$(0.50) - $(0.40) |

|

|

|

|

|

|

|

Operating Properties |

|

|

|

|

|

|

Revenue Growth, before utility reimbursements |

|

5.0% |

|

3.25% - 3.75% |

|

1.75% - 3.75% |

Operating Expense Growth, net of utility reimbursements |

|

4.3% |

|

6.00% - 7.50% |

|

6.00% - 8.00% |

Net Operating Income Growth |

|

5.3% |

|

1.50% - 2.75% |

|

-0.75% - 2.75% |

Recurring Capital Expenditures |

|

$7 |

|

$11 - $13 |

|

$11 - $13 |

|

|

|

|

|

|

|

Active Developments and Redevelopments |

|

|

|

|

|

|

Total Direct Costs of Projects in Occupancy Stabilization at Period End [2] |

|

$68 |

|

$648 |

|

$648 |

Total Direct Costs of Projects Under Construction at Period End [2] |

|

$580 |

|

$0 - $250 |

|

$0 - $250 |

Direct Project Costs |

|

$49.0 |

|

$70 - $100 |

|

$70 - $100 |

Other Capitalized Costs |

|

$14.5 |

|

$18 - $20 |

|

$15 - $20 |

Construction Loan Draws [3] |

|

$62.4 |

|

$88 - $90 |

|

$85 - $90 |

JV Partner Equity Funding |

|

$0 |

|

$0 - $25 |

|

$0 - $25 |

AIV Equity Funding [4] |

|

$1.1 |

|

$0 - $5 |

|

$0 - $5 |

|

|

|

|

|

|

|

Pipeline Projects |

|

|

|

|

|

|

Pipeline Size Gross Square Feet at Period End [5] |

|

13.3 |

|

9.5 - 13.3 |

|

9.5 - 13.3 |

Pipeline Size Multifamily Units at Period End [5] |

|

5,972 |

|

4,358 - 5,972 |

|

4,358 - 5,972 |

Pipeline Size Commercial Sq Ft at Period End [5] |

|

1.7 |

|

1.2 - 1.7 |

|

1.2 - 1.7 |

Planning Costs |

|

$4.1 |

|

$5 - $10 |

|

$8 - $15 |

|

|

|

|

|

|

|

Real Estate Transactions |

|

|

|

|

|

|

Acquisitions |

|

None |

|

None |

|

None |

Dispositions [6] |

|

None |

|

See Below |

|

See Below |

|

|

|

|

|

|

|

General and Administrative |

|

$16.1 |

|

$33 - $35 |

|

$33 - $35 |

|

|

|

|

|

|

|

Leverage |

|

|

|

|

|

|

Interest Expense, net of capitalization [7] |

|

$23.0 |

|

$56 - $58 |

|

$52 - $57 |

[1] Net income (loss) per share - diluted does not include any gains associated with potential transactions in 2024.

[2] Includes land or leasehold value.

[3] Construction loan draws at Aimco share in first half of 2024 were $53.8 million.

[4] Full year AIV equity funding is expected to be between $0 and $5 million. Quarter-end balances may fluctuate depending on timing of construction loan draws.

[5] Includes pipeline projects as presented on Supplemental Schedule 5b.

[6] While Aimco does not provide specific guidance related to future transactions, in the first half of 2024, Aimco brought to market its Brickell Assemblage, a two-property waterfront assemblage located in Miami, Florida, and The Hamilton, its recently completed waterfront redevelopment in Miami’s Edgewater neighborhood.

[7] Includes GAAP interest expense, exclusive of the amortization of deferred financing costs, and reduced by interest rate option payments which are included in the Realized and unrealized gains (losses) on interest rate options line on Aimco's income statement.

Second Quarter 2024 Earnings Release and Supplemental Schedules | 7

Supplemental Information

The full text of this Earnings Release and the Supplemental Information referenced in this release are available on Aimco’s website at investors.aimco.com.

Glossary & Reconciliations of Non-GAAP Financial and Operating Measures

Financial and operating measures found in this Earnings Release and the Supplemental Information include certain financial measures used by Aimco management that are measures not defined under accounting principles generally accepted in the United States, or GAAP. Certain Aimco terms and Non-GAAP measures are defined in the Glossary in the Supplemental Information and Non-GAAP measures reconciled to the most comparable GAAP measures.

About Aimco

Aimco is a diversified real estate company primarily focused on value add and opportunistic investments, targeting the U.S. multifamily sector. Aimco’s mission is to make real estate investments where outcomes are enhanced through our human capital so that substantial value is created for investors, teammates, and the communities in which we operate. Aimco is traded on the New York Stock Exchange as AIV. For more information about Aimco, please visit our website www.aimco.com.

Team and Culture

Aimco has a national presence with corporate headquarters in Denver, Colorado and Washington, D.C. Our investment platform is managed by experienced professionals based in three regions, where it will focus its new investment activity: Southeast Florida, the Washington D.C. Metro Area and Colorado's Front Range. By regionalizing this platform, Aimco can leverage the in-depth local market knowledge of each regional leader, creating a comparative advantage when sourcing, evaluating, and executing investment opportunities.

