UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2014

Commission File Number: 001-35783

Alamos Gold

Inc.

(Translation of registrant’s name into English)

130 Adelaide Street West, Suite 2200

Toronto, Ontario, Canada

M5H 3P5

(Address of

principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EXHIBIT INDEX

|

|

|

| EXHIBIT

NO. |

|

DESCRIPTION |

|

|

| 99.1 |

|

Press release, dated October 23, 2014. |

|

|

| 99.2 |

|

Unaudited Condensed Interim Consolidated Financial Statements. |

|

|

| 99.3 |

|

Management’s Discussion and Analysis. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Alamos Gold Inc. |

|

|

|

|

| Date: October 23, 2014 |

|

|

|

By: |

|

/s/ James Porter |

|

|

|

|

Name: |

|

James Porter |

|

|

|

|

Title: |

|

Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

|

|

|

|

|

|

|

|

|

ALAMOS GOLD INC. |

|

|

|

|

130 Adelaide Street West, Suite 2200

Toronto, Ontario M5H 3P5 Telephone: (416) 368-9932 or 1 (866)

788-8801 |

All amounts are in United States dollars, unless otherwise stated.

Alamos Reports Third Quarter 2014 Results

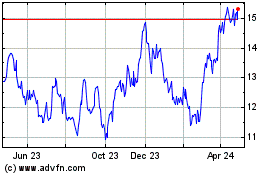

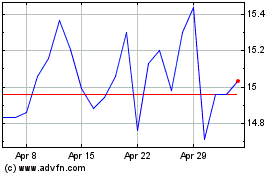

Toronto, Ontario (October 23, 2014) – Alamos Gold Inc. (TSX: AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported

its financial results for the third quarter ended September 30, 2014 and reviewed its operating, exploration and development activities.

“Operationally we had a solid quarter with 51,900 contained ounces stacked on the leach pad, the highest in more than a year with grades well above our

annual budget. Gold production of 28,000 ounces reflected sharply lower recoveries in the quarter as we experienced a severe rainy season, culminating with record rainfall in September. This resulted in dilution of the heap leach solutions and

delayed the recovery of a significant portion of these ounces; however, we expect to see the benefit of these stacked ounces in the fourth quarter. I am pleased to report that the modifications to the mill have been completed and we began processing

high grade ore from San Carlos during the first week of October. We will be ramping up high grade mill production through the fourth quarter and combined with the deferred production from the leach pad, we remain on track to achieve the low end of

our full year production guidance of 150,000 ounces,” said John A. McCluskey, President and Chief Executive Officer.

Third Quarter 2014

Highlights

Financial Performance

| |

• |

|

Realized quarterly loss of $2.2 million ($0.02 per share) compared to earnings of $9.2 million ($0.07 per share) in the third quarter of 2013 |

| |

• |

|

Generated cash from operating activities before changes in non-cash working capital of $9.9 million ($0.08 per share) |

| |

• |

|

Sold 30,000 ounces of gold at an average realized price of $1,284 per ounce for quarterly revenues of $38.5 million |

| |

• |

|

Reported cash and cash equivalents and short-term investments of $375.2 million as at September 30, 2014 |

| |

• |

|

Announced a semi-annual dividend of US$0.10 per common share payable on October 31, 2014. Including this dividend, the Company has returned over $102 million to shareholders in the form of dividends and share

repurchases over the past four years |

Operational Performance

| |

• |

|

Produced 28,000 ounces of gold at a total cash cost of $784 per ounce of gold sold, and at an all-in sustaining cost of $1,148 per ounce of gold sold. Costs for the third quarter were higher than budgeted given a severe

rainy season that diluted solution grades and resulted in the deferral of production to the fourth quarter |

TRADING SYMBOL: TSX:AGI NYSE:AGI

| |

• |

|

Mined and stacked ore on the leach pad grading 1.08 g/t Au, 27% above annual budgeted grades, resulting in 51,900 contained ounces stacked to the leach pad in the third quarter, the highest this year. This is expected

to contribute to a substantial increase in fourth quarter production |

| |

• |

|

Continued development activities at San Carlos and commenced underground mining of high grade ore. Approximately 25,000 tonnes of high grade ore from San Carlos were stockpiled at quarter end at grades above the current

mineral reserve grade of 7 g/t Au |

| |

• |

|

Received the approval of the Environmental Impact Assessment (“EIA”) certificate for the Aği Daği project in Turkey |

| |

• |

|

Achieved average crusher throughput of 16,400 tonnes per day in the third quarter, despite record rainfall levels |

Subsequent to Quarter-end

| |

• |

|

Completed modifications to the milling circuit and began processing San Carlos high grade ore in the first week of October |

| |

• |

|

Entered into agreements to acquire water concessions sufficient for all future mining activities at the Esperanza Gold Project, representing a significant milestone towards preparation of the project permit applications

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q3 2014 |

|

|

Q3 2013 |

|

|

Change (%) |

|

| Ounces produced |

|

|

28,000 |

|

|

|

43,000 |

|

|

|

(35 |

%) |

| Ounces sold |

|

|

30,000 |

|

|

|

48,000 |

|

|

|

(38 |

%) |

|

|

|

|

| Operating Revenues (000) |

|

$ |

38,523 |

|

|

$ |

63,811 |

|

|

|

(40 |

%) |

| Earnings (loss) before income taxes (000) |

|

($ |

3,667 |

) |

|

$ |

15,010 |

|

|

|

(124 |

%) |

| Earnings (loss) (000) |

|

($ |

2,238 |

) |

|

$ |

9,249 |

|

|

|

(124 |

%) |

| Earnings (loss) per share (basic and diluted) |

|

($ |

0.02 |

) |

|

$ |

0.07 |

|

|

|

(129 |

%) |

|

|

|

|

| Cash flow from operating activities before changes in non-cash working capital (000) |

|

$ |

9,904 |

|

|

$ |

26,362 |

|

|

|

(62 |

%) |

| Cash flow (used in) from operating activities (000) |

|

($ |

26 |

) |

|

$ |

25,697 |

|

|

|

(100 |

%) |

|

|

|

|

| Cash and short-term investments (000) (2) |

|

$ |

375,167 |

|

|

$ |

433,658 |

|

|

|

(13 |

%) |

|

|

|

|

| Realized gold price per ounce |

|

$ |

1,284 |

|

|

$ |

1,329 |

|

|

|

(3 |

%) |

| Average London PM Fix gold price per ounce |

|

$ |

1,282 |

|

|

$ |

1,326 |

|

|

|

(3 |

%) |

|

|

|

|

| Total cash cost per ounce (1) |

|

$ |

784 |

|

|

$ |

491 |

|

|

|

60 |

% |

| All-in sustaining cost per ounce (1) |

|

$ |

1,148 |

|

|

$ |

810 |

|

|

|

42 |

% |

| All-in cost per ounce (1) |

|

$ |

1,498 |

|

|

$ |

970 |

|

|

|

54 |

% |

| (1) |

“Total cash cost per ounce”, “All-in sustaining cost per ounce” and “All-in cost per ounce” are non-GAAP measures. Refer to the “Cautionary non-GAAP Measures and Additional GAAP

