false000170471500017047152024-10-152024-10-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 15, 2024

ALPHA METALLURGICAL RESOURCES, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| | | | | |

001-38735 | 81-3015061 |

(Commission File Number) | (I.R.S Employer Identification No.) |

| | | | | | | | |

340 Martin Luther King Jr. Blvd. Bristol, Tennessee 37620 |

| (Address of principal executive offices, zip code) |

(423) 573-0300

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | AMR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On October 15, 2024, Alpha Metallurgical Resources, Inc. (the “Company”) issued a press release announcing certain preliminary financial results for its fiscal quarter ended September 30, 2024. The press release is attached hereto as Exhibit 99.1.

This Current Report on Form 8-K and the earnings press release attached hereto are being furnished by the Registrant pursuant to Item 2.02 “Results of Operations and Financial Condition.” In accordance with General Instruction B.2 of Form 8-K, the information contained in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. In addition, this information shall not be deemed incorporated by reference into any of the Registrant’s filings with the Securities and Exchange Commission, except as shall be expressly set forth by specific reference in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit 99.1 | Press Release dated October 15, 2024 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| | | | | | | | |

| Alpha Metallurgical Resources, Inc. |

| | |

Date: October 15, 2024 | By: | /s/ J. Todd Munsey |

| | Name: J. Todd Munsey |

| | Title: Chief Financial Officer |

EXHIBIT INDEX

| | | | | |

| Exhibit No. | Description |

| Exhibit 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Alpha Announces Third Quarter 2024 Preliminary Sales Volumes and Realizations

BRISTOL, Tenn., October 15, 2024 – Alpha Metallurgical Resources, Inc. (NYSE: AMR) (“Alpha” or the “Company”), a leading U.S. supplier of metallurgical products for the steel industry, today announced preliminary sales volumes and realizations for the third quarter of 2024.

“Our preliminary third quarter results reflect the market softness of the last few months, with revenues and shipment volumes both lower than in first or second quarter,” said Andy Eidson, Alpha’s chief executive officer. "With a significant slowdown in spot activity during the quarter, we continued to fulfill our existing contracts, which resulted in 4.1 million tons shipped in Q3, and we believe we will end the year toward the higher end of our previously issued shipment guidance range. While the coal market indexes remain soft, we continue focusing on the controllable aspects of our business, including cost of coal sales, which we believe will end the year within the existing guidance range despite experiencing some additional adversity due to weather and mining conditions in the back half of the year. We look forward to providing additional information on the third quarter when we announce our definitive results on November 1st, at which time we will also share our thoughts about 2025.”

Preliminary Financial Performance

Coal Revenues

| | | | | | | |

| (millions) |

| Three months ended | |

| Sept. 30, 2024 | | |

| Met Segment | $669.8 | | |

Met Segment (excl. freight & handling)(1) | $550.7 | | |

| | | | | | | |

| Tons Sold | (millions) |

| Three months ended | |

| Sept. 30, 2024 | | |

| Met Segment | 4.1 | | |

__________________________________

1. Represents Non-GAAP coal revenues which is defined and reconciled under "Non-GAAP Financial Measures" and "Results of Operations."

Coal Sales Realization(1)

| | | | | | | |

| (per ton) |

| Three months ended | |

| Sept. 30, 2024 | | |

| Met Segment | $132.76 | | |

__________________________________

1. Represents Non-GAAP coal sales realization which is defined and reconciled under "Non-GAAP Financial Measures" and "Results of Operations."

Third quarter net realized pricing for the Met segment was $132.76 per ton.