Above all else, Aimco is committed to a culture of integrity, respect, and collaboration.

Contact

Matt Foster, Sr. Director, Capital Markets and Investor Relations

Investor Relations 303-793-4661, investor@aimco.com

Second Quarter 2024 Earnings Release and Supplemental Schedules | 8

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief, or expectations. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. The forward-looking statements in this document include, without limitation, statements regarding our future plans and goals, including our pipeline investments and projects, our plans to eliminate certain near term debt maturities, our estimated value creation and potential, our timing, scheduling and budgeting, projections regarding revenue and expense growth, our plans to form joint ventures, our plans for new acquisitions or dispositions, our strategic partnerships and value added therefrom, the potential for adverse economic and geopolitical conditions, which negatively impact our operations, including on our ability to maintain current or meet projected occupancy, rental rate and property operating results; the effect of acquisitions, dispositions, developments, and redevelopments; our ability to meet budgeted costs and timelines, and achieve budgeted rental rates related to our development and redevelopment investments; expectations regarding sales of our apartment communities and the use of proceeds thereof; the availability and cost of corporate debt; and our ability to comply with debt covenants, including financial coverage ratios. We caution investors not to place undue reliance on any such forward-looking statements.

These forward-looking statements are based on management’s judgment as of this date, which is subject to risks and uncertainties that could cause actual results to differ materially from our expectations, including, but not limited to: the risk that the 2024 plans and goals may not be completed, as expected, in a timely manner or at all; geopolitical events which may adversely affect the markets in which our securities trade, and other macro-economic conditions, including, among other things, rising interest rates and inflation, which heightens the impact of the other risks and factors described herein; real estate and operating risks, including fluctuations in real estate values and the general economic climate in the markets in which we operate and competition for residents in such markets; national and local economic conditions, including the pace of job growth and the level of unemployment; the amount, location and quality of competitive new housing supply; the timing and effects of acquisitions, dispositions, developments and redevelopments; expectations regarding sales of apartment communities and the use of proceeds thereof; insurance risks, including the cost of insurance, and natural disasters and severe weather such as hurricanes; supply chain disruptions, particularly with respect to raw materials such as lumber, steel, and concrete; financing risks, including the availability and cost of financing; the risk that cash flows from operations may be insufficient to meet required payments of principal and interest; the risk that earnings may not be sufficient to maintain compliance with debt covenants, including financial coverage ratios; legal and regulatory risks, including costs associated with prosecuting or defending claims and any adverse outcomes; the terms of laws and governmental regulations that affect us and interpretations of those laws and regulations; and possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of apartment communities presently owned by us.

In addition, our current and continuing qualification as a real estate investment trust involves the application of highly technical and complex provisions of the Internal Revenue Code of 1986, as amended (the “Code”) and depends on our ability to meet the various requirements imposed by the Code through actual operating results, distribution levels and diversity of stock ownership.

Readers should carefully review Aimco’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of Aimco’s Annual Report on Form 10-K for the year ended December 31, 2023, and subsequent Quarterly Reports on Form 10-Q and other documents Aimco files from time to time with the SEC. These filings identify and address important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

These forward-looking statements reflect management’s judgment and expectations as of this date, and Aimco undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Second Quarter 2024 Earnings Release and Supplemental Schedules | 9

Consolidated Statements of Operations

(in thousands, except per share data) (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