Measures” disclosure at the end of this press release for a description and calculation of these measures. |

| (2) |

Cash and short-term investments are shown as at September 30, 2014 and September 30, 2013. |

TRADING SYMBOL: TSX:AGI NYSE:AGI

Third Quarter 2014 Financial Results

The Company’s operating margins in the third quarter of 2014 were negatively impacted by a weaker gold price and lower production caused by heavy

rainfall. The Company generated $9.9 million ($0.08 per share) cash from operating activities (before changes in non-cash working capital). Cash used in operating activities of $0.03 million decreased significantly relative to the same period of

2013 as a result of lower gold sales and higher cash costs.

A loss before income taxes of $3.7 million or $0.03 per share was incurred in the third

quarter of 2014, compared to earnings of $15.0 million or $0.12 per basic share in the third quarter of 2013. On an after-tax basis, the Company recorded a loss in the third quarter of 2014 of $2.2 million or $0.02 per share compared to earnings of

$9.2 million in the same period of 2013 as a result of lower gold sales and higher cash costs.

Capital expenditures in the third quarter of 2014 totaled

$15.3 million. Sustaining capital totaled $3.9 million in Mexico in the third quarter, including $1.9 million of spending on interlift liners for the leach pad and cleaning of the ponds, $1.3 million on construction activities, and $0.5 million for

component changes. Sustaining capital of $11.2 million year to date is in line with annual guidance of $13.2 million.

In addition, development spending

of $10.9 million in Mexico was focused on underground development of the San Carlos deposit, waste removal at El Victor, modifications to the mill circuit and capitalized exploration. Construction of the bridge over the Mulatos River was completed

before the onset of the rainy season in July, allowing for year-round access to San Carlos.

Key financial highlights for the three and nine months ended

September 30, 2014 and 2013 are presented at the end of this release in Table 1. The unaudited interim consolidated statements of financial position, comprehensive income, and cash flows for the three and nine months ended September 30,

2014 and 2013 are presented at the end of this release in Table 2.

Third Quarter 2014 Operating Results

Gold production of 28,000 ounces in the third quarter of 2014 decreased 35% compared to 43,000 ounces in the same period of 2013, attributable to less high

grade mill production and higher than normal rainfall, which resulted in leach pad dilution and lower crusher throughput.

Total crusher throughput in the

third quarter of 2014 averaged 16,400 tpd, below the annual budgeted throughput as a result of above average rainfall in the quarter and lower high grade mill feed from Escondida Deep. The Company expects to return to budgeted crusher throughput

levels in the fourth quarter of 2014 with the ramp up of high-grade mill production from San Carlos.

The ratio of ounces produced to contained ounces

stacked or milled (or recovery ratio) in the third quarter was 51% compared to 70% in the third quarter of 2013, and well below the annualized budget of 75%. The recovery ratio was significantly impacted by heavy rains at the mine throughout the

entire quarter, including record rainfall for the month of September. The heavy rainfall resulted in dilution of the gold-bearing solution on the leach pad, thereby deferring a significant portion of production to the fourth quarter of 2014. With

the completion of the rainy season, the Company shocked the leach pad with additional cyanide, which is expected to result in the recovery of deferred production.

TRADING SYMBOL: TSX:AGI NYSE:AGI

The Company continued to benefit from higher grades in the third quarter of 2014, with the grade of crushed

ore stacked on the leach pad of 1.08 g/t Au being 27% higher than the budgeted annual grade of 0.85 g/t Au. Despite the lower recovery ratio caused by the heavy rains, contained ounces stacked to the leach pad of 51,900 ounces in the quarter were

the highest this year, the benefit of which is expected to be realized in the fourth quarter.

The grade of ore mined and milled from the Escondida Deep

deposit was 8.47 g/t Au for the quarter, consistent with the reserve grade. The number of tonnes mined and processed from the Escondida Deep deposit in the third quarter was in line with revised expectations but below the annual budget level. The

Company has exhausted the current mineral reserves at Escondida Deep, but will continue exploration activities with the objective of delineating additional high grade mineral resources at other underground targets in proximity to Escondida Deep.

Escondida Deep development will be used as infrastructure support for future underground exploration activities.

Development of the San Carlos high grade

underground deposit was the primary focus during the third quarter. The Company advanced approximately 600 metres during the third quarter, with total development to date of 1,050 metres. The Company is currently developing three primary headings to

support mining stopes, which will be mined in the fourth quarter.

The Company completed the upgrade to the existing mill circuit in early October. The

upgraded mill circuit is designed to optimize recoveries from the various ore types within San Carlos to ensure the budgeted recovery of 75% is achievable. While the mill improvements were ongoing in the third quarter, the Company stockpiled high

grade development ore from the San Carlos deposit. At the end of the third quarter, the stockpile had reached a total of 25,000 tonnes, with average grades above the current mineral reserve grade of 7 g/t Au. The upgraded mill circuit began

processing the high grade stockpile during the first week of October.

Cash operating costs of $719 per ounce of gold sold in the third quarter of 2014

were above the Company’s annual guidance range of $630 to $670 per ounce, and were 66% higher than $434 per ounce reported in the third quarter of 2013. This increase is primarily attributable to higher cost per tonne of ore mined and higher

costs associated with underground production, as well as lower production from the high grade deposit which has a lower cost profile. On a year-to-date basis, cash operating costs of $617 per ounce remain below the low end of the Company’s

annual guidance range. Including royalties, total cash costs were $784 per ounce of gold sold in the third quarter of 2014.

Key operational metrics and

production statistics for the third quarter and year to date in 2014 compared to the same periods of 2013 are presented in Table 3 at the end of this press release.

