false000091591300009159132024-07-312024-07-310000915913us-gaap:CommonStockMember2024-07-312024-07-310000915913us-gaap:SeriesAPreferredStockMember2024-07-312024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________

FORM 8-K

_________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) July 31, 2024

_________________________________

ALBEMARLE CORPORATION

(Exact name of Registrant as specified in charter)

_________________________________

| | | | | | | | | | | | | | |

| Virginia | | 001-12658 | | 54-1692118 |

(State or other jurisdiction

of incorporation) | | (Commission

file number) | | (IRS employer

identification no.) |

4250 Congress Street, Suite 900

Charlotte, North Carolina 28209

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code

(980) 299-5700

Not applicable

(Former name or former address, if changed since last report)

_________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a- 12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| COMMON STOCK, $.01 Par Value | | ALB | | New York Stock Exchange |

| DEPOSITARY SHARES, each representing a 1/20th interest in a share of 7.25% Series A Mandatory Convertible Preferred Stock | | ALB PR A | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2) If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 - Financial Information

Item 2.02. Results of Operations and Financial Condition.

On July 31, 2024, Albemarle Corporation (the “Company”) issued a press release reporting its results for the second quarter ended June 30, 2024. A copy of this release is being furnished as Exhibit 99.1 hereto and incorporated herein by reference. In addition, on August 1, 2024, the Company will hold a teleconference for analysts and media to discuss results for the second quarter ended June 30, 2024. The teleconference will be webcast on the Company’s website at www.albemarle.com.

The press release includes presentations of adjusted net income attributable to Albemarle Corporation, adjusted diluted earnings per share, adjusted effective income tax rates, EBITDA, adjusted EBITDA, EBITDA margin and adjusted EBITDA margin. These are financial measures that are not required by, nor presented in accordance with, accounting principles generally accepted in the United States (“GAAP”), but are included to provide additional useful measurements to review our operations, provide transparency to investors and enable period-to-period comparability of financial performance.

Our presentations of adjusted net income attributable to Albemarle Corporation, adjusted diluted earnings per share, EBITDA margin, adjusted EBITDA margin, EBITDA, adjusted EBITDA, adjusted effective income tax rates or other comparable measures should not be considered as alternatives to Net income attributable to Albemarle Corporation (“earnings”), diluted earnings per share and effective income tax rates as determined in accordance with GAAP. Further, EBITDA margin and adjusted EBITDA margin should not be considered as alternatives to earnings as a percentage of our consolidated net sales as would be determined in accordance with GAAP. The Company has included in the press release certain reconciliation information for these measures to their most directly comparable financial measures calculated and reported in accordance with GAAP.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Section 9 - Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit | | |

| Number | | Exhibit |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 31, 2024

ALBEMARLE CORPORATION

| | | | | |

| By: | /s/ Kristin M. Coleman |

| Kristin M. Coleman |

| Executive Vice President, General Counsel and Corporate Secretary |

| | | | | |

| Contact: | |

| Meredith Bandy | 1.980.999.5168 |

Albemarle Reports Second Quarter 2024 Results

CHARLOTTE, N.C. – July 31, 2024 - Albemarle Corporation (NYSE: ALB), a global leader in providing essential elements for mobility, energy, connectivity and health, today announced its results for the second quarter ended June 30, 2024.

Second-Quarter 2024 and Recent Highlights

(Unless otherwise stated, all percentage changes represent year-over-year comparisons)

•Net sales of $1.4 billion, as lower pricing year-over-year was partly offset by Energy Storage volume growth of 37% as new capacity additions ramp

•Net loss of ($188) million, or ($1.96) per diluted share attributable to common shareholders, which included an after-tax charge of $215 million related to capital project asset write-offs and associated contract cancellation costs

•Adjusted diluted EPS attributable to common shareholders of $0.04

•Adjusted EBITDA of $386 million, up sequentially, driven by higher equity income from increased Talison JV sales volumes

•Cash from operations of $363 million, an increase of $289 million year-over-year, driven by higher Talison JV dividends and working capital improvements

•Delivered more than $150 million in productivity benefits; on track to exceed the company’s full-year restructuring and productivity target by 50%

•Maintaining full-year outlook considerations; notably, the previously published $15/kg scenario is expected to apply even assuming lower July market pricing persists for the remainder of the year

•Initiating comprehensive review of cost and operating structure to maintain competitive position, while addressing current end-market realities, including immediate footprint changes at the Kemerton, Australia site

“Our operational mindset continued to serve us well in the second quarter as Albemarle progressed important organic growth initiatives while taking actions to maintain our long-term competitive position,” said Kent Masters, Albemarle’s chairman and CEO. “We achieved the first commercial sales of product from our Meishan conversion plant and delivered more than $150 million in productivity benefits. We are also maintaining our full-year 2024 corporate outlook considerations.”

Masters continued, “Building on the progress already underway, we are announcing a comprehensive review of our cost and operating structure, beginning with immediate footprint actions at our Kemerton site in Australia. The review and steps underway will maintain Albemarle’s competitive position and ensure we execute with agility today and in the future.”

Announcement of Asset and Cost Actions and Initiation of Review to Optimize Cost and Operating Structure

Albemarle announced today asset and cost actions designed to enhance its long-term competitiveness as part of a comprehensive review of its cost and operating structure. The review will help ensure that Albemarle maintains its competitive position throughout the cycle and is positioned for long-term value creation as it navigates end-market challenges, primarily in the lithium value chain. The asset and cost actions announced today include placing Kemerton Train 2 in care and maintenance, stopping construction on Kemerton Train 3, and focusing on optimizing and ramping Kemerton Train 1. As a result, Albemarle expects to recognize a charge in the range of $0.9-$1.1 billion as an exceptional item in the company’s third-quarter 2024 results.

