UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF A

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2022

Commission File Number: 1-16269

AMÉRICA MÓVIL, S.A.B. DE C.V.

(Exact Name of the Registrant as Specified in the Charter)

America Mobile

(Translation of Registrant’s Name into English)

Lago Zurich 245,

Plaza

Carso / Edificio Telcel, Piso 16

Colonia Ampliación Granada,

Alcaldía Miguel Hidalgo,

11529, Mexico City,

México

(Address of

Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

TABLE OF CONTENTS

The information in this report supplements information contained in our annual report on Form 20-F for the year ended December 31, 2020 (File No. 001-16269), filed with the U.S. Securities Exchange Commission (the “SEC”) on April 29, 2021 (our “2020 Form 20-F”).

These disclosures have been provided to prospective investors in

a potential offering of debt securities of América Móvil, S.A.B de C.V. (“América Móvil,” “we,” “us” or “our”) being conducted pursuant to the exemptions from registration with the

SEC provided by Rule 144A and Regulation S under the U.S. Securities Act of 1933, as amended, and the rules and regulations of the SEC promulgated thereunder. The offering relates to the spin-off (through an

escisión) by América Móvil of certain of its telecommunications towers and other associated passive infrastructure outside of Mexico to a new company (the “Sitios

Spin-off”) to be named Sitios Latinoamérica, S.A.B. de C.V. (“Sitios”). On the date on which Sitios is duly incorporated in accordance with Mexican law, pursuant to the resolutions

approved by the shareholders of América Móvil in the extraordinary shareholders’ meeting dated as of September 29, 2021 (the “Spin-off Effective Date”), Sitios will assume all

of the obligations of América Móvil with respect to any debt securities issued in such offering and all liabilities with respect thereto will be transferred to Sitios, and América Móvil will be released from all of its

obligations with respect thereto. The information in this report is inclusive of disclosures relating to Sitios and its subsidiaries.

References herein to “U.S.$” are to U.S. dollars. References herein to “Ps.” are to Mexican pesos. U.S. dollar amounts in

the tables are presented solely for convenience, using the exchange rate of Ps.20.5835 to U.S.$1.00, which was the rate reported by Banco de México as of December 31, 2021, as published in the Mexican Official Gazette of the Federation

(Diario Oficial de la Federación). You should not construe these translations, or any other currency translations included herein, as representations that the Mexican peso amounts actually represent the U.S. dollar or other foreign

currency amounts or could be converted into U.S. dollars or such other foreign currency at the rate used or indicated. The peso has appreciated against the U.S. dollar since December 31, 2021, and the exchange rate as of March 25, 2022 was

Ps.20.1313 to U.S.$.1.00.

On November 23, 2021, we completed the sale of our U.S. operations (TracFone Wireless, Inc.,

“TracFone”) to Verizon Communications Inc. (“Verizon”) as previously disclosed in our press release filed on a report on Form 6-K on November 23, 2021. As a result, in accordance with

IFRS 5, TracFone’s operations are classified as discontinued operations for all years presented in the consolidated financial information included in this report. Accordingly, results are presented in a single amount as profit after tax from

discontinued operations in the consolidated financial information included in this report. Operating and financial information presented herein therefore excludes Tracfone, including for periods prior to the sale.

i

FORWARD-LOOKING

STATEMENTS

Some of the information contained or incorporated by reference in this report may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Although we have based these

forward-looking statements on our expectations and projections about future events, it is possible that actual events may differ materially from our expectations. In many cases we include, together with the forward-looking statements themselves, a discussion of factors that may cause actual events to differ from our forward-looking statements. Examples of forward-looking statements include the following:

| |

• |

|

information about our expected commercial, operating or financial performance, our financing, our capital

structure or our other financial items or ratios; |

| |

• |

|

statements of our plans, objectives or goals, including those relating to acquisitions, competition and rates;

|

| |

• |

|

statements concerning regulation or regulatory developments; |

| |

• |

|

the impact of COVID-19; |

| |

• |

|

statements about our future economic performance or that of Mexico or other countries in which we operate,

including statements regarding currency and inflation; |

| |

• |

|

competitive developments in the telecommunications sector; |

| |

• |

|

other factors and trends affecting the telecommunications industry generally and our financial condition in

particular; and |

| |

• |

|

statements of assumptions underlying the foregoing statements. |

We use words such as “believe,” “anticipate,” “plan,” “expect,” “intend,”

“target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “should” and other similar expressions to identify forward-looking

statements, but they are not the only way we identify such statements.

Forward-looking statements

involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. These factors, some of which are discussed under “Risk Factors” in our 2020 Form 20-F, include the impact of the COVID-19 pandemic, economic and political conditions and government policies in Mexico, Brazil, Colombia, Europe and elsewhere, inflation rates, exchange rates, regulatory developments, technological improvements,

customer demand and competition. We caution you that the foregoing list of factors is not exclusive and that other risks and uncertainties may cause actual results to differ materially from those in

forward-looking statements. You should evaluate any statements made by us in light of these important factors.

Forward-looking statements speak only as of the date they are made. We undertake no obligation to

publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

2

AMÉRICA MÓVIL

We provide telecommunications services in 24 countries or territories. We are a leading telecommunications service provider in Latin America,

ranking first in wireless, fixed-line, broadband and Pay TV services, based on the number of revenue generating units (“RGUs”). Our largest operations are in Mexico and Brazil, which together account

for over half of our total RGUs and where we have the largest market share based on RGUs. We also have operations in 15 other countries in the Americas and seven countries in Central and Eastern Europe. As of December 31, 2021, we had

286.5 million wireless voice and data subscribers and 80.5 million fixed RGUs. We have identified RGUs as a key performance indicator (“KPI”) that helps measure the performance of our operations. The table below includes the

number of our wireless subscribers and our fixed RGUs, which together make up the total RGUs, in the countries where we operate. Wireless subscribers consist of the number of prepaid and postpaid subscribers to our wireless services. Fixed RGUs

consist of fixed voice, fixed data and Pay TV units (which include customers of our Pay TV services and, separately, of certain other digital services). The figures below reflect total wireless subscribers and fixed RGUs of all our consolidated

subsidiaries, without adjustments to reflect our equity interest, in the following reportable segments:

| |

• |

|

Southern Cone (Argentina, Chile, Paraguay and Uruguay); |

| |

• |

|

Andean Region (Ecuador and Peru); |

| |

• |

|

Central America (Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua and Panama); |

