Strong execution drives second-quarter

performance; Company raises full-year outlook

Quarterly Financial Highlights

(All comparisons against the second quarter of 2023, unless

otherwise noted)

- Net earnings per share (EPS) of $1.77, up 9.9% compared with

$1.61; Adjusted EPS of $1.96, up 11.4% compared with $1.76

- Revenues of $965.6 million, up 5.8% on a reported basis and up

5.2% on an organic basis

- Operating margin of 21.6%, compared with 20.2%; Adjusted

operating margin of 23.7%, up 150 basis points compared with

22.2%

Full-Year Outlook Highlights

- Raising full-year reported revenue growth to a range of 2.5% to

3.5%

- Raising full-year adjusted EPS outlook to a range of $7.15 to

$7.30

- Affirming available cash flow outlook

Allegion plc (NYSE: ALLE), a leading global security products

and solutions provider, today reported financial results for its

second quarter (ended June 30, 2024).

“Strong execution by the entire Allegion team drove record Q2

revenue and adjusted EPS,” said Allegion President and CEO John H.

Stone.

“Q2 revenue growth and margin expansion demonstrate the

resilience of Allegion’s business model. We see stability in demand

given our broad end-market exposure and specification expertise. We

are accelerating capital deployment, consistently returning cash to

shareholders and investing in accretive acquisitions like Krieger

Specialty Products and Unicel Architectural.”

“We’re raising our full-year guidance for reported revenue and

adjusted EPS, and we’re affirming our available cash flow outlook.

I’m proud of how the Allegion team lives our values while driving

results for our customers and shareholders.”

Company Results

(All comparisons against the second quarter of 2023, unless

otherwise noted)

Allegion reported second-quarter 2024 net revenues of $965.6

million and net earnings of $155.4 million, or $1.77 per share.

Adjusted net earnings were $171.7 million, or $1.96 per share, up

11.4%, excluding charges related to restructuring, acquisition and

integration costs, a non-cash impairment charge, as well as

amortization expense related to acquired intangible assets.

Second-quarter 2024 net revenues increased 5.8%. Net revenues

increased 5.2% on an organic basis, excluding impacts of

acquisitions, divestitures and foreign currency movements. The

organic revenue increase was driven by price realization and volume

growth. Reported revenue reflects a 0.9% positive impact from

acquisitions and a modest headwind from foreign currency.

Second-quarter 2024 operating income was $209.0 million, an

increase of $24.4 million or 13.2%. Adjusted operating income in

second-quarter 2024 was $228.6 million, an increase of $26.0

million or 12.8%.

Second-quarter 2024 operating margin was 21.6%, compared with

20.2%. The adjusted operating margin in second-quarter 2024 was

23.7%, compared with 22.2%. The 150-basis-point increase in

adjusted operating margin is attributable to positive price and

productivity net of inflation and investments as well as favorable

volume leverage.

Segment Results

(All comparisons against the second quarter of 2023, unless

otherwise noted)

The Americas segment revenues were up 6.0% (up 5.7% on an

organic basis). The organic revenue increase was driven by price

realization as well as volume growth. The non-residential business

was up mid-single digits, and the residential business grew

low-single digits. The reported revenue reflects a positive impact

from acquisitions.

The International segment revenues increased 5.2% (up 3.1% on an

organic basis). The organic revenue increase was driven by price

realization and volume growth. Reported revenue reflects a positive

impact from acquisitions of 3.2%, partially offset by a 1.1%

headwind in foreign currency.

Additional Items

(All comparisons against the second quarter of 2023, unless

otherwise noted)

Interest expense for second-quarter 2024 was $25.1 million, an

increase of $1.4 million.

Other income, net for second-quarter 2024 was $5.1 million,

compared to other income, net of $1.6 million.

The company’s effective tax rate for second-quarter 2024 was

17.8%, compared with 12.6%. The company’s adjusted effective tax

rate for second-quarter 2024 was 18.2%, compared with 13.9%.