Turkey Developments

In August 2013, the Turkish Ministry

of Environment and Urbanization (the “Ministry”) formally approved the Company’s EIA for the Kirazli project. However, in January 2014, the Çanakkale Administrative Court in Turkey (the “Court”) granted an injunction

order in response to a lawsuit claiming that the Ministry’s approval of the EIA for the Company’s Kirazli project failed to assess the “cumulative impacts” of the Kirazli project and other potential mining projects in the region.

The Ministry contested the Court’s decision on the basis that there was no applicable regulatory requirement to include such an assessment in an EIA report at the relevant time. Notwithstanding this factor, in the third quarter, the

Çanakkale Administrative

TRADING SYMBOL: TSX:AGI NYSE:AGI

Court, as the first instance court, cancelled the Ministry’s EIA approval in relation to the Kirazli main project due to the lack of cumulative impact assessment (“CIA”). The

Court’s basis for the injunction did not relate to concerns with any technical aspect of the Kirazli project.

The Ministry and the Company appealed

this ruling to the Turkish High Administrative Court. The appeal decision remains pending, but is expected to be finalized within three to six months. In order to address the CIA requirements and concerns of the Court, the Company has prepared and

submitted a CIA assessment for the Kirazli project, which is currently under review by the Ministry.

In August 2014, the Ministry signed and issued

formal approval in the form of an EIA Positive Decision Certificate for the Aği Daği project. A new legislative process was recently implemented in Turkey, whereby any legal challenge to an EIA must be registered within 30 days of the

approval by the Ministry. This deadline has passed and the Company is not aware of any legal challenges filed, therefore, the Company does not currently anticipate the same legal challenges that have faced the Kirazli EIA. Obtaining forestry and

operating permits are the next steps in the permitting process for the project.

The Company has budgeted spending of $4.8 million in Turkey in 2014 for

permitting, community and government relations and general administration costs only. Given the continuing delay in receipt of key permits, the Company reduced its headcount early in 2014 and curtailed spending significantly in Turkey. A full

development budget for Kirazli and Aği Daği will be re-initiated once the required permits are received.

Third Quarter 2014 Exploration

Update

Total exploration expenditures in the third quarter of 2014 were $8.4 million primarily focused at Mulatos where exploration spending totaled

$7.1 million. This included $5.4 million of infill drilling at San Carlos and Puerta del Aire, which was capitalized. An additional $1.7 million spent at East Estrella, Escondida Deep and administration costs were expensed.

Mulatos

During the third quarter, the focus of exploration was

on three areas; additional infill drilling to support underground mining, mineral reserve and resource drilling, and exploration drilling. The Company had up to nine drill rigs active at Mulatos to support the exploration program during the quarter.

Four deposits were drilled during the quarter, including San Carlos, Escondida Deep, Puerto del Aire, and East Estrella. Up to five drill rigs were

active from surface at San Carlos, two rigs at each of East Estrella and Puerto del Aire, and one underground diamond rig at Escondida Deep and San Carlos.

San Carlos remains the highest priority for exploration with approximately 21,205 metres (“m”) drilled on the deposit during the third quarter.

Approximately half of this was tight infill drilling to support underground mining operations and planning. The remainder was drilled as part of the ongoing exploration program to upgrade existing mineral resources and to extend the strike and dip

of existing mineral resources.

TRADING SYMBOL: TSX:AGI NYSE:AGI

Drilling at Puerto del Aire was designed to upgrade inferred mineral resources and to test a high-grade zone

of mineralization in the north-eastern extension of the deposit. A total of 9,916m was drilled during the quarter. Results are being analyzed and a decision on a second phase of drilling is expected in 2015 to further test the high-grade zone.

A total of 3,054m was drilled at East Estrella during the quarter with the objective of extending and upgrading existing mineral resources.

Esperanza

The Company capitalized $1.1 million at the Esperanza

Gold Project in the third quarter. These development costs were primarily related to the collection of baseline study data to support resubmission of the EIA. The Company is currently completing preparatory work for a planned geotechnical and

exploration drill program in the first half of 2015.

In addition, the Company has entered into agreements with local vendors to acquire water concessions

sufficient for all future mining activities at the Esperanza Gold Project, representing a significant milestone towards preparation of the project permit applications. The Company is in the process of finalizing these agreements.

Quartz Mountain

During the third quarter, the Company invested

$0.2 million at the Quartz Mountain project, which was expensed. The drill program envisioned for the third quarter was delayed due to high forest fire hazard levels in the region. An expanded 8,000m drill program is in the approval process and

drilling is expected to begin in October 2014.

Outlook

The Company expects to achieve the low end of its full year production guidance of 150,000 ounces in 2014. Gold production in the first nine months of 2014

totaled 98,000 ounces at total cash cost levels within the Company’s guidance range for the year. While the Company has continued to benefit from grades 19% higher than budgeted from heap leach ore throughout the first three quarters of 2014,

heavy rains in the third quarter resulted in the deferral of significant gold production to the fourth quarter. Contained ounces stacked to the leach pad in the third quarter were the highest thus far this year. The benefit of this is expected to be

realized in the fourth quarter with recoveries anticipated to increase significantly following the end of the rainy season. Combined with the ramp-up of high-grade mill production from San Carlos, the Company expects a significant increase in

production in the fourth quarter.

San Carlos underground development to-date has focused on completing sufficient headings to support the ramp up of

underground ore production. The Company mined and stockpiled approximately 25,000 tonnes of development ore during the third quarter, at grades above the current mineral reserve grade of 7 g/t Au, and will commence mining stopes in the fourth

quarter. The Company expects to ramp up mining rates during the quarter with the objective of achieving approximately 500 tonnes per day of ore mined by the end of the fourth quarter. Ore mined during the third quarter was stockpiled while

modifications to the milling circuit were being completed in order to ensure optimal recoveries from the different ore types within the San Carlos deposit. The modifications to the milling circuit were completed in early October, and the Company has

begun processing high grade ore. Mill throughput is expected to ramp up to over 500 tonnes per day processed by the end of the quarter.

