Net Sales Increased 6.8% Compared to the

Fourth Quarter of 2023, with U.S. Net Sales up 21.6%

Raised Adjusted EBITDA1 Guidance to be

Between $6.0 million and $6.2 Million in the Fourth Quarter

a.k.a. Brands Holding Corp. (NYSE: AKA), a

portfolio of next generation fashion brands, today announced

preliminary financial results for the fourth quarter and fiscal

year ended December 31, 2024.

Preliminary Results for the Fourth

Quarter

- Net sales increased 6.8% to approximately $159.0 million,

compared to $148.9 million in the fourth quarter of 2023.

- In the U.S., net sales increased 21.6% to approximately $96.1

million, compared to $79.1 million in the fourth quarter of

2023.

- The company now expects adjusted EBITDA1 to be between $6.0

million and $6.2 million in the fourth quarter, compared to $1.3

million in the fourth quarter of 2023.

Preliminary Results for the Full Year

2024

- Net sales increased 5.2% to approximately $574.7 million,

compared to $546.3 million for fiscal year 2023.

- Net sales in the U.S. increased 16.9% to approximately $368.8

million, compared to $315.5 million for fiscal year 2023.

- The company now expects adjusted EBITDA1 to be between $23.0 to

$23.2 million for the full year 2024, compared to $13.8 million for

fiscal year 2023.

“Our strong fourth quarter preliminary results exceeded our

expectations on both the top and bottom lines,” said Ciaran Long,

Chief Executive Officer. “Net sales increased 6.8% to $159 million,

with notable strength in our U.S. business where sales grew 21.6%

to $96 million. Further demonstrating the power of our business

model, we are raising our adjusted EBITDA expectations to be

between $6.0 and $6.2 million.”

“I am pleased to report that in addition to the strength across

our direct-to-consumer channel, our omnichannel initiatives are

gaining momentum. Based on Petal & Pup’s success in 40

Nordstrom stores in the Fall, Petal & Pup is expected to be

available at all Nordstrom stores this Spring. Additionally,

Princess Polly opened two new stores in California in the fourth

quarter and is on track to open its first store in New York City

early this year. Our strong fourth-quarter results, combined with

continued progress across our strategic initiatives, highlight the

significant growth opportunities ahead and our ability to deliver

value over the long-term.”

Today the Company also announced that Ciaran Long has been

appointed to Chief Executive Officer, effective immediately. For

more details please reference the related press release on the

investor relations website www.ir.aka-brands.com.

The foregoing results are preliminary and remain subject to the

completion of normal quarter end accounting procedures and closing

adjustments. It is possible that the final results may differ from

the preliminary results.

Use of Non-GAAP Financial Measures and Other Operating

Metrics

In addition to results determined in accordance with accounting

principles generally accepted in the United States of America

(GAAP), management utilizes certain non-GAAP performance measures

such as adjusted EBITDA for purposes of evaluating ongoing

operations and for internal planning and forecasting purposes. We

believe that this non-GAAP operating measure, when reviewed

collectively with our GAAP financial information, provide useful

supplemental information to investors in assessing our operating

performance. The non-GAAP financial measures should not be

considered in isolation or as a substitute for the GAAP financial

measures. The non-GAAP financial measures used by the Company may

be different from similarly-titled non-GAAP financial measures used

by other companies.

About a.k.a. Brands

a.k.a. Brands is a portfolio of next-generation fashion brands

for the next generation of consumers. Each brand in the a.k.a.

portfolio targets a distinct Gen Z and millennial audience, creates

authentic and inspiring social content and offers quality exclusive

merchandise. a.k.a. Brands leverages its next-generation retail

platform to help each brand accelerate its growth, scale in new

markets and enhance its profitability. Current brands in the a.k.a.

Brands portfolio include Princess Polly, Culture Kings, mnml and

Petal & Pup.