Cash Flow and Liquidity

Year-to-date available cash flow for 2024 was $176.0 million, a

decrease of $14.1 million versus the prior-year period. The company

ended second-quarter 2024 with cash and cash equivalents of $747.5

million, as well as total debt of $2,404.6 million.

Cash and debt balances include proceeds of $400.0 million from

the May 2024 issuance of new 2034 senior notes, which will be used

to repay the $400.0 million senior note maturity in the second half

of 2024.

Share Repurchase and Dividends

In the second quarter of 2024, the company repurchased

approximately 0.3 million shares for approximately $40 million and

paid quarterly dividends of $0.48 per ordinary share or $41.8

million.

Updated Full-Year Outlook

(All comparisons against full-year 2023, unless otherwise

noted)

The company is raising its revenue growth for full-year 2024,

which is expected to be 2.5% to 3.5%, and tightening its organic

revenue growth to be 1.5% to 2.5%, excluding the impacts of

acquisition, divestitures and foreign currency movements.

The company is raising the outlook for full-year 2024 EPS and

expects it to be in the range of $6.50 to $6.65, or $7.15 to $7.30

on an adjusted basis. The outlook assumes a headwind of

approximately $0.37 based on a full-year adjusted effective tax

rate of 18.0% to 19.0%, inclusive of the estimated impacts of

global minimum tax.

Adjustments to 2024 EPS include estimated impacts of

approximately $0.52 per share for acquisition-related amortization,

as well as $0.13 per share for M&A, restructuring and

other.

The outlook assumes an average diluted share count for the full

year of approximately 87.7 million shares.

The company affirms expected full-year available cash flow of

approximately $540 to $570 million.

Conference Call Information

On Wednesday, July 24, 2024, President and CEO John H. Stone and

Senior Vice President and Chief Financial Officer Mike Wagnes will

conduct a conference call for analysts and investors, beginning at

8 a.m. ET, to review the company's results.

A real-time, listen-only webcast of the conference call will be

broadcast live online. Individuals wishing to listen may access the

call through the company's website at

https://investor.allegion.com.

About Allegion

Allegion (NYSE: ALLE) is a global pioneer in seamless access,

with leading brands like CISA®, Interflex®, LCN®, Schlage®,

SimonsVoss® and Von Duprin®. Focusing on security around the door

and adjacent areas, Allegion secures people and assets with a range

of solutions for homes, businesses, schools and institutions.

Allegion had $3.7 billion in revenue in 2023, and its security

products are sold around the world. For more, visit

www.allegion.com.

Non-GAAP Measures

This news release includes adjusted non-GAAP financial

information which should be considered supplemental to, not a

substitute for or superior to, the financial measure calculated in

accordance with GAAP. The company presents operating income,

operating margin, effective tax rate, net earnings and diluted

earnings per share (EPS) on both a U.S. GAAP basis and on an

adjusted (non-GAAP) basis, revenue growth on a U.S. GAAP basis and

organic revenue growth on a non-GAAP basis, EBITDA, adjusted EBITDA

and adjusted EBITDA margin (all non-GAAP measures) and Available

Cash Flow (“ACF,” a non-GAAP measure), including in certain cases,

on a segment basis. The company presents these non-GAAP measures

because management believes these non-GAAP measures provide

management and investors useful perspective of the company’s

underlying business results and trends and a more comparable

measure of period-over-period results. These measures are also used

to evaluate senior management and are a factor in determining

at-risk compensation. Investors should not consider non-GAAP

measures as alternatives to the related U.S. GAAP measures. Further

information about the adjusted non-GAAP financial tables is

attached to this news release. The 2024 Full Year Outlook contains

non-GAAP financial measures that exclude or otherwise have been

adjusted for non-GAAP adjustment items from our U.S. GAAP financial

statements. When we provide forward-looking outlooks for any of the

various non-GAAP metrics described above, we do not provide

reconciliations of the U.S. GAAP measures as we are unable to

predict with a reasonable degree of certainty the actual impact of

the non-GAAP adjustment items. By their very nature, non-GAAP

adjustment items are difficult to anticipate with precision because

they are generally associated with unexpected and unplanned events

that impact our company and its financial results. Therefore, we

are unable to provide a reconciliation of these measures without

unreasonable efforts.