|

Rental and other property revenues |

|

$ |

51,148 |

|

|

$ |

45,674 |

|

|

$ |

101,350 |

|

|

$ |

89,942 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

Property operating expenses |

|

|

22,557 |

|

|

|

18,783 |

|

|

|

43,756 |

|

|

|

36,287 |

|

Depreciation and amortization |

|

|

22,110 |

|

|

|

17,031 |

|

|

|

41,578 |

|

|

|

33,302 |

|

General and administrative expenses |

|

|

7,577 |

|

|

|

7,890 |

|

|

|

16,126 |

|

|

|

16,293 |

|

Total operating expenses |

|

|

52,244 |

|

|

|

43,704 |

|

|

|

101,460 |

|

|

|

85,882 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

2,535 |

|

|

|

2,478 |

|

|

|

5,183 |

|

|

|

4,536 |

|

Interest expense [1] |

|

|

(16,820 |

) |

|

|

(9,656 |

) |

|

|

(30,190 |

) |

|

|

(19,381 |

) |

Realized and unrealized gains (losses) on interest rate options |

|

|

640 |

|

|

|

3,383 |

|

|

|

2,312 |

|

|

|

2,326 |

|

Realized and unrealized gains (losses) on

equity investments [2] |

|

|

(47,264 |

) |

|

|

1,094 |

|

|

|

(47,535 |

) |

|

|

1,231 |

|

Gains on dispositions of real estate |

|

|

- |

|

|

|

1,878 |

|

|

|

- |

|

|

|

1,878 |

|

Other income (expense), net |

|

|

(1,286 |

) |

|

|

(1,420 |

) |

|

|

(2,876 |

) |

|

|

(4,872 |

) |

Income (loss) before income tax benefit |

|

|

(63,291 |

) |

|

|

(273 |

) |

|

|

(73,216 |

) |

|

|

(10,222 |

) |

Income tax benefit (expense) |

|

|

2,188 |

|

|

|

417 |

|

|

|

4,917 |

|

|

|

4,613 |

|

Net income (loss) |

|

|

(61,103 |

) |

|

|

144 |

|

|

|

(68,299 |

) |

|

|

(5,609 |

) |

Net (income) loss attributable to redeemable noncontrolling

interests in consolidated real estate partnerships |

|

|

(3,598 |

) |

|

|

(3,576 |

) |

|

|

(7,158 |

) |

|

|

(6,849 |

) |

Net (income) loss attributable to noncontrolling interests

in consolidated real estate partnerships |

|

|

811 |

|

|

|

(348 |

) |

|

|

827 |

|

|

|

(613 |

) |

Net (income) loss attributable to common noncontrolling

interests in Aimco Operating Partnership |

|

|

3,364 |

|

|

|

178 |

|

|

|

3,918 |

|

|

|

652 |

|

Net income (loss) attributable to Aimco |

|

$ |

(60,526 |

) |

|

$ |

(3,602 |

) |

|

$ |

(70,712 |

) |

|

$ |

(12,419 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to common stockholders per

share – basic |

|

$ |

(0.43 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.50 |

) |

|

$ |

(0.09 |

) |

Net income (loss) attributable to common stockholders per

share – diluted |

|

$ |

(0.43 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.50 |

) |

|

$ |

(0.09 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding –

basic |

|

|

139,816 |

|

|

|

144,195 |

|

|

|

140,205 |

|

|

|

145,007 |

|

Weighted-average common shares outstanding –

diluted |

|

|

139,816 |

|

|

|

144,195 |

|

|

|

140,205 |

|

|

|

145,007 |

|

[1] Interest expense increased in the three and six months ended June 30, 2024 from the same periods ending June 30, 2023, due primarily to increased construction loan draws and reduced capitalization as development projects are advanced and completed.

[2] In the second quarter 2024, realized and unrealized losses on equity investments were $47.3 million primarily due to a non-cash impairment charge related to its passive equity investment in IQHQ.

Second Quarter 2024 Earnings Release and Supplemental Schedules | 10

Consolidated Balance Sheets

(in thousands) (unaudited)

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

|

Buildings and improvements |

|

$ |

1,657,258 |

|

|

$ |

1,593,802 |

|

Land |

|

|

620,246 |

|

|

|

620,821 |

|

Total real estate |

|

|

2,277,504 |

|

|

|

2,214,623 |

|

Accumulated depreciation |

|

|

(602,375 |

) |

|

|

(580,802 |

) |

Net real estate |

|

|

1,675,129 |

|

|

|

1,633,821 |

|

Cash and cash equivalents |

|

|

88,539 |

|

|

|

122,601 |

|

Restricted cash |

|

|

20,859 |

|

|

|

16,666 |

|

Notes receivable |

|

|

57,660 |

|

|

|

57,554 |

|

Right-of-use lease assets - finance leases |

|

|

108,353 |

|

|

|

108,992 |

|

Other assets, net |

|

|

106,574 |

|

|

|

149,841 |

|

Total assets |

|

$ |

2,057,114 |

|

|

$ |

2,089,475 |

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

Non-recourse property debt, net |

|

$ |

845,237 |

|

|

$ |

846,298 |

|

Non-recourse construction loans, net |

|

|

366,078 |

|

|

|

301,443 |

|

Total indebtedness |

|

|

1,211,315 |

|

|

|

1,147,741 |

|

Deferred tax liabilities |

|

|

106,537 |

|

|

|

110,284 |

|

Lease liabilities - finance leases |

|

|

120,353 |

|

|

|

118,697 |

|

Accrued liabilities and other |

|

|

126,155 |

|

|

|

121,143 |

|

Total liabilities |

|

|

1,564,360 |

|

|

|

1,497,865 |

|

|

|

|

|

|

|

|

Redeemable noncontrolling interests in consolidated real estate partnerships |

|

|

174,849 |

|

|

|

171,632 |

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

Common Stock |

|

|

1,372 |

|

|

|

1,406 |

|

Additional paid-in capital |

|

|

439,168 |

|

|

|

464,538 |

|

Retained earnings (deficit) |

|

|

(187,004 |

) |

|

|

(116,292 |

) |

Total Aimco equity |

|

|

253,536 |

|

|

|

349,652 |

|

Noncontrolling interests in consolidated real estate partnerships |

|

|

50,280 |

|

|

|

51,265 |

|

Common noncontrolling interests in Aimco Operating Partnership |

|

|

14,089 |

|

|

|

19,061 |

|

Total equity |

|

|

317,905 |

|

|

|

419,978 |

|

Total liabilities and equity |

|

$ |

2,057,114 |

|

|

$ |

2,089,475 |

|

Second Quarter 2024 Earnings Release and Supplemental Schedules | 11

Supplemental Schedule 1

EBITDAre and Adjusted EBITDAre

(in thousands) (unaudited)