Forward-Looking Statements & Preliminary Financial

Information

Certain statements made in this release are “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the United States Private Securities Litigation Reform Act of 1995.

When used in this press release, the words “estimates,”

“projected,” “expects,” “anticipates,” “forecasts,” “plans,”

“intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,”

“propose,” “preliminary” and variations of these words or similar

expressions (or the negative versions of such words or expressions)

are intended to identify forward-looking statements, including

statements regarding preliminary results for the fourth quarter and

year ended December 31, 2024. The preliminary financial information

and outlook presented in this release are estimates based on

information available to management as of the date of this release,

have not been reviewed or audited by the Company’s independent

registered accounting firm, and are subject to change. There can be

no assurance that the Company’s actual results will not differ from

the preliminary financial information presented in this release.

The preliminary financial information presented in this release

should not be viewed as a substitute for full financial statements

prepared in accordance with GAAP.

These forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the Company’s control, that

could cause actual results or outcomes to differ materially from

those discussed in the forward-looking statements.

Important factors, among others, that may affect actual results

or outcomes include risks and uncertainties, related to the

Company’s preliminary financial results for the three months and

year ended December 31, 2024, including that final results may

differ due to the completion of the financial closing procedures

and/or the annual audit process; the effects of economic downturns

and unstable market conditions; our ability in the future to

continue to comply with the New York Stock Exchange’s (NYSE)

listing standards and maintain the listing of our common stock on

the NYSE; risks related to doing business in China; our ability to

anticipate rapidly-changing consumer preferences in the apparel,

footwear and accessories industries; our ability to execute our

strategic initiatives, including transitioning Culture Kings to a

data-driven, short lead time merchandising cycle; our ability to

acquire new customers, retain existing customers or maintain

average order value levels; the effectiveness of our marketing and

our level of customer traffic; merchandise return rates; our

ability to manage our inventory effectively; our success in

identifying brands to acquire, integrate and manage on our

platform; our ability to expand into new markets; the global nature

of our business, including international economic, geopolitical

instability (including the ongoing Russia-Ukraine and

Israel-Palestine wars), legal, compliance and supply chain risks;

interruptions in or increased costs of shipping and distribution,

which could affect our ability to deliver our products to the

market; our use of social media platforms and influencer

sponsorship initiatives, which could adversely affect our

reputation or subject us to fines or other penalties; fluctuating

operating results; the inherent challenges in measuring certain of

our key operating metrics, and the risk that real or perceived

inaccuracies in such metrics may harm our reputation and negatively

affect our business; the potential for tax liabilities that may

increase the costs to our consumers; our ability to attract and

retain highly qualified personnel, including key members of our

leadership team; fluctuations in wage rates and the price,

availability and quality of raw materials and finished goods, which

could increase costs; foreign currency fluctuations; and other

risks and uncertainties set forth in the sections entitled “Risk

Factors,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and “Forward-Looking

Statements” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023, quarterly reports on Form 10-Q and

any other periodic reports that the Company may file with the

Securities and Exchange Commission (the SEC). a.k.a. Brands does

not undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

___________________________ 1 The Company has not provided a

quantitative reconciliation of its adjusted EBITDA outlook to GAAP

net income outlook because it is unable to project certain

reconciling items, such as income taxes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250113464448/en/

Investor Contact investors@aka-brands.com

Media Contact media@aka-brands.com

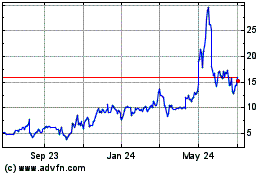

aka Brands (NYSE:AKA)

Historical Stock Chart

From Jan 2025 to Feb 2025

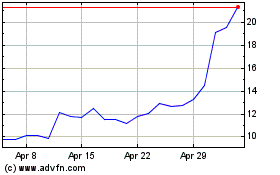

aka Brands (NYSE:AKA)

Historical Stock Chart

From Feb 2024 to Feb 2025