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933, and Section 21E of

the Securities Exchange Act of 1934, including, but not limited to,

statements under the headings “Full-Year Outlook Highlights,”

“Affirmed Full-Year Outlook” and statements regarding the company's

2024 and future financial performance, the company’s business plans

and strategy, the company’s growth strategy, the company’s capital

allocation strategy, the company’s ability to successfully complete

and integrate acquisitions and achieve anticipated strategic and

financial benefits and the performance of the markets in which the

company operates. These forward-looking statements generally are

identified by the words “believe,” “aim,” “project,” “expect,”

“anticipate,” “estimate,” “forecast,” “outlook,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result”

or the negative thereof or variations thereon or similar

expressions generally intended to identify forward-looking

statements. Forward-looking statements may relate to such matters

as projections of revenue, margins, expenses, tax rate and

provisions, earnings, cash flows, benefit obligations, dividends,

share purchases or other financial items; any statements of the

plans, strategies and objectives of management for future

operations, including those relating to any statements concerning

expected development, performance or market share relating to our

products and services; any statements regarding future economic

conditions or our performance; any statements regarding pending

investigations, claims or disputes; any statements of expectation

or belief; and any statements of assumptions underlying any of the

foregoing. Undue reliance should not be placed on any

forward-looking statements, as these statements are based on the

company's currently available information and our current

assumptions, expectations and projections about future events. They

are subject to future events, risks and uncertainties - many of

which are beyond the company’s control - as well as potentially

inaccurate assumptions, that could cause actual results to differ

materially from those in the forward-looking statements. Important

factors and other risks that may affect the company's business or

that could cause actual results to differ materially are included

in filings the company makes with the Securities and Exchange

Commission from time to time, including its Annual Report on Form

10-K and its Quarterly Reports on Form 10-Q and in its other SEC

filings. All forward-looking statements in this press release are

expressly qualified by such cautionary statements and by reference

to the underlying assumptions. The company undertakes no obligation

to update these forward-looking statements, whether as a result of

new information, future events or otherwise, except as required by

law.

ALLEGION PLC

Condensed and Consolidated Income

Statements

(In millions, except per share

data)

UNAUDITED

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Net revenues

$

965.6

$

912.5

$

1,859.5

$

1,835.5

Cost of goods sold

537.3

510.6

1,039.8

1,042.6

Gross profit

428.3

401.9

819.7

792.9

Selling and administrative expenses

219.3

217.3

438.6

437.3

Operating income

209.0

184.6

381.1

355.6

Interest expense

25.1

23.7

48.0

47.3

Other income, net

(5.1

)

(1.6

)

(8.8

)

(1.9

)

Earnings before income taxes

189.0

162.5

341.9

310.2

Provision for income taxes

33.6

20.5

62.7

44.6

Net earnings

155.4

142.0

279.2

265.6

Less: Net earnings attributable to

noncontrolling interests

—

—

—

0.1

Net earnings attributable to Allegion

plc

$

155.4

$

142.0

$

279.2

$

265.5

Basic earnings per ordinary

share

attributable to Allegion plc

shareholders:

$

1.78

$

1.62

$

3.19

$

3.02

Diluted earnings per ordinary

share

attributable to Allegion plc

shareholders:

$

1.77

$

1.61

$

3.18

$

3.01

Shares outstanding - basic

87.3

87.9

87.5

88.0

Shares outstanding - diluted

87.7

88.3

87.9

88.3

ALLEGION PLC

Condensed and Consolidated Balance

Sheets

(In millions)