Today’s announcement builds on the proactive measures announced by Albemarle in January 2024 to re-phase its organic growth investments and optimize its cost structure. Regarding those measures, in the second quarter, Albemarle delivered more than $150 million in productivity and restructuring cost improvements and is on track to exceed the company’s initial target by approximately 50%. During the second quarter of 2024, the company recorded an after-tax charge of $215 million primarily related to stopping construction on Kemerton Train 4 and other capital project asset write-offs and associated contract cancellation costs.

Total Corporate Outlook Considerations

The company is maintaining its prior full-year outlook considerations, which are based on observed lithium market price scenarios. Notably, the previously published $15/kg range is expected to apply even when assuming that lower July market pricing persists for the remainder of the year, due to enterprise-wide cost improvements, strong volume growth, higher shipments from the Talison JV, and Energy Storage contract performance. These factors are expected to more than offset lower pricing and a reduced Specialties outlook.

| | | | | | | | | | | |

| Total Corporate FY 2024E

Including Energy Storage Scenarios |

Observed market price case(a) | Recent pricing | Q4 2023 average | H2 2023 average |

Average lithium market price ($/kg LCE)(a) | $12-15 | ~$20 | ~$25 |

| Net sales | $5.5 - $6.2 billion | $6.1 - $6.8 billion | $6.9 - $7.6 billion |

Adjusted EBITDA(b)(c) | $0.9 - $1.2 billion | $1.6 - $1.8 billion | $2.3 - $2.6 billion |

Weighted-average common shares outstanding (diluted)(d) | ~118 million | ~118 million | 135 - 139 million |

(a) Price represents blend of relevant Asia and China market indices for the periods referenced.

(b) The company does not provide a reconciliation of forward-looking non-GAAP financial measures to the most directly comparable financial measures calculated and reported in accordance with GAAP, as the company is unable to estimate significant non-recurring or unusual items without unreasonable effort. See “Additional Information regarding Non-GAAP Measures” for more information.

(c) Presented under updated adjusted EBITDA definition as of 2024. FY23 adjusted EBITDA under updated definition would be $3.5B. See Non-GAAP Reconciliations for further details.

(d) Each quarter, Albemarle will report the more dilutive of either: 1) adding the underlying shares in the mandatory to the share count or 2) reducing Albemarle’s net income to common shareholders by the mandatory dividend. The 20-day volume-weighted average common share price will be used in determining the underlying shares to be added to the share count.

2024 Other Corporate Outlook Considerations

The company is reducing its Specialties adjusted EBITDA outlook due to a slower than expected market rebound and higher logistics costs related to the ongoing conflict in the Middle East. Capital expenditures are now expected to be at the high-end of $1.7 to $1.8 billion related to timing of capital spending. Depreciation and amortization reflects a tighter range in light of year-to-date expense. Lower expected corporate costs reflect favorable interest income and on-going cost and productivity improvements. Lower interest and financing expenses reflect the repayment of short-term debt. Below are outlook considerations updated from our first quarter earnings release issued on May 1, 2024. All other corporate outlook considerations are unchanged.

| | | | | |

| Other FY 2024E Considerations |

| Specialties adj. EBITDA | $210 - $260 million |

| Capital expenditures | $1.7 - $1.8 billion |

| Depreciation and amortization | $580 - $630 million |

| Corporate costs (excluding FX) | $60 - $90 million |

| Interest and financing expenses | $140 - $170 million |

Second Quarter 2024 Results | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | |

| In millions, except per share amounts | Q2 2024 | | Q2 2023 | | $ Change | | % Change | | | |

| Net sales | $ | 1,430.4 | | | $ | 2,370.2 | | | $ | (939.8) | | | (39.7) | % | | | |

|

| | | | | | | | | | |

| Net (loss) income attributable to Albemarle Corporation | $ | (188.2) | | | $ | 650.0 | | | $ | (838.2) | | | (129.0) | % | | | |

|

Adjusted EBITDA(a)(b) | $ | 386.4 | | | $ | 1,266.2 | | | $ | (879.9) | | | (69.5) | % | | | |

|

| | | | | | | | | | |

| Diluted (loss) earnings per share attributable to common shareholders | $ | (1.96) | | | $ | 5.52 | | | $ | (7.48) | | | (135.5) | % | | | |

| | | | | | | | | | |

Non-recurring and other unusual items(a) | 1.99 | | | 1.81 | | | | | | | | |

| | | | | | | | | | |

Adjusted diluted earnings per share attributable to common shareholders(a)(c) | $ | 0.04 | | | $ | 7.33 | | | $ | (7.29) | | | (99.5) | % | | | |

(a) See Non-GAAP Reconciliations for further details.

(b) For comparability, 2023 figures presented under adjusted EBITDA definition that the company adopted beginning in 2024.

(c) Totals may not add due to rounding.

Net sales for the second quarter of 2024 were $1.4 billion compared to $2.4 billion for the prior-year quarter, a year-over-year decline of 40% driven primarily by lower pricing in Energy Storage. Net loss attributable to Albemarle of ($188) million decreased by $838 million. During the second quarter of 2024, we recorded a charge of $215 million after income taxes related to capital project asset write-offs and associated contract cancellation costs. Adjusted EBITDA of $386 million declined by $880 million from the prior-year quarter primarily due to margin compression and reduced equity earnings as a result of lower lithium market pricing, which more than offset favorable volume growth. Sequentially, adjusted EBITDA rose, driven by higher equity income from increased sales volumes at the Talison JV.

The effective income tax rate for the second quarter of 2024 was 6.2% compared to 25.5% in the same period of 2023. On an adjusted basis, the effective income tax rates were (25.9)% and 12.9% for the second quarter of 2024 and 2023, respectively, with the decrease primarily due to changes in the geographic income mix and the impact of a valuation allowance for losses in certain entities in China.

