UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C Information

Information Statement Pursuant to Section 14 (c)

of the Securities Exchange Act of 1934

Check the appropriate box:

| ☒ | Preliminary Information Statement | ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5 (d)(2)) |

| ☐ | Definitive Information Statement | | |

| WeTrade Group, Inc. |

| (Name of Registrant as Specified in Its Charter) |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | | |

| | 2) | Form, Schedule or Registration Statement No: |

| | | |

| | 3) | Filing Party: |

| | | |

| | 4) | Date Filed: |

WeTrade Group Inc.

Room 101, Level 1 Building 8,

No. 18, Kechuang 10th Street,

Beijing Economic and Technological Development Zone

People’s Republic of China 100020

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF THE

SECURITIES EXCHANGE ACT OF 1934 AND REGULATION 14C THEREUNDER

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

To the Holders of Common Stock of WeTrade Group Inc.:

This Information Statement has been filed with the Securities and Exchange Commission and is being furnished, pursuant to Section 14C of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to the holders (the “Stockholders”) of common stock, with no par value (the “Common Stock”), of WeTrade Group Inc., a Wyoming corporation (the “Company”), to notify the Stockholders that on May 9, 2023, the Company received a majority written consent in lieu of a special meeting of the Stockholders of 51.9% of the Company’s Common Stock (the “Majority Stockholders”), together holding in the aggregate more than a majority of the total voting power of all issued and outstanding voting capital of the Company. The Majority Stockholders authorized a reverse stock split of the outstanding shares of the Company’s common stock, at a split ratio of between 1-for-50 and 1-for-200 (the “Reverse Split”).

On May 9, 2023, the Board of Directors of the Company (the “Board”) approved, and recommended to the Majority Stockholder that they approve the Reverse Split.

The written consent by the Majority Stockholders was obtained pursuant to Section 17-16-704 of the Wyoming Business Corporation Act.

For further information regarding the matters as to which Majority Stockholders’ consent was given, I urge you to carefully read the accompanying Information Statement.

| | By Order of the Board of Directors, |

| | |

| May 9, 2023 | /s/ Biming Guo |

| | Biming Guo Chairman of the board |

WeTrade Group Inc.

Room 101, Level 1 Building 8,

No. 18, Kechuang 10th Street,

Beijing Economic and Technological Development Zone

People’s Republic of China 100020

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF THE

SECURITIES EXCHANGE ACT OF 1934

May 9, 2023

GENERAL INFORMATION

This Information Statement has been filed with the Securities and Exchange Commission and is being furnished, pursuant to Section 14C of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to the holders (the “Stockholders”) of common stock, with no par value (the “Common Stock”), of WeTrade Group Inc., a Wyoming corporation (the “Company”), to notify the Stockholders that on May 9, 2023, the Company received a majority written consent in lieu of a special meeting of the Stockholders of 51.9% of the Company’s Common Stock (the “Majority Stockholders”), together holding in the aggregate more than a majority of the total voting power of all issued and outstanding voting capital of the Company. The Majority Stockholders authorized a reverse stock split of the outstanding shares of the Company’s common stock, at a split ratio of between 1-for-50 and 1-for-200(the “Reverse Split”).

Pursuant to 17 CFR Section 240.14c -2(b), these actions will not be effective until 20 days after this Information Statement is mailed to the Stockholders. Dissenting Stockholders do not have any statutory appraisal rights as a result of the action taken. The Board of Directors of the Company (the “Board”) does not intend to solicit any proxies or consents from any other Stockholders in connection with this action.

There will not be a meeting of Stockholders and none is required under Wyoming Business Corporation Act when an action has been approved by written consent of the holders of a majority of the outstanding shares of our Common Stock as permitted by the Articles of Incorporation of the Company.

The entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the Common Stock held of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith. The Board of Directors has fixed the close of business on May 2, 2023, as the record date (the “Record Date”) for the determination of Stockholders who are entitled to receive this Information Statement.