UNAUDITED

June 30, 2024

December 31, 2023

ASSETS

Cash and cash equivalents

$

747.5

$

468.1

Accounts and notes receivables, net

474.1

412.8

Inventories

444.6

438.5

Other current assets

49.6

41.5

Total current assets

1,715.8

1,360.9

Property, plant and equipment, net

370.5

358.1

Goodwill

1,488.3

1,443.1

Intangible assets, net

609.8

572.8

Other noncurrent assets

594.7

576.6

Total assets

$

4,779.1

$

4,311.5

LIABILITIES AND EQUITY

Accounts payable

$

253.6

$

259.2

Accrued expenses and other current

liabilities

364.3

407.9

Short-term borrowings and current

maturities of long-term debt

416.3

412.6

Total current liabilities

1,034.2

1,079.7

Long-term debt

1,988.3

1,602.4

Other noncurrent liabilities

331.3

311.1

Equity

1,425.3

1,318.3

Total liabilities and equity

$

4,779.1

$

4,311.5

ALLEGION PLC

Condensed and Consolidated Statements

of Cash Flows

(In millions)

UNAUDITED

Six months ended June

30,

2024

2023

Operating Activities

Net earnings

$

279.2

$

265.6

Depreciation and amortization

59.5

55.5

Changes in assets and liabilities and

other non-cash items

(114.6

)

(91.0

)

Net cash provided by operating

activities

224.1

230.1

Investing Activities

Capital expenditures

(48.1

)

(40.0

)

Acquisition of businesses, net of cash

acquired

(120.8

)

(28.6

)

Other investing activities, net

2.9

7.4

Net cash used in investing activities

(166.0

)

(61.2

)

Financing Activities

Net proceeds from (repayments of) debt

393.6

(36.3

)

Debt financing costs

(6.6

)

—

Dividends paid to ordinary

shareholders

(83.8

)

(79.3

)

Repurchase of ordinary shares

(80.0

)

(19.9

)

Other financing activities, net

5.0

(2.9

)

Net cash from (used) in financing

activities

228.2

(138.4

)

Effect of exchange rate changes on cash

and cash equivalents

(6.9

)

4.1

Net increase in cash and cash

equivalents

279.4

34.6

Cash and cash equivalents - beginning of

period

468.1

288.0

Cash and cash equivalents - end of

period

$

747.5

$

322.6

SUPPLEMENTAL

SCHEDULES

ALLEGION PLC

SCHEDULE 1

SELECTED OPERATING SEGMENT

INFORMATION

(In millions)

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Net revenues

Allegion Americas

$

770.7

$

727.2

$

1,480.0

$

1,468.1

Allegion International

194.9

185.3

379.5

367.4

Total net revenues

$

965.6

$

912.5

$

1,859.5

$

1,835.5

Operating income (loss)

Allegion Americas

$

214.3

$

195.4

$

401.3

$

382.0

Allegion International

17.7

13.9

30.7

24.5

Corporate unallocated

(23.0

)

(24.7

)

(50.9

)

(50.9

)

Total operating income

$

209.0

$

184.6

$

381.1

$

355.6

ALLEGION PLC

SCHEDULE 2

The Company presents operating income,

operating margin, net earnings and diluted earnings per share (EPS)

on both a U.S. GAAP basis and on an adjusted (non-GAAP) basis,

revenue growth on a U.S. GAAP basis and organic revenue growth on a

non-GAAP basis, EBITDA, adjusted EBITDA and adjusted EBITDA margin

(all non-GAAP measures), and available cash flow ("ACF", a non-GAAP

measure). The Company presents these non-GAAP measures because

management believes they provide useful perspective of the

Company’s underlying business results and trends and a more

comparable measure of period-over-period results. These measures

are also used to evaluate senior management and are a factor in

determining at-risk compensation. Investors should not consider

non-GAAP measures as alternatives to the related U.S. GAAP

measures.

The Company defines the presented non-GAAP

measures as follows:

- Adjustments to operating income, operating margin, net

earnings, EPS and EBITDA include items such as goodwill,

indefinite-lived trade name and other asset impairment charges,

restructuring charges, acquisition and integration costs,

amortization of acquired intangible assets, debt financing costs,

gains or losses related to the divestiture of businesses or equity

method investments and non-operating investment gains or

losses;

- Organic revenue growth is defined as U.S. GAAP revenue growth

excluding the impact of divestitures, acquisitions and currency

effects; and

- ACF is defined as U.S. GAAP net cash from operating activities

less capital expenditures.

