American Express 4Q Earnings Fall as Costs, Credit-Loss Provision Rise

January 27 2023 - 7:31AM

Dow Jones News

By Will Feuer

American Express Co.'s profit fell in the fourth quarter as the

company stashed away more cash to cover potential credit losses

down the line.

The New York City-based credit-card company logged net income of

$1.57 billion, or $2.07 a share, down from $1.72 billion, or $2.18

a share, a year earlier. Analysts surveyed by FactSet were

expecting earnings of $2.23 a share.

Revenue net of interest expense rose 17% to $14.18 billion,

driven by increased member spending and higher net-interest income.

Analysts surveyed by FactSet had been expecting revenue of $14.23

billion.

The company's provision for credit losses in the fourth quarter

surged to $1.03 billion from $53 million a year ago, though

American Express said credit metrics remained strong in the quarter

and below prepandemic levels. Financial companies have broadly been

growing their provision for credit losses, an indication that the

sector is bracing for an economic slowdown to hit their

customers.

Costs in the quarter rose 15% to $11.3 billion, reflecting

higher costs tied to customer engagement and increased usage of

travel-related benefits. Operating costs also rose, mostly due to

higher compensation costs and a net loss on Amex Ventures

investments of $234 million in the quarter.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

January 27, 2023 07:16 ET (12:16 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

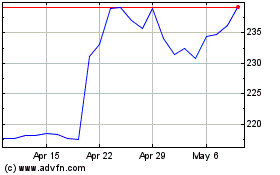

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2024 to May 2024

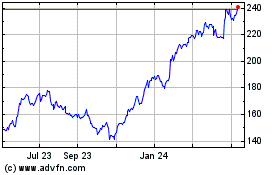

American Express (NYSE:AXP)

Historical Stock Chart

From May 2023 to May 2024