UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | | | | |

| | |

| SCHEDULE 14A INFORMATION | |

| | |

| PROXY STATEMENT PURSUANT TO SECTION 14(A) OF |

| THE SECURITIES EXCHANGE ACT OF 1934 |

| (AMENDMENT NO. ____) |

| | |

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

| | | | | | | | |

Check the appropriate box: |

| | |

¨ | | Preliminary Proxy Statement |

| |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

¨ | | Definitive Proxy Statement |

| |

x | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Pursuant to §240.14a-12 |

| | |

AMBAC FINANCIAL GROUP, INC. |

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | | | | | | | | | | |

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): |

| | | | |

| x | | No fee required. |

| |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which the transaction applies: |

| | (2) | | Aggregate number of securities to which the transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

EXPLANATORY NOTE

The information in this supplement is being filed to update and supplement the proxy statement filed by Ambac Financial Group, Inc. (“Ambac”) with the Securities and Exchange Commission (the "SEC") on September 6, 2024 (the "Proxy Statement"), relating to the Ambac’s special meeting of stockholders to be held on October 16, 2024 in connection with the proposed sale by Ambac of all of the issued and outstanding shares of common stock, par value $2.50 per share, of Ambac Assurance Corporation, a Wisconsin stock insurance company and wholly-owned subsidiary of Ambac to American Acorn Corporation, a Delaware corporation owned by funds managed by Oaktree Capital Management, L.P., for aggregate consideration of $420,000,000 in cash, subject to certain adjustments (the “Sale”).

As of October 11, 2024, subsequent to the filing of the Proxy Statement, six stockholder demand letters have been sent to Ambac by alleged Ambac stockholders in connection with the Sale. A stockholder demand letter was sent on behalf of Margot Boeckmann on September 19, 2024. A stockholder demand letter was sent on behalf Keith Jones on September 25, 2024. A stockholder demand letter was sent on behalf of James Smith on September 26, 2024. A stockholder demand letter was sent on behalf of Sean Riley on September 27, 2024. A stockholder demand letter was sent on behalf of Alfred Yarkony on September 27, 2024. A stockholder demand letter was sent on behalf of Miriam Nathan on September 30, 2024. Each of the letters alleges disclosure deficiencies in the Proxy Statement and demands that additional disclosures be made before Ambac stockholders vote on the Sale.

In addition, two complaints have been filed against Ambac and the Board of Directors of Ambac (the “Ambac Board”) in the Supreme Court of New York. A complaint was filed on behalf of Nathan Smith on September 24, 2024. A complaint was filed on behalf of James Walsh on September 25, 2024. Each of the complaints alleges negligent misrepresentation and concealment in violation of New York State common law.

Ambac may receive additional stockholder demand letters and additional complaints related to the Sale may be filed in the future.

Ambac believes that the claims asserted in the demand letters and the complaints are without merit and that no supplemental disclosure to the Proxy Statement is required under any applicable rule, statute, regulation or law. However, to, among other things, reduce the burden, inconvenience, expense, risk and disruption of continuing or potential litigation, and without admitting liability or wrongdoing, Ambac has determined that it will make the below supplemental disclosures. Nothing in these supplemental disclosures shall be deemed an admission of the legal necessity or materiality under applicable law of any of the disclosures set forth herein. The Ambac Board continues to recommend unanimously that you vote "FOR" the proposals being considered at Ambac’s special meeting of stockholders.

The information contained in this supplement is incorporated by reference into the Proxy Statement. All page references in this supplement are to pages of the Proxy Statement, and all terms used in this supplement, but not otherwise defined, shall have the meanings ascribed to such terms in the Proxy Statement. The following information should be read in conjunction with the Proxy Statement, which should be read in its entirety. To the extent that information in this supplement differs from or updates information contained in the Proxy Statement, the information in this supplement shall supersede or supplement such information in the Proxy Statement.

SUPPLEMENTAL DISCLOSURE

The disclosure on page 33 of the Proxy Statement in the section entitled “Proposal No. 1-The Sale Proposal—Background of the Sale” is hereby supplemented by adding a sentence at the end of the carryover paragraph as follows (with new text underlined):

The other NDAs did not contain a contractual standstill provision, but those counterparties remained subject to federal securities laws, ownership restrictions under state insurance regulations and the restriction in Ambac’s amended and restated certificate of incorporation that prohibits any person from owning 5% or more of Ambac’s common stock without the written approval of the Ambac Board. None of the standstill provisions contained in

the NDAs entered into by Ambac would prevent or restrict the other party from making a topping bid or any other proposal for AAC following the announcement of the Oaktree proposal. The NDAs generally expire 12 to 24 months after the date the NDA was executed, with certain NDAs expiring upon the earlier of the consummation of the Sale or Ambac’s decision not to pursue the Sale.