These non-GAAP measures may not be defined and calculated the

same as similar measures used by other companies.

RECONCILIATION OF GAAP TO NON-GAAP NET

EARNINGS

(In millions, except per share

data)

Three months ended June 30,

2024

Three months ended June 30,

2023

Reported

Adjustments

Adjusted (non-GAAP)

Reported

Adjustments

Adjusted (non-GAAP)

Net revenues

$

965.6

$

—

$

965.6

$

912.5

$

—

$

912.5

Operating income

209.0

19.6

(1)

228.6

184.6

18.0

(1)

202.6

Operating margin

21.6

%

23.7

%

20.2

%

22.2

%

Earnings before income taxes

189.0

20.9

(2)

209.9

162.5

18.0

(2)

180.5

Provision for income taxes

33.6

4.6

(3)

38.2

20.5

4.6

(3)

25.1

Effective income tax rate

17.8

%

18.2

%

12.6

%

13.9

%

Net earnings attributable to Allegion

plc

$

155.4

$

16.3

$

171.7

$

142.0

$

13.4

$

155.4

Diluted earnings per ordinary share

attributable to

Allegion plc shareholders:

$

1.77

$

0.19

$

1.96

$

1.61

$

0.15

$

1.76

(1)

Adjustments to operating income for the

three months ended June 30, 2024, consist of $4.7 million of

restructuring charges and acquisition and integration expenses and

$14.9 million of amortization expense related to acquired

intangible assets. Adjustments to operating income for the three

months ended June 30, 2023, consist of $4.3 million of

restructuring charges and acquisition and integration expenses, and

$13.7 million of amortization expense related to acquired

intangible assets.

(2)

Adjustments to earnings before income

taxes for the three months ended June 30, 2024, consist of the

adjustments to operating income discussed above, as well as a $1.3

million impairment on an equity investment. Adjustments to earnings

before income taxes for the three months ended June 30, 2023,

consist of the adjustments to operating income discussed above.

(3)

Adjustments to the provision for income

taxes for the three months ended June 30, 2024, and 2023, consist

of $4.6 million and $4.6 million, respectively, of tax expense

related to the excluded items discussed above.

Six months ended June 30,

2024

Six months ended June 30,

2023

Reported

Adjustments

Adjusted (non-GAAP)

Reported

Adjustments

Adjusted (non-GAAP)

Net revenues

$

1,859.5

$

—

$

1,859.5

$

1,835.5

$

—

$

1,835.5

Operating income

381.1

36.8

(1)

417.9

355.6

39.4

(1)

395.0

Operating margin

20.5

%

22.5

%

19.4

%

21.5

%

Earnings before income taxes

341.9

38.1

(2)

380.0

310.2

39.4

(2)

349.6

Provision for income taxes

62.7

8.7

(3)

71.4

44.6

10.0

(3)

54.6

Effective income tax rate

18.3

%

18.8

%

14.4

%

15.6

%

Net earnings

279.2

29.4

308.6

265.6

29.4

295.0

Noncontrolling interests

—

—

—

0.1

0.1

0.2

Net earnings attributable to Allegion

plc

$

279.2

$

29.4

$

308.6

$

265.5

$

29.3

$

294.8

Diluted earnings per ordinary share

attributable to

Allegion plc shareholders:

$

3.18

$

0.33

$

3.51

$

3.01

$

0.33

$

3.34

(1)

Adjustments to operating income for the

six months ended June 30, 2024, consist of $8.0 million of

restructuring charges and acquisition and integration expenses and

$28.8 million of amortization expense related to acquired

intangible assets. Adjustments to operating income for the six

months ended June 30, 2023, consist of $11.6 million of

restructuring charges and acquisition and integration expenses,

$27.8 million of amortization expense related to acquired

intangible assets.

(2)

Adjustments to earnings before income

taxes for the six months ended June 30, 2024, consist of the

adjustments to operating income discussed above, as well as a $1.3

million impairment on an equity investment. Adjustments to earnings

before income taxes for the six months ended June 30, 2023, consist

of the adjustments to operating income discussed above.