TRADING SYMBOL: TSX:AGI NYSE:AGI

Looking beyond 2014, the Company expects development of the Cerro Pelon and La Yaqui satellite deposits to

bring on low cost production growth. The Company closed the acquisition of the surface rights to La Yaqui in June 2014 and expects to close the acquisition of surface rights for Cerro Pelon shortly. The two projects are expected to contribute an

average of 33,000 ounces per year of low cost gold production over a 5 year mine life, with peak annual production of 50,000 ounces. Baseline work has commenced in order to compile information for the environmental impact assessments (MIA), with

approvals expected in approximately 15-18 months. This will be followed by a 6-8 month construction period at La Yaqui and 8-10 month construction period at Cerro Pelon. Total initial capital to construct both projects is expected to be

approximately $21 million. In conjunction with the completion of the environmental baseline studies, the Company will undertake further detailed economic analysis as well as additional exploration drilling at both La Yaqui and Cerro Pelon.

Gold production from the first of the Company’s Turkish projects, Kirazli, is expected within 18 months of receipt of the outstanding forestry and

operating permits. The Company remains confident that these permits will be granted. However, legal challenges have increased uncertainty of the expected timing for receipt of these permits. The Company has prepared and filed with the Ministry of

Environment a cumulative impact assessment for the Kirazli project. The EIA for the Aği Daği project was formally approved in August 2014 and requires forestry and operating permits before proceeding with construction.

Work in support of an EIA submission for the Esperanza Gold Project in 2015 is underway. Drilling at the Quartz Mountain Property focused on validating the

existing mineral resources is expected to begin at the end of October 2014.

The lower gold price environment further emphasizes the strategic importance

of financial strength and flexibility and the Company is evaluating its capital allocation decisions accordingly. The Company’s financial position remains strong, with approximately $375.2 million in cash and cash equivalents and no debt. The

Company is well positioned to pursue accretive opportunities and to deliver on its development project pipeline.

Associated Documents

This press release should be read in conjunction with the Company’s interim consolidated financial statements for the three and nine month periods ended

September 30, 2014 and September 30, 2013 and associated Management’s Discussion and Analysis (“MD&A”), which are available from the Company’s website, www.alamosgold.com, in the “Investor Centre” tab in

the “Reports and Financial Statements” section, and on SEDAR (www.sedar.com) and EDGAR (www.sec.gov).

Reminder of Third Quarter 2014 Results

Conference Call

The Company’s senior management will host a conference call on Thursday, October 23, 2014 at 12:00 pm ET to discuss the

third quarter 2014 financial results and update operating, exploration, and development activities.

Participants may join the conference call by dialling

(416) 340-8527 or (877) 677-0837 for calls within Canada and the United States, or via webcast at www.alamosgold.com.

TRADING SYMBOL: TSX:AGI NYSE:AGI

A playback will be available until November 6, 2014 by dialling (905) 694-9451 or

(800) 408-3053 within Canada and the United States. The pass code is 5647875. The webcast will be archived at www.alamosgold.com.

About

Alamos

Alamos is an established Canadian-based gold producer that owns and operates the Mulatos Mine in Mexico, and has exploration and development

activities in Mexico, Turkey and the United States. The Company employs more than 500 people and is committed to the highest standards of sustainable development. Alamos has approximately $375 million in cash and cash equivalents, is debt-free, and

unhedged to the price of gold. As of October 21, 2014, Alamos had 127,357,486 common shares outstanding (139,279,652 shares fully diluted), which are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Scott K. Parsons

Director, Investor Relations

(416) 368-9932 x 439

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note

No stock exchange, securities commission

or other regulatory authority has approved or disapproved the information contained herein. This News Release includes certain “forward-looking statements”. All statements other than statements of historical fact included in this release,

including without limitation statements regarding forecast gold production, gold grades, recoveries, waste-to-ore ratios, total cash costs, potential mineralization and reserves, exploration results, and future plans and objectives of Alamos, are

forward-looking statements that involve various risks and uncertainties. These forward-looking statements include, but are not limited to, statements with respect to mining and processing of mined ore, achieving projected recovery rates, anticipated

production rates and mine life, operating efficiencies, costs and expenditures, changes in mineral resources and conversion of mineral resources to proven and probable reserves, and other information that is based on forecasts of future operational

or financial results, estimates of amounts not yet determinable and assumptions of management.

Exploration results that include geophysics, sampling, and

drill results on wide spacings may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to

be classed as a category of mineral resource. A mineral resource that is classified as “inferred” or “indicated” has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that

any or part of an “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category of resource. Investors are cautioned not to assume that all or any part of mineral deposits in these

categories will ever be converted into proven and probable reserves.

Any statements that express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”,

“anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might”

or “will” be taken, occur or be achieved) are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual

events or results to differ from those reflected in the forward-looking statements.

TRADING SYMBOL: TSX:AGI NYSE:AGI

There can be no assurance that forward-looking statements will prove to be accurate and actual results and

future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Alamos’ expectations include, among others, risks related to international operations,

the actual results of current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined as well as future prices of gold and silver, as well as those factors discussed in the

section entitled “Risk Factors” in Alamos’ Annual Information Form. Although Alamos has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements.

Note to U.S. Investors

Alamos prepares its disclosure in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S.

securities laws. Terms relating to mineral resources in this presentation are defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining,

Metallurgy, and Petroleum Standards on Mineral Resources and Mineral Reserves. The United States Securities and Exchange Commission (the “SEC”) permits mining companies, in their filings with the SEC, to disclose only those mineral

deposits that a company can economically and legally extract or produce. Alamos may use certain terms, such as “measured mineral resources”, “indicated mineral resources”, “inferred mineral resources” and “probable

mineral reserves” that the SEC does not recognize (these terms may be used in this presentation and are included in the public filings of Alamos, which have been filed with the SEC and the securities commissions or similar authorities in

Canada).

Cautionary non-GAAP Measures and Additional GAAP Measures

Note that for purposes of this section, GAAP refers to IFRS. The Company believes that investors use certain non-GAAP and additional GAAP measures as

indicators to assess gold mining companies. They are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared with GAAP. Non-GAAP and additional GAAP measures do not

have a standardized meaning prescribed under IFRS and therefore may not be comparable to similar measures presented by other companies.

| (i) |

Cash flow from operating activities before changes in non-cash working capital |

“Cash flow from

operating activities before changes in non-cash working capital” is a non-GAAP performance measure that could provide an indication of the Company’s ability to generate cash flows from operations, and is calculated by adding back the

change in non-cash working capital to “Cash provided by (used in) operating activities” as presented on the Company’s consolidated statements of cash flows.