| |

• |

|

the Caribbean (the Dominican Republic and Puerto Rico); and |

| |

• |

|

Europe (Austria, Belarus, Bulgaria, Croatia, Macedonia, Serbia and Slovenia). |

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, |

|

| |

|

2020 |

|

|

2021 |

|

| |

|

|

|

|

|

|

| |

|

(in thousands) |

|

| Wireless Subscribers: |

|

|

|

|

| Mexico |

|

|

77,789 |

|

|

|

80,539 |

|

| Brazil |

|

|

63,140 |

|

|

|

70,541 |

|

| Colombia |

|

|

33,009 |

|

|

|

35,062 |

|

| Southern Cone |

|

|

30,669 |

|

|

|

33,322 |

|

| Andean Region |

|

|

18,877 |

|

|

|

20,774 |

|

| Central America |

|

|

15,044 |

|

|

|

16,508 |

|

| Caribbean |

|

|

6,422 |

|

|

|

7,020 |

|

| Europe |

|

|

21,864 |

|

|

|

22,766 |

|

|

|

|

|

|

|

|

|

|

| Total Wireless Subscribers |

|

|

266,814 |

|

|

|

286,532 |

|

|

|

|

|

|

|

|

|

|

| Fixed RGUs: |

|

|

|

|

|

|

|

|

| Mexico |

|

|

21,925 |

|

|

|

21,408 |

|

| Brazil |

|

|

32,648 |

|

|

|

31,287 |

|

| Colombia |

|

|

8,318 |

|

|

|

8,876 |

|

| Southern Cone |

|

|

2,836 |

|

|

|

3,349 |

|

| Andean Region |

|

|

2,158 |

|

|

|

2,444 |

|

| Central America |

|

|

4,247 |

|

|

|

4,412 |

|

| Caribbean |

|

|

2,558 |

|

|

|

2,608 |

|

| Europe |

|

|

6,050 |

|

|

|

6,082 |

|

|

|

|

|

|

|

|

|

|

| Total Fixed RGUs |

|

|

80,740 |

|

|

|

80,466 |

|

|

|

|

|

|

|

|

|

|

| Total RGUs |

|

|

347,554 |

|

|

|

366,998 |

|

|

|

|

|

|

|

|

|

|

3

We operate in all of our geographic segments under the Claro brand name, except in Mexico

and Europe, where we principally do business under the brand names listed below.

|

|

|

|

|

| COUNTRY |

|

PRINCIPAL BRANDS |

|

SERVICES AND PRODUCTS |

| Mexico |

|

Telcel |

|

Wireless voice

Wireless data |

|

|

|

|

|

Telmex Infinitum |

|

Fixed voice

Fixed data |

|

|

|

| Europe |

|

A1 |

|

Wireless voice

Wireless data

Fixed voice

Fixed data

Pay TV |

Acquisitions, Other Investments and Divestitures

Geographic diversification has been a key to our financial success, as it has provided for greater stability in our cash flow and profitability

and has contributed to our strong credit ratings. In recent years, we have been evaluating the expansion of our operations to regions outside of Latin America. We believe that Europe and other areas beyond Latin America present opportunities for

investment in the telecommunications sector that could benefit us and our shareholders over the long term.

We continue to seek ways to

optimize our portfolio, including by finding investment opportunities in telecommunications and related companies worldwide, including in markets where we are already present, and we often have several possible acquisitions under consideration. We

may pursue opportunities in Latin America or in other areas in the world. Some of the assets that we acquire may require significant funding for capital expenditures. We can give no assurance as to the extent, timing or cost of such investments. We

also periodically evaluate opportunities for dispositions, in particular for businesses and in geographies that we no longer consider strategic. Recent developments related to acquisitions, other investments and divestitures include:

| |

• |

|

On September 13, 2020, we entered into an agreement to sell our wholly-owned subsidiary TracFone to Verizon.

On November 23, 2021, we completed the sale of TracFone to Verizon. We received the closing consideration of U.S.$3,625.7 million in cash, which included U.S.$500.7 million of customary adjustment for TracFone’s cash and working

capital and 57,596,544 shares of Verizon’s common stock, par value U.S.$0.10 per share. Verizon has asserted post-closing claims under the adjustments and other provisions of this agreement, which may result in payments by us. Subject to

TracFone continuing to achieve certain operating metrics (earn-out), Verizon will be required pay up to an additional U.S.$650 million of cash consideration within two years from November 23, 2021.

|

| |

• |

|

In December 2020, our Brazilian subsidiary, Claro S.A. (“Claro”), together with two other offerors, won

a competitive bid to acquire the mobile business owned by Oi Group in Brazil. Pursuant to the transaction, Claro will pay R$3.6 billion for 32% of Oi Group’s mobile business and approximately 4.7 thousand mobile access sites

(representing 32% of Oi Group’s mobile business access sites). Claro also committed to enter into long term agreements with Oi Group for the supply of data transmission capacity. The closing of the transaction is subject to customary

conditions, including obtaining regulatory approval, and we expect the closing to occur during 2022. |

| |

• |

|

In February 2021, our Board of Directors approved a plan to spin off our telecommunications towers and other

related passive infrastructure in Latin America outside of Mexico. The Sitios Spin-off was approved by our shareholders in an extraordinary shareholders’ meeting on September 29, 2021. In the Sitios Spin-off and the associated corporate restructuring, we will contribute to Sitios a portion of our capital stock, assets and liabilities, mainly consisting of the shares of our subsidiaries holding

telecommunications towers and other associated infrastructure in Latin America outside of Mexico, other than Colombia and our telecommunications towers existing in Peru prior to the Sitios Spin-off. This

operation is intended to maximize the infrastructure’s value, as the resulting entity, Sitios, will be separate from América Móvil and will have its own management and personnel, who will be exclusively focused on developing,

building and leasing telecommunications towers for wireless services. We will have master services agreements with subsidiaries of Sitios under which we will have access to and use of the tower space to provide wireless services. Completion of the

Sitios Spin-off is subject to the fulfillment of conditions that are typical in these type of transactions, as well as the implementation of several previous steps in several of the countries involved in the

transaction, including receipt of confirmation from the Mexican Tax Administration Service (Servicio de Administración Tributaria) that the Sitios Spin-off and the transactions contemplated

thereby, among other things, comply with all requirements under Mexican tax law and regulations so that the Sitios Spin-off and the corporate reorganization arising from it are considered neutral for Mexican

tax purposes, and the receipt of all necessary approvals in the applicable countries and the expiration of all legal or statutory waiting periods for its effectiveness in all applicable countries, all of which are outside of our control.

|

4

| |

• |

|

On September 15, 2021, we announced that we entered into an agreement with Cable & Wireless Panama,

S.A., an affiliate of Liberty Latin America LTD., to sell 100% of our interest in our subsidiary Claro Panama, S.A. The transaction excludes (i) all telecommunication towers owned indirectly by América Móvil in Panama and

(ii) the Claro trademarks. The agreed purchase price is U.S.$200 million on a cash/debt free basis. The closing of the transaction is subject to customary conditions for this type of transactions, including obtaining required governmental

approvals, and we expect closing to occur during first half of 2022. |

| |

• |

|

On September 29, 2021, we announced an agreement with Liberty Latin America LTD. to combine our respective

Chilean operations, VTR and Claro Chile, to form a 50-50 joint venture. The proposed transaction combines the complementary operations of VTR, a leading provider of high-speed consumer fixed products, such as

broadband and Pay TV services, where it connects close to 3 million subscribers nationwide, and Claro Chile, one of Chile’s leading telecommunications service providers with over 6.5 million mobile customers. Completion of the

transaction is subject to certain customary closing conditions, including obtaining required regulatory approvals, and we expect closing to occur during the second half of 2022. |

Effects of the COVID-19 Pandemic

The unprecedented health crisis arising from the COVID-19 pandemic has resulted in a severe global

economic downturn and has caused significant volatility, uncertainty, and disruption. We continue to monitor the evolution of the COVID-19 pandemic in the countries where we operate to take preventive measures

to ensure the continuity of operations and safeguard the health and safety of our personnel and customers.

