Johnson & Johnson Sells 10-Year Bonds At 3.15%, 30-Year At 4.631%

August 12 2010 - 5:46PM

Dow Jones News

Johnson & Johnson sold $1.1 billion of bonds Thursday at the

lowest rates ever for 10-year and 30-year corporate debt

securities, illustrating how eager investors are for corporate

bonds at a time of record-low payouts on government debt.

Corporations with top credit ratings have been able to take

advantage of investor demand and raise cash cheaply in recent

weeks. Some of the best-known issuers have tapped the debt markets

at near-record-low rates, including International Business Machines

Corp. (IBM), Wal-Mart Stores Inc. (WMT) and McDonald's Corp.

(MCD).

Credit-market yields are at their lowest point since 2003,

having fallen further this week after the Federal Reserve said it

would buy Treasury debt in a bid to boost the U.S. economy.

"Issuers are using this environment to extend their liabilities

and retire front-end debt, locking in low borrowing rates for an

extended period of time," said Michael Hyman, head of

investment-grade credit at ING Investment Management, whose team

manages $30 billion in corporate bonds and bought the new Johnson

& Johnson bonds. "It would have been very tempting for them to

issue at these levels."

The healthcare-products company sold its 10-year bonds with a

nominal interest rate of 2.95% at a discount to yield 3.15%, or a

risk premium of 0.43 percentage point over comparable Treasurys.

The 30-year securities priced with a rate of 4.5% and also sold at

a discount to yield 4.631%, a premium of 0.68 percentage point over

Treasurys.

The tranches on the deal were split equally, with $550 million

in each maturity. Price guidance on the deal had been 0.45 and 0.70

percentage point, respectively, over Treasurys.

It is the second time since 2000 that Johnson & Johnson has

reaped record-low borrowing rates for these maturities, according

to data provider Dealogic. Johnson & Johnson declined to

comment.

Hyman said the securities were attractive because they are from

one of the highest-quality borrowers in the U.S. and because it was

challenging to obtain bonds from the company in the secondary bond

market.

"Johnson & Johnson is a bellwether credit--one of only four

nonfinancial issuers to still carry a AAA credit rating," he said.

"They are relatively infrequent issuers, so if we want exposure to

a credit like this, participating in the new issue is the best way

to purchase blocks of bonds."

The price of the company's existing 5.15% bonds due July 2018

improved in secondary market trading, rising to 116.154 pennies on

the dollar of face value on Thursday afternoon from 115.944

Wednesday, according to MarketAxess.

The lowest rates on record for 10- and 30-year corporate bonds

to date were scored recently by McDonald's and Northern States

Power Co. of Minnesota, a subsidiary of Xcel Energy Inc. (XEL).

McDonald's raised $450 million in 10-year bonds at a discount

with an interest rate of 3.5% to yield 3.548% and Northern States

Power raised $250 million at a rate of 4.85% to yield 4.868%.

Orders for the Johnson & Johnson bonds were in the range of

$2 billion for the 10-year and $1.6 billion for the 30-year

maturity.

"This points to how strong a credit this is even in a market

that is not nearly as good as it was on Monday or all of last

week," said David Trahan, head of U.S. investment-grade syndicate

at Citigroup Inc. in New York.

Citigroup, Goldman Sachs Group Inc. and J.P. Morgan Chase &

Co. are the lead bookrunners on the deal.

-By Katy Burne, Dow Jones Newswires; 212-416-3084;

katy.burne@dowjones.com

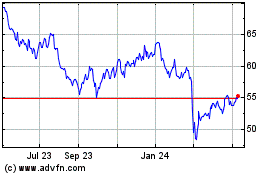

Xcel Energy (NASDAQ:XEL)

Historical Stock Chart

From May 2024 to Jun 2024

Xcel Energy (NASDAQ:XEL)

Historical Stock Chart

From Jun 2023 to Jun 2024