Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

November 01 2012 - 4:58PM

Edgar (US Regulatory)

ING U.S. Investment Management

|

Client Talking Points

|

November 1, 2012

|

Filed by ING Partners, Inc. (SEC File Nos.: 333-32575; 811-08319) and ING Variable Funds (SEC File Nos.: 002-51739; 811-02514) pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended.

ING Thornburg Value Portfolio Update

The Board of Directors (the “Board”) of ING Thornburg Value Portfolio (the “Portfolio”) approved a change with respect to the Portfolio’s sub-adviser from Thornburg Investment Management, Inc. to ING Investment Management Co. LLC (“ING IM”) with related changes to the Portfolio’s name, investment objective, principal investment strategies, and expense structure. The Board of the Portfolio also approved the reorganization of the Portfolio into ING Growth and Income Portfolio (together with the Portfolio, the “Portfolios”). The approval of shareholders of the Portfolio is required before this reorganization may take place.

·

What is happening?

·

Thornburg will be removed as sub-adviser to be effective on November 16, 2012, followed by a two-week transition period

·

ING IM will be appointed and manage the Portfolio during the Interim Period, which is expected to last from November 30, 2012 to March 23, 2013

·

Pending approval, the merger will occur on or around March 23, 2013. Shareholders of another ING Portfolio, ING UBS U.S. Large Cap Equity Portfolio, also are being asked to approve the merger of their Portfolio with the Portfolio. If those shareholders approve that other merger, it also would occur on or around March 23, 2013.

·

Shareholders of the Portfolio also will be asked to approve a “permanent” sub-advisory agreement with ING IM relating to the Portfolio, which would be put into place in the event that shareholders do not approve the reorganization before the expiration of the interim sub-advisory agreement on March 23, 2013

·

Why is there a two-step transition?

·

The Board believed expedited action was reasonable, and approved the removal of Thornburg as sub-adviser to be effective on November 16, 2012

·

During the Interim Period, the Portfolio will be managed by ING IM using the same strategy as the Surviving Portfolio

·

During Interim Period, shareholders will vote to approve the reorganization

·

What is the experience of the ING Growth and Income team?

·

The Portfolio will be managed by the ING IM team of Chris Corapi and Mike Pytosh using the same strategy as ING Growth and Income Portfolio during the Interim Period.

·

Pending shareholder approval, the Portfolio will merge into ING Growth and Income Portfolio on or around March 23, 2013.

For Internal Use Only — Not To Be Shared With The Public.

The performance is set out below.

|

As of September 30, 2012

|

|

YTD

|

|

1 year

|

|

3 year

|

|

5 year

|

|

10 year

|

|

|

ING Thornburg Value— Class I

|

|

8.43

|

%

|

14.36

|

%

|

3.71

|

%

|

(2.91

|

)%

|

6.18

|

%

|

|

ING Growth and Income — Class I

|

|

17.12

|

|

32.50

|

|

11.87

|

|

1.29

|

|

7.20

|

%

|

·

What are the Portfolios’ expenses?

Effective November 30, 2012, the Portfolios’ Prospectuses will be revised as follows:

ING Thornburg Value Portfolio (to be renamed ING Growth and Income Core Portfolio)

Annual Portfolio Operating Expenses(1)

Expenses you pay each year as a % of the value of your investment

|

Class

|

|

|

|

ADV

|

|

I

|

|

S

|

|

S2

|

|

|

Management Fees

|

|

%

|

|

0.65

|

|

0.65

|

|

0.65

|

|

0.65

|

|

|

Distribution and/or Shareholder Services (12b-1) Fees

|

|

%

|

|

0.50

|

|

None

|

|

0.25

|

|

0.50

|

|

|

Administrative Services Fees

|

|

%

|

|

0.10

|

|

0.10

|

|

0.10

|

|

0.10

|

|

|

Other Expenses

|

|

%

|

|

0.07

|

|

0.07

|

|

0.07

|

|

0.07

|

|

|

Total Annual Portfolio Operating Expenses

|

|

%

|

|

1.32

|

|

0.82

|

|

1.07

|

|

1.32

|

|

|

Waivers and Reimbursements(2)

|

|

%

|

|

(0.28

|

)

|

(0.23

|

)

|

(0.23

|

)

|

(0.33

|

)

|

|

Total Annual Portfolio Operating Expenses after Waivers and Reimbursements

|

|

%

|

|

1.04

|

|

0.59

|

|

0.84

|

|

0.99

|

|

|

(1)

|

Expense ratios have been adjusted to reflect current contractual rates.