During 2021, there were

lockdowns and other measures implemented to control the spread of COVID-19 in our region of operations, resulting in the closure of shops and customer-care centers, the imposition of constraints on the

mobility of our clients and the disruption of our supply chain for handsets and other equipment. In order to mitigate the effects of supply-chain disruption and handset scarcity, we began ordering excess quantities of handsets in each country in

which we operate in October, November and December of 2021. Most major smartphone manufacturers were able to respond to our increased handset orders.

Our investments in capital expenditures are expected to return to pre-pandemic levels in 2022.

5

OPERATING AND FINANCIAL REVIEW AS OF DECEMBER 31, 2021,

AND FOR THE YEARS ENDED DECEMBER 31, 2020 AND 2021

The following is a summary and discussion of our unaudited preliminary consolidated financial information as of December 31, 2021 and

unaudited preliminary consolidated results of operations for the year ended December 31, 2021. For comparative purposes, the tables include financial information as of and for the year ended December 31, 2020. The following tables and

discussion should be read in conjunction with our audited annual consolidated financial statements as of and for the year ended December 31, 2020, which are included in our 2020 Form 20-F.

Our consolidated financial statements as of and for the year ended December 31, 2021 are not yet available, and the independent audit of

those financial statements has not yet been completed. The unaudited preliminary financial information as of and for the year ended December 31, 2021, presented below, is preliminary and subject to change as we complete our financial closing

procedures and prepare our consolidated financial statements for publication, and as our independent registered public accounting firm completes its audit of such consolidated financial statements. As of the date of this report on Form 6-K, our independent registered public accounting firm has not expressed an opinion or any other form of assurance on any financial information as of or for the year ended December 31, 2021, or on our internal

control over financial reporting as of December 31, 2021. Our audited consolidated financial statements may differ materially from this preliminary information and will also include notes providing extensive additional disclosures.

6

Condensed Consolidated Financial Data of América Móvil

The following tables set forth our preliminary unaudited consolidated financial information for the year ended December 31, 2021 and as

of December 31, 2021, as well as our audited consolidated financial information for the year ended December 31, 2020 and as of December 31, 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the year ended December 31, |

|

| |

|

2020 |

|

|

2021 |

|

| |

|

|

|

|

|

|

| |

|

(in millions of Mexican pesos) |

|

|

(in millions of U.S.

dollars) |

|

| |

|

(audited) |

|

|

(unaudited preliminary) |

|

| Income Statement Data |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| Service revenues |

|

Ps. |

708,484 |

|

|

|

Ps. 714,244 |

|

|

U.S.$ |

34,700 |

|

| Sales of equipment |

|

|

131,223 |

|

|

|

141,290 |

|

|

|

6,864 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating revenues |

|

|

839,707 |

|

|

|

855,534 |

|

|

|

41,564 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales and services |

|

|

334,882 |

|

|

|

341,060 |

|

|

|

16,570 |

|

| Commercial, administrative and general expenses |

|

|

191,902 |

|

|

|

180,838 |

|

|

|

8,786 |

|

| Other expenses |

|

|

4,738 |

|

|

|

4,877 |

|

|

|

237 |

|

| Depreciation and amortization |

|

|

162,682 |

|

|

|

162,627 |

|

|

|

7,901 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

|

|

694,204 |

|

|

|

689,402 |

|

|

|

33,494 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

145,503 |

|

|

|

166,132 |

|

|

|

8,070 |

|

| Interest income |

|

|

5,062 |

|

|

|

3,835 |

|

|

|

186 |

|

| Interest expense |

|

|

(38,661 |

) |

|

|

(36,025 |

) |

|

|

(1,750 |

) |

| Foreign currency exchange loss, net |

|

|

(65,366 |

) |

|

|

(17,046 |

) |

|

|

(828 |

) |

| Valuation of derivatives, interest cost from labor obligations and other financial items,

net |

|

|

1,293 |

|

|

|

(14,250 |

) |

|

|

(692 |

) |

| Equity interest in net losses of associated companies |

|

|

(287 |

) |

|

|

114 |

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit before income tax |

|

|

47,544 |

|

|

|

102,760 |

|

|

|

4,992 |

|

| Income tax |

|

|

13,509 |

|

|

|

28,145 |

|

|

|

1,367 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit for the period continuing |

|

|

34,035 |

|

|

|

74,615 |

|

|

|

3,625 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit for the period discontinued |

|

|

16,992 |

|

|

|

125,313 |

|

|

|

6,088 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit for the period |

|

Ps. |

51,027 |

|

|

|

Ps.199,928 |

|

|

U.S.$ |

9,713 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit for the period attributable to: |

|

|

|

|

|

|

|

|

| Equity holders of the parent continuing |

|

|

29,861 |

|

|

|

70,712 |

|

|

|

3,435 |

|

| Equity holders of the parent discontinued |

|

|

16,992 |

|

|

|

125,313 |

|

|

|

6,088 |

|

| Non-controlling interests |

|

|

4,174 |

|

|

|

3,903 |

|

|

|

190 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ps. |

51,027 |

|

|

|

Ps.199,928 |

|

|

U.S.$ |

9,713 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At December 31, |

|

| |

|

2020 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(in millions of Mexican pesos) |

|

|

(in millions of U.S.

dollars) |

|

| |

|

(audited) |

|

|

(unaudited preliminary) |

|

| Balance Sheet Data |

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

Ps. |

355,683 |

|

|

Ps. |

404,157 |

|

|

U.S.$ |

19,635 |

|

| Total non-current assets |

|

|

1,269,365 |

|

|

|

1,283,949 |

|

|

|

62,378 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

1,625,048 |

|

|

|

1,688,106 |

|

|

|

82,013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

507,311 |

|

|

|

528,867 |

|

|

|

25,694 |

|

| Long-term debt |

|

|

480,300 |

|

|

|

418,809 |

|

|

|

20,348 |

|

| Derivative financial instruments |

|

|

84,259 |

|

|

|

71,022 |

|

|

|

3,450 |

|

| Deferred income taxes |

|

|

49,067 |

|

|

|

49,465 |

|

|

|

2,403 |

|

| Deferred revenues |

|

|

2,875 |

|

|

|

2,698 |

|

|

|

131 |

|

| Asset retirement obligation |

|

|

17,888 |

|

|

|

16,752 |

|

|

|

814 |

|

| Employee benefits |

|

|

168,230 |

|

|

|

142,850 |

|

|

|

6,940 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

1,309,930 |

|

|

|

1,230,463 |

|

|

|

59,780 |

|

| Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

| Capital stock |

|

|

96,342 |

|

|

|

96,333 |

|

|

|

4,680 |

|

| Retained earnings: |

|

|

— |

|

|

|

— |

|

|

|

|

|

| Prior year |

|

|

267,865 |

|

|

|

255,267 |

|

|

|

12,402 |

|

| Profit for the year |

|

|

46,853 |

|

|

|

196,025 |

|

|

|

9,523 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total retained earnings |

|

|

314,718 |

|

|

|

451,292 |

|

|

|

21,925 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive loss items |

|

|

(160,581 |

) |

|

|

(154,389 |

) |

|

|

(7,501 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity attributable to equity holders of the parent |

|

|

250,479 |

|

|

|

393,236 |

|

|

|

19,104 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-controlling interests |

|

|

64,639 |

|

|

|

64,407 |

|

|

|

3,129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

315,118 |

|

|

|

457,643 |

|

|

|

22,233 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

Ps. |

1,625,048 |

|

|

Ps. |

1,688,106 |

|

|

U.S.$ |

82,013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Results of Operations for the Years Ended December 31, 2020 and 2021

Our financial statements are presented in Mexican pesos, but our operations outside Mexico account for a significant portion of our revenues.

