Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

September 26 2023 - 12:45PM

Edgar (US Regulatory)

Portfolio of Investments (unaudited)

As of July 31, 2023

abrdn Global Premier Properties Fund

|

|

| Shares

| Value

|

| COMMON STOCKS—118.7%

|

|

| AUSTRALIA—1.8%

|

| Diversified REITs—0.9%

|

|

|

|

| Mirvac Group

|

| 2,086,127

| $ 3,288,362

|

| Retail REITs—0.3%

|

|

|

|

| Scentre Group

|

| 681,961

| 1,290,469

|

| Self Storage REITs—0.6%

|

|

|

|

| National Storage REIT

|

| 1,318,749

| 2,059,805

|

| Total Australia

|

| 6,638,636

|

| BELGIUM—2.3%

|

| Health Care REITs—1.6%

|

|

|

|

| Aedifica SA

|

| 85,813

| 5,893,715

|

| Industrial REITs—0.7%

|

|

|

|

| Warehouses De Pauw CVA

|

| 81,837

| 2,418,060

|

| Total Belgium

|

| 8,311,775

|

| CANADA—2.3%

|

| Multi-Family Residential REITs—0.8%

|

|

|

|

| Canadian Apartment Properties REIT

|

| 78,239

| 3,050,292

|

| Retail REITs—1.5%

|

|

|

|

| SmartCentres Real Estate Investment Trust(a)

|

| 289,816

| 5,474,778

|

| Total Canada

|

| 8,525,070

|

| FINLAND—0.4%

|

| Real Estate Operating Companies—0.4%

|

|

|

|

| Kojamo Oyj

|

| 139,929

| 1,367,139

|

| FRANCE—2.5%

|

| Diversified REITs—0.5%

|

|

|

|

| ICADE

|

| 46,408

| 1,890,686

|

| Office REITs—1.3%

|

|

|

|

| Covivio SA

|

| 39,045

| 1,885,156

|

| Gecina SA

|

| 25,193

| 2,723,678

|

|

|

|

| 4,608,834

|

| Retail REITs—0.7%

|

|

|

|

| Unibail-Rodamco-Westfield(b)

|

| 47,493

| 2,691,089

|

| Total France

|

| 9,190,609

|

| GERMANY—2.4%

|

| Real Estate Development—0.6%

|

|

|

|

| Instone Real Estate Group SE(c)

|

| 332,743

| 2,312,203

|

| Real Estate Operating Companies—1.8%

|

|

|

|

| TAG Immobilien AG(b)

|

| 259,303

| 2,914,714

|

| Vonovia SE(a)

|

| 159,349

| 3,712,828

|

|

|

|

| 6,627,542

|

| Total Germany

|

| 8,939,745

|

| HONG KONG—4.9%

|

| Diversified Real Estate Activities—2.7%

|

|

|

|

| Sun Hung Kai Properties Ltd.

|

| 791,500

| 9,938,564

|

| Real Estate Operating Companies—1.6%

|

|

|

|

| Swire Properties Ltd.

|

| 1,085,800

| 2,724,624

|

| Wharf Real Estate Investment Co. Ltd.

|

| 628,000

| 3,370,141

|

|

|

|

| 6,094,765

|

| Retail REITs—0.6%

|

|

|

|

| Link REIT

|

| 382,159

| 2,148,175

|

| Total Hong Kong

|

| 18,181,504

|

|

|

| Shares

| Value

|

|

|

|

| JAPAN—11.8%

|

| Diversified Real Estate Activities—4.6%

|

|

|

|

| Mitsui Fudosan Co. Ltd.

|

| 381,200

| $ 7,831,729

|

| Sumitomo Realty & Development Co. Ltd.

|

| 103,300

| 2,768,380

|

| Tokyu Fudosan Holdings Corp.

|

| 1,095,400

| 6,512,090

|

|

|

|

| 17,112,199

|

| Diversified REITs—1.3%

|

|

|

|

| Canadian Solar Infrastructure Fund, Inc., UNIT

|

| 5,896

| 4,919,289

|

| Hotel & Resort REITs—0.8%

|

|

|

|

| Invincible Investment Corp.

