As filed with the Securities and Exchange

Commission on June 14, 2024

Registration No. 333-279954

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT NO. 1

TO

FORM

F-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

X3

HOLDINGS CO., LTD.

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

Not

applicable |

(State or other jurisdiction

of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

Suite

412, Tower A, Tai Seng Exchange

One

Tai Seng Avenue

Singapore

536464

Tel:

+65-8038-6502

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Puglisi

& Associates

850

Library Avenue

Suite

204

Newark,

Delaware 19711

+302-738-6680

(Name,

address including zip code, and telephone number, including area code, of agent for service)

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the SEC, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| SUBJECT

TO COMPLETION |

|

June

14, 2024 |

PROSPECTUS

X3

HOLDINGS CO., LTD.

Up

to $277,700,000

Class

A Ordinary Share

Preferred

share

Debt

Securities

Warrants

Rights

Units

and

Up to 49,107,392

Class A Ordinary Shares

Offered by Selling Shareholder

We may from time to time

offer, issue and sell up to US$277,700,000, or its equivalent in any other currency, currency units, or composite currency or currencies,

of our Class A ordinary shares, par value US$0.40, preferred shares, debt securities, warrants to purchase our Class A ordinary shares,

rights and a combination of the foregoing securities, separately or as units, in one or more offerings. We refer to our Class A ordinary

shares, preferred shares, warrants, rights and units collectively as “securities” in this prospectus. This prospectus provides

a general description of offerings of these securities that we may undertake.

The

selling shareholder identified in this prospectus (the “Selling Shareholder”) may also offer up to an aggregate of 48,750,762 Class

A ordinary shares pursuant to the standby equity purchase agreement (the “SEPA”) dated May 16, 2024, by and among the

Company and such Selling Shareholder and 356,630 Commitment Shares to be issued to the Selling Shareholder pursuant to the SEPA.

We have agreed to bear all of the expenses incurred in connection with the registration of the Conversion Shares. The Selling Shareholder

will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred

for the resale the Conversion Shares. We will not receive any proceeds from the sale or other distribution of our Class A ordinary shares

by the Selling Shareholder.

On May 16, 2024, we entered

into the SEPA with YA II PN, LTD., a Cayman Islands exempt limited partnership (“Yorkville”), pursuant to which the Company

has the right to sell to Yorkville, and Yorkville agreed to purchase from the Company, up to $30.0 million of its Class A ordinary shares,

par value US$0.40 (the “Commitment Amount”), subject to certain limitations and conditions set forth in the SEPA, from time

to time during the term of the SEPA. Sales of the shares of Ordinary shares to Yorkville under the SEPA, and the timing of any such sales,

are at the Company’s option, and the Company is under no obligation to sell any ordinary shares to Yorkville under the SEPA except

in connection with notices that may be submitted by Yorkville, in certain circumstances as described below. The Company shall not affect

any sales under the SEPA, and Yorkville shall not have any obligation to purchase our Class A Ordinary shares under the SEPA, to the

extent that after giving effect to such purchase and sale, Yorkville would beneficially own more than 4.99% of the Company’s Class

A ordinary shares at the time of such issuance (the “Ownership Limitation”). As a result of (i) and (ii) above, the Company

may not have access to the full $30.0 million amount available under the SEPA.

In connection with the

SEPA, and subject to the conditions set forth therein, Yorkville agreed to advance us an aggregate principal amount of up to US$8,000,000

through four pre-paid advances (each a “Pre-Paid Advance”) evidenced by convertible promissory notes (the “Convertible

Promissory Note”) to be issued to Yorkville at a purchase price equal to 93.0% of the principal amount of each Pre-Paid Advance.

On May 16, 2024, the first Pre-Paid Advance was disbursed in the principal amount of US$4,756,986.10. Pursuant to the terms of the SEPA,

the second Pre-Paid Advance shall be in an amount of US$1,500,000 and advanced on the second trading day after the filing of the initial

Registration Statement (the “Second Pre-Advance Closing”), the third Pre-Paid Advance shall be in an amount of US$871,506.95

and advanced on the second trading day after the effectiveness of the initial Registration Statement (the “Third Pre-Advance Closing”),

and the fourth Pre-Paid Advance shall be in an amount of US$871,506.95 and advanced on the sixtieth calendar day following the date the

initial Registration Statement is declared effective by the SEC (the “Fourth Pre-Advance Closing”). Interest shall accrue

on the outstanding balance of the Convertible Promissory Note at an annual rate equal to 8.0%, subject to an increase to 18% upon an

event of default as described in the Convertible Promissory Notes. The maturity date of the Convertible Promissory Note issued in connection

with each Pre-Paid Advance will be 12 months from the date of each closing. Yorkville may convert the Convertible Promissory Notes into

shares of our Class A ordinary shares at a conversion price equal to the lower of (i) US$0.9856 per Ordinary Share (the “Fixed

Conversion Price”), or (ii) 93% of the lowest daily VWAP (as defined in the Notes) during the 10 consecutive trading days immediately

preceding the conversion date or other date of determination, but not lower than the floor price of US$0.1641 per Ordinary Share (the

“Conversion Price”). On the later to occur of May 27, 2024 or the effectiveness of this Registration Statement (the “Fixed

Price Reset Date”), the Fixed Conversion Price shall be adjusted (downwards only) to equal the average VWAP for the five trading

days immediately prior to the Fixed Price Reset Date. Yorkville, in its sole discretion and providing that there is a balance remaining

outstanding under the Convertible Promissory Note, may deliver a notice under the SEPA requiring the issuance and sale of shares of Class

A ordinary shares to Yorkville at a price per share equivalent to the Conversion Price as determined in accordance with the Convertible

Promissory Note in effect on the date of delivery of such notice in consideration of an offset to the Convertible Promissory Note (“Yorkville

Advance”). Yorkville, in its sole discretion, may select the amount of any Yorkville Advance, provided that the number of shares

issued does not cause Yorkville to exceed: (i) the Ownership Limitation, or (ii) the number of shares registered pursuant to this Registration

Statement. Any amounts payable under a Convertible Promissory Note will be offset by such amount sold pursuant to a Yorkville Advance.