Energy Storage Results | | | | | | | | | | | | | | | | | | | | | | | |

| In millions | Q2 2024 | | Q2 2023 | | $ Change | | % Change |

| Net Sales | $ | 830.1 | | | $ | 1,763.1 | | | $ | (933.0) | | | (52.9) | % |

Adjusted EBITDA | $ | 283.0 | | | $ | 1,165.1 | | | $ | (882.1) | | | (75.7) | % |

Energy Storage net sales for the second quarter of 2024 were $830 million, a decrease of $933 million, or 53%, due to lower pricing (-89%), which more than offset higher volumes (+37%) related to the ramp of lithium projects, including the La Negra expansion in Chile and the processing plant in Qinzhou, China, and sales of chemical-grade spodumene. Adjusted EBITDA of $283 million decreased $882 million, driven by margin compression from lower lithium market pricing and reduced equity earnings as a result of lower pricing, which more than offset favorable volume growth. Sequentially, adjusted EBITDA rose $85 million, driven by higher equity income from increased Talison JV sales volumes and further volume ramp of new facilities.

Specialties Results | | | | | | | | | | | | | | | | | | | | | | | |

| In millions | Q2 2024 | | Q2 2023 | | $ Change | | % Change |

| Net Sales | $ | 334.6 | | | $ | 371.3 | | | $ | (36.7) | | | (9.9) | % |

Adjusted EBITDA | $ | 54.2 | | | $ | 60.2 | | | $ | (6.0) | | | (10.0) | % |

Specialties net sales for the second quarter of 2024 were $335 million, a decrease of $37 million, or 10%, primarily due to lower prices (-18%), which more than offset higher volumes (+9%). Adjusted EBITDA of $54 million decreased $6 million versus the year-ago quarter. Net sales and adjusted EBITDA were sequentially higher, driven by improved end-market demand and the absence of planned and unplanned maintenance outages that impacted results in the prior quarter.

Ketjen Results | | | | | | | | | | | | | | | | | | | | | | | |

| In millions | Q2 2024 | | Q2 2023 | | $ Change | | % Change |

| Net Sales | $ | 265.7 | | | $ | 235.8 | | | $ | 29.9 | | | 12.7 | % |

Adjusted EBITDA | $ | 37.8 | | | $ | 42.9 | | | $ | (5.0) | | | (11.8) | % |

Ketjen net sales of $266 million for the second quarter of 2024 were up 13% compared to the prior-year quarter due to higher volumes (+14%), partially offset by lower prices (-1%), primarily from clean fuel technologies. Adjusted EBITDA of $38 million decreased $5 million as the prior-year adjusted EBITDA included a one-time insurance claim receipt.

Cash Flow and Capital Deployment

Second-quarter cash from operations of $363 million increased by $289 million versus the prior year, driven by higher Talison JV dividends and working capital improvements. Year-to-date cash from operations of $461 million decreased $334 million versus the prior-year period, driven by lower adjusted EBITDA and reduced dividends received from equity investments, partially offset by inflows from working capital. Year-to-date capital expenditures of $1.0 billion increased by $108 million versus the prior-year period due to the timing of project spend. Capital expenditures for the full-year 2024 are now expected to be at the high-end of $1.7 billion to $1.8 billion related to timing of capital spending.

Balance Sheet and Liquidity

As of June 30, 2024, Albemarle had estimated liquidity of approximately $3.5 billion, including $1.8 billion of cash and cash equivalents, $1.5 billion available under its revolver and $144 million available under other credit lines. Total debt was $3.5 billion, representing a debt covenant net debt to adjusted EBITDA of approximately 2.1 times.

Earnings Call

| | | | | |

| Date: | Thursday, August 1, 2024 |

| Time: | 8:00 AM Eastern time |

| Dial-in (U.S.): | 1-800-590-8290 |

| Dial-in (International): | 1-240-690-8800 |

| Conference ID: | ALBQ2 |

The company’s earnings presentation and supporting material are available on Albemarle’s website at https://investors.albemarle.com.

About Albemarle

Albemarle Corporation (NYSE: ALB) is a global leader in transforming essential resources into critical ingredients for mobility, energy, connectivity, and health. We partner to pioneer new ways to move, power, connect and protect with people and planet in mind. A reliable and high-quality global supply of lithium and bromine allow us to deliver advanced solutions for our customers. Learn more about how the people of Albemarle are enabling a more resilient world at albemarle.com and on X (formerly Twitter) @AlbemarleCorp.

Albemarle regularly posts information to www.albemarle.com, including notification of events, news, financial performance, investor presentations and webcasts, non-GAAP reconciliations, Securities and Exchange Commission (“SEC”) filings and other information regarding the company, its businesses and the markets it serves.

Forward-Looking Statements

This press release contains statements concerning our expectations, anticipations and beliefs regarding the future, which constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, which are based on assumptions that we have made as of the date hereof and are subject to known and unknown risks and uncertainties, often contain words such as “anticipate,” “believe,” “estimate,” “expect,” “guidance,” “intend,” “may,” “outlook,” “scenario,” “should,” “would,” and “will”. Forward-looking statements may include statements regarding: our 2024 company and segment outlooks, including expected market pricing of lithium and spodumene and other underlying assumptions and outlook considerations; expected capital expenditure amounts and the corresponding impact on cash flow; market pricing of lithium carbonate equivalent and spodumene; plans and expectations regarding other projects and activities, cost reductions and accounting charges, and all other information relating to matters that are not historical facts. Factors that could cause Albemarle’s actual results to differ materially from the outlook expressed or implied in any forward-looking statement include: changes in economic and business conditions; financial and operating performance of customers; timing and magnitude of customer orders; fluctuations in lithium market prices; production volume shortfalls; increased competition; changes in product demand; availability and cost of raw materials and energy; technological change and development; fluctuations in foreign currencies; changes in laws and government regulation; regulatory actions, proceedings, claims or litigation; cyber-security breaches,

terrorist attacks, industrial accidents or natural disasters; political unrest; changes in inflation or interest rates; volatility in the debt and equity markets; acquisition and divestiture transactions; timing and success of projects; performance of Albemarle’s partners in joint ventures and other projects; changes in credit ratings; and the other factors detailed from time to time in the reports Albemarle files with the SEC, including those described under “Risk Factors” in Albemarle’s most recent Annual Report on Form 10-K and any subsequently filed Quarterly Reports on Form 10-Q, which are filed with the SEC and available on the investor section of Albemarle’s website (investors.albemarle.com) and on the SEC’s website at www.sec.gov. These forward-looking statements speak only as of the date of this press release. Albemarle assumes no obligation to provide any revisions to any forward-looking statements should circumstances change, except as otherwise required by securities and other applicable laws.