Currency variations between the Mexican peso and the currencies of our non-Mexican subsidiaries, especially the euro, U.S. dollar, Brazilian real, Colombian and Argentine peso, affect our results of operations

as reported in Mexican pesos. In the following discussion regarding our results, we include a discussion of the change in the different components of our revenues between periods at constant exchange rates, i.e., using the same exchange rate to

translate the local-currency results of our non-Mexican operations for both periods. We believe that this additional information helps investors better understand the

performance of our non-Mexican operations and their contribution to our consolidated results.

On

November 23, 2021, we completed the sale of our U.S. operations to Verizon as previously disclosed in our press release filed on a report on Form 6-K on November 23, 2021. As a result, in accordance

with IFRS 5, TracFone’s operations are classified as discontinued operations for all years presented in the consolidated financial information included in this report. Accordingly, results are presented in a single amount as profit after tax

from discontinued operations in the consolidated financial information included in this report. Operating and financial information presented herein therefore excludes Tracfone, including for periods prior to the sale.

Operating Revenues

Total

operating revenues for 2021 increased by 1.9%, or Ps.15.8 billion, over 2020. At constant exchange rates, total operating revenues for 2021 increased by 7.8% over 2020. This increase principally reflects an increase in one-off items including the impact of the sale of towers by our subsidiary Teléfonos de México, S.A.B. de C.V. and an increase in equipment sales and handset financing revenues, partially offset by a

decrease in Pay TV service revenues.

Service Revenues – Service revenues for 2021 increased by 0.8%, or Ps.5.8 billion,

over 2020. At constant exchange rates, service revenues for 2021 increased by 6.8% over 2020. This increase principally reflects increases in revenues from our postpaid mobile services, fixed broadband and corporate networks, which were partially

offset by a decrease in revenues from our Pay TV services.

8

Sales of Equipment – Sales of equipment revenues for 2021 increased by 7.7%, or

Ps.10.1 billion, over 2020. At constant exchange rates, sales of equipment revenues for 2021 increased by 12.8% over 2020. This increase principally reflects higher sales of smartphones, data-enabled devices and accessories.

Operating Costs and Expenses

Total operating costs and expenses for 2021 decreased by 0.9%, or Ps.4.7 billion, over 2020. At constant exchange rates, total operating

costs and expenses for 2021 increased by 4.9% over 2020. This increase in operating costs and expenses at constant exchange rates principally reflects increased network maintenance, infrastructure, lease space and electric energy costs and certain one-off items, including a write-off of certain uncollectible accounts.

Cost of Sales and Services – Cost of sales and services increased by 1.8%, or Ps.6.2 billion, over 2020. At constant exchange

rates, cost of sales and services for 2021 increased by 7.3% over 2020. This increase principally reflects an increase in sales of higher-end smartphones and handset financing plans as well as increased

network maintenance, infrastructure, lease space and electricity costs. This increase, which was also due to inflationary pressures, was partially offset by the success of our continued cost savings program.

Commercial, Administrative and General Expenses – Commercial, administrative and general expenses for 2021 decreased by 5.8%, or

Ps.11.1 billion, over 2020. As a percentage of operating revenues, commercial, administrative and general expenses were 21.1% for 2021, as compared to 22.9% for 2020. At constant exchange rates, commercial, administrative and general expenses

for 2021 increased by 0.7% over 2020. This increase principally reflects one-off items, including a write-off of certain uncollectible accounts, which decreased our

balance of expenditures.

Other Expenses – Other expenses for 2021 increased by Ps.0.1 billion over 2020.

Depreciation and Amortization – Depreciation and amortization for 2021 decreased by 0.03%, or Ps.0.1 billion, over 2020. As a

percentage of operating revenues, depreciation and amortization were 19.0% for 2021, as compared to 19.4% for 2020. At constant exchange rates, depreciation and amortization for 2021 increased by 8.5% over 2020. This increase principally reflects

depreciation and amortization expenses resulting from the revaluation of the passive infrastructure of the telecommunications towers, which became effective as of December 31, 2020.

Operating Income

Operating income

for 2021 increased by 14.2%, or Ps.20.6 billion, over 2020. Operating margin (operating income as a percentage of operating revenues) was 19.4% for 2021, as compared to 17.3% for 2020.

Non-Operating Items

Net Interest Expense – Net interest expense (interest expense less interest income) for 2021 decreased by 4.2%, or

Ps.1.4 billion, over 2020. This decrease principally reflects a decrease in interest expense on lease liabilities and a decrease in interest on debt.

Foreign Currency Exchange Loss, Net – We recorded a net foreign currency exchange loss of Ps.17.0 billion for 2021, compared

to our net foreign currency exchange loss of Ps.65.4 billion for 2020. The loss principally reflects the appreciation of some of the currencies in which our indebtedness is denominated, particularly the euro and the U.S. dollar.

Valuation of Derivatives, Interest Cost From Labor Obligations and Other Financial Items, Net – We recorded a net loss of

Ps.14.3 billion for 2021 on the valuation of derivatives, interest cost from labor obligations and other financial items, net, compared to a net gain of Ps.1.3 billion for 2020. The change in 2021 principally reflects a loss on hedging

instruments as a result of the depreciation of some of the currencies in which our indebtedness is denominated.

Income Tax –

Our income tax expense related to continuing operations for 2021 increased by 108.3%, or Ps.14.6 billion, over 2020. This increase principally reflects higher profit before income tax due to a decrease in our net foreign currency exchange loss

of Ps.48.3 billion compared to 2020.

Our income tax expense related to discontinued operations for 2021 resulted from the sale of

100% of our ownership in TracFone as described above.

Our effective corporate income tax rate as a percentage of profit before income tax

was 22.7% for 2021, compared to 24.3% for 2020. This rate differed from the Mexican statutory rate of 30.0% and changed year over year principally due to our discontinued operations, local tax inflation effects and registry of benefits related to

tax losses credits in Brazil and Chile and impairment related to subsidiaries in Europe, which lowered our income tax expense and our effective corporate income tax for 2021.

9

Net Profit

We recorded a net profit of our continuing operations of Ps.74.6 billion for 2021, an increase of 119.2%, or Ps.40.6 billion over

2020.

The net profit obtained through both the operation of TracFone until its sale on November 23, 2021 and the sale itself is

classified as net profit for the period discontinued, which totaled Ps.125.3 billion in 2021. Together with the net income of our continuing operations, in 2021, we recorded a net profit of Ps.199.9 billion, compared to

Ps.51.0 billion in 2020.