The shares of Class A

ordinary shares will be sold to Yorkville pursuant to the SEPA at the election of the Company as specified in the Advance Notice and

at a per share price equal to: (i) the VWAP of the ordinary shares for any period commencing (i) if submitted to Yorkville prior to 9:00

a.m. Eastern Time on a trading day, the open of trading on such day or (ii) if submitted to Yorkville after 9:00 a.m. Eastern Time on

a trading day, upon receipt by the Company of written confirmation of acceptance of such Advance Notice by Yorkville and ending on 4:00

p.m. New York City time on the applicable Advance notice date (the “Option 1 Pricing Period”), and (ii) the lowest daily

VWAP of the ordinary shares for the three consecutive trading days commencing on the Advance notice date (the “Option 2 Pricing

Period,” and each of the Option 1 Pricing Period and the Option 2 Pricing Period, a “Pricing Period”).

In connection with the

execution of the SEPA, the Company paid a structuring fee to Yorkville in the amount of $15,000 in cash. Additionally, the Company agreed

to pay a commitment fee of $300,000 (the “Commitment Fee”), which is equal to 1% of the Commitment Amount under the SEPA,

to Yorkville on the date this Registration Statement has been declared effective by the SEC, at the option of the Company, in cash or

by the issuance of Class A ordinary shares in such number that is equal to the Commitment Fee divided by the closing price of our ordinary

shares as of the trading day immediately prior to the date of the SEPA (the “Commitment Shares”).

Yorkville is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”), and any profits

on the sales of shares of our Class A ordinary shares by Yorkville and any discounts, commissions, or concessions received by Yorkville

are deemed to be underwriting discounts and commissions under the Securities Act. Yorkville may offer and sell the securities covered

by this prospectus from time to time. Yorkville may offer and sell the securities covered by this prospectus in a number of different

ways and at varying prices. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and

any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable

from the information set forth, in any applicable prospectus supplement.

The

securities may be sold by us or the Selling Shareholder to or through underwriters or dealers, directly to purchasers or through agents

designated from time to time. The Selling Shareholder identified in this prospectus, or their respective transferees, pledgees, donees

or other successors-in-interest, may offer the Shares through public or private transactions at prevailing market prices, at prices related

to prevailing market prices or at privately negotiated prices. For additional information on the methods of sale, see the section entitled

“Plan of Distribution” on page 13.

The

Selling Shareholder may sell any, all or none of the securities offered by this prospectus, and we do not know when or in what amount

the Selling Shareholder may sell their Shares hereunder following the effective date of this registration statement.

We

will provide specific terms of any offering in one or more supplements to this prospectus. Any prospectus supplement may also add, update,

or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement

as well as the documents incorporated or deemed to be incorporated by reference in this prospectus before you purchase any of the securities

offered hereby.

These

securities may be offered and sold in the same offering or in separate offerings; to or through underwriters, dealers, and agents; or

directly to purchasers. The names of any underwriters, dealers, or agents involved in the sale of our securities, their compensation

and any options to purchase additional securities held by them will be described in the applicable prospectus supplement. For a more

complete description of the plan of distribution of these securities, see the section entitled “Plan of Distribution” on

page 13.

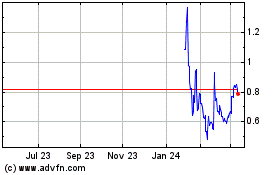

Our

Ordinary Shares are currently listed on the Nasdaq Capital Market under the symbol “XTKG.” On June 11, 2024, the last reported

sale price of our Ordinary Shares on the Nasdaq Capital Market was US$0.71 per share. The applicable prospectus supplement will contain

information, where applicable, as to other listings, if any, on the Nasdaq Capital Market or other securities exchange of the securities

covered by the prospectus supplement.

If

any underwriters are involved in the sale of the securities with respect to which this prospectus is being delivered, the names of such

underwriters and any applicable discounts or commissions and over-allotment options will be set forth in the applicable prospectus supplement.

This prospectus also describes the general manner in which the Shares may be offered and sold. If necessary, the specific manner in which

the Shares may be offered and sold will be described in a supplement to this prospectus.

Investing

in our securities involves risks. You should carefully review the risks described under the heading “Risk Factors” beginning

on page 10 and in the documents which are incorporated by reference herein before you invest in our securities.

Our Company is not an

operating company but a Cayman Islands holding company. Our operations are primarily conducted through our subsidiaries in Singapore

and the PRC. Investors investing in our ordinary shares thus are purchasing equity interest in a Cayman Islands holding company and not

in an operating entity.

We face various risks

and uncertainties relating to doing business in China. A substantial part of our business operations is conducted in China, and we are

subject to complex and evolving PRC laws and regulations. For example, we face risks associated with regulatory requirements on overseas

offerings, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy, which may impact our ability to conduct

certain businesses, accept foreign investments, or list and conduct offerings on a stock exchange in the United States or other foreign

jurisdiction, and we are required to make filings with the China Securities Regulatory Commission (the “CSRC”) for applicable

securities offerings, including an offering made pursuant to this prospectus. We are required to file with the CSRC within three working

days after the subsequent securities offering made pursuant to this prospectus is completed and we might face warnings or fines if we

fail to fulfill related filing procedure. Although there are still uncertainties regarding the interpretation and implementation of relevant

regulatory guidance, our operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating

to its business or industry. These risks could materially and adversely impact our operations and the value of our ordinary shares, significantly

limit or completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly

decline or become worthless.

The Holding Foreign Companies

Accountable Act, or the HFCAA, was enacted on December 18, 2020. The HFCAA states that if the SEC determines that we have filed audit

reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years

beginning in 2021, the SEC will prohibit our shares or the ordinary shares from being traded on a national securities exchange or in

the over-the-counter trading market in the United States. On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination

that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and

Hong Kong (the “2021 Determinations”). In June 2021, the Senate passed the Accelerating Holding Foreign Companies Accountable

Act (the “AHFCAA”), which was signed into law on December 29, 2022, amending the HFCAA and requiring the SEC to prohibit

an issuer’s securities from trading on any U.S. stock exchange if its auditor is not subject to PCAOB inspections for two consecutive

years instead of three consecutive years. On August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “SOP”)

with the China Securities Regulatory Commission and the Ministry of Finance of China. The SOP, together with two protocol agreements

governing inspections and investigations, establishes a specific, accountable framework to make possible complete inspections and investigations

by the PCAOB of audit firms based in mainland China and Hong Kong, as required under U.S. law. On December 15, 2022, the PCAOB announced

that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland

China and Hong Kong completely in 2022 and vacated the 2021 Determinations that the PCAOB was unable to inspect or investigate completely

registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to conduct

inspections and investigations completely to its satisfaction of PCAOB-registered public accounting firms headquartered in mainland China

and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our current auditor’s, control, including

positions taken by authorities of the PRC. The PCAOB is expected to continue to demand complete access to inspections and investigations

against accounting firms headquartered in mainland China and Hong Kong in the future and states that it has already made plans to resume

regular inspections in early 2023 and beyond. The PCAOB is required under the HFCAA to make its determination on an annual basis with

regard to its ability to inspect and investigate completely accounting firms based in mainland China and Hong Kong. The possibility of

being a “Commission-Identified Issuer” and the risk of delisting could continue to adversely affect the trading price of

our securities. Should the PCAOB again encounter impediments to inspections and investigations in mainland China or Hong Kong as a result

of positions taken by any authority in either jurisdiction, the PCAOB will make determinations under the HFCAA as and when appropriate.

