Current Report Filing (8-k)

March 31 2023 - 9:19AM

Edgar (US Regulatory)

0001477845

false

0001477845

2023-03-31

2023-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

March 31, 2023

ANNOVIS BIO, INC.

(Exact Name of Registrant as Specified in Charter)

| |

|

|

| Delaware |

001-39202 |

26-2540421 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

1055 Westlakes Drive, Suite 300

Berwyn, PA 19312

(Address of Principal Executive Offices, and

Zip Code)

(610) 727-3913

Registrant’s Telephone Number, Including

Area Code

Not

Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name

of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

ANVS |

New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communication pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 7.01 |

Regulation FD Disclosure. |

Annovis Bio, Inc. (NYSE: ANVS) (the “Company”) has received

the interim analysis for sample size re-estimation for its Phase 3 clinical trial for the treatment of early Parkinson’s Disease

(“PD”). This trial, which was initiated in August 2022, is a randomized, double-blind, placebo-controlled trial investigating

the efficacy, safety, and tolerability of Buntanetap in patients with early PD.

The Phase 3 trial is designed to enroll 450 early PD patients, which

are separated into three cohorts of 150 patients. Patients are randomly assigned to receive either 10 or 20 mg of Buntanetap or placebo

once per day. The trial’s primary endpoints will be evaluated after patients have been treated for six months using the following

measures: the MDS-Unified PD Rating Scale (MDS-UPDRS) Part II and III, which is a 42-item rating scale designed to assess PD-related disability

and impairment, and evaluates activities of daily living and motor function; and safety and tolerability, which is assessed using physical

examinations, vital signs, clinical laboratory test results, electrocardiogram findings, adverse events leading to study discontinuation,

drug related adverse events, severity of adverse events and adverse events.

The Company has received the results of the pre-planned interim

analysis conducted by a data analytics provider based on 132 patients from all cohorts collectively for which baseline and two-month

data was available. As the interim analysis was conducted at two months of the six-month endpoint and only on 132 patients, it may

not be indicative of the results at six months for the full patient population because as the trial progresses, clinical outcomes

may materially change as patient enrollment continues and more patient data become available, or different conclusions or

considerations may qualify such results once additional data have been received and fully evaluated. Based on the results of the

interim analysis, the Company intends to proceed with the trial as planned in accordance with the previously established protocol.

The Company remains blinded to the Phase 3 trial and does not have safety or efficacy data from the trial. A separate safety interim

analysis is in process and the Company expects that interim analysis to be released in the second quarter of 2023.

Forward-Looking Statements

This Current Report on Form 8-K

contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are statements that could

be deemed forward-looking statements. The Company advises caution in reliance on forward-looking statements. Forward-looking statements

include, without limitation, the Company’s plans related to clinical trials. These statements involve known and unknown risks, uncertainties

and other factors that may cause actual results to differ materially from those implied by forward-looking statements, including regarding,

patient enrollment, the effectiveness of Buntanetap and the timing, effectiveness, and anticipated results of the Company’s clinical

trials evaluating the efficacy, safety and tolerability of Buntanetap. See also additional risk factors set forth in the Company’s

periodic filings with the SEC, including, but not limited to, those risks and uncertainties listed in the section entitled “Risk

Factors,” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the SEC. All forward-looking

statements in this Current Report on Form 8-K are based on information available to the Company as of the date of this filing. The Company

expressly disclaims any obligation to update or alter its forward-looking statements, whether as a result of new information, future events

or otherwise, except as required by applicable law.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ANNOVIS BIO, INC. |

| |

|

|

| Date: March 31, 2023 |

By: |

/s/ Henry Hagopian, III |

| |

|

Name: Henry Hagopian, III |

| |

|

Title: Chief Financial Officer |

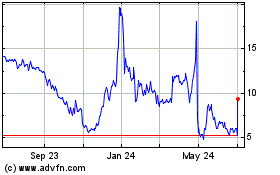

Annovis Bio (NYSE:ANVS)

Historical Stock Chart

From Jun 2024 to Jul 2024

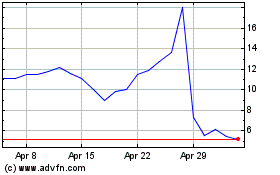

Annovis Bio (NYSE:ANVS)

Historical Stock Chart

From Jul 2023 to Jul 2024