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, 2024 |

|

|

Twelve Months Ended

June 30, 2024 |

|

Net Income (loss) |

$ |

(61,103 |

) |

|

$ |

(219,993 |

) |

Adjustments: |

|

|

|

|

|

Interest expense |

|

16,820 |

|

|

|

48,527 |

|

Income tax (benefit) expense |

|

(2,188 |

) |

|

|

(13,057 |

) |

Gains on dispositions of real estate |

|

- |

|

|

|

(6,106 |

) |

Depreciation and amortization |

|

22,110 |

|

|

|

77,110 |

|

Adjustment related to EBITDAre of unconsolidated partnerships |

|

217 |

|

|

|

673 |

|

EBITDAre |

$ |

(24,144 |

) |

|

$ |

(112,846 |

) |

Net (Income) loss attributable to redeemable noncontrolling Interests consolidated real estate partnerships |

|

(3,598 |

) |

|

|

(14,233 |

) |

Net (Income) loss attributable to noncontrolling interests consolidated real estate partnerships |

|

811 |

|

|

|

(2,551 |

) |

EBITDAre adjustments attributable to noncontrolling interests |

|

(929 |

) |

|

|

(1,765 |

) |

Mezzanine investment (income) loss, net |

|

628 |

|

|

|

156,813 |

|

Realized and unrealized (gains) losses on interest rate contracts |

|

(640 |

) |

|

|

(1,105 |

) |

Unrealized (gains) losses on IQHQ investment |

|

46,972 |

|

|

|

46,972 |

|

Adjusted EBITDAre |

$ |

19,100 |

|

|

$ |

71,285 |

|

Second Quarter 2024 Earnings Release and Supplemental Schedules | 12

Supplemental Schedule 2

Aimco Leverage and Maturities

(dollars in thousands) (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aimco Share of |

|

|

|

|

|

Total |

|

|

Weighted

Average |

|

|

Weighted Average Interest Rate |

|

Debt |

|

Consolidated |

|

|

Unconsolidated

Partnerships |

|

|

Noncontrolling

Interests |

|

|

Aimco

Share |

|

|

Maturity

(Years) [3] |

|

|

Stated |

|

|

Capped |

|

Fixed rate loans payable |

|

$ |

770,128 |

|

|

$ |

4,346 |

|

|

|

— |

|

|

$ |

774,474 |

|

|

|

6.7 |

|

|

|

4.25 |

% |

|

|

4.25 |

% |

Floating rate loans payable |

|

|

81,300 |

|

|

|

9,360 |

|

|

|

— |

|

|

|

90,660 |

|

|

|

1.3 |

|

|

|

9.83 |

% |

|

|

8.00 |

% |

Construction loan debt [1] |

|

|

371,584 |

|

|

|

— |

|

|

|

(34,045 |

) |

|

|

337,539 |

|

|

|

1.6 |

|

|

|

9.39 |

% |

|

|

7.74 |

% |

Total non-recourse debt [2] |

|

$ |

1,223,012 |

|

|

$ |

13,706 |

|

|

$ |

(34,045 |

) |

|

$ |

1,202,673 |

|

|

|

4.8 |

|

|

|

6.19 |

% |

|

|

5.56 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revolving Credit Facility |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Cash and restricted cash |