Segment Results of Operations for the Years Ended December 31, 2020 and 2021

The following table sets forth the exchange rates used to translate the results of our significant

non-Mexican operations, as expressed in Mexican pesos per foreign currency unit, and the change from the rate used in the prior period indicated. The U.S. dollar is our functional currency in several of the

countries or territories in which we operate, including Ecuador, Puerto Rico, Panama and El Salvador.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Mexican pesos

per foreign currency unit

(average for the period)

for the

years ended December 31, |

|

|

|

|

| |

|

2020 |

|

|

2021 |

|

|

% Change |

|

| Brazilian real |

|

|

4.1850 |

|

|

|

3.7625 |

|

|

|

(10.1 |

) |

| Colombian peso |

|

|

0.0058 |

|

|

|

0.0054 |

|

|

|

(7.1 |

) |

| Argentine peso |

|

|

0.3070 |

|

|

|

0.2137 |

|

|

|

(30.4 |

) |

| U.S. dollar |

|

|

21.4859 |

|

|

|

20.2768 |

|

|

|

(5.6 |

) |

| Euro |

|

|

24.5080 |

|

|

|

23.9834 |

|

|

|

(2.1 |

) |

The tables below set forth operating revenues and operating income for each of our segments for the periods

indicated.

|

|

|

|

|

|

|

|

|

| |

|

For the Year ended December 31, 2020 |

|

| |

|

Operating

revenues |

|

|

Operating

income (loss) |

|

| |

|

|

|

|

|

|

| |

|

(in millions of Mexican Pesos)

(audited) |

|

| Mexico Wireless |

|

Ps. |

232,242 |

|

|

Ps. |

70,852 |

|

| Mexico Fixed |

|

|

91,589 |

|

|

|

11,204 |

|

| Brazil |

|

|

168,073 |

|

|

|

25,204 |

|

| Colombia |

|

|

77,635 |

|

|

|

15,112 |

|

| Southern Cone |

|

|

56,705 |

|

|

|

1,877 |

|

| Andean Region |

|

|

53,935 |

|

|

|

8,699 |

|

| Central America |

|

|

48,195 |

|

|

|

4,005 |

|

| Caribbean |

|

|

38,624 |

|

|

|

6,701 |

|

| Europe |

|

|

111,472 |

|

|

|

13,160 |

|

| Eliminations |

|

|

(38,763 |

) |

|

|

(11,311 |

) |

|

|

|

|

|

|

|

|

|

| Total |

|

Ps. |

839,707 |

|

|

Ps. |

145,503 |

|

|

|

|

|

|

|

|

|

|

10

|

|

|

|

|

|

|

|

|

| |

|

For the Year ended December 31, 2021 |

|

| |

|

Operating

revenues |

|

|

Operating

income |

|

| |

|

|

|

|

|

|

| |

|

(in millions of Mexican Pesos)

(unaudited) |

|

| Mexico Wireless |

|

Ps. |

243,261 |

|

|

Ps. |

77,784 |

|

| Mexico Fixed |

|

|

102,427 |

|

|

|

21,100 |

|

| Brazil |

|

|

152,774 |

|

|

|

21,867 |

|

| Colombia |

|

|

79,673 |

|

|

|

15,165 |

|

| Southern Cone |

|

|

62,359 |

|

|

|

2,145 |

|

| Andean Region |

|

|

52,962 |

|

|

|

7,458 |

|

| Central America |

|

|

48,567 |

|

|

|

8,217 |

|

| Caribbean |

|

|

39,929 |

|

|

|

8,661 |

|

| Europe |

|

|

113,838 |

|

|

|

13,421 |

|

| Eliminations |

|

|

(40,256 |

) |

|

|

(9,686 |

) |

|

|

|

|

|

|

|

|

|

| Total |

|

Ps. |

855,534 |

|

|

Ps. |

166,132 |

|

|

|

|

|

|

|

|

|

|

11

Interperiod Segment Comparisons

The following discussion addresses the financial performance of each of our reportable segments by comparing results for 2021 and 2020. In the year-to-year comparisons for each segment, we include percentage changes in operating revenues, percentage changes in operating income and operating margin (operating income

as a percentage of operating revenues).

Each reportable segment includes all income, cost and expense eliminations that occurred between

subsidiaries within the reportable segment. The Mexico Wireless segment also includes corporate income, costs and expenses.

Comparisons

in the following discussion are calculated using figures in Mexican pesos. We also include percentage changes in adjusted segment operating revenues, adjusted segment operating income and adjusted operating margin (adjusted operating income as a

percentage of adjusted operating revenues). The adjustments eliminate (i) certain intersegment transactions, (ii) for our non-Mexican segments, the effects of exchange rate changes and (iii) for

the Mexican Wireless segment only, revenues and costs of group corporate activities and other businesses that are allocated to the Mexico Wireless segment.

Mexico Wireless

The number of

prepaid wireless subscribers for 2021 increased by 4.3% over 2020, and the number of postpaid wireless subscribers increased by 0.1%, resulting in an increase in the total number of wireless subscribers in Mexico of 3.5%, or 2.7 million, to

approximately 80.5 million as of December 31, 2021.

Segment operating revenues for 2021 increased by 4.7% over 2020. Adjusted

segment operating revenues for 2021 increased by 5.0% over 2020. This increase in segment operating revenues principally reflects an increase in prepaid, postpaid and equipment sales and handset financing plans.

Segment operating margin was 32.0% in 2021, as compared to 30.5% in 2020. Adjusted segment operating margin for this segment was 39.1% in

2021, as compared to 36.7% in 2020. This increase in segment operating margin for 2021 principally reflects the success of our corporate cost savings program in operations, optimization in networks and maintenance costs, which we successfully

continue to implement without affecting the quality of our services and coverage.

Mexico Fixed

The number of fixed voice RGUs in Mexico for 2021 decreased by 4.6% over 2020, and the number of broadband RGUs in Mexico increased by 0.3%,

resulting in a decrease in total fixed RGUs in Mexico of 2.4% over 2020, or 517 thousand, to approximately 21.4 million as of December 31, 2021.

Segment operating revenues for 2021 increased by 11.8% over 2020. Adjusted segment operating revenues for 2021 increased by 11.9% over 2020.

This increase in segment operating revenues principally reflects an increase in corporate networks services by 2.8% and broadband by 3.2%, which was partially offset by a decrease in fixed voice revenues of 2.6%.

Segment operating income for 2021 increased by 88.3% over 2020. Adjusted segment operating income for 2021 increased by 298.2% over 2020. This

increase principally reflects an increase in services provided and one-off revenue due to the sale of towers, partially set off by increases in the contractual salary of our employees and higher information

technology and customer service costs.

Segment operating margin was 20.6% in 2021, as compared to 12.2% in 2020. Adjusted segment

operating margin was 10.6% in 2021, as compared to 3.0% in 2020. The increase in segment operating margin for 2021 principally reflects an increase in revenues from voice services, partially offset by a decrease in segment depreciation expenses.