Albemarle Corporation and Subsidiaries

Consolidated Statements of (Loss) Income

(In Thousands Except Per Share Amounts) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 1,430,385 | | | $ | 2,370,190 | | | $ | 2,791,121 | | | $ | 4,950,442 | |

| Cost of goods sold | 1,440,963 | | | 1,811,703 | | | 2,762,761 | | | 3,115,415 | |

| Gross (loss) profit | (10,578) | | | 558,487 | | | 28,360 | | | 1,835,027 | |

| Selling, general and administrative expenses | 168,948 | | | 397,070 | | | 346,660 | | | 551,376 | |

| Capital project asset write-off | 292,315 | | | — | | | 309,515 | | | — | |

| Research and development expenses | 20,770 | | | 21,419 | | | 44,302 | | | 41,890 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating (loss) profit | (492,611) | | | 139,998 | | | (672,117) | | | 1,241,761 | |

| Interest and financing expenses | (35,187) | | | (25,577) | | | (73,156) | | | (52,354) | |

| Other income, net | 33,666 | | | 53,954 | | | 83,567 | | | 136,446 | |

| (Loss) income before income taxes and equity in net income of unconsolidated investments | (494,132) | | | 168,375 | | | (661,706) | | | 1,325,853 | |

| Income tax (benefit) expense | (30,660) | | | 42,987 | | | (34,381) | | | 319,950 | |

| (Loss) income before equity in net income of unconsolidated investments | (463,472) | | | 125,388 | | | (627,325) | | | 1,005,903 | |

| Equity in net income of unconsolidated investments (net of tax) | 286,878 | | | 551,051 | | | 467,378 | | | 947,239 | |

| | | | | | | |

| | | | | | | |

| Net (loss) income | (176,594) | | | 676,439 | | | (159,947) | | | 1,953,142 | |

| Net income attributable to noncontrolling interests | (11,604) | | | (26,396) | | | (25,803) | | | (64,519) | |

| Net (loss) income attributable to Albemarle Corporation | (188,198) | | | 650,043 | | | (185,750) | | | 1,888,623 | |

| Mandatory convertible preferred stock dividends | (41,688) | | | — | | | (53,272) | | | — | |

| Net (loss) income attributable to Albemarle Corporation common shareholders | $ | (229,886) | | | $ | 650,043 | | | $ | (239,022) | | | $ | 1,888,623 | |

| Basic (loss) earnings per share attributable to common shareholders | $ | (1.96) | | | $ | 5.54 | | | $ | (2.03) | | | $ | 16.10 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted (loss) earnings per share attributable to common shareholders | $ | (1.96) | | | $ | 5.52 | | | $ | (2.03) | | | $ | 16.03 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Weighted-average common shares outstanding – basic | 117,528 | | | 117,332 | | | 117,489 | | | 117,282 | |

| Weighted-average common shares outstanding – diluted | 117,528 | | | 117,769 | | | 117,489 | | | 117,805 | |

Albemarle Corporation and Subsidiaries

Condensed Consolidated Balance Sheets

(In Thousands) (Unaudited)

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,830,227 | | | $ | 889,900 | |

| Trade accounts receivable | 785,553 | | | 1,213,160 | |

| Other accounts receivable | 412,181 | | | 509,097 | |

| Inventories | 1,800,114 | | | 2,161,287 | |

| Other current assets | 397,630 | | | 443,475 | |

| | | |

Total current assets | 5,225,705 | | | 5,216,919 | |

| Property, plant and equipment | 12,788,646 | | | 12,233,757 | |

| Less accumulated depreciation and amortization | 2,951,614 | | | 2,738,553 | |

Net property, plant and equipment | 9,837,032 | | | 9,495,204 | |

| Investments | 1,160,674 | | | 1,369,855 | |

| | | |

| Other assets | 320,598 | | | 297,087 | |

| Goodwill | 1,600,938 | | | 1,629,729 | |

| Other intangibles, net of amortization | 243,335 | | | 261,858 | |

| Total assets | $ | 18,388,282 | | | $ | 18,270,652 | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable to third parties | $ | 1,138,975 | | | $ | 1,537,859 | |

| Accounts payable to related parties | 184,198 | | | 550,186 | |

| Accrued expenses | 508,334 | | | 544,835 | |

| | | |

| Current portion of long-term debt | 3,213 | | | 625,761 | |

| Dividends payable | 60,668 | | | 46,666 | |

| | | |

| | | |

| Income taxes payable | 63,070 | | | 255,155 | |

Total current liabilities | 1,958,458 | | | 3,560,462 | |

| Long-term debt | 3,519,504 | | | 3,541,002 | |

| Postretirement benefits | 25,925 | | | 26,247 | |

| Pension benefits | 141,627 | | | 150,312 | |

| | | |

| Other noncurrent liabilities | 758,283 | | | 769,100 | |

| Deferred income taxes | 501,330 | | | 558,430 | |

| Commitments and contingencies | | | |

| Equity: | | | |

| Albemarle Corporation shareholders’ equity: | | | |

| Common stock | 1,175 | | | 1,174 | |

| Mandatory convertible preferred stock | 2,235,105 | | | — | |

| Additional paid-in capital | 2,969,851 | | | 2,952,517 | |

| Accumulated other comprehensive loss | (637,551) | | | (528,526) | |

| Retained earnings | 6,653,979 | | | 6,987,015 | |

| Total Albemarle Corporation shareholders’ equity | 11,222,559 | | | 9,412,180 | |