The disclosure on page 39 of the Proxy Statement in the section entitled “Proposal No. 1-The Sale Proposal—Background of the Sale” is hereby supplemented by adding a sentence at the end of the eighth full paragraph as follows (with new text underlined):

Other than with respect to Mr. Barranco and Mr. Eisman, there were no discussions with management or the Ambac Board regarding employment by AAC or Oaktree following the Sale. None of the Oaktree bids or proposals discussed or required management retention with AAC following the Sale. In addition, the Purchase Agreement provides that all directors, managers and officers of AAC must resign from AAC effective at the Closing of the Sale.

The disclosure on page 50 of the Proxy Statement in the section entitled “Proposal No. 1-The Sale Proposal—Opinion of Ambac’s Financial Advisor—Dividend Discount Model Analysis” is hereby supplemented by adding language in the second sentence of the second full paragraph as follows (with new text underlined):

Moelis utilized a range of discount rates of 13.75% to 20.0% based on an estimated range of AAC’s cost of equity. The estimated cost of equity range was derived using the Capital Asset Pricing Model, based on Moelis’ professional judgment and experience, using a (i) risk free rate based on 20-year U.S. government bonds, (ii) a selected range of unlevered betas informed by the selected publicly traded companies described below, (iii) a selected range of debt to equity ratios informed by the selected publicly traded companies described below, including Ambac, (iv) an equity risk premium and (v) a size premium based on publicly traded companies with similar equity values to AAC. Moelis used the foregoing range of discount rates to calculate the estimated present values as of March 31, 2024 of AAC’s future projected dividends.

The disclosure on page 51 of the Proxy Statement in the section entitled “Proposal No. 1-The Sale Proposal—Opinion of Ambac’s Financial Advisor—Selected Precedent Transaction Analysis” is hereby supplemented by adding a sentence at the end of the second full paragraph as follows (with new text underlined):

Moelis applied the following ranges of selected multiples derived from the selected precedent transactions of 0.30x to 0.65x to Ambac’s estimate of AAC’s Adjusted Book Value; 0.55x to 0.75x to Ambac’s estimate of AAC’s Adjusted Statutory Book Value; and 0.35x to 0.70x to Ambac’s estimate of AAC’s Tangible Book Value. Ambac’s estimates of AAC’s Adjusted Book Value, AAC’s Adjusted Statutory Book Value and AAC’s Tangible Book Value, in each case as of March 31, 2024, were approximately $849 million, $687 million and $674 million, respectively.

The disclosure on page 52 of the Proxy Statement in the section entitled “Proposal No. 1-The Sale Proposal—Opinion of Ambac’s Financial Advisor—Selected Publicly Traded Companies Analysis” is hereby supplemented by adding a sentence at the end of the second full paragraph as follows (with new text underlined):

Moelis applied the following ranges of selected multiples derived from the selected publicly traded companies of 0.40x to 0.50x to Ambac’s estimate of AAC’s Adjusted Book Value; 0.30x to 0.60x to Ambac’s estimate of AAC’s Adjusted Statutory Book Value; and 0.55x to 0.70x to Ambac’s estimate of AAC’s Tangible Book Value. Ambac’s estimates of AAC’s Adjusted Book Value, AAC’s Adjusted Statutory Book Value and AAC’s Tangible Book Value, in each case as of March 31, 2024, were approximately $849 million, $687 million and $674 million, respectively.

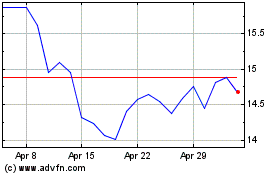

Ambac Financial (NYSE:AMBC)

Historical Stock Chart

From Oct 2024 to Nov 2024

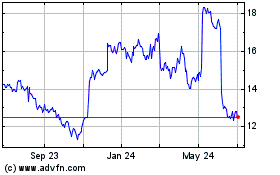

Ambac Financial (NYSE:AMBC)

Historical Stock Chart

From Nov 2023 to Nov 2024