false

0000803578

0000803578

2024-08-12

2024-08-12

--12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 12, 2024

WAVEDANCER, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

001-41092

|

|

54-1167364

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

1100 Military Road

Kenmore, NY

|

|

14217

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 888-237-6412

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.0001 par value per share

|

|

WAVD

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

INTRODUCTORY NOTE

The Merger

As previously disclosed, on November 15, 2023, WaveDancer, Inc. (“WaveDancer” or “Company”) and its wholly owned subsidiary, FFN Merger Sub, Inc. (“FFN”), entered into an Agreement and Plan of Merger (as amended by that certain Amendment No. 1, dated as of January 12, 2024, and that certain Amendment No. 2, dated as of June 17, 2024, “Merger Agreement”) with Firefly Neuroscience, Inc. (“Firefly”). In accordance with the Merger Agreement, FFN merged with and into Firefly, with Firefly surviving as a wholly owned subsidiary of WaveDancer. On August 12, 2024, (i) pursuant to the Amended and Restated Certificate of Incorporation of WaveDancer, Inc., WaveDancer changed its name to Firefly Neuroscience, Inc., and (ii) pursuant to an amendment to its Certificate of Incorporation Firefly, Firefly changed its name to Firefly Neuroscience 2023, Inc. and (iii) Firefly and FFN filed the Certificate of Merger with the State of Delaware (the “Merger”). On August 12, 2024, the Merger closed (the “Closing” and such date, the “Closing Date”).

At the effective time of the Merger, each holder of outstanding shares of Firefly’s common stock, par value $0.00001 per share (the “Firefly Common Stock”) received the number of shares of common stock, par value $0.0001 per share, of the Company (the “New Firefly Common Stock”) equal to the number of shares of Firefly Common Stock such stockholders held multiplied by the exchange ratio, or an aggregate of 7,870,251 shares of WaveDancer common stock at closing using an exchange ratio (the “Exchange Ratio”) of 0.1040. Additionally, upon at the effective time of the Merger: (i) each outstanding option to purchase Firefly Common Stock that was not exercised prior to the Closing was assumed by the Company subject to certain terms contained in the Merger Agreement and became an option to purchase shares of New Firefly Common Stock, subject to adjustment to give effect to the Exchange Ratio, (ii) each outstanding Firefly restricted share unit outstanding immediately prior to the Closing was accelerated and vested pursuant to the terms thereof, and (iii) each outstanding warrant to purchase shares of Firefly Common Stock that was not exercised prior to the Closing was assumed by the Company, subject to certain terms contained in the Merger Agreement. The board of directors of Firefly after the Merger consists of four members (the “Board”).

Following the Closing, there are 7,870,251 shares of New Firefly Common Stock outstanding, with former Firefly stockholders owning approximately 92% and former WaveDancer stockholders owning 8% of the Company’s outstanding securities.

The foregoing description of the Merger is a summary only and is qualified in its entirety by reference to the full text of the Merger Agreement, which was filed as Exhibit 2.1 to the Company’s registration statement on Form S-4, as amended, and incorporated herein by reference.

Reverse Stock Split

As previously reported, on March 14, 2024, WaveDancer held a special meeting of WaveDancer’s stockholders, at which meeting WaveDancer’s stockholders approved an amendment (the “Reverse Stock Split Amendment”) to WaveDancer’s Amended and Restated Certificate of Incorporation to effect a reverse stock split of all of the issued and outstanding shares of WaveDancer’s common stock, par value $0.001 per share (the “WaveDancer Common Stock”), at a ratio in the range of 1-for-1.5 to 1-for-20, with the exact ratio and timing to be determined by WaveDancer’s board of directors (the “WaveDancer Board”) in its discretion and included in a public announcement (the “Reverse Stock Split”). Following the Annual Meeting, on May 28, 2024, the WaveDancer Board determined to effect the Reverse Stock Split at a ratio of 1-for-3 and approved the corresponding final form of the Reverse Stock Split Amendment. On August 12, 2024, WaveDancer filed the Reverse Stock Split Amendment with the Secretary of State of the State of Delaware to effect the Reverse Stock Split, effective as of 12:01 p.m. (New York time) on August 12, 2024.

As a result of the Reverse Stock Split, every three (3) shares of issued and outstanding WaveDancer Common Stock were automatically combined into one (1) issued and outstanding share of WaveDancer Common Stock, without any change in the par value per share or the number of authorized shares of common stock. No fractional shares will be issued as a result of the Reverse Stock Split. All fractional shares issuable to WaveDancer’s stockholders as a result of the Reverse Stock Split were aggregated and rounded up to the nearest whole share. The Reverse Stock Split reduced the number of shares of WaveDancer’s Common Stock outstanding from 2,013,180 shares to approximately 671,060. Following the Closing, there are 7,870,251 shares of New Firefly Common Stock outstanding, on a Reverse Stock Split-adjusted basis.

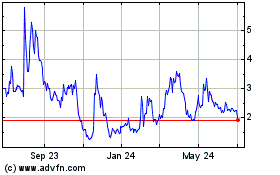

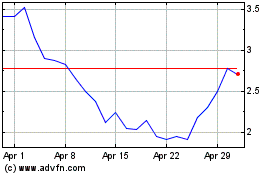

Following the Closing, the New Firefly Common Stock will begin trading on a Reverse Stock Split-adjusted basis on the Nasdaq Capital Market on August 13, 2024, under the symbol “AIFF.” The new CUSIP number for the New Firefly Common Stock following the Reverse Stock Split is 317970101.

Unless noted otherwise, all post-Merger share and per-share information presented in this Current Report on Form 8-K reflects the Reverse Stock Split of our outstanding shares of the Company’s Common Stock, however, certain of documents and information filed herewith or incorporated by reference into this Current Report on Form 8-K, do not give effect to the Reverse Stock Split.

Private Placement

As previously reported, on July 26, 2024, Firefly entered into a securities purchase agreement (the “Purchase Agreement”) with certain institutional investors, pursuant to which Firefly agreed to issue and sell (i) 2,639,517 shares (the “PIPE Shares”) of Firefly Common Stock or, to the extent that such purchase of PIPE Shares would result in the investors, together with their affiliates and certain related parties, beneficially owning more than 4.99% of the outstanding shares of the Company immediately following the consummation of the Merger, pre-funded warrants (the “Pre-Funded Warrants”) to purchase such PIPE Shares in excess of 4.99% of the outstanding shares of the Company’s common stock, and (ii) warrants (the “Warrants”) to purchase up to 2,639,517 shares of Firefly Common Stock in a private placement (the “Private Placement”). The purchase price of each PIPE Share and accompanying Warrant was $1.326 and the purchase price of each Pre-Funded Warrant and accompanying Warrant was $1.3257. The Private Placement closed on August 12, 2024, substantially contemporaneous with the consummation of the Merger. The aggregate gross proceeds from the transaction were approximately $3.5 million, before deducting estimated offering expenses payable by the Company.

None of the issuances of the PIPE Shares, the Pre-Funded Warrants, the Warrants, or the shares of the Company’s common stock issuable upon exercise of the Pre-Funded Warrants and the Warrants (collectively, the “Warrant Shares”) were registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws. The PIPE Shares, the Pre-Funded Warrants, the Warrants and the Warrant Shares have been and will be, as applicable, issued in reliance on the exemptions from registration provided by Section 4(a)(2) under the Securities Act and/or Regulation D promulgated thereunder. The investors that entered into to a Purchase Agreement represented that they accredited investors, as defined in Rule 501 of Regulation D promulgated under the Securities Act.