| Noncontrolling interests | 260,596 | | | 252,919 | |

| Total equity | 11,483,155 | | | 9,665,099 | |

| Total liabilities and equity | $ | 18,388,282 | | | $ | 18,270,652 | |

Albemarle Corporation and Subsidiaries

Selected Consolidated Cash Flow Data

(In Thousands) (Unaudited)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| Cash and cash equivalents at beginning of year | $ | 889,900 | | | $ | 1,499,142 | |

| Cash flows from operating activities: | | | |

| Net (loss) income | (159,947) | | | 1,953,142 | |

| Adjustments to reconcile net (loss) income to cash flows from operating activities: | | | |

| Depreciation and amortization | 262,030 | | | 180,356 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Non-cash capital project assets write-off | 276,013 | | | — | |

| Stock-based compensation and other | 15,439 | | | 20,017 | |

| Equity in net income of unconsolidated investments (net of tax) | (467,378) | | | (947,239) | |

| Dividends received from unconsolidated investments and nonmarketable securities | 270,926 | | | 1,079,439 | |

| Pension and postretirement expense | 2,529 | | | 3,933 | |

| Pension and postretirement contributions | (9,428) | | | (8,632) | |

| Realized loss on investments in marketable securities | 33,746 | | | — | |

| Unrealized loss (gain) on investments in marketable securities | 23,777 | | | (61,434) | |

| | | |

| Deferred income taxes | (129,087) | | | (144,720) | |

| Working capital changes | 460,937 | | | (1,155,408) | |

| | | |

| Other, net | (118,711) | | | (124,767) | |

| Net cash provided by operating activities | 460,846 | | | 794,687 | |

| Cash flows from investing activities: | | | |

| | | |

| Acquisitions, net of cash acquired | — | | | (8,240) | |

| | | |

| Capital expenditures | (1,026,936) | | | (919,295) | |

| | | |

| | | |

| | | |

| | | |

| Sales (purchases) of marketable securities, net | 82,578 | | | (123,979) | |

| | | |

| Investments in equity investments and nonmarketable securities | (148) | | | (1,192) | |

| Net cash used in investing activities | (944,506) | | | (1,052,706) | |

| Cash flows from financing activities: | | | |

| | | |

| Proceeds from issuance of mandatory convertible preferred stock | 2,236,750 | | | — | |

| Repayments of long-term debt and credit agreements | (56,453) | | | — | |

| Proceeds from borrowings of long-term debt and credit agreements | 56,453 | | | 300,000 | |

| Other debt repayments, net | (627,390) | | | (1,500) | |

| | | |

| Dividends paid to common shareholders | (93,916) | | | (93,317) | |

| Dividends paid to mandatory convertible preferred shareholders | (39,376) | | | — | |

| Dividends paid to noncontrolling interests | (18,137) | | | (53,145) | |

| | | |

| Proceeds from exercise of stock options | 86 | | | 81 | |

| Withholding taxes paid on stock-based compensation award distributions | (10,677) | | | (24,910) | |

| | | |

| Other | (2,758) | | | — | |

| Net cash provided by financing activities | 1,444,582 | | | 127,209 | |

| Net effect of foreign exchange on cash and cash equivalents | (20,595) | | | 231,406 | |

| Increase in cash and cash equivalents | 940,327 | | | 100,596 | |

| Cash and cash equivalents at end of period | $ | 1,830,227 | | | $ | 1,599,738 | |

Albemarle Corporation and Subsidiaries

Consolidated Summary of Segment Results

(In Thousands) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales: | | | | | | | |

| Energy Storage | $ | 830,110 | | | $ | 1,763,065 | | | $ | 1,631,008 | | | $ | 3,706,747 | |

| Specialties | 334,600 | | | 371,302 | | | 650,665 | | | 790,080 | |

| Ketjen | 265,675 | | | 235,823 | | | 509,448 | | | 453,615 | |

| | | | | | | |

| | | | | | | |

| Total net sales | $ | 1,430,385 | | | $ | 2,370,190 | | | $ | 2,791,121 | | | $ | 4,950,442 | |

| | | | | | | |

| Adjusted EBITDA: | | | | | | | |

| Energy Storage | $ | 282,979 | | | $ | 1,165,080 | | | $ | 480,975 | | | $ | 2,732,772 | |

| Specialties | 54,175 | | | 60,200 | | | 99,356 | | | 222,358 | |

| Ketjen | 37,836 | | | 42,882 | | | 59,815 | | | 57,425 | |

| | | | | | | |

| Total segment adjusted EBITDA | 374,990 | | | 1,268,162 | | | 640,146 | | | 3,012,555 | |

| Corporate | 11,370 | | | (1,920) | | | 37,450 | | | 15,391 | |

| Total adjusted EBITDA | $ | 386,360 | | | $ | 1,266,242 | | | $ | 677,596 | | | $ | 3,027,946 | |

See accompanying non-GAAP reconciliations below.

Additional Information regarding Non-GAAP Measures

It should be noted that adjusted net income attributable to Albemarle Corporation, adjusted net income attributable to Albemarle Corporation common shareholders, adjusted diluted earnings per share attributable to common shareholders, non-operating pension and other post-employment benefit (“OPEB”) items per diluted share, non-recurring and other unusual items per diluted share, adjusted effective income tax rates, EBITDA, adjusted EBITDA (on a consolidated basis), EBITDA margin and adjusted EBITDA margin are financial measures that are not required by, or presented in accordance with, accounting principles generally accepted in the United States, or GAAP. These non-GAAP measures should not be considered as alternatives to Net (loss) income attributable to Albemarle Corporation (“earnings”) or other comparable measures calculated and reported in accordance with GAAP. These measures are presented here to provide additional useful measurements to review the company’s operations, provide transparency to investors and enable period-to-period comparability of financial performance. The company’s chief operating decision maker uses these measures to assess the ongoing performance of the company and its segments, as well as for business and enterprise planning purposes.

