Increases Quarterly Cash Dividend by

25%

Board Authorizes $2 Billion Share Repurchase

Program

Details Further Investments in Business,

Associates and Communities

Drives Continued Acceleration of Customers

for Life Strategy

Albertsons Companies, Inc. (NYSE: ACI) (the "Company") today

announced it has exercised its right to terminate its merger

agreement with Kroger after the U.S. District Court in Oregon and

the King County Superior Court for the State of Washington issued

injunctions with respect to the proposed merger on December 10,

2024.

Vivek Sankaran, CEO, commented: “Given the recent federal and

state court decisions to block our proposed merger with Kroger, we

have made the difficult decision to terminate the merger agreement.

We are deeply disappointed in the courts’ decisions.”

Mr. Sankaran continued, “We start this next chapter in strong

financial condition with a track record of positive business

performance. Over the last two years, we have invested in our core

business and in new sources of revenue, while enhancing our

capabilities through the rollout of new technologies. All of this

has been built on a rich asset base, including our beloved brands

in premium locations with substantial real estate value. These

assets provide us the opportunity to optimize the acceleration of

our Customers for Life strategy and other value-creating

initiatives. We are excited about our agenda to create long-term

value and are committed to returning cash to our stockholders both

in the near term and in the future. We will be providing additional

details on our plan no later than our earnings conference call in

January 2025.”

Mr. Sankaran concluded, “Finally, we want to thank all our

285,000 dedicated team members for their relentless focus on taking

care of our customers and communities that we serve, day in and day

out.”

Jim Donald, Board Chair, added: “This leadership team continues

to transform the business and adapt to an ever-changing consumer

landscape. The Board of Directors is energized by the progress made

to date and is confident in the leadership team’s plans to continue

driving long-term stockholder value.”

Furthermore, Cerberus Capital Management, L.P. (“CCM”), the

Company’s largest shareholder, stated that, “While we are

disappointed with the courts’ decisions, we remain confident in

Albertsons’ strength as a standalone company, and we believe that

it is significantly undervalued in its current trading range.

Accordingly, Cerberus has no intention of selling any of its shares

in the Company. Cerberus initially invested in Albertsons in 2006,

with additional investments in 2013 and 2015 to support significant

and strategic value creation opportunities. As a long-term investor

in and partner to Albertsons across multiple investments and

throughout the evolution of its competitive environment, Cerberus

is proud of the Company’s performance and it will continue to be a

strong supporter of Albertsons, its talented leadership team, and

its dedicated associates.”

Accelerating Growth Through Our

Customers for Life Strategic Framework

Our Customers for Life strategy is anchored on placing the

customer at the center of everything we do and is underpinned by

the following:

- Improving our value proposition with customers.

- Investing in our stores, technology, our associates and

communities.

- Accelerating omnichannel revenue by connecting with customers

in our stores, in eCommerce and across our loyalty and health

platforms.

- Accelerating growth in the Albertsons Media Collective.

- Transforming our supply chain, merchandising, sourcing and

support functions to deliver new productivity to fund growth

investments.

- Identifying additional opportunities for value creation through

the optimization of our substantial real estate footprint and other

assets.

We believe the acceleration of our Customers for Life Strategy

will result in a long-term financial operating model that

includes:

- Identical sales growth in the range of 2%+ over time.

- Adjusted EBITDA growth higher than identical sales growth over

time.

- Annual capital expenditures in the range of $1.7 billion - $1.9

billion.

- Updated capital return program, including increased quarterly

dividends and share repurchase program.

Fiscal 2024 Outlook

We look forward to the remainder of fiscal 2024 and expect our

financial results to be as follows:

- Annual identical sales growth in the range of 1.8% to

2.2%.

- Annual adjusted EBITDA in the range of $3.90 to $3.98

billion.

- Annual adjusted net income per Class A common share (“Adjusted

EPS”) in the range of $2.20 to $2.30 per share.

- Annual income tax rate of approximately 23%.

- Annual capital expenditures in the range of $1.8 to $1.9

billion.

The Company is unable to provide a full reconciliation of the

GAAP and Non-GAAP Measures (as defined below) used in the updated

fiscal 2024 outlook without unreasonable effort because it is not

possible to predict certain of the adjustment items with a

reasonable degree of certainty. This information is dependent upon

future events and may be outside of the Company's control and could

have a significant impact on its GAAP financial results for fiscal

2024. The expected effective tax rate does not reflect potential

rate adjustments for the resolution of tax audits or potential

changes in tax laws, which cannot be predicted with reasonable

certainty.

Updates to Capital Allocation

Strategy

The Company announced today that its Board of Directors intends

to increase its quarterly cash dividend 25% from $0.12 per share to

$0.15 per share, which we expect to take effect beginning with the

next quarterly dividend declaration.

The Board of Directors has also authorized a share repurchase

program of up to $2 billion, inclusive of the existing

authorization. The Company’s share repurchase program could include

open market repurchases, accelerated share repurchase programs,

tender offers, block trades, potential privately-negotiated

transactions, or trading plans intended to comply with the federal

securities laws. The Company’s dividend increase, and share

repurchase program are expected to be funded with cash generated

from operations.