Brazil

The number of prepaid

wireless subscribers for 2021 increased by 6.0% over 2020, and the number of postpaid wireless subscribers increased by 16.2%, resulting in an increase in the total number of wireless subscribers in Brazil of 11.7%, or 7.4 million, to

approximately 70.5 million as of December 31, 2021. The increase in the number of postpaid wireless subscribers is due primarily to commercial efforts aimed at converting prepaid subscribers to postpaid subscribers. The number of fixed

voice RGUs for 2021 decreased by 5.7% over 2020, the number of broadband RGUs decreased by 1.2%, and the number of Pay TV RGUs decreased by 5.3%, resulting in a decrease in total fixed RGUs in Brazil of 4.2%, or 1.4 million, to approximately

31.3 million as of December 31, 2021.

12

Segment operating revenues for 2021 decreased by 9.1% over 2020. Adjusted segment operating

revenues for 2021 increased by 0.9% over 2020. This increase in segment operating revenues principally reflects higher mobile data and fixed data revenues in 2021 over 2020. The increase in mobile data revenues in 2021 principally reflects the

increased usage of social networking platforms, cloud services and other content, and fixed data revenues increased principally due to an increase in broadband revenues, which were, in each case, partially offset by a decrease in Pay TV revenues.

Segment operating income for 2021 decreased by 13.2% over 2020. Adjusted segment operating income for 2021 increased by 4.5% over 2020.

Segment operating margin was 14.3% in 2021, as compared to 15.0% in 2020. Adjusted segment operating margin was 14.6% in 2021, as

compared to 14.1% in 2020. This increase in segment operating margin for 2021 principally reflects an increase in doubtful accounts allowances and optimization of call centers, mainly as a result of our cost savings program.

Colombia

The number of prepaid

wireless subscribers for 2021 increased by 4.2% over 2020, and the number of postpaid wireless subscribers increased by 12.7%, resulting in an increase in the total number of wireless subscribers in Colombia of 6.2%, or 2.0 million, to

approximately 35.1 million as of December 31, 2021. The number of fixed voice RGUs for 2021 increased by 8.5% over 2020, the number of broadband RGUs increased by 6.4% and the number of Pay TV RGUs increased by 5.5%, resulting in an

increase in total fixed RGUs in Colombia of 6.7%, or 558 thousand, to approximately 8.9 million as of December 31, 2021.

Segment operating revenues for 2021 increased by 2.6% over 2020. Adjusted segment operating revenues for 2021 increased by 10.0% over 2020.

This increase in segment operating revenues principally reflects increase in fixed data revenues, mobile data revenues, both in prepaid and postpaid mobile data, and Pay TV revenues.

Segment operating income for 2021 increased by 0.4% over 2020. Adjusted segment operating income for 2021 increased by 16.2% over 2020.

Segment operating margin was 19.0% in 2021, as compared to 19.5% in 2020. Adjusted segment operating margin was 26.1% in 2021, as compared to

24.7% in 2020. This increase is due to an amortization expenses caused by investments in spectrum and submarine cables.

Southern

Cone—Argentina, Chile, Paraguay and Uruguay

The number of prepaid wireless subscribers for 2021 increased by 9.0% over 2020,

and the number of postpaid wireless subscribers increased by 8.1%, resulting in an increase in the total number of wireless subscribers in our Southern Cone segment of 8.7%, or 2.7 million, to approximately 33.3 million as of

December 31, 2021. The number of fixed voice RGUs for 2021 increased by 22.7% over 2020, the number of broadband RGUs increased by 23.4%, and the number of Pay TV RGUs increased by 6.6%, resulting in an increase in total fixed RGUs in our

Southern Cone segment of 18.1%, or 513 thousand, to approximately 3.3 million as of December 31, 2021.

Segment operating

revenues for 2021 increased by 10.0% over 2020. Adjusted segment operating revenues for 2021 decreased by 1.6% over 2020. This decrease principally reflects a decrease in adjusted operating revenues in Argentina and Paraguay. In Argentina, we

experienced a decrease in revenues from prepaid and postpaid wireless voice and corporate networks, which were attributable to adverse economic conditions and which were partially offset by an increase in broadband, fixed voice and Pay TV. In Chile,

we experienced an increase in postpaid and Pay TV revenues. For this segment, we analyze results in Argentina, Paraguay and Uruguay in terms of the Argentine peso, because Argentina accounts for the major portion of the operations in these three

countries.

Segment operating income for 2021 increased by 14.3% over 2020. Adjusted segment operating income for 2021 increased by 1.3%

over 2020.

Segment operating margin was 3.4% in 2021, as compared to 3.3% in 2020. Adjusted segment operating margin was 17.4% in 2021,

as compared to 15.7% in 2020. This increase in the segment operating margin for 2021 principally reflects a decrease in revenues, as described above, coupled with a decrease in costs and expenses, including as a result of inflation or exchange

rates.

13

Andean Region—Ecuador and Peru

The number of prepaid wireless subscribers for 2021 increased by 7.3% over 2020, and the number of postpaid wireless subscribers increased by

15.7%, resulting in an increase in the total number of wireless subscribers in our Andean Region segment of 10.0%, or 1.9 million, to approximately 21.0 million as of December 31, 2021. The number of fixed voice RGUs for 2021

increased by 13.6% over 2020, the number of broadband RGUs increased by 15.6% and the number of Pay TV RGUs increased by 4.0%, resulting in an increase in total fixed RGUs in our Andean Region segment of 13.2%, or 286 thousand, to approximately

2.5 million as of December 31, 2021.

Segment operating revenues for 2021 decreased by 1.8% over 2020. Adjusted segment

operating revenues for 2021 increased by 11.0% over 2020. This increase principally reflects an increase in revenues in Peru, partially offset by a decrease in Ecuador. The increase in revenues in Peru reflects an increase in revenues from prepaid

and postpaid wireless, broadband, corporate networks, fixed voice and Pay TV services. The decrease in revenues in Ecuador reflects a decrease in revenues from postpaid mobile.

Segment operating income for 2021 decreased by 14.3% over 2020. Adjusted segment operating income for 2021 increased by 17.1% over 2020. This

increase principally reflects an operating income increase of 55.9% in Peru partially offset by a decrease of 10.2% in Ecuador.

Segment

operating margin was 14.1% in 2021, as compared to 16.1% in 2020. Adjusted segment operating margin was 19.6% in 2021, as compared to 18.4% in 2020. This increase in the segment operating margin for 2021 principally reflects a recovery in Peru,

partially offset by a decrease in operating income in Ecuador.

Central America—Guatemala, El Salvador, Honduras, Nicaragua, Panama and Costa

Rica

The number of prepaid wireless subscribers for 2021 increase by 10.7% over 2020, and the number of postpaid wireless

subscribers increased by 4.4%, resulting in an increase in the total number of wireless subscribers in our Central America segment of 9.7%, or 1.5 million, to approximately 16.5 million as of December 31, 2021. The number of fixed

voice RGUs for 2021 decreased by 2.1% over 2020, the number of broadband RGUs increased by 7.1%, and the number of Pay TV RGUs increased by 10.6%, resulting in an increase in total fixed RGUs in our Central America segment of 3.9%, or

165 thousand, to approximately 4.4 million as of December 31, 2021.

Segment operating revenues for 2021 increased by 0.8%

over 2020. Adjusted segment operating revenues for 2021 increased by 6.5% over 2020.