A description of other non-GAAP financial measures that Albemarle uses to evaluate its operations and financial performance, and reconciliation of these non-GAAP financial measures to the most directly comparable financial measures calculated and reported in accordance with GAAP can be found on the following pages of this press release, which is also is available on Albemarle’s website at https://investors.albemarle.com. The company does not provide a reconciliation of forward-looking non-GAAP financial measures to the most directly comparable financial measures calculated and reported in accordance with GAAP, as the company is unable to estimate significant non-recurring or unusual items without unreasonable effort. The amounts and timing of these items are uncertain and could be material to the company's results calculated in accordance with GAAP.

ALBEMARLE CORPORATION AND SUBSIDIARIES

Non-GAAP Reconciliations

(Unaudited)

See below for a reconciliation of adjusted net income attributable to Albemarle Corporation, adjusted net income attributable to Albemarle Corporation common shareholders, EBITDA and adjusted EBITDA (on a consolidated basis), which are non-GAAP financial measures, to Net (loss) income attributable to Albemarle Corporation (“earnings”), the most directly comparable financial measure calculated and reported in accordance with GAAP. Adjusted net income attributable to Albemarle Corporation common shareholders is defined as net (loss) income after mandatory convertible preferred stock dividends, but before the non-recurring, other unusual and non-operating pension and other post-employment benefit (OPEB) items as listed below. The non-recurring and unusual items may include acquisition and integration related costs, gains or losses on sales of businesses, restructuring charges, facility divestiture charges, certain litigation and arbitration costs and charges, and other significant non-recurring items. EBITDA is defined as net (loss) income attributable to Albemarle Corporation before interest and financing expenses, income tax expense, and depreciation and amortization. Adjusted EBITDA is defined as EBITDA plus or minus the proportionate share of Windfield Holdings income tax expense, non-recurring, other unusual and non-operating pension and OPEB items as listed below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

In thousands, except percentages and per share amounts | $ | | % of net sales | | $ | | % of net sales | | $ | | % of net sales | | $ | | % of net sales |

| Net (loss) income attributable to Albemarle Corporation | ($188,198) | | | |

| $ | 650,043 | | | |

| ($185,750) | | | |

| $ | 1,888,623 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Add back: | | | | | | | | | | | | | | | |

Non-operating pension and OPEB items (net of tax) | (336) | | | |

| 381 | | | |

| (687) | | | |

| 755 | | | |

Non-recurring and other unusual items (net of tax) | 234,498 | | | |

| 213,194 | | | |

| 274,542 | | | |

| 190,420 | | | |

| Adjusted net income attributable to Albemarle Corporation | 45,964 | | | |

| 863,618 | | | |

| 88,105 | | | |

| 2,079,798 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Mandatory convertible preferred stock dividends | (41,688) | | | | | — | | | | | (53,272) | | | | | — | | | |

| Adjusted net income attributable to Albemarle Corporation common shareholders | $4,276 | | | | | $ | 863,618 | | | | | $34,833 | | | | | $ | 2,079,798 | | | |

|

| | |

|

| | |

|

| | |

|

| | |

| Adjusted diluted earnings per share attributable to common shareholders | $ | 0.04 | | | |

| $ | 7.33 | | | |

| $ | 0.30 | | | |

| $ | 17.65 | | | |

|

| | |

|

| | |

|

| | |

|

| | |

| Adjusted weighted-average common shares outstanding – diluted | 117,703 | | | | | 117,769 | | | | | 117,685 | | | | | 117,805 | | | |

|

| | |

|

| | |

|

| | |

|

| | |

| Net income attributable to Albemarle Corporation | ($188,198) | | | (13.2) | % |

| $ | 650,043 | | | 27.4 | % |

| ($185,750) | | | (6.7) | % |

| $ | 1,888,623 | | | 38.2 | % |

Add back: |

| | |

|

| | |

|

| | |

|

| | |

| | | | | | | | | | | | | | | |

Interest and financing expenses | 35,187 | | | 2.5 | % |

| 25,577 | | | 1.1 | % |

| 73,156 | | | 2.6 | % |

| 52,354 | | | 1.1 | % |

| Income tax (benefit) expense | (30,660) | | | (2.1) | % |

| 42,987 | | | 1.8 | % |

| (34,381) | | | (1.2) | % |

| 319,950 | | | 6.5 | % |

Depreciation and amortization | 138,279 | | | 9.7 | % |

| 93,085 | | | 3.9 | % |

| 262,030 | | | 9.4 | % |

| 180,356 | | | 3.6 | % |

EBITDA | (45,392) | | | (3.2) | % |

| 811,692 | | | 34.2 | % |

| 115,055 | | | 4.1 | % |

| 2,441,283 | | | 49.3 | % |

| Proportionate share of Windfield income tax expense | 119,780 | | | 8.4 | % | | 233,976 | | | 9.9 | % | | 193,469 | | | 6.9 | % | | 399,961 | | | 8.1 | % |

Non-operating pension and OPEB items | (337) | | | — | % |

| 612 | | | — | % |

| (662) | | | — | % |

| 1,213 | | | — | % |

| Non-recurring and other unusual items | 312,309 | | | 21.8 | % |

| 219,962 | | | 9.3 | % |

| 369,734 | | | 13.2 | % |

| 185,489 | | | 3.7 | % |

Adjusted EBITDA | $386,360 | | | 27.0 | % |

| $ | 1,266,242 | | | 53.4 | % |

| $ | 677,596 | | | 24.3 | % |

| $ | 3,027,946 | | | 61.2 | % |

|

| | |

|

| | |

|

| | |

|

| | |

Net sales | $ | 1,430,385 | | | |

| $ | 2,370,190 | | | |

| $ | 2,791,121 | | | |

| $ | 4,950,442 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Non-operating pension and OPEB items, consisting of mark-to-market actuarial gains/losses, settlements/curtailments, interest cost and expected return on assets, are not allocated to Albemarle’s operating segments and are included in the Corporate category. In addition, the company believes that these components of pension cost are mainly driven by market performance, and the company manages these separately from the operational performance of the company’s businesses. In accordance with GAAP, these non-operating pension and OPEB items are included in Other income, net. Non-operating pension and OPEB items were as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| | | | | | | |

| Interest cost | $ | 8,501 | | | $ | 9,027 | | | $ | 17,006 | | | $ | 18,037 | |

| Expected return on assets | (8,838) | | | (8,415) | | | (17,668) | | | (16,824) | |

| Total | $ | (337) | | | $ | 612 | | | $ | (662) | | | $ | 1,213 | |

In addition to the non-operating pension and OPEB items disclosed above, the company has identified certain other items and excluded them from Albemarle’s adjusted net income calculation for the periods presented. A listing of these items, as well as a detailed description of each follows below (per diluted share):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Restructuring and other charges(1) | $ | 0.02 | | | $ | 0.05 | | | $ | 0.13 | | | $ | 0.05 | |