For details, see “Risk Factors— Risks Related to Doing Business in China — Our Ordinary Shares may be delisted under

the HFCAA if the PCAOB is unable to inspect auditors or their affiliates that are located in mainland China. The delisting of our Ordinary

Shares, or the threat of such delisting, may materially and adversely affect the value of your investment. Additionally, the inability

of the PCAOB to conduct inspections deprives our investors of the benefits of such inspections.”, which is included in our most

recent annual report on Form 20-F. Recent developments with respect to audits of China-based companies may still also create uncertainty

about the ability of our auditor to fully cooperate with the PCAOB’s inspection requests without the approval of the relevant PRC

authorities. The delisting of our ordinary shares, or the threat of their being delisted, may have a material adverse impact on our listing

and trading in the U.S. and the trading prices of our ordinary shares.

our ability to pay dividends

to the shareholders and to service any debt it may incur may depend upon dividends paid by our PRC subsidiaries. If any of our subsidiaries

incurs debt on its own behalf in the future, the instruments governing such debt may restrict its ability to pay dividends to us. Under

PRC laws and regulations, our PRC subsidiaries are subject to certain restrictions with respect to payment of dividends or other transfers

of any of their net assets to us. Our PRC subsidiaries are permitted to pay dividends only out of their retained earnings, if any, as

determined in accordance with PRC accounting standards and regulations. PRC laws also require a foreign-invested enterprise to set aside

at least 10% of its after-tax profits as the statutory common reserve fund until the cumulative amount of the statutory common reserve

fund reaches 50% or more of such enterprise’s registered capital, if any, to fund its statutory common reserves, which are not

available for distribution as cash dividends. Remittance of dividends by a wholly foreign-owned enterprise out of mainland China is also

subject to examination by the banks designated by the PRC State Administration of Foreign Exchange. These restrictions are benchmarked

against the paid-up capital and the statutory reserve funds of our PRC subsidiaries. To the extent cash in our business is in China or

in an entity in mainland China, the funds may not be available to fund operations or for other use outside of mainland China due to interventions

in or the imposition of restrictions and limitations by the PRC government on our ability to transfer cash. As a result, our ability

to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our

business may be materially and adversely affected.

Neither

the Securities and Exchange Commission, Cayman Islands, nor any state securities commission has approved or disapproved of

these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024.

TABLE

OF CONTENTS

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not

authorized any person to provide you with different or additional information. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy

securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus

or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate

as of the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have

changed since those dates.

ABOUT

THIS PROSPECTUS

This

prospectus is a part of a registration statement that we filed with the Securities and Exchange Commission, or the Commission, using

a resale and “shelf” registration process. Under this resale and shelf registration process, we may offer to sell any of

the securities, or any combination of the securities, described in this prospectus, in each case in one or more offerings, up to a total

amount of $277,700,000 and the Selling Shareholder may offer from time to time up to an aggregate of up to 48,750,762 Class A ordinary

shares. You should rely only on the information contained in this prospectus and the related exhibits, any prospectus supplement or amendment

thereto and the documents incorporated by reference, or to which we have referred you, before making your investment decision. You should

read both this prospectus and any applicable prospectus supplement, together with additional information described below under the caption

“Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.” Neither we nor the

Selling Shareholder have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus, any prospectus supplement or amendments thereto do not constitute an offer to

sell, or a solicitation of an offer to purchase, the Class A Ordinary Shares offered by this prospectus, any prospectus supplement or

amendments thereto in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of

an offer in such jurisdiction. You should not assume that the information contained in this prospectus, any prospectus supplement or

amendments thereto, as well as information we have previously filed with the U.S. Securities and Exchange Commission (the “SEC”),

is accurate as of any date other than the date on the front cover of the applicable document.

If

necessary, the specific manner in which the securities may be offered and sold will be described in a supplement to this prospectus,

which supplement may also add, update or change any of the information contained in this prospectus. To the extent there is a conflict

between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus

supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later

date-for example, a document incorporated by reference in this prospectus or any prospectus supplement-the statement in the document

having the later date modifies or supersedes the earlier statement.

Neither

the delivery of this prospectus nor any distribution of Class A Ordinary Shares pursuant to this prospectus shall, under any circumstances,

create any implication that there has been no change in the information set forth or incorporated by reference into this prospectus or

in our affairs since the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed

since such date.

When

used herein, unless the context requires otherwise, references to the “X3 Holdings,” “the Company,” “our

Company,” “we,” “our” and “us” refer to X3 Holdings Co., Ltd., a Cayman Islands exempted company.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, the applicable prospectus supplement or amendment and the information incorporated by reference in this prospectus contain

various forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities and Exchange

Act of 1934, as amended (the “Exchange Act”), which represent our expectations or beliefs concerning future events. Forward-looking

statements include statements that are predictive in nature, which depend upon or refer to future events or conditions, and/or which

include words such as “believes,” “plans,” “intends,” “anticipates,” “estimates,”

“expects,” “may,” “will” or similar expressions. In addition, any statements concerning future financial

performance, ongoing strategies or prospects, and possible future actions, which may be provided by our management, are also forward-looking

statements. Forward-looking statements are based on current expectations and projections about future events and are subject to risks,

uncertainties, and assumptions about our company, economic and market factors, and the industry in which we do business, among other

things. These statements are not guarantees of future performance, and we undertake no obligation to publicly update any forward-looking

statements, whether as a result of new information, future events, or otherwise, except as required by law. Actual events and results

may differ materially from those expressed or forecasted in forward-looking statements due to a number of factors. Factors that could

cause our actual performance, future results and actions to differ materially from any forward-looking statements include, but are not

limited to, those discussed under the heading “Risk Factors” in any of our filings with the SEC pursuant to Sections 13(a),

13(c), 14 or 15(d) of the Exchange Act. The forward-looking statements in this prospectus, the applicable prospectus supplement or any

amendments thereto and the information incorporated by reference in this prospectus represent our views as of the date such statements

are made. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date

such statements are made.