The following table reconciles the non-GAAP measure to the consolidated statements of cash flows.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q3

2014 |

|

|

Q3

2013 |

|

|

YTD

2014 |

|

|

YTD

2013 |

|

| Cash flow from operating activities – IFRS (000) |

|

($ |

26 |

) |

|

$ |

25,697 |

|

|

$ |

16,938 |

|

|

$ |

71,540 |

|

| Changes in non-cash working capital (000) |

|

|

9,930 |

|

|

|

665 |

|

|

|

22,120 |

|

|

|

29,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flow from operating activities before changes in non-cash working capital (000) |

|

$ |

9,904 |

|

|

$ |

26,362 |

|

|

$ |

39,058 |

|

|

$ |

100,541 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (ii) |

Mining cost per tonne of ore |

“Mining cost per tonne of ore” and “Cost per tonne of

ore” are non-GAAP performance measures that could provide an indication of the mining and processing efficiency and effectiveness of the mine. These measures are calculated by dividing the relevant mining and processing costs and total costs by

the tonnes of ore processed in the period. “Cost per tonne of ore” is usually affected by operating efficiencies and waste-to-ore ratios in the period. The following table reconciles the non-GAAP measure to the consolidated statements of

comprehensive income.

TRADING SYMBOL: TSX:AGI NYSE:AGI

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q3

2014 |

|

|

Q3

2013 |

|

|

YTD

2014 |

|

|

YTD

2013 |

|

| Mining and processing costs – IFRS (000) |

|

$ |

21,565 |

|

|

$ |

20,855 |

|

|

$ |

59,367 |

|

|

$ |

60,618 |

|

| Inventory adjustments and period costs (000) |

|

|

(4,349 |

) |

|

|

453 |

|

|

|

(11,969 |

) |

|

|

974 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost (000) |

|

$ |

25,914 |

|

|

$ |

21,308 |

|

|

$ |

71,336 |

|

|

$ |

61,592 |

|

| Tonnes Ore stacked / milled (000) |

|

|

1,507.5 |

|

|

|

1,656.9 |

|

|

|

4,608.3 |

|

|

|

4,868.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost per tonne of ore |

|

$ |

17.19 |

|

|

$ |

12.86 |

|

|

$ |

15.48 |

|

|

$ |

12.65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (iii) |

Cash operating costs per ounce and total cash costs per ounce |

“Cash operating costs per

ounce” and “total cash costs per ounce” as used in this analysis are non-GAAP terms typically used by gold mining companies to assess the level of gross margin available to the Company by subtracting these costs from the unit price

realized during the period. These non-GAAP terms are also used to assess the ability of a mining company to generate cash flow from operations. There may be some variation in the method of computation of “cash operating costs per ounce” as

determined by the Company compared with other mining companies. In this context, “cash operating costs per ounce” reflects the cash operating costs allocated from in-process and dore inventory associated with ounces of gold sold in the

period. “Cash operating costs per ounce” may vary from one period to another due to operating efficiencies, waste-to-ore ratios, grade of ore processed and gold recovery rates in the period. “Total cash costs per ounce” includes

“cash operating costs per ounce” plus applicable royalties. Cash operating costs per ounce and total cash costs per ounce are exclusive of exploration costs.

The following table reconciles these non-GAAP measure to the consolidated statements of comprehensive income.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q3

2014 |

|

|

Q3

2013 |

|

|

YTD

2014 |

|

|

YTD

2013 |

|

| Mining and processing costs – IFRS (000) |

|

$ |

21,565 |

|

|

$ |

20,855 |

|

|

$ |

59,367 |

|

|

$ |

60,618 |

|

| Divided by: Gold ounces sold |

|

|

30,000 |

|

|

|

48,000 |

|

|

|

96,200 |

|

|

|

156,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Cash operating costs per ounce |

|

$ |

719 |

|

|

$ |

434 |

|

|

$ |

617 |

|

|

$ |

389 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mining and processing costs – IFRS (000) |

|

$ |

21,565 |

|

|

$ |

20,855 |

|

|

$ |

59,367 |

|

|

$ |

60,618 |

|

| Royalties – IFRS (000) |

|

|

1,958 |

|

|

|

2,707 |

|

|

|

6,578 |

|

|

|

11,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Cash costs (000) |

|

$ |

23,523 |

|

|

$ |

23,562 |

|

|

$ |

65,945 |

|

|

$ |

71,988 |

|

| Divided by: Gold ounces sold |

|

|

30,000 |

|

|

|

48,000 |

|

|

|

96,200 |

|

|

|

156,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Cash costs per ounce |

|

$ |

784 |

|

|

$ |

491 |

|

|

$ |

686 |

|

|

$ |

461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (iv) |

All-in sustaining cost per ounce |

Effective 2013, in conjunction with a non-GAAP initiative being

undertaken by the gold mining industry, the Company is adopting an “all-in sustaining cost per ounce” non-GAAP performance measure. The Company believes the measure more fully defines the total costs associated with producing gold;

however, this performance measure has no standardized meaning. Accordingly, there may be some variation in the method of computation of “all-in sustaining cost per ounce” as determined by the Company compared with other mining companies.

In this context, “all-in sustaining cost per ounce” reflects total mining and processing costs, corporate and administrative costs, exploration costs, sustaining capital, and other operating costs. Sustaining capital expenditures are

expenditures that do not increase annual gold ounce production at a mine site and excludes all expenditures at the Company’s development projects as well as certain expenditures at the Company’s operating sites that are deemed expansionary

in nature.