The foregoing descriptions of the Purchase Agreement, the Pre-Funded Warrants and the Warrants do not purport to be complete and are qualified in their entirety by reference to the forms of Purchase Agreement, Pre-Funded Warrant and Warrant, which were filed as Exhibits 10.1, 4.1 and 4.2, respectively, to the Company’s Current Report on Form 8-K, filed with the SEC on July 29, 2024, and incorporated herein by reference.’

Tellenger Sale

On November 15, 2023, WaveDancer entered into the Stock Purchase Agreement (the “Tellenger Agreement”) with Wavetop Solutions, Inc. and Tellenger, Inc. The Tellenger Agreement provides that Wavetop will purchase from WaveDancer all of the issued and outstanding shares of common stock, par value $1.00 per share, of Tellenger prior to the merger, for an aggregate purchase price of $1.5 million, plus the assumption of the employment agreements that WaveDancer was obligated under with G. James Benoit, Jr., Gwen Pal and Stan Reese, which includes provisions to pay severance under certain circumstances. The purchase price will be paid in full in cash at the closing less the outstanding balance of WaveDancer’s $500,000 credit facility with Summit Commercial Bank, N.A (“SCB”). The Tellenger Sale Transaction is expected to close simultaneous with, or immediately after, the Closing. The Tellenger Agreement contains customary limited representations and warranties of the parties, events of default and termination provisions.

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Indemnification Agreements

In connection with the Merger, on the Closing Date, the Company entered into indemnification agreements (each, an “Indemnification Agreement” and collectively, the “Indemnification Agreements”) with each of its directors and executive officers. The Indemnification Agreements provide for indemnification and advancement by the Company of certain expenses and costs relating to claims, suits, or proceedings arising from service to the Company or, at its request, service to other entities to the fullest extent permitted by applicable law.

The foregoing description of the Indemnification Agreements is a summary only and is qualified in its entirety by reference to the full text of the form of Indemnification Agreement, which is incorporated by reference as Exhibit 10.8 to this Current Report on Form 8-K and incorporated herein by reference.

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

The disclosure set forth in the “Introductory Note” above is incorporated by reference into this Item 2.01.

FORM 10 INFORMATION

Cautionary Note Regarding Forward-Looking Statements

Statements in this Current Report on Form 8-K, including statements incorporated by reference, may constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, that address activities, events, or developments that the Company expects, believes, or anticipates will or may occur in the future, including statements related to plans, strategies, and objectives of management, the Company’s business prospects, the Company’s systems and technology, future profitability, and the Company’s competitive position, are forward-looking statements. The words “will,” “may,” “believes,” “anticipates,” “thinks,” “expects,” “estimates,” “plans,” “intends,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those anticipated by these forward-looking statements. The inclusion of any statement in this Current Report on Form 8-K does not constitute an admission by the Company or any other person that the events or circumstances described in such statement are material. In addition, new risks may emerge from time to time and it is not possible for management to predict such risks or to assess the impact of such risks on the Company’s business or financial results. Accordingly, future results may differ materially from historical results or from those discussed or implied by these forward-looking statements. Given these risks and uncertainties, the reader should not place undue reliance on these forward-looking statements. These risks and uncertainties include, but are not limited to, the following:

| |

●

|

following the merger, important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include but are not limited to:

|

| |

●

|

fluctuation and volatility in market price of the combined company’s common stock due to market and industry factors, as well as general economic, political and market conditions;

|

| |

●

|

the impact of dilution on the stockholders of the combined company, including through the issuance of additional equity securities in the future;

|

| |

●

|

the combined company’s ability to realize the intended benefits of the merger;

|

| |

●

|

the impact of the combined company’s ability to realize the anticipated tax impact of the merger;

|

| |

●

|

the outcome of litigation or other proceedings the combined company may become subject to in the future;

|

| |

●

|

delisting of the New Firefly Common Stock from the Nasdaq or the failure for an active trading market to develop;

|

| |

●

|

the failure of altered business operations, strategies and focus of the combined company to result in an improvement for the value of New Firefly Common Stock;

|

| |

●

|

the availability of and the Company ability to continue to obtain sufficient funding to conduct planned operations and realize potential profits;

|

| |

●

|

the Company’s limited operating history;

|

| |

●

|

the impact of the complexity of the regulatory landscape on the Company’s ability to seek and obtain regulatory approval for its BNA Platform, both within and outside of the U.S.;

|

| |

●

|

challenges the Company may face with maintaining regulatory approval, if achieved;

|

| |

●

|

the impact of the concertation of capital stock ownership with insiders of the combined company after the merger on stockholders’ ability to influence corporate matters.

|

| |

●

|

the impacts of future acquisitions of businesses or products and the potential to fail to realize intended benefits of such acquisition.

|

| |

●

|

the potential impact of changes in the legal and regulatory landscape, both within and outside of the U.S.;

|

| |

●

|

the Company’s dependence on third parties;

|

| |

●

|

challenges the Company may face with respect to its BNA Platform achieving market acceptance;

|

| |

●

|

the impact of pricing of the Company’s BNA Platform;

|

| |

●

|

emerging competition and rapidly advancing technology in the Company’s industry;

|

| |

●

|

the Company’s ability to obtain, maintain and protect its trade secrets or other proprietary rights, operate without infringing upon the proprietary rights of others and prevent others from infringing on its proprietary rights; and

|

| |

●

|

the Company’s ability to maintain adequate cyber security and information systems.

|

Additional information concerning these and other risks is described under “Risk Factors,” “Firefly Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “WaveDancer’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the joint proxy statement/prospectus, dated February 1, 2024 (as amended, the “Proxy Statement/Prospectus”) and filed with the Securities and Exchange Commission (the “SEC”). The Company expressly disclaims any obligation to update any of these forward-looking statements, except to the extent required by applicable law.

Business and Properties

The Company’s business and properties are described in the Proxy Statement/Prospectus in the section titled “Information about Firefly” beginning on page 222, which is incorporated herein by reference.

Risk Factors

The risks associated with the Company’s business are described above and in the Proxy Statement/Prospectus in the section entitled “Risk Factors,” beginning on page 47 of the Proxy Statement/Prospectus, which is incorporated herein by reference. A summary of the risks associated with the Company’s business is also included on pages 45-56 of the Proxy Statement/Prospectus under the heading “Summary of Risk Factors” and is incorporated herein by reference.

Financial Information

The information set forth in Item 9.01 of this Current Report on Form 8-K concerning the financial information Firefly and WaveDancer is incorporated herein by reference. The unaudited pro forma condensed combined balance sheets as of March 31, 2024, and as of December 31, 2023, for Firefly is set forth in Exhibit 99.5 hereto and is incorporated herein by reference.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The Management’s Discussion and Analysis of Financial Condition and Results of Operations of WaveDancer for the year ended December 31, 2023, and the three months ended March 31, 2024, included in WaveDancer’s Annual Report on 10-K filed with the SEC on March 20, 2024, and Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 14, 2024, respectively, are incorporated herein by reference.