OUR

COMPANY

This

summary highlights information contained in the documents incorporated herein by reference. Before making an investment decision, you

should read the entire prospectus, and our other filings with the SEC, including those filings incorporated herein by reference, carefully,

including the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements.” Unless

otherwise indicated or the context otherwise requires, references in this prospectus to “we,” “our,” “us,”

and other similar terms refer to X3 Holdings Co., Ltd. and its consolidated subsidiaries.

Overview

X3

Holdings Co., Ltd., headquartered in Singapore, is a global provider of digital solutions and technology services spanning diverse industries.

We harness cutting edge technologies to forge agile, innovative business models across targeted global markets by integrating pivotal

resources in technology applications, financial prowess, and streamlined operations. We target accelerated and transformative growth

across digital technologies, cryptomining operations, renewable energy, and agriculture technologies, focusing on key markets in Asia,

the Middle East, Africa, and Europe. Our vision is to be a differentiated and valuable company excelling in high growth industries with

a global reach.

Digital

Technologies

With

over two decades of technology and industry expertise, X3 Holdings capitalizes on the digital transformation sweeping the global trade

industry. We provide integrated solutions and services to both public and private entities by developing a comprehensive suite of cross-border

digital trade platforms and services. Our global trade supply chain and compliance platform services have been adopted in China, Indonesia,

the Netherlands, Spain and the United Kingdom, with plans to reach even more countries.

Cryptomining

Operations

X3

Holdings engages in developing globally diversified bitcoin cryptomining operations supported by sustainable energy sources. We partner

with top-tier mining machine providers to ensure stable access and supply of next generation miners. We also collaborate with global

partners to intertwine cryptomining with agriculture and renewable energy to slash electricity and operational costs. Already operational

in Central Asia, the Company plans to gear up for a sizable bitcoin mining fleet in the near term.

Renewable

Energy

X3

Holdings aligns with industry leading players, weaving together policy, technology, capital and regional resources to develop scalable

renewable energy projects. This initiative champions renewable energy adoption for new energy vehicle and agriculture machinery development

in targeted markets. The Company also pursues integrated renewable energy solutions for cryptomining and agriculture, creating a blueprint

for reduced electricity cost and environmental stewardship.

Agriculture

Technologies

X3

Holdings offers smart platforms and digital technologies and to enhance agricultural farming efficiency and operations, utilizing big

data, AI, blockchain and IoT. We collaborate with global partners in seeds and fertilizers to help facilitate higher crop yields, reduced

resource consumption, and sustainable practices. The Company also develop an integrated solution marrying greenhouse operations with

collocated cryptomining facilities, with the waste heat repurposed and recycled.

We

believe our competitive strengths are contributing to our success and differentiating us from our competitors. We have a diversified

business with clear and robust growth strategies in what we believe high growth markets with multiple revenue and profit models, supported

by our over two decades of industry and technology expertise and capabilities underpinning business innovation and transformation.

We

are striving to create values for all stakeholders, facilitated by our globally integrated resources and operations to support our overall

growth. We believe there is a potent entrepreneurial spirit prevalent throughout our global operations, shared by our management, employees,

and business partners, led by our agile and seasoned management team and complemented by a partnership network adept at realizing our

global vision.

Our

Solutions and Services

X3

Holdings is a provider of digital solutions and technology services spanning diverse industries in targeted markets, operating across

diversified business segments in digital technologies, cryptomining operations, renewable energy, and agriculture technologies.

Digital

Technologies

With

over two decades of technology and industry expertise, X3 Holdings capitalizes on the digital transformation sweeping the global trade

industry. We provide integrated solutions and services to both public and private entities by developing a comprehensive suite of cross-border

digital trade platforms and services. Our global trade supply chain and compliance platform services have been adopted in China, Indonesia,

the Netherlands, Spain and the United Kingdom, with plans to reach even more countries.

Global

Trade Digital Platforms: We provide global digital trade platforms and services to both public and private entities, servicing all

stakeholders in the global trade ecosystem including international trading partners, logistics service providers, customs authorities,

and other government agencies. Our platforms and services encompass cross-border trades, logistics and shipping, customs clearance, and

transactions and settlements, with enhanced traceability and transparency across the entire supply chain. We also offer fintech services

for financial institutions for enhancing risk control and ensuring efficient supply chain financing.

Trade

Zone Operations Solutions: We offer digital solutions and services for developing and operating free trade zones, bonded goods facilities,

cross border trade zones, and other regulated trade zones and facilities. Our solutions and services are designed for trade zone operations,

enterprise trade applications, customs monitoring and clearance, and other financial and logistics services for trade zone authorities

and enterprises. Our blockchain applications enable supply chain transparency, streamlined customs clearance, expedited import and export

process, and increased international trade volume for the regulated trade zones

Supply

Chain and Compliance Solutions: We provide global trade supply chain and compliance platforms and solutions for multinational manufacturing

and international trade enterprises, satisfying regulatory requirements of customs authorities in various countries. Our solutions facilitate

streamlined documentation process and integrated data sharing relating to customs, tax, logistics and shipping, and strengthen collaboration

among customers’ subsidiaries and operations worldwide. Our solutions expedite the flow of raw materials and finished goods across

the entire supply chain, fostering customer’s global market expansion.

International

Trading of Products: We engage in international trading of select products by using data from our global trade platforms and market

analysis on trade composition, trade logistics, and market trends and development. We collaborate with supply and channel partners to

capitalize on international trading opportunities for consumer products and commodity products with high profit and growth opportunities.

We gain access to efficient logistics channels to minimize shipping costs, leveraging on our over two decades of international trade

industry experience and a global network of operations and logistics partners.

Cryptomining

Operations

X3

Holdings engages in developing globally diversified bitcoin cryptomining operations supported by sustainable energy sources. We partner

with top-tier mining machine providers to ensure stable access and supply of next generation miners. We also collaborate with global

partners to intertwine cryptomining with agriculture and renewable energy to slash electricity and operational costs. Already operational

in Central Asia, the Company plans to gear up for a sizable bitcoin mining fleet in the near term.

Cryptomining

Business: We develop and operate renewable energy supported and sustainability-focused bitcoin mining operations with high performance

mining machines, diversified across hosting sites in Central Asia and other regions. We adopt an asset light model by focusing on investment

in mining machines rather than infrastructure for maximized return of investment on revenue generating assets and minimized capital expenditure.

We partner with leading crypto machine manufacturers for stable access to top-tiered performance mining hardware to drive an efficient

scaling of our miner fleet.