WHAT VOTE WAS REQUIRED TO APPROVE THE REVERSE SPLIT?

For the approval of the Reverse Split, the affirmative vote of at least 50% of the outstanding voting stock was required for approval.

CONSENTING STOCKHOLDERS

On May 9, 2023, our Board unanimously adopted resolutions declaring the advisability of, and recommended that Stockholders approve the Reverse Split. In connection with the adoption of these resolutions, the Board elected to seek the written consent of the holders of a majority of our outstanding voting stock. As of May 2, 2023, there were issued and outstanding 195,057,503 shares of our Common Stock with no par value.

On May 9, 2023, AiShangYou Limited. and Future Science and Technology Co., Ltd., which collectively own 51.9% of our outstanding Common Stock, consented in writing to the Reverse Split.

Under the Wyoming Business Corporation Act, we are required to give all Stockholders written notice of any actions that are taken by written consent without a Stockholder meeting.

We are not seeking written consent from any of our Stockholders and our other Stockholders will not be given an opportunity to vote with respect to the Reverse Split. All necessary corporate approvals have been obtained, and this Information Statement is furnished solely for the purposes of advising Stockholders of the action taken by written consent, as required by the Wyoming Business Corporation Act.

Stockholders who were not afforded an opportunity to consent or otherwise vote with respect to the actions taken have no right under Wyoming Business Corporation Act to dissent or require a vote of all our Stockholders.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of May 2, 2023, the number and percentage of shares of outstanding Common Stock of the Company, owned of record and beneficially, by each person known by the Company to own 5% or more of such stock, each director of the Company, and by all executive officers and directors of the Company. Unless otherwise indicated below, the address of each person listed in the table below is

| Executive Officers and Directors | | Amount of Beneficial Ownership of Common Stock(1) | | | Percentage Ownership of Common Stock(2) | |

| | | | | | | |

| Directors and Named Executive Officers: | | | | | | |

| Chunwei He | | | - | | | | -- | |

| Annie Huang | | | - | | | | -- | |

| Hanfeng Li | | | - | | | | -- | |

| Biming Guo | | | - | | | | - | |

| Daxue Li | | | - | | | | - | |

| Yuxing Ye | | | - | | | | - | |

| Hung Fai Choi | | | - | | | | - | |

| Ning Qin | | | - | | | | - | |

| All executive officers and directors as a group (9 persons) | | | 0 | | | | 0 | % |

| | | | | | | | | |

| 5% or Greater Shareholders | | | | | | | | |

| Future Science and Technology Co Ltd(3) | | | 52,290,290 | | | | 26.8 | % |

| AiShangYou Limited(4) | | | 49,035,182 | | | | 25.1 | % |

| LD Property Limited (5) | | | 10,800,000 | | | | 5.8 | % |

*Less than 1%.

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the common stock. All shares represent only common stock held by shareholders as no options are issued or outstanding. |

| (2) | Calculation based on 195,057,503 shares of common stock issued and outstanding as of the date of this Reporting. |

| (3) | Zheng Dai has sole voting and dispositive power over the shares held by Future Science and Technology Co Ltd. |

| | |

| (4) | Shufeng Zang, a non-affiliate of the registrant, has sole voting and dispositive power over the shares held by AiShangYou Limited. |

| | |

| (5) | It is an equity incentive trust company, the shares of common stock under this company were held for the employees of the Company, and therefore are not free-trading shares. |

PROPOSAL

THE REVERSE SPLIT

As a result of the Reverse Split, which is defined by the SEC as a transaction that reduces the number of shares and increases the share price proportionately, each share of Common Stock outstanding at the effective time of the Reverse Split, will become, without any action on the part of the holder thereof, one-fiftieth to two hundredth of a share of Common Stock. The reverse split will not affect the par value per share of the Company’s common stock as the Company’s Common Stock does not have par value. For purposes of this description, the Common Stock, as presently constituted, is referred to as the “Old Common Stock” and the Common Stock resulting from the Reverse Split is referred to as the “New Common Stock.” The bid price of the Company’s Common Stock on May 8, 2023 was $0.061.

