ATR Adds To Bumper Order Crop With Fresh Sale To GECAS

January 04 2012 - 11:04AM

Dow Jones News

ATR, a Franco-Italian builder of turboprop passenger aircraft,

said Wednesday it has booked two new firm orders and two options

from GE Capital Aviation Services, the commercial aircraft leasing

and financing arm of General Electric Co. (GE).

The orders for short-haul, 78-seat ATR72-600 aircraft adds to

ATR's bulging order book, which was boosted by a record order

intake in 2011 of more than 150 fresh orders, making a backlog

equivalent to four years of production. The previous annual sales

record was 2007, when ATR sold 113 aircraft.

ATR has benefited from the rising cost of jet fuel, which has

encouraged regional airlines to opt for turboprop aircraft, which

offer reduced fuel burn and generally cheaper operating costs than

jet aircraft.

The latest GECAS orders, potentially worth more than $91 million

if the options are converted into firm orders, follows on from a

firm contract for 17 ATR aircraft and the same number of options

signed at the Paris Air Show in June.

GECAS has already leased three of the aircraft to Brazilian

regional carrier TRIP Linhas Aereas and has signed with Jet Airways

(India) Ltd. (532617.BY) for another five units, ATR said.

ATR is a joint venture between European Aeronautic Defence &

Space Co. NV (EAD.FR) and Alenia Aermacci, a unit of Italy's

Finmeccanica SpA (FNC.MI).

With some 180 airlines now operating ATRs worldwide, it has

become easier for leasing companies to place their aircraft. About

20% of the ATR airfcraft sold last year went to leasing

companies.

-By David Pearson, Dow Jones Newswires; +331 4017 1740;

david.pearson@dowjones.com

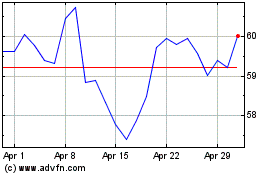

Allete (NYSE:ALE)

Historical Stock Chart

From May 2024 to Jun 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2023 to Jun 2024