Apollo-Led Consortium Acquires Minority Stake in Budweiser Brewer's US Container Plants

December 23 2020 - 7:28PM

Dow Jones News

By Kimberly Chin

An investor consortium led by private-equity firm Apollo Global

Management Inc. has acquired a 49.9% interest in Anheuser-Busch

InBev NV's metal container plants in the U.S. for roughly $3

billion.

The deal will help the Budweiser brewer get the best value from

the business for shareholders and the proceeds will go toward

paying down its debt, the companies said Wednesday.

AB InBev's debt has ballooned following its 2016,

$100-billion-plus deal to buy SABMiller, the world's second-largest

brewer at the time.

AB InBev will retain operational control of the U.S.-based metal

container plants, where it produces such items as cans and kegs.

The company will have a long-term supply agreement with the

investor group that will ensure it continues to have a supply of

metal containers in place throughout their relationship.

Under the deal's terms, AB InBev will be able to reacquire the

minority stake in five years following the deal's closing, the

company said.

The transaction wasn't linked to a metal can shortage that has

plagued some of its rivals due to the rise of beer sales from

homebound drinkers due to the pandemic, an AB InBev spokeswoman

said.

"This isn't directly Covid-related," the spokeswoman said,

adding the transaction ensures the company will be able to meet its

metal needs.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

December 23, 2020 19:13 ET (00:13 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

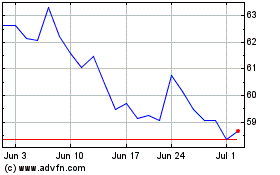

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Sep 2024 to Oct 2024

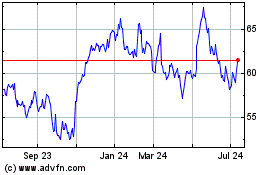

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Oct 2023 to Oct 2024