The Management’s Discussion and Analysis of Financial Condition and Results of Operations of Firefly for the year ended December 31, 2023, and for the three months ended March 31, 2024, are included in Exhibits 99.2 and 99.4 hereto and are incorporated herein by reference.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of New Firefly Common Stock as of August 12, 2024, by:

| |

•

|

each person who is known to be the beneficial owner of more than 5% of the outstanding shares of New Firefly Common Stock;

|

| |

•

|

each of the Company’s directors and named executive officers; and

|

| |

•

|

all directors and executive officers of the Company as a group.

|

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she, or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days.

The beneficial ownership percentages set forth in the following table are based on 7,870,251 shares of New Firefly Common Stock outstanding as of August 12, 2024.

Unless otherwise indicated, the Company believes that all persons named in the table below have sole voting and investment power with respect to the voting securities beneficially owned by them. Unless otherwise indicated, the address of each individual below is 1100 Military Road, Kenmore, NY 14217.

|

Name of Beneficial Owner

|

|

Number of Shares

of New Firefly

Common Stock

Beneficially Owned

|

|

|

% of Ownership

|

|

|

Five Percent Holders

|

|

|

|

|

|

|

|

|

|

Windsor Private Capital LP / Jordan Kupinsky (1)

|

|

|

1,616,405 |

|

|

|

20.7 |

% |

|

Roxy Capital Corporation (2)

|

|

|

569,460 |

|

|

|

7.3 |

% |

|

Directors and Executive Officers

|

|

|

|

|

|

|

|

|

|

Dave DeCaprio (3)

|

|

|

3,314 |

|

|

|

* |

|

|

Jon Olsen (4)

|

|

|

110,875 |

|

|

|

1.4 |

% |

|

Greg Lipschitz (5)

|

|

|

302,882 |

|

|

|

3.8 |

% |

| Arun Menawat (6) |

|

|

9,544 |

|

|

|

* |

|

|

Paul Krzywicki(7)

|

|

|

1,552 |

|

|

|

* |

|

|

Brian Posner

|

|

|

0 |

|

|

|

0 |

% |

|

Gil Issachar (8)

|

|

|

131,464 |

|

|

|

1.7 |

% |

| Samer Kaba(9) |

|

|

520 |

|

|

|

* |

|

|

All Directors and Executive Officers of the Company as a Group (8 persons)

|

|

|

487,491 |

|

|

|

6.0 |

% |

|

*

|

Represents beneficial ownership of less than 1%.

|

|

(1)

|

Consists of (1) 1,523,397 shares of New Firefly Common Stock held by Windsor Private Capital LP (“Windsor”), (2) shares underlying warrants to purchase up to 24,226 shares of New Firefly Common Stock held by Windsor that are currently exercisable or exercisable within 60 days of August 12, 2024, and (3) 68,783 shares of New Firefly Common Stock held by Jordan Kupinsky. Jordan Kupinsky has voting control and investment discretion over, and therefore may be deemed to have beneficial ownership of, the securities held by Windsor. |

|

(2)

|

Consists of (1) 367,299 shares of New Firefly Common Stock and (2) shares underlying warrants to purchase up to 11,395 New Firefly Common Stock that are currently exercisable or exercisable within 60 days of August 12, 2024. Eric Lazer has voting control and investment discretion over, and therefore may be deemed to have beneficial ownership of, the securities held by Roxy Capital Corp. |

|

(3)

|

Consists of shares underlying options to purchase up to 3,314 shares of New Firefly Common Stock that are currently exercisable or exercisable within 60 days of August 12, 2024.

|

|

(4)

|

Consists of (1) 31,655 shares of Firefly New Common Stock held by Mr. Olsen, (2) 29,645 shares of Firefly New Common Stock held by Slate Water Ltd., an entity controlled by Mr. Olsen, and (3) shares underlying options to purchase up to 49,574 shares of New Firefly Common Stock that are currently exercisable or exercisable within 60 days of August 12, 2024. |

|

(5)

|

Consists of (1) 280,540 shares of New Firefly Common Stock and (2) shares underlying warrants to purchase up to 2,460 shares of New Firefly Common Stock that are currently exercisable or exercisable within 60 days of August 12, 2024, and (3) shares underlying options to purchase up to 19,883 shares of New Firefly Common Stock that are currently exercisable or exercisable within 60 days of August 12, 2024, held by Bower Four Capital Corp., an entity in which Mr. Lipschitz is the sole stockholder. |

|

(6)

|

Consists of 9,544 shares of New Firefly Common Stock. |

|

(7)

|

Consist of options to purchase up to 1,552 shares of New Firefly Common Stock that are currently exercisable or exercisable within 60 days of August 12, 2024. |

|

(8)

|

Consist of (1) 29,641 shares of Firefly New Common Stock held by Mr. Issachar, (2) underlying options to purchase up to 42,541 shares of New Firefly Common Stock that are currently exercisable or exercisable within 60 days of August 12, 2024. |

|

(9)

|

Consist of options to purchase up to 520 shares of New Firefly Common Stock that are currently exercisable or exercisable within 60 days of August 12, 2024. |

Directors and Executive Officers

Upon the consummation of the Merger, David DeCaprio, Arun Menawat, Brian Posner, Jon Olsen and Greg Lipschitz were appointed as directors of the Board to serve until the end of their respective terms and until their successors are elected and qualified. David DeCaprio, Brian Posner and Arun Menawat were appointed to serve on each of the Audit Committee of the Board (the “Audit Committee”), the Compensation Committee of the Board (the “Compensation Committee”), and the Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”), with Brian Posner serving as the chair of the Compensation Committee, the Nominating Committee and the Audit Committee and qualifying as an audit committee financial expert, as such term is defined in Item 407(d)(5) of Regulation S-K.

Arun Menawat has an accomplished history of executive leadership success in the healthcare industry. Dr. Menawat is the Chief Executive Officer and a Director of Profound Medical Corp. Prior to joining Profound, he served as the Chairman, President and CEO of Novadaq Technologies Inc., a TSX and Nasdaq listed company that marketed medical imaging and therapeutic devices for use in the operating room. Previously, he was President and Chief Operating Officer and Director of another publicly listed medical imaging software company, Cedara Software. His educational background includes a Bachelor of Science in Biology, University of District of Columbia, Washington, D.C., and a Ph.D. in Chemical Engineering, from the University of Maryland, College Park, MD, including graduate research in Biomedical Engineering from the National Institute of Health, Bethesda, MD. He also earned an Executive M.B.A. from the J.L. Kellogg School of Management, Northwestern University, Evanston, IL.

There is no family relationship between Dr. Menawat and any director or executive officer of the Company. There are no transactions between Dr. Menawat and the Company that would be required to be reported under Item 404(a) of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Brian Posner has served as Chief Financial Officer at several life science and emerging technology companies. He currently serves as the Chief Financial Officer of electroCore, Inc. (Nasdaq: ECOR), a commercial stage bioelectronic medicine and wellness company. Prior to electroCore, Mr. Posner served as Chief Financial Officer of Cellectar Biosciences, Alliqua BioMedical, Ocean Power Technologies, Power Medical Interventions and Pharmacopeia. Mr. Posner holds an undergraduate degree in accounting from Queens College and an M.B.A. in managerial accounting from Pace University.

There is no family relationship between Mr. Posner and any director or executive officer of the Company. There are no transactions between Mr. Posner and the Company that would be required to be reported under Item 404(a) of Regulation S-K of the Exchange Act.