The Reverse Split will become effective at least 20 days after this Information Statement is mailed to the Stockholders

Purpose and Effects of the Reverse Split

The principal effects of the Reverse Split will be as follows:

Based upon the 195,057,503 shares of Old Common Stock outstanding on the Record Date, the Reverse Split would decrease the outstanding shares of Old Common Stock to a number of shares between and including one-fiftieth to two hundredth that amount, as the case may be based on the ratio for the reverse stock split as determined by our Board, which will result in the number of New Common Stock falling within the range between 3,901,150 shares and 975,287 shares.

The Company will obtain a new CUSIP number for the New Common Stock at the time of the Reverse Split. Following the effectiveness of the Reverse Split, each yet to be determined number of shares of Old Common Stock, without any action on the part of the holder, will represent one share of New Common Stock.

Subject to the provisions for elimination of fractional shares, as described below, consummation of the Reverse Split will not result in a change in the relative equity position or voting power of the holders of Old Common Stock.

The Reverse Split will decrease the number of shares of Old Common Stock outstanding and presumably increase the per share market price for the New Common Stock. Theoretically, the number of shares outstanding should not, by itself, affect the marketability of the stock, the type of investor who acquires it, or the Company’s reputation in the financial community, but in practice this is not necessarily the case, as many investors look upon a stock trading at or under $1.00 per share as unduly speculative in nature and, as a matter of policy, avoid investment in such stocks.

Many leading brokerage firms are reluctant to recommend lower-priced securities to their clients and a variety of brokerage house policies and practices currently tend to discourage individual brokers within firms from dealing in lower-priced stocks. Some of those policies and practices pertain to the payment of brokers’ commissions and to time-consuming procedures that make the handling of lower priced stocks unattractive to brokers from an economic standpoint. In addition, the structure of trading commissions also tends to have an adverse impact upon holders of lower priced stocks because the brokerage commission on a sale of a lower priced stock generally represents a higher percentage of the sales price than the commission on a relatively higher priced issue.

The Board believes that the Reverse Split is in the best interest of the Company and its Stockholders because it would reduce the number of shares of its Common Stock outstanding to amounts that the Board believes are more reasonable in light of its size and market capitalization. The Company requires additional capital for its operations and does not believe that it will be able to raise the necessary capital unless the price of the Common Stock is higher than the current Common Stock price levels. However, no assurance can be given that the Reverse Split will result in any increase in the Common Stock price or that the Company will be able to complete any financing following the Reverse Split.

The result of the Reverse Split will only affect the issued and outstanding shares. It is important we preserve our flexibility to issue additional shares of Common Stock. The Board believes that the additional authorized shares of Common Stock is advisable to provide us with the flexibility to take advantage of opportunities to issue such stock in order to obtain capital, as consideration for possible acquisitions or for other purposes including, without limitation, the issuance of additional shares of Common Stock through stock splits and stock dividends in appropriate circumstances. There are, at present, no plans, understandings, agreements or arrangements concerning the issuance of additional shares of Common Stock.

Exchange of Certificate and Elimination of Fractional Share Interests

On the Effective Date, each fifty to two hundred shares of Old Common Stock will automatically be combined and changed into one share of New Common Stock. No additional action on the part of the Company or any Stockholder will be required in order to affect the Reverse Split. Stockholders will be requested to exchange their certificates representing shares of Old Common Stock held prior to the Reverse Split for new certificates representing shares of New Common Stock. Stockholders will be furnished the necessary materials and instructions to affect such exchange promptly following the Effective Date. Certificates representing shares of Old Common Stock subsequently presented for transfer will not be transferred on the books and records of the Company but will be returned to the tendering person for exchange. Stockholders should not submit any certificates until requested to do so. In the event any certificate representing shares of Old Common Stock is not presented for exchange upon request by the Company, any dividends that may be declared after the Effective Date of the Reverse Split with respect to the Common Stock represented by such certificate will be withheld by the Company until such certificate has been properly presented for exchange, at which time all such withheld dividends which have not yet been paid to a public official pursuant to relevant abandoned property laws will be paid to the holder thereof or his designee, without interest.