Acquisition and integration related costs(2) | 0.01 | | | 0.04 | | | 0.02 | | | 0.08 | |

Capital project assets write-off(3) | 1.82 | | | — | | | 1.94 | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Loss (gain) in fair value of public equity securities(4) | 0.12 | | | (0.10) | | | 0.47 | | | (0.39) | |

Legal accrual(5) | — | | | 1.82 | | | — | | | 1.82 | |

Other(6) | (0.03) | | | 0.02 | | | (0.18) | | | 0.07 | |

Tax related items(7) | 0.05 | | | (0.02) | | | (0.05) | | | (0.01) | |

| Total non-recurring and other unusual items | $ | 1.99 | | | $ | 1.81 | | | $ | 2.33 | | | $ | 1.62 | |

(1)In January 2024, the Company announced it was taking measures to unlock near term cash flow and generate long-term financial flexibility by re-phasing organic growth investments and optimizing its cost structure. As a result, the Company recorded severance costs for employees in Corporate and each of the businesses. During the three and six months ended June 30, 2024, $2.5 million and $18.9 million were recorded in Selling, general and administrative expenses ($2.0 million and $15.1 million after income taxes, or $0.02 and $0.13 per share), respectively. The severance has primarily been paid, with the remainder to be paid in 2024. During the three and six months ended June 30, 2023, $7.4 million of severance costs in the Ketjen business were recorded in Selling, general and administrative expenses ($5.7 million after income taxes, or $0.05 per share).

(2)Costs related to the acquisition, integration and divestitures for various significant projects, recorded in Selling, general and administrative expenses for the three and six months ended June 30, 2024 were $1.6 million and $3.5 million ($1.2 million and $2.7 million after income taxes, or $0.01 and $0.02 per share), respectively, and for the three and six months ended June 30, 2023 were $6.5 million and $11.6 million ($5.0 million and $9.0 million after income taxes, or $0.04 and $0.08 per share), respectively.

.

(3)As part of the organic growth investment re-phasing, during 2024 the Company wrote-off the value of assets related to certain capital projects no longer part of the Company’s modified capital plan. The Company determined that these assets will not provide future value or will require significant re-engineering if the related projects are restarted. Losses of $275.9 million and $293.1 million recorded in Operating (loss) profit for the three and six months ended June 30, 2024, respectively, and losses of $2.6 million and $5.4 million recorded in Other income, net for the three and six months ended June 30, 2024, respectively ($214.5 million and $228.5 million after income taxes, or $1.82 and $1.94 per share), related to these capital project asset write-offs and associated contract cancellation costs.

(4)Losses of $17.8 million and $27.2 million recorded in Other income, net resulting from the net change in fair value of investments in public equity securities for the three and six months ended June 30, 2024, respectively, and a loss of $33.7 million recorded in Other income, net for the six months ended June 30, 2024 resulting from the sale of investments in public equity securities ($13.9 million and $55.0 million after income taxes, or $0.12 and $0.47 per share). Gain of $15.0 million and $60.8 million ($11.2 million and $45.6 million after income taxes, or $0.10 and $0.39 per share) recorded in Other income, net for the three and six months ended June 30, 2023, respectively, resulting from the net increase in fair value of investments in public equity securities.

(5)Accrual of $218.5 million ($214.9 million after income taxes, or $1.82 per share) recorded in Selling, general and administrative expenses resulting from agreements in principle to resolve a previously disclosed legal matter with the DOJ and SEC related to conduct in our Ketjen business prior to 2018.

(6)Other adjustments for the three months ended June 30, 2024 included amounts recorded in:

•Selling, general and administrative expenses - $5.1 million of expenses related to certain historical legal and environmental matters.

•Other income, net - $8.9 million gain from PIK dividends of preferred equity in a Grace subsidiary and a $0.6 million gain from an updated cost estimate of an environmental reserve at a site not part of our operations.

After income taxes, these net gains totaled $3.7 million, or $0.03 per share.

Other adjustments for the three months ended June 30, 2023 included amounts recorded in:

•Selling, general and administrative expenses - $0.7 million of facility closure expenses related to offices in Germany and $0.6 million primarily related to shortfall contributions for a multiemployer plan financial improvement plan.

•Other income, net - $3.9 million of a loss resulting from the adjustment of indemnification related to previously disposed businesses, partially offset by a $2.7 million gain in the fair value of preferred equity of a Grace subsidiary.

After income taxes, these charges totaled $2.7 million, or $0.02 per share.

Other adjustments for the six months ended June 30, 2024 included amounts recorded in:

•Cost of goods sold - $1.4 million of expenses related to non-routine labor and compensation related costs that are outside normal compensation arrangements.

•Selling, general and administrative expenses - $5.2 million of expenses related to certain historical legal and environmental matters.

•Other income, net - $17.6 million gain from PIK dividends of preferred equity in a Grace subsidiary, a $17.3 million gain primarily from the sale of assets at a site not part of our operations, a $2.4 million gain primarily resulting from the adjustment of indemnification related to a previously disposed business and a $0.6 million gain from an updated cost estimate of an environmental reserve at a site not part of our operations, partially offset by $2.9 million of charges for asset retirement obligations at a site not part of our operations.

After income taxes, these net gains totaled $21.0 million, or $0.18 per share.