(3)

Adjustments to the provision for income

taxes for the six months ended June 30, 2024, and 2023, consist of

$8.7 million and $10.0 million, respectively, of tax expense

related to the excluded items discussed above.

ALLEGION PLC

SCHEDULE 3

RECONCILIATION OF GAAP TO NON-GAAP

REVENUE AND OPERATING INCOME BY REGION

(In millions)

Three months ended June 30,

2024

Three months ended June 30,

2023

As Reported

Margin

As Reported

Margin

Allegion Americas

Net revenues (GAAP)

$

770.7

$

727.2

Operating income (GAAP)

$

214.3

27.8

%

$

195.4

26.9

%

Acquisition and integration costs

2.7

0.4

%

2.1

0.3

%

Amortization of acquired intangible

assets

9.2

1.2

%

8.4

1.1

%

Adjusted operating income

226.2

29.4

%

205.9

28.3

%

Depreciation and amortization of

nonacquired intangible assets

10.3

1.3

%

8.2

1.1

%

Adjusted EBITDA

$

236.5

30.7

%

$

214.1

29.4

%

Allegion International

Net revenues (GAAP)

$

194.9

$

185.3

Operating income (GAAP)

$

17.7

9.1

%

$

13.9

7.5

%

Restructuring charges

0.2

0.1

%

1.5

0.8

%

Acquisition and integration costs

—

—

%

0.2

0.1

%

Amortization of acquired intangible

assets

5.7

2.9

%

5.3

2.9

%

Adjusted operating income

23.6

12.1

%

20.9

11.3

%

Depreciation and amortization of

nonacquired intangible assets

4.6

2.4

%

4.4

2.4

%

Adjusted EBITDA

$

28.2

14.5

%

$

25.3

13.7

%

Corporate

Operating loss (GAAP)

$

(23.0

)

$

(24.7

)

Acquisition and integration costs

1.8

0.5

Adjusted operating loss

(21.2

)

(24.2

)

Depreciation and amortization of

nonacquired intangible assets

0.2

0.2

Adjusted EBITDA

$

(21.0

)

$

(24.0

)

Total

Net revenues

$

965.6

$

912.5

Adjusted operating income

$

228.6

23.7

%

$

202.6

22.2

%

Depreciation and amortization of

nonacquired intangible assets

15.1

1.6

%

12.8

1.4

%

Adjusted EBITDA

$

243.7

25.3

%

$

215.4

23.6

%

Six months ended June 30,

2024

Six months ended June 30,

2023

As Reported

Margin

As Reported

Margin

Allegion Americas

Net revenues (GAAP)

$

1,480.0

$

1,468.1

Operating income (GAAP)

$

401.3

27.1

%

$

382.0

26.0

%

Restructuring charges

0.1

—

%

—

—

%

Acquisition and integration costs

4.6

0.3

%

5.2

0.4

%

Amortization of acquired intangible

assets

17.5

1.2

%

16.8

1.1

%

Adjusted operating income

423.5

28.6

%

404.0

27.5

%

Depreciation and amortization of

nonacquired intangible assets

19.5

1.3

%

16.4

1.1

%

Adjusted EBITDA

$

443.0

29.9

%

$

420.4

28.6

%

Allegion International

Net revenues (GAAP)

$

379.5

$

367.4

Operating income (GAAP)

$

30.7

8.1

%

$

24.5

6.7

%

Restructuring charges

0.5

0.1

%

4.7

1.3

%

Acquisition and integration costs

0.4

0.1

%

0.4

0.1

%

Amortization of acquired intangible

assets

11.3

3.0

%

11.0

3.0

%

Adjusted operating income

42.9

11.3

%

40.6

11.1

%

Depreciation and amortization of

nonacquired intangible assets

9.1

2.4

%

9.1

2.4

%

Adjusted EBITDA

$

52.0

13.7

%

$

49.7

13.5

%

Corporate

Operating loss (GAAP)

$

(50.9

)

$

(50.9

)

Restructuring charges

0.1

—

Acquisition and integration costs

2.3

1.3

Adjusted operating loss

(48.5

)