|

| 6,802

| 2,817,968

|

| Industrial REITs—1.6%

|

|

|

|

| CRE Logistics REIT, Inc.

|

| 814

| 1,004,488

|

| LaSalle Logiport REIT

|

| 1,952

| 2,088,272

|

| Nippon Prologis REIT, Inc.

|

| 1,316

| 2,691,099

|

|

|

|

| 5,783,859

|

| Multi-Family Residential REITs—1.0%

|

|

|

|

| Comforia Residential REIT, Inc.

|

| 794

| 1,900,806

|

| Daiwa Securities Living Investments Corp.

|

| 2,044

| 1,637,207

|

|

|

|

| 3,538,013

|

| Office REITs—2.5%

|

|

|

|

| Kenedix Office Investment Corp., REIT

|

| 1,592

| 3,785,364

|

| Nippon Building Fund, Inc., REIT

|

| 926

| 3,881,617

|

| Orix JREIT, Inc.

|

| 1,360

| 1,730,215

|

|

|

|

| 9,397,196

|

| Total Japan

|

| 43,568,524

|

| MEXICO—4.2%

|

| Industrial REITs—2.1%

|

|

|

|

| Prologis Property Mexico SA de CV

|

| 1,411,618

| 5,241,827

|

| TF Administradora Industrial S de Real de CV

|

| 1,227,675

| 2,496,407

|

|

|

|

| 7,738,234

|

| Real Estate Operating Companies—2.1%

|

|

|

|

| Corp Inmobiliaria Vesta SAB de CV

|

| 2,097,954

| 7,606,258

|

| Total Mexico

|

| 15,344,492

|

| NETHERLANDS—0.6%

|

| Real Estate Operating Companies—0.6%

|

|

|

|

| CTP NV(a)(c)

|

| 167,975

| 2,301,597

|

| SINGAPORE—3.1%

|

| Industrial REITs—1.3%

|

|

|

|

| Daiwa House Logistics Trust

|

| 10,299,000

| 4,763,215

|

| Real Estate Operating Companies—1.1%

|

|

|

|

| Capitaland India Trust, UNIT

|

| 4,659,180

| 3,994,410

|

| Retail REITs—0.7%

|

|

|

|

| CapitaLand Integrated Commercial Trust

|

| 1,779,100

| 2,731,424

|

| Total Singapore

|

| 11,489,049

|

| SWEDEN—1.0%

|

| Real Estate Operating Companies—1.0%

|

|

|

|

| Catena AB

|

| 90,513

| 3,477,089

|

| SWITZERLAND—0.6%

|

| Real Estate Operating Companies—0.6%

|

|

|

|

| PSP Swiss Property AG

|

| 18,580

| 2,189,467

|

| UNITED KINGDOM—7.0%

|

| Diversified REITs—1.2%

|

|

|

|

| Land Securities Group PLC(a)

|

| 536,423

| 4,454,880

|

See accompanying

Notes to Portfolio of Investments.

Portfolio of Investments (unaudited) (concluded)

As of July 31, 2023

abrdn Global Premier Properties Fund

|

|

| Shares

| Value

|

| COMMON STOCKS (continued)

|

|

| UNITED KINGDOM (continued)

|

| Industrial REITs—2.7%

|

|

|

|

| Segro PLC(a)

|

| 1,015,276

| $ 9,949,251

|

| Multi-Family Residential REITs—1.4%

|

|

|

|

| UNITE Group PLC (The)

|

| 409,104

| 5,107,893

|

| Self Storage REITs—1.7%

|

|

|

|

| Safestore Holdings PLC(a)

|

| 539,397

| 6,131,784

|

| Total United Kingdom

|

| 25,643,808

|

| UNITED STATES—73.8%

|

| Data Center REITs—11.1%

|

|

|

|

| Digital Realty Trust, Inc.(a)

|

| 135,274

| 16,857,846

|

| Equinix, Inc.(a)

|

| 29,540

| 23,925,037

|

|

|

|

| 40,782,883

|

| Health Care REITs—9.0%

|

|

|

|

| Omega Healthcare Investors, Inc.(a)

|

| 140,642

| 4,486,480

|

| Sabra Health Care REIT, Inc.