Cryptomining

Operations: We leverage our strong partnerships with diversified hosting facilities operated and supported by sustainable energy

sources to minimize electricity and operational cost, and mitigate regulatory and site related risks. We focus on expansion of global

bitcoin mining capacities powered by renewable energy sources collocated with the hosting sites. We continue to pursue and execute a

prudent and efficient scaling of our mining capacities at existing operations and expanded locations with low-cost, energy efficient

sustainable energy sources, with a projected sizable miner fleet in the near term.

Sustainability

Focus: We engage in the development of bitcoin mining operations and facilities powered by renewable energy sources from solar energy,

wind power and hydroelectric power across global geographically diversified locations. We continue to emphasize on a broader international

footprint and deploy miners at renewable energy powered hosting sites with a long-term goal to become entirely carbon neutral. We also

develop cleantech solutions to recover and repurpose excessive heat from the cryptomining facilities as a heating source for collocated

farming greenhouses, further reducing carbon emissions.

Cryptomining

and Agribusiness: We develop sustainability focused cleantech solutions for recovering and repurposing the excessive heat generated

from the cryptomining sites for heating use in the collocated farming greenhouses. The cryptomining operations benefit from an added

revenue stream and lower cooling cost offsetting electricity, while the greenhouses benefit from lower cost for heating and microclimate

control, resulting in the same renewable energy being used twice, leading to substantial less carbon emissions by the efficient use of

heat at collocated cryptomining operations and farming greenhouses.

Renewable

Energy

X3

Holdings aligns with industry leading players, weaving together policy, technology, capital and regional resources to develop scalable

renewable energy projects. This initiative champions renewable energy adoption for new energy vehicle and agriculture machinery development

in targeted markets. The Company also pursues integrated renewable energy solutions for cryptomining and agriculture, creating a blueprint

for reduced electricity cost and environmental stewardship.

Renewable

Energy Business: We engage in an integrated renewable energy business model driving for the adoption of renewable energy and development

of new energy vehicles and agriculture machinery in key developing markets. We collaborate with industry leading players, weaving together

policy, technology, capital, and regional resources to cultivate a scalable renewable energy business with robust growth potential. We

deploy diverse operational models in research and development, manufacturing and operations, and platform and channel services, fostering

an efficient ecosystem for all stakeholders.

Electric

Vehicles and Agriculture Equipment Projects: We collaborate with leading manufacturers and suppliers of electric vehicles and agriculture

machinery and equipment for the project design, implementation and operations in target markets. We harnessing our partners’ technological

and manufacturing capacities to establish regional brands and extending brand influence and market reach across developing and emerging

markets. We implement financial and investment strategies and solutions to support production facility development and operations as

well as brand and channel development.

Solar

Power Projects: We forge strategic alliances with leading solar system providers in developing a portfolio of regional solar energy

and storage projects catering to agricultural and industrial needs of target markets. We explore opportunities in research and

development as well as assembly and production of photovoltaic panels and systems in developing countries with favorable cost structures

and regulatory environments. We also develop solar energy charging stations tailored for electrical vehicles and clean energy driven

agricultural machinery, complete with integrated digital technology solutions and services.

Integrated

Operations Models: We develop integrated renewable energy solutions for agriculture and cryptomining, resulting in lower electricity

cost and reduced carbon emission with a positive impact on the environment and society. Our renewable energy-based agriculture services

encompass distributed energy and storage system installation, greenhouse and digital agritech operations, renewable energy powered farming

equipment, and electric charging stations. We collaborate with cryptomining hosting facilities by leveraging cost effective renewable

energy sources to drive sustainable practices.

Agriculture

Technologies

X3

Holdings offers smart platforms and digital technologies and to enhance agricultural farming efficiency and operations, utilizing big

data, AI, blockchain and IoT. We collaborate with global partners in seeds and fertilizers to help facilitate higher crop yields, reduced

resource consumption, and sustainable practices. The Company also develop an integrated solution marrying greenhouse operations with

collocated cryptomining facilities, with the waste heat repurposed and recycled.

Smart

Agritech: We provide smart agritech platform and services for monitoring and managing crops and livestock farming, utilizing big

data, artificial intelligence and IoT technologies to provide data analysis and decision-making tools. For crops, our services provide

environment data and insights such as temperature and humidity, as well as soil properties such as moisture, pH and soil fertility for

enhanced farm management and operations. For livestock, our digital services integrate IoT sensors, satellite positioning, electronic

fences and livestock biometric for managing livestock identification, quantity, location, and health status.

Greenhouse

Solutions: We offer integrated solutions for greenhouse development and operations, with benefits including higher crop yield, less

water and fertilizer used, increased food safety, and enhanced sustainability with solar power. We collaborate with global partners and

integrate technologies such as IoT and AI, microclimate control and refrigeration, lighting technologies, and pest and disease control.

We also integrate greenhouse operations with collocated cryptomining facilities where the heat generated are recycled and repurposed

for climate and temperature control in the greenhouses.

Agriculture

Fintech Services: We provide fintech solutions and services for farming customers through the use of blockchain, IoT, and big data

technologies by developing digital asset models for agricultural crop and livestock. Our digital asset models transforming agriculture

assets into traceable digital assets tradable on agriculture digital markets and utilized by farming and processing enterprises to obtain

financing. We also develop a digital platform for managing and monitoring livestock with digital assets created as a collateral

for financial institutions in providing financing to farming communities.

Integrated

Operations and Services: We offer a package of sales and services encompassing agriculture machines and equipment, photovoltaic modules,

and solar powered charging stations for regional farmers and farming communities. We engage in growing of high demand and high profit

specialty fruits, vegetables and teas such as fruit flavored corns, multi-color tomatoes, and multi flavored teas in the greenhouses

and open fields. Our sales of specialty fruits and vegetables through regional wholesale and distribution channels, as well as direct

sales to consumers on leading global and regional ecommerce retail platforms.