Segment operating income for 2021 increased by

105.2% over 2020. Adjusted segment operating income for 2021 increased by 102.2% over 2020. This increase in segment operating income for 2021 principally reflects a decrease in depreciation expenses as a result of the exhaustion of the useful life

of certain assets in Guatemala in 2021 and the recognition of asset impairment in Panama and Honduras in the prior year, which was not recognized in 2021.

Segment operating margin was 16.9% in 2021, as compared to 8.3% in 2020. Adjusted segment operating margin was 19.1% in 2021, as compared to

10.1% in 2020. This increase in segment operating margin for 2021 principally reflects an increase in income, particularly in El Salvador, Honduras, Guatemala, Nicaragua and Costa Rica.

Caribbean—The Dominican Republic and Puerto Rico

The number of prepaid wireless subscribers for 2021 increased by 12.1% over 2020, and the number of postpaid wireless subscribers increased by

3.3%, resulting in an increase in the total number of wireless subscribers in our Caribbean segment of 9.3%, or 600 thousand, to approximately 7.0 million as of December 31, 2021. The number of fixed voice RGUs for 2021 decreased by

1.2% over 2020, the number of broadband RGUs increased by 4.6% and the number of Pay TV RGUs increased by 5.3%, resulting in an increase in total fixed RGUs in our Caribbean segment of 1.9%, or 50 thousand, to approximately 2.6 million as

of December 31, 2021.

Segment operating revenues for 2021 increased by 3.4% over 2020. Adjusted segment operating revenues for 2021

increased by 7.5% over 2020. This increase in segment operating revenues principally reflects increase in operating revenues in Puerto Rico and the Dominican Republic. We analyze segment results in U.S. dollars because it is the functional currency

of our operations in Puerto Rico.

Segment operating income for 2021 increased by 29.2% over 2020. Adjusted segment operating income for

2021 increased by 32.4% over 2020. This increase principally reflects an increase of 34.3% in Puerto Rico and 22.4% in the the Dominican Republic.

Segment operating margin was 21.7% in 2021, as compared to 17.3% in 2020. Adjusted segment operating margin was 18.4% in 2021, as compared to

14.9% in 2020. This increase in segment operating margin for 2021 principally reflects an increase in service revenues in Puerto Rico in postpaid and Pay TV and in the Dominican Republic, driven by broadband and fixed data services, and the effects

of the cost savings program, partially offset by the depreciation of the Dominican Peso.

14

Europe

The number of prepaid wireless subscribers for 2021 decreased by 4.1% over 2020, and the number of postpaid wireless subscribers increased by

6.0%, resulting in an increase in the total number of wireless subscribers in our Europe segment of 4.1%, or 901 thousand, to approximately 22.8 million as of December 31, 2021. The number of fixed voice RGUs for 2021 decreased by

1.7% over 2020, the number of broadband RGUs increased by 1.8% and the number of Pay TV RGUs increased by 1.1%, resulting in an increase in total fixed RGUs in our Europe segment of 0.5%, or 31 thousand, to approximately 6.0 million as of

December 31, 2021.

Segment operating revenues for 2021 increased by 2.1% over 2020. Adjusted segment operating revenues for 2021

increased by 4.4% over 2020. This increase in segment operating revenues principally reflects an increase in mobile services.

Segment

operating income for 2021 increased by 2.0% over 2020. Adjusted segment operating income for 2021 increased by 21.5% over 2020. Segment operating margin was 11.8% in 2021, the same as in 2020. Adjusted segment operating margin was 13.6% in 2021, as

compared to 11.7% in 2020. This increase in segment operating margin for 2021 principally reflects our corporate cost savings program and improved performance in all the countries in our Europe segment.

Liquidity and Capital Resources

Management defines net debt as total debt minus cash and cash equivalents, minus marketable securities (including Koninklijke KPN N.V.

(“KPN”) shares and Verizon shares), other short term investments and fixed-income securities with a tenor of more than one year. Verizon shares are factored into calculations of net debt for information as of December 31, 2021, but

are not factored into calculations of net debt for information as of December 31, 2020. As of December 31, 2021, we had net debt of Ps.400.8 billion, compared to Ps.537.8 billion as of December 31, 2020.

Without taking into account the effects of derivative financial instruments that we use to manage our interest rate and currency risk,

approximately 84.8% of our indebtedness at December 31, 2021 was denominated in currencies other than Mexican pesos (approximately 36.4% of such non-Mexican peso debt was in U.S. dollars and 63.6% in

other currencies), and approximately 13.5% of our consolidated debt obligations bore interest at floating rates. After the effects of derivative transactions and excluding the debt of Telekom Austria AG, approximately 46.3% of our net debt as of

December 31, 2021 was denominated in Mexican pesos.

The maturities of our long-term debt as

of December 31, 2021 were as follows:

|

|

|

|

|

| Years |

|

Amount |

|

| |

|

(in millions of

Mexican pesos) |

|

| 2023 |

|

Ps. |

24,599,324 |

|

| 2024 |

|

|

80,031,350 |

|

| 2025 |

|

|

5,292,314 |

|

| 2026 |

|

|

31,497,974 |

|

| 2027 and thereafter |

|

|

277,386,468 |

|

|

|

|

|

|

| Total |

|

Ps. |

418,807,430 |

|

|

|

|

|

|

We regularly assess our interest rate and currency exchange exposures in order to determine how to manage the

risk associated with these exposures. We have indebtedness denominated in currencies other than the currency of our operating environments, and we have expenses for operations and for capital expenditures in a variety of currencies. We use

derivatives to manage the resulting exchange rate and interest rate exposures. We do not use derivatives to hedge the exchange rate exposures that arise from having operations in different countries. Our practices vary from time to time depending on

our judgment of the level of risk, expectations as to exchange rate or interest rate movements and the costs of using derivative financial instruments. We may stop using derivative financial instruments or modify our practices at any time. As of

December 31, 2021, the net fair value of our derivatives and other financial items was a net asset of Ps.0.1 billion.

During

2021, we used approximately Ps.158.7 billion to fund capital expenditures. We have also continued to repurchase shares of our capital stock under our share repurchase program. During 2021, we repurchased approximately 2,173 million Series

L shares for an aggregate purchase price of Ps.36.8 billion.

15

RECENT DEVELOPMENTS

The information presented below summarizes certain recent developments since the filing of our 2020 Form

20-F on April 29, 2021.

ICSID Award

In May 2021, a Tribunal from the International Center for Settlement of Investment Disputes (“ICSID”) issued an award in the

arbitration proceeding initiated in August 2016 against the Republic of Colombia (“Colombia”) pursuant to the Free Trade Agreement between Mexico and Colombia (the “FTA”).

The ICSID Tribunal held that certain measures adopted by Colombia in relation with the concessions terminated in 2013 by our subsidiary,

Comunicación Celular, S.A. (“COMCEL”), did not represent an expropriation of our investments in COMCEL in violation of the FTA, and ordered us to pay approximately U.S.$2.2 million corresponding to costs of the arbitration

proceeding.

IFT Resolution Lifting Price Regulation

In August 2021, our subsidiaries Red Nacional Última Milla, S.A.P.I. de C.V. and Red Última Milla del Noroeste, S.A.P.I. de C.V.

(jointly “Red Nacional”), received a resolution issued by the Federal Telecommunications Institute (“IFT”), lifting price regulation on access to the local loop in 52 municipalities.

