Form 8-K - Current report

July 19 2024 - 4:15PM

Edgar (US Regulatory)

0001722964false00017229642024-07-162024-07-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 16, 2024

Y-MABS THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| | | | |

Delaware | | 001-38650 | | 47-4619612 |

(State or other jurisdiction of

incorporation or organization) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

230 Park Avenue

Suite 3350

New York, New York 10169

(Address of principal executive offices) (Zip Code)

(646) 885-8505

(Registrant’s telephone number, include area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.0001 par value | | YMAB | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 16, 2024, in connection with the previously-disclosed resignation of Bo Kruse, the former Executive Vice President, Chief Financial Officer, Treasurer and Secretary of Y-mAbs Therapeutics, Inc. (the “Company”), Y-mAbs Therapeutics A/S, the wholly-owned subsidiary of the Company, entered into a separation agreement (the “Separation Agreement”) with Mr. Kruse and the Company entered into a consultancy agreement (the “Consultancy Agreement”) with Investeringsselskabet GH ApS pursuant to which Mr. Kruse will provide consulting services to the Company.

Separation Agreement

Pursuant to the Separation Agreement, Mr. Kruse’s last day of employment with the Company will be July 31, 2024 and he will be eligible to receive:

| ● | payment of his base salary at the current rate up to and including July 31, 2024; |

| ● | a pro-rated fiscal year 2024 bonus in the amount of $151,376 (1,035,867 Danish krone, translated to U.S. dollars at an exchange rate of 6.8430:1, which is the exchange rate as of July 16, 2024), which amount represents Mr. Kruse’s target 2024 bonus, pro-rated for the portion of the year he was employed by the Company; |

| ● | continued vesting of equity awarded to him before September 28, 2022 in accordance with the terms of the applicable award agreements and equity incentive plans; and |

| ● | continued vesting through July 31, 2025 of equity awarded to him on or after September 28, 2022. |

The Separation Agreement contains restrictive covenants, including confidentiality and non-disparagement covenants, and a mutual release of claims.

Consultancy Agreement

The Consultancy Agreement is effective August 1, 2024, has a one-year term (the “Consulting Period”) and may be terminated by either party in the event of material breach by the other party that remains uncured after a two-week notice period or suspension of payment, liquidation, bankruptcy or insolvency of the other party. Pursuant to the Consultancy Agreement, during the Consulting Period, Mr. Kruse will provide consulting services relating to financial operations and corporate governance and will be available to assist the Company with any other matters arising from his time as an employee of the Company. In compensation for such services, the Company will pay a fixed monthly fee of $43,251 (295,967 Danish krone, excluding VAT, translated to U.S. dollars at an exchange rate of 6.8430:1, which is the exchange rate as of July 16, 2024). The Consultancy Agreement also contains a confidentiality covenant.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Y-MABS THERAPEUTICS, INC. |

| | |

Date: July 19, 2024 | By: | /s/ Michael Rossi |

| | Michael Rossi |

| | President and Chief Executive Officer |

15th July 2024

BETWEEN

Y-mAbs Therapeutics A/S

(CVR no. 37053678)

Agern Alle 11

2970 Hørsholm

("Company")

AND

Bo Kruse

Ängavångsvägen 4

S-21851 Klagshamn

Sverige (SE)

("BK” )

(jointly the "Parties" or individually the “Party”)

1. | Termination of employment |

1.1 | Effective as of 1 October 2015, BK was employed by the Company as CFO on the terms and conditions set out in a service agreement dated 21 January 2016 (the “Service Agreement”) and as an integral part of this employment, BK has served as chairman of the Company`s board of directors (the “Board”) since 12 May 2022. |

1.2 | As BK has expressed his wish to continue his work life as an independent consultant through his private company, Investeringsselskabet GH ApS (cvr.nr. 31767520), the Parties have agreed that BK will resign from his employment with the Company on 31 July 2024 (the “Effective Date of Termination”). |

1.3 | The Company`s US-based parent company, Y-mAbs Therapeutics, Inc., a Delaware corporation, has expressed its interest in contracting with Investeringsselskabet GH ApS/BK as financial advisor post the Effective Date of Termination and BK has expressed the interest in such affiliation. |

1.4 | Negations of the terms and conditions applying to such affiliation shall be set out in a separate Consultancy Agreement exclusively between Y-mAbs Therapeutics, Inc. and Investeringsselskabet GH ApS and shall be of no concern of the Company or have any impact on the employment relationship between the Company and BK and/or the terms of cessation set out in this separation agreement (the “Agreement”). |

1.5 | All matters relating to the cessation of BK`s employment relationship with the Company is as further set out in this Agreement. |

2. | Work duties until the Effective Date of Termination |

2.1 | BK is duly informed that the Company has already initiated the process of recruiting a new employee to take over the position as CFO, and that currently there is a candidate identified for the position. Against this background, BK will continue his usual work until the right candidate has been onboarded. |

2.2 | With effect from the date on which the new CFO commences his employment with the Company (the “Commencement Date” ), until the Effective Date of Termination, BK shall continue to work, but with primary focus of assisting with the proper onboarding of the new CFO including introduction to the Company's financial systems and hand-over of all uncompleted work tasks. |

2.3 | Until otherwise decided BK shall remain as chairman of the Company`s Board, potentially also post the Effective Date of Termination. |

Last working day and return of belongings to the Company.

2.4 | BK`s last working day is Wednesday 31 July 2024, unless holiday is utilized up to the Effective Date of Termination, cf. clause 5.1 below. |

2.5 | On the last working day, BK shall return keys/access cards, laptop and any other IT-equipment, any other type of property together with all documents (whether in physical or electronic form and including all copies) belonging to the Company and being in BK`s possession, including, but not limited to, internal work documents, concepts, and business-related correspondence. |

2.6 | With respect to paid internet access at BK private address and payment of accident insurance for the benefit of BK, these subscriptions will be terminated by the Company to expire effective as from 1 August 2024. |

3. | Payment of cash compensation |

3.1 | Up to and including the Effective Date of Termination, BK will receive his usual monthly gross salary currently DKK 295,967. payable in arrears on or before the last working day of the month. |

Bonus 2023

4.1 | BK has already received full payment of bonus for FY-2023. |

Bonus 2024

4.2 | The Parties have agreed that BK shall receive a fixed amount of DKK 1,035,886.67 (gross) in full and final settlement of prorated bonus for FY-2024. The bonus shall be paid out end of July 2024. |

4.3 | By signing this Agreement BK confirms that any and all bonus payments relative to his employment with the Company have been settled in full. |

Equity - Stock options and RSUs

4.4 | Equity grants provided to BK will be treated in accordance with the terms and conditions of the 2015 Equity Incentive Plan and 2018 Equity Incentive Plan (as applicable) and the applicable Stock Option & RSU Agreements & Stock Option & RSU Grant Notices. Equity granted to BK before September 28, 2022, will continue to vest and become exercisable in accordance with the applicable vesting schedule and, further, that upon the occurrence of an event constituting a Change of Control (as defined in the 2015 Equity Incentive Plan and 2018 Equity Incentive Plan), such equity may become exercisable in full. Exercise shall take place in accordance with the general terms and conditions regarding vesting and exercise of stock options. Equity granted to BK on September 28, 2022, or later, that has not already vested, will vest through July 31, 2025, and any equity that will not vest as of July 31, 2025 will beforfeited as of July 31, 2024 without payment of any consideration therefor. |

5.1 | Any and all non-utilized holidays accrued in the calendar year 2024 shall be utilized before the Effective Date of Termination and placing hereof shall be agreed beforehand with CEO, Michael Rossi. |

5.2 | BK shall not be entitled to receive any cash compensation for accrued holiday not utilized on or before the Effective Date of Termination. |

6. | Duty of confidentiality and trade secrets |

6.1 | BK is legally obligated to observe strict confidentiality both during the employment well as after the Effective Date of Termination with respect to all aspects of the Company including its activities, practices and business dealings and relations. BK shall further on a continuous basis adhere to all rules, regulations, internal policies, and guidelines issued by the Company. |

6.2 | For the sake of clarity, it is noted that the duty of confidentiality does not in any way restrict BK from revealing such confidential information to Y-mAbs Therapeutics, Inc., in connection with Investeringsselskabet GH ApS`s performance of consultancy services to Y-mAbs Therapeutics, Inc., in accordance with the separate consultancy agreement, cf. clause 1.4 above. |

6.3 | The duty of confidentiality also applies to all material, including, but not limited to information relating to customers and prices, marketing material, patents, know-how, software, strategies and concepts, technical drawings, formulas, and models, regardless of the form or medium in which it exists. |

6.4 | As part of BK`s duty of loyalty and confidentiality BK shall refrain from making any statements or representations, or otherwise communicate in writing, orally or otherwise, or take any action that may, directly or indirectly, disparage or be damaging to the Company. Failure to meet these obligations will constitute a material breach of BK`s obligations and may, depending on the circumstances, entitle the Company to rescind the employment. |

6.5 | In addition, BK must observe the rules of the Danish Marketing Practices Act (section 3 in particular), and the Danish Act on Trade Secrets (section 4 in particular). |

7. | IT systems, e-mail account and social media |

7.1 | BK’s access to the Company’s IT systems and BK’s Company e-mail account will be closed on or before 31 July 2024. E-mails received on BK’s Company e-mail account will be accessed only by the Company`s management and relevant employees having a justifiable business need for this access. BK`s work e-mail account may have an autoreply set-up. |

7.2 | It rests upon BK to ensure that any profiles etc., on social media and network services are changed no later than the Effective Date of Termination, to reflect the fact that he no longer has any employment relation to the Company. |

8. | Public statements and confidentiality relative to the Agreement |

8.1 | The Company will see to that all statements, if any (internal as well as external), informing of termination of the employment are announced/published. The Company decides discretionally |

the wording of the statements, provided always that the wording is kept in a respectful tone and duly considers the interest of both Parties in a fair and balanced way.

9.1 | The tax implications for BK of this Agreement are of no concern to the Company. |

10. | Full and final settlement |

10.1 | This Agreement has been concluded subject to BK expressly agreeing that the Agreement reflects a mutual agreement to settle fully and finally all outstanding issues relating to BK’s employment with and separation from the Company. The terms of this Agreement are thus in full and final settlement of all claims (if any), whether based on the Service Agreement, including any Addenda thereto, claims based on oral agreements or claims based on Danish employment law and/or general employment law principle. |

11. | Governing Law and venue |

11.1 | This Agreement is governed by Danish law. |

11.2 | Any dispute arising from or in connection with this Agreement shall be before Lyngby City Court as the agreed venue. |

12.1 | This Agreement may be executed through electronic signature (DocuSign, Penneo or similar) or PDF-copies in any number of counterparts, any of which need not contain the signature of more than one Party, but all such counterparts taken together shall constitute one and the same instrument |

Date: 16-Jul-2024 | | Date: 18-Jul-2024 |

| | |

On behalf of Y-mAbs Therapeutics A/S | | On behalf of Y-mAbs Therapeutics A/S |

| | |

| | |

/s/ Michael J. Rossi | | /s/ Thomas Gad |

Michael J. Rossi, CEO | | Thomas Gad, member of the Board |

| | |

| | |

| Date: 16-Jul-2024 | |

| | |

| | |

| /s/ Bo Kruse | |

| Bo Kruse | |

| | |

Date: 17-Jul-2024 | | Date: 16-Jul-2024 |

| | |

With its signature, Y-mAbs Therapeutics, Inc. accedes to clauses 1.3, 1.4 and 4.4 |

| | |

| | |

/s/ John LaRocca | | /s/ Chris Naylor |

John LaRocca, General Counsel | | Chris Naylor, Head of HR |

| | |

Exhibit 10.2

Consultancy agreement

This consultancy agreement (the “Agreement”) has been made by and between:

1. | Y-mAbs Therapeutics, Inc., a company limited by shares incorporated in the United States under corporate registration number 47-4619612 (the “Company”), with registered address at 230 Park Avenue, Suite 3350 New York, NY 10169, USA; and |

2. | Investeringsselskabet GH ApS, a company limited by shares incorporated in Denmark under corporate registration number 31767520 (the “Consultant”), with registered address at Orebyvej 43, 4990 Sakskøbing, Denmark; |

(each a “Party” and collectively the “Parties”).

1.1 | The Company is a commercial-stage biopharmaceutical company focused on the development and commercialization of novel radioimmunotherapy and antibody-based therapeutic products for the treatment of cancer. |

1.2 | The Company requires specific competence in relation to Financial Operations and Corporate Governance under a transitory period. The Consultant has the relevant and necessary qualifications, experience and abilities to provide the services that the Company requires. |

1.3 | The Company wishes to hire the Consultant to provide consulting services for the Company. |

1.4 | In light of the aforementioned, the Parties have agreed to enter into this Agreement for the Consultant’s future provision of consulting services. |

2.1 | The Consultant shall provide specific consulting services relating to Financial Operations and Corporate Governance and provide telephone, video meeting and e-mail consultations to the Company, each on a call-off basis (collectively referred to as ”Services”). |

2.2 | The Services shall be performed by Bo Kruse at the Consultant. The Consultant is only entitled to have someone else perform the Services with the Company’s prior written consent. The Consultant is fully liable for any sub-contractor, including sub-contractor’s work results and intellectual property rights. |

2.3 | The Consultant shall perform the Services in the manner and at times as agreed upon by the Parties from time to time, provided that the Consultant shall use best efforts to be available for consultations as soon as possible upon the Company’s request. |

2.4 | The Services shall be performed at the Consultant’s premises in Sweden, unless otherwise agreed between the Parties. |

2.5 | The Consultant warrants that the Services will be performed in a professional and workmanlike manner and in compliance with all applicable laws and regulations in the industry, as well as in accordance with the terms in this Agreement. The Consultant is, in relation to the Company, independently responsible for the performance of the Services in every way. The Consultant is therefore free to organize and perform the Services, within the limits of this Agreement, as the Consultant sees fit. |

2.6 | The Consultant shall during the performance of the Services continuously and to a reasonable extent keep the Company informed about the performance of the Services and allow the Company full insight into all matters related to the Services. When the Services (or parts thereof) have been completed, the Consultant shall, as instructed by the Company, provide to the Company all documents, material and other information relating to the Services, including a report of work conducted and results according to agreed formats. |

2.7 | The Consultant undertakes to carry out the Services as an independent contractor in relation to the Company and the Consultant will, at its own cost, provide mobile phone, computer and other technical equipment typically necessary to effectively perform the Services. The Company may provide hardware for security purposes. This Agreement does not create any employment, partnership or similar relationship between the Parties. |

2.8 | During the term of the Agreement, the Consultant shall make Bo Kruse reasonably available to the Company to assist with any litigation or other legal proceedings involving matters arising from his time as an employee of the Company including without limitation, assistance with discovery, providing deposition or other testimony and providing such other assistance as the Company reasonably requests. |

3. | OTHER ASSIGNMENTS AND CONFLICT OF INTERESTS |

3.1 | For the duration of the Agreement, the Consultant shall have the right to provide services to other principals, unless such services and/or assignments are in breach of this Agreement, or may otherwise prejudicially affect the Consultant’s possibilities to fulfil its obligations toward the Company pursuant to this Agreement or in any other way harm the Company’s business. If the Consultant is considering taking on assignments for a competitor of the Company, the Consultant must always inform the Company before commencing such assignments. |

3.2 | Notwithstanding Clause 3.1, the Consultant shall act loyally towards the Company and ensure the Company’s interests during the performance of the Services. If the Consultant identifies a risk of a conflict of interest between the Company and the Consultant or in relation to other services performed by the Consultant, such a conflict of interest shall be notified to the Company immediately. |

4.1 | For the performance of the Services, the Company shall pay the Consultant a fixed monthly fee amounting to DKK 295,967. excluding VAT. |

4.2 | The Consultant is further entitled to compensation for necessary, pre-approved and verified expenses relating to the performance of the Services, such as travel expenses for physical meetings requested by the Company. The expenses shall be verified with receipt and/or other documentation. |

4.3 | The Consultant shall invoice the Company on a monthly basis in arrears. Invoices shall be paid net 30 days from date of invoice by the Company. Penalty interest is paid in accordance with law. |

5.1 | The Consultant confirms that the Consultant is registered for Swedish F-tax (Sw. F-skatt) and undertakes to remain so for the entire duration of this Agreement. The Consultant shall upon request provide the Company with written evidence of such current and valid registration. |

5.2 | The Consultant is solely responsible for the payment of all statutory taxes and fees for the Consultant’s employees that perform the Services. |

5.3 | If the Company is imposed by an official decision to pay a tax, fee or tax surcharge on the compensation paid for the Services, the Consultant shall on demand indemnify the Company and hold the Company harmless from such tax, fee or tax surcharge. In such case, the Company is entitled to deduct the amount of such tax, fee or tax surcharge from any amount due to the Consultant under this Agreement. |

6. | LIABILITY AND INSURANCE |

6.1 | The Consultant shall during the term of this Agreement and for minimum one year thereafter maintain an adequate professional liability insurance, to cover possible liability for damages towards the Company or third party. The Consultant is obliged to provide a copy of the Consultant’s current insurance letter at the Company’s request. |

6.2 | The Consultant shall have liability for and shall indemnify the Company and any group company or affiliated company for any loss, liability, costs (including reasonable legal costs), damages or expenses arising from any breach of the terms of this Agreement including any negligent or reckless act, omission or default in the performance of the Services, by the Consultant, the Consultants employees or other that the Consultant is responsible for. |

7.1 | The results of the Services (the “Results”) in this Agreement refers to all results generated in connection with the Services and any intellectual property rights attributable thereto, including but not limited to know-how, inventions, trademarks, copyright, source code, rights in databases, design, demo-material etc., and any other documentation and software. |

7.2 | To the extent possible by law, the Consultant hereby transfers to the Company the ownership of the Results produced by the Consultant in the performance of the Services or otherwise in connection with this Agreement, whereby the Company shall have the right to freely adjust, disclose, use, transfer, grant rights and licenses in or to, and change the same, apply for patent of or in any other way have disposal over the Result, as well as register intellectual property that entirely or partly has arisen in connection with the Services. The Consultant further waives, as far as is legally possible, its right to be listed as the originator when producing copies of works and when works are made available to the public. The Parties agree that the Result in its entirety shall accrue to the Company completely without compensation to the Consultant in addition to what is stated in Clause 4 (Fee and invoicing) above. |

7.3 | Unless there is a written agreement between the Parties to the contrary, the Consultant guarantees that the Results have been produced exclusively for the Company and that no part of the Results infringes (whether in use, transfer, lease or other disposal) any intellectual property rights belonging to a third party. |

7.4 | The Consultant warrants that its employees undertake a corresponding transfer of Results as set out above, that is legally binding and enforceable on behalf of the Consultant. In the event the Consultant (after the Company’s written consent) assigns or uses any sub-contractor for the performance of the Services, the Consultant warrants that such sub-contractor undertakes a corresponding transfer of Results as set out above, that is legally binding and enforceable on behalf of the Consultant. |

7.5 | In addition to the foregoing, the Consultant and Bo Kruse acknowledge that Bo Kruse shall remain subject to the terms of the Company’s Insider Trading Policy and that the terms of the Confidentiality and Invention Assignment Policy into which he entered with the Company shall remain in full force and effect. |

8.1 | The content of this Agreement shall be kept strictly confidential and not be disclosed to any third party without the prior written consent of the other Party (such consent must not to be unreasonably withheld). |

8.2 | For the purposes of this Agreement, “Confidential Information” refers to all information relating to the Company or its business which is not publicly available - whether oral or written or in visual, electronic or tangible form, commercial or of any other kind, regardless if the information is documented or not, including trade secrets as defined in the Swedish Trade Secrets Act (2018:558), which has been disclosed or may be disclosed to the Consultant or which the Consultant has or may otherwise become aware of in connection with the performance of the Services or otherwise in connection with this Agreement. |

8.3 | The Consultant undertakes not to gain unauthorised access to, use or disclose any Confidential Information related to (i) the Company or any group company, or (ii) the Company’s clients and suppliers, and to ensure that any employees, consultants and directors of the Consultant complies with the same confidentiality. |

8.4 | The confidentiality obligation pursuant to the provisions set forth above applies without limitation in time, i.e. also for the period after this Agreement has been terminated or ceased. |

8.5 | In the event of any breach by the Consultant of the confidentiality provisions set forth above or the Clause 7 (Right to results), the Consultant shall pay liquidated damages to the Company corresponding to six (6) times the monthly fee paid for the Services. The payment of liquidated damages shall not affect the Company’s right to enforce other sanctions due to the breach, or to demand additional compensation if the actual damage exceeds the compensation for the damages. |

8.6 | In the event the Consultant (after the Company’s written consent) assigns or uses any sub-contractor for the performance of the Services, the Consultant shall procure that such sub-contractor undertakes a corresponding confidentiality undertaking as set out in this Clause 8 (Confidentiality). |

9. | CONTRACT PERIOD AND TERMINATION |

9.1 | This Agreement shall commence on 1 August 2024 and shall remain in full force and effect for one (1) year. The Agreement cannot be terminated during the one (1) year period, unless: |

| (a) | the other Party should commit or permit a material breach or non-performance of material importance to the other Party and should fail to remedy such material breach or non-performance within two (2) weeks after receipt of written notice; or |

| (b) | the other Party suspends payments, enters into liquidation, is petitioned or files for bankruptcy, initiates composition proceedings or company reconstruction or is otherwise considered as insolvent, |

in which case the Agreement can be terminated without notice.

9.2 | No later than one (1) week after the termination of this Agreement or at the earlier time that the Consultant is separated from the Service – regardless of the reason for this – the Consultant will promptly return to the Company all documents and all other information the Consultant has in possession such as market information, business plans, codes, memoirs etc. and (if so requested by the Company) delete any electronical copies of such documents held in the possession of the Consultant. The Consultant is not allowed to withhold from the Company such documents or such information. |

The Parties agree that this Agreement may involve the Parties’ processing of personal information related to the other Party, such as contact information to and names of employees. The Parties are separate data controllers for each of their processing of the other Party’s personal information.

11.1 | This Agreement constitutes the complete and exclusive agreement between the Parties concerning the subject matter and supersedes all previous and contemporaneous agreements and understandings, written or oral, concerning the subject matter described herein. |

11.2 | The failure of either Party to enforce its rights under this Agreement at any time for any period shall not be construed as a waiver of such right. |

11.3 | No changes or modifications or waivers to this Agreement will be effective unless in writing and duly signed by both Parties. |

11.4 | In the event that any provision of this Agreement is determined to conflict with applicable law or is otherwise deemed as unenforceable, that provision shall be limited or eliminated to the minimum extent necessary so that this Agreement otherwise remain in full force and effect. |

11.5 | This Agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same agreement. Each Party consents to be bound by the electronic (e.g. scanned and emailed or made through an e-signing tool) signature of an authorized representative of a Party to this Agreement. |

12. | DISPUTES AND GOVERNING LAW |

12.1 | This Agreement shall be governed by and construed in accordance with Danish law. |

12.2 | Any dispute, controversy or claim arising out of, or in connection with, this Agreement, or the breach, termination, or invalidity thereof, or any non-contractual obligations arising out of or in connection with this Agreement, shall be finally settled by arbitration administered by the Danish Institute of Arbitration in accordance with the Rules of Arbitration adopted by the Board of the Danish Institute of Arbitration. The seat of arbitration shall be Malmö, Sweden. The language to be used in the arbitral proceedings shall be English. |

12.3 | All arbitral proceedings conducted pursuant to Clause 12.2, all information disclosed and all documents submitted or issued by or on behalf of any of the disputing Parties or the arbitrators in any such proceedings as well as all decisions and awards made or declared in the course of any such proceedings shall be kept strictly confidential and may not be used for any other purpose than these proceedings or the enforcement of any such decision or award nor be disclosed to any |

third party without the prior written consent of the Party to which the information relates or, as regards to a decision or award, the prior written consent of all the other disputing Parties.

Signature page follows

This Agreement is signed electronically and each Party will receive a signed counterpart by e-mail.

Date: 16-Jul-2024 | | Date: 16-Jul-2024 |

| | |

Y-MABS THERAPEUTICS, INC | | INVESTERINGSSELSKABET GH APS |

| | |

| | |

/s/ Michael Rossi | | /s/ Bo Kruse |

Michael Rossi - CEO | | Bo Kruse |

| | |

| | |

/s/ John LaRocca | | |

John LaRocca – General Counsel | | |

Personal commitment

The undersigned, who performs the Services or parts of the Services, hereby undertakes to personally comply with and be bound by the undertakings in this Agreement in Clause 7 (Right to results), Clause 8 (Confidentiality) and Clause 12 (Disputes and governing law).

Date: 16-Jul-2024 | |

| |

| |

/s/ Bo Kruse | |

Bo Kruse | |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

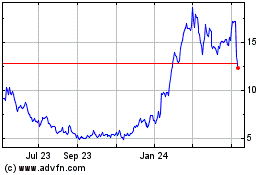

Y mAbs Therapeutics (NASDAQ:YMAB)

Historical Stock Chart

From Nov 2024 to Dec 2024

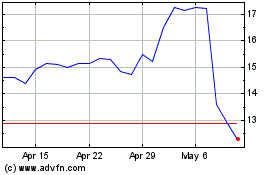

Y mAbs Therapeutics (NASDAQ:YMAB)

Historical Stock Chart

From Dec 2023 to Dec 2024