TRADING SYMBOL: TSX:AGI NYSE:AGI

The following table reconciles these non-GAAP measures to the consolidated statements of comprehensive

income.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q3

2014 |

|

|

Q3

2013 |

|

|

YTD

2014 |

|

|

YTD

2013 |

|

| Mining and processing costs (000) |

|

$ |

21,565 |

|

|

$ |

20,855 |

|

|

$ |

59,367 |

|

|

$ |

60,618 |

|

| Royalties (000) |

|

|

1,958 |

|

|

|

2,707 |

|

|

|

6,578 |

|

|

|

11,370 |

|

| Corporate and administration (000) (1) |

|

|

3,453 |

|

|

|

3,735 |

|

|

|

10,737 |

|

|

|

15,904 |

|

| Share-based compensation (000) |

|

|

19 |

|

|

|

3,524 |

|

|

|

1,019 |

|

|

|

3,944 |

|

| Exploration costs (000) (2) |

|

|

3,169 |

|

|

|

2,762 |

|

|

|

9,343 |

|

|

|

7,530 |

|

| Reclamation cost accretion (000) |

|

|

351 |

|

|

|

212 |

|

|

|

1,041 |

|

|

|

688 |

|

| Sustaining capital expenditures (000) |

|

|

3,929 |

|

|

|

5,058 |

|

|

|

11,215 |

|

|

|

13,648 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

34,444 |

|

|

$ |

38,853 |

|

|

$ |

99,300 |

|

|

$ |

113,702 |

|

| Divided by: Gold ounces sold |

|

|

30,000 |

|

|

|

48,000 |

|

|

|

96,200 |

|

|

|

156,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| All-in sustaining cost per ounce |

|

$ |

1,148 |

|

|

$ |

810 |

|

|

$ |

1,032 |

|

|

$ |

729 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Excludes corporate and administration costs incurred at the Company’s development projects |

| (2) |

Excludes exploration associated with the Company’s development projects |

Effective 2013, in conjunction with a non-GAAP initiative being undertaken by the gold

mining industry, the Company is adopting an “all-in cost per ounce” non-GAAP performance measure; however, this performance measure has no standardized meaning. Accordingly, there may be some variation in the method of computation of

“all-in cost per ounce” as determined by the Company compared with other mining companies. In this context, “all-in cost per ounce” reflects total all-in sustaining cash costs, plus capital, operating, and exploration costs

associated with the Company’s development projects.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q3

2014 |

|

|

Q3

2013 |

|

|

YTD

2014 |

|

|

YTD

2013 |

|

| All-in sustaining cost (above) |

|

$ |

34,444 |

|

|

$ |

38,853 |

|

|

$ |

99,300 |

|

|

$ |

113,702 |

|

| Add: Development and expansion capital (000) |

|

|

8,514 |

|

|

|

6,892 |

|

|

|

20,974 |

|

|

|

22,607 |

|

| Add: Other development and exploration (000) |

|

|

1,552 |

|

|

|

483 |

|

|

|

4,322 |

|

|

|

2,728 |

|

| Add: Development project corporate and administration (000) |

|

|

419 |

|

|

|

336 |

|

|

|

1,569 |

|

|

|

1,385 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44,929 |

|

|

|

46,564 |

|

|

|

126,165 |

|

|

|

140,422 |

|

| Divided by: Gold ounces sold |

|

|

30,000 |

|

|

|

48,000 |

|

|

|

98,200 |

|

|

|

156,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| All-in cost per ounce |

|

$ |

1,498 |

|

|

$ |

970 |

|

|

$ |

1,311 |

|

|

$ |

900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (vi) |

Other additional GAAP measures |

Additional GAAP measures that are presented on the face of the

Company’s consolidated statements of comprehensive income and are not meant to be a substitute for other subtotals or totals presented in accordance with IFRS, but rather should be evaluated in conjunction with such IFRS measures. The following

additional GAAP measures are used and are intended to provide an indication of the Company’s mine and operating performance:

| |

• |

|

Mine operating costs – represents the total of mining and processing, royalties, and amortization expense |

| |

• |

|

Earnings from mine operations – represents the amount of revenues in excess of mining and processing, royalties, and amortization expense. |

| |

• |

|

Earnings from operations – represents the amount of earnings before net finance income/expense, foreign exchange gain/loss, other income/loss, and income tax expense |

TRADING SYMBOL: TSX:AGI NYSE:AGI

Table 1: Financial Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q3

2014 |

|

|

Q3

2013 |

|

|

YTD

2014 |

|

|

YTD

2013 |

|

| Cash provided by operating activities before changes in non-cash working capital

(000)(1) (2) |

|

$ |

9,904 |

|

|

$ |

26,362 |

|

|

$ |

39,058 |

|

|

$ |

100,541 |

|

| Changes in non-cash working capital |

|

($ |

9,930 |

) |

|

($ |

665 |

) |

|

($ |

22,120 |

) |

|

($ |

29,001 |

) |

| Cash provided (used) by operating activities (000) |

|

($ |

26 |

) |

|

$ |

25,697 |

|

|

$ |

16,938 |

|

|

$ |

71,540 |

|

|

|

|

|

|

| Earnings (loss) before income taxes (000) |

|

($ |

3,667 |

) |

|

$ |

15,010 |

|

|

$ |

5,542 |

|

|

$ |

72,877 |

|

| Earnings (loss) (000) |

|

($ |

2,238 |

) |

|

$ |

9,249 |

|

|

$ |

1,241 |

|

|

$ |

44,066 |

|

|

|

|

|

|

| Earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - basic |

|

$ |

(0.02 |

) |

|

$ |

0.07 |

|

|

$ |

0.01 |

|

|

$ |

0.35 |

|

| - diluted |

|

$ |

(0.02 |

) |

|

$ |

0.07 |

|

|

$ |

0.01 |

|

|

$ |

0.35 |

|

|

|

|

|

|

| Comprehensive income (000) |

|

($ |

2,887 |

) |

|

$ |

8,960 |

|

|

$ |

35 |

|

|

$ |

44,841 |

|

| Weighted average number of common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - basic |

|

|

127,357,000 |

|

|

|

127,445,000 |

|

|

|

127,399,000 |

|

|

|

127,215,000 |

|

| - diluted |

|

|

127,357,000 |

|

|

|

127,752,000 |

|

|

|

127,403,000 |

|

|

|

127,393,000 |

|

|

|

|

|

|

| Assets (000) (3) |

|

|

|

|

|

|

|

|

|

$ |

891,578 |

|

|

$ |

898,028 |

|

| (1) |

A non-GAAP measure calculated as cash provided by operating activities as presented on the consolidated statements of cash flows and adding back changes in non-cash working capital. |

| (2) |

Refer to “Cautionary non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release for a description and calculation of this measure. |

| (3) |

Assets are shown as at September 30, 2014 and December 31, 2013. |

TRADING SYMBOL: TSX:AGI NYSE:AGI

Table 2: Unaudited Consolidated Statements of Financial Position, Comprehensive

Income, and Cash Flows

ALAMOS GOLD

INC.