|

| 332,112

| 4,314,135

|

| Ventas, Inc.(a)

|

| 164,045

| 7,959,463

|

| Welltower, Inc.(a)

|

| 197,941

| 16,260,853

|

|

|

|

| 33,020,931

|

| Hotel & Resort REITs—2.8%

|

|

|

|

| DiamondRock Hospitality Co.(a)

|

| 216,003

| 1,836,025

|

| Host Hotels & Resorts, Inc.(a)

|

| 462,634

| 8,512,466

|

|

|

|

| 10,348,491

|

| Industrial REITs—11.1%

|

|

|

|

| Americold Realty Trust, Inc.

|

| 191,948

| 6,222,954

|

| Prologis, Inc.(a)

|

| 277,497

| 34,617,751

|

|

|

|

| 40,840,705

|

| Mortgage REITs—0.7%

|

|

|

|

| Blackstone Mortgage Trust, Inc., Class A(a)

|

| 108,818

| 2,501,726

|

| Multi-Family Residential REITs—6.6%

|

|

|

|

| AvalonBay Communities, Inc.(a)

|

| 73,177

| 13,804,841

|

| UDR, Inc.

|

| 254,854

| 10,418,431

|

|

|

|

| 24,223,272

|

| Office REITs—4.0%

|

|

|

|

| Alexandria Real Estate Equities, Inc.

|

| 51,693

| 6,496,776

|

| Boston Properties, Inc.(a)

|

| 59,872

| 3,989,272

|

| Equity Commonwealth

|

| 225,268

| 4,413,000

|

|

|

|

| 14,899,048

|

|

|

| Shares

| Value

|

|

|

|

|

|

| Other Specialized REITs—4.6%

|

|

|

|

| Gaming and Leisure Properties, Inc.(a)

|

| 133,026

| $ 6,313,414

|

| VICI Properties, Inc.(a)

|

| 333,113

| 10,486,397

|

|

|

|

| 16,799,811

|

| Retail REITs—11.4%

|

|

|

|

| Brixmor Property Group, Inc.(a)

|

| 155,403

| 3,533,864

|

| NNN REIT, Inc.

|

| 183,245

| 7,820,896

|

| Realty Income Corp.(a)

|

| 268,838

| 16,391,053

|

| Regency Centers Corp.

|

| 52,405

| 3,434,100

|

| Simon Property Group, Inc.(a)

|

| 40,688

| 5,069,725

|

| Spirit Realty Capital, Inc.

|

| 145,878

| 5,883,260

|

|

|

|

| 42,132,898

|

| Self Storage REITs—6.1%

|

|

|

|

| Extra Space Storage, Inc.(a)

|

| 46,754

| 6,525,456

|

| Public Storage(a)

|

| 57,188

| 16,112,719

|

|

|

|

| 22,638,175

|

| Single-Family Residential REITs—5.5%

|

|

|

|

| American Homes 4 Rent, Class A

|

| 211,333

| 7,920,761

|

| Equity LifeStyle Properties, Inc.(a)

|

| 170,984

| 12,170,641

|

|

|

|

| 20,091,402

|

| Telecom Tower REITs—0.9%

|

|

|

|

| American Tower Corp.(a)

|

| 16,935

| 3,222,900

|

| Total United States

|

| 271,502,242

|

| Total Common Stocks

|

| 436,670,746

|

| MUTUAL FUNDS—0.9%

|

|

| CBRE Global Real Estate Income Fund

|

| 628,194

| 3,486,477

|

Total Investments

(Cost $435,699,281)—119.6%

|

| 440,157,223

|

| Liabilities in Excess of Other Assets—(19.6%)

|

| (72,239,835)

|

| Net Assets—100.0%

|

| $367,917,388

|

| (a)

| All or a portion of the security has been designated as collateral for the line of credit.

|

| (b)

| Non-income producing security.

|

| (c)

| Denotes a security issued under Regulation S or Rule 144A.

|

| CVA

| Dutch Certificate

|

| PLC

| Public Limited Company

|

| REIT

| Real Estate Investment Trust

|

See accompanying

Notes to Portfolio of Investments.

Notes to Portfolio of Investments

July 31, 2023 (unaudited)

1. Summary of Significant

Accounting Policies

a. Security Valuation:

The Fund values its

securities at current market value or fair value, consistent with regulatory requirements. "Fair value" is defined in the Fund's Valuation and Liquidity Procedures as the price that could be received to sell an asset

or paid to transfer a liability in an orderly transaction between willing market participants without a compulsion to transact at the measurement date. Pursuant to Rule 2a-5 under the Investment Company Act of 1940,

as amended (the "1940 Act"), the Board designated abrdn Investments Limited (the "Adviser") as the valuation designee ("Valuation Designee") for the Fund to perform the fair value determinations relating to Fund

investments for which market quotations are not readily available.

Equity securities that are

traded on an exchange are valued at the last quoted sale price or the official close price on the principal exchange on which the security is traded at the “Valuation Time” subject to application, when

appropriate, of the valuation factors described in the paragraph below. Under normal circumstances, the Valuation Time is as of the close of regular trading on the New York Stock Exchange ("NYSE") (usually 4:00 p.m.

Eastern Time). In the absence of a sale price, the security is valued at the mean of the bid/ask price quoted at the close on the principal exchange on which the security is traded. Securities traded on NASDAQ are

valued at the NASDAQ official closing price.

Foreign equity securities that

are traded on foreign exchanges that close prior to the Valuation Time are valued by applying valuation factors to the last sale price or the mean price as noted above. Valuation factors are provided by an independent

pricing service provider. These valuation factors are used when pricing the Fund's portfolio holdings to estimate market movements between the time foreign markets close and the time the Fund values such foreign

securities. These valuation factors are based on inputs such as depositary receipts, indices, futures, sector indices/ETFs, exchange rates, and local exchange opening and closing prices of each security. When prices

with the application of valuation factors are utilized, the value assigned to the foreign securities may not be the same as quoted or published prices of the securities on their primary markets. A security that

applies a valuation factor is determined to be a Level 2 investment because the exchange-traded price has been adjusted. Valuation factors are not utilized if the independent pricing service provider is unable to

provide a valuation factor or if the valuation factor falls below a predetermined threshold; in such case, the security is determined to be a Level 1 investment.

Short-term investments are

comprised of cash and cash equivalents invested in short-term investment funds which are redeemable daily. The Fund sweeps available cash into the State Street Institutional U.S. Government Money Market Fund,

which has elected to qualify as a “government money market fund” pursuant to Rule 2a-7 under the 1940 Act, and has an objective, which is not guaranteed, to maintain a $1.00 per share NAV. Registered

investment companies are valued at their NAV as reported by such company. Generally, these investment types are categorized as Level 1 investments.

In the event that a

security’s market quotations are not readily available or are deemed unreliable (for reasons other than because the foreign exchange on which it trades closes before the Valuation Time), the security is valued

at fair value as determined by the Valuation Designee, taking into account the relevant factors and surrounding circumstances using valuation policies and procedures approved by the Board. A security that has been

fair valued by the Adviser may be classified as Level 2 or Level 3 depending on the nature of the inputs.

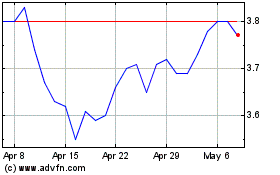

abrdn Global Premier Pro... (NYSE:AWP)

Historical Stock Chart

From Nov 2024 to Dec 2024

abrdn Global Premier Pro... (NYSE:AWP)

Historical Stock Chart

From Dec 2023 to Dec 2024