The table below provides a breakdown of our Met segment coal sold in the third quarter by pricing mechanism.

| | | | | | | | | | | | | | | | | | | |

| (in millions, except per ton data) | | | |

| Met Segment Sales | Three months ended Sept. 30, 2024 | | | |

| Tons Sold | Coal Revenues | Realization/ton(1) | % of Met Tons Sold | | | |

| Export - Other Pricing Mechanisms | 1.9 | $241.0 | $129.31 | 48% | | | |

| Domestic | 0.9 | $145.9 | $160.35 | 23% | | | |

| Export - Australian Indexed | 1.1 | $144.8 | $128.61 | 29% | | | |

| Total Met Coal Revenues | 3.9 | $531.8 | $136.35 | 100% | | | |

| Thermal Coal Revenues | 0.2 | $18.9 | $76.33 | | | | |

Total Met Segment Coal Revenues (excl. freight & handling)(1) | 4.1 | $550.7 | $132.76 | | | | |

| | | | | | | |

__________________________________

1. Represents Non-GAAP coal sales realization which is defined and reconciled under "Non-GAAP Financial Measures" and "Results of Operations."

Liquidity and Capital Resources

As of September 30, 2024, the company had total liquidity of $507.0 million, including cash and cash equivalents of $484.6 million and $97.5 million of unused availability under the ABL, partially offset by a minimum required liquidity of $75.0 million as required by the ABL. Total liquidity increased by $150.3 million relative to the second quarter largely driven by working

capital movement resulting from lower accounts receivable and inventory balances. As of September 30, 2024, the company had no borrowings and $57.5 million in letters of credit outstanding under the ABL. Total long-term debt, including the current portion of long-term debt as of September 30, 2024, was $6.7 million.

2024 Guidance Adjustments

Alpha is increasing its net cash interest income guidance range to $10 million to $14 million, up from the prior range of $2 million to $8 million. The company expects depreciation, depletion and amortization of $160 million to $180 million for the full year, up from the prior range of $140 million to $160 million. Contributions to equity affiliates are expected to be between $32 million and $42 million, down from the prior range of $40 million to $50 million. Alpha is lowering its 2024 tax rate guidance to 5% to 10%, down from the prior range of 10% to 15%.

| | | | | | | | |

| 2024 Guidance |

| in millions of tons | Low | High |

| Metallurgical | 15.5 | | 16.5 | |

| Thermal | 0.9 | | 1.3 | |

| Met Segment - Total Shipments | 16.4 | | 17.8 | |

| | |

Costs per ton1 | Low | High |

| Met Segment | $110.00 | | $116.00 | |

| | |

| In millions (except taxes) | Low | High |

SG&A2 | $60 | | $66 | |

| Idle Operations Expense | $25 | | $33 | |

| Net Cash Interest Income | $10 | | $14 | |

| DD&A | $160 | | $180 | |

| Capital Expenditures | $210 | | $240 | |

Capital Contributions to Equity Affiliates3 | $32 | | $42 | |

| Tax Rate | 5 | % | 10 | % |

Notes:

1.Note: The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP cost of coal sales per ton sold financial measures to the most directly comparable GAAP measures without unreasonable efforts due to the inherent difficulty in forecasting and quantifying with reasonable accuracy significant items required for the reconciliation. The most directly comparable GAAP measure, GAAP cost of sales, is not accessible without unreasonable efforts on a forward-looking basis. The reconciling items include freight and handling costs, which are a component of GAAP cost of sales. Management is unable to predict without unreasonable efforts freight and handling costs due to uncertainty as to the end market and FOB point for uncommitted sales volumes and the final shipping point for export shipments. These amounts have varied historically and may continue to vary significantly from quarter to quarter and material changes to these items could have a significant effect on our future GAAP results.

2.Excludes expenses related to non-cash stock compensation and non-recurring expenses.

3.Includes contributions to fund normal operations at our DTA export facility and expected capital investments related to the facility upgrades.

Definitive Earnings Announcement and Conference Call

The company plans to announce its definitive third quarter 2024 financial results before the market opens on Friday, November 1, 2024. The company also expects to hold a conference call regarding its third quarter 2024 results on November 1, 2024, at 10:00 a.m. Eastern time. The conference call will be available live on the investor section of the company’s website at https://alphametresources.com/investors. Analysts who would like to participate in the conference call should dial 877-407-0832 (domestic toll-free) or 201-689-8433 (international) approximately 15 minutes prior to start time.