Consolidated Statements of Financial Position

(Unaudited - stated in thousands of United States dollars)

|

|

|

|

|

|

|

|

|

| |

|

September 30,

2014 |

|

|

December 31,

2013 |

|

| A S S E T S |

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

375,167 |

|

|

$ |

409,663 |

|

| Short-term investments |

|

|

— |

|

|

|

7,792 |

|

| Available-for-sale securities |

|

|

1,728 |

|

|

|

1,896 |

|

| Other financial assets |

|

|

— |

|

|

|

442 |

|

| Amounts receivable |

|

|

15,444 |

|

|

|

11,200 |

|

| Income taxes receivable |

|

|

9,774 |

|

|

|

— |

|

| Advances and prepaid expenses |

|

|

7,185 |

|

|

|

9,068 |

|

| Inventory |

|

|

57,324 |

|

|

|

37,972 |

|

|

|

|

|

|

|

|

|

|

| Total Current Assets |

|

|

466,622 |

|

|

|

478,033 |

|

|

|

|

| Non-Current Assets |

|

|

|

|

|

|

|

|

| Other non-current assets |

|

|

5,314 |

|

|

|

2,696 |

|

| Exploration and evaluation assets |

|

|

218,587 |

|

|

|

214,387 |

|

| Mineral property, plant and equipment |

|

|

201,055 |

|

|

|

202,912 |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

891,578 |

|

|

$ |

898,028 |

|

|

|

|

|

|

|

|

|

|

| L I A B I L I T I E S |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

$ |

30,999 |

|

|

$ |

23,487 |

|

| Dividends payable |

|

|

12,736 |

|

|

|

— |

|

| Income taxes payable |

|

|

— |

|

|

|

1,783 |

|

|

|

|

|

|

|

|

|

|

| Total Current Liabilities |

|

|

43,735 |

|

|

|

25,270 |

|

|

|

|

| Non-Current Liabilities |

|

|

|

|

|

|

|

|

| Deferred income taxes |

|

|

41,145 |

|

|

|

38,715 |

|

| Decommissioning liability |

|

|

21,392 |

|

|

|

21,406 |

|

| Other liabilities |

|

|

539 |

|

|

|

690 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

106,811 |

|

|

|

86,081 |

|

|

|

|

|

|

|

|

|

|

| E Q U I T Y |

|

|

|

|

|

|

|

|

| Share capital |

|

$ |

509,068 |

|

|

$ |

510,473 |

|

| Warrants |

|

|

21,667 |

|

|

|

21,667 |

|

| Contributed surplus |

|

|

25,726 |

|

|

|

24,236 |

|

| Accumulated other comprehensive loss |

|

|

(2,299 |

) |

|

|

(1,093 |

) |

| Retained earnings |

|

|

230,605 |

|

|

|

256,664 |

|

|

|

|

|

|

|

|

|

|

| Total Equity |

|

|

784,767 |

|

|

|

811,947 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Equity |

|

$ |

891,578 |

|

|

$ |

898,028 |

|

|

|

|

|

|

|

|

|

|

TRADING SYMBOL: TSX:AGI NYSE:AGI

ALAMOS GOLD INC.

Consolidated Statements of Comprehensive Income

(Unaudited - stated in thousands of United States dollars, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three-month

periods ended |

|

|

For the nine-month

periods ended |

|

| |

|

September 30,

2014 |

|

|

September 30,

2013 |

|

|

September 30,

2014 |

|

|

September 30,

2013 |

|

| OPERATING REVENUES |

|

$ |

38,523 |

|

|

$ |

63,811 |

|

|

$ |

123,877 |

|

|

$ |

228,356 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MINE OPERATING COSTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mining and processing |

|

|

21,565 |

|

|

|

20,855 |

|

|

|

59,367 |

|

|

|

60,618 |

|

| Royalties |

|

|

1,958 |

|

|

|

2,707 |

|

|

|

6,578 |

|

|

|

11,370 |

|

| Amortization |

|

|

10,709 |

|

|

|

15,845 |

|

|

|

31,832 |

|

|

|

45,241 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34,232 |

|

|

|

39,407 |

|

|

|

97,777 |

|

|

|

117,229 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS FROM MINE OPERATIONS |

|

|

4,291 |

|

|

|

24,404 |

|

|

|

26,100 |

|

|

|

111,127 |

|

|

|

|

|

|

| EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exploration |

|

|

1,982 |

|

|

|

2,105 |

|

|

|

4,882 |

|

|

|

4,277 |

|

| Corporate and administrative |

|

|

3,871 |

|

|

|

4,071 |

|

|

|

12,305 |

|

|

|

17,289 |

|

| Share-based compensation |

|

|

19 |

|

|

|

3,524 |

|

|

|

1,019 |

|

|

|

3,944 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,872 |

|

|

|

9,700 |

|

|

|

18,206 |

|

|

|

25,510 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS (LOSS) FROM OPERATIONS |

|

|

(1,581 |

) |

|

|

14,704 |

|

|

|

7,894 |

|

|

|

85,617 |

|

|

|

|

|

|

| OTHER INCOME (EXPENSES) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Finance income |

|

|

783 |

|

|

|

1,016 |

|

|

|

2,289 |

|

|

|

2,334 |

|

| Financing expense |

|

|

(350 |

) |

|

|

(212 |

) |

|

|

(1,048 |

) |

|

|

(688 |

) |

| Foreign exchange loss |

|

|

(2,078 |

) |

|

|

(431 |

) |

|

|

(2,039 |

) |

|

|

(7,395 |

) |

| Other loss |

|

|

(441 |

) |

|

|

(67 |

) |

|

|

(1,554 |

) |

|

|

(6,991 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS (LOSS) BEFORE INCOME TAXES FOR THE PERIOD |

|

|

(3,667 |

) |

|

|

15,010 |

|

|

|

5,542 |

|

|

|

72,877 |

|

|

|

|

|

|

| INCOME TAXES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current tax recovery (expense) |

|

|

1,109 |

|

|

|

(8,186 |

) |

|

|

(1,871 |

) |

|

|

(34,611 |

) |

| Deferred tax recovery (expense) |

|

|

320 |

|

|

|

2,425 |

|

|

|

(2,430 |

) |

|

|

5,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS (LOSS) FOR THE PERIOD |

|

$ |

(2,238 |

) |

|

$ |

9,249 |

|

|

$ |

1,241 |

|

|

$ |

44,066 |

|

|

|

|

|

|

| Other comprehensive loss to be reclassified to profit or loss in subsequent periods: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - Unrealized loss on securities |