|

|

(109,398 |

) |

|

|

— |

|

|

|

403 |

|

|

|

(108,995 |

) |

|

|

|

|

|

|

|

|

|

Net Leverage |

|

$ |

1,113,614 |

|

|

$ |

13,706 |

|

|

$ |

(33,642 |

) |

|

$ |

1,093,678 |

|

|

|

|

|

|

|

|

|

|

Aimco Share Non-Recourse Debt

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Rate on Maturing Debt |

|

|

|

Amortization |

|

|

Maturities [3] |

|

|

Total |

|

|

Maturities as a

Percent of Total |

|

|

Stated |

|

|

Capped |

|

2024 3Q |

|

$ |

999 |

|

|

$ |

— |

|

|

$ |

999 |

|

|

|

— |

% |

|

|

— |

% |

|

|

— |

% |

2024 4Q |

|

|

1,014 |

|

|

|

— |

|

|

|

1,014 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Total 2024 |

|

|

2,013 |

|

|

|

— |

|

|

|

2,013 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025 1Q |

|

|

1,028 |

|

|

|

— |

|

|

|

1,028 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

2025 2Q [4] |

|

|

1,025 |

|

|

|

146,981 |

|

|

|

148,006 |

|

|

|

12.22 |

% |

|

|

9.89 |

% |

|

|

8.06 |

% |

2025 3Q [5] |

|

|

1,035 |

|

|

|

100,700 |

|

|

|

101,735 |

|

|

|

8.37 |

% |

|

|

8.64 |

% |

|

|

6.31 |

% |

2025 4Q |

|

|

1,050 |

|

|

|

175,400 |

|

|

|

176,450 |

|

|

|

14.58 |

% |

|

|

9.78 |

% |

|

|

8.45 |

% |

Total 2025 |

|

|

4,138 |

|

|

|

423,081 |

|

|

|

427,219 |

|

|

|

35.17 |

% |

|

|

9.54 |

% |

|

|

7.80 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2026 |

|

|

2,816 |

|

|

|

75,519 |

|

|

|

78,335 |

|

|

|

6.28 |

% |

|

|

3.10 |

% |

|

|

3.10 |

% |

2027 |

|

|

2,116 |

|

|

|

— |

|

|

|

2,116 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

2028 |

|

|

2,195 |

|

|

|

— |

|

|

|

2,195 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

2029 |

|

|

2,278 |

|

|

|

179,646 |

|

|

|

181,924 |

|

|

|

14.94 |

% |

|

|

4.66 |

% |

|

|

4.66 |

% |

2030 |

|

|

2,363 |

|

|

|

— |

|

|

|

2,363 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

2031 |

|

|

1,696 |

|

|

|

104,508 |

|

|

|

106,204 |

|

|

|

8.69 |

% |

|

|

3.20 |

% |

|

|

3.20 |

% |

2032 |

|

|

112 |

|

|

|

221,639 |

|

|

|

221,751 |

|

|

|

18.43 |

% |

|

|

4.62 |

% |

|

|

4.62 |

% |

2033 |

|

|

— |

|

|

|

173,435 |

|

|

|

173,435 |

|

|

|

14.42 |

% |

|

|

4.60 |

% |

|

|

4.60 |

% |

Thereafter |

|

|

— |

|

|

|

5,118 |

|

|

|

5,118 |

|

|

|

0.43 |

% |

|

|

3.25 |

% |

|

|

3.25 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Aimco Share |

|

$ |

19,727 |

|

|

$ |

1,182,946 |

|

|

$ |

1,202,673 |

|

|

|

|

|

|

|

|

|

|

[1] Aimco’s construction loan debt consists primarily of non-recourse, floating rate loans.

[2] Consolidated total non-recourse debt excludes $11.7 million of deferred financing costs.

[3] Debt maturities are presented with the earliest maturity date and do not include contractual extension options. Including extensions, the weighted average maturity is 5.4 years and Aimco has only $9.4 million of loans, at Aimco share, maturing prior to May 2026.

[4] In the second quarter, Aimco and its joint venture partner refinanced the project's land loan, Aimco's share of the new loan is $9.4 million and has an initial maturity date in the second quarter 2025.

[5] In the second quarter, Aimco exercised a 1-year contractual extension on the construction loan at The Hamilton.

Common Stock, Partnership Units, and Equivalents

(in thousands) (unaudited)

|

|

|

|

|

June 30, 2024 |

|

Class A Common Stock Outstanding |

|

137,167 |

|

Participating unvested restricted stock |

|

2,448 |

|

Potentially dilutive options, share equivalents, and non-participating unvested restricted stock |

|

1,684 |

|

Total shares and potentially dilutive share equivalents |

|

141,299 |

|

Common Partnership Units and equivalents outstanding |

|

8,642 |

|

Total shares, units and potentially dilutive share equivalents |

|

149,941 |

|

Second Quarter 2024 Earnings Release and Supplemental Schedules | 13

Supplemental Schedule 3

Aimco Portfolio

(square feet in thousands) (land in acres) (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Properties |

|

|

Number of Apartment

Homes [3] |

|

|

Office and Retail Sq Ft |

|

|

Hotel Keys |

|

|

Development Land [4] |

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stabilized Operating Properties |

|

|

21 |

|

|

|

5,600 |

|

|

|

27.1 |

|

|

|

- |

|

|

|

- |

|

Other Real Estate [1] |

|

|

2 |

|

|

|

- |

|

|

|

295.0 |

|

|

|

106 |

|

|

|

- |

|

Development and Redevelopment - Owned [2] |

|

|

3 |

|

|

|

1,185 |

|

|

|

114.1 |

|

|

|

- |

|

|

|

- |

|

Development and Redevelopment - Land [3] |

|

|

6 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

21.9 |

|

Development and Redevelopment - Leased |

|

|

1 |

|

|

|

24 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Total Consolidated |

|

|

33 |

|

|

|

6,809 |

|

|

|

436.2 |

|

|

|

106 |

|

|

|

21.9 |

|

Unconsolidated |

|

|

6 |

|

|

|

142 |

|

|

|

- |

|

|

|

- |

|

|

|

2.8 |

|

Total Portfolio |

|

|

39 |

|

|

|

6,951 |

|

|

|

436.2 |

|

|

|

106 |

|

|

|

24.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Consolidated (Aimco Share) |

|

|

|

|

|

6,729 |

|

|

|

425.2 |

|

|

|

106.0 |

|

|

|

20.6 |

|

Total Unconsolidated (Aimco Share) |

|

|

|

|

|

73 |

|

|

|

- |

|

|

|

- |

|

|

|

0.6 |

|

Total Portfolio (Aimco Share) |

|

|

|

|

|

6,802 |

|

|

|

425.2 |

|

|

|

106 |

|

|

|

21.2 |

|

[1] Other Real Estate includes:

•1001 Brickell Bay Drive, Aimco’s office building adjacent to Yacht Club Apartments in the Brickell neighborhood of Miami, Florida; and The Benson Hotel and Faculty Club on the Anschutz Medical Campus in Aurora, Colorado.

[2] Development and Redevelopment - Owned includes:

•The Hamilton a 276-unit recently completed redevelopment in Miami, Florida, Upton Place a 689-unit substantially completed development in Upper Northwest Washington D.C. with 105,053 square feet of retail, and Strathmore Square a 220-unit apartment community with 9,000 square feet of retail that is being constructed in Bethesda, Maryland.

[3] Development and Redevelopment – Land includes:

•Flying Horse, developable land in Colorado Springs, Colorado;

•Two land parcels in Miami, Florida for potential future developments adjacent to The Hamilton;

•One land parcel along Broward Boulevard and the land in Flagler Village in Fort Lauderdale, Florida for potential future developments; and

•One land parcel for multifamily development on the Anschutz Medical Campus in Aurora, Colorado.

[4] Number of apartment homes includes all current apartments and those authorized for development.

[5] Development land includes the number of acres of land held by Aimco for future development, land with projects in active development is not included in this presentation.

Second Quarter 2024 Earnings Release and Supplemental Schedules | 14

Supplemental Schedule 4

Aimco Capital Additions

(consolidated amounts in thousands) (unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

June 30, 2024 |

|

|

June 30, 2024 |

|

|

|

|

|

|

|

|

Capital Replacements and Casualty |

|

$ |

4,319 |

|

|

$ |

7,046 |

|

Property Upgrades |

|

|

115 |

|

|

|

223 |

|

Tenant Improvements |

|

|

2,543 |

|

|

|

2,818 |

|

Development and Redevelopment |

|

|

29,809 |

|

|

|

72,568 |

|

Total Capital Additions [1] |

|

$ |

36,785 |

|

|

$ |

82,655 |

|

|

|

|

|

|

|

|

[1] Second quarter 2024 total capital additions include $22.0 million of Direct Capital Investment ($18.7 million on active projects and $3.3 million on projects in planning) and certain other costs capitalized in accordance with GAAP.

Second Quarter 2024 Earnings Release and Supplemental Schedules | 15

Supplemental Schedule 5(a)

Aimco Active Development Project Summaries

(dollars in millions) (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated / Actual |

Project Name |

|

Location |

|

Units |

|

|

Units Leased or

Pre-Leased |

|

|

Commercial

Sq Ft |

|

|

Commercial

Pre-Leased |

|

|

Initial

Occupancy

[6] |

|

|

Stabilized

Occupancy

[6] |

|

NOI

Stabilization

[6] |

Upton Place [1] |

|

Washington, D.C. |

|

|

689 |

|

|

28% |

|

|

|

105,053 |

|

|

82% |

|

|

4Q 2023 |

|

|

4Q 2025 |

|

4Q 2026 |

Strathmore Square |

|

Bethesda, MD |

|

|

220 |

|

|

11% |

|

|

|

9,000 |

|

|

— |

|

|

2Q 2024 |

|

|

4Q 2025 |

|

4Q 2026 |

Oak Shore |

|

Corte Madera, CA |

|

|

24 |

|

|

38% |

|

|

— |

|

|

— |

|

|

4Q 2023 |

|

|

1Q 2025 |

|

1Q 2026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

933 |

|

|

|

|

|

|

114,053 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct Capital Investment |

|

|

|

|

|

Project Name |

|

Status |

|

Aimco Ownership [5] |

|

|

Land Cost/

Leasehold Value |

|

|

Planned |

|

|

To-Date |

|

|

Remaining |

|

|

|

|

|

Upton Place [2] |

|

Lease-up |

|

90% |

|

|

|

92.8 |

|

|

|

245.0 |

|

|

|

234.8 |

|

|

|

10.2 |

|

|

|

|

|

Strathmore Square |

|

Lease-up / Active Construction |

|

95% |

|

|

|

24.9 |

|

|

|

164.0 |

|

|

|

147.3 |

|

|

|

16.7 |

|

|

|

|

|

Oak Shore |

|

Lease-up / Active Construction |

|

100% |

|

|

|

6.1 |

|

|

|

47.1 |

|

|

|

41.7 |

|

|

|

5.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

$ |

123.8 |

|

|

$ |

456.1 |

|

|

$ |

423.8 |

|

|

$ |

32.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Direct Costs of Active Projects [3] |

|

|

$ |

579.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Direct Costs of Projects in Occupancy Stabilization [4] |

|

|

$ |

68.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Estimated Direct Costs of Development Portfolio |

|

|

$ |

648.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Stabilized NOI |

|

|

$ |

44.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[1] As of July 31, 2024, the commercial space at Upton Place was 88% leased.