Note About Preliminary Results

The financial results presented in this release are preliminary and may change. This preliminary financial information includes calculations or figures that have been prepared internally by management. There can be no assurance that the Company’s actual results for the periods presented herein will not differ from the preliminary financial results presented herein, and such differences could be material. These preliminary financial results should not be viewed as a substitute for full financial statements prepared in accordance with GAAP and are not necessarily indicative of the results to be achieved for any future period. This preliminary financial information could be impacted by the effects of the Company’s financial closing procedures, final adjustments, and other developments.

About Alpha Metallurgical Resources

Alpha Metallurgical Resources (NYSE: AMR) is a Tennessee-based mining company with operations across Virginia and West Virginia. With customers across the globe, high-quality reserves and significant port capacity, Alpha reliably supplies metallurgical products to the steel industry. For more information, visit www.AlphaMetResources.com.

Forward-Looking Statements

This news release includes forward-looking statements. These forward-looking statements are based on Alpha's expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Alpha’s control. Forward-looking statements in this news release or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Alpha to predict these events or how they may affect Alpha. Except as required by law, Alpha has no duty to, and does not intend to, update or revise the forward-looking statements in this news release or elsewhere after the date this release is issued. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this news

release may not occur. See Alpha's filings with the U.S. Securities and Exchange Commission for more information.

FINANCIAL TABLES FOLLOW

Non-GAAP Financial Measures

The discussion below contains “non-GAAP financial measures.” These are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP” or “GAAP”). Specifically, we make use of the non-GAAP financial measure “non-GAAP coal revenues.” We use non-GAAP coal revenues to present coal revenues generated, excluding freight and handling fulfillment revenues. Non-GAAP coal sales realization per ton for our operations is calculated as non-GAAP coal revenues divided by tons sold. The presentation of these measures should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP.

Management uses non-GAAP financial measures to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. The definition of these non-GAAP measures may be changed periodically by management to adjust for significant items important to an understanding of operating trends and to adjust for items that may not reflect the trend of future results by excluding transactions that are not indicative of our core operating performance. Furthermore, analogous measures are used by industry analysts to evaluate the Company’s operating performance. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, capital investments and other factors.

Included below are reconciliations of non-GAAP financial measures to GAAP financial measures.

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

RESULTS OF OPERATIONS

| | | | | |

| (In thousands, except for per ton data) | Three Months Ended September 30, 2024 |

| Coal revenues - Met | $ | 669,783 | |

| Less: Freight and handling fulfillment revenues | (119,093) | |

| Non-GAAP Coal revenues - Met | $ | 550,690 | |

| Tons sold - Met | 4,148 | |

| Non-GAAP Coal sales realization per ton - Met | $ | 132.76 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 |

| (In thousands, except for per ton data) | Tons Sold | | Coal Revenues | | Non-GAAP Coal sales realization per ton | | % of Met Tons Sold |

| Export - other pricing mechanisms | 1,864 | | | $ | 241,027 | | | $ | 129.31 | | | 48 | % |

| Domestic | 910 | | | 145,922 | | | $ | 160.35 | | | 23 | % |

| Export - Australian indexed | 1,126 | | | 144,810 | | | $ | 128.61 | | | 29 | % |

| Total Met segment - met coal | 3,900 | | | 531,759 | | | $ | 136.35 | | | 100 | % |

| Met segment - thermal coal | 248 | | | 18,931 | | | $ | 76.33 | | | |

| Non-GAAP Coal revenues | 4,148 | | | 550,690 | | | $ | 132.76 | | | |

| Add: Freight and handling fulfillment revenues | — | | | 119,093 | | | | | |

| Coal revenues | 4,148 | | | $ | 669,783 | | | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

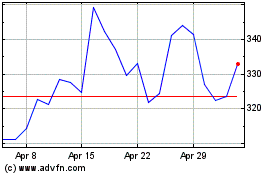

Alpha Metallurgical Reso... (NYSE:AMR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Alpha Metallurgical Reso... (NYSE:AMR)

Historical Stock Chart

From Feb 2024 to Feb 2025