|

|

(649 |

) |

|

|

(289 |

) |

|

|

(1,206 |

) |

|

|

(1,893 |

) |

| - Reclassification of realized losses on available-for-sale securities included in earnings |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,668 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE INCOME (LOSS) FOR THE PERIOD |

|

$ |

(2,887 |

) |

|

$ |

8,960 |

|

|

$ |

35 |

|

|

$ |

44,841 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS (LOSS) PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| – basic |

|

$ |

(0.02 |

) |

|

$ |

0.07 |

|

|

$ |

0.01 |

|

|

$ |

0.35 |

|

| – diluted |

|

$ |

(0.02 |

) |

|

$ |

0.07 |

|

|

$ |

0.01 |

|

|

$ |

0.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - basic |

|

|

127,357,000 |

|

|

|

127,445,000 |

|

|

|

127,399,000 |

|

|

|

127,215,000 |

|

| - diluted |

|

|

127,357,000 |

|

|

|

127,752,000 |

|

|

|

127,403,000 |

|

|

|

127,393,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRADING SYMBOL: TSX:AGI NYSE:AGI

ALAMOS GOLD INC.

Consolidated Statements of Cash Flows

(Unaudited - stated

in thousands of United States dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three-month

periods ended |

|

|

For the nine-month

periods ended |

|

| |

|

September 30,

2014 |

|

|

September 30,

2013 |

|

|

September 30,

2014 |

|

|

September 30,

2013 |

|

| CASH PROVIDED BY (USED IN): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) for the period |

|

$ |

(2,238 |

) |

|

$ |

9,249 |

|

|

$ |

1,241 |

|

|

$ |

44,066 |

|

| Adjustments for items not involving cash: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization |

|

|

10,709 |

|

|

|

15,845 |

|

|

|

31,832 |

|

|

|

45,241 |

|

| Financing expense |

|

|

350 |

|

|

|

212 |

|

|

|

1,048 |

|

|

|

688 |

|

| Unrealized foreign exchange loss |

|

|

1,195 |

|

|

|

41 |

|

|

|

1,198 |

|

|

|

5,037 |

|

| Deferred tax (recovery) expense |

|

|

(320 |

) |

|

|

(2,425 |

) |

|

|

2,430 |

|

|

|

(5,800 |

) |

| Share-based compensation |

|

|

19 |

|

|

|

3,524 |

|

|

|

1,019 |

|

|

|

3,944 |

|

| Loss on sale of securities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,840 |

|

| Other |

|

|

189 |

|

|

|

(84 |

) |

|

|

290 |

|

|

|

525 |

|

| Changes in non-cash working capital: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fair value of forward contracts |

|

|

(40 |

) |

|

|

(856 |

) |

|

|

— |

|

|

|

— |

|

| Amounts receivable and income taxes receivable |

|

|

(14,346 |

) |

|

|

(4,815 |

) |

|

|

(23,585 |

) |

|

|

(15,501 |

) |

| Inventory |

|

|

(5,609 |

) |

|

|

(1,384 |

) |

|

|

(16,665 |

) |

|

|

(4,725 |

) |

| Advances and prepaid expenses |

|

|

(1,019 |

) |

|

|

2,975 |

|

|

|

2,983 |

|

|

|

(9,081 |

) |

| Accounts payable and accrued liabilities, and income taxes payable |

|

|

11,084 |

|

|

|

3,415 |

|

|

|

15,147 |

|

|

|

306 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(26 |

) |

|

|

25,697 |

|

|

|

16,938 |

|

|

|

71,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales (purchase) of securities |

|

|

(1,011 |

) |

|

|

— |

|

|

|

(176 |

) |

|

|

111,116 |

|

| Short-term investments (net) |

|

|

— |

|

|

|

(3,688 |

) |

|

|

7,792 |

|

|

|

43,966 |

|

| Contractor advances |

|

|

— |

|

|

|

(1,055 |

) |

|

|

(1,100 |

) |

|

|

(1,055 |

) |

| Acquisition of Esperanza |

|

|

— |

|

|

|

(44,663 |

) |

|

|

— |

|

|

|

(44,663 |

) |

| Acquisition of Orsa |

|

|

— |

|

|

|

(3,403 |

) |

|

|

— |

|

|

|

(3,403 |

) |

| Proceeds on sale of equipment |

|

|

266 |

|

|

|

— |

|

|

|

266 |

|

|

|

— |

|

| Exploration and evaluation assets |

|

|

(1,430 |

) |

|

|

(3,444 |

) |

|

|

(4,200 |

) |

|

|

(15,517 |

) |

| Mineral property, plant and equipment |

|

|

(13,912 |

) |

|

|

(9,622 |

) |

|

|

(36,847 |

) |

|

|

(26,720 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(16,087 |

) |

|

|

(65,875 |

) |

|

|

(34,265 |

) |

|

|

63,724 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares issued |

|

|

— |

|

|

|

3,901 |

|

|

|

— |

|

|

|

4,883 |

|

| Shares repurchased and cancelled |

|

|

— |

|

|

|

— |

|

|

|

(3,233 |

) |

|

|

(2,624 |

) |

| Dividends paid |

|

|

— |

|

|

|

— |

|

|

|

(12,736 |

) |

|

|

(12,749 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

3,901 |

|

|

|

(15,969 |

) |

|

|

(10,490 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rates on cash and cash |

|

|

(1,190 |

) |

|

|

(165 |

) |

|

|

(1,200 |

) |

|

|

(860 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (decrease) increase in cash and cash equivalents |

|

|

(17,303 |

) |

|

|

(36,442 |

) |

|

|

(34,496 |

) |

|

|

123,914 |

|

| Cash and cash equivalents - beginning of the period |

|

|

392,470 |

|

|

|

466,412 |

|

|

|

409,663 |

|

|

|

306,056 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH AND CASH EQUIVALENTS - END OF PERIOD |

|

$ |

375,167 |

|

|

$ |

429,970 |

|

|

$ |

375,167 |

|

|

$ |

429,970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRADING SYMBOL: TSX:AGI NYSE:AGI

Table 3: Production Summary & Statistics (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Production summary |

|

Q3

2014 |

|

|

Q3

2013 |

|

|

YTD

2014 |

|

|

YTD

2013 |

|

| Ounces produced (1) |

|

|

28,000 |

|