false

0000001750

Common Stock, $1.00 par value

AIR

0000001750

2024-12-19

2024-12-19

0000001750

us-gaap:CommonStockMember

exch:XCHI

2024-12-19

2024-12-19

0000001750

us-gaap:CommonStockMember

exch:XNYS

2024-12-19

2024-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

| Common

Stock, $1.00 par value |

|

AIR |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

December 19, 2024

AAR

CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-6263 |

|

36-2334820 |

| (State of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification No.) |

| One

AAR Place |

| 1100 N. Wood

Dale Road |

| Wood Dale,

Illinois

60191 |

| (Address and Zip Code of Principal Executive Offices) |

| |

| Registrant’s telephone number, including

area code: (630) 227-2000 |

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common Stock, $1.00 par value |

|

AIR |

|

New York Stock Exchange |

| |

|

|

|

Chicago Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.06 | Material Impairments. |

On December 19, 2024,

AAR CORP. (the “Company”) entered into a definitive agreement to divest its Landing Gear Overhaul (“LGO”) business

to GA Telesis. The transaction is valued at $51 million and is expected to close in the first quarter of the 2025 calendar year, subject

to customary and regulatory closing conditions. The Company currently expects to use substantially all proceeds from the transaction to

repay amounts outstanding under the credit agreement.

In connection with the decision

to exit the LGO business, on December 19, 2024, the Company determined that it will recognize a non-cash, pre-tax loss of approximately

$60 million in the fiscal third quarter ending February 28, 2025 reflecting the adjustment of LGO’s carrying value to its fair

value less costs to sell. The estimated pre-tax loss above reflects the Company’s best estimate at this time; however, the Company

continues to evaluate the amount of the pre-tax loss, and the pre-tax loss recorded in the quarter ending February 28, 2025 could

differ from the Company’s preliminary estimate.

On December 20, 2024,

the Company issued a press release announcing the divestiture of its LGO business. The text of the press release is attached as Exhibit 99.1

hereto and incorporated by reference herein.

Forward-Looking

Statements

This Current Report on Form 8-K contains certain statements relating

to future results, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995,

which reflect management’s expectations about future conditions, including, but not limited to, the expected divestiture of the

LGO business and the financial impact to the Company resulting therefrom.

Forward-looking statements often address our expected future operating

and financial performance and financial condition, or sustainability targets, goals, commitments, and other business plans, and often

may also be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” or similar expressions and the negatives of those terms.

These forward-looking statements are based on the beliefs of Company

management, as well as assumptions and estimates based on information available to the Company as of the dates such assumptions and estimates

are made, and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results

or those anticipated, depending on a variety of factors, including: (i) factors that adversely affect the commercial aviation industry;

(ii) adverse events and negative publicity in the aviation industry; (iii) a reduction in sales to the U.S. government and its

contractors; (iv) cost overruns and losses on fixed-price contracts; (v) nonperformance by subcontractors or suppliers; (vi) a

reduction in outsourcing of maintenance activity by airlines; (vii) a shortage of skilled personnel or work stoppages; (viii) competition

from other companies; (ix) financial, operational and legal risks arising as a result of operating internationally; (x) inability

to integrate acquisitions effectively and execute operational and financial plans related to the acquisitions; (xi) failure to realize

the anticipated benefits of acquisitions; (xii) circumstances associated with divestitures; (xiii) inability to recover costs

due to fluctuations in market values for aviation products and equipment; (xiv) cyber or other security threats or disruptions; (xv) a

need to make significant capital expenditures to keep pace with technological developments in our industry; (xvi) restrictions on

use of intellectual property and tooling important to our business; (xvii) inability to fully execute our stock repurchase program

and return capital to stockholders; (xviii) limitations on our ability to access the debt and equity capital markets or to draw down

funds under loan agreements; (xix) non-compliance with restrictive and financial covenants contained in our debt and loan agreements;

(xx) changes in or non-compliance with laws and regulations related to federal contractors, the aviation industry, international

operations, safety, and environmental matters, and the costs of complying with such laws and regulations; and (xxi) exposure to product

liability and property claims that may be in excess of our liability insurance coverage. Should one or more of those risks or uncertainties

materialize adversely, or should underlying assumptions or estimates prove incorrect, actual results may vary materially from those described.

Those events and uncertainties are difficult or impossible to predict accurately and many are beyond our control.

For a discussion of these and other risks and uncertainties, refer

to our Annual Report on Form 10-K, Part I, “Item 1A, Risk Factors” and our other filings from time to time with

the U.S. Securities and Exchange Commission. These events and uncertainties are difficult or impossible to predict accurately and many

are beyond the Company’s control. The risks described in these reports are not the only risks we face, as additional risks and uncertainties

are not currently known or foreseeable or impossible to predict accurately or risks that are beyond the Company’s control or deemed

immaterial may materially adversely affect our business, financial condition or results of operations in future periods. We assume no

obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect

the occurrence of anticipated or unanticipated events, except as required by law.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 20, 2024

| AAR CORP. |

| | |

| |

By: |

/s/ Sean M.

Gillen |

| |

|

Sean M. Gillen |

| |

|

Senior Vice President and Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

December 20, 2024

Contact:

Media Team

+1-630-227-5100

Editor@aarcorp.com

AAR announces divestiture of non-core Landing

Gear Overhaul business to optimize portfolio

Wood Dale, Illinois — AAR

CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, MROs, and OEMs, announced today that

it has entered into a definitive agreement to divest its Landing Gear Overhaul business to GA Telesis. The transaction is valued at $51

million and is expected to close in the first quarter of the 2025 calendar year, subject to customary and regulatory closing conditions.

The divestiture will be immediately accretive to margins and earnings.

The divestiture is part of AAR’s strategic

plan to optimize its portfolio by investing in core functions that will accelerate its targeted growth and margin expansion initiatives.

The transaction with GA Telesis includes AAR’s

Miami, Florida, based Landing Gear Overhaul business, part of the Company’s Repair & Engineering segment, that provides

full-service landing gear maintenance, repair, and overhaul services to commercial and government customers. AAR will remain prime contractor

for the United States Air Force Landing Gear Performance Based Logistics contract, and the current maintenance services will be continued

by GA Telesis as a subcontractor.

“This transaction will increase our operating margins,

improve our cash flow and enable us to re-allocate resources to drive further growth in our core businesses,” said John M.

Holmes, AAR’s Chairman, President and CEO. “We are confident GA Telesis will continue to deliver excellent service to the Landing

Gear customers.”

CIBC Capital Markets served as AAR’s

financial advisor, and Jones Day served as AAR’s legal advisor in this transaction.

About AAR

AAR is a global aerospace and defense aftermarket solutions company with operations in over 20 countries. Headquartered in the Chicago

area, AAR supports commercial and government customers through four operating segments: Parts Supply, Repair & Engineering, Integrated

Solutions, and Expeditionary Services. Additional information can be found at aarcorp.com.

About GA Telesis

GA Telesis, a global leader in aerospace solutions, is renowned for its unmatched excellence in aftermarket services and lifecycle

management. The GA Telesis Ecosystem™ is a vast global network spanning 54 locations in 30 countries on six continents.

The company’s integrated solutions include parts and distribution services, logistics solutions, inventory management, leasing

and financing, engine overhaul, and MRO services. GA Telesis is committed to sustainability through innovative

sustainability initiatives and advanced technologies, including digital transformation, and using advanced materials. The company’s

aerospace systems and connected aircraft technologies drive efficiency and performance, while its MRO network and 24/7

AOG support provide unparalleled reliability.

| This press release contains certain statements relating to future business opportunities and conditions, as well as anticipated benefits of the proposed divestiture by AAR CORP. (the “Company”) of the Company’s Landing Gear Overhaul business (the “Divestiture”). Such statements are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995 and reflect management’s expectations about future conditions. Forward-looking statements may also be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,’’ “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and the negatives of those terms. Factors that may cause actual results to differ materially from current expectations include, among others, risks associated with the Company’s ability to close the Divestiture; the Company’s ability to realize the anticipated benefits of the Divestiture as rapidly or to the extent anticipated; the effect of the Divestiture on the Company’s operating results and business generally; the amount of costs, fees and expenses related to the Divestiture; and other factors that could affect the Company’s business, results of operations and financial condition. These forward-looking statements are based on beliefs of Company management, as well as assumptions and estimates based on information currently available to the Company, and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated. For a discussion of these and other risks and uncertainties, refer to “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, as well as the Company’s other subsequent filings with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize adversely, or should underlying assumptions or estimates prove incorrect, actual results may vary materially from those described and the anticipated benefits of the Divestiture may not be realized. These events and uncertainties are difficult or impossible to predict accurately and many are beyond the Company’s control. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company assumes no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law. |

v3.24.4

Cover

|

Dec. 19, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 19, 2024

|

| Entity File Number |

1-6263

|

| Entity Registrant Name |

AAR

CORP.

|

| Entity Central Index Key |

0000001750

|

| Entity Tax Identification Number |

36-2334820

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

One

AAR Place

|

| Entity Address, Address Line Two |

1100 N. Wood

Dale Road

|

| Entity Address, City or Town |

Wood Dale

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60191

|

| City Area Code |

630

|

| Local Phone Number |

227-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] | NYSE CHICAGO, INC. [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $1.00 par value

|

| Trading Symbol |

AIR

|

| Security Exchange Name |

CHX

|

| Common Stock [Member] | NEW YORK STOCK EXCHANGE, INC. [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $1.00 par value

|

| Trading Symbol |

AIR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

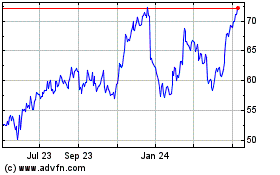

AAR (NYSE:AIR)

Historical Stock Chart

From Dec 2024 to Jan 2025

AAR (NYSE:AIR)

Historical Stock Chart

From Jan 2024 to Jan 2025