Red Nacional initiated operations in March 2020 as a result of the functional separation of Teléfonos de México, S.A.B. de C.V.

and Teléfonos del Noroeste, S.A. de C.V. (jointly “Telmex”) ordered by the IFT. Red Nacional provides wholesale services to all service providers in the same terms that it provides such services to Telmex and other of its

affiliates. Red Nacional’s board of directors, management and personnel are independent from Telmex.

Agreement to Sell Claro Panama to

Cable & Wireless Panama

In September 2021, we entered into an agreement with Cable & Wireless Panama, S.A. an

affiliate of Liberty Latin America LTD. (“LLA”), to sell our 100% interest in our subsidiary Claro Panama, S.A. The transaction excludes (i) all telecommunication towers owned indirectly by América Móvil in Panama and

(ii) the Claro trademarks. The agreed purchase price is U.S.$200 million on a cash/debt free basis. The closing of the transaction is subject to customary conditions for this type of transactions, including obtaining required governmental

approvals. Parties expect the closing to occur during first half of 2022.

Agreement to Create a Joint Venture in Chile with Liberty Latin America

In September 2021, we entered into an agreement with LLA to combine our respective Chilean operations, Claro Chile and VTR, to

form a 50:50 joint venture. Pursuant to the agreement, LLA made a commitment to contribute a business with net debt of CLP 1,095 billion (U.S.$1.5 billion) and we made a commitment to contribute a business with net debt of CLP 259 billion

(U.S.$0.4 billion). In addition, LLA will make a balancing payment to us of CLP 73 billion (U.S.$0.1 billion). The proposed transaction combines the complementary operations of VTR, a leading provider of high-speed consumer fixed products, such

as broadband and Pay TV services, where it connects close to 3 million subscribers nationwide, and Claro Chile, one of Chile’s leading telecommunications service providers with over 6.5 million mobile customers, to create a business

with greater scale, product diversification, and a capital structure that will enable significant investment for fixed fiber footprint expansion and to be at the forefront of 5G mobile delivery. By 2025, the joint venture anticipates passing

6 million homes through its fixed network and the majority will have access to FTTH infrastructure. The joint venture is expected to generate significant operating benefits and associated value creation, with estimated runrate synergies of over

U.S.$180 million, 80% of which are expected to be achieved within three years post completion. Completion of the transaction is subject to certain customary closing conditions, including obtaining required regulatory approvals, and we expect

closing to occur during the second half of 2022.

Approval of Tower Spin-Off

In September 2021, shareholders representing approximately 98% of our capital stock approved the Sitios

Spin-off (escisión) of all telecommunications towers and other associated passive infrastructure deployed in certain Latin American countries where we operate. By virtue of the Sitios Spin-off, we will contribute to Sitios a portion of our capital stock, assets and liabilities, mainly consisting of the shares of our subsidiaries holding telecommunications towers and other associated

infrastructure outside of Mexico, other than Colombia and our telecommunications towers existing in Peru prior to the Sitios Spin-off. The Sitios Spin-off is subject to

customary conditions and adjustments for corporate reorganizations and must comply with applicable requirements under the laws of Mexico and of the jurisdictions where the telecommunications towers are located.

16

Sale of TracFone to Verizon

In November 2021, we completed the sale to Verizon of 100% of our interest in TracFone, the largest mobile virtual prepaid service operator in

the United States. Pursuant to the sale, we received closing consideration of U.S.$3,625.7 million in cash, which includes U.S.$500.7 million of customary adjustment for TracFone’s cash and working capital, and 57,596,544 shares of

Verizon stock. Subject to TracFone continuing to achieve certain operating metrics (earn-out), Verizon will be required to pay up to an additional U.S.$650 million of cash consideration within two years

from November 23, 2021.

Increase in Buyback Program

In November 2021, our shareholders approved an increase in the balance of our buyback program fund by Ps.26 billion (U.S.$1.2 billion) for

the period April 2021 to April 2022.

Appointment of New Directors

In November 2021, our shareholders approved the appointment of Claudia Jañez Sanchez and Gisselle Morán Jiménez as

independent members of our Board of Directors. Following these appointments, our Board of Directors consists of the following members:

|

|

|

| Carlos Slim Domit (Chairman) |

|

Claudia Jañez Sanchez |

|

|

| Patrick Slim Domit (Vice Chairman) |

|

Rafael Moisés Kalach Mizrahi |

|

|

| Antonio Cosío Pando |

|

Francisco Medina Chávez |

|

|

| Arturo Elías Ayub |

|

Gisselle Morán Jiménez |

|

|

| Pablo Roberto González Guajardo |

|

Luis Alejandro Soberón Kuri |

|

|

| Daniel Hajj Aboumrad |

|

Ernesto Vega Velasco |

|

|

| Vanessa Hajj Slim |

|

Oscar Von Hauske Solís |

|

|

| David Ibarra Muñoz |

|

|

Sitios Credit Facility

On March 18, 2022, we entered into a credit agreement providing for borrowings in an amount up to Ps.20,558,500,000 with a group of

lenders and BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México, as administrative agent for the lenders (the “Sitios Credit Facility”). The full principal amount available under the

Sitios Credit Facility was disbursed on March 23, 2022. Under this credit agreement, we are initial co-borrowers with Torres Latinoamérica, S.A. de C.V. (“Torres”). On the Spin-off Effective Date, we will be released from our obligations under the Sitios Credit Facility and all liabilities with respect thereto will be transferred to Sitios, and Sitios will assume all of our

obligations thereunder. After such date, Torres will continue to be a co-borrower under the Sitios Credit Facility and Torres do Brasil S.A. (“Torres do Brasil”) will become a guarantor thereunder. We also expect Torres do Brasil to enter

into a new credit facility denominated in Brazilian reais (the “Torres do Brasil Credit Facility”). Sitios will not directly receive any proceeds from these credit facilities.

The use of proceeds for both of these credit facilities will be the refinancing of existing indebtedness of América Móvil and

its subsidiaries, as well as for general corporate purposes.

The consummation of the Torres do Brasil Credit Facility is subject to

market conditions and to the completion of a definitive agreement. There can be no assurance that the Torres do Brasil Credit Facility will be entered into, or, if it is, as to the terms, including the size, thereof. In the event that the Torres do

Brasil Credit Facility is not entered into, América Móvil and/or its subsidiaries, including entities that will be subsidiaries of Sitios after the Sitios Spin-off, may enter into one or more

financing facilities that are not currently contemplated.

17

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: March 28, 2022

|

|

|

| AMÉRICA MÓVIL, S.A.B. DE C.V. |

|

|

| By: |

|

/s/ Carlos José Garcia Moreno Elizondo |

| Name: |

|

Carlos José Garcia Moreno Elizondo |

| Title: |

|

Chief Financial Officer |

18

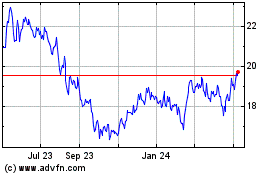

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Dec 2024 to Jan 2025

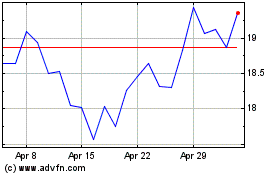

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Jan 2024 to Jan 2025