(49.6

)

Depreciation and amortization of

nonacquired intangible assets

0.5

0.9

Adjusted EBITDA

$

(48.0

)

$

(48.7

)

Total

Net revenues

$

1,859.5

$

1,835.5

Adjusted operating income

$

417.9

22.5

%

$

395.0

21.5

%

Depreciation and amortization of

nonacquired intangible assets

29.1

1.5

%

26.4

1.5

%

Adjusted EBITDA

$

447.0

24.0

%

$

421.4

23.0

%

ALLEGION PLC

SCHEDULE 4

RECONCILIATION OF CASH PROVIDED BY

OPERATING ACTIVITIES TO AVAILABLE CASH FLOW AND NET EARNINGS TO

ADJUSTED EBITDA

(In millions)

Six months ended June

30,

2024

2023

Net cash provided by operating

activities

$

224.1

$

230.1

Capital expenditures

(48.1

)

(40.0

)

Available cash flow

$

176.0

$

190.1

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Net earnings (GAAP)

$

155.4

$

142.0

$

279.2

$

265.6

Provision for income taxes

33.6

20.5

62.7

44.6

Interest expense

25.1

23.7

48.0

47.3

Amortization of acquired intangible

assets

14.9

13.7

28.8

27.8

Depreciation and amortization of

nonacquired intangible assets

15.1

12.8

29.1

26.4

EBITDA

244.1

212.7

447.8

411.7

Other income, net

(5.1

)

(1.6

)

(8.8

)

(1.9

)

Acquisition and integration costs and

restructuring charges

4.7

4.3

8.0

11.6

Adjusted EBITDA

$

243.7

$

215.4

$

447.0

$

421.4

ALLEGION PLC

SCHEDULE 5

RECONCILIATION OF GAAP REVENUE GROWTH

TO NON-GAAP ORGANIC REVENUE GROWTH BY REGION

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Allegion Americas

Revenue growth (GAAP)

6.0

%

23.8

%

0.8

%

32.4

%

Acquisitions

(0.4

)%

(16.4

)%

(0.2

)%

(18.0

)%

Currency translation effects

0.1

%

0.3

%

0.1

%

0.3

%

Organic growth (non-GAAP)

5.7

%

7.7

%

0.7

%

14.7

%

Allegion International

Revenue growth (GAAP)

5.2

%

(0.3

)%

3.3

%

(5.2

)%

Acquisitions

(3.2

)%

(0.1

)%

(2.3

)%

0.2

%

Currency translation effects

1.1

%

(0.6

)%

0.2

%

2.0

%

Organic growth (non-GAAP)

3.1

%

(1.0

)%

1.2

%

(3.0

)%

Total

Revenue growth (GAAP)

5.8

%

18.0

%

1.3

%

22.6

%

Acquisitions

(0.9

)%

(12.5

)%

(0.6

)%

(13.2

)%

Currency translation effects

0.3

%

0.1

%

0.1

%

0.8

%

Organic growth (non-GAAP)

5.2

%

5.6

%

0.8

%

10.2

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724900354/en/

Media Contact: Whitney Moorman – Director, Global

Communications 317-810-3241 Whitney.Moorman@allegion.com

Analyst Contacts: Jobi Coyle – Director, Investor

Relations 317-810-3107 Jobi.Coyle@allegion.com

Josh Pokrzywinski – Vice President, Investor Relations

463-210-8595 Joshua.Pokrzywinski@allegion.com

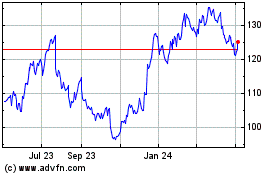

Allegion (NYSE:ALLE)

Historical Stock Chart

From Nov 2024 to Dec 2024

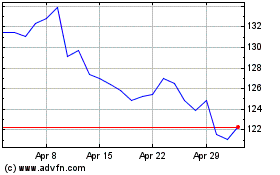

Allegion (NYSE:ALLE)

Historical Stock Chart

From Dec 2023 to Dec 2024