Additionally, on June 21, 2024, Firefly appointed Samer Kaba, M.D., as its Chief Medical Officer. Prior to joining Firefly, Dr. Kaba held multiple leadership positions in the pharmaceutical industry and served as Chief Medical Officer of various biotechnology companies, where he led the development of multiple pharmaceutical products. In addition to his large expertise in drug development, medical affairs, and regulatory sciences, Dr. Kaba has over 20 years of experience in managing patients with neurological conditions. Dr. Kaba is a board-certified neurologist with additional training in Neuro-immunology (Multiple Sclerosis) at the State University of New York at Buffalo, and in Neuro-oncology at the University of Texas M.D.

There is no family relationship between Dr. Kaba and any director or executive officer of the Company. There are no transactions between Dr. Kaba and the Company that would be required to be reported under Item 404(a) of Regulation S-K of the Exchange Act.

Reference is also made to the disclosure described in the Proxy Statement/Prospectus in the section titled “Executive Officers and Directors of the Combined Company Following the Merger” beginning on page 183 for biographical information about each of the directors following the Transactions, which is incorporated herein by reference.

Certain relationships and related person transactions of the Company and its directors are described in the Proxy Statement/Prospectus in the section titled “Related Party Transactions” beginning on page 202 and are incorporated herein by reference.

In connection with the consummation of the Merger, each of the Company’s executive officers and directors entered into an indemnification agreement with the Company, a form of which is attached hereto as Exhibit 10.5 to this Current Report on Form 8-K and incorporated herein by reference.

Executive and Director Compensation

Information with respect to the compensation of the Company’s named executive officers and directors is set forth in the Proxy Statement/Prospectus in the section titled “Firefly’s Executive Officer Compensation” and “Firefly’s Director Compensation” beginning on page 188 and 195, respectively, and that information is incorporated herein by reference.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee has ever served as an officer of the Company. None of the Company’s directors has an interlocking or other relationship with another board or compensation committee that would require disclosure under Item 407(e)(4) of SEC Regulation S-K.

Certain Relationships and Related Transactions, and Director Independence

Information with respect to certain relationships and related person transactions of the Company are described in the Proxy Statement/Prospectus in the section titled “Related Party Transactions” beginning on page 292, and that information is incorporated herein by reference.

Effective upon the Closing, the Board of the Company adopted the listing standards of The Nasdaq Stock Market LLC (“Nasdaq”) to assess director independence. The Board has determined that each of the Company’s directors, other than Jon Olsen, the Chief Executive Officer of the Company, qualifies as “independent” under the listing requirements of Nasdaq.

Legal Proceedings

From time to time, the Company may be subject to various legal proceedings, investigations, or claims that arise in the ordinary course of our business activities. As of the date of this filing, the Company is not currently a party to any litigation, investigation, or claim the outcome of which, if determined adversely to it, would individually or in the aggregate be reasonably expected to have a material adverse effect on the Company’s business, financial position, results of operations, or cash flows or which otherwise is required to be disclosed under Item 103 of Regulation S-K.

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

Shares of New Firefly Common Stock will begin trading on the Nasdaq Capital Market under the symbol “AIFF” on August 13, 2024, on a post-Reverse Stock Split adjusted basis.

As of the Closing Date, the Company had 7,947,993 shares of Common Stock issued and outstanding held of record by approximately 250 holders.

The Company has not paid any cash dividends on New Firefly Common Stock to date. It is the present intention of the Board to retain future earnings for the development, operation, and expansion of its business, and the Board does not anticipate declaring or paying any cash dividends for the foreseeable future. The payment of dividends is within the discretion of the Board and will be contingent upon the Company’s future revenues and earnings, as well as its capital requirements and general financial condition.

Recent Sales of Unregistered Securities

The information set forth in the “Introductory Note” under the heading “Private Placement” is incorporated herein by reference.

Description of Registrant’s Securities to be Registered

The description of the Company’s securities included in the Proxy Statement/Prospectus in the section titled “Description of Combined Company Securities” beginning on page 251 is incorporated herein by reference.

Indemnification of Directors and Officers

The disclosure set forth under the heading “Indemnification Agreements” in Item 1.01 of this Report is incorporated herein by reference.

Further information about the indemnification of the Company’s directors and officers is set forth in the Proxy Statement/Prospectus in the section titled “Description of Combined Company Securities-Limitations of Director Liability and Indemnification of Directors, Officers and Employees” on page 255, and is incorporated herein by reference.

Financial Statements and Supplementary Data

The information set forth in Item 9.01 of this Report is incorporated herein by reference.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

The information set forth in Item 4.01 of this Report is incorporated herein by reference.

Financial Statements and Exhibits

The information set forth in Item 9.01 of this Report is incorporated herein by reference.

|

Item 3.01

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

On August 8, 2024, WaveDancer received a letter from the Staff (the “Staff”) of the Nasdaq Stock Market LLC (the “Letter”) indicating that in WaveDancer’s Quarterly Report on Form 10-Q filed with the SEC on May 14, 2024, WaveDancer reported stockholders’ equity of $1,708,520 for the period ended March 31, 2024, which does not comply with Listing Rule 5550(b)(1) (the “Minimum Stockholders’ Equity Requirement”). As previously reported, in a decision dated November 14, 2023, a Nasdaq Hearings Panel (the “Panel”) confirmed that WaveDancer had regained compliance with the Minimum Stockholders’ Equity Requirement. In the decision, the Panel imposed a Mandatory Panel Monitor for a period of one year or until November 14, 2024, which would require the Staff to issue a Delist Determination Letter in the event that WaveDancer failed to maintain compliance with the Minimum Stockholders’ Equity Rule (the “Panel Monitor”). Due to the Panel Monitor, WaveDancer is not eligible to submit a plan to the Staff to request an extension of up to 180 calendar days in which to regain compliance with the Minimum Stockholders’ Equity Requirement and as a result, the Staff has determined to delist WaveDancer’s securities from Nasdaq. Accordingly, unless WaveDancer requests an appeal of this determination by August 15, 2024, WaveDancer’s securities will be scheduled for delisting from Nasdaq and will be suspended at the opening of business on August 19, 2024.

The Company believes that following the consummation of the Merger and following the Closing, it will satisfy the Minimum Stockholder’s Equity Requirement.

|

Item 3.02

|

Unregistered Sale of Equity Securities.

|

The information set forth in the “Introductory Note” under the heading “Private Placement” is incorporated herein by reference.

|

Item 3.03

|

Material Modifications to Rights of Security Holders.

|

On August 3, 2022, in connection with the Merger, the Company filed the Certificate of Incorporation with the Secretary of State of the State of Delaware. On August 12, 2024, effective upon the Closing, the Board adopted Amended and Restated Bylaws (the “Bylaws”), which became effective as of the Closing Date. The material terms of the Certificate of Incorporation and the Bylaws and the general effect upon the rights of holders of WaveDancer’s capital stock are discussed in the Proxy Statement/Prospectus in the sections titled “Description of Combined Company Securities” beginning on page 251, “WaveDancer Proposal 3 – A&R Charter Proposal” beginning on page 113 and “Comparison of Corporate Governance and Stockholders’ Rights” beginning on page 256, which are incorporated herein by reference.

|

Item 4.01

|

Changes in Registrant’s Certifying Accountant.

|

On August 7, 2024, the Audit Committee of the WaveDancer Board approved the engagement of Marcum LLP (“Marcum”) as WaveDancer’s independent registered public accounting firm to audit WaveDancer’s consolidated financial statements for the year ending December 31, 2024. As previously reported, on May 16, 2024, CohnReznick LLP, the previous independent registered public accounting firm for WaveDancer, advised WaveDancer that it was resigning from such role.