Our

Growth Strategies

We

plan to grow and expand our business by pursuing the following growth strategies:

| ● | Focus

on executing business segment strategies to expand and strengthen expertise, capabilities

and resources to drive overall growth; |

| ● | Continue

to pursue a global and diversified business growth strategy to ensure sustained growth, effectively

countering market uncertainties; |

| ● | Accelerate

our research and development of cutting-edge technologies to continue expanding our solutions

and service offerings; |

| ● | Persist

in creating and replicating agile and innovative business models, capitalizing on market

opportunities to accelerate revenue and profit growth; |

| ● | Expand

by organic and inorganic growth wherever strategic opportunities emerge, adopting to a disciplined

approach to ensure future earnings growth. |

We

adopt differentiated and tailored growth strategies and priorities for each business segment:

| ● | Digital

Technologies: Harness the power of digital transformation to redefine global trade and increase

market penetration with expanded solutions and offerings. |

| ● | Cryptomining

Operations: Scale up bitcoin cryptomining capacities with sustainable energy sources across

globally diversified hosting sites. |

| ● | Renewable

Energy: Focus on development and operations of large scale integrated renewable energy projects

in key markets. |

| ● | Agriculture

Technologies: Amplify market presence with expanded smart agritech and IoT solutions and

services in select markets. |

Our

Technology

Our

product applications, industry solutions and platform services are designed and built from our multiple proprietary technology infrastructure

platforms which are developed based on industry leading infrastructure technologies. Our infrastructure technology platforms are designed

for high performance reliability, flexibility and scalability, allowing us to expand our solutions and services rapidly and efficiently

to consistently address the changing needs of our global customers and partners. We are developing our own technologies as well as working

with other technology and infrastructure partners with the best use of big data, artificial intelligence, blockchain, Internet of Things,

and 5G, among other technologies. We are continuing to leverage our industry expertise and product knowledge, utilizing cutting-edge

technologies to enhance our core technology and application capabilities in continually expanding the scope of our solutions and services.

Our

Customers

We

provide our solutions and services to a broad spectrum of both private and public entities globally. Our private sector customers include

import and export companies, international trade manufacturers, cross-border eCommerce platforms, freight forwarding and shipping agencies,

customs and clearance inspection brokers, warehouse operators, logistics and transportation companies, expressed courier service providers,

financial institutions, insurance service providers, farming communities and groups, agribusiness organizations, agriculture related

companies, and other business project related companies and organizations. Our public sector customers are various government agencies,

authorities and organizations, including government agencies such as customs, maritime affair, transportation and commerce, and government

authorities and organizations such as port authorities, free trade zones, bonded facilities and warehouses, and others government regulated

facility operators.

Our

Go-To-Market Approach

Our

go-to-market approach is focused on expanding the adoption of our solutions and services with existing customers and acquiring new customers

with a direct sales force and a network of global channel partners, designed to accelerate and scale up our market adoption efficiently

and globally. We believe our customer relationship-focused sales model is an advantage compared to other competitors’ product focused

approach, enabling us to develop and form strong, long-term relationships with our existing and potential customers. Our direct sales

and marketing teams are comprised of field sales, corporate sales and business development based on customer size, geographic markets,

channel networks, and target industries, striving to sustain our high customer retention and long customer tenure. We continue to focus

on cross-sell additional products and platforms with our existing customers to expand the scope of adoption for our solutions and services.

Our

Competitive Strengths

We

believe that the following competitive strengths contribute to our success and differentiate us from our competitors:

| ● | A

diversified business with clear and robust growth strategies in high growth markets with

multiple revenue and profit models. |

| ● | Over

two decades of technology expertise and capabilities underpinning business innovation and

transformation. |

| ● | Consistent

value creation for stakeholders facilitated by globally integrated resources and operations

to support overall growth. |

| ● | A

potent entrepreneurial spirit prevalent throughout global operations, shared by our management,

employees, and business partners. |

| ● | An

agile and seasoned management, complemented by a partnership network adept at realizing the

company’s global vision. |

Corporate

Structure

The

following diagram illustrates our corporate structure of our principal subsidiaries as of the date of this prospectus:

Corporate

Information

Our

principal executive office is located at Suite 412, Tower A, Tai Seng Exchange, One Tai Seng Avenue, Singapore 536464. Our telephone

number is +65-8038-6502. We maintain a website at www.x3holdings.com that contains information about our company, though no information

contained on our website is part of this prospectus.

Summary

of Risk Factors

Investing

in our ordinary shares involves significant risks. You should carefully consider all of the information in this prospectus before making

an investment in our ordinary shares. Below please find a summary of the principal risks we face, organized under relevant headings.

These risks are discussed more fully in “Item 3. Key Information—D. Risk Factors” in our annual report on Form 20-F

for the fiscal year ended December 31, 2023, which is incorporated herein by reference.

Risks

Related to Our Business and Industry

Risks

and uncertainties related to our business and industry include, but are not limited to, the following:

| ● | Economic

uncertainties or downturns could materially adversely affect our business. |

| ● | The

growth and success of our business depends on our ability to develop new services and enhance existing services in order to keep pace

with rapid changes in technology. |

| ● | If

we do not succeed in attracting new customers for our services and growing revenues from existing customers, we may not achieve our revenue

growth goals. |

| ● | We

may be unable to effectively manage our expansion for the anticipated growth, which could place significant strain on our management

personnel, systems and resources. We may not be able to achieve anticipated growth, which could materially and adversely affect our business

and prospects. |

| ● | We

face risks associated with having an extended selling and implementation cycle for our services that require us to make significant resource

commitments prior to realizing revenues for those services. |

| ● | Adverse

changes in the economic environment, either in China or globally, could reduce our customers’ purchases from us and increase pricing

pressure, which could materially and adversely affect our revenues and results of operations. |

| ● | We

generate a significant portion of our revenues from a relatively small number of major customers and loss of business from these customers

could reduce our revenues and significantly harm our business. |

| ● | We

may be forced to reduce the prices of our services due to increased competition and reduced bargaining power with our customers, which

could lead to reduced revenues and profitability. |

| ● | A

portion of our income is generated, and will in the future continue to be generated, on a project basis with a fixed price; we may not

be able to accurately estimate costs and determine resource requirements in relation to our projects, which would reduce our margins

and profitability. |

Risks

Related to Our Corporate Structure

Risks

and uncertainties related to our corporate structure include, but are not limited to, the following:

| ● | We

are a Cayman Islands company and, because judicial precedent regarding the rights of shareholders is more limited under Cayman Islands

law than under U.S. law, shareholders may have less protection for their shareholder rights than they would under U.S. law. |

| ● | Judgments

obtained against us by our shareholders may not be enforceable. |

| ● | We

may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses. |

| ● | Our

disclosure controls and procedures may not prevent or detect all errors or acts of fraud. |

| ● | If

we fail to establish and maintain proper internal financial reporting controls, our ability to produce accurate financial statements

or comply with applicable regulations could be impaired. |

Risks

Related to Our Ordinary Shares

Risks

and uncertainties related to our Shares include, but are not limited to, the following:

| ● | Our

Shares may be delisted from the Nasdaq Capital Market as a result of our failure of meeting the Nasdaq Capital Market continued listing

requirements. |

| ● | Our

issuance of new shares and convertible note had a dilutive effect on our existing shareholders and may adversely impact the market price