Other adjustments for the six months ended June 30, 2023 included amounts recorded in:

•Selling, general and administrative expenses - $1.9 million of charges primarily for environmental reserves at sites not part of our operations, $1.4 million of facility closure expenses related to offices in Germany and $0.6 million primarily related to shortfall contributions for a multiemployer plan financial improvement plan.

•Other income, net - $3.9 million of a loss resulting from the adjustment of indemnification related to previously disposed businesses and $3.6 million of asset retirement obligation charges primarily for a site not part of our operations, partially offset by a $2.7 million gain in the fair value of preferred equity of a Grace subsidiary.

After income taxes, these charges totaled $7.5 million, or $0.07 per share.

(7)Included in Income tax benefit for the three and six months ended June 30, 2024 are discrete net tax expenses of $6.5 million, or $0.05 per share, and benefits of $5.7 million, or $0.05 per share, respectively, primarily related to the reduction in a foreign tax reserve and excess tax benefits realized from stock-based compensation arrangements.

Included in Income tax expense for the three and six months ended June 30, 2023 are discrete net tax benefits of $3.9 million, or $0.02 per share and $1.0 million, or $0.01 per share, respectively. The net benefit primarily related to foreign return to provisions offset by excess tax benefits realized from stock-based compensation arrangements.

See below for a reconciliation of the adjusted effective income tax rate, the non-GAAP financial measure, to the effective income tax rate, the most directly comparable financial measure calculated and reported in accordance with GAAP (in thousands, except percentages).

| | | | | | | | | | | | | | | | | |

| (Loss) Income before income taxes and equity in net income of unconsolidated investments | | Income tax (benefit) expense | | Effective income tax rate |

| Three months ended June 30, 2024 | | | | | |

| As reported | $ | (494,132) | | | $ | (30,660) | | | 6.2 | % |

| Non-recurring, other unusual and non-operating pension and OPEB items | 311,972 | | | 77,810 | | | |

| As adjusted | $ | (182,160) | | | $ | 47,150 | | | (25.9) | % |

| | | | | |

| Three months ended June 30, 2023 | | | | | |

| As reported | $ | 168,375 | | | $ | 42,987 | | | 25.5 | % |

| Non-recurring, other unusual and non-operating pension and OPEB items | 220,574 | | | 6,999 | | | |

| As adjusted | $ | 388,949 | | | $ | 49,986 | | | 12.9 | % |

| | | | | |

| Six months ended June 30, 2024 | | | | | |

| As reported | $ | (661,706) | | | $ | (34,381) | | | 5.2 | % |

| Non-recurring, other unusual and non-operating pension and OPEB items | 369,072 | | | 95,217 | | | |

| As adjusted | $ | (292,634) | | | $ | 60,836 | | | (20.8) | % |

| | | | | |

| Six months ended June 30, 2023 | | | | | |

| As reported | $ | 1,325,853 | | | $ | 319,950 | | | 24.1 | % |

| Non-recurring, other unusual and non-operating pension and OPEB items | 186,702 | | | (4,473) | | | |

| As adjusted | $ | 1,512,555 | | | $ | 315,477 | | | 20.9 | % |

As noted above, beginning in 2024, the company changed its definition of adjusted EBITDA for financial accounting purposes. The updated definition includes Albemarle’s share of the pre-tax earnings of the Talison joint venture, whereas the prior definition included Albemarle’s share of Talison earnings net of tax. See below for a reconciliation of adjusted EBITDA (on a consolidated basis), the non-GAAP financial measure, to Net income attributable to Albemarle Corporation (“earnings”), the most directly comparable financial measure calculated and reported in accordance with GAAP, as if it were presented under the new definition for the year ended December 31, 2023.

| | | | | |

| Net income attributable to Albemarle Corporation | $ | 1,573,476 | |

| Depreciation and amortization | 429,944 | |

| Interest and financing expenses | 116,072 | |

| Income tax expense | 430,277 | |

| Proportionate share of Windfield income tax expense | 779,703 | |

| Gain on sale of business/interest in properties, net | (71,190) | |

| Acquisition and integration related costs | 26,767 | |

| Goodwill impairment | 6,765 | |

| Non-operating pension and OPEB items | (7,971) | |

| Mark-to-market gain on public equity securities | 44,732 | |

| Legal accrual | 218,510 | |

| Other | (1,097) | |

| Total adjusted EBITDA | $ | 3,545,988 | |

Cover Document

|

Jul. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 31, 2024

|

| Entity Registrant Name |

ALBEMARLE CORPORATION

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity File Number |

001-12658

|

| Entity Tax Identification Number |

54-1692118

|

| Entity Address, Address Line One |

4250 Congress Street, Suite 900

|

| Entity Address, City or Town |

Charlotte

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28209

|

| City Area Code |

980

|

| Local Phone Number |

299-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000915913

|

| Common Stock |

|

| Cover [Abstract] |

|

| Title of 12(b) Security |

COMMON STOCK, $.01 Par Value

|

| Trading Symbol |

ALB

|

| Security Exchange Name |

NYSE

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

COMMON STOCK, $.01 Par Value

|

| Trading Symbol |

ALB

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock |

|

| Cover [Abstract] |

|

| Title of 12(b) Security |

DEPOSITARY SHARES, each representing a 1/20th interest in a share of 7.25% Series A Mandatory Convertible Preferred Stock

|

| Trading Symbol |

ALB PR A

|

| Security Exchange Name |

NYSE

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

DEPOSITARY SHARES, each representing a 1/20th interest in a share of 7.25% Series A Mandatory Convertible Preferred Stock

|

| Trading Symbol |

ALB PR A

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

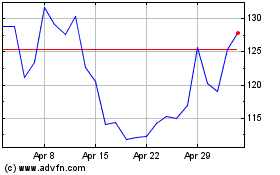

Albemarle (NYSE:ALB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Albemarle (NYSE:ALB)

Historical Stock Chart

From Dec 2023 to Dec 2024