No fractional shares of New Common Stock will be issued to any Stockholder. Accordingly, Stockholders of record who would otherwise be entitled to receive fractional shares of New Common Stock, will, upon surrender of their certificates representing shares of Old Common Stock, receive a new certificate representing the New Common Stock rounded up to the nearest whole share.

Federal Income Tax Consequences of the Reverse Split

The combination of shares of the Old Common Stock into one share of New Common Stock should be a tax-free transaction under the Internal Revenue Code of 1986, as amended, and the holding period and tax basis of the Old Common Stock will be transferred to the New Common Stock received in exchange therefor.

This discussion should not be considered as tax or investment advice, and the tax consequences of the Reverse Split may not be the same for all shareholders. Stockholders should consult their own tax advisors to know their individual Federal, state, local and foreign tax consequences.

PRINCIPAL EFFECTS OF THE

REVERSE SPLIT

We must first notify FINRA of the intended Reverse Split by filing the Issuer Company Related Action Notification Form no later than ten (10) days prior to the anticipated record date of such action. Our failure to provide such notice may constitute fraud under Section 10 of the Exchange Act.

The following table, which is for illustrative purposes only, illustrates the effects of the reverse stock split at certain exchange ratios within the foregoing range, without giving effect to any adjustments for fractional shares of common stock, on our outstanding shares of common stock and authorized shares of capital stock as of May 2, 2023:

| | | Before reverse | | | After Reverse Split | |

| | | stock split | | | 1-for-50 | | | 1-for-100 | | | 1-for-200 | |

| Common Stock Issued and Outstanding | | | 195,057,503 | | | | 3,901,150 | | | | 1,950,575 | | | | 975,287 | |

Common Stock

Each share of our common stock entitles the owner thereof to vote at the rate of one (1) vote for each share held.

DISSENTER'S RIGHTS OF APPRAISAL

Holders of our voting securities do not have dissenter’s rights under the Wyoming Business Corporation Act in connection with our Proposal.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, and in accordance with the Securities Exchange Act, we file periodic reports, documents, and other information with the Securities and Exchange Commission relating to our business, financial statements, and other matters. These reports and other information may be inspected and are available for copying at the offices of the Securities and Exchange Commission, 100 F Street, N.E., Washington, DC 20549. Our SEC filings are also available to the public on the SEC's website at http://www.sec.gov.

ADDITIONAL INFORMATION

Only one information statement is being delivered to multiple shareholders sharing an address, unless we have received contrary instructions from one or more of the shareholders. We will undertake to deliver promptly upon written or oral request a separate copy of the information statement to a stockholder at a shared address to which a single copy of the information statement was delivered. You may make a written or oral request by sending a written notification to our principal executive offices stating your name, your shared address, and the address to which we should direct the additional copy of the information statement or by calling our principal executive offices at +86-135-011-76409. If multiple shareholders sharing an address have received one copy of this information statement and would prefer us to mail each stockholder a separate copy of future mailings, you may send notification to or call our principal executive offices. Additionally, if current shareholders with a shared address received multiple copies of this information statement and would prefer us to mail one copy of future mailings to shareholders at the shared address, notification of that request may also be made by mail or telephone call to our principal executive offices.

| | By Order of the Board of Directors, |

| | |

| | /s/ Biming Guo |

| | Biming Guo Chairman of the Board |

May 9, 2023

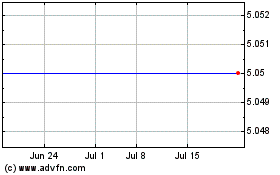

WeTrade (NASDAQ:WETG)

Historical Stock Chart

From Oct 2024 to Nov 2024

WeTrade (NASDAQ:WETG)

Historical Stock Chart

From Nov 2023 to Nov 2024