of our Ordinary Shares. |

Risks

Related to Doing Business in China

Risks

and uncertainties related to conducting business in China include, but are not limited to, the following:

| ● | The

Chinese government may exert substantial influence over the manner in which we must conduct our business activities. We are currently

not required to obtain approval from Chinese authorities to issue securities to foreign investors, however, if our subsidiaries or the

holding company were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges,

we will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors. |

| ● | We

may be influenced by changes in the political and economic policies of the PRC government. |

| ● | Uncertainties

with respect to the interpretation and enforcement of PRC laws, rules and regulations could have a material adverse effect on us. |

| ● | Recent

regulatory initiatives implemented by the PRC competent government authorities on cyberspace data security may have introduced uncertainty

in our business operations and compliance status, which could result in materially adverse impact on our business, results of operations

and our listing on Nasdaq. |

| ● | We

may be adversely affected by the complexity and uncertainties of and changes in PRC regulation of Internet business and related companies. |

| ● | U.S.

regulators’ ability to conduct investigations or enforce rules in China is limited. |

| ● | We

face uncertainty regarding the PRC tax reporting obligations and consequences for certain indirect transfers of the stock of our operating

company. |

SUMMARY

OF THE SECONDARY OFFERING

The secondary offering of this prospectus

relates to the offer and resale by the Selling Shareholder of up to an aggregate of 48,750,762 Class

A ordinary shares and 356,630 commitment fee shares. All of the Class A ordinary shares

will be sold by the Selling Shareholder. The Selling Shareholder may sell the Class A ordinary shares from time to time at prevailing

market prices or at privately negotiated prices.

| Securities

Offered by the Selling Shareholder: |

|

Up

to an aggregate of 48,750,762 Class A Ordinary Shares. |

| |

|

|

| Use of Proceeds: |

|

All of the Class A Ordinary

Shares offered by the Selling Shareholder pursuant to this prospectus will be sold by the Selling Shareholder for its account. We

will not receive any proceeds from the sale of shares by the Selling Shareholder.

|

RISK

FACTORS

An

investment in our securities involves significant risks. You should carefully consider the risk factors described under “Item 3.

Key Information—D. Risk Factors” in our most recent annual report on Form 20-F, which is incorporated herein by reference,

as well as the risk factors contained in any prospectus supplement and in our filings with the SEC, as well as all of the information

contained in this prospectus and the related exhibits, any prospectus supplement or amendments thereto, and the documents incorporated

by reference herein or therein, before you decide to invest in our securities. Our business, prospects, financial condition and results

of operations may be materially and adversely affected as a result of any of such risks. The value of our securities could decline as

a result of any of these risks. You could lose all or part of your investment in our securities. Some of our statements in sections entitled

“Risk Factors” are forward-looking statements. The risks and uncertainties that we have described are not the only

ones that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect

our business, prospects, financial condition and results of operations.

Please

see “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference” for information

on where you can find the documents we have filed with or furnished to the SEC and which are incorporated into this prospectus by reference.

SELLING

SHAREHOLDER

The

table below lists the Selling Shareholder and other information regarding the “beneficial ownership” of the Class A ordinary

shares by the Selling Shareholder. In accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), “beneficial ownership” includes any Class A ordinary shares as to which the Selling Shareholder have sole or

shared voting power or investment power and any Class A ordinary shares that the Selling Shareholder hold.

The second column indicates

the number of Class A ordinary shares beneficially owned by the Selling Shareholder, based on their respective ownership as of June

14, 2024.

The third column lists

the Class A ordinary shares being offered by this prospectus by the Selling Shareholder. As the daily prices of our Class A ordinary

shares that are the inputs to the determination of the purchase price pursuant to the SEPA, the number of shares that may be sold by

the Company under the SEPA may be fewer than the number of shares being offered by this prospectus.

This

prospectus covers the resale of all of the Class A ordinary shares that are held by the Selling Shareholder. The Selling Shareholder

can offer all, some or none of their Class A ordinary shares, thus we have no way of determining the number of the Class A ordinary shares

that will be held after this offering. Therefore, the fourth and fifth columns assume that the Selling Shareholder will sell all of the

Class A ordinary shares which are covered by this prospectus. See “Plan of Distribution.”

| | |

Number of

Class A

ordinary

shares

Owned

Prior to

Offering | | |

Maximum

Number of

Class A

ordinary

shares to

be Sold

Pursuant to

this

Prospectus(2) | | |

Number of

Ordinary

Shares

Owned

After

Offering(3) | | |

Percentage

Beneficially

Owned

After

Offering | |

| YA II PN, LTD. (1) | |

| 0 | | |

| 49,107,392 | | |

| 0 | | |

| * | % |

| (1) |

YA II PN, Ltd. is a

fund managed by Yorkville Advisors Global, LP (“Yorkville LP”). Yorkville Advisors Global II, LLC (“Yorkville LLC”)

is the general partner of Yorkville LP. All investment decisions for YAII PN, Ltd., Yorkville LP and Yorkville LLC are

made by Yorkville LLC’s President and managing member, Mr. Mark Angelo. The business address of Yorkville is 1012 Springfield

Avenue, Mountainside, NJ 07092. |

| (2) |

Consists of 48,750,762 shares

of Class A ordinary shares required to be registered under the initial Yorkville Registration Rights

Agreement and 356,630 commitment fee shares issued to YAII

PN, Ltd. under the SEPA, however the number of shares of Class A ordinary shares that may

actually be acquired by YAII PN, Ltd. pursuant to the SEPA is not currently known, and

is subject to satisfaction of certain conditions and other limitations set forth in the Yorkville

SEPA, including the Ownership Limitation. |

| (3) |

Assumes the sale of

all shares of our Class A ordinary shares being offered for resale pursuant to this prospectus. |

CAPITALIZATION

AND INDEBTEDNESS

Our

capitalization will be set forth in the applicable prospectus supplement or in a report on Form 6-K subsequently furnished to the SEC

and specifically incorporated by reference into this prospectus.

USE

OF PROCEEDS

We

intend to use the net proceeds from the sale of the securities we offer as set forth in the applicable prospectus supplement(s). We will

not receive any of the proceeds from the sale of any securities offered pursuant to this prospectus by any Selling Shareholder. The Selling

Shareholder will receive all of the proceeds from the sale of Class A ordinary shares under the secondary offering of this prospectus.

The Selling Shareholder will pay any agent’s commissions and expenses they incur for brokerage, accounting, tax or legal services

or any other expenses that they incur in disposing of the Class A ordinary shares. We will bear all other costs, fees and expenses incurred

in effecting the registration of the Class A ordinary shares covered by this prospectus and any prospectus supplement. These may include,

without limitation, all registration and filing fees, SEC filing fees and expenses of compliance with Cayman Islands laws.

See

“Plan of Distribution” elsewhere in this prospectus for more information.

PLAN

OF DISTRIBUTION

We

may sell the securities offered through this prospectus (i) to or through underwriters or dealers, (ii) directly to purchasers, including

our affiliates, (iii) through agents, or (iv) through a combination of any these methods. The securities may be distributed at a fixed

price or prices, which may be changed, market prices prevailing at the time of sale, prices related to the prevailing market prices,

or negotiated prices. The prospectus supplement will include the following information:

| |

● |

the terms

of the offering; |

| |

● |

the names of any underwriters

or agents; |

| |

● |

the name or names of any

managing underwriter or underwriters; |

| |

● |

the purchase price of the

securities; |

| |

● |

any over-allotment options

under which underwriters may purchase additional securities from us; |

| |

● |

the net proceeds from the

sale of the securities; |

| |

● |

any delayed delivery arrangements; |

| |

● |

any underwriting discounts,

commissions and other items constituting underwriters’ compensation; |

| |

● |

any initial public offering

price; |

| |

● |

any discounts or concessions

allowed or reallowed or paid to dealers; |

| |

● |

any commissions paid to

agents; and |

| |

● |

any securities exchange

or market on which the securities may be listed. |

Yorkville is an “underwriter” within

the meaning of Section 2(a)(11) of the Securities Act. Except as set forth above, we know of no existing arrangements between Yorkville

and any other shareholder, broker, dealer, underwriter or agent relating to the sale or distribution of the shares of our ordinary shares

offered by this prospectus.

Sale through Underwriters or Dealers

Only

underwriters named in the prospectus supplement are underwriters of the securities offered by the prospectus supplement. If underwriters

are used in the sale, the underwriters will acquire the securities for their own account, including through underwriting, purchase, security

lending or repurchase agreements with us. The underwriters may resell the securities from time to time in one or more transactions, including

negotiated transactions. Underwriters may sell the securities in order to facilitate transactions in any of our other securities (described

in this prospectus or otherwise), including other public or private transactions and short sales. Underwriters may offer securities to

the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more firms acting

as underwriters. Unless otherwise indicated in the prospectus supplement, the obligations of the underwriters to purchase the securities

will be subject to certain conditions, and the underwriters will be obligated to purchase all the offered securities if they purchase

any of them. The underwriters may change from time to time any public offering price and any discounts or concessions allowed or reallowed

or paid to dealers.

If

dealers are used in the sale of securities offered through this prospectus, we will sell the securities to them as principals. They may

then resell those securities to the public at varying prices determined by the dealers at the time of resale. The prospectus supplement

will include the names of the dealers and the terms of the transaction.

We

will provide in the applicable prospectus supplement any compensation we will pay to underwriters, dealers or agents in connection with

the offering of the securities, and any discounts, concessions or commissions allowed by underwriters to participating dealers.

Direct Sales and Sales through Agents

We

may sell the securities offered through this prospectus directly. In this case, no underwriters or agents would be involved. Such securities

may also be sold through agents designated from time to time. The prospectus supplement will name any agent involved in the offer or

sale of the offered securities and will describe any commissions payable to the agent. Unless otherwise indicated in the prospectus supplement,

any agent will agree to use its reasonable best efforts to solicit purchases for the period of its appointment.

We

may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning of the

Securities Act with respect to any sale of those securities. The terms of any such sales will be described in the prospectus supplement.

Delayed Delivery Contracts

If

the prospectus supplement indicates, we may authorize agents, underwriters or dealers to solicit offers from certain types of institutions

to purchase securities at the public offering price under delayed delivery contracts. These contracts would provide for payment and delivery

on a specified date in the future. The contracts would be subject only to those conditions described in the prospectus supplement. The

applicable prospectus supplement will describe the commission payable for solicitation of those contracts.

Market Making, Stabilization and Other

Transactions

Unless

the applicable prospectus supplement states otherwise, other than our Ordinary Share all securities we offer under this prospectus will

be a new issue and will have no established trading market. We may elect to list offered securities on an exchange or in the over-the-counter

market. Any underwriters that we use in the sale of offered securities may make a market in such securities, but may discontinue such

market making at any time without notice. Therefore, we cannot assure you that the securities will have a liquid trading market.

Any

underwriter may also engage in stabilizing transactions, syndicate covering transactions and penalty bids in accordance with Rule 104

under the Securities Exchange Act. Stabilizing transactions involve bids to purchase the underlying security in the open market for the

purpose of pegging, fixing or maintaining the price of the securities. Syndicate covering transactions involve purchases of the securities

in the open market after the distribution has been completed in order to cover syndicate short positions.

Penalty

bids permit the underwriters to reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate

member are purchased in a syndicate covering transaction to cover syndicate short positions. Stabilizing transactions, syndicate covering

transactions and penalty bids may cause the price of the securities to be higher than it would be in the absence of the transactions.

The underwriters may, if they commence these transactions, discontinue them at any time.

Selling Shareholder’s Plan of Distribution

The

Selling Shareholder and any of its respective pledgees, assignees and successors-in-interest may, from time to time, sell any or all

of their securities covered hereby on any trading market, share exchange or other trading facility on which the securities are traded

or in private transactions. These sales may be at fixed or negotiated prices. The Selling Shareholder may use any one or more of the

following methods when selling securities:

| |

● |

ordinary brokerage transactions

and transactions in which the broker-dealer solicits purchasers; |

| |

● |

block trades in which the

broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate

the transaction; |

| |

● |

purchases by a broker-dealer

as principal and resale by the broker-dealer for its account; |

| |

● |

an exchange distribution

in accordance with the rules of the applicable exchange; |

| |

● |

privately negotiated transactions; |

| |

● |

settlement of short sales; |

| |

● |

in transactions through

broker-dealers that agree with the Selling Shareholder to sell a specified number of such securities at a stipulated price per security; |

| |

● |

through the writing or

settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

● |

a combination of any such

methods of sale; or |

| |

● |

any other method permitted

pursuant to applicable law. |

The

Selling Shareholder may also sell securities under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers

engaged by the Selling Shareholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the Selling Shareholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or

markdown in compliance with FINRA IM-2440.

In

connection with the sale of the securities covered hereby, the Selling Shareholder may enter into hedging transactions with broker-dealers