During the years ended December 31, 2023, and December 31, 2022, and the subsequent period through August 7, 2024, WaveDancer did not consult Marcum with respect to either (i) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on the Company’s financial statements, and no written report or oral advice was provided to WaveDancer by Marcum that Marcum concluded was an important factor considered by WaveDancer in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement, as that term is described in Item 304(a)(1)(iv) of Regulation S-K under the Exchange Act and the related instructions to Item 304 of Regulation S-K under the Exchange Act, or a reportable event, as that term is defined in Item 304(a)(1)(v) of Regulation S-K under the Exchange Act.

|

Item 5.01

|

Change in Control of Registrant.

|

The information set forth in the “Introductory Note” and in Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference.

As a result of the consummation of the Merger, a change of control of WaveDancer occurred, and the stockholders of WaveDancer immediately prior to the Closing held approximate 8% of the outstanding shares of New Firefly Common Stock immediately following the Closing.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Upon the Closing, and in accordance with the terms of the Merger Agreement, each executive officer of WaveDancer resigned from his or her position, and each of G. James Benoit, Jr., Jack L. Johnson, Jr., William H. Pickle, Paul B. Becker, James C. DiPaula, Jr. and Bonnie K. Wachtel resigned as members of the WaveDancer Board, with David DeCaprio, Jon Olsen, Greg Lipschitz and Brian Posner to serve on the Board, effective as of the resignation of the members of the WaveDancer Board.

The applicable information set forth in the sections titled “Directors and Executive Officers of the Combined Company Following the Merger,” “Management of the Combined Company,” and “Related Party Transactions” as related to the Board and in Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference.

Firefly Neuroscience, Inc. 2024 Long-Term Incentive Plan

At a special meeting of WaveDancer’s stockholders on March 14, 2024, the stockholders of WaveDancer considered and approved the WaveDancer 2024 Long-Term Incentive Plan (the “WaveDancer Incentive Plan”). The WaveDancer Incentive Plan was previously approved and adopted, subject to stockholder approval, by the WaveDancer Board on February 1, 2024. On the Closing Date, the Board approved the adoption of the WaveDancer Incentive Plan and to change the name of the WaveDancer Incentive Plan to the Firefly Neuroscience, Inc. 2024 Long-Term Incentive Plan (the “Incentive Plan”), as well as the forms of Nonqualified Stock Option and Incentive Stock Option Agreement.

A description of the Incentive Equity Plan is included in the Proxy Statement/Prospectus in the section titled “WaveDancer Proposal 4 – Approval of the Incentive Pan Proposal” beginning on page 114 of the Proxy Statement/Prospectus, and such description is incorporated herein by reference. The foregoing description of the Incentive Plan, the form of Nonqualified Stock Option and form of Incentive Stock Option Agreement are qualified in their entirety by the full text of the Incentive Plan, which is filed as Annex G to the Proxy Statement/Prospectus and Exhibits 10.6 and 10.7 to this Current Report on Form 8-K, respectively, and incorporated herein by reference.

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

The information set forth in Item 3.03 of this Current Report on Form 8-K is incorporated herein by reference.

|

Item 5.05

|

Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics.

|

In connection with the Merger, on August 12, 2024, the Board approved and adopted a new Code of Business Conduct and Ethics applicable to all employees, officers, and directors of the Company, including its Chief Executive Officer, Chief Financial Officer and other executive and senior financial officers. A copy of the Code of Business Conduct and Ethics can be found in the Investors section of the Company’s website at https://fireflyneuro.com/.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On August 9, 2024, WaveDancer issued a press release announcing the Reverse Stock Split. A copy of the press release is attached hereto as Exhibit 99.6 and incorporated herein by reference.

On August 12, 2024, the Company issued a press release announcing the closing of the Merger. A copy of the press release is filed hereto as Exhibit 99.7 and incorporated by reference herein. The Company undertakes no obligation to update, supplement or amend the materials attached hereto furnished under this Item 7.01.

The information in this Current Report on Form 8-K (including Exhibits 99.6 and 99.7 attached hereto) are being furnished pursuant to Item 7.01 and shall not be deemed to be filed for purposes of Section 18 of the Exchange Act, or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(a) Financial Statements of Businesses Acquired.

The audited financial statements of Firefly and the related notes thereto as of December 31, 2023, and 2022 are set forth on Exhibit 99.1 hereto and is incorporated herein by reference.

The unaudited condensed financial statements of Firefly as of March 31, 2024, and the related notes are set forth on Exhibit 99.3 hereto and are incorporated herein by reference.

The audited consolidated balance sheets of WaveDancer as of December 31, 2022, and 2021, and for the years then ended and the related notes are included in the Proxy Statement/Prospectus beginning on page F-18 and are incorporated herein by reference. The unaudited condensed consolidated balance sheets as of September 30, 2023, and December 31, 2022, and for the three and nine months ended September 30, 2023, and 2022 are included in the Proxy Statement/Prospectus beginning on page F-2 and are incorporated herein by reference.

The audited consolidated balance sheets of Firefly as of December 31, 2022, and 2021, and for the years then ended and the related notes are included in the Proxy Statement/Prospectus beginning on page F-62 and are incorporated herein by reference. The unaudited condensed consolidated financial statements of Firefly as of September 30, 2023, and December 31, 2022, and for the three and nine months ended September 30, 2023, and 2022 and the related notes are included in the Proxy Statement/Prospectus beginning on page F-47 and are incorporated herein by reference.

(b) Pro Forma Financial Information.

The unaudited pro forma condensed combined financial balance sheets of the Company as of March 31, 2024, and the year ended December 31, 2023, are set forth on Exhibit 99.5 hereto and are incorporated herein by reference.

(d) Exhibits.