About Albertsons

Companies

Albertsons Companies is a leading food and drug retailer in the

United States. As of September 7, 2024, the Company operated 2,267

retail food and drug stores with 1,726 pharmacies, 405 associated

fuel centers, 22 dedicated distribution centers and 19

manufacturing facilities. The Company operates stores across 34

states and the District of Columbia under more than 20 well known

banners including Albertsons, Safeway, Vons, Jewel-Osco, Shaw's,

Acme, Tom Thumb, Randalls, United Supermarkets, Pavilions, Star

Market, Haggen, Carrs, Kings Food Markets and Balducci's Food

Lovers Market. The Company is committed to helping people across

the country live better lives by making a meaningful difference,

neighborhood by neighborhood. In 2023, along with the Albertsons

Companies Foundation, the Company contributed more than $350

million in food and financial support, including more than $35

million through our Nourishing Neighbors Program to ensure those

living in our communities and those impacted by disasters have

enough to eat.

Forward-Looking Statements and Factors

That Impact Our Operating Results and Trends

This press release includes "forward-looking statements" within

the meaning of the federal securities laws. The "forward-looking

statements" include our current expectations, assumptions,

estimates and projections about our business and our industry. They

include statements relating to our future operating or financial

performance which the Company believes to be reasonable at this

time. You can identify forward-looking statements by the use of

words such as "outlook," "may," "should," "could," "estimates,"

"predicts," "potential," "continue," "anticipates," "believes,"

"plans," "expects," "future" and "intends" and similar expressions

which are intended to identify forward-looking statements.

These statements are not guarantees of future performance and

are subject to numerous risks and uncertainties which are beyond

our control and difficult to predict and could cause actual results

to differ materially from the results expressed or implied by the

statements. Risks and uncertainties that could cause actual results

to differ materially from such statements include:

- litigation in connection with, or related to the transactions

contemplated by, the merger agreement and arising out of pending

regulatory actions;

- actions of our competitors following the termination of the

merger agreement;

- changes in macroeconomic conditions such as rates of food price

inflation or deflation, fuel and commodity prices and expiration of

student loan payment deferments;

- changes in consumer behavior and spending due to the impact of

macroeconomic factors;

- failure to achieve productivity initiatives, unexpected changes

in our objectives and plans, inability to implement our strategies,

plans, programs and initiatives, or enter into strategic

transactions, investments or partnerships in the future on terms

acceptable to us, or at all;

- changes in wage rates, ability to attract and retain qualified

associates and negotiate acceptable contracts with labor

unions;

- availability and cost of goods used in our food products;

- challenges with our supply chain;

- operational and financial effects resulting from cyber

incidents at the Company or at a third party, including outages in

the cloud environment and the effectiveness of business continuity

plans during a ransomware or other cyber incident; and

- changes in tax rates, tax laws, and regulations that directly

impact our business or our customers may adversely impact our

financial condition and results of operations.

All forward-looking statements attributable to us or persons

acting on our behalf are expressly qualified in their entirety by

these cautionary statements and risk factors. Forward-looking

statements contained in this press release reflect our view only as

of the date of this press release. We undertake no obligation,

other than as required by law, to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

In evaluating our financial results and forward-looking

statements, you should carefully consider the risks and

uncertainties more fully described in the "Risk Factors" section or

other sections in our reports filed with the SEC including the most

recent annual report on Form 10-K and any subsequent periodic

reports on Form 10-Q and current reports on Form 8-K.

Non-GAAP Measures and Identical

Sales

Non-GAAP Measures. Adjusted EBITDA and Adjusted EPS

(collectively, the "Non-GAAP Measures") are performance measures

that provide supplemental information the Company believes is

useful to analysts and investors to evaluate its ongoing results of

operations, when considered alongside other GAAP measures such as

net income, operating income, gross margin, and net income per

Class A common share. These Non-GAAP Measures exclude the financial

impact of items management does not consider in assessing the

Company's ongoing core operating performance, and thereby provide

useful measures to analysts and investors of its operating

performance on a period-to-period basis. Other companies may have

different definitions of Non-GAAP Measures and provide for

different adjustments, and comparability to the Company's results

of operations may be impacted by such differences. The Company also

uses Adjusted EBITDA for board of director and bank compliance

reporting. The Company's presentation of Non-GAAP Measures should

not be construed as an inference that its future results will be

unaffected by unusual or non-recurring items.

Identical Sales. As used in this earnings release, the term

"identical sales" includes stores operating during the same period

in both the current fiscal year and the prior fiscal year,

comparing sales on a daily basis. Direct to consumer digital sales

are included in identical sales, and fuel sales are excluded from

identical sales.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211817240/en/

media@albertsons.com

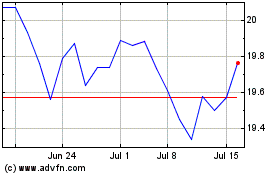

Albertsons Companies (NYSE:ACI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Albertsons Companies (NYSE:ACI)

Historical Stock Chart

From Jan 2024 to Jan 2025