|

|

(2)

|

The adviser is contractually obligated to limit expenses to 1.40%, 0.90%, 1.15%, and 1.30% for Class ADV, I, S and Class S2 shares, respectively, through May 1, 2013. The obligation will automatically renew for one-year terms unless it is terminated by the Portfolio or the adviser upon written notice within 90 days of the end of the current term or upon termination of the advisory agreement and is subject to possible recoupment by the adviser within three years. In addition, effective November 30, 2012, the adviser is contractually obligated to further limit expenses to 1.04%, 0.59%, 0.84%, and 0.99% for Class ADV, I, S and Class S2 shares, respectively, through May 1, 2014. There is no guarantee this obligation will continue after May 1, 2014. The obligation will only renew if the adviser elects to renew it. Any fees waived pursuant to this obligation are not eligible for recoupment. These obligations do not extend to interest, taxes, brokerage commissions, extraordinary expenses, and Acquired Fund Fees and Expenses. Pursuant to a side agreement effective November 30, 2012, the distributor is contractually obligated to waive 0.05% of the distribution fee for Class ADV shares through May 1, 2014. There is no guarantee that the distribution fee waiver will continue after May 1, 2014. The distribution fee waiver will continue only if the distributor elects to renew it. Last, the distributor is contractually obligated to waive 0.10% of the distribution fee for Class S2 through May 1, 2013. There is no guarantee that the distribution fee waiver will continue after May 1, 2013. The distribution fee waiver will only renew if the distributor elects to renew it.

|

ING Growth and Income Portfolio

Annual Portfolio Operating Expenses

Expenses you pay each year as a % of the value of your investment

|

Class

|

|

|

|

ADV

|

|

I

|

|

S

|

|

S2

|

|

|

Management Fees

|

|

%

|

|

0.50

|

|

0.50

|

|

0.50

|

|

0.50

|

%

|

|

Distribution and/or Shareholder Services (12b-1) Fees

|

|

%

|

|

0.50

|

|

None

|

|

0.25

|

|

0.50

|

%

|

|

Administrative Services Fees

|

|

%

|

|

0.06

|

|

0.06

|

|

0.06

|

|

0.06

|

%

|

|

Other Expenses

|

|

%

|

|

0.02

|

|

0.02

|

|

0.02

|

|

0.02

|

%

|

|

Total Annual Portfolio Operating Expenses

|

|

%

|

|

1.38

|

|

0.58

|

|

0.83

|

|

1.08

|

%

|

|

Waivers and Reimbursements(1)

|

|

%

|

|

(0.05

|

)

|

(0.00

|

)

|

(0.00

|

)

|

(0.10

|

)%

|

|

Total Annual Portfolio Operating Expenses after Waivers and Reimbursements

|

|

%

|

|

1.03

|

|

0.58

|

|

0.83

|

|

0.99

|

%

|

|

(1)

|

The distributor is contractually obligated to waive 0.05% for Class ADV and 0.10% for Class S2 of the distribution fee through May 1, 2013. There is no guarantee that the distribution fee waiver will continue after May 1, 2013. The distribution fee waiver will continue only if the distributor elects to renew it.

|

For Internal Use Only

Not for Inspection by or Distribution to the General Public.

The foregoing is not an offer to sell, nor a solicitation of an offer to buy, shares of any fund, nor is it a solicitation of any proxy. For information regarding the Portfolio or ING Growth and Income Portfolio please call ING Funds toll free at 1-800-992-0180. To receive a free copy of a Proxy Statement/Prospectus relating to a proposed merger (once a registration statement relating to the proposed merger has been filed with the SEC and becomes effective) please call ING Funds toll free at 1-800-992-0180. The Proxy Statement/Prospectus (when available) will contain important information about fund objectives, strategies, fees, expenses and risk considerations, and therefore you are advised to read it when and if it becomes available. The Proxy Statement/Prospectus (when available), shareholder reports and other information are or will also be available for free on the SEC’s website (www.sec.gov). Please read any Proxy Statement/Prospectus carefully before making any decision to invest or to approve any merger.

Contents of this communication may contain information regarding past performance, market opinions, competitor data, projections, forecasts and other forward-looking statements that cannot be shared with clients, prospective clients or current investors of ING investment products. The information presented has been obtained from sources ING Investment Management (“ING IM”) deems to be reliable, however, this data is subject to unintentional errors, omissions and changes prior to distribution without notice. This information is provided to ING IM employees for internal or educational use only and cannot be used as sales or marketing material, nor can it be distributed outside of the firm. Please only use compliance-approved marketing materials with clients and prospects. These materials contain compliant sales language, appropriate risk disclosures and other relevant disclaimers that provide a sound basis for evaluating our investment products and services. This information cannot be reproduced in whole or in part in any manner without the prior permission of an ING IM Compliance Officer.

CID -

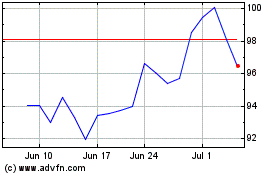

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

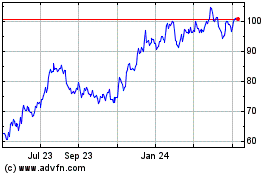

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jul 2023 to Jul 2024