| |

|

Incorporated by Reference

|

|

Exhibit

Number

|

Description of Exhibit

|

Form

|

Exhibit

or

Annex

|

Filing Date

|

File Number

|

| |

|

|

|

|

|

|

2.1†§

|

|

S-4/A

|

A-1

|

02/02/2024

|

333-276649

|

| |

|

|

|

|

|

|

2.2

|

|

S-4/A

|

A-2

|

02/02/2024

|

333-276649

|

| |

|

|

|

|

|

|

2.3

|

|

8-K

|

2.1

|

06/21/2024

|

001-41092

|

| |

|

|

|

|

|

|

2.4

|

|

S-4/A

|

F

|

02/02/2024

|

333-276649

|

| |

|

|

|

|

|

|

3.1*

|

|

|

|

|

|

| |

|

|

|

|

|

|

3.2*

|

|

|

|

|

|

| |

|

|

|

|

|

|

4.1

|

|

8-K

|

4.1

|

08/30/2021

|

000-22405

|

| |

|

|

|

|

|

|

4.2

|

|

8-K

|

4.1

|

12/16/2021

|

001-41092

|

| |

|

|

|

|

|

|

4.3

|

|

S-4/A

|

4.6

|

02/02/2024

|

333-276649

|

| |

|

|

|

|

|

|

4.4

|

|

S-4/A

|

4.7

|

02/02/2024

|

333-276649

|

|

4.5

|

|

S-4/A

|

4.8

|

02/02/2024

|

333-276649

|

| |

|

|

|

|

|

|

4.6

|

|

S-4/A

|

4.10

|

02/02/2024

|

333-276649

|

| |

|

|

|

|

|

|

4.7

|

|

S-4/A

|

4.11

|

02/02/2024

|

333-276649

|

| |

|

|

|

|

|

|

4.8

|

|

S-4/A

|

4.12

|

02/02/2024

|

333-276649

|

| |

|

|

|

|

|

|

10.1#

|

|

Schedule14A

|

A

|

04/19/2006

|

000-22405

|

|

|

|

|

|

|

|

|

10.2#

|

|

Schedule14A

|

A

|

04/11/2016

|

000-22405

|

| |

|

|

|

|

|

|

10.3#

|

|

Schedule 14A

|

4

|

10/26/2021

|

000-22405

|

| |

|

|

|

|

|

|

10.4#

|

|

Form S-4/A

|

10.12

|

02/02/2024

|

333-276649

|

| |

|

|

|

|

|

|

10.5*#

|

|

|

|

|

|

| |

|

|

|

|

|

|

10.6*#

|

|

|

|

|

|

| |

|

|

|

|

|

|

10.7*#

|

|

|

|

|

|

| |

|

|

|

|

|

|

10.8*

|

|

|

|

|

|

| |

|

|

|

|

|

|

10.9

|

|

8-K

|

10.1

|

07/11/2022

|

001-41092

|

| |

|

|

|

|

|

|

10.10

|

|

8-K |

10.2

|

07/11/2022 |

001-41092 |

| |

|

|

|

|

|

|

21.1*

|

|

|

| |

|

|

|

99.1*

|

|

|

| |

|

|

|

99.2*

|

|

|

| |

|

|

|

99.3

|

|

|

| |

|

|

|

99.4

|

|

|

| |

|

|

|

99.5*

|

|

|

| |

|

|

|

99.6*

|

|

|

| |

|

|

|

99.7*

|

|

|

| |

|

|

|

104*

|

Cover Page Interactive Data File

|

|

|

†

|

Certain of the exhibits or schedules to this Exhibit have been omitted in accordance with Item 601(a)(5) of Regulation S-K. The Registrant agrees to furnish a copy of all omitted exhibits and schedules to the SEC upon its request.

|

|

§

|

Portions of this exhibit have been redacted in compliance with Regulation S-K Item 601(a)(6).

# Management contract or compensatory plan or arrangement.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| |

|

FIREFLY NEUROSCIENCE, INC.

|

| |

|

|

|

Date: August 12, 2024

|

By:

|

/s/ Jon Olsen

|

| |

Name:

|

Jon Olsen

|

| |

Title:

|

Chief Executive Officer

|

Exhibit 3.1

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION OF

WAVEDANCER, INC.

WaveDancer, Inc., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), certifies that:

A. The present name of the corporation is WaveDancer, Inc. The Corporation was originally incorporated by the filing of its original Certificate of Incorporation with the Secretary of State of the State of Delaware on December 14, 2021 as WaveDancer, Inc.

B. This Amended and Restated Certificate of Incorporation was duly adopted by the Board of Directors of the Corporation in accordance with Sections 242 and 245 of the General Corporation Law of the State of Delaware.

C. Thereafter, this Amended and Restated Certificate of Incorporation was duly approved by the holders of the requisite number of shares of capital stock of the Corporation at a special meeting of the Corporation duly called and held, and upon notice duly given, in accordance with the applicable provisions of Sections 216 and 242 of the General Corporation Law of the State of Delaware.

D. The text of the Certificate of Incorporation is amended and restated to read as set forth in EXHIBIT A attached hereto.

E. This document becomes effective on August 12, 2024 at 4:00 PM, Eastern Time.

[Signature Page Follows]

IN WITNESS WHEREOF, WaveDancer, Inc. has caused this Amended and Restated Certificate of Incorporation to be signed by G. James Benoit, a duly authorized officer of the Corporation, on August 12, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ James Benoit

|

|

|

|

|

G. James Benoit

|

|

|

|

|

Chief Executive Officer

|

|

EXHIBIT A

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

FIREFLY NEUROSCIENCE, INC.

I.

The name of this corporation is Firefly Neuroscience, Inc. (the “Corporation”).

II.

The address of the registered office of the Corporation in the State of Delaware is 1209 Orange Street, City of Wilmington, County of New Castle, Delaware 19801. The name of its registered agent at such address is The Corporation Trust Company.

III.

The purpose of the Corporation is to engage in any lawful act or activity for which a corporation may be organized under the General Corporation Law of the State of Delaware (the “DGCL”).

IV.

A. The Corporation is authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred Stock.” The total number of shares that the Corporation is authorized to issue is 101,000,000 shares, consisting of (1) 100,000,000 shares of Common Stock, par value of $0.0001 per share, and (2) 1,000,000 shares of Preferred Stock, par value of $0.0001 per share.

B. The Preferred Stock may be issued from time to time in one or more series. The Board of Directors of the Corporation (the “Board of Directors”) is hereby expressly authorized to provide for the issue of all or any of the unissued and undesignated shares of the Preferred Stock, in one or more series, and to fix the number of shares of such series and to determine or alter for each such series, such voting powers, full or limited, or no voting powers, and such designation, preferences, and relative, participating, optional, or other rights and such qualifications, limitations, or restrictions thereof, as shall be stated and expressed in the resolution or resolutions adopted by the Board of Directors providing for the issuance of such shares and as may be permitted by the DGCL. The number of authorized shares of Preferred Stock, or any series thereof, and Common Stock may be increased or decreased (but not below the number of shares thereof then outstanding plus, if applicable, the number of shares of such class or series reserved for issuance) by the affirmative vote of the holders of a majority of the voting power of all of the outstanding shares of stock of the Corporation entitled to vote thereon, without a separate vote of the holders of the Preferred Stock, or of any series thereof, or Common Stock, respectively, irrespective of Section 242(b)(2) of the DGCL, unless a vote of any such holder is required pursuant to this Amended and Restated Certification of Incorporation (as further amended from time to time, the “Amended and Restated Certificate of Incorporation”) (including any certificate of designation relating to any series of Preferred Stock).

C. Each outstanding share of Common Stock shall entitle the holder thereof to one vote on each matter properly submitted to the stockholders of the Corporation for their vote; provided, however, that, except as otherwise required by applicable law, holders of Common Stock shall not be entitled to vote on any amendment to this Amended and Restated Certificate of Incorporation (including any certificate of designation filed with respect to any series of Preferred Stock) that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of such affected series of Preferred Stock are entitled, either separately or together as a class with the holders of one or more other such series of Preferred Stock, to vote thereon pursuant to applicable law or the Amended and Restated Certificate of Incorporation (including any certificate of designation filed with respect to any series of Preferred Stock).

D. Subject to the prior or equal rights, if any, of the holders of shares of any series of Preferred Stock duly created hereunder, the holders of Common Stock shall be entitled (i) to receive dividends when and as declared by the Board of Directors out of any funds legally available therefor, (ii) in the event of any dissolution. liquidation or winding-up of the Corporation, whether voluntary or involuntary (sometimes referred to herein as a liquidation), after payment or provision for payment of the debts and other liabilities of the Corporation, to receive the remaining assets of the Corporation, ratably according to the number of shares of Common Stock held, and (iii) to one vote for each share of Common Stock held on all matters submitted to a vote of stockholders.

V.

For the management of the business and for the conduct of the affairs of the Corporation, and in further definition, limitation and regulation of the powers of the Corporation, of its directors and stockholders, or any class thereof, as the case may be, it is further provided that:

A. Management of the Business

Except as otherwise provided by the DGCL or the Amended and Restated Certificate of Incorporation, the business and affairs of the Corporation shall be managed by or under the direction of the Board. Subject to any rights of the holders of shares of any one or more series of Preferred Stock then outstanding to elect additional directors under specified circumstances, the number of directors that shall constitute the Board shall be fixed exclusively by the Board.

B. Board of Directors.

Subject to the rights of the holders of any series of Preferred Stock to elect additional directors under specified circumstances, the directors shall be divided into three classes designated as Class I, Class II and Class III, respectively. Each class shall consist, as nearly as practicable, of a number of directors equal to one-third of the number of members of the Board of Directors authorized as provided in Section A of this Article V. The Board of Directors is authorized to assign members of the Board of Directors already in office to such classes at the time the classification becomes effective. At the first annual meeting of stockholders following the filing of this Amended and Restated Certificate of Incorporation, the initial term of office of the Class I directors shall expire and Class I directors shall be elected for a full term of three years. At the second annual meeting of stockholders following the filing of this Amended and Restated Certificate of Incorporation, the initial term of office of the Class II directors shall expire and Class II directors shall be elected for a full term of three years. At the third annual meeting of stockholders following the filing of this Amended and Restated Certificate of Incorporation, the initial term of office of the Class III directors shall expire and Class III directors shall be elected for a full term of three years. At each succeeding annual meeting of stockholders, directors shall be elected for a full term of three years to succeed the directors of the class whose terms expire at such annual meeting. At any time that applicable law prohibits a classified board as described in this Article V, all directors shall be elected at each annual meeting of stockholders to hold office until the next annual meeting. No stockholder entitled to vote at an election for directors may cumulate votes.

Notwithstanding the foregoing provisions of this section, each director shall serve until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation or removal. If the total number of directors is changed, any increase or decrease shall be apportioned by the Board among the classes so as to maintain the number of directors in each class as nearly equal as possible, and any additional director of any class elected to fill a newly created directorship resulting from an increase in such class shall hold office for a term that shall coincide with the remaining term of that class, but in no case shall a decrease in the number of directors constituting the Board remove or shorten the term of any incumbent director.

C. Removal of Directors.

For so long as the Board of Directors is classified and subject to the rights of any series of Preferred Stock to remove directors elected by such series of Preferred Stock, any individual director or the entire Board of Directors may be removed from office at any time, but only for cause, and only by the affirmative vote of the holders of at least 662/3% of the voting power of all the then-outstanding shares of the capital stock of the Corporation entitled to vote generally at an election of directors, voting together as a single class.

D. Vacancies.

Subject to any limitations imposed by applicable law and subject to the rights of the holders of any series of Preferred Stock to elect additional directors or fill vacancies in respect of such directors, any vacancies on the Board of Directors resulting from death, resignation, disqualification, removal or other causes and any newly created directorships resulting from any increase in the number of directors, shall be filled only by the affirmative vote of a majority of the directors then in office, even though less than a quorum of the Board of Directors, or by a sole remaining director, and not by the stockholders. Any director elected in accordance with the preceding sentence shall hold office for the remainder of the full term of the director for which the vacancy was created or occurred and until such director’s successor shall have been elected and qualified or such director’s earlier death, resignation or removal.

E. Preferred Stockholders’ Election Rights.

Whenever the holders of any one or more series of Preferred Stock shall have the right, voting separately as a series or separately as a class with one or more such other series, to elect directors at an annual or special meeting of stockholders, the election, term of office, removal and other features of such directorships shall be governed by the terms of the Amended and Restated Certificate of Incorporation (including any certificate of designation relating to any series of Preferred Stock) applicable thereto. The number of directors that may be elected by the holders of any such series of Preferred Stock shall be in addition to the number fixed pursuant to Section A of Article V hereof, and the total number of directors constituting the whole Board shall be automatically adjusted accordingly. Except as otherwise provided by the Board in the resolution or resolutions establishing such series, whenever the holders of any series of Preferred Stock having such right to elect additional directors are divested of such right pursuant to the provisions of such stock, the terms of office of all such additional directors elected by the holders of such stock, or elected to fill any vacancies resulting from the death, resignation, disqualification or removal of such additional directors, shall forthwith terminate (in which case each such director thereupon shall cease to be qualified as, and shall cease to be, a director) and the total authorized number of directors of the Corporation shall automatically be reduced accordingly.

F. Bylaw Amendments.

The Board of Directors is expressly authorized and empowered to adopt, amend or repeal any provisions of the Amended and Restated Bylaws of the Corporation (as amended from time to time, the “Amended and Restated Bylaws”). The stockholders shall also have power to adopt, amend or repeal the Amended and Restated Bylaws; provided, however, that, in addition to any vote of the holders of any class or series of stock of the Corporation required by law or by the Amended and Restated Certificate of Incorporation, such action by stockholders shall require the affirmative vote of the holders of at least 662/3% of the voting power of all of the then-outstanding shares of the capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class.

G. Stockholder Actions.

| |

1.

|

The directors of the Corporation need not be elected by written ballot unless the Amended and Restated Bylaws so provide.

|

| |

2.

|

Subject to any rights of the holders of shares of any one or more series of Preferred Stock then outstanding, any action required or permitted to be taken by the stockholders of the Corporation must be effected at an annual or special meeting of the stockholders and may not be effected by consent in lieu of a meeting.

|

| |

3.

|

Subject to any rights of the holders of shares of any series of Preferred Stock then outstanding, special meetings of stockholders of the Corporation may be called only by the Chairperson of the Board of Directors, the Chief Executive Officer, the President or the Board of Directors, but a special meeting may not be called by any other person or persons and any power of stockholders to call a special meeting of stockholders is specifically denied. Only such business shall be considered at a special meeting of stockholders as shall have been stated in the notice for such meeting.

|

| |

4.

|

An annual meeting of stockholders for the election of directors to succeed those whose terms expire and for the transaction of such other business as may properly come before the meeting, shall be held at such place, if any, on such date, and at such time as shall be fixed exclusively by the Board or a duly authorized committee thereof.

|

| |

5.

|

Advance notice of stockholder nominations for the election of directors and of business to be brought by stockholders before any meeting of the stockholders of the Corporation shall be given in the manner provided in the Amended and Restated Bylaws.

|

VI.

A. No director or officer of the Corporation shall be liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or officer, except to the extent such exemption from liability or limitation thereof is not permitted under the DGCL, as the same exists or may hereafter be amended. Any amendment, modification or repeal of the foregoing sentence shall not adversely affect any right or protection of a director or officer of the Corporation hereunder in respect of any act or omission occurring prior to the time of such amendment, modification or repeal.

VII.

A. The Corporation shall have the power to provide rights to indemnification and advancement of expenses to its current and former officers, directors, employees and agents and to any person who is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, trust or other enterprise.

VIII.

A. Unless the Corporation consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware (or, if and only if the Court of Chancery of the State of Delaware lacks subject matter jurisdiction, any state court located within the State of Delaware or, if and only if all such state courts lack subject matter jurisdiction, the federal district court for the District of Delaware) and any appellate court therefrom shall be the sole and exclusive forum for the following claims or causes of action under Delaware statutory or common law: (A) any derivative claim or cause of action brought on behalf of the Corporation; (B) any claim or cause of action for breach of a fiduciary duty owed by any current or former director, officer or other employee or stockholder of the Corporation, to the Corporation or the Corporation’s stockholders; (C) any claim or cause of action against the Corporation or any current or former director, officer or other employee of the Corporation, arising out of or pursuant to any provision of the DGCL, the Amended and Restated Certificate of Incorporation or the Amended and Restated Bylaws; (D) any claim or cause of action seeking to interpret, apply, enforce or determine the validity of the Amended and Restated Certificate of Incorporation or the Amended and Restated Bylaws (including any right, obligation, or remedy thereunder); (E) any claim or cause of action as to which the DGCL confers jurisdiction on the Court of Chancery of the State of Delaware; and (F) any claim or cause of action against the Corporation or any current or former director, officer or other employee of the Corporation, governed by the internal-affairs doctrine or otherwise related to the Corporation’s internal affairs, in all cases to the fullest extent permitted by applicable law and subject to the court having personal jurisdiction over the indispensable parties named as defendants. This Section A of Article VIII shall not apply to claims or causes of action brought to enforce a duty or liability created by the Securities Act of 1933, as amended (the “1933 Act”) or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or any other claim for which the federal courts have exclusive jurisdiction.

B. Unless the Corporation consents in writing to the selection of an alternative forum, to the fullest extent permitted by applicable law, the federal district courts of the United States of America shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the 1933 Act, including all causes of action asserted against any defendant named in such complaint. For the avoidance of doubt, this provision is intended to benefit and may be enforced by the Corporation, its officers and directors, the underwriters for any offering giving rise to such complaint, and any other professional entity whose profession gives authority to a statement made by that person or entity and who has prepared or certified any part of the documents underlying the offering.

C. Failure to enforce the foregoing provisions would cause the Corporation irreparable harm, and the Corporation shall be entitled to equitable relief, including injunctive relief and specific performance, to enforce the foregoing provisions.

IX.

A. Any person or entity holding, owning, or otherwise acquiring any interest in any security of the Corporation shall be deemed to have notice of and consented to the provisions of this Amended and Restated Certificate of Incorporation.

B. The Corporation reserves the right to amend, alter, change or repeal, at any time and from time to time, any provision contained in the Amended and Restated Certificate of Incorporation, in the manner now or hereafter prescribed by statute, except as provided in Section C of this Article IX and all rights, preferences and privileges of whatsoever nature conferred upon the stockholders, directors or any other persons whomsoever by and pursuant to this Amended and Restated Certificate of Incorporation are granted subject to this reservation.

C. Notwithstanding any other provisions of this Amended and Restated Certificate of Incorporation or any provision of applicable law that might otherwise permit a lesser vote or no vote, but in addition to any affirmative vote of the holders of any particular class or series of capital stock of the Corporation required by applicable law or by the Amended and Restated Certificate of Incorporation or any certificate of designation filed with respect to a series of Preferred Stock, the affirmative vote of the holders of at least 662/3% of the voting power of all of the then-outstanding shares of capital stock of the Corporation entitled to vote in the election of directors, voting together as a single class, shall be required to alter, amend or repeal (whether by merger, consolidation or otherwise), or adopt any provision inconsistent with, Articles V, VI, VII, VIII, IX, X and XI.

X.

A. The Corporation hereby renounces any interest or expectancy in any business opportunity, transaction or other matter in which any Designated Party participates or desires or seeks to participate in and that involves any aspect of the same or similar activities or related lines of business as those in which the Corporation, directly or indirectly, may engage and/or other business activities that overlap with or compete with those in which the Corporation, directly or indirectly, may engage (each, a “Business Opportunity”) other than a Business Opportunity that (i) is first presented to a Designated Party solely in such person’s capacity as a director or officer of the Corporation or its Subsidiaries and with respect to which, at the time of such presentment, no other Designated Party (other than a Nominee) has independently received notice of or otherwise identified such Business Opportunity or (ii) is identified by a Designated Party solely through the disclosure of information by or on behalf of the Corporation (each Business Opportunity other than those referred to in clauses (i) or (ii) are referred to as a “Renounced Business Opportunity”). No Designated Party, including any Nominee, shall have any obligation to communicate or offer any Renounced Business Opportunity to the Corporation, and any Designated Party may pursue a Renounced Business Opportunity, provided that such Renounced Business Opportunity is conducted by such Designated Party in accordance with the standard set forth in Section B of this Article X. The Corporation shall not be prohibited from pursuing any Business Opportunity with respect to which it has renounced any interest or expectancy as a result of this Section A of Article X. Nothing in this Section A of Article X. shall be construed to allow any director to usurp a Business Opportunity of the Corporation or its Subsidiaries solely for his or her personal benefit.

B. In the event that a Designated Party acquires knowledge of a Renounced Business Opportunity, such Designated Party may pursue such Renounced Business Opportunity if such Renounced Business Opportunity is developed and pursued solely through the use of personnel and assets of the Designated Party (including, as applicable, such Designated Party in his or her capacity as a director, officer, employee or agent of a Designated Party).

C. Provided a Renounced Business Opportunity is conducted by a Designated Party in accordance with the standards set forth in Section B of this Article X, no Designated Party shall be liable to the Corporation or a stockholder of the Corporation for breach of any fiduciary or other duty by reason of such Renounced Business Opportunity. In addition, subject to Section D of this Article X. hereof, no Designated Party shall be liable to the Corporation or a stockholder of the Corporation for breach of any fiduciary duty as a director or controlling stockholder of the Corporation, as applicable, by reason of the fact that such Designated Party conducts, pursues or acquires such Renounced Business Opportunity for itself, directs such Renounced Business Opportunity to another Person or does not communicate information regarding such Renounced Business Opportunity to the Corporation.

D. Should any director of the Corporation have actual knowledge that he or she or his or her Affiliates is pursuing a Renounced Business Opportunity also pursued by the Corporation, he or she shall disclose to the Board that he or she may have a conflict of interest, so that the Board may consider his or her withdrawal from discussions in Board deliberations, as appropriate.

E.

| |

(a)

|

For purposes of this Article X, “Designated Parties” shall include all Subsidiaries and Affiliates of each Designated Party (other than the Corporation and its Subsidiaries).

|

| |

(b)

|

As used in this Article X, the following definitions shall apply:

|

(i) “Affiliate” means with respect to a specified person, a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, the person specified, and any directors, officers, partners or 5% or more owners of such person.

(ii) “Designated Parties” means any member of the Board who is not at the time also an officer of the Corporation or any entity through which such Person operates (each of which being a “Designated Party”).

(iii) “Nominee” means any officer, director, employee or other agent of any Designated Party who serves as a director (including Chairman of the Board) or officer of the Corporation or its Subsidiaries.