[2] The ground lease for Upton Place is presented at its initial GAAP value recorded at the formation of the joint venture.

[3] Estimated Direct Costs of Projects Under Construction represents the total of the land cost or property valuation for leasehold and the planned Direct Capital Investment.

[4] Includes the land cost and Direct Capital Investment for The Benson Hotel and Faculty Club, a 106-key hotel and event space on the Anschutz Medical Campus in Aurora, Colorado.

[5] Aimco ownership presented as estimated upon construction completion.

[6] Occupancy timing and stabilization are estimates subject to change.

Second Quarter 2024 Earnings Release and Supplemental Schedules | 16

Supplemental Schedule 5(b)

Aimco Development and Redevelopment Pipeline Projects

(unaudited)

Aimco controls a robust pipeline with opportunity for significant value creation. Aimco expects to fund pipeline development projects with 50% to 60% loan-to-cost construction loans, Aimco equity of 10% to 15% of the total development cost, and the remaining costs funded with Co-GP and/or LP equity. In the aggregate, Aimco's equity currently embedded in these pipeline assets exceeds the Aimco equity required to fund construction of the pipeline in full. In addition, annual pipeline carry costs (exclusive of incremental investment) are fully covered by the cash flow from operating properties on the Brickell Assemblage. As previously announced, Aimco is marketing the Brickell Assemblage for sale.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated / Currently Planned [1] |

Property Location |

|

Project Name/

Description |

|

Acreage [2] |

|

|

Gross Sq Ft |

|

|

Multifamily Units |

|

|

Leasable Commercial Sq Ft |

|

|

Earliest Vertical Construction Start |

Southeast Florida |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

556-640 NE 34th Street (Miami) |

|

Hamilton House |

|

|

1.10 |

|

|

|

560,000 |

|

|

|

114 |

|

|

|

6,500 |

|

|

3Q 2024 |

3333 Biscayne Boulevard (Miami) |

|

3333 Biscayne [3] |

|

|

2.80 |

|

|

|

1,760,000 |

|

|

|

650 |

|

|

|

176,000 |

|

|

2025 |

510-532 NE 34th Street (Miami) |

|

One Edgewater |

|

|

0.50 |

|

|

|

533,000 |

|

|

|

204 |

|

|

|

— |

|

|

2025 |

300 Broward Boulevard (Fort Lauderdale) |

|

300 Broward [3] |

|

|

2.31 |

|

|

|

1,700,000 |

|

|

|

935 |

|

|

|

40,000 |

|

|

2025 |

901 N Federal Highway (Fort Lauderdale) |

|

Flagler Village Phase I |

|

|

5.70 |

|

|

|

1,830,000 |

|

|

|

690 |

|

|

|

230,000 |

|

|

2025 |

1001-1111 Brickell Bay Drive (Miami) |

|

Brickell Assemblage |

|

|

4.25 |

|

|

|

3,200,000 |

|

|

|

1,500 |

|

|

|

500,000 |

|

|

2027 |

NE 9th Street & NE 5th Avenue (Fort Lauderdale) |

|

Flagler Village Phase II |

|

|

1.70 |

|

|

|

400,000 |

|

|

|

300 |

|

|

|

— |

|

|

2027 |

NE 9th Street & NE 5th Avenue (Fort Lauderdale) |

|

Flagler Village Phase III |

|

|

1.40 |

|

|

|

400,000 |

|

|

|

300 |

|

|

|

— |

|

|

2028 |

Washington D.C. Metro Area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5300 Block of Tuckerman Lane (Bethesda) |

|

Strathmore Square Phase II [3] |

|

|

1.35 |

|

|

|

525,000 |

|

|

|

399 |

|

|

|

11,000 |

|

|

2025 |

Colorado's Front Range |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E 23rd Avenue & N Scranton Street (Aurora) |

|

Fitzsimons 4 [3] |

|

|

1.77 |

|

|

|

415,000 |

|

|

|

285 |

|

|

|

— |

|

|

4Q 2024 |

1765 Silversmith Road (Colorado Springs) |

|

Flying Horse |

|

|

7.45 |

|

|

|

300,000 |

|

|

|

95 |

|

|

|

— |

|

|

2025 |

E 23rd Avenue & N Scranton Street (Aurora) |

|

Bioscience 4 |

|

|

1.53 |

|

|

|

232,000 |

|

|

|

— |

|

|

|

225,000 |

|

|

2025 |

E 22nd Avenue & N Scranton Street (Aurora) |

|

Fitzsimons 2 |

|

|

2.29 |

|

|

|

390,000 |

|

|

|

275 |

|

|

|

— |

|

|

2026 |

E 23rd Avenue & N Scranton Street (Aurora) |

|

Bioscience 5 |

|

|

1.22 |

|

|

|

230,000 |

|

|

|

— |

|

|

|

190,000 |

|

|

2026 |

E 23rd Avenue & Uvalda (Aurora) |

|

Fitzsimons 3 |

|

|

1.11 |

|

|

|

400,000 |

|

|

|

225 |

|

|

|

— |

|

|

2027 |

E 23rd Avenue & N Scranton Street (Aurora) |

|

Bioscience 6 |

|

|

2.04 |

|

|

|

385,000 |

|

|

|

— |

|

|

|

315,000 |

|

|

2028 |

Total Future Pipeline |

|

|

|

|

38.52 |

|

|

|

13,260,000 |

|

|

|

5,972 |

|

|

|

1,693,500 |

|

|

|

[1] Project metrics are estimated and could deviate substantially from what is currently planned.

[2] Acreage includes land owned and land controlled through options for future development, for the Bioscience project, acreage is presented proportionate based on the buildable gross square feet.

[3] Owned in a joint venture structure.

Second Quarter 2024 Earnings Release and Supplemental Schedules | 17

Supplemental Schedule 6

Stabilized Operating Results

(amounts in thousands, except community, home and per home data) (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2Q 2024 v. 2Q 2023 |

|

|

|

|

Revenues, Before Utility

Reimbursements |

|

|

Expenses, Net of Utility

Reimbursements |

|

|

Net Operating Income |

|

|

|

Net Operating

Income

Margin |

|

Average Daily

Occupancy

During Period |

|

Average

Revenue per

Aimco Apartment

Home |

|

|

Apartment

Communities |

|

Apartment

Homes |

|

|

2Q 2024 |

|

2Q 2023 |

|

Growth |

|

|

2Q 2024 |

|

2Q 2023 |

|

Growth |

|

|

2Q 2024 |

|

2Q 2023 |

|

Growth |

|

|

|

2Q 2024 |

|

2Q 2024 |

2Q 2023 |

|

2Q 2024 |

|

2Q 2023 |

|

Boston |

|

5 |

|

|

2,719 |

|

|

$ |

16,850 |

|

$ |

15,893 |

|

|

6.0 |

% |

|

$ |

4,760 |

|

$ |

4,267 |

|

|

11.6 |

% |

|

$ |

12,090 |

|

$ |

11,626 |

|

|

4.0 |

% |

|

|

71.8% |

|

96.4% |

95.5% |

|

$ |

2,142 |

|

$ |

2,041 |

|

Chicago |

|

7 |

|

|

1,495 |

|

|

|

10,356 |

|

|

9,931 |

|

|

4.3 |

% |

|

|

3,385 |

|

|

3,243 |

|

|

4.4 |

% |

|

|

6,971 |

|

|

6,688 |

|

|

4.2 |

% |

|

|

67.3% |

|

96.8% |

97.5% |

|

|

2,386 |

|

|

2,271 |

|

New York City |

|

3 |

|

|

150 |

|

|

|

2,129 |

|

|

2,019 |

|

|

5.4 |

% |

|

|

855 |

|

|

877 |

|

|

(2.5 |

%) |

|

|

1,274 |

|

|

1,142 |

|

|

11.6 |

% |

|

|

59.8% |

|

98.4% |

98.2% |

|

|

4,809 |

|

|

4,567 |

|

SE Florida |

|

2 |

|

|

729 |

|

|

|

6,340 |

|

|

6,068 |

|

|

4.5 |

% |

|

|

2,095 |

|

|

2,069 |

|

|

1.3 |

% |

|

|

4,245 |

|

|

3,999 |

|

|

6.2 |

% |

|

|

67.0% |

|

96.4% |

96.3% |

|

|

3,008 |

|

|

2,881 |

|

Other Markets [1] |

|

4 |

|

|

507 |

|

|

|

3,026 |

|

|

3,100 |

|

|

(2.4 |

%) |

|

|

1,057 |

|

|

1,040 |

|

|

1.6 |

% |

|

|

1,969 |

|

|

2,060 |

|

|

(4.4 |

%) |

|

|

65.1% |

|

93.5% |

95.2% |

|

|

2,128 |

|

|

2,141 |

|

Total |

|

21 |

|

|

5,600 |

|

|

$ |

38,701 |

|

$ |

37,011 |

|

|

4.6 |

% |

|

$ |

12,152 |

|

$ |

11,496 |

|

|

5.7 |

% |

|

$ |

26,549 |

|

$ |

25,515 |

|

|

4.1 |

% |

|

|

68.6% |

|

96.3% |

96.2% |

|

$ |

2,392 |

|

$ |

2,291 |

|

|

|

|

|

|

|

|

|

|

|

|

|