Xerox Holdings Corporation Announces Full Exercise of Over-Allotment Option for its 3.75% Convertible Senior Notes due 2029, and Completion of Series of Financing Transactions

March 25 2024 - 7:30AM

Business Wire

Xerox Holdings Corporation (NASDAQ: XRX) (the “Company”) today

announced the full exercise of the over-allotment option for its

offering of 3.75% Convertible Senior Notes due 2030 (the

“Convertible Notes”), raising an additional $50,000,000 and

bringing the total gross proceeds from the Convertible Notes

offering to $400,000,000. This announcement follows the Company’s

announcements last week of the closing of its offering of

$500,000,000 aggregate principal amount of 8.875% Senior Notes due

2029 (the “Senior Notes”), as well as the early settlement of its

previously announced cash tender offers, resulting in the

repurchase of $82,842,000 aggregate principal amount of its 3.800%

senior notes due 2024 (“2024 Notes”) and $362,000,000 aggregate

principal amount of its 5.000% senior notes due 2025 (“2025

Notes”).

“The recently completed note offerings and repurchase of our

2024 and 2025 Notes greatly enhance the Company’s financial

flexibility as we execute Xerox’s Reinvention and invest in our

growing Digital and IT businesses,” said Xavier Heiss, Chief

Financial Officer of Xerox Holdings Corporation. “We intend to use

the remaining net proceeds to repay the balance of the 2024 Notes

at maturity and a portion of our other outstanding indebtedness,

resulting in a cost-effective extension of our debt maturity

profile. We are pleased with the outcome of the note offerings,

with strong demand for both the Convertible Notes and Senior Notes

allowing us to upsize the final issuance size of each

offering.”

The aggregate principal amount of the Convertible Notes is

convertible into cash only and the remainder, if any, can be

settled in cash, stock or a combination thereof, at the Company’s

election. To further reduce potential dilution to the holders of

the Company’s common stock upon conversion of the Convertible

Notes, the Company entered into privately negotiated capped call

transactions which effectively raise the strike price on the

Convertible Notes from $20.84 to $28.34 (~70% effective conversion

premium relative to the last reported sale price as of the pricing

date of March 6, 2024).

The offerings of the Convertible Notes and Senior Notes were

made in private placements to persons reasonably believed to be

qualified institutional buyers pursuant to Rule 144A under the

Securities Act of 1933, as amended (the “Act”), and, in the case of

the Senior Notes offering, to non-U.S. persons outside the United

States pursuant to Regulation S under the Act.

This press release shall not constitute an offer to sell, or a

solicitation of an offer to buy, the Convertible Notes or the

Senior Notes, the related guarantees or any other security, and

shall not constitute an offer, solicitation or sale of any

securities in any state or jurisdiction in which, or to any persons

to whom, such offering, solicitation or sale would be unlawful. In

addition, this press release shall not constitute an offer to

purchase or a solicitation of an offer to purchase the 2024 Notes

or the 2025 Notes. Any tender offer will be made solely pursuant to

an offer to purchase to the holders of the 2024 Notes and the 2025

Notes.

About Xerox Holdings Corporation (NASDAQ: XRX)

For more than 100 years, Xerox has continually redefined the

workplace experience. Harnessing our leadership position in office

and production print technology, we’ve expanded into software and

services to sustainably power the hybrid workplace of today and

tomorrow. Today, Xerox is continuing its legacy of innovation to

deliver client-centric and digitally-driven technology solutions

and meet the needs of today’s global, distributed workforce. From

the office to industrial environments, our differentiated business

and technology offerings and financial services are essential

workplace technology solutions that drive success for our clients.

At Xerox, we make work, work.

Forward-Looking Statements

This release and other written or oral statements made from time

to time by management contain “forward looking statements” as

defined in the Private Securities Litigation Reform Act of 1995.

The words “anticipate”, “believe”, “estimate”, “expect”, “intend”,

“will”, “should”, “targeting”, “projecting”, “driving” and similar

expressions, as they relate to us, our performance and/or our

technology, are intended to identify forward-looking statements.

These statements reflect management’s current beliefs, assumptions

and expectations and are subject to a number of factors that may

cause actual results to differ materially. Such factors include but

are not limited to: global macroeconomic conditions, including

inflation, slower growth or recession, delays or disruptions in the

global supply chain, higher interest rates, and wars and other

conflicts, including the current conflict between Russia and

Ukraine; our ability to succeed in a competitive environment,

including by developing new products and service offerings and

preserving our existing products and market share as well as

repositioning our business in the face of customer preference,

technological, and other change, such as evolving return-to-office

and hybrid working trends; failure of our customers, vendors, and

logistics partners to perform their contractual obligations to us;

our ability to attract, train, and retain key personnel; execution

risks around our Reinvention; the risk of breaches of our security

systems due to cyber, malware, or other intentional attacks that

could expose us to liability, litigation, regulatory action or

damage our reputation; our ability to obtain adequate pricing for

our products and services and to maintain and improve our cost

structure; changes in economic and political conditions, trade

protection measures, licensing requirements, and tax laws in the

United States and in the foreign countries in which we do business;

the risk that multi-year contracts with governmental entities could

be terminated prior to the end of the contract term and that civil

or criminal penalties and administrative sanctions could be imposed

on us if we fail to comply with the terms of such contracts and

applicable law; interest rates, cost of borrowing, and access to

credit markets; risks related to our indebtedness; the imposition

of new or incremental trade protection measures such as tariffs and

import or export restrictions; funding requirements associated with

our employee pension and retiree health benefit plans; changes in

foreign currency exchange rates; the risk that our operations and

products may not comply with applicable worldwide regulatory

requirements, particularly environmental regulations and directives

and anticorruption laws; the outcome of litigation and regulatory

proceedings to which we may be a party; laws, regulations,

international agreements and other initiatives to limit greenhouse

gas emissions or relating to climate change, as well as the

physical effects of climate change; and other factors as set forth

from time to time in the Company’s Securities and Exchange

Commission filings, including the Company’s Annual Report on Form

10-K for the year ended December 31, 2023.

The Company intends these forward-looking statements to speak

only as of the date of this release and does not undertake to

update or revise them as more information becomes available, except

as required by law.

Xerox® is a trademark of Xerox in the United States and/or other

countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240325621146/en/

Media Contact: Justin Capella, Xerox, +1-203-258-6535,

Justin.Capella@xerox.com

Investor Contact: David Beckel, Xerox, +1-203-849-2318,

David.Beckel@xerox.com

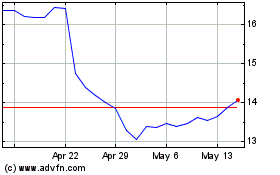

Xerox (NASDAQ:XRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

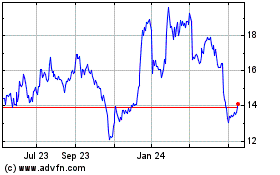

Xerox (NASDAQ:XRX)

Historical Stock Chart

